Protecting Your Peace of Mind: Why Renters Insurance Matters

Renting comes with risks. Many renters mistakenly believe their landlord's insurance covers their possessions. It doesn't. It only covers the building structure. Why is renters insurance important? This listicle provides six key reasons, explaining how it safeguards your belongings, finances, and peace of mind. Learn about personal property protection, liability coverage, additional living expenses, and how renters insurance addresses gaps in landlord coverage, extends beyond your rental unit, and may even provide identity theft and fraud protection. We'll show you how Wexford Insurance Solutions can protect your rented space in New York and Florida.

1. Personal Property Protection: A Cornerstone of Renters Insurance

One of the most compelling reasons why renters insurance is so important is the crucial personal property protection it provides. Imagine losing everything you own in a fire, a burglary, or even a burst pipe. The financial and emotional toll can be devastating. Renters insurance acts as a safety net, shielding you from the potentially crippling costs of replacing your belongings. Unlike homeowners insurance, which primarily covers the physical structure of the building, renters insurance focuses specifically on your possessions within the rented space, including furniture, electronics, clothing, appliances, and other personal items. This protection extends to a variety of perils, such as theft, fire, vandalism, windstorms, and certain types of water damage. Essentially, it safeguards the things you’ve worked hard to acquire.

Most renters insurance policies offer coverage through one of two valuation methods: replacement cost or actual cash value. Understanding the difference is critical. Replacement cost coverage reimburses you for the amount it would cost to buy a brand-new equivalent of the damaged or stolen item. Actual cash value coverage, on the other hand, factors in depreciation, meaning you'll receive the current market value of the item, which is typically less than what it would cost to replace it. While actual cash value policies often have lower premiums, the payout might not be sufficient to replace your belongings after a loss. Renters insurance policies typically offer coverage ranging from $15,000 to $300,000 for personal property, allowing you to select a coverage amount that aligns with the value of your belongings.

Why is this protection so vital? Consider these real-world scenarios: A college student's laptop is stolen from their dorm room. With renters insurance, the cost of replacing the laptop is covered. An apartment fire destroys all of a tenant’s furniture and clothing. A comprehensive renters insurance policy can cover the full replacement cost, enabling the tenant to rebuild their life. A burglar steals $5,000 worth of electronics. Renters insurance will reimburse the policyholder for the loss, minus their deductible. These examples underscore the value of having a financial safety net in place.

Here's why personal property protection deserves its place at the top of the list of reasons why renters insurance is important:

- Comprehensive Protection: It covers a wide range of personal belongings, from everyday items to valuable electronics and furniture.

- Coverage Inside and Outside: Your possessions are protected not just within your apartment or rental home, but also while they're away from the premises (e.g., a laptop stolen from a coffee shop).

- Affordability: Renters insurance offers a surprisingly high level of coverage for a relatively low cost, making it an accessible and essential investment.

- Peace of Mind: Knowing that your belongings are protected provides invaluable peace of mind, allowing you to focus on other important aspects of your life.

However, it’s important to be aware of some potential drawbacks:

- High-Value Items: Extremely valuable items like jewelry, art, or antiques may require additional coverage through scheduled personal property endorsements or riders.

- Actual Cash Value Depreciation: As mentioned earlier, actual cash value policies factor in depreciation, which can result in a lower payout than you might expect.

- Exclusions: Certain items, such as cars or business equipment, are typically excluded from standard renters insurance policies.

To maximize your personal property protection, consider these tips:

- Detailed Inventory: Create a comprehensive inventory of your belongings, including photos and receipts. This documentation will be invaluable in the event of a claim.

- Opt for Replacement Cost: Choose replacement cost coverage whenever possible to ensure you receive the full amount needed to replace your items.

- Additional Coverage for Valuables: Consider purchasing additional coverage for high-value items to ensure they are adequately protected.

- Secure Storage for Documentation: Store your inventory documentation in cloud storage or a safety deposit box to ensure it is readily accessible in the event of a loss.

Renters insurance isn’t just a good idea; it’s a crucial step in protecting your financial well-being. By understanding the importance of personal property protection and taking the necessary steps to secure adequate coverage, you can safeguard your possessions and enjoy the peace of mind that comes with knowing you’re prepared for the unexpected.

2. Liability Coverage Protection

One of the most compelling reasons why renters insurance is so important is the liability coverage it provides. This often-overlooked aspect of a policy can protect you from significant financial hardship if someone is injured on your property or if you accidentally damage someone else's belongings. Understanding how this coverage works is crucial to appreciating the full value of renters insurance. Why is renters insurance important? Because it offers a safety net against unforeseen events that could otherwise derail your finances.

Liability coverage in a renters insurance policy acts as a financial shield in two primary scenarios: First, if a guest is injured within your rented home or apartment, regardless of whether you own the property or not. This could be due to something as simple as a slip and fall or a more complex incident. Second, it protects you if you accidentally damage someone else's property. Imagine, for instance, an overflowing bathtub causing water damage to the apartment below. Without liability coverage, you could be held personally responsible for the repair costs.

Renters insurance policies typically offer personal liability coverage ranging from $100,000 to $500,000. This coverage can pay for the injured party's medical bills, legal fees, and any damages awarded in a lawsuit resulting from the incident. In addition to personal liability, most policies include medical payments coverage, generally between $1,000 and $5,000, to cover medical expenses for injured guests regardless of fault. This means that even if you are not legally liable, your insurance can help cover your guest's medical costs, fostering goodwill and avoiding potential disputes. Importantly, your policy also covers your legal defense costs, even if the lawsuit against you is frivolous. This can save you thousands of dollars in legal expenses, even if you are ultimately found not liable.

Consider these examples: A guest slips on a wet bathroom floor and breaks their leg. Your liability coverage can handle their medical bills and any potential lawsuit. Alternatively, imagine a child visitor getting injured by a falling bookshelf, resulting in a $75,000 medical claim – again, your liability coverage would step in. These examples underscore why renters insurance is important, particularly the liability component, which protects you from potentially devastating financial consequences. This coverage offers peace of mind, especially when hosting guests.

While liability coverage is extremely beneficial, it's essential to be aware of its limitations. It doesn't cover intentional acts or criminal behavior. Certain professional activities might also be excluded, and the coverage limits may be insufficient for major lawsuits. For higher net worth individuals, a personal umbrella policy, which provides additional liability coverage beyond your renters insurance, can be a valuable addition. Learn more about Liability Coverage Protection to see if an umbrella policy is right for you.

To maximize the benefits of your liability coverage, document any safety measures you've taken in your rental, such as installing smoke detectors or securing loose rugs. Report incidents to your insurance company immediately, and consider higher liability limits if you frequently entertain guests. For those with substantial assets, or who regularly host gatherings, higher limits can provide an extra layer of protection. By understanding the intricacies of liability coverage and taking proactive steps, you can significantly enhance your financial security and peace of mind, making renters insurance a truly invaluable investment. This is especially critical for our target audience which includes homeowners, high-net-worth families, business owners, professionals, and even plane owners, all of whom could face significant liability risks. Remembering why renters insurance is important can help you avoid substantial financial loss in the face of unforeseen circumstances.

3. Additional Living Expenses (ALE) Coverage: A Crucial Component of Renters Insurance

One of the most compelling reasons why renters insurance is so important is its provision of Additional Living Expenses (ALE) coverage. This often-overlooked benefit can be a financial lifeline when disaster strikes, protecting you from the significant costs associated with temporary displacement from your home. ALE coverage kicks in when your rental becomes uninhabitable due to a covered peril, such as a fire, severe storm damage, or water damage from a burst pipe. It helps bridge the gap between your normal living expenses and the increased costs you incur while your rental is being repaired or you're searching for new housing. This can make a significant difference in your ability to maintain your lifestyle and avoid financial hardship during an already stressful time. Why is renters insurance important in this context? Because without it, you would be solely responsible for these unexpected and potentially substantial expenses.

ALE coverage typically covers a range of expenses, including temporary housing costs, such as hotel bills or short-term rentals. It also helps cover the increased cost of food, transportation, and other necessary expenses incurred due to your displacement. The amount of ALE coverage you have is usually calculated as a percentage of your personal property coverage, typically ranging from 10% to 30%. So, for example, if your personal property coverage is $20,000, your ALE coverage might be between $2,000 and $6,000. The duration of coverage also varies depending on the policy and the specific circumstances of the loss, often ranging from a few weeks to several months.

Examples of ALE Coverage in Action:

-

Fire Displacement: Imagine a fire ravages your apartment building, rendering your unit uninhabitable for three months while repairs are underway. ALE coverage would help pay for your hotel stay during this period, as well as the increased cost of dining out and commuting to work.

-

Water Damage Relocation: A burst pipe floods your apartment, forcing you to relocate for six weeks while the damage is repaired and the unit is dried out. ALE coverage would assist with the cost of a short-term rental, additional transportation costs, and increased food expenses.

-

Storm Damage Displacement: A severe storm causes significant damage to your apartment building, making it unsafe to live in for two months. ALE coverage would help cover the cost of temporary housing and other necessary expenses until your apartment is habitable again.

Pros of ALE Coverage:

- Financial Security: ALE coverage prevents significant financial hardship during displacement by covering unexpected living expenses.

- Cost Difference Coverage: It covers the difference between your normal living costs and the often-higher costs associated with emergency housing and dining.

- Housing Flexibility: Provides flexibility in choosing temporary housing options that best suit your needs.

- Stress Reduction: Reduces stress and anxiety during an already difficult and disruptive situation.

Cons of ALE Coverage:

- Coverage Limits: The coverage limits may not be sufficient to cover the full cost of comparable housing in expensive areas or for extended displacements.

- Time Restrictions: There are time limits on coverage duration, which may not be adequate in all situations.

- Receipt Requirements: You must keep detailed receipts for all expenses to be reimbursed.

- Comparable Housing Costs: May not cover the full cost of comparable housing in expensive areas.

Tips for Utilizing ALE Coverage Effectively:

- Keep Detailed Records: Maintain meticulous records and receipts of all temporary living expenses.

- Understand Your Policy: Thoroughly understand your policy's coverage limits and time restrictions.

- Consider Extended Coverage: If you live in a high-cost area, consider purchasing extended ALE coverage.

- Prompt Reporting: Report your displacement to your insurance company immediately to initiate the claims process.

ALE coverage is a vital component of renters insurance, providing crucial financial protection when your rental becomes uninhabitable. Understanding its benefits, limitations, and how to utilize it effectively can make a significant difference in your ability to navigate a challenging displacement situation with greater peace of mind. This is yet another key reason why is renters insurance important for anyone renting a home or apartment.

4. Protection Against Landlord Insurance Gaps

One of the most critical reasons to invest in renters insurance is to address the significant gap between what a landlord's insurance policy covers and what it doesn't. Many renters operate under the false assumption that their landlord's insurance protects their personal belongings in the event of a fire, theft, or other covered peril. This is a dangerous misconception that can lead to substantial financial losses. Why is renters insurance important in this context? It bridges this critical protection gap, providing coverage where your landlord's policy falls short. Landlord insurance primarily focuses on the building structure itself and the landlord's liability related to the property. It doesn't extend to the tenant's personal possessions or their individual liability.

Renters insurance steps in to fill this void. It provides coverage for your personal property, such as furniture, electronics, clothing, and other belongings, against a range of perils including fire, theft, vandalism, and certain types of water damage. Furthermore, it offers personal liability protection, which is crucial if someone is injured in your rented space and decides to sue. This liability coverage can protect you from legal fees and potential payouts, a protection your landlord's policy won't offer. This is especially important for high-net-worth families who may have significant assets to protect.

For example, if a fire damages the building, the landlord's insurance would cover the structural repairs to the building itself. However, it wouldn't cover the replacement cost of your damaged furniture, electronics, or other personal items. Similarly, if a guest slips and falls in your apartment, your landlord's liability insurance wouldn't cover you if the guest decides to sue. Your renters insurance policy, however, would provide liability protection in such a scenario. Another common example is theft. If your belongings are stolen from your apartment, your landlord's insurance wouldn't cover the loss. Your renters insurance, on the other hand, would help you replace the stolen items.

Here are some actionable tips to ensure you're adequately protected:

- Never assume landlord insurance covers your belongings: Always obtain your own renters insurance policy to protect your personal property and liability.

- Ask your landlord to clarify what their insurance covers: While this information won’t impact your need for renters insurance, it's good to be aware of the extent of their coverage.

- Review your lease agreement for insurance requirements: Many landlords now require tenants to have renters insurance as a condition of the lease.

- Understand the distinction between building and contents coverage: Building coverage protects the physical structure, while contents coverage protects the belongings inside. Only renters insurance provides contents coverage for your personal possessions.

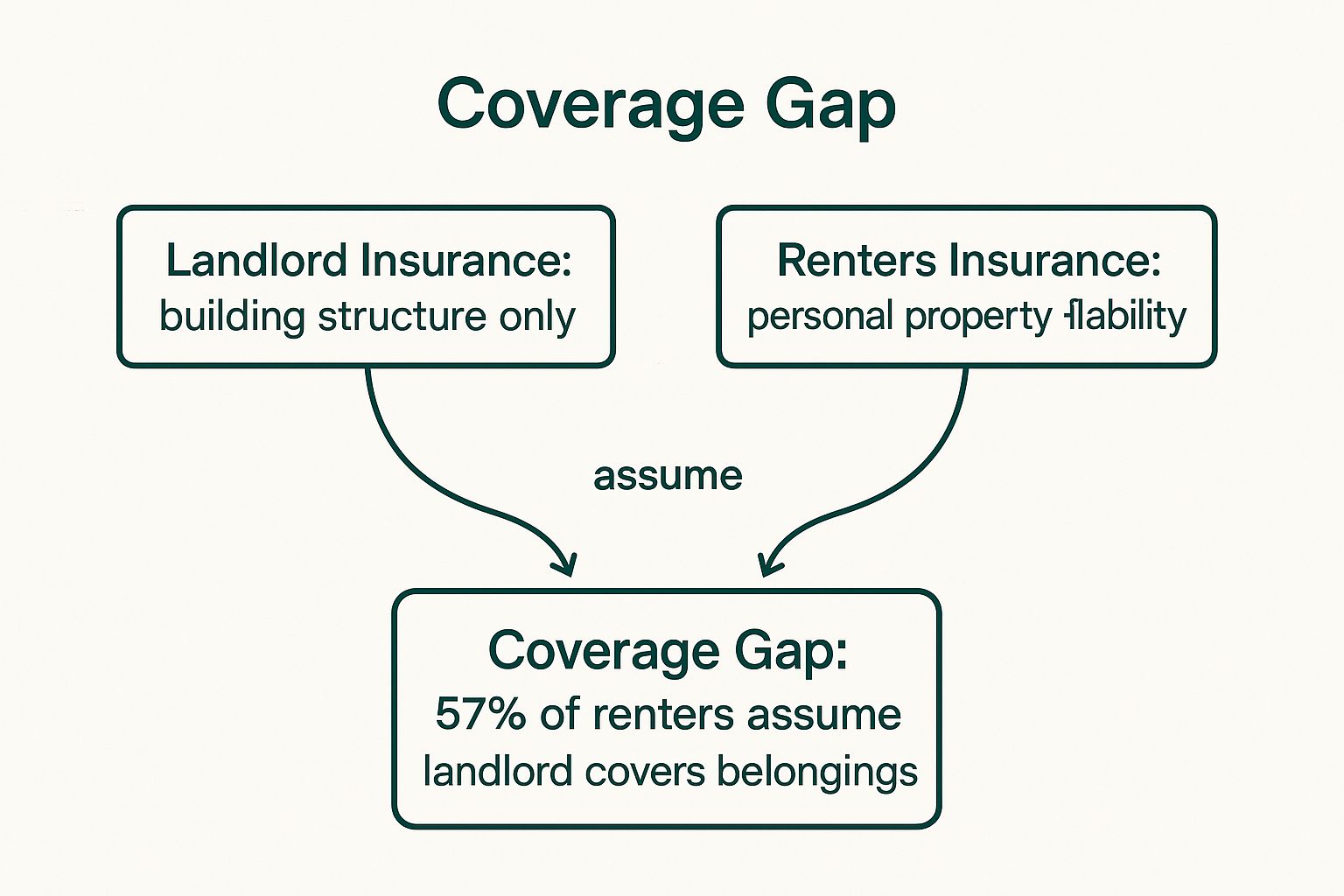

The following infographic visualizes the key relationships between landlord insurance, renters insurance, and the common misconception that often leads to a significant coverage gap. It highlights how these different policies interact and where renters are often left vulnerable.

The infographic clearly demonstrates that while landlord insurance covers the building structure, renters insurance is essential for personal property and liability protection, addressing the coverage gap created by the 57% of renters who mistakenly believe their landlord's policy covers their belongings. This misunderstanding underscores why renters insurance is so important.

While renters insurance adds an additional expense beyond rent, the relatively low cost of these policies pales in comparison to the potential financial burden of replacing all your belongings or facing a lawsuit without liability coverage. It also offers peace of mind, knowing you are fully protected. This peace of mind is especially valuable for professionals, service providers, and business owners who need to minimize potential disruptions to their operations. Even if there's some overlap with your landlord’s policy, the comprehensive protection and peace of mind offered by renters insurance make it a worthwhile investment. Learn more about Protection Against Landlord Insurance Gaps This is crucial information for everyone renting, from individuals seeking tailored personal insurance to high-net-worth families, and even extends to small and mid-sized business owners who might store business-related items within their rented spaces. Whether you’re a homeowner, a renter, a business owner, or even a pilot with unique insurance needs, understanding these coverage nuances is paramount.

Renters insurance provides indispensable protection that landlord insurance simply cannot offer, making it a vital component of financial security for anyone renting a property. Understanding why renters insurance is important is the first step towards safeguarding your belongings and protecting yourself from potential financial hardship.

5. Coverage Beyond the Rental Unit: Why Renters Insurance Protects You Wherever You Go

One of the most compelling reasons why renters insurance is important is its extensive coverage that extends far beyond the walls of your apartment or rental home. This often-overlooked benefit provides a significant safety net for your belongings, regardless of their location. Understanding the "off-premises" coverage offered by renters insurance can be crucial in protecting your possessions and understanding why renters insurance is so vital in today’s mobile world. This protection isn’t just for people who are constantly on the move; it benefits anyone who ever leaves their home with valuable possessions.

Renters insurance offers worldwide coverage for your personal belongings. This means whether your items are in your rental unit, tucked away in your car, at the office, sitting in checked luggage, or even across the globe, they are typically covered. This comprehensive coverage extends to a variety of unfortunate events, including theft, damage, and loss, making it invaluable for those with active and mobile lifestyles. Imagine the peace of mind knowing your belongings are protected whether you're across town or across the continent! This is a key reason why renters insurance is important for anyone who values their possessions.

This broad coverage encompasses several key features:

- Worldwide Coverage: Your belongings are protected whether you're traveling domestically for a weekend getaway or embarking on an international adventure.

- Multi-Location Protection: Renters insurance covers items in multiple locations simultaneously. Your laptop at the coffee shop, your luggage at the airport, and your furniture in your apartment are all covered under the same policy.

- Temporary Storage Coverage: If you need to store items elsewhere temporarily, such as in a storage unit or a friend's garage, your renters insurance will likely extend to these locations as well.

- No Need for Separate Travel Insurance (for belongings): While you might still want travel insurance for trip interruptions or medical emergencies, your renters insurance likely negates the need for separate baggage coverage.

The Advantages are Clear:

- Comprehensive Protection: The most obvious pro is the comprehensive protection it offers beyond your rental unit. This adds an extra layer of security to your belongings, knowing they are insured no matter where they are.

- Ideal for Frequent Travelers: For individuals who travel frequently for work or leisure, this feature is especially beneficial, ensuring continuous protection for their possessions.

- Simplified Coverage: Having a single policy that covers your belongings in multiple locations simplifies insurance management and avoids the need for multiple policies.

Understanding the Limitations:

While the off-premises coverage provided by renters insurance is undeniably beneficial, it's essential to be aware of its potential limitations. Understanding these nuances will help you maximize your coverage and avoid potential surprises when filing a claim.

- Coverage Limits: The coverage limits for belongings outside your home might be lower than the limits for items inside your rental unit. Review your policy carefully to understand these limits and consider increasing coverage if needed.

- Exclusions: Certain high-risk locations or activities might be excluded from coverage. For example, items lost or damaged during extreme sports or in war zones might not be covered.

- Documentation Requirements: Regardless of where an incident occurs, filing a claim will require documentation. Keeping an inventory of valuable items, particularly those you frequently take outside your home, and taking photos, especially when traveling, can greatly simplify the claims process. Always report thefts to the local police and obtain a police report, as this is often required by insurance companies.

Real-World Examples:

- Laptop Stolen from Coffee Shop: If your laptop is stolen while you’re working at a coffee shop, your renters insurance would likely cover the replacement cost, subject to your deductible and coverage limits.

- Lost Luggage During International Travel: Should your luggage get lost during an international trip, your renters insurance can reimburse you for the value of the lost belongings.

- Camera Equipment Stolen from Car: If your camera equipment is stolen from your car during a road trip, your renters insurance can help you replace it.

Tips for Maximizing Your Coverage:

- Understand Your Policy: Carefully review your renters insurance policy to fully understand the off-premises coverage limits, exclusions, and requirements.

- Inventory Your Belongings: Maintain a detailed inventory of valuable items, especially those you frequently take outside your home. Include descriptions, purchase dates, and estimated values.

- Document Your Travels: When traveling, take photos or videos of your valuable items. This can serve as proof of ownership and condition in case of loss or damage.

- Report Thefts Promptly: If your belongings are stolen, report the theft to the local police immediately and obtain a police report.

Learn more about Coverage Beyond the Rental Unit This link provides additional information on how you can protect your valuable assets with the right insurance coverage. Understanding your options is an important step in securing your financial well-being. Why is renters insurance important? Because it provides a level of protection that extends far beyond your front door, offering valuable peace of mind in an uncertain world.

6. Identity Theft and Fraud Protection: A Crucial Component of Renters Insurance

In today's digital age, identity theft is a pervasive threat, impacting individuals from all walks of life. This makes identity theft protection a critical consideration when asking "why is renters insurance important?". While renters insurance primarily focuses on protecting your belongings and providing liability coverage, many policies now offer an invaluable add-on: identity theft and fraud protection. This coverage can be a lifeline in the aftermath of an identity theft incident, helping you navigate the complex and often costly recovery process. This is why understanding the benefits of this coverage is crucial for anyone renting a property, especially considering the increasing prevalence of data breaches and online fraud.

Identity theft occurs when someone steals your personal information, such as your Social Security number, driver's license number, or credit card details, and uses it for fraudulent purposes. This could involve opening fraudulent accounts in your name, making unauthorized purchases, filing taxes under your identity, or even obtaining medical care using your information. The repercussions of identity theft can be devastating, impacting your credit score, financial stability, and even your reputation.

Renters insurance with identity theft coverage helps mitigate these risks by providing financial assistance and expert guidance during the recovery process. This coverage typically includes reimbursement for expenses related to:

- Legal Fees: Identity theft often requires legal intervention to clear your name and pursue legal action against the perpetrators. Identity theft coverage can help cover the cost of hiring an attorney and other legal expenses.

- Lost Wages: If you need to take time off work to deal with the aftermath of identity theft, such as filing police reports, contacting creditors, and meeting with legal counsel, this coverage can compensate you for lost income.

- Credit Monitoring Services: Regularly monitoring your credit reports is essential for early detection of fraudulent activity. Many policies cover the cost of credit monitoring services, providing ongoing alerts and reports about changes to your credit profile.

- Document Replacement Costs: If your personal documents, such as your driver's license or Social Security card, are stolen, identity theft coverage can help cover the costs associated with replacing them.

- Identity Theft Recovery Services: Some policies offer access to professional identity theft recovery services, providing expert assistance and guidance throughout the recovery process. These professionals can help you navigate the complexities of dealing with credit bureaus, law enforcement, and other relevant agencies.

Examples of How Identity Theft Coverage Can Help:

- Imagine a scenario where a fraudster opens several credit card accounts in your name, racking up thousands of dollars in debt. Identity theft coverage could help pay for the legal fees required to dispute the charges and clear your credit report.

- In another instance, someone might file taxes using your Social Security number, resulting in significant complications with the IRS. Identity theft coverage can reimburse you for the cost of hiring a tax professional to resolve the issue and compensate for any lost wages incurred while addressing the situation.

- Even medical identity theft, where someone receives medical care using your name, can create a complicated mess of false medical records and potential billing issues. Your coverage can help manage the process of correcting those records and ensuring your medical history remains accurate.

Pros and Cons of Identity Theft Coverage:

Pros:

- Addresses the Growing Threat of Identity Theft: Given the increasing prevalence of identity theft, this coverage provides much-needed protection in a digital world.

- Comprehensive Recovery Assistance: It offers financial and professional support during a challenging and often confusing time.

- Financial Protection During a Vulnerable Time: It helps mitigate the financial burden associated with identity theft recovery.

Cons:

- May Not Be Included in All Policies: It is often an optional add-on, so be sure to check your policy details.

- Coverage Limits May Be Relatively Low: Pay close attention to the specific coverage limits to ensure they are adequate for your needs.

- Doesn't Prevent Identity Theft: This coverage focuses on recovery, not prevention. While valuable, it doesn't replace the need for proactive identity protection measures.

- May Require an Additional Premium: Adding this coverage to your renters insurance policy will likely increase your premium.

Tips for Utilizing Identity Theft Coverage:

- Verify Inclusion and Coverage Limits: Carefully review your policy documents to confirm that identity theft coverage is included and understand the specific coverage limits and exclusions.

- Act Quickly if Identity Theft is Suspected: The sooner you report suspected identity theft, the better your chances of minimizing the damage.

- Keep Detailed Records: Maintain meticulous documentation of all expenses related to the identity theft incident, including legal fees, lost wages, and other recovery costs.

The inclusion of identity theft protection in renters insurance demonstrates how policies are evolving to meet the changing needs of renters in a digitally interconnected world. By understanding "why is renters insurance important," especially in the context of identity theft protection, you can make informed decisions about your coverage and ensure you have the necessary support in the event of an identity theft incident. Major insurers like State Farm, Allstate, and Progressive have recognized the growing need for this type of coverage and have incorporated it into their renters insurance offerings. This underlines the importance of this protection and reinforces its value as a crucial component of a comprehensive renters insurance policy.

6 Key Benefits of Renters Insurance

| Coverage Type | Implementation Complexity 🔄 | Resource Requirements 💡 | Expected Outcomes 📊 | Ideal Use Cases ⭐ | Key Advantages ⚡ |

|---|---|---|---|---|---|

| Personal Property Protection | Moderate: Requires detailed inventory | Low cost monthly premium; inventory management | Reimbursement for stolen/damaged belongings | Protecting personal belongings in rental property | Comprehensive coverage for possessions; low cost |

| Liability Coverage Protection | Moderate: Understand liability limits | Inexpensive add-on; may need legal advice | Covers medical/legal fees from injuries or damages | Hosting guests; accidental injuries/damages on property | Protects from major financial loss; legal defense |

| Additional Living Expenses (ALE) | Moderate: Requires receipt tracking | Moderate; must manage temporary housing costs | Covers temporary housing and extra living costs | When rental is uninhabitable due to covered events | Prevents financial hardship during displacement |

| Protection Against Landlord Gaps | Low: Mainly policy review and awareness | Minimal to moderate; requires lease review | Fills gaps landlord insurance doesn't cover | Tenants needing personal and liability coverage | Avoids false assumptions; lease requirement compliance |

| Coverage Beyond Rental Unit | Low to Moderate: Know off-premises limits | Minimal additional resources; keep travel inventory | Protection for belongings outside rental premises | Frequent travelers; mobile lifestyles | Worldwide coverage; no need for separate travel insurance |

| Identity Theft & Fraud Protection | Moderate: Verify inclusion and coverage | May require additional premium; monitor identity | Covers recovery expenses from identity theft/fraud | Victims of identity theft; fraud expense management | Financial & legal support during identity recovery |

Secure Your Future with Renters Insurance from Wexford

Understanding why renters insurance is important is crucial for safeguarding your financial stability and peace of mind. Throughout this article, we've explored the key benefits, from personal property protection covering your belongings against theft or damage, to liability coverage protecting you from lawsuits. We've also highlighted the importance of additional living expenses (ALE) coverage, protection against gaps in your landlord's insurance, coverage extending beyond your rental unit, and even safeguards against identity theft and fraud. Mastering these concepts empowers you to make informed decisions about your financial security and ensures you're prepared for unforeseen events. The relatively small cost of renters insurance pales in comparison to the potential financial burden of navigating these situations without coverage. Why is renters insurance important? Because it provides a comprehensive safety net, allowing you to focus on building your future, not rebuilding after a loss.

For tailored renters insurance solutions that address your specific needs in New York or Florida, contact Wexford Insurance Solutions today. Wexford understands the importance of comprehensive renters insurance and offers personalized policies to protect your valuables and provide financial security. Visit Wexford Insurance Solutions to learn more and get a quote – securing the right coverage is a crucial step towards protecting your future.

How Much Umbrella Insurance Do I Need: Complete Guide

How Much Umbrella Insurance Do I Need: Complete Guide Jewelry Appraisal For Insurance: Your Complete Guide

Jewelry Appraisal For Insurance: Your Complete Guide