Securing Your Family's Future: Smart Estate Tax Planning

Estate tax planning strategies are crucial for preserving your wealth and ensuring a smooth transfer of assets to your heirs. This listicle outlines seven key estate tax planning strategies to minimize tax liabilities and maximize your legacy. Learn about Irrevocable Life Insurance Trusts (ILITs), Grantor Retained Annuity Trusts (GRATs), Family Limited Partnerships (FLPs), Charitable Remainder Trusts (CRTs), Qualified Personal Residence Trusts (QPRTs), Annual Gifting, and Intentionally Defective Grantor Trusts (IDGTs). Understanding these strategies empowers you to protect your family's financial future.

1. Irrevocable Life Insurance Trust (ILIT)

An Irrevocable Life Insurance Trust (ILIT) is a powerful estate tax planning strategy that allows high-net-worth individuals to remove life insurance proceeds from their taxable estate. This means that the death benefit passes to beneficiaries tax-free, preserving wealth and providing immediate liquidity for expenses like estate taxes, debts, or ongoing business operations. The grantor funds the trust by making gifts to it, which the trustee then uses to pay the insurance premiums. A key component of an ILIT involves sending "Crummey notices" to beneficiaries, granting them a temporary right to withdraw the gifted funds. This satisfies certain legal requirements, allowing the gifts to qualify for annual gift tax exclusions.

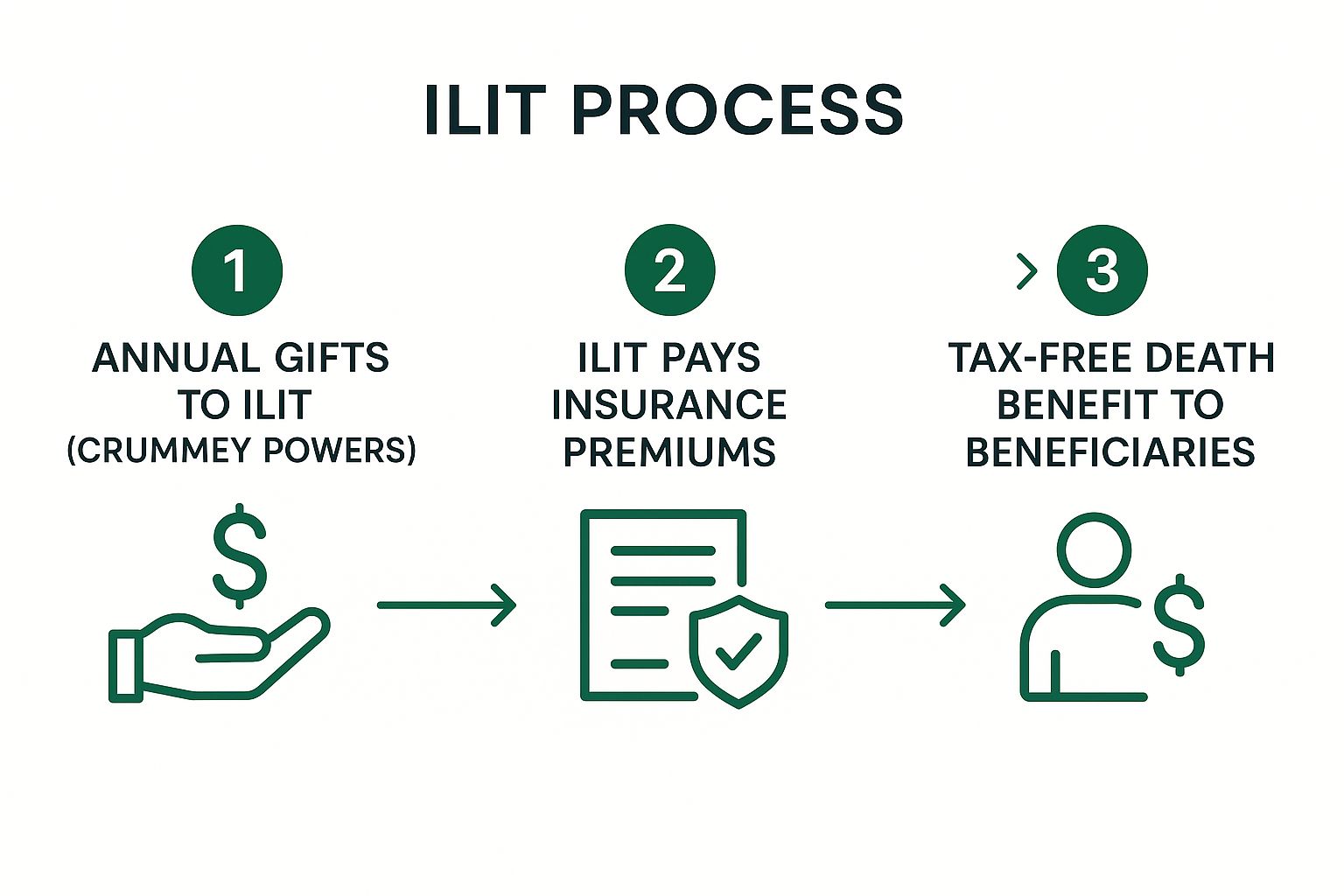

The infographic below visualizes the process flow of establishing and utilizing an ILIT. It illustrates the step-by-step journey from creating the trust and funding it to the eventual distribution of the death benefit.

As illustrated, the grantor makes contributions to the ILIT, which then uses these funds to pay premiums on the life insurance policy. Upon the grantor’s death, the death benefit is paid to the trust and distributed to the beneficiaries, bypassing the estate and avoiding estate taxes. The sequence highlights the importance of the trust owning the policy and managing the funds outside of the estate.

This approach deserves a place in any comprehensive estate tax planning strategy due to its effectiveness in minimizing tax liabilities and maximizing the inheritance passed on to beneficiaries. It’s particularly beneficial for high-net-worth individuals and business owners. For example, a business owner could establish an ILIT to provide liquidity for estate taxes, allowing heirs to retain the business rather than being forced to sell it to cover tax burdens. High-net-worth families can utilize ILITs as part of a multi-generational wealth transfer plan.

Pros:

- Insurance proceeds avoid estate taxation.

- Provides immediate liquidity upon death.

- Can leverage annual gift tax exclusions through Crummey powers.

- Protects assets from creditors and spendthrift beneficiaries.

Cons:

- Irrevocable structure means loss of control over assets.

- Administrative burden of sending annual Crummey notices.

- Premiums paid are typically not tax-deductible.

- Requires careful planning and professional guidance.

Tips for Implementing an ILIT:

- Select an independent trustee to avoid inclusion in the estate.

- Ensure Crummey notices are properly delivered to beneficiaries.

- Consider using annual exclusion gifts to fund premium payments.

- Review beneficiary designations regularly.

- Choose the appropriate life insurance product based on long-term objectives.

When considering estate tax planning strategies, an ILIT can be a valuable tool. Learn more about Irrevocable Life Insurance Trust (ILIT) for a deeper understanding of this important strategy. Consulting with an estate planning attorney and financial advisor is crucial to ensure proper implementation and alignment with your individual circumstances and objectives.

2. Grantor Retained Annuity Trust (GRAT)

A Grantor Retained Annuity Trust (GRAT) is a sophisticated estate tax planning strategy designed to transfer appreciating assets to beneficiaries (typically children or grandchildren) while minimizing gift tax consequences. It works by allowing the grantor (the individual creating the trust) to transfer assets into the trust while retaining the right to receive fixed annuity payments for a specified term, typically 2 to 10 years. At the end of this term, any remaining assets in the trust, including any appreciation, pass to the designated beneficiaries. GRATs are particularly effective in a low-interest-rate environment and with assets expected to appreciate significantly. This makes them a powerful tool for high-net-worth individuals looking to efficiently transfer wealth to future generations.

The GRAT's effectiveness as an estate tax planning strategy lies in its ability to "freeze" the value of the assets for gift tax purposes. The gift tax is calculated based on the present value of the assets transferred to the trust, less the present value of the annuity payments the grantor will receive. This calculation uses a rate of return mandated by the IRS (Section 7520 rate). If the assets within the GRAT appreciate at a rate higher than the Section 7520 rate, that appreciation effectively passes to the beneficiaries free of gift tax. A "zeroed-out GRAT" is a specific type of GRAT designed to minimize the gift tax as much as possible, often resulting in a negligible gift.

Features and Benefits:

- Fixed Term: Typically 2-10 years.

- Annuity Payments: Grantor receives regular payments during the trust term.

- Appreciation Transfer: Focuses on transferring the appreciation of assets, not the principal itself.

- Zeroed-Out GRAT: Can be structured to virtually eliminate gift tax.

Pros:

- Minimizes Gift Tax: Shifts future appreciation to beneficiaries with minimal or no gift tax.

- Income Stream: Grantor retains an income stream during the trust term.

- Effective with Volatile Assets: Particularly suitable for assets with high growth potential.

Cons:

- Mortality Risk: If the grantor dies during the GRAT term, assets may be included back into the estate.

- Performance Requirement: Assets must outperform the IRS Section 7520 rate for the GRAT to be effective.

- Limited Generation-Skipping Transfer Tax Benefits: GRATs offer limited benefits for transferring wealth across multiple generations.

- Complexity: Requires sophisticated legal and tax advice for proper structuring and implementation.

Examples of Successful Implementation:

- Mark Zuckerberg, the founder of Facebook, reportedly utilized GRATs to transfer pre-IPO shares with minimal tax impact.

- Business owners frequently use GRATs before selling their company, effectively transferring the appreciation of their business interests to their heirs.

Tips for Utilizing a GRAT:

- Shorter Terms: Consider shorter terms to mitigate mortality risk.

- High-Growth Assets: Use with assets likely to appreciate significantly, such as pre-IPO stock or rapidly growing business interests.

- Rolling GRATs: Create "rolling" or "cascading" GRATs for ongoing benefits.

- Low-Interest Rate Environment: Time GRAT creation during periods of low interest rates to maximize benefits.

Popularized By:

- The Walton family (Walmart)

- Many Silicon Valley executives and founders

A GRAT deserves its place in the list of estate tax planning strategies due to its potential for significant tax savings when transferring appreciating assets. However, due to its complexities and potential drawbacks, it's crucial to seek professional legal and tax counsel before implementing a GRAT as part of your estate plan. This strategy is particularly relevant for high-net-worth individuals and families concerned with minimizing estate tax burdens and efficiently transferring wealth to future generations.

3. Family Limited Partnership (FLP)

A Family Limited Partnership (FLP) is a powerful estate tax planning strategy that allows families to efficiently manage and transfer wealth across generations while potentially minimizing estate tax liabilities. It achieves this by structuring ownership of assets within a partnership framework, distinguishing between general and limited partners. This structure allows for the gradual transfer of wealth while maintaining family control over the assets. The FLP is a crucial tool in comprehensive estate tax planning because it combines asset management, wealth transfer, and tax benefits.

Typically, senior family members (often parents) act as general partners, retaining control over the partnership's assets and operational decisions. Children or trusts established for their benefit become limited partners. While limited partners have economic rights to the partnership's assets and income, they have limited control over management. This distinction is key to the tax advantages of an FLP, as the limited partnership interests held by the younger generation can often be valued at a discount for gift and estate tax purposes due to their lack of control and marketability. This means the value of the gifts made to the limited partners is reduced, thus lowering the applicable gift and estate taxes.

Features and Benefits of an FLP:

- Partnership Structure: Clear delineation between general and limited partners.

- Control Retention: General partners maintain control over assets and operations.

- Valuation Discounts: Limited partnership interests often qualify for significant valuation discounts (potentially 20-40%) for gift and estate tax purposes.

- Asset Protection: Assets held within the FLP can offer a degree of protection from creditors and divorcing spouses (though this varies by jurisdiction).

- Succession Planning: Facilitates smooth transition of family businesses or other assets to the next generation.

- Consolidated Management: Streamlines management of family assets within a single entity.

Pros:

- Maintains family control of assets during wealth transfer.

- Significant potential for valuation discounts, minimizing gift and estate taxes.

- Enhanced asset protection.

- Facilitates business succession planning.

- Streamlined asset management.

Cons:

- Increased IRS scrutiny; the FLP must have a legitimate business purpose beyond tax avoidance.

- Administrative requirements, including annual meetings and separate accounting.

- Valuation discounts can be challenged by the IRS.

- Limited liability protection compared to some other entity structures.

Examples:

- A family with significant real estate holdings transfers the properties to an FLP to manage them more efficiently and gradually transfer ownership to the next generation.

- A family-owned business utilizes an FLP structure to transition ownership to the children while the parents retain control during their lifetime.

Tips for Successful FLP Implementation:

- Maintain meticulous partnership formalities, including regular meetings and thorough documentation.

- Strictly avoid commingling personal and partnership assets.

- Establish a legitimate business purpose beyond tax savings.

- Obtain a professional valuation from a qualified appraiser to support claimed discounts.

- Consider using an FLP in conjunction with an annual gifting strategy to maximize tax benefits.

When and Why to Use an FLP:

An FLP is a valuable estate tax planning strategy for families with substantial assets, especially those seeking to:

- Minimize estate tax liabilities.

- Maintain control over family assets during wealth transfer.

- Facilitate smooth business succession.

- Protect assets from creditors and legal challenges.

High-net-worth families and business owners, like the Pritzker family (Hyatt Hotels), have successfully used FLPs to manage their wealth and transfer it to future generations. Estate planning attorneys frequently recommend FLPs as part of a comprehensive estate plan. Learn more about Family Limited Partnership (FLP) to determine if it's the right strategy for your needs. Remember to consult with experienced legal and financial professionals to ensure proper implementation and compliance.

4. Charitable Remainder Trust (CRT)

A Charitable Remainder Trust (CRT) is a powerful estate tax planning strategy that allows you to benefit both your loved ones and your chosen charities. It's a type of irrevocable split-interest trust, meaning it benefits two parties: a non-charitable beneficiary (typically you or your family) and a charitable organization. This approach deserves a spot on this list due to its unique ability to reduce estate taxes, avoid capital gains on appreciated assets, and generate an income stream, all while supporting philanthropic goals. It's a particularly attractive option for those with highly appreciated assets they wish to sell, but are hesitant due to the potential tax implications.

How it Works:

You transfer assets into the irrevocable CRT. The trust then sells these assets, ideally without incurring capital gains tax, thanks to the trust's tax-exempt status. The proceeds are invested, and the trust pays a regular income stream to the designated non-charitable beneficiaries for a specified term (up to 20 years or the lifetime of the beneficiaries). After this term, the remaining assets in the trust are distributed to the pre-selected charitable organization(s).

There are two main types of CRTs:

- Charitable Remainder Annuity Trust (CRAT): Pays a fixed annual amount to the non-charitable beneficiary.

- Charitable Remainder Unitrust (CRUT): Pays a variable annual amount to the non-charitable beneficiary, typically a fixed percentage of the trust's assets revalued annually.

Examples of Successful Implementation:

High-profile philanthropists like Bill Gates and Warren Buffett have made extensive use of charitable trusts, including CRTs, as part of their estate planning and charitable giving strategies. More commonly, retired executives holding significant amounts of appreciated company stock often use CRTs to diversify their holdings, avoid a large immediate capital gains tax hit, and create an income stream. University endowment programs frequently promote CRTs to alumni as a way to make significant charitable gifts while also receiving financial benefits.

Pros:

- Immediate Income Tax Deduction: You receive a tax deduction in the year the CRT is funded, based on the present value of the future charitable remainder.

- Avoidance of Capital Gains Tax: Appreciated assets can be sold within the trust without triggering immediate capital gains tax.

- Income Stream: Provides a steady income stream to you or other designated beneficiaries.

- Estate Tax Reduction: Assets placed in the CRT are removed from your taxable estate, potentially reducing estate tax liability.

- Charitable Giving: Supports causes you care about.

Cons:

- Irrevocability: The trust is irrevocable, meaning you generally cannot change the charitable beneficiary or retrieve the assets once the trust is established.

- Complex Administration: CRTs have specific administrative and compliance requirements that necessitate professional management.

- Reduced Inheritance: Heirs may receive less inheritance overall as a portion of the assets is designated for charity.

- Taxable Income Payments: Income payments from the CRT are taxable to the recipients.

Actionable Tips:

- Fund with Appreciated Assets: CRTs are most effective when funded with highly appreciated assets with a low cost basis.

- CRAT vs. CRUT: Carefully consider whether a fixed-payment CRAT or variable-payment CRUT better suits your income needs.

- Wealth Replacement Trust: Explore pairing a CRT with a wealth replacement trust funded by life insurance to offset the reduction in inheritance for your heirs.

- Experienced Trustee: Select a trustee with experience in managing CRTs and complying with their complex requirements.

- Aligned Charities: Choose charitable beneficiaries that are aligned with your personal values and philanthropic goals.

When and Why to Use a CRT:

A CRT is a valuable estate tax planning strategy for individuals with:

- Highly appreciated assets: Especially those who wish to sell these assets but are concerned about capital gains taxes.

- Charitable intentions: Those who wish to support charitable organizations while also receiving financial benefits.

- A need for income: Those who seek a reliable income stream for themselves or their loved ones.

- Significant estates: Those whose estates may be subject to estate taxes.

By carefully considering the features, benefits, and drawbacks of a CRT, and working with experienced professionals, you can determine if this powerful tool is the right fit for your estate plan.

5. Qualified Personal Residence Trust (QPRT)

A Qualified Personal Residence Trust (QPRT) is a powerful estate tax planning strategy that allows homeowners to transfer their primary residence or a vacation home to their beneficiaries at a reduced gift tax value. This technique is particularly beneficial for individuals looking to minimize estate taxes and transfer wealth efficiently to future generations. It deserves a place in any discussion of estate tax planning strategies because it directly addresses a significant asset for many individuals: their home.

How a QPRT Works:

A QPRT involves placing your residence into an irrevocable trust for a predetermined period (the “term”). You retain the right to live in the home during this term. At the end of the term, ownership of the property transfers to the beneficiaries you've named in the trust document. The key advantage is that the gift tax value is calculated based on the present value of the future transfer, meaning it's discounted because the beneficiaries must wait to receive the property. This discount is greater when interest rates are high. Essentially, you're freezing the value of the home for estate tax purposes at the time the QPRT is established. Any appreciation in the property's value after the QPRT is established is removed from your estate.

Features and Benefits:

- Irrevocable Trust: The irrevocable nature of the trust removes the property from your estate.

- Retained Use: You maintain the right to live in the home for the specified term.

- Discounted Gift Tax Value: The present value calculation significantly reduces the taxable value of the gift.

- Future Appreciation Transfer: Any increase in the property’s value during and after the term benefits the beneficiaries, not your estate.

Pros:

- Reduces both gift and estate tax liability related to the residence.

- Freezes the property’s value for estate tax purposes.

- Allows you to continue living in the home during the term.

- Transfers future appreciation to the next generation.

Cons:

- Mortality Risk: If you die during the term, the property is included back into your estate, negating the tax benefits.

- Post-Term Rent: After the term expires, you must pay fair market rent to your beneficiaries to continue living in the home.

- Interest Rate Sensitivity: QPRTs are less effective in low interest rate environments as the discount is smaller.

- Limited Applicability: Only primary residences and vacation homes qualify for QPRTs.

Examples of Successful Implementation:

Jacqueline Kennedy Onassis famously used QPRTs for her Martha's Vineyard and New York properties. This strategy is also popular among affluent families in high-value real estate markets like Manhattan, San Francisco, and the Hamptons, where property appreciation is often significant.

Actionable Tips:

- Balance Term Length: Carefully consider the trade-off between a longer term (greater discount) and the increased mortality risk.

- Consider Appreciation Potential: QPRTs are most effective in areas with high property appreciation potential.

- Plan for Post-Term Arrangements: Make arrangements for post-term rental payments in advance.

- Capital Gains: Be aware of the potential capital gains tax consequences for beneficiaries when they eventually sell the property.

- Significant Appreciation: Use QPRTs with properties likely to significantly appreciate in value.

When and Why to Use a QPRT:

A QPRT is an excellent estate tax planning strategy if you:

- Own a valuable primary residence or vacation home.

- Anticipate significant appreciation in the property's value.

- Want to minimize estate taxes and transfer wealth to your heirs.

- Are comfortable with the implications of an irrevocable trust.

By carefully considering the features, benefits, and potential drawbacks, you can determine whether a QPRT is a suitable tool for your overall estate plan. Consult with an estate planning attorney to determine if a QPRT aligns with your specific financial goals and circumstances.

6. Annual Gifting Strategy: A Powerful Tool for Estate Tax Reduction

The annual gifting strategy is a simple yet effective method for reducing your taxable estate and minimizing potential estate tax liabilities. It leverages the annual gift tax exclusion, allowing you to systematically transfer wealth to your beneficiaries without incurring gift tax or using your lifetime gift and estate tax exemption. This makes it a valuable component of comprehensive estate tax planning strategies.

How it Works:

The annual gifting strategy revolves around the annual gift tax exclusion, which is $17,000 per recipient for 2023. This means you can gift up to $17,000 to as many individuals as you wish each year, completely tax-free. Furthermore, married couples can leverage "gift-splitting," effectively doubling their annual exclusion to $34,000 per recipient. This strategy allows for significant wealth transfer over time without impacting your lifetime exemption. In addition to the annual exclusion, you can make unlimited direct payments for tuition and medical expenses on behalf of any individual. These payments are made directly to the educational institution or medical provider and do not count toward the annual gift tax exclusion.

Examples of Successful Implementation:

- Grandparents gifting to grandchildren and their spouses: Grandparents could gift $17,000 each to each grandchild and each grandchild's spouse annually. This allows them to maximize the benefit of the exclusion and transfer wealth to multiple generations.

- Funding 529 plans: Annual gifts can be used to contribute to 529 education savings plans for beneficiaries, providing tax-advantaged growth for future educational expenses.

- Business succession planning: A business owner can gradually transfer shares of their company to their children each year using the annual exclusion, sometimes combined with valuation discounts for minority interests or lack of marketability, to further reduce the taxable value of the gift.

Actionable Tips:

- Set reminders: Create calendar reminders to ensure you make your annual gifts consistently.

- Gift to spouses: Consider gifting to the spouses of children or grandchildren to double the amount transferred to each family unit.

- Direct payments for education and medical expenses: Take advantage of the unlimited exclusion for direct payments to educational institutions and medical providers. This is especially useful for significant medical expenses or higher education costs.

- Gift appreciating assets: Gifting assets that are expected to appreciate in value allows you to transfer the future growth out of your estate.

- Custodial accounts and 529 plans: Use custodial accounts (UTMA/UGMA) for gifts to minors or 529 plans for education funding.

Pros and Cons:

Pros:

- Simplicity: Annual gifting is straightforward to implement and doesn't require complex trust structures.

- Gradual reduction of taxable estate: Consistent annual gifting can significantly reduce your taxable estate over time.

- Beneficiary benefit: Allows heirs to benefit from gifts during the donor's lifetime.

- Unlimited educational and medical exclusions: Provides additional opportunities for tax-free transfers.

- Minimal administration: No ongoing administrative burden associated with trusts or other legal structures.

Cons:

- Slow for large estates: It may take many years to transfer substantial wealth using only annual gifting.

- Loss of control: You relinquish control over gifted assets.

- No step-up in basis: Gifted assets do not receive a step-up in basis at the donor's death, unlike inherited assets. This means the recipient's capital gains tax liability will be based on the original cost basis.

- Requires consistency: Requires consistent implementation over many years for maximum impact.

When and Why to Use this Approach:

The annual gifting strategy is suitable for individuals and families who want a simple and effective method to reduce their taxable estate over time. It is particularly beneficial for those who are confident in their gifting decisions and are comfortable relinquishing control over the gifted assets. While it's not a quick fix for very large estates, it can be a powerful tool as part of a comprehensive estate tax plan, especially when combined with other strategies. This strategy is particularly useful when you have multiple beneficiaries, enabling you to maximize the benefit of the annual exclusion. By consistently implementing this strategy, you can significantly reduce your estate tax liability and ensure more of your wealth passes to your loved ones.

7. Intentionally Defective Grantor Trust (IDGT)

An Intentionally Defective Grantor Trust (IDGT) is a sophisticated estate tax planning strategy that allows for the transfer of wealth to future generations while minimizing gift and estate tax liabilities. It deserves a place on this list because it offers a unique combination of tax benefits and estate planning flexibility, making it a powerful tool for high-net-worth individuals, particularly those with significant appreciated assets or family businesses. This strategy hinges on a carefully crafted "defect" – the trust is designed to be treated as separate from the grantor for estate tax purposes, but not for income tax purposes.

Here's how it works: The grantor transfers assets to the irrevocable IDGT, often starting with a small "seed" gift (typically around 10% of the intended sale value). The IDGT then purchases the remaining assets from the grantor in exchange for an installment note. Because the grantor is still considered the owner for income tax purposes, they pay the income taxes on any earnings generated by the trust assets. This seemingly disadvantageous feature is actually a key benefit: the grantor's payment of these taxes is considered an additional tax-free gift to the trust beneficiaries, further reducing the size of the taxable estate. As the assets within the trust appreciate, that growth occurs outside of the grantor's estate, effectively shielding it from future estate taxes.

Features and Benefits:

- Dual Tax Status: The trust is a separate entity for estate tax purposes, but not income tax purposes.

- Seed Gift: Often funded initially with a small gift to allow for the purchase of assets.

- Installment Sale: Grantor sells assets to the trust in exchange for a promissory note.

- Tax-Free Gifting: Grantor's payment of income tax on trust earnings is considered an additional tax-free gift.

- Flexibility: Can be structured with provisions to adapt to changing circumstances.

- Business Succession Planning: Highly effective for transferring business interests to the next generation.

Pros:

- Removes assets and future appreciation from the taxable estate.

- Facilitates tax-free sales between the grantor and the trust.

- Provides an avenue for additional tax-free gifting through income tax payments.

- Offers structural flexibility to accommodate changing circumstances.

- Serves as a powerful tool for business succession planning.

Cons:

- Complexity: Requires sophisticated legal and tax counsel to establish and maintain.

- IRS Scrutiny: Transactions between grantors and IDGTs are subject to increased IRS scrutiny.

- Legislative Risk: Potential changes in tax law could impact the effectiveness of IDGTs.

- Formalities: Requires strict adherence to trust formalities to avoid legal challenges.

Examples of Successful Implementation:

- A family business owner sells company shares to an IDGT in exchange for a long-term note, effectively freezing the value of the shares in their estate while transferring future appreciation to their children.

- A real estate investor uses an IDGT to transfer appreciating properties to their children with minimal gift tax consequences.

Actionable Tips:

- Ensure a proper valuation of assets sold to the trust.

- Structure the promissory note with commercially reasonable terms and interest rates.

- Consider using defined value clauses to mitigate valuation risk.

- Coordinate the IDGT strategy with other estate planning vehicles.

- Maintain separate records for the trust and meticulously respect all trust formalities.

When and Why to Use an IDGT:

An IDGT is particularly beneficial for individuals with:

- Significant appreciated assets expected to continue appreciating.

- A desire to transfer wealth to future generations with minimal tax implications.

- A need for flexibility in managing and distributing assets.

- Family businesses they wish to transition to the next generation.

This approach is complex and requires careful planning. Individuals considering an IDGT should consult with experienced estate planning attorneys and tax advisors. Learn more about Intentionally Defective Grantor Trust (IDGT) to understand how it interacts with other aspects of financial planning. The concept was popularized by estate planning attorneys Richard Covey and Dan Hastings who pioneered many of the techniques used today and is now widely utilized by family business owners and wealthy families as a core element of their estate tax planning strategies.

Estate Tax Planning Strategies Comparison

| Strategy | Implementation Complexity 🔄 | Resource Requirements 💡 | Expected Outcomes ⭐📊 | Ideal Use Cases 💡 | Key Advantages ⚡ |

|---|---|---|---|---|---|

| Irrevocable Life Insurance Trust (ILIT) | High – requires legal setup and ongoing administration | Moderate – trustee, legal, insurance costs | Estate tax-free death benefit; liquidity for estate taxes | High-net-worth families needing multigenerational wealth transfer and estate liquidity | Estate tax avoidance; asset protection; immediate liquidity at death |

| Grantor Retained Annuity Trust (GRAT) | High – complex legal and tax structuring | Moderate – legal, tax advisors, asset management | Transfer future appreciation tax-efficiently; minimal gift tax | Owners of appreciating assets in low interest rate environments | Minimized gift tax; income stream retention; effective asset appreciation transfer |

| Family Limited Partnership (FLP) | High – entity formation, compliance, ongoing administration | High – legal, accounting, appraisal, management | Wealth transfer with valuation discounts, family control | Families managing shared assets or businesses seeking valuation discounts | Family control; valuation discounts; asset protection; business succession planning |

| Charitable Remainder Trust (CRT) | High – irrevocable trust with complex compliance | Moderate – trustee, legal, tax advice | Income stream plus charitable remainder; capital gains deferral | Donors with highly appreciated assets wanting income and philanthropy | Immediate tax deduction; capital gains avoidance; income stream; charitable support |

| Qualified Personal Residence Trust (QPRT) | Moderate – trust setup and term management | Low to moderate – legal fees, property valuation | Reduced gift tax on residence; future appreciation transfer | Homeowners with valuable residences expecting appreciation | Gift tax discount; freezes property value; continued residence use during term |

| Annual Gifting Strategy | Low – simple and straightforward | Low – minimal legal or administrative needs | Gradual taxable estate reduction over time | Individuals with smaller estates or supplementing other strategies | Easy to implement; no complex structures; consistent estate reduction |

| Intentionally Defective Grantor Trust (IDGT) | Very high – complex legal, tax planning, and compliance | High – legal, valuation, tax advisors | Removes assets and appreciation from estate; tax-free sales to trust | Business owners or asset holders seeking estate freeze and income tax leverage | Estate tax reduction; income tax paid by grantor benefits beneficiaries; flexibility |

Planning for a Secure Future: Next Steps in Estate Tax Planning

Effectively navigating estate tax planning strategies is crucial for preserving wealth and ensuring a smooth transition for your beneficiaries. This article explored several key strategies, including Irrevocable Life Insurance Trusts (ILITs), Grantor Retained Annuity Trusts (GRATs), Family Limited Partnerships (FLPs), Charitable Remainder Trusts (CRTs), Qualified Personal Residence Trusts (QPRTs), annual gifting, and Intentionally Defective Grantor Trusts (IDGTs). Each of these tools offers unique advantages for minimizing estate tax liabilities and maximizing the value passed down to future generations. Remember, the most important takeaway is that a proactive approach to estate tax planning is key.

By understanding and implementing these estate tax planning strategies, you can take control of your legacy and provide lasting financial security for your loved ones. For a comprehensive guide on protecting your family's future through estate planning, explore this helpful resource: Estate planning for families. Mastering these concepts not only minimizes potential tax burdens but also allows you to strategically distribute assets according to your wishes, ensuring that your family's future remains secure.

A well-structured estate plan is a cornerstone of long-term financial stability. To further protect your assets and create a comprehensive financial strategy, consider exploring the resources and support available through Wexford Insurance Solutions. Wexford Insurance Solutions can help you integrate your estate tax planning with appropriate insurance coverage to safeguard your legacy against unforeseen circumstances and further minimize financial risk.

Asset Protection Insurance: Secure Your Financial Future

Asset Protection Insurance: Secure Your Financial Future Homeowner Insurance Claim Process: Complete Victory Guide

Homeowner Insurance Claim Process: Complete Victory Guide