Demystifying Business Insurance: What Successful Companies Know

Navigating the complexities of business insurance can be daunting. However, a solid understanding of the fundamentals can equip you to protect your business effectively. This goes beyond simply checking boxes; it's about establishing a robust financial safety net for your company's future. Let's explore how successful companies approach this critical aspect of business.

Why Business Insurance Is an Investment, Not an Expense

Many business owners see insurance as just another overhead cost. Thriving businesses, however, recognize its true purpose: risk mitigation. Think of it like this: you wouldn't operate a vehicle without insurance. Your business, your livelihood, is a far more valuable asset. Just as car insurance protects you financially in the event of an accident, business insurance safeguards your company from unforeseen circumstances.

For instance, a simple slip and fall incident on your business property could result in a costly lawsuit. Without general liability insurance, your business could face substantial financial burdens. Investing in the right coverage allows you to focus on growth, knowing you're protected.

The Devastating Impact of Uninsured Losses

Uninsured losses can have a catastrophic impact on a business, potentially leading to closure. Imagine a fire destroying your inventory or a natural disaster damaging your office. Without sufficient coverage, rebuilding can be insurmountable.

The increasing frequency of cyberattacks highlights the importance of cyber liability insurance. A data breach can be financially crippling and severely damage your reputation. Protecting your business from these digital threats is crucial in today's interconnected world.

Global Trends and Rising Premiums

Business insurance adoption and risk management are increasingly shaped by global factors. Regulatory requirements and climate-related considerations play a significant role in influencing insurance practices. Over the past five years, insurance premiums have increased by an average of 8% annually. This rise is driven by both increasing risks and a higher demand for comprehensive coverage. These trends demonstrate how business insurance fundamentals are influenced not only by market forces, but also by broader regulatory, environmental, and social developments worldwide. For a deeper dive into this topic, explore the insights provided by Costero Brokers.

Insurance: A Strategic Investment for Long-Term Stability

Successful companies view business insurance not as an expense, but as a strategic investment in their long-term stability. It's a proactive approach to managing risk, enabling businesses to navigate unexpected challenges. Just as you invest in marketing to expand your customer base, investing in insurance protects your existing assets. This crucial mindset shift enables you to see the bigger picture and plan strategically for a secure future.

The Business Insurance Toolkit: Coverage That Actually Matters

Protecting your business isn't about checking off a list; it's about understanding which insurance policies truly safeguard your operations. This guide clarifies the essential coverage types that create a strong business insurance strategy. We'll explore how each policy works when you need it most, ensuring you're not caught unprepared.

General Liability: Your First Line of Defense

General liability insurance is the foundation of most business insurance plans. It protects you from financial losses due to common incidents, such as customer injuries on your property or property damage caused by your business operations. For instance, if a client slips and falls in your store, general liability insurance can cover their medical expenses and legal costs. This fundamental coverage is vital for mitigating everyday risks.

Professional Liability: Shielding Your Expertise

If your business provides services or advice, professional liability insurance (also known as errors and omissions insurance) is essential. It protects you against claims of negligence, mistakes, or inadequate work. This coverage is critical for consultants, lawyers, accountants, and other professionals whose work depends on their expertise.

Property Insurance: Safeguarding Your Assets

Property insurance protects your physical assets—buildings, equipment, inventory—from damage or loss due to events like fire, theft, or natural disasters. Whether you own or lease your workspace, this coverage is vital for business continuity. It helps you recover by covering repair or replacement costs.

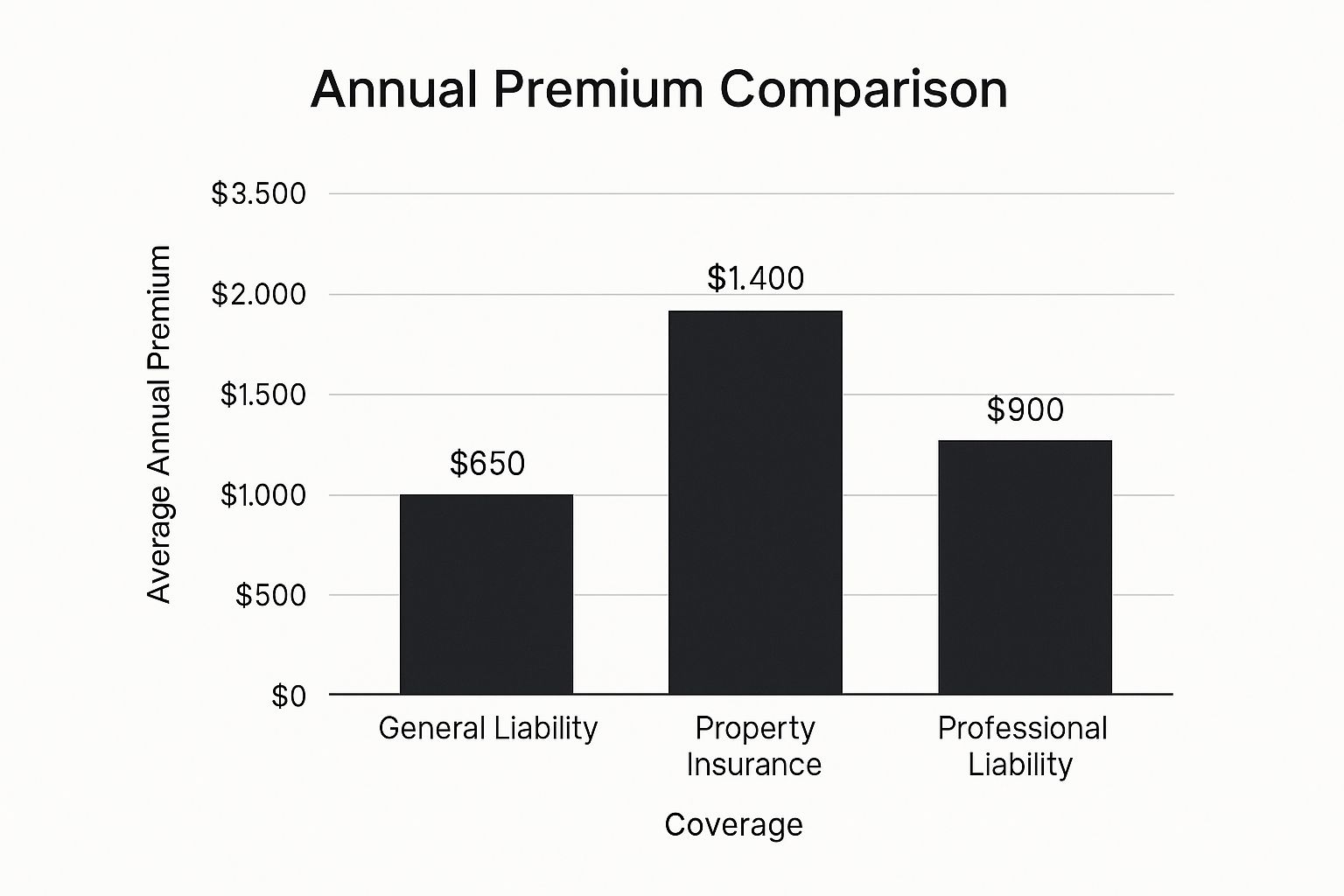

The following infographic shows the average annual premiums for three main business insurance types: general liability, property insurance, and professional liability.

As the infographic shows, general liability insurance often has the lowest average annual premium compared to property and professional liability. This difference illustrates the varying costs associated with different types of risk protection. You might also find helpful information about navigating insurance markets, such as this resource on Florida insurance.

Business Interruption Insurance: Bridging the Gap After Disaster

Often overlooked, business interruption insurance is crucial after a covered event forces a temporary closure. It covers lost income and ongoing expenses, such as rent and salaries, helping your business stay afloat during difficult times. This coverage provides a financial bridge while you recover.

Cyber Liability: Protecting Your Digital World

In an increasingly interconnected world, cyber liability insurance is more important than ever. It covers the costs of data breaches, cyberattacks, and other digital threats, including data recovery, legal fees, and notification requirements. Cyber liability insurance is essential for any business that stores or handles sensitive data.

Workers' Compensation: A Necessity for Employers

If you have employees, workers' compensation insurance is typically required by law. It provides benefits to employees injured on the job, covering medical expenses and lost wages. This protects both your employees and your business from the financial impact of workplace accidents.

Specialized Coverage: Tailoring Protection to Your Needs

Beyond these core policies, some industries need specialized coverage. This includes builders risk insurance for construction projects or liquor liability insurance for businesses serving alcohol. These policies address specific risks linked to particular industries or operations. Addressing these niche exposures ensures comprehensive, tailored protection.

To help you compare different business insurance policies, we've compiled the following table:

Common Business Insurance Policies Comparison

This table compares essential business insurance policies, helping business owners understand what each covers, typical costs, and who needs them most.

| Policy Type | What It Covers | Typical Annual Cost Range | Who Needs It Most | Common Exclusions |

|---|---|---|---|---|

| General Liability | Bodily injury, property damage, advertising injury | $500 – $2,000 | Most businesses, especially those interacting with the public | Intentional acts, professional errors |

| Professional Liability | Negligence, errors and omissions in professional services | $1,000 – $5,000 | Consultants, lawyers, accountants, medical professionals | Illegal acts, intentional misrepresentation |

| Property Insurance | Damage or loss to business property (buildings, equipment, inventory) | Varies widely based on property value and location | Businesses that own or lease physical assets | Flood, earthquake (often require separate policies) |

| Business Interruption | Lost income and ongoing expenses due to covered events | Varies based on expected income and expenses | Businesses that rely on physical location for operations | Events not covered by underlying property insurance |

| Cyber Liability | Data breaches, cyberattacks, and related expenses | $500 – $3,000+ | Businesses that store or handle sensitive data | Physical damage, insider threats (sometimes covered) |

| Workers' Compensation | Medical expenses and lost wages for employees injured on the job | Varies based on payroll and industry | Businesses with employees | Injuries occurring outside of work, independent contractors |

This table provides a general overview; actual costs and coverage details vary. Consulting with an insurance professional is crucial to determine the best coverage for your specific business needs. Remember, securing the right insurance is an investment in your business's long-term health and stability.

What's Really Driving Your Insurance Costs

Understanding business insurance goes beyond simply knowing the available coverage types. It requires a closer look at the factors that influence your premiums. These costs can differ significantly, even between businesses that appear similar. This section explores the often-unseen variables that can drastically impact your business insurance expenses.

Industry Classification: Not All Businesses Are Created Equal

A primary driver of insurance costs is your business's industry classification. Insurers group businesses based on the risk level of their operations. For example, a construction company typically faces higher premiums than a software company. This is due to the higher probability of on-site accidents in construction. This difference highlights how two businesses with identical revenue can have drastically different insurance costs solely because of their industry.

Risk Factors: Under the Microscope

Beyond industry classification, insurers evaluate numerous risk factors unique to your business. These factors can include your claims history, the age of your business, your business location, and even your existing safety measures. A business with a history of frequent claims presents a higher risk. As a result, it will likely incur higher premiums.

Understanding self-employment taxes is crucial for businesses when assessing insurance costs, especially for LLCs. For more information on this topic, see this helpful resource: LLC Self Employment Taxes.

The Influence of Macroeconomic Trends

Beyond individual business characteristics, broader economic trends also affect insurance pricing. Inflation, market cycles, and global events can all influence rates. Business insurance has a cyclical nature. For example, according to Deloitte, global insurance premiums grew by 3.3% in 2024. The combined ratio for the non-life sector in the United States, a key profitability indicator, improved to 98.5% in both 2024 and 2025. This shows how market conditions directly affect business insurance premiums and profitability. Learn more about this at Deloitte's insurance industry outlook. Even with a constant business risk profile, your premiums could fluctuate due to these larger economic factors.

Deductibles and Premiums: Balancing Act

Your deductible significantly influences overall insurance costs. The deductible is the amount you pay before your insurance coverage begins. A higher deductible generally results in lower premiums. Conversely, a lower deductible means higher premiums. Choosing the right deductible involves balancing your risk tolerance with your budget. A higher deductible can benefit businesses with substantial financial reserves, while a lower deductible offers greater security for those with limited funds.

Negotiating and Timing: Strategies for Cost Control

Navigating business insurance can be complex. However, there are ways to manage your costs. Working with an experienced insurance broker can help you find the best rates. The timing of your policy renewal can also impact your premium. Comparing quotes from different insurers is essential to finding the most competitive coverage. These strategies help you control your business insurance costs and make well-informed coverage decisions.

Building Your Business Insurance Strategy

Building a robust business insurance strategy isn't just about acquiring several policies. It's about understanding the specific risks your business faces and developing a targeted approach to protect against them. This involves systematically assessing your vulnerabilities and selecting the right coverage levels. Let's explore how to create a strategy that evolves alongside your business.

Identifying and Quantifying Your Risks

Effective risk management starts with identifying potential vulnerabilities in your operations. Think of it like a doctor diagnosing a patient: you need a thorough understanding of your business, inside and out. Consider your daily activities, potential external disruptions, and everything in between. A restaurant, for example, faces different risks than a software company. Food safety is paramount for the restaurant, while data security is critical for the software company. Quantifying these risks—estimating their potential financial impact—is key to determining appropriate coverage.

Understanding potential financial impact allows you to make informed decisions about your coverage levels. This ensures your resources are used efficiently and effectively to protect your business.

To help visualize and assess your risks, let's look at a practical tool: the Business Risk Assessment Matrix.

Business Risk Assessment Matrix

This table helps business owners identify and prioritize potential risks by categorizing them according to likelihood and severity, guiding insurance purchasing decisions.

| Risk Type | Likelihood (Low/Medium/High) | Potential Financial Impact | Recommended Coverage | Risk Mitigation Strategies |

|---|---|---|---|---|

| Fire Damage | Medium | $50,000 – $250,000 | Property Insurance | Fire suppression systems, regular inspections |

| Data Breach | Medium | $10,000 – $100,000 | Cyber Liability Insurance | Data encryption, multi-factor authentication |

| Customer Injury (Slip and Fall) | Low | $1,000 – $50,000 | General Liability Insurance | Regular maintenance, safety signage |

| Product Liability Lawsuit | Low | $5,000 – $75,000 | Product Liability Insurance | Rigorous product testing, quality control |

| Business Interruption (Natural Disaster) | Low | $25,000 – $150,000 | Business Interruption Insurance | Disaster recovery plan, backup systems |

This matrix provides a framework for assessing and prioritizing risks, but you should tailor it to your specific business needs.

Addressing Your Specific Risks

Once you’ve identified and quantified your risks, you can select the appropriate insurance policies and coverage amounts. This involves aligning your insurance choices with your risk profile. For instance, if your business handles sensitive customer data, robust cyber liability insurance is crucial. A business with substantial physical assets, on the other hand, needs adequate property insurance. This tailored approach ensures your insurance strategy effectively addresses your specific vulnerabilities.

Adapting Your Insurance as Your Business Evolves

Your business insurance strategy shouldn’t be static. As your business grows and changes, so should your coverage. New products, services, or locations introduce new risks that require adjustments to your insurance portfolio. Expanding internationally, for example, necessitates considering international insurance regulations and options. This dynamic approach ensures your insurance remains aligned with your evolving business needs. Check out our guide on How to Master Your Insurance Needs As Your Company Expands.

Brokers vs. Direct Carriers: Navigating the Insurance Marketplace

You have two main options for purchasing business insurance: working with a broker or going directly to a carrier. Brokers are independent advisors representing multiple insurers, helping you find the best coverage at the most competitive price. Direct carriers offer policies directly to businesses. Choosing the right approach depends on your needs and resources. Brokers provide a broader market perspective and personalized guidance, while direct carriers may offer a more streamlined process. Effective workforce management plays a significant role in minimizing risk. Learn about absence management strategies.

Balancing Cost and Protection

Balancing insurance costs with potential losses is a crucial element of your strategy. While cost is a factor, the primary focus should be on adequate protection against potentially devastating events. A comprehensive risk assessment helps determine the appropriate balance between premiums and coverage, allowing you to make informed decisions that prioritize protection without unnecessary expenses.

Navigating Today's Complex Insurance Marketplace

The business insurance market is in constant flux, creating both obstacles and advantages for businesses. Understanding these changes is essential for obtaining the right coverage at the optimal price. This section explores the dynamic factors shaping the insurance landscape and how businesses can successfully navigate these changes.

Market Cycles and Coverage Options

The insurance market operates in cycles, fluctuating between "hard" and "soft" market conditions. Hard markets are defined by increasing premiums, more stringent underwriting requirements, and less coverage availability. Soft markets, on the other hand, feature lower premiums, greater underwriting flexibility, and broader coverage choices. Recognizing the current market cycle can greatly impact your insurance purchasing strategy.

For instance, in a hard market, securing adequate coverage becomes the priority, even with higher premiums. Conversely, a soft market allows businesses to explore more competitive pricing and broader coverage options. Careful evaluation of market conditions is key to making informed decisions.

Emerging risks also continually reshape the insurance environment. The rise of cyber threats, for example, prompted the creation of specialized cyber liability policies. Similarly, escalating climate-related risks affect property insurance underwriting and pricing.

Staying abreast of these emerging risks helps businesses proactively address potential vulnerabilities. You may find this resource helpful: Understanding Current Business Risks and Insurance Needs. Understanding the evolving risk landscape is critical for long-term business resilience.

Underwriting practices and insurance capacity have also seen substantial changes. Data from Aon's Q1 2025 Global Insurance Market Overview reveals these shifts across major business lines. Global cyber premiums are forecast to hit $16.6 billion in 2025, an 8% rise from 2024, underscoring the growing need for cyber insurance. For more detailed statistics, refer to this report: Aon's Q1 2025 Global Insurance Market Overview.

Technology's Impact on Insurance

Technology is transforming how insurance policies are delivered and claims are processed. Digital platforms and online portals are simplifying the application process, making it faster and more convenient. These platforms also provide increased transparency and control over policy administration.

Advancements in data analytics and artificial intelligence are enhancing risk assessment and claims handling. This improved efficiency and accuracy can streamline operations and reduce costs for both insurers and businesses. These technological developments ultimately benefit businesses by simplifying insurance management and potentially lowering expenses.

Specialized Markets and Carrier Consolidation

New specialized insurance markets are emerging to cover previously uninsurable risks. This provides coverage options for niche sectors and specific business exposures. For instance, parametric insurance, which disburses payments based on pre-determined triggers, is growing in popularity for weather-related coverage. This expansion of specialized markets offers tailored solutions for unique business needs.

However, consolidation among insurance carriers is also impacting the market. Fewer carriers can lead to decreased competition and potentially higher premiums. This emphasizes the importance of comparing options from different providers. Businesses need to be proactive in evaluating choices and negotiating terms to secure the most favorable coverage.

Leveraging New Insurance Models

Progressive businesses are exploring innovative insurance models to enhance their coverage and cost-effectiveness. Captive insurance programs, where a business establishes its own insurance company, provide greater control over risk management. This approach can offer significant cost savings and tailored coverage.

Digital platforms are also expanding access to a wider array of insurance providers and customized coverage solutions. This empowers businesses to develop a more strategic and individualized approach to their insurance needs. By adapting to these evolving market dynamics, businesses can safeguard their financial security and stability.

Turning Insurance Claims Into Positive Outcomes

A solid understanding of business insurance basics includes knowing how to effectively navigate the claims process. When disaster strikes, your response can significantly impact your recovery. This section offers a practical guide to navigating insurance claims, from the initial incident to the final settlement.

First Steps: Protecting Your Rights and Maximizing Settlement Potential

The initial steps after an incident are critical. This is when you build the foundation for a successful claim. Thorough documentation is paramount. This includes taking photographs, gathering witness statements, and preserving any physical evidence. Promptly notifying your insurance carrier is equally crucial. Delays can negatively affect your claim. Your insurer needs complete information about the incident, much like a doctor needs a comprehensive medical history for an accurate diagnosis. These initial actions protect your rights and maximize your settlement potential.

Documentation Practices: Building a Strong Case

Detailed documentation is the cornerstone of a strong insurance claim. Maintain meticulous records of all communication with your insurer. This includes phone calls, emails, and letters. Keep a detailed log of all expenses incurred because of the incident. This might include repair costs, lost income, and other related expenses. Think of your documentation as building a legal case, piece by piece. Comprehensive records substantially strengthen your position during the process and increase the likelihood of a favorable outcome.

Avoiding Common Mistakes: Preventing Claim Denials

Several common errors can lead to claim denials. Failing to thoroughly understand your policy terms is a frequent oversight. Not providing sufficient documentation or misrepresenting information can also jeopardize your claim. These mistakes can be easily avoided by carefully reviewing your policy and keeping diligent records. Just as a lawyer meticulously prepares for trial, you must thoroughly prepare for the claims process. This proactive approach helps prevent claim denials.

Negotiation Techniques for Disputed Claims

Disputes sometimes arise during the claims process. Effective negotiation can be key to resolving these disagreements. Clearly articulate your position, supporting it with evidence and documentation. Be prepared to compromise, but also be firm about your rights under the policy. Negotiating a claim can be like walking a tightrope. It requires both assertiveness and flexibility to reach a mutually acceptable resolution.

Seeking Professional Assistance: Knowing When to Engage an Expert

While some claims can be handled internally, others may benefit from professional help. Public adjusters can advocate for you, helping ensure a fair settlement. Attorneys can provide legal guidance, especially in complex or disputed claims. Knowing when to engage these professionals can greatly influence the outcome. Similar to consulting a specialist for a complex medical issue, consider engaging an expert for complex insurance claims. This specialized assistance can be extremely valuable.

Maintaining Business Operations: Practical Strategies During Claim Processing

Dealing with an insurance claim can disrupt your business. Implementing strategies to maintain operations during this time is essential. This might involve setting up temporary workspaces, utilizing backup systems, or outsourcing essential tasks. These practical steps minimize disruptions and ensure business continuity, allowing you to focus on recovery.

Leveraging Claim Experiences: Strengthening Your Risk Management Program

Every claim is a learning opportunity. Use these experiences to strengthen your risk management program. Identify vulnerabilities that contributed to the incident and implement measures to mitigate them. This proactive approach can reduce the likelihood of future claims and enhance your overall risk profile. For instance, if a fire caused significant damage, review and update your fire safety procedures. This long-term perspective can save you time, money, and stress in the future.

Securing More Favorable Coverage Terms: Using Claims Data to Your Advantage

Your claims history affects future coverage terms. Use your claims data to negotiate better terms with your insurer. Highlight improvements in your risk management program to justify lower premiums or enhanced coverage. This strategic approach can help you secure more favorable terms down the line.

Navigating the insurance claims process can be challenging. However, with a clear understanding of the process and the right approach, you can turn a potentially negative event into a positive outcome. By taking proactive steps, documenting incidents thoroughly, and knowing when to seek professional assistance, you can protect your business and ensure a smooth recovery.

Ready to simplify your business insurance and ensure you have the appropriate coverage? Contact Wexford Insurance Solutions today. We offer personalized service and technology-driven solutions to help you navigate the intricacies of business insurance. Visit us at Wexford Insurance Solutions to learn more.

Article created using Outrank

Workers comp Experience Mods and how they effect your premium and ultimately your bottom line.

Workers comp Experience Mods and how they effect your premium and ultimately your bottom line. Private Client Insurance: Protect Your High-Value Assets

Private Client Insurance: Protect Your High-Value Assets