Understanding What Umbrella Insurance Actually Protects

Umbrella insurance provides an extra layer of liability coverage beyond your existing homeowners or auto insurance policies. It's a crucial safety net for your finances, protecting you from potentially devastating financial consequences. If you are held liable for an accident and the resulting damages surpass your primary policy's limits, umbrella insurance steps in.

This additional coverage can prevent financial ruin in the event of a substantial lawsuit. It offers peace of mind knowing that you have an extra layer of protection against unforeseen circumstances. Understanding how umbrella insurance works can empower you to make informed decisions about your financial security.

How Umbrella Insurance Works With Existing Policies

Your auto and homeowners insurance serve as your initial lines of defense. They cover typical incidents up to a specified limit. Umbrella insurance acts as the secondary line of defense, taking effect when these limits are exceeded.

For instance, imagine you cause a car accident resulting in $500,000 in damages, but your auto policy covers only $300,000. Your umbrella insurance would cover the remaining $200,000. This demonstrates how umbrella insurance supplements your existing policies, providing a broader safety net.

Addressing Misconceptions About Umbrella Insurance

Contrary to popular belief, umbrella insurance isn't solely for the wealthy. Anyone with assets they wish to protect can benefit from this coverage. This includes homes, savings, investments, and even future earnings. You might be interested in: What does a Personal Umbrella Policy cover?.

Furthermore, umbrella insurance is often more affordable than many people realize. It provides significant financial protection for a relatively modest premium. This makes it an accessible and valuable tool for safeguarding your financial well-being.

The Growing Importance of Umbrella Coverage

The demand for this type of protection is steadily rising. Umbrella insurance is categorized by type, such as personal or business, and is distributed through various channels, including independent agents, captive agents, and online platforms. The global umbrella insurance market is projected to grow significantly, from approximately $2.84 billion in 2023 to $4.54 billion by 2033, at a CAGR of 4.80%. You can find more detailed statistics here.

This growth is fueled by an increasing need for supplemental liability protection across residential, commercial, and industrial sectors. Understanding how much umbrella insurance you require is crucial for securing your financial future, irrespective of your current net worth. This knowledge helps you make well-informed decisions about your coverage in an increasingly litigious environment.

Calculating Your Personal Asset Value and Risk Exposure

Determining the appropriate amount of umbrella insurance hinges on a comprehensive understanding of your assets and potential risk exposure. Many people underestimate their true asset value, often overlooking key components that contribute to their overall financial picture. A systematic evaluation, similar to strategies employed by wealth managers, can provide a much clearer understanding.

Identifying Your Assets: More Than Meets the Eye

Begin by cataloging readily apparent assets such as your home and vehicles. Crucially, determine their current market value, not just the original purchase price. Next, delve into less obvious assets: retirement accounts, investment portfolios, and even valuable personal belongings like jewelry or art. You might be interested in: Learn more in our article about asset protection insurance. A critical, often overlooked asset is your future earning potential. This represents a significant, yet vulnerable, asset that lawsuits can target.

Understanding Your Risk Exposure: Lifestyle Matters

Beyond assets, your lifestyle significantly influences your risk exposure. Owning rental properties, having teenage drivers, or participating in activities like coaching youth sports can substantially increase your potential liability. When determining the right amount of umbrella insurance, it's essential to consider both your total asset value and the potential risks—lawsuits or accidents—that could lead to financial loss. For instance, if someone has $500,000 in assets, they might consider an umbrella insurance policy with a coverage limit of at least $1 million. This ensures sufficient protection against liabilities that exceed their primary insurance coverage. Learn more about umbrella insurance here.

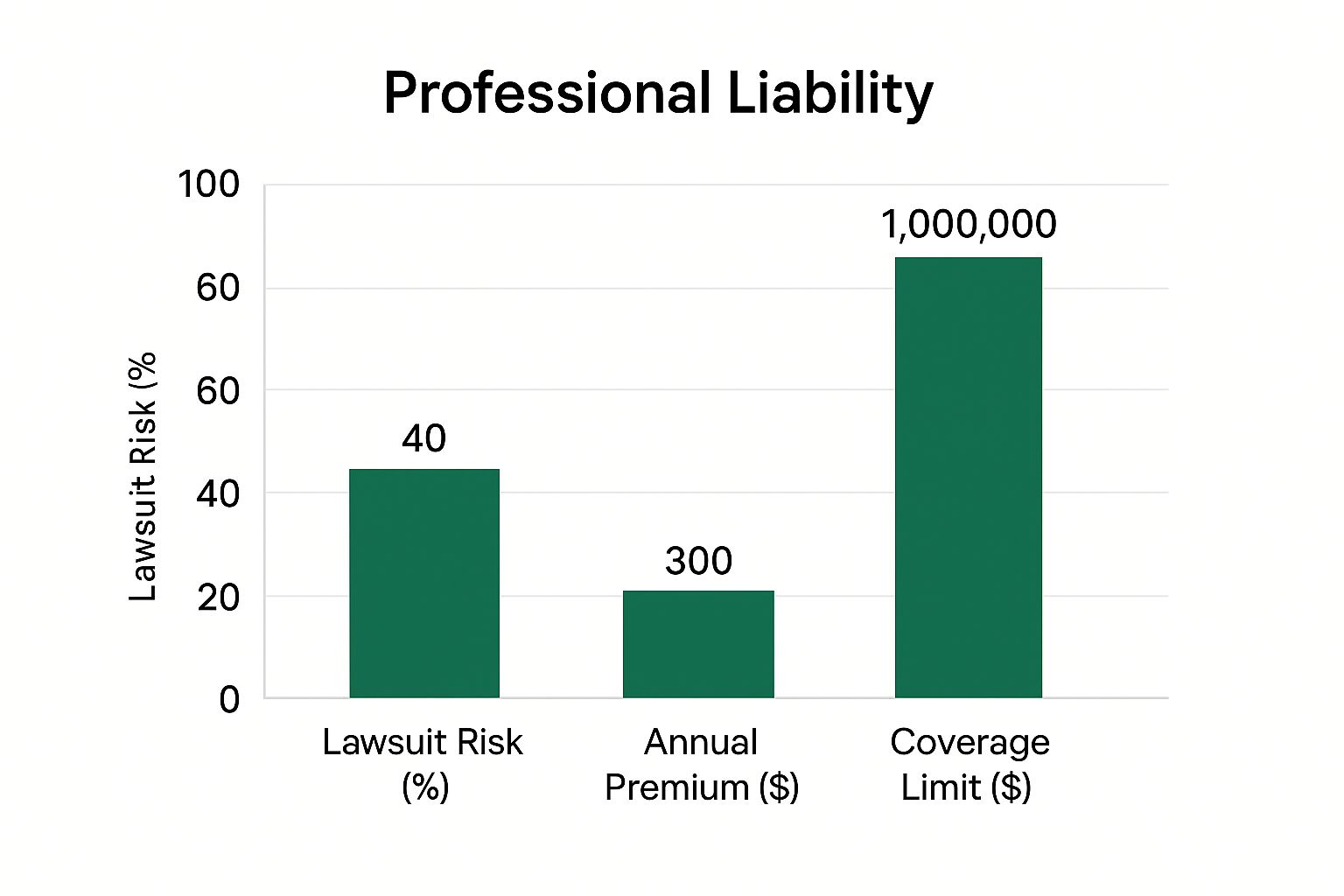

The infographic below illustrates the relationship between lawsuit risk, annual premium, and coverage limit.

As shown, even with a 40% lawsuit risk, $1,000,000 in coverage can be obtained for a relatively low annual premium of $300. This highlights the cost-effectiveness of umbrella insurance in mitigating substantial financial risks.

Translating Assets and Risk into Coverage: A Balancing Act

Your calculated asset value and risk assessment directly inform your recommended umbrella insurance coverage. Coverage should generally exceed your net worth, providing a financial cushion against potential liabilities. However, striking the right balance between adequate protection and affordable premiums requires careful consideration.

To help illustrate recommended coverage amounts, let's look at the table below:

Asset-Based Coverage Recommendations: A comprehensive breakdown showing recommended umbrella insurance coverage amounts based on different asset levels and risk profiles.

| Total Asset Value | Recommended Coverage | Risk Level | Monthly Premium Range |

|---|---|---|---|

| $500,000 | $1,000,000 | Low | $15-$25 |

| $1,000,000 | $2,000,000 | Moderate | $25-$40 |

| $2,500,000 | $5,000,000 | High | $50-$75 |

| $5,000,000 | $10,000,000 | Very High | $100+ |

As you can see, the recommended coverage generally doubles the total asset value, increasing with higher risk profiles. The monthly premium ranges provide an estimate of the cost for such coverage. This table provides a general guideline. Consulting with an insurance professional is always recommended to determine the most suitable coverage for your individual circumstances. This personalized approach ensures you have the right level of protection without overspending.

Coverage Amount Guidelines By Income And Lifestyle

Generic advice isn't helpful when determining your umbrella insurance needs. Your individual circumstances, like your profession, lifestyle, and financial management, heavily influence the appropriate coverage amount. Let's explore how these factors impact your umbrella insurance requirements.

How Profession Impacts Liability

Your profession significantly affects your liability risk. Certain professions, such as doctors, lawyers, and business owners, have a greater likelihood of facing lawsuits. This higher risk often necessitates higher umbrella insurance coverage.

For example, a doctor might need a $5 million policy, while a $1 million policy might suffice for a teacher. Serving on a board of directors or holding community leadership positions also increases your liability exposure. Understanding these professional risks is crucial for determining appropriate coverage.

Lifestyle Choices and Coverage Requirements

Lifestyle choices also play a role in your umbrella insurance needs. Frequently hosting gatherings, owning multiple properties, or having teenage drivers all elevate risk. These activities increase the potential for accidents and subsequent lawsuits, requiring higher coverage.

Landlords, for example, face significantly higher lawsuit risks than those who own only their primary residence. This increased risk typically necessitates substantially more umbrella insurance coverage.

Income vs. Coverage: A Surprising Relationship

While income is a factor, it's not the only one. Someone with a $100,000 annual income might need more coverage than someone earning $200,000, depending on their assets and lifestyle. Focusing solely on income can be misleading.

Consider two individuals, each earning $150,000 annually. One rents an apartment and has minimal assets, while the other owns a large home, rental properties, and significant investments. The second individual clearly requires more coverage despite identical incomes.

Finding the Sweet Spot: Protection and Premiums

The goal is to balance comprehensive protection with affordable premiums. This requires carefully assessing your circumstances. Successful individuals often choose coverage that aligns with their net worth and potential risks.

$1 million to $2 million in coverage often provides adequate protection for many. However, those with substantial assets and higher risk profiles may opt for $5 million or even $10 million. Consulting an experienced insurance professional is the best way to determine the right coverage for your unique needs. They can guide you on how much umbrella insurance you need to secure your financial future.

Regional Factors That Impact Your Coverage Needs

Your location plays a surprising role in how much umbrella insurance you need. While evaluating your assets and lifestyle is critical, understanding regional differences in legal environments, medical costs, and litigation trends is equally important. These factors can significantly influence your potential liability and, consequently, your necessary coverage.

Regional Differences in Legal Environments and Jury Awards

Different regions have unique legal climates. Some areas are known for being more “litigious,” meaning lawsuits are more frequent. This higher frequency of lawsuits, combined with regional variations in jury award tendencies, significantly affects recommended umbrella insurance amounts. For instance, a state with a history of high jury awards in personal injury cases would require higher coverage than a state with more conservative awards.

The Impact of Medical Costs on Coverage Needs

Medical costs fluctuate significantly across regions. Higher medical expenses in your area mean higher potential payouts in liability cases. This directly impacts the necessary amount of umbrella insurance to safeguard your assets. Furthermore, differences in healthcare regulations and access can influence the frequency and severity of medical malpractice claims, which can vary considerably by region. This means individuals in areas with higher healthcare costs and greater malpractice risks may need more substantial umbrella coverage.

Emerging Trends in Liability Claims by Region

Staying informed about emerging liability trends in your region is crucial. Certain areas might see a rise in lawsuits related to specific activities, such as cycling or dog ownership. In major markets like the United States, Europe, and Asia Pacific, umbrella insurance is becoming increasingly vital due to escalating living costs and increasing legal liabilities. For example, in the United States, excess/umbrella rates have driven a significant surge in casualty rates, with an 8% increase in the first quarter of 2025. In regions with higher living costs and stricter legal systems, you might need higher coverage limits (e.g., $5 million or more) for comprehensive protection. Find more detailed statistics here. These trends can significantly affect your risk exposure and, therefore, the umbrella coverage you should consider. This underscores the importance of understanding regional trends when assessing your umbrella insurance requirements.

Adapting Your Strategy Based on Regional Factors

Savvy insurance buyers tailor their strategies to their local conditions. This includes considering regional data on average claim settlements, prevailing legal precedents, and local insurance market dynamics. Consulting with an insurance professional knowledgeable about your area is invaluable. They can offer personalized guidance based on your specific regional risks, ensuring you have sufficient protection. Overlooking regional factors could leave you underinsured, even if you’ve followed general coverage recommendations.

Common Coverage Amounts And What They Actually Cost

Many people believe umbrella insurance is an unnecessary luxury. However, the truth is that it's often more affordable than you might think. This section explores the actual costs of various coverage levels, ranging from a $1 million policy to $5 million or more, particularly beneficial for high-net-worth individuals. By understanding the factors that influence premiums, you'll discover why umbrella insurance is a valuable financial tool.

Typical Coverage Levels and Premiums

Umbrella insurance offers a range of coverage levels tailored to different needs and budgets. The most common coverage amounts are $1 million, $2 million, $3 million, $4 million, and $5 million, with even higher amounts available for those with significant assets. The actual cost of your coverage will depend on factors like your location, individual risk profile, and the existing limits on your homeowners and auto insurance policies.

Let's break down the typical coverage levels and their associated costs:

-

$1 Million Coverage: This baseline coverage level is often surprisingly affordable, usually falling between $150 and $300 annually. It's a suitable starting point for individuals with moderate assets and a lower risk profile.

-

$2 Million to $5 Million Coverage: As you increase your coverage amount, the premium will also rise. Policies within this range typically cost between $250 and $750 per year. This mid-range protection is a good fit for homeowners with higher asset values and potentially greater liabilities.

-

$5 Million+ Coverage: Individuals with substantial wealth frequently opt for coverage beyond $5 million to safeguard their assets. Premiums for these policies generally start at $750 per year and increase based on the specific coverage amount selected.

To provide a clearer picture of the relationship between coverage levels and costs, the following table outlines typical annual premium ranges.

To help illustrate these costs, we've compiled the table below:

Coverage Levels And Associated Costs: A detailed comparison of different umbrella insurance coverage amounts with typical annual premiums and what scenarios each level protects against

| Coverage Amount | Annual Premium Range | Best For | Protection Scenarios |

|---|---|---|---|

| $1 Million | $150 – $300 | Individuals with moderate assets and lower risk profiles | Covers basic liabilities like minor accidents and property damage. |

| $2 Million | $250 – $400 | Homeowners with higher asset values and greater potential liabilities | Offers increased protection for larger claims, such as serious injuries or significant property damage. |

| $3 Million | $350 – $500 | Individuals with significant assets and a higher risk profile, like those with rental properties | Provides more substantial coverage for lawsuits involving multiple parties or severe injuries. |

| $4 Million | $450 – $600 | Individuals with substantial assets and concerns about potential lawsuits related to their profession or activities | Offers increased protection for high-value lawsuits and situations involving significant legal expenses. |

| $5 Million | $550 – $750 | High-net-worth individuals seeking comprehensive asset protection | Protects against catastrophic losses and ensures sufficient coverage for complex legal battles. |

As this table shows, the cost of increased protection scales with the coverage amount, providing options for a variety of financial situations.

Cost-Effectiveness of Umbrella Insurance

While the annual premium might seem like an additional expense, umbrella insurance provides significant protection for a relatively modest cost. Consider that a $1 million policy could cost less than a dollar per day. This small investment can potentially shield you from substantial financial losses resulting from a major lawsuit.

Optimizing Your Coverage and Costs

There are several ways to optimize your umbrella insurance coverage and manage costs effectively. Bundling your umbrella policy with your home and auto insurance through the same carrier can often result in discounts. Increasing your deductibles on your underlying policies may also lower your umbrella premium. Working with an independent insurance agent can provide access to multiple carriers, helping you compare rates and find the best fit for your needs. For example, an agency like Wexford Insurance Solutions can offer this type of personalized service.

By understanding the different coverage amounts and their associated costs, you can make informed decisions about your insurance protection. Weighing the potential risks against the affordable premiums allows you to choose coverage that balances your budget and protection needs, providing valuable peace of mind.

Red Flags That Indicate You Need Higher Coverage

Life is full of changes, and these can significantly impact your insurance needs. Recognizing the warning signs that indicate you might need higher umbrella insurance coverage is crucial for protecting your financial future. This awareness can help you avoid a situation where your existing coverage falls short when you need it most.

Increased Net Worth and Asset Accumulation

As your net worth grows, so does your potential liability. A significant increase in assets necessitates a reassessment of your umbrella insurance coverage. This could be due to purchasing a new home, inheriting property, or experiencing substantial investment growth. For example, if your net worth doubles, your umbrella coverage should likely increase as well to adequately protect your expanded assets.

New Business Ventures and Increased Liability

Venturing into business ownership, especially in fields with higher liability risks, often requires significantly more umbrella coverage. Business-related liabilities can arise from various sources, such as customer injuries, product defects, or professional errors. These risks often extend beyond the scope of standard business insurance. Increased umbrella coverage becomes essential in these situations. You might be interested in learning more about estate tax planning strategies: Learn more in our article about estate tax planning strategies.

Lifestyle Changes and Increased Risk Exposure

Certain lifestyle changes can also increase your risk profile. These changes often necessitate a re-evaluation of your umbrella insurance requirements.

- Becoming a landlord

- Owning a swimming pool

- Having a teenage driver

These activities introduce new potential liabilities, from tenant injuries to vehicle accidents. Consequently, they should prompt you to consider increasing your coverage to match your heightened risk. Even seemingly minor changes, like increased social media activity, can create a need for higher coverage due to the risk of online defamation lawsuits.

Understanding When Your Current Coverage Is Inadequate

It's crucial to recognize when your current umbrella insurance is no longer sufficient. This understanding can help you avoid the devastating financial consequences of being underinsured in a lawsuit. For example, if your current coverage is $1 million, but your assets and potential liabilities now exceed that amount, increasing your coverage is a wise decision.

Proactive Reassessment: Staying Ahead of Your Protection Needs

Rather than reacting after a claim occurs, reassess your umbrella insurance needs proactively. Regularly reviewing your coverage, ideally annually, allows you to adjust your protection as your circumstances change. This proactive approach ensures you always have the right level of coverage to protect your assets and your future financial security.

Making Your Final Coverage Decision

Now that you understand the factors influencing the need for umbrella insurance, let's explore how to personalize a strategy that balances comprehensive protection with practical considerations. This crucial process involves carefully evaluating your assets, risk tolerance, and financial goals to determine the optimal coverage amount. It's not just about buying a policy; it's about creating a robust financial shield that can adapt and grow alongside your success.

Building Your Personalized Umbrella Insurance Strategy

A strong umbrella insurance strategy begins with a clear understanding of your financial landscape. Consider not only your current assets, like your home, investments, and savings, but also your future earning potential. Then, take the time to assess your risk profile. This includes considering your profession, lifestyle, and location. Are you a landlord? Do you have teenage drivers in your household? Do you live in an area known for higher rates of litigation? These factors can significantly impact your ideal coverage amount.

For example, a doctor with a high net worth residing in a major city will likely require more umbrella coverage than a retiree in a rural area with fewer assets. This individualized approach is essential for ensuring effective and appropriate financial protection.

Evaluating Insurance Carriers and Policy Terms

When choosing an insurance carrier for your umbrella policy, it's important to look beyond just the price. Compare policy terms, coverage exclusions, and the company's reputation for claims handling. J.D. Power provides valuable insights into customer satisfaction with various insurance providers. Understanding these nuances will help you secure the best value for your investment.

Additionally, consider working with a financial advisor or insurance professional. They can provide personalized guidance and help you seamlessly integrate umbrella insurance into your broader wealth protection plan.

Avoiding Common Pitfalls and Staying Ahead of Your Needs

One common mistake people make with umbrella insurance is underestimating their potential liabilities. It's crucial to factor in not just your current risks, but also potential future risks as your financial situation evolves. Another pitfall is neglecting to review your coverage regularly. Your needs can change significantly over time, so your umbrella insurance coverage should adapt accordingly. The global umbrella insurance market is experiencing substantial growth. It was valued at approximately $72.07 billion in 2021 and is projected to reach $187.78 billion by 2030. This growth highlights an increasing demand for this type of protection as individuals and businesses seek to safeguard their assets. Learn more about this market trend here.

Taking Action: Securing Appropriate Coverage

Establish a regular timeline for reviewing your umbrella insurance policy, ideally annually, or whenever significant life changes occur, such as a marriage, the birth of a child, or a substantial increase in net worth. This proactive approach ensures your coverage consistently aligns with your evolving needs. Take actionable steps now by contacting an insurance agent or financial advisor to discuss your specific situation and obtain personalized recommendations.

Ready to secure the right umbrella insurance coverage for your unique needs? Contact Wexford Insurance Solutions today for a personalized consultation. We can help you navigate the complexities of umbrella insurance and create a comprehensive protection plan tailored to your specific circumstances. Visit us at Wexford Insurance Solutions to learn more and get a free quote.

What Does a Personal Umbrella Policy Cover? Key Insights

What Does a Personal Umbrella Policy Cover? Key Insights Why Is Renters Insurance Important in 2025? Discover the Key Benefits

Why Is Renters Insurance Important in 2025? Discover the Key Benefits