Understanding Your Jewelry Appraisal Needs

A jewelry appraisal for insurance is more than just an assessment of value; it's a vital document safeguarding your investment. This requires a clear understanding of your insurance company’s specific requirements to ensure you have the right coverage. Let's explore why a specialized appraisal is essential for insuring your precious jewelry.

Why a Specialized Appraisal Is Crucial

A standard appraisal might determine the current market value, but an insurance appraisal focuses on retail replacement value. This represents the cost to replace the item with a new, comparable piece at current market prices. This distinction is critical. In the event of loss or theft, you'll need to replace your jewelry with a similar piece.

Consider the loss of a vintage ring with unique characteristics. A regular appraisal might reflect its current market value. However, finding and purchasing a comparable vintage replacement could be far more expensive. A jewelry appraisal for insurance addresses this by concentrating on the replacement value, ensuring you have sufficient coverage.

Insurance appraisals primarily serve to establish this retail replacement value. This ensures jewelry owners can recoup the full value of their items in case of loss or theft. The Federal Trade Commission (FTC) provides guidelines for appraisals, emphasizing a fair retail selling price, not an inflated value. For more information on accurate appraisals, see Jewelry Appraisals.

Key Components of a Jewelry Appraisal for Insurance

A comprehensive jewelry appraisal for insurance purposes should include several key details:

- Detailed description: This includes the metal type, specific gemstone characteristics (cut, clarity, color, carat weight), and any distinguishing markings.

- Photographs: High-resolution images of the jewelry from various angles are vital for accurate identification.

- Replacement value: This is the most important element for insurance, reflecting the cost to replace the item with a comparable piece.

- Appraiser qualifications: The appraiser's credentials and professional affiliations should be clearly documented to ensure the appraisal's credibility.

These elements create a comprehensive record of your jewelry’s characteristics and value, forming the foundation of your insurance coverage. A complete and accurate appraisal protects your investment, ensuring adequate compensation should your jewelry be lost or damaged.

Why Professional Appraisals Matter More Than Ever

The jewelry market is dynamic, making professional jewelry appraisals for insurance essential. Several factors contribute to this need, including rising material costs, the increasing demand for vintage jewelry, and constantly developing authentication techniques. Understanding these factors helps protect your valuable pieces.

Market Volatility and Your Coverage

Market fluctuations significantly impact jewelry values. A diamond ring bought years ago could be worth substantially more today due to rising diamond prices. Your current insurance, based on the original purchase price, might not be enough. A professional appraisal ensures your coverage reflects the current market value, preventing potential losses if you need to make a claim.

The Limitations of DIY Valuations

Online resources offer a convenient way to estimate value, but these estimates often lack the detail of a certified appraisal. Nuances like the specific cut, clarity, and setting of your jewelry are often overlooked. A professional appraiser provides expertise and specialized knowledge, resulting in an accurate valuation for insurance. This minimizes the risk of underinsurance, ensuring you receive the full replacement value if needed. For further insights into insurance, consider reading How to Master Private Client Insurance.

Technology’s Role in Appraisal Accuracy

Technology is transforming appraisals. Modern tools allow for precise analysis of gemstones and metals. This increased accuracy not only strengthens insurance claims but also provides a deeper understanding of your jewelry's worth. The global jewelry appraisal market is expected to grow by USD 2068.2 million between 2024 and 2029. This represents a CAGR of 9.8%, driven by demand for insurance appraisals and the increasing popularity of antique and vintage jewelry. You can find more detailed statistics from Global Jewelry Appraisal Market.

The Gold Standard: Certified Appraisers

Certified appraisers follow stringent standards and ethical guidelines. Their credentials and experience provide credibility with insurance companies, simplifying the claims process. This professional validation offers additional security, ensuring your appraisal is trustworthy and reliable. A professional appraisal is an investment in peace of mind, protecting your valuable jewelry from unforeseen events.

How Insurance Companies Really Value Your Pieces

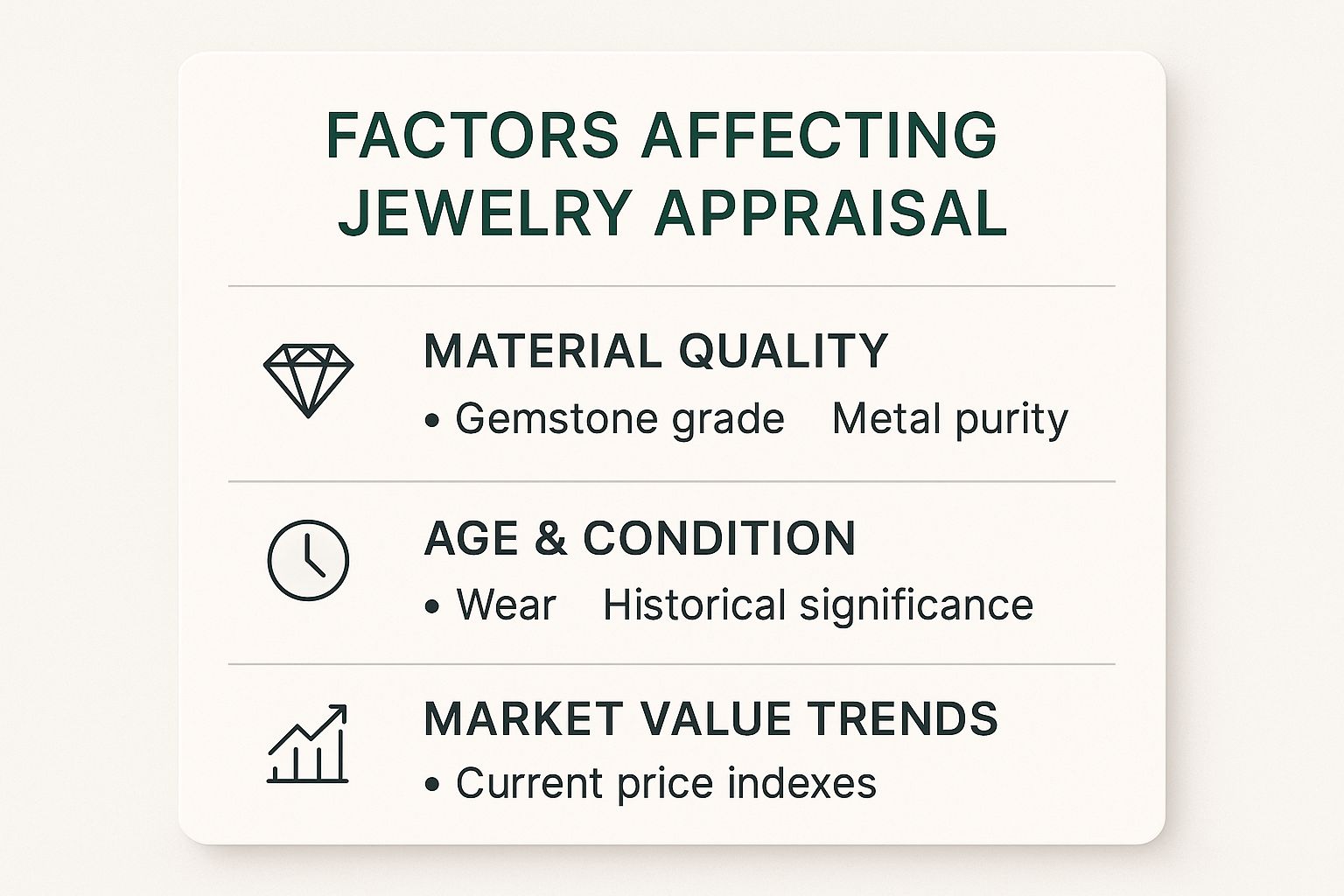

The infographic above summarizes the key factors influencing a jewelry appraisal for insurance: Material Quality, Age & Condition, and Market Value Trends. These elements are crucial in determining the right coverage for your precious items. Understanding how these factors interact is essential for ensuring adequate protection.

Insurance companies use appraisals to determine not only coverage amounts but also your premiums. This goes beyond simply accepting the appraised value. Insurers use complex formulas that consider the item's various characteristics.

For example, a piece with high material quality but significant wear might be appraised differently than a pristine piece of lesser quality. Insurers also analyze current market trends, especially for precious metals and gemstones, to adjust their valuation models.

Understanding Replacement Strategies

Insurance companies typically offer two primary replacement strategies: repairing the damaged piece or replacing it with a comparable item. The chosen approach often depends on the damage.

A simple repair might suffice for a broken clasp, while a lost gemstone could require a full replacement. This leads to another key aspect: the partnerships between insurance companies and jewelers.

The Insurer-Jeweler Relationship

Many insurance companies partner with specific jewelers for replacements. These partnerships offer several advantages, including streamlined claims processing and potentially discounted replacement costs.

However, it's important to understand the implications for your choices. Some policies may limit your replacement options to the insurer's preferred jewelers. Understanding this aspect of your policy can help you navigate claims more effectively.

Policy Types and Coverage Limitations

Various insurance policy types exist, each with its own coverage limitations. Understanding these differences is crucial for choosing the right policy. Some policies might exclude specific damages, such as "mysterious disappearance," while others offer more comprehensive coverage, including international travel protection.

Working with your insurance provider, like Wexford Insurance Solutions, helps ensure you have the best possible coverage. Learn more about Wexford's valuable items coverage. A proactive approach helps you protect your jewelry investment effectively.

To help you understand the various coverage options available, let's look at a comparison of common insurance types for jewelry.

Insurance Coverage Types for Jewelry

Comparison of different insurance coverage options available for jewelry, including coverage limits, deductibles, and replacement methods

| Coverage Type | Protection Level | Typical Deductible | Replacement Method | Best For |

|---|---|---|---|---|

| Scheduled Personal Property | High | Variable, often higher | Replacement with similar kind and quality | High-value individual items |

| Blanket Coverage | Moderate | Generally lower | Repair or replacement, often with insurer's network jeweler | Multiple items of moderate value |

| Homeowners/Renters Insurance | Basic | Fixed, often lower | Repair or cash settlement, up to policy limits | Lower-value items, part of overall home coverage |

| Inland Marine Insurance | High | Variable | Agreed value replacement | Items frequently transported or with unique risks |

This table highlights the key differences in coverage levels, deductibles, and replacement methods across various insurance types. Choosing the right type depends on the value of your jewelry and your specific needs. For high-value items, scheduled coverage offers the most comprehensive protection. For multiple items of moderate value, blanket coverage is a practical option. Finally, remember to review your policy details and discuss any questions with your insurance provider.

Getting Your Jewelry Appraised: A Realistic Walkthrough

Ready to protect your valuable jewelry with an insurance appraisal? This guide offers a practical look at the process, from initial preparation to receiving the final documentation. Understanding each step empowers you to safeguard your investment effectively.

Preparing For Your Appraisal

A smooth appraisal starts with preparation. Organizing your jewelry and related documents beforehand saves time and ensures accuracy. Gather any existing paperwork, such as prior appraisals, purchase receipts, or gemstone certificates.

Cleaning your jewelry is also recommended. This allows the appraiser to clearly assess its condition and characteristics. A clean diamond, for example, allows for precise evaluation of its clarity and cut, enabling the appraiser to focus on valuation.

During The Appraisal: What To Expect

The appraisal itself involves a meticulous examination of each piece. The appraiser carefully documents the materials used, including the type of metal and specific gemstone characteristics. For diamonds, this includes noting the 4Cs: cut, clarity, color, and carat weight.

Detailed photographs are crucial. High-quality images taken from various angles document the piece's condition and unique attributes. This thorough documentation is vital for insurance claims in the event of loss or damage. The appraiser then uses this information, along with market data, to determine the retail replacement value.

Understanding Appraisal Methods

Different appraisal methods exist, and the appraiser selects the most suitable one based on the nature of your jewelry. The comparable sales method analyzes recent sales of similar items to establish market value. This is frequently used for common jewelry types.

For unique or antique pieces, the cost approach assesses the cost to recreate the item. This takes into account current material and labor prices. In some cases, gemological testing might be necessary, especially for valuable gemstones. This testing verifies authenticity and analyzes characteristics, enhancing the appraisal’s credibility.

Verifying Insurance Requirements

After the appraisal, verify it meets your insurer's requirements. Confirm that the appraisal includes all necessary details, such as descriptions, photos, and the crucial retail replacement value. Open communication with your insurance provider ensures proper coverage aligned with the appraised value. This safeguards your investment and provides peace of mind. You can contact Wexford Insurance Solutions for assistance with your appraisal and ensuring you have adequate coverage. A jewelry appraisal is a valuable tool for protecting cherished pieces. Understanding the process and preparing accordingly ensures a seamless experience and comprehensive protection.

What To Expect: Costs, Timing, and Red Flags

Let's explore the practical side of jewelry appraisal for insurance: costs, turnaround times, and potential warning signs. Understanding these elements helps you budget effectively and navigate the process smoothly.

Understanding Appraisal Fees

Jewelry appraisal fees depend on a few key factors. Some appraisers charge a per-item fee, convenient for smaller collections. Others use an hourly rate, often better suited for larger or more complex collections. The piece's complexity matters, too. Appraising a simple, modern piece will typically cost less than a vintage or custom-designed piece.

For instance, a basic appraisal for a modern gold necklace might cost between $75 and $150. A complex appraisal for a vintage diamond ring could range from $150 to $300, or even more. These prices can also fluctuate based on the appraiser's experience and location.

Factors Affecting Appraisal Complexity (and Cost)

Several factors can add to an appraisal’s complexity, impacting cost and time. Vintage pieces often require more research to pinpoint their origin and accurate value. Custom designs, with their unique aspects, demand closer scrutiny. Jewelry with unclear provenance (ownership history) also presents challenges, as verifying authenticity and ownership can be lengthy.

Realistic Timelines for Jewelry Appraisals

Turnaround times vary, but knowing typical timelines helps with planning. A simple appraisal might take a few days, while a more complex one could take several weeks. Rush service is usually an option for an extra fee, but even expedited appraisals need a reasonable timeframe. Always confirm the turnaround time with your appraiser upfront.

Identifying Red Flags and Getting Value for Your Investment

When choosing a jewelry appraiser for insurance, watch for red flags. Avoid appraisers who charge a percentage of the jewelry’s value, as this presents a conflict of interest. Instead, seek certified appraisers with credentials from respected organizations like the American Society of Appraisers (ASA) or the National Association of Jewelry Appraisers (NAJA). This ensures they adhere to professional standards and ethical practices.

To maximize your appraisal’s value, make sure the report includes detailed descriptions, high-quality photographs, and a clear statement of the retail replacement value. This information is essential for insurance, ensuring sufficient coverage and a smoother claims process if needed.

To understand appraisal requirements and ensure adequate coverage, consider consulting with resources such as Wexford Insurance Solutions.

Jewelry Appraisal Cost Breakdown

The following table provides a general overview of potential appraisal costs. Remember, these are estimates, and actual prices can vary. Consulting with a qualified appraiser is the best way to get an accurate quote for your specific jewelry.

| Jewelry Type | Simple Appraisal | Complex Appraisal | Rush Service | Geographic Variation |

|---|---|---|---|---|

| Modern Ring (Gold, simple setting) | $50 – $100 | $100 – $150 | +$25 – $50 | Varies by region |

| Vintage Ring (Diamond, intricate setting) | $100 – $200 | $200 – $400 | +$50 – $100 | Varies by region |

| Necklace (Gold chain) | $40 – $75 | $75 – $125 | +$20 – $40 | Varies by region |

| Earrings (Diamond studs) | $50 – $100 | $100 – $175 | +$25 – $50 | Varies by region |

| Bracelet (Gemstone bracelet) | $75 – $150 | $150 – $250 | +$40 – $75 | Varies by region |

It's important to discuss specific needs and pricing with your chosen appraiser for a personalized estimate. Factors such as the appraiser's experience, location, and the complexity of your jewelry will influence the final cost.

Keeping Your Appraisals Current and Valuable

Your jewelry appraisal isn't a fixed document. Think of it as a living record that needs regular updates to maintain its accuracy and ensure its protective value remains relevant. Just as the market value of your jewelry can fluctuate, your insurance coverage needs to adapt to these changes. This ensures you're adequately protected should loss, theft, or damage occur.

Why Regular Updates Are Essential

Several factors contribute to the importance of current appraisals. First, market fluctuations in precious metal and gemstone prices can significantly influence your jewelry's overall value. For instance, a sudden increase in gold prices might mean your current coverage isn't enough to replace a cherished gold necklace.

Changes to your jewelry itself, such as repairs or modifications, also affect its value. A new diamond setting, for example, increases replacement cost. Regular appraisal updates accurately reflect these alterations, guaranteeing appropriate insurance coverage. This proactive approach helps you avoid the unpleasant discovery of being underinsured when you need to file a claim. You might also want to consider How Much Umbrella Insurance Do I Need? for a broader perspective on financial protection strategies.

Market Fluctuations and Your Coverage

The global jewelry insurance market is intrinsically linked to the appraisal market, since accurate appraisals are fundamental for adequate coverage. This market was valued at USD 4.5 billion in 2023 and is projected to grow at a CAGR of 7.30% between 2023 and 2030. You can learn more about the jewelry insurance market trends. This growth highlights the increasing need for precise valuations to ensure comprehensive insurance protection.

As jewelry values increase, accurate and updated appraisals become even more critical. Failing to update your appraisal could leave you substantially underinsured.

When to Schedule Re-evaluations

While a general guideline suggests reappraisals every 3-5 years, certain situations call for more frequent updates. Significant market fluctuations, especially in precious metal prices, should prompt a re-evaluation. Likewise, any modifications or repairs to your jewelry should be documented in an updated appraisal.

Acquiring new pieces also necessitates adding them to your insured items with appropriate documentation and valuation. Actively managing your appraisals this way ensures your coverage aligns with the current value of your collection. This offers the best protection for your valuable possessions, strengthens your financial safety net, and provides peace of mind.

Advanced Strategies For Maximum Protection

Protecting your valuable jewelry goes beyond a basic insurance policy. It requires a proactive and strategic approach to appraisals and coverage. This section explores advanced strategies to help you maximize the protection of your treasured pieces.

Advanced Documentation Techniques

Detailed documentation is paramount. Photographs and descriptions are essential, but consider adding videos to your records. Videos offer a 360-degree view, capturing details that static images might miss. This is invaluable during the claims process. Furthermore, keep records of all maintenance or repairs and their associated costs to strengthen your documentation.

Working With Multiple Appraisers

For exceptional pieces, consider appraisals from multiple qualified professionals. This gives a broader perspective on the item’s value, especially beneficial for unique or antique jewelry. It also provides a check and balance, ensuring accuracy and avoiding undervaluation. This strategy is particularly useful for items with fluctuating market values.

Building Relationships With Trusted Professionals

A relationship with a trusted appraiser and insurance broker is crucial. This allows for ongoing consultation, proactive advice on market trends, and personalized guidance as your collection evolves. For instance, a trusted advisor can alert you to market shifts that might require an appraisal update. This ensures your coverage remains adequate. You might be interested in: How to master Asset Protection Insurance.

Emerging Trends and Technological Innovations

The appraisal industry is constantly evolving. New technologies, such as AI-powered valuation tools and advanced gemstone analysis techniques, enhance accuracy and efficiency. Staying informed about these advancements ensures your appraisals utilize the latest methods for accurate valuations. For example, some appraisers now use 3D scanning to create detailed digital models.

Managing Large Collections and Inherited Pieces

Large collections and inherited pieces present unique challenges. For extensive collections, create a systematic inventory process with detailed documentation for each item. With inherited jewelry, obtain an estate appraisal to establish fair market value for probate. This simplifies management and ensures proper insurance coverage.

Contact Wexford Insurance Solutions today for a comprehensive review of your jewelry insurance needs. We offer personalized service and tailored solutions to protect your valuable possessions. Visit us at https://www.wexfordis.com to learn more.

Why Is Renters Insurance Important in 2025? Discover the Key Benefits

Why Is Renters Insurance Important in 2025? Discover the Key Benefits Insuring Fine Art: Essential Tips to Protect Your Collection

Insuring Fine Art: Essential Tips to Protect Your Collection