The Real-World Power of Asset Protection Insurance

Asset protection insurance isn't just about having basic coverage; it's a strategic approach to safeguarding your wealth and future. Think of it as a financial shield, protecting your hard-earned assets from various threats. These threats can include lawsuits, creditor claims, accidents, or even natural disasters.

This proactive approach to financial security provides a crucial safety net. It allows you to focus on your goals without constantly worrying about potential losses.

Understanding the Value of a Financial Safety Net

Imagine asset protection insurance as a fortified wall around your financial resources. While standard insurance policies often cover common risks, they can leave gaps in your defenses. Asset protection insurance fills those gaps, offering specialized protection tailored to your specific needs and vulnerabilities.

This specialized coverage addresses potential scenarios that typical policies might overlook. For instance, if you're involved in a lawsuit and a judgment exceeds your standard liability coverage, asset protection insurance can cover the excess. This prevents the seizure of your personal assets.

The Growing Importance of Asset Protection

The need for robust asset protection is increasingly important. The global insurance market, which includes asset protection insurance, is experiencing substantial growth. Insurance premiums are expected to grow by 3.3% in 2024, with advanced markets contributing 75% of this expansion.

This growth highlights a rising global awareness of the importance of protecting one's assets. You can find more detailed statistics here: Deloitte Insights. This trend reflects a broader movement toward proactive risk management. It also shows a greater understanding of the potential financial devastation unforeseen events can cause. Individuals and businesses are becoming more proactive in securing their financial futures.

Real-World Examples: How Asset Protection Makes a Difference

The true value of asset protection insurance lies in its real-world impact. Countless cases demonstrate how these policies have saved individuals and businesses from financial ruin.

For example, consider a business owner facing a lawsuit related to a product defect. Without adequate asset protection, their personal assets could be at risk. With the right coverage, however, their personal wealth remains protected, allowing them to rebuild and move forward.

Similarly, a homeowner facing a significant liability claim after an accident on their property can rely on asset protection insurance. This coverage can handle the costs, preventing the loss of their home or other assets.

These examples emphasize the vital role of asset protection in mitigating financial risks and preserving financial stability. Protecting your assets isn't just about preserving wealth; it's about ensuring peace of mind and navigating life's uncertainties with confidence.

Beyond Basic Coverage: Asset Protection Policies That Work

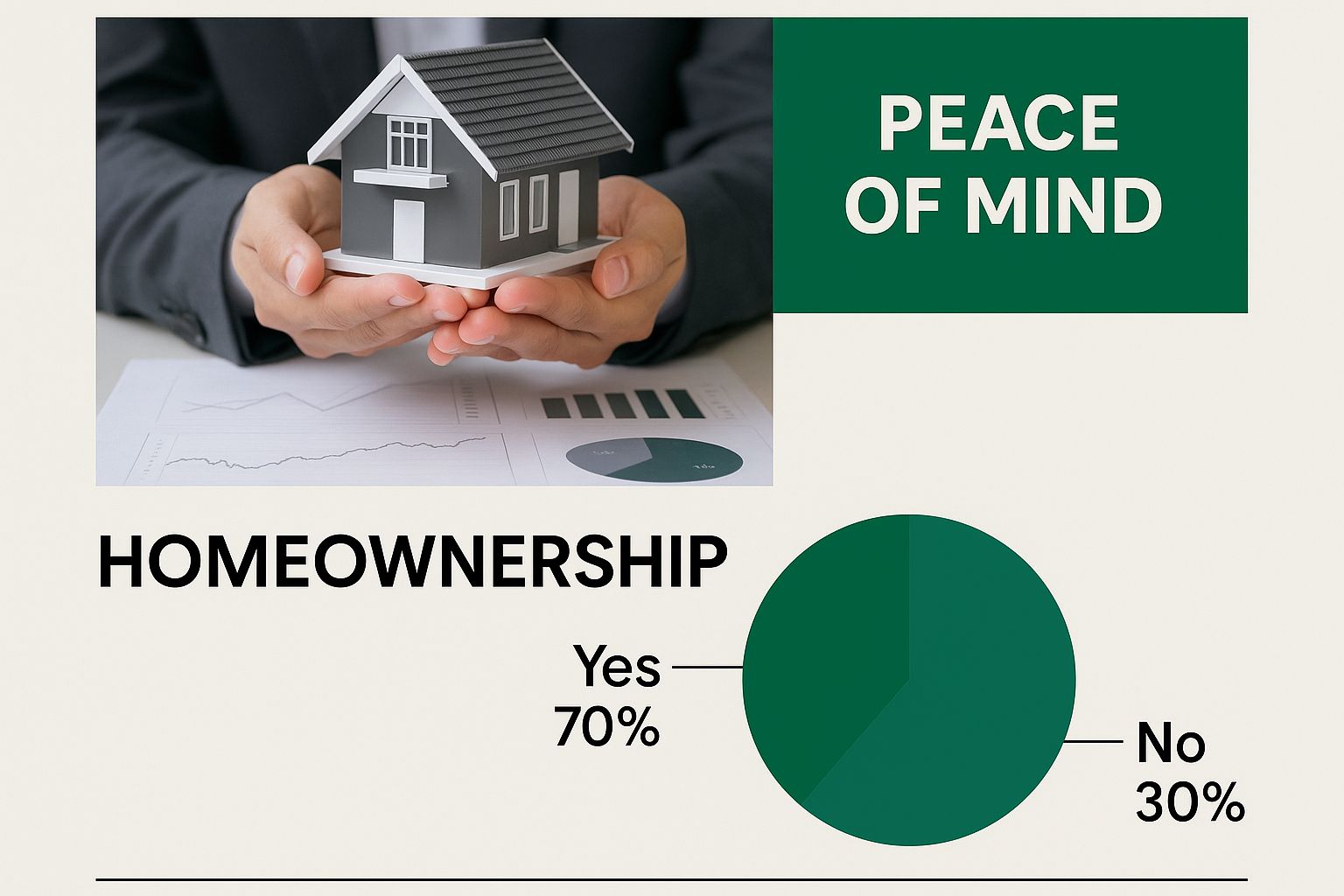

The infographic above illustrates the peace of mind achieved through protecting your home and finances. It represents the core purpose of asset protection insurance: securing your financial future. The image evokes the feeling of stability provided by a strong financial safety net.

Protecting your assets is a multifaceted endeavor. Not all asset protection insurance policies are created equal. Understanding the nuances of each policy is vital. We'll explore specialized policies designed for various asset classes, including real estate, vehicles, business assets, and personal valuables. For further insights into private client insurance, you can explore this helpful resource: How to master….

Specialized Policies for Comprehensive Protection

Different assets require different types of coverage. Your real estate, for example, might need specialized coverage beyond your standard homeowner's insurance. Likewise, protecting your vehicles often goes beyond basic auto insurance. For practical applications of asset protection, consider reviewing these asset protection insurance strategies.

Protecting your assets requires a multi-layered approach. Umbrella policies offer additional liability coverage beyond your existing policies. GAP insurance, or Guaranteed Auto Protection, covers the difference between your vehicle's actual cash value and the outstanding loan balance, a crucial consideration for new car owners. Strategic policy riders can further enhance your coverage by adding tailored protections.

Coverage Limitations and Strategic Combinations

Understanding your policy's details is essential. This includes being aware of coverage limitations. Some policies have exclusions that could leave you vulnerable. Knowing these limitations is critical for comprehensive protection. For instance, certain lawsuits or damages from specific events may not be covered.

Effective asset protection often involves a combination of strategies. A multi-layered approach, combining insurance with legal structures like trusts and LLCs, offers the most robust protection. Diversifying your protection methods minimizes vulnerabilities and maximizes security.

The Growth of GAP Insurance: A Market Indicator

The increasing importance of asset protection, particularly in the automotive sector, is reflected in current market trends. The GAP insurance market is experiencing significant growth. It's projected to rise from $3.97 billion in 2024 to $4.38 billion in 2025, reflecting a 10.3% CAGR. This growth is driven by higher vehicle sales and increased transportation demand. The market is further projected to reach $6.48 billion by 2029, fueled by online marketplaces, personalized insurance solutions, and technologies like Usage-Based Insurance (UBI). To learn more about these trends, explore this report on GAP insurance and market trends. This expansion highlights the growing global demand for robust asset protection solutions and the increasing awareness of protecting valuable assets like vehicles from financial loss.

The following table provides a comparison of various asset protection insurance types:

Comparison of Asset Protection Insurance Types

This table compares different types of asset protection insurance policies across key features and benefits.

| Insurance Type | Assets Protected | Average Cost | Key Benefits | Typical Exclusions |

|---|---|---|---|---|

| Umbrella Insurance | Broad range of assets (home, auto, etc.) | $150-$300 per year | Extends liability coverage beyond existing policies | Intentional acts, business liabilities (unless specifically covered) |

| GAP Insurance | Vehicles | $400-$700 (one-time fee) | Covers the "gap" between loan balance and vehicle's actual cash value after an accident | Mechanical breakdowns, normal wear and tear |

| Homeowners Insurance | Home and personal property | Varies based on location and coverage | Protects against property damage, theft, and liability | Flood, earthquake (often requires separate policies) |

| Business Insurance | Business assets, including property and equipment | Varies widely based on industry and risk | Protects against property damage, liability, and business interruption | Specific events like pandemics (may require separate coverage) |

This table highlights the importance of selecting the right type of asset protection insurance based on your specific needs. While umbrella insurance provides broad liability coverage, GAP insurance focuses specifically on vehicle financing. Homeowners and business insurance offer specialized protection for their respective asset classes. By carefully considering the assets you need to protect and the potential risks you face, you can build a comprehensive asset protection strategy.

The Shifting Landscape of Asset Protection Solutions

Asset protection insurance isn't a fixed concept. It's a dynamic field, constantly evolving to meet new challenges and leverage emerging opportunities. Technology, economic shifts, and changing risk profiles are all reshaping the available protection options. Staying informed about these developments is essential for effectively safeguarding your wealth.

Emerging Insurance Models and Digital Transformation

The insurance industry is embracing innovation. New insurance models are moving beyond one-size-fits-all solutions to offer more personalized coverage. This shift allows individuals and businesses to tailor their protection strategies to their specific needs and risk exposures. For example, some insurers now offer policies with premiums that adjust based on real-time risk assessments.

Digital transformation is another key driver of change. Online platforms and mobile apps are making comprehensive asset protection more accessible. This empowers individuals to research, compare, and manage their insurance coverage more easily and efficiently.

Global Market Trends and Adapting Your Strategy

The broader insurance market significantly influences the asset protection insurance sector. For example, personal lines Property and Casualty (P&C) insurance premiums experienced a 9.5% increase from 2022 to 2023, reaching a total of $1.1 trillion. This growth surpassed nominal global GDP by half a percentage point, indicating robust demand for asset protection products. You can find more detailed statistics in the McKinsey Global Insurance Report.

This trend highlights the growing awareness of the importance of protecting assets from unforeseen risks. The increasing preference for excess over primary coverages is also impacting how asset protection insurance is structured and priced. In this dynamic environment, forward-thinking individuals and businesses are proactively adjusting their asset protection approaches. For contractors, understanding professional liability insurance is crucial, as explained in this article: Understanding Professional Liability Insurance for Contractors.

They are staying ahead of emerging threats, such as cyberattacks and data breaches, by integrating new types of coverage into their strategies. They are also optimizing their insurance investments to maximize security while minimizing costs.

Proactive Asset Protection in a Changing World

This proactive approach involves continually reassessing risk exposures, exploring new protection options, and adapting strategies as needed. It also requires staying informed about industry trends and consulting with experts to ensure coverage remains adequate and effective.

By understanding the forces shaping the asset protection landscape, individuals and businesses can make informed decisions. These decisions will enable them to build a robust and resilient financial foundation – one that can withstand uncertainty and protect their assets over the long term.

Mapping Your Asset Protection Needs With Precision

Effective asset protection requires more than a one-size-fits-all approach. It demands a precise, personalized strategy built on understanding your specific vulnerabilities. This section will guide you through the key steps of creating a tailored asset protection plan.

Conducting a Comprehensive Asset Inventory

The first step is understanding exactly what you need to protect. Create a detailed inventory of all your assets, from obvious items like your house and car to less obvious ones like valuable collections or intellectual property. Include not just a list of these assets, but also their estimated current market value.

This comprehensive inventory highlights potential vulnerabilities and forms the bedrock of your protection plan. It allows you to ask crucial questions. For example, are certain assets more susceptible to lawsuits or market fluctuations? Knowing this helps prioritize your protection efforts.

Identifying Risk Exposure and Coverage Levels

Once you have a clear picture of your assets, assess the risks each one faces. This includes considering the likelihood of lawsuits, market volatility, and potential natural disasters. A doctor, for instance, may face different liability risks than a writer. A business owner might have assets exposed to market fluctuations.

By identifying these risks, you can determine the right coverage levels. Ensure your insurance policies provide sufficient protection for each asset's value. This is especially important for high-value items that might exceed standard policy limits. Understanding the challenges of regulatory compliance is also essential.

Life Events and Reassessments

Your asset protection needs are not static; they change throughout your life. Major events like marriage, the growth of a business, or acquiring property can significantly impact your risk profile. These changes require regular review and adjustments to your asset protection strategy.

Getting married, for example, might mean updating beneficiaries on your policies or considering joint ownership of assets. Starting a business introduces new liabilities that require specialized coverage. Regular reassessments ensure your plan stays current with your evolving needs.

Prioritizing Assets and Identifying Coverage Gaps

Not all assets are created equal. Some hold more financial value, while others carry significant sentimental value. Prioritizing helps you identify which assets require the most protection. This involves considering both financial and personal value.

A family heirloom, for instance, might not be financially valuable but could hold immense sentimental significance, making it a high priority for protection. Identifying coverage gaps is also important. Carefully examine your existing policies to ensure they address all identified risks. Look for any exclusions or limitations that could leave you vulnerable and address these with additional coverage or alternative protection strategies.

Asset Protection Risk Assessment Matrix

This table helps readers evaluate their assets' risk exposure and appropriate insurance coverage levels

| Asset Category | Value Range | Risk Factors | Recommended Coverage | Protection Priority |

|---|---|---|---|---|

| Primary Residence | $500,000 – $1,000,000+ | Fire, Theft, Liability | Homeowners Insurance, Umbrella Insurance | High |

| Vehicle | $20,000 – $100,000+ | Accidents, Theft | Auto Insurance, GAP Insurance | Medium |

| Business Assets | Varies Widely | Lawsuits, Market Fluctuations | Business Interruption Insurance, Professional Liability Insurance | High |

| Investments | Varies Widely | Market Volatility | Portfolio Diversification, Investment Insurance (if applicable) | Medium |

This table provides a starting point for evaluating your assets and associated risks. By systematically assessing each category, you can create a personalized protection plan that addresses your specific needs and circumstances. This allows you to make informed decisions about your financial future and effectively protect what matters most.

Is Asset Protection Insurance Worth The Investment?

Protecting your assets is crucial for financial planning. With the variety of options available, it's understandable to question the value of asset protection insurance. This section explores the cost-benefit analysis of these policies to help you make informed decisions about safeguarding your wealth. You might be interested in: How to master business insurance basics.

Understanding Premium Calculations

Asset protection insurance premiums are calculated based on several key factors. These include the types of assets being protected, their value, and the perceived level of risk. For instance, insuring a high-value property in a disaster-prone area will likely result in a higher premium compared to insuring a less valuable property in a low-risk zone.

Your personal risk profile, including your credit and claims history, also influences your premium. It's similar to car insurance: drivers with accident histories typically pay more than those with clean records.

Factors Influencing Costs

Several factors influence asset protection insurance costs. The value of your assets is a primary driver. Higher value often requires more coverage, leading to higher premiums. The risk level associated with those assets is also important. Assets prone to theft or damage generally need more expensive coverage.

The location of your assets matters as well. Properties in high-risk areas, such as those susceptible to natural disasters, will have higher premiums. Lastly, the specific policy features you choose, like higher coverage limits or added riders, will affect the overall cost.

Return on Investment: Coverage Elements That Matter

While asset protection insurance has a cost, the potential benefits can significantly outweigh the expense. The true return on investment (ROI) lies in the protection it offers against unforeseen events like lawsuits or natural disasters. Without sufficient protection, these events could decimate your savings.

Asset protection insurance acts as a safety net, mitigating these risks and preserving your financial well-being. Specific coverage elements, such as high liability limits and comprehensive coverage for various perils, can be particularly valuable. These offer substantial protection and justify potential premium increases.

Scenarios: Protection vs. Inadequate Coverage

Comparing scenarios can highlight the value of this insurance. Imagine two individuals with comparable assets: one with comprehensive protection and the other with insufficient coverage. If a major lawsuit arises, the protected individual might avoid significant financial loss, while the other could face devastating consequences, including property loss.

A similar comparison applies to natural disasters. The adequately insured individual will have the resources to rebuild, but the other person might struggle to recover financially. These scenarios demonstrate the importance of robust asset protection.

Optimizing Coverage Without Compromising Security

Balancing cost and coverage is crucial. You can optimize your asset protection insurance by carefully assessing your needs and risk tolerance. Consider increasing deductibles to lower premiums, but be prepared for higher out-of-pocket expenses if you make a claim. Bundling different insurance types, such as home and auto, can also save money.

Regularly review and adjust your coverage as needed. As your assets grow or your risk profile changes, ensure your insurance remains adequate. Proactive choices and informed decisions help optimize your coverage without compromising your financial security.

Building Your Asset Protection Fortress

Planning forms the foundation of any successful endeavor, and asset protection is no different. It's time to put your asset protection plan into motion. This involves a more strategic approach than simply buying insurance. It requires a comprehensive strategy integrating insurance, legal structures, and financial planning to achieve maximum security.

Assembling Your Team of Professionals

Creating a robust asset protection plan often requires the guidance of various professionals. This can include risk management professionals, attorneys specializing in asset protection, and financial advisors. These experts offer valuable insights tailored to your specific situation.

Choosing the right professionals is key. Look for individuals with a proven track record in asset protection and a thorough understanding of your unique needs. For instance, a business owner will likely require different expertise compared to a high-net-worth individual. A coordinated team ensures all elements of your plan work together harmoniously.

Coordinating Asset Protection With Wealth Management

Asset protection shouldn't be a standalone strategy. It should be an integral part of your overall wealth management approach. Your asset protection plan should complement your investment goals, retirement planning, and estate planning.

This integrated approach creates synergy between your different financial objectives. For example, certain legal structures used for asset protection, such as trusts, can also be effective estate planning tools. This coordination maximizes efficiency and aligns all aspects of your financial life.

Regular Review and Adaptation: A Dynamic Approach

Your asset protection needs aren't fixed. They change as your life and circumstances do. Regularly reviewing your plan is crucial for maintaining its effectiveness.

This includes examining your insurance policies, evaluating the performance of your legal structures, and adapting your strategy as life events unfold. Significant changes like marriage, business growth, or the purchase of major assets might necessitate adjustments to your plan. This dynamic approach ensures your protection remains relevant and comprehensive.

Navigating Implementation Challenges

Implementing an asset protection plan can present obstacles. One common hurdle is understanding policy exclusions. Thoroughly review your insurance policies to clearly understand what is and isn't covered. Be mindful of any limitations or exceptions that could create vulnerabilities.

Properly documenting valuable assets is another vital step. Keeping accurate records of ownership, appraisals, and other pertinent information is crucial in the event of a claim. Proactively addressing these challenges significantly improves the effectiveness of your asset protection plan.

Building and Maintaining Your Fortress

Building a strong asset protection system is a continuous process, not a one-time event. It demands careful planning, diligent execution, and consistent maintenance. Much like a fortress, your asset protection plan requires solid foundations and regular upkeep to withstand potential threats.

By following these steps and collaborating with qualified professionals, you can establish an asset protection system that offers genuine peace of mind. This allows you to focus on your objectives, confident in the security of your financial future.

Are you ready to build your asset protection fortress and safeguard your financial future? Contact Wexford Insurance Solutions today at https://www.wexfordis.com for a personalized consultation. Our experienced team can guide you through the complexities of asset protection and develop a customized plan to address your specific needs.

Private Client Insurance: Protect Your High-Value Assets

Private Client Insurance: Protect Your High-Value Assets 7 Estate Tax Planning Strategies to Protect Your Legacy

7 Estate Tax Planning Strategies to Protect Your Legacy