Understanding Today's Fine Art Insurance Market

The art world is undergoing a significant transformation, with fine art insurance becoming increasingly relevant for a broader audience than just museums and established collectors. A key driver of this trend is the growing recognition of art as a valuable asset class, attracting a wider range of individuals to invest in it.

The rise in high-net-worth individuals (HNWIs) and their increasing interest in art acquisition has played a crucial role in fueling the demand for specialized art insurance. This shift reflects a move beyond appreciating art solely for its aesthetic value, recognizing its potential for financial growth and portfolio diversification.

The global fine art insurance market, valued at approximately USD 3.4 billion in 2023, is projected to reach USD 5.8 billion by 2032. This impressive growth, with a compound annual growth rate (CAGR) of 6.2%, is largely attributed to the expanding wealth among HNWIs and the increasing recognition of art as a valuable investment. For a deeper dive into these statistics, visit the DataIntelo Fine Art Insurance Market report.

Technology's Impact on Fine Art Insurance

Technological advancements are reshaping the landscape of fine art insurance and art collection management. Digital platforms and online marketplaces like Artsy are democratizing access to art, connecting a wider audience of buyers and sellers. This increased accessibility, coupled with the growing globalization of the art market, necessitates insurance coverage for a larger number of artworks.

Insurance providers are adapting to these changes by offering flexible and comprehensive coverage options tailored to diverse needs and circumstances. This includes addressing the unique challenges of insuring art purchased online, such as verifying authenticity and provenance.

Appraisal and Valuation in the Digital Age

The evolution of appraisal methods is another significant factor contributing to the changing dynamics of fine art insurance. Advanced appraisal tools, often utilizing data analysis and machine learning, offer more accurate and efficient valuations.

These tools empower collectors with a clearer understanding of their art's worth, enabling them to make informed decisions about appropriate insurance coverage. This increased accuracy benefits both collectors and insurers, leading to fairer premiums and a smoother claims process. Furthermore, digital documentation and secure storage solutions are simplifying art asset management, further enhancing the overall insurance experience.

The Future of Fine Art Insurance

The confluence of factors like art's growing recognition as an investment, advancements in appraisal technology, and the rise of digital platforms is transforming the fine art insurance landscape. This creates valuable opportunities for both new and established collectors to protect their investments effectively.

As the market continues to evolve, we can anticipate the emergence of even more innovative insurance solutions, solidifying art's position as a valuable and insurable asset class. This includes exploring new insurance models, incorporating blockchain technology for provenance tracking, and personalized coverage options based on individual collector needs.

Choosing Coverage That Actually Protects Your Investment

Insuring fine art is a crucial step in protecting your valuable investment. However, it's essential to understand that not all insurance policies are the same. Choosing the right coverage requires careful consideration of the specific risks your art faces, going beyond basic protection to address the unique needs of your collection.

Understanding Your Coverage Options

A variety of coverage options exist to protect your art from various risks, ranging from everyday accidents to specialized concerns like transit and exhibition. These options cater to the unique needs of art collectors, offering a spectrum of protection.

-

Property Damage Coverage: This fundamental coverage protects against common risks like fire, theft, and water damage occurring within your home or designated storage facility. While it's a cornerstone of any art insurance policy, it's important to remember it might not cover every possible scenario. This type of coverage dominates the market, representing approximately 40% of the market share, largely driven by museums and galleries safeguarding their valuable collections. Learn more about the state of the fine art insurance market.

-

Transit Coverage: Essential for art frequently on the move, transit coverage protects your pieces during transportation for exhibitions, loans, or storage. It safeguards against potential damage or loss that may occur while your art is in transit.

-

Exhibition Coverage: This specialized coverage is designed for art loaned out for exhibitions, providing protection against damage or loss while your pieces are on display at another location.

-

Restoration Coverage: This valuable coverage addresses the costs involved in restoring a damaged piece of art back to its original condition. It plays a crucial role in preserving the value and integrity of your collection.

To help you better understand the different coverage types available, we've compiled a comparison table:

Fine Art Insurance Coverage Types Comparison

Comparison of different insurance coverage options including coverage scope, typical costs, and best use cases

| Coverage Type | Protection Scope | Typical Premium Range | Best For |

|---|---|---|---|

| Property Damage | Damage from fire, theft, water, etc. within your home or storage facility | 0.5% – 1.5% of the art's value annually | All collectors, especially those storing art long-term |

| Transit | Damage or loss during transportation | 0.1% – 0.5% of the art's value per trip | Collectors frequently lending or moving art |

| Exhibition | Damage or loss while on display at another location | 0.2% – 1% of the art's value per exhibition | Collectors loaning art for exhibitions |

| Restoration | Costs of restoring a damaged piece to its original condition | Varies depending on the piece and extent of damage | Collectors with valuable or historically significant pieces |

This table summarizes the key differences between the various coverage options, helping you select the most appropriate protection for your collection. Remember to consult with an insurance specialist to tailor coverage to your specific needs.

The Importance of Valuation

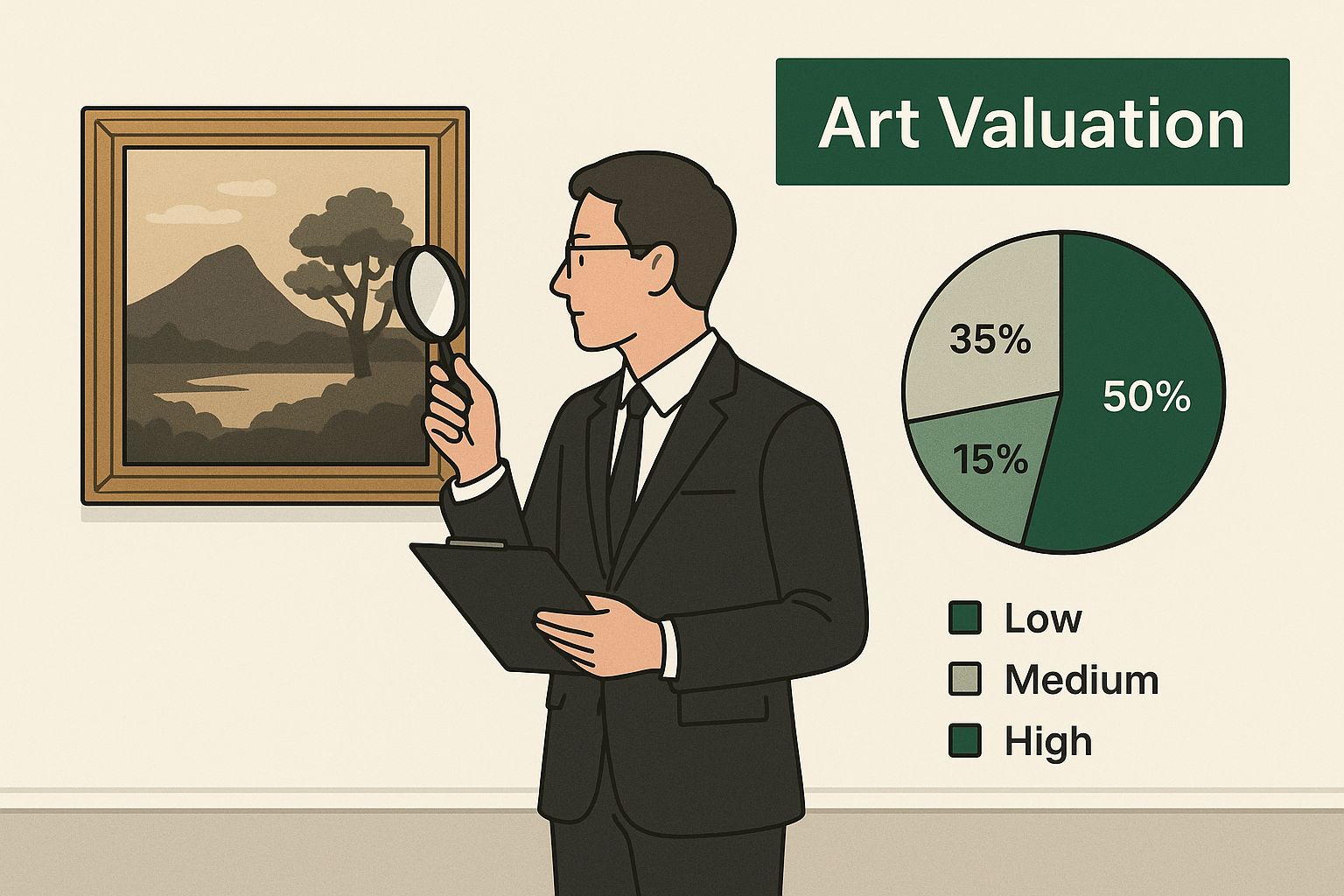

The infographic above illustrates the art valuation process, a critical aspect of fine art insurance. A professional appraiser meticulously examines the piece, considering factors like its provenance, condition, and current market value. This thorough assessment ensures your artwork is insured for its appropriate worth. Accurate valuations are essential not only for determining premiums but also for ensuring adequate compensation in case of a claim. You might find this resource helpful: How to master jewelry appraisals for insurance.

Identifying Gaps in Standard Policies

While standard insurance policies provide essential protection, they often have limitations. It’s crucial to carefully review your policy and identify potential gaps in coverage. For instance, some policies might exclude specific types of damage, such as those caused by natural disasters or acts of terrorism.

Furthermore, standard policies might not fully cover the costs of restoration or account for the diminished value of a piece after damage. Understanding these limitations allows you to seek additional coverage tailored to your collection's specific requirements. This might involve adding riders to your current policy or acquiring separate specialized coverage. By proactively addressing these potential gaps, you can ensure comprehensive protection for your art investment against a broader spectrum of risks.

Where Geography Shapes Your Insurance Strategy

When considering fine art insurance, location plays a surprisingly significant role. The geographical location of your collection can dramatically influence your insurance options, affecting everything from pricing to the types of coverage available. This makes location a key factor in any art collector's insurance strategy.

North America and Europe: Established Markets With Distinct Approaches

North America and Europe represent mature markets for fine art insurance, each with distinct advantages. North American policies often emphasize broader coverage options, including specialized protection for natural disasters like earthquakes or hurricanes. European policies, conversely, might prioritize comprehensive coverage for theft and transit, reflecting regional differences in risk.

North America held a market size of approximately USD 0.78 billion in 2024, expected to grow to USD 1.28 billion by 2033. Europe is projected to increase from USD 0.62 billion in 2024 to USD 1.02 billion by 2033. These established markets offer a strong foundation for art insurance, but understanding their nuances is critical. Learn more about the fine art insurance market.

Emerging Opportunities in Asia-Pacific and the Middle East

Beyond traditional art hubs, the Asia-Pacific and Middle Eastern markets are experiencing significant growth. This presents new opportunities for collectors, along with important insurance considerations. These regions are developing specialized insurance products to cater to burgeoning local art scenes. Understanding local regulations and legal frameworks is crucial for navigating these emerging markets. As these regions grow as art centers, collectors will find increasing insurance options tailored to their specific needs.

The Influence of Museums and Cultural Institutions

The presence of major museums and cultural institutions can indirectly influence insurance options within a region. These institutions often drive the demand for specialized insurance services and expert conservation. This can lead to a wider range of coverage options and more competitive pricing for individual collectors. Furthermore, these institutions often influence standards for art handling and storage, which can impact insurance requirements. The growth of these cultural centers can significantly benefit the availability and quality of art insurance services.

Navigating Regional Legal Frameworks

Legal frameworks regarding art ownership and insurance vary significantly across regions. Understanding these differences is essential for ensuring adequate protection. Regulations on import/export and taxes on art sales, for example, can impact how insurance policies are structured. Different regions may also have different standards for appraisals and valuations, affecting the claims process. Consulting with a specialist familiar with regional legal frameworks is essential for developing a robust insurance strategy. By carefully considering these geographic factors, collectors can develop a plan that effectively protects their investment, wherever their collection resides.

Finding Insurance Providers Who Actually Understand Art

Choosing the right insurance provider for your fine art collection is paramount. Selecting a generic insurer who treats a masterpiece like any other household item can be a costly mistake, especially if disaster strikes. This section will guide you through the essential criteria for identifying specialist art insurers and help you avoid common pitfalls.

The Art of Choosing an Art Insurance Specialist

The critical difference between a true art insurance specialist and a general insurer lies in their understanding of the art market. Specialists possess in-depth knowledge of art valuation, provenance, and the specific risks associated with owning and preserving fine art. They understand a painting isn't just furniture; it represents history, culture, and often, a substantial financial investment.

This expertise becomes essential when assessing damage, facilitating restoration, and navigating the intricacies of the art world during a claim. For example, a specialist understands the fluctuating value of art based on market trends and artist recognition, unlike a general insurer who might rely on a basic appraisal without these considerations.

Additionally, a specialist will have a network of trusted art conservators and restorers, ensuring damaged pieces receive appropriate care. This deep understanding of the art world is what distinguishes specialists and provides collectors with well-deserved peace of mind.

Evaluating Insurers: Key Questions and Red Flags

Evaluating potential insurers requires careful consideration. Look beyond marketing brochures and focus on demonstrable expertise. Carefully examine their track record with claims, especially those involving fine art. Do they have a dedicated team of art experts, or do they outsource assessments? How do they handle valuations? Do they consider market fluctuations and provenance, or simply the original purchase price?

To help guide your evaluation, consider the following checklist:

Before the table explaining its purpose: The following table provides a framework for evaluating potential insurance providers, outlining key factors to consider and their relative importance. It also suggests crucial questions to ask prospective insurers.

| Evaluation Factor | High Priority | Medium Priority | Low Priority | Questions to Ask |

|---|---|---|---|---|

| Specialized Art Expertise | ✅ | Do you have a dedicated team for fine art claims? | ||

| Valuation Methods | ✅ | How do you assess the value of art, especially with market fluctuations? | ||

| Claims Handling Record | ✅ | What is your average claim settlement time for fine art? | ||

| Network of Art Professionals | ✅ | Do you work with trusted art conservators and restorers? | ||

| Financial Stability | ✅ | What are your financial ratings and stability? | ||

| Policy Customization | ✅ | Can the policy be tailored to my specific collection needs? |

After the table summarizing key insights: Using this checklist allows collectors to prioritize essential factors like specialized expertise and valuation methods while also considering important aspects such as the insurer's financial stability and network of art professionals.

Red flags include vague policy wording, a lack of in-house art expertise, and a history of protracted or disputed claims. Thorough research and asking the right questions are crucial. Learning from other collectors’ experiences—both positive and negative—can offer valuable insights. Check out our guide on Private Client Insurance for a broader perspective on managing valuable assets. By taking a proactive approach, you can find a provider who truly understands the nuances of insuring fine art.

Beyond the Basics: Understanding Your Collection's Unique Needs

Every art collection is unique, requiring an insurance approach that reflects its distinct characteristics. While a basic policy may suffice for some, others may require more specialized coverage. Consider factors like the age, medium, and historical significance of your pieces. Are they frequently transported for exhibitions or loans? Are they stored in a climate-controlled environment?

These details help determine the appropriate coverage levels and ensure your policy adequately protects your investment. For example, antique sculptures might require specialized restoration coverage due to their fragility, while contemporary prints might prioritize transit coverage for frequent exhibition loans. Considering these nuances allows you to fine-tune your insurance and avoid underinsurance, potentially leading to significant financial loss during a claim.

Getting Documentation Right Before You Need It

Proper documentation is the cornerstone of a successful fine art insurance claim. Inadequate documentation is a leading cause of claim denial—a situation entirely preventable with diligent preparation. Having the right paperwork readily available can make all the difference in your ability to recover losses. This section outlines the essential documentation needed for insuring fine art and how to acquire it.

The Importance of Professional Appraisals

A professional appraisal is the foundation of your art insurance coverage. It provides an expert assessment of your artwork's value, considering factors like provenance, artist reputation, market trends, and the piece's condition. Think of it as a detailed inspection report for a house; it offers an objective assessment of value, which is crucial for determining adequate insurance coverage.

A professional appraisal isn't a one-time event. Regular updates are essential, especially in the dynamic art market. An emerging artist's work, for example, might appreciate significantly after a major exhibition. An updated appraisal would then be necessary to reflect the increased worth. This ensures your coverage remains adequate and prevents underinsurance in case of loss.

Documentation That Makes or Breaks Your Claim

Beyond appraisals, maintaining detailed records of your collection is crucial. These records should include:

- Photographs: High-quality images of each artwork, capturing all angles and details. These serve as irrefutable proof of its condition and existence.

- Bills of Sale: These documents verify ownership and the original purchase price, providing a starting point for valuation.

- Provenance Documentation: Any records related to the artwork's history, such as previous ownership, exhibition history, and restoration records. These details add to its value and authenticity.

- Condition Reports: Detailed descriptions of the artwork's current state, noting any existing damage or imperfections. This protects your interests in case of future damage.

These documents create a comprehensive history of your artwork, proving its value and authenticity if you need to make a claim. Having this information organized and readily accessible can significantly expedite the claims process.

Leveraging Technology for Documentation

Modern technology simplifies the documentation process. Digital platforms and art collection management systems offer secure storage and easy access to all your records, eliminating the need for cumbersome physical files. These systems also facilitate communication with insurers and appraisers, streamlining the claims process. A centralized approach ensures that all essential information is available when you need it most.

What to Expect During the Claims Process

When filing a claim, be prepared to provide your insurer with all relevant documentation. This includes the appraisal, photographs, provenance records, and any other supporting evidence. The insurer will review this information to verify ownership, assess the damage, and determine the appropriate compensation.

Organized documentation can significantly expedite this process and prevent delays in settling your claim. This is especially important in time-sensitive situations, such as damage from natural disasters.

Real-World Examples and Cautionary Tales

Real-world examples demonstrate the vital importance of meticulous documentation. Countless cases exist where detailed records saved collections from significant financial loss after a fire or theft. Conversely, insufficient documentation has led to denied claims and devastating financial consequences for collectors. These stories highlight how crucial documentation is in protecting your investment and ensuring a smooth claims process.

For further information on protecting your assets, explore our resources on Asset Protection Insurance. This resource provides additional insights into safeguarding your valuables and minimizing potential risks. Prioritizing comprehensive documentation is a proactive step toward protecting your fine art investment and ensuring its long-term value.

Protection Strategies That Actually Reduce Risk

Insuring fine art is an important step, but it's truly effective when paired with proactive risk reduction. Much like car insurance doesn't replace safe driving, art insurance requires protective measures to minimize potential problems. This proactive approach not only safeguards your art but can also result in lower premiums.

Beyond Basic Alarms: Comprehensive Security Strategies

Protecting valuable art demands more than a simple alarm system. A truly comprehensive approach uses layered security, including:

-

Environmental Monitoring: Systems that track temperature, humidity, and light levels help prevent damage from environmental fluctuations. For example, too much humidity can lead to mold, while direct sunlight can fade colors.

-

Robust Security Systems: This encompasses not only alarms, but also surveillance cameras, motion detectors, and secure access controls. These deter theft and vandalism, effectively protecting your investment.

-

Safe Storage Solutions: Proper storage in climate-controlled vaults or secure facilities minimizes risks from both environmental damage and theft. Think of it like storing a classic car in a secure, climate-controlled garage.

-

Disaster Preparedness Plans: A clear plan for fire, flood, or other disasters is essential. This plan should detail procedures for evacuating artwork, contacting emergency services, and documenting any damage.

These combined strategies create a strong security framework, significantly lowering the risk of damage or loss.

The Role of Emerging Technologies

Technology is increasingly vital in art protection. IoT sensors, for example, offer real-time monitoring of environmental conditions and security breaches, instantly alerting you to potential issues. This rapid response helps prevent small problems from becoming major losses. Furthermore, technologies like blockchain help verify provenance and authenticity, adding an extra layer of security for your collection.

Conservation Practices That Insurers Value

Proper conservation not only preserves artwork but also demonstrates responsible ownership to insurers. Regular cleaning, appropriate framing, and careful handling contribute to the long-term health of your collection. These practices show a commitment to protection, often reflected in lower insurance premiums. Insurers understand that proactive conservation reduces the risk of damage and, consequently, claims. Explore our guide on Asset Protection Insurance for more information on protecting your valuable possessions.

Assessing Security Investments

Not every security investment offers the same value. Some provide greater risk reduction than others. For example, a climate-controlled storage facility might offer more protection than upgrading a home alarm system. It’s important to assess your collection’s specific needs and vulnerabilities when deciding how to allocate resources. A collection of fragile watercolors, for instance, needs climate control more than a collection of bronze sculptures.

Real-World Examples: Prevention in Action

Real-world scenarios demonstrate the effectiveness of these strategies. Museums with robust security have successfully prevented thefts and minimized damage from environmental disasters. Private collectors using climate-controlled storage and detailed documentation have smoother claims processes and better recovery after incidents. These examples show how proactive risk management can effectively protect your fine art investment.

Key Takeaways

Insuring fine art is a complex process, but understanding the key aspects can help you protect your valuable collection. This section provides practical advice and clear steps you can implement today.

Understanding Your Collection and Its Value

The first step in insuring fine art is understanding your collection's specific needs. This goes beyond the purchase price. Factors like the age, medium, provenance, and historical significance contribute to each piece's value and influence the necessary coverage. For example, antique porcelain might require specialized coverage for breakage, while contemporary paintings might prioritize transit coverage for exhibitions. Up-to-date professional appraisals are crucial for accurate valuations and avoiding underinsurance.

- Key Action: Inventory your collection, noting each piece's key characteristics.

- Progress Indicator: A complete inventory list with estimated values and specific risk considerations for each piece.

Choosing the Right Insurance Provider

Choosing a specialist art insurance provider is paramount. Unlike general insurers, specialists understand art valuation, the nuances of the art market, and have relationships with art conservators and restorers. They offer tailored coverage for your collection's specific needs. Look for insurers with a strong track record handling art-related claims and an understanding of the art world.

- Key Action: Research and compare art insurance providers, focusing on expertise and claims handling. Ask about valuation methods and their network of art professionals.

- Progress Indicator: A shortlist of potential insurers with detailed service information and a plan to contact each for quotes.

Documentation: Your Best Defense

Meticulous documentation is crucial for claims. High-quality photographs, bills of sale, provenance records, and condition reports prove your artwork’s value and condition. These records should be stored securely and be easily accessible. Think of it as building a case file for your art—the more comprehensive, the better.

- Key Action: Compile detailed records for each artwork, including images, purchase records, and condition reports. Consider a digital art management system for secure storage and easy access.

- Progress Indicator: A complete digital or physical archive of all essential documentation for each piece.

Proactive Risk Management

Effective insurance is just one part of protecting your art. Proactive risk management, like environmental monitoring, robust security systems, and safe storage, can significantly reduce damage or loss. These measures protect your art and can lower insurance premiums.

- Key Action: Evaluate your storage and security, identifying areas for improvement. Implement measures based on your collection’s specific risks.

- Progress Indicator: An implemented risk management plan with regular maintenance schedules and protocols for different scenarios (e.g., fire, flood).

Reviewing and Updating Your Strategy

The art world is constantly changing, and so should your insurance strategy. Regularly review your policy and update documentation to reflect any changes in your collection or the market. This ensures adequate coverage and protects your collection.

- Key Action: Set reminders to review your policy and update your documentation annually or after significant changes to your collection.

- Progress Indicator: A schedule for regular policy reviews and updates, aligned with your collection’s changing needs.

For a personalized assessment of your art insurance needs and access to comprehensive solutions, contact Wexford Insurance Solutions today. Our specialists can guide you through every step, ensuring your collection receives the protection it deserves.

Jewelry Appraisal For Insurance: Your Complete Guide

Jewelry Appraisal For Insurance: Your Complete Guide Commercial vs Personal Auto Insurance: 7 Key Differences Explained

Commercial vs Personal Auto Insurance: 7 Key Differences Explained