Navigating the Road to Proper Auto Coverage

Understanding the difference between commercial and personal auto insurance is critical for proper protection. This listicle outlines 7 key distinctions between commercial vs personal auto insurance to help you make the right coverage choices for your needs, whether for personal vehicles, business use, or fleet operations. Choosing correctly avoids costly mistakes and ensures adequate financial protection. We'll cover coverage scope, liability limits, costs, exclusions, claims processes, fleet management, and driver requirements so you can confidently navigate your insurance options.

1. Coverage Scope and Business Operations

One of the most fundamental distinctions in the insurance world lies in the difference between commercial and personal auto insurance. Understanding this difference is crucial for ensuring you have the right coverage for your needs and avoiding potentially costly legal and financial ramifications. This section delves into the scope of coverage and business operations related to each type of policy, highlighting why this distinction is paramount for both individuals and businesses. Choosing the wrong type of coverage can lead to denied claims, policy cancellation, and significant out-of-pocket expenses in the event of an accident.

Commercial auto insurance is specifically designed for vehicles used for business purposes. This encompasses a broad range of activities, from deliveries and client visits to employee transportation and the operation of commercial fleets. The core principle behind commercial auto insurance is the recognition of the increased risk and potential liability associated with business operations. For instance, a delivery driver making multiple stops throughout the day faces a statistically higher risk of accidents compared to someone commuting to and from work. Similarly, a business transporting clients or employees assumes a greater liability in case of an accident.

Conversely, personal auto insurance is strictly intended for personal use of a vehicle. This includes commuting, running errands, leisure trips, and general personal transportation. These policies are designed to cover the individual and their family members while using the vehicle for non-business-related activities. The risk profile for personal use is generally lower, as the vehicle is typically used less frequently for business-related driving, and the potential liability is often limited to personal injury and property damage.

The features of each policy type reflect this core difference. Commercial auto insurance often includes coverage for business equipment and cargo carried in the vehicle, reflecting the needs of businesses transporting goods or tools. Personal policies, on the other hand, focus on individual and family transportation needs, with coverage tailored to personal belongings and medical expenses.

Both types of insurance offer distinct advantages and disadvantages. Commercial auto insurance provides comprehensive business protection, covering a wide array of business-related driving activities and potential liabilities. Personal auto insurance offers a simpler, more straightforward coverage option, often with lower premiums for basic coverage, reflecting the lower risk associated with personal use. However, the simplicity of a personal policy comes with significant limitations. Crucially, using a personally insured vehicle for business purposes can void the coverage entirely, leaving you exposed in the event of an accident. Commercial policies, while more expensive due to the higher risk they cover, offer peace of mind knowing that your business operations are protected.

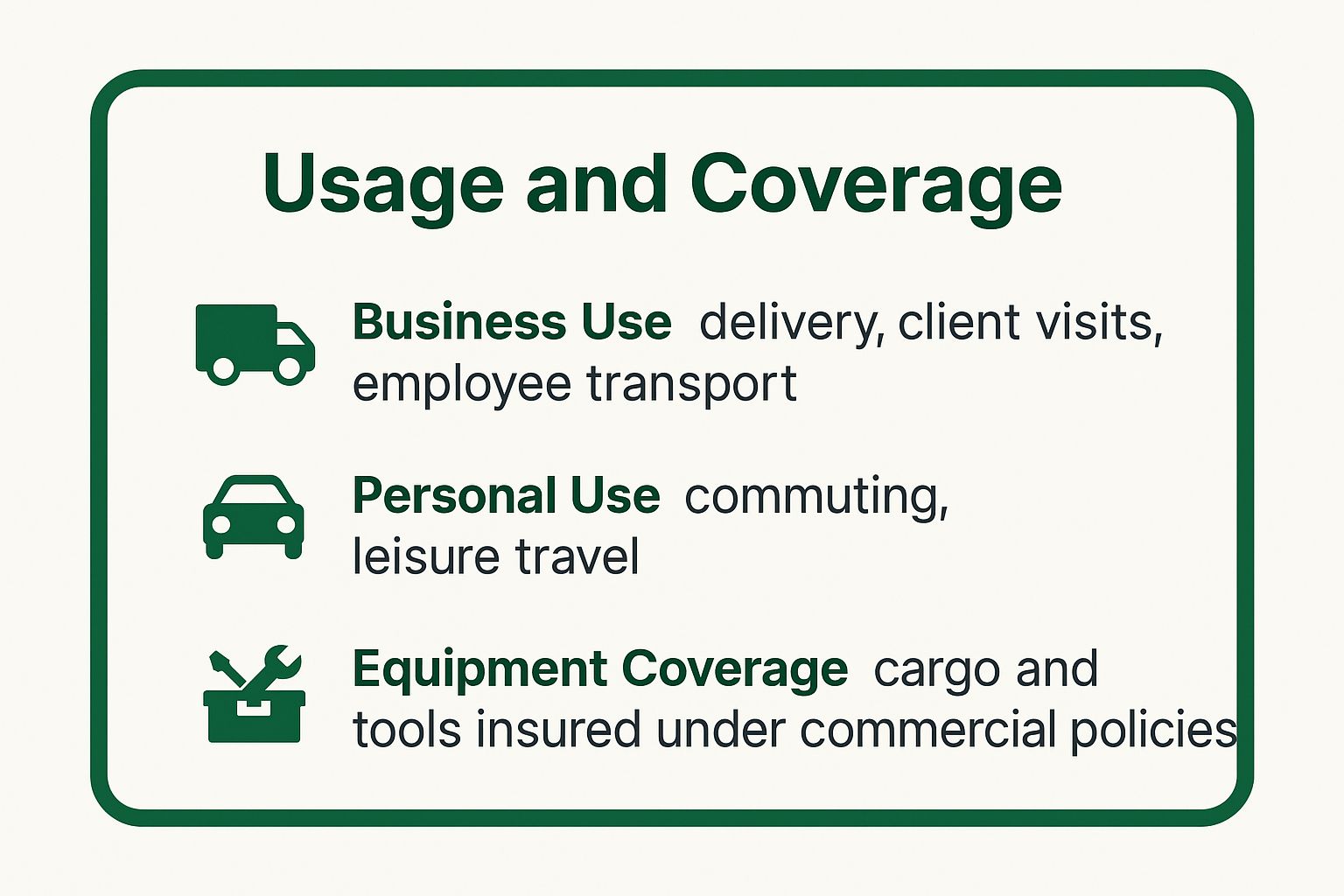

The following infographic summarizes the key differences in coverage scope:

As the infographic clearly illustrates, commercial auto insurance addresses business use cases like deliveries and client visits, while personal insurance focuses on commuting and leisure. A crucial distinction highlighted is the equipment coverage provided by commercial policies, protecting valuable cargo and tools.

Real-world examples further illustrate this distinction. Delivery companies rely on commercial coverage for their fleets, recognizing the constant business use and associated risks. Similarly, real estate agents transporting clients require commercial coverage to protect themselves and their business. Conversely, a family using their vehicle solely for vacations and commuting benefits from the simplicity and affordability of a personal auto policy. Ride-share drivers present a unique case, often requiring specialized commercial or hybrid policies due to the mixed nature of their vehicle use. Learn more about Coverage Scope and Business Operations.

Choosing between commercial vs personal auto insurance hinges on clearly defining how your vehicle will be used. Carefully review policy exclusions regarding business use restrictions, and consider commercial coverage if you generate any income with your vehicle, even occasionally. For borderline cases or if you have questions about which policy is right for you, consulting with insurance agents is highly recommended. They can help you navigate the complexities of commercial vs. personal auto insurance and ensure you have adequate coverage for your specific needs.

2. Liability Limits and Financial Protection

A critical distinction between commercial and personal auto insurance lies in the liability limits and the level of financial protection they offer. Understanding these differences is crucial for selecting the right coverage and ensuring adequate protection in case of an accident. This aspect is so vital because the financial ramifications of an accident, especially one involving a business vehicle, can be devastating without sufficient coverage. Choosing between commercial vs personal auto insurance hinges heavily on your liability needs.

Liability coverage is designed to protect you financially if you are at fault in an accident that causes bodily injury or property damage to others. It covers expenses such as medical bills, legal fees, and property repairs. However, the required level of protection differs significantly between personal and commercial use.

Commercial auto insurance typically demands much higher liability limits than personal auto insurance. This stems from the increased risk and potential for higher damages associated with business operations. Businesses face greater exposure to lawsuits, particularly if their vehicles are involved in accidents causing significant injuries or property damage. For instance, a delivery driver causing an accident while on the job could lead to a lawsuit against both the driver and the employing company. Therefore, commercial policies often mandate minimum liability limits of $1 million or more, with some policies requiring limits of $2 million, $3 million, or even $5 million, especially for businesses operating large vehicles or transporting hazardous materials. Trucking companies, construction companies using heavy equipment, and businesses with extensive vehicle fleets often carry these higher limits. A trucking company carrying $1 million in liability coverage recognizes the potential for catastrophic damage involving their large vehicles, while a construction company with $5 million in limits understands the risks associated with operating heavy machinery near public works and populated areas.

Conversely, personal auto insurance policies typically offer liability limits ranging from $25,000 to $500,000 per incident. These limits are generally deemed sufficient for individual needs, covering accidents involving personal vehicles. A driver with $100,000/$300,000 liability limits, for example, has coverage up to $100,000 for bodily injury per person, $300,000 for total bodily injury per accident, and a separate amount for property damage. While these limits meet most state minimum requirements and protect personal assets in many situations, they may prove inadequate in cases of severe accidents involving substantial medical expenses or property damage.

Another important difference in liability coverage is uninsured/underinsured motorist coverage. Commercial policies frequently include higher uninsured/underinsured motorist limits, recognizing that accidents involving commercial vehicles might involve other drivers with insufficient or no insurance. This protects the business in situations where the at-fault driver cannot cover the damages. Personal policies also offer this coverage, but the focus is primarily on protecting the individual and their passengers from uninsured or underinsured drivers.

Pros and Cons:

- Commercial Insurance Pros: Offers extensive protection against potentially devastating business lawsuits, safeguards business assets and operations, and provides higher uninsured/underinsured motorist coverage.

- Commercial Insurance Cons: High liability limits significantly increase premium costs, and over-insurance can strain business budgets.

- Personal Insurance Pros: Offers adequate protection for many individuals at reasonable costs and efficiently meets state minimum requirements.

- Personal Insurance Cons: Standard liability limits may be insufficient for serious accidents involving significant damages, and coverage may not adequately protect high-net-worth individuals.

Tips for Choosing the Right Coverage:

- Assess Business Assets: Carefully evaluate the value of your business assets and potential lawsuit exposure when determining commercial liability limits.

- Consider Umbrella Policies: High-net-worth individuals and businesses should consider purchasing umbrella policies to supplement their existing liability coverage and provide additional protection. A wealthy individual concerned about protecting their assets might opt for an umbrella policy to provide coverage beyond their standard auto insurance limits.

- Review State Minimum Requirements: Familiarize yourself with your state’s minimum liability requirements as a baseline for coverage, but understand that these minimums might not provide sufficient protection in many situations.

- Evaluate Lawsuit Exposure: Consider your business type, location, and the inherent risks involved in your operations when evaluating potential lawsuit exposure and choosing appropriate liability limits.

Selecting the right liability coverage is a crucial element of responsible financial planning. By understanding the nuances of commercial vs personal auto insurance, individuals and businesses can make informed decisions to protect their financial well-being in the event of an accident.

3. Premium Costs and Pricing Structure

One of the most significant differences between commercial and personal auto insurance lies in the premium costs and how those prices are determined. Understanding these distinctions is crucial for making informed decisions about your insurance coverage, whether you're a small business owner using a vehicle for deliveries or a large corporation managing a fleet of trucks. Choosing the wrong policy can leave you underinsured or paying unnecessarily high premiums. This section breaks down the complexities of commercial and personal auto insurance pricing, empowering you to make the right choice for your specific needs. Commercial auto insurance premiums are typically 15-40% higher than personal coverage due to the increased risk exposure, higher liability limits, and inherent factors related to business use. Pricing structures also differ significantly. While personal policies focus primarily on driving records and personal factors, commercial policies consider a broader range of elements, including business revenue, employee count, the types of vehicles used, and the specific operational risks associated with the business.

Commercial auto insurance premiums are calculated based on the perceived risk your business operations present to the insurer. For example, a delivery service operating multiple vehicles in a busy urban area will likely face higher premiums than a small consulting firm with a single company car rarely used for business travel. This is because the delivery service has a greater chance of accidents, and the potential for higher claims payouts. The pricing structure reflects this, taking into account factors like the estimated annual mileage of business vehicles, the type of goods transported, the number of employees driving company vehicles, and the business's overall revenue. Similarly, industries considered high-risk, such as construction or transportation, will typically have higher premiums compared to lower-risk sectors like office-based businesses.

On the other hand, personal auto insurance premiums are predominantly determined by the driver's history and personal characteristics. Insurers assess factors such as age, driving record (including accidents and traffic violations), credit score, and the type of vehicle being insured. These factors contribute to a risk profile, which determines the individual's premium. Because these factors are largely standardized across similar demographic groups, personal auto insurance rates tend to be more consistent and predictable than commercial rates.

Commercial Auto Insurance – Pros and Cons:

Pros:

- Comprehensive Business Protection: Offers higher liability limits and coverage tailored to business-specific risks, protecting your business assets in case of accidents or lawsuits.

- Tailored to Specific Business Risks: Policies can be customized to address the unique needs of different businesses, providing coverage for specialized equipment, cargo, or other industry-specific requirements.

Cons:

- Significantly More Expensive: Premiums are notably higher compared to personal auto insurance due to the increased risk exposure associated with business use.

- Fluctuating Rates: Premiums can fluctuate based on business performance, claims history, and changes in the risk profile of the business.

Personal Auto Insurance – Pros and Cons:

Pros:

- Affordable Protection for Individual Needs: Provides cost-effective coverage for personal vehicle use, focusing on individual driving records and personal factors.

- Competitive Consumer Market: Benefits from a competitive market, offering consumers various options and potentially lower rates.

Cons:

- Insufficient for Business Liability Exposure: Does not provide adequate coverage for business-related liabilities, leaving personal assets vulnerable in case of accidents while using the vehicle for business purposes.

- Limited Customization Options: Policies may offer fewer customization options compared to commercial insurance, potentially leaving gaps in coverage for specific business needs.

Examples:

- A delivery service might pay $3,000 annually for commercial auto insurance compared to $1,200 for a similar vehicle under a personal policy.

- A construction company with multiple work trucks could face annual premiums of $8,000 or more. In contrast, a personal SUV owner might pay around $1,500 annually for comprehensive coverage.

- A small business owner switching from personal to commercial auto insurance could see a premium increase of 25% or more.

Tips:

- Obtain multiple commercial quotes: Due to significant rate variations among insurers, shopping around and comparing quotes from different providers is essential.

- Bundle commercial auto with other business insurance: Bundling policies, such as general liability or property insurance, can often lead to discounted premiums.

- Maintain good business credit: A positive business credit history can help qualify for better commercial insurance rates.

- Consider usage-based pricing: For vehicles with limited business use, usage-based insurance programs that track mileage and driving behavior might offer cost savings.

Learn more about Premium Costs and Pricing Structure for more detailed information regarding auto insurance, especially if you're in Florida. Properly understanding the differences between commercial vs personal auto insurance is critical for protecting your assets and ensuring adequate coverage.

4. Policy Exclusions and Coverage Restrictions

Understanding the specific exclusions and coverage restrictions within both personal and commercial auto insurance policies is paramount when deciding which type of coverage best suits your needs. This critical distinction between commercial vs personal auto insurance can significantly impact your financial protection in the event of an accident. Overlooking these nuances can lead to denied claims and unexpected out-of-pocket expenses, leaving you financially vulnerable. This section delves into the specific exclusions inherent in each policy type, highlighting the importance of selecting the correct coverage for your circumstances.

Personal auto insurance policies are designed to cover the personal use of a vehicle. This means using your car for commuting, running errands, personal trips, and general day-to-day activities. Crucially, personal policies explicitly exclude any business-related use. This includes using your vehicle for:

- Delivery Services: Using your personal vehicle to deliver goods, even occasionally, like delivering pizzas or groceries for a side hustle, voids your personal auto insurance coverage in most cases.

- Ride-Sharing: Driving for companies like Uber or Lyft necessitates a commercial policy or a specific ride-sharing endorsement added to a personal policy. Standard personal auto insurance will not cover accidents that occur while engaging in ride-sharing activities.

- Business Transportation: Transporting clients, equipment, or supplies related to your business, even if it's infrequent, is generally excluded under personal auto insurance.

These exclusions are in place to keep premiums lower for individuals who use their vehicles for personal purposes only. Insuring business activities involves a different level of risk assessment and requires a specialized commercial policy.

Conversely, commercial auto insurance policies are designed specifically for business use of vehicles. These policies cover vehicles owned by a business, used for business operations, and driven by employees within the scope of their employment. However, commercial policies typically exclude personal use by unauthorized drivers. This means:

- Personal Use by Employees: An employee driving a company-owned vehicle for personal errands without explicit permission from the company would not be covered under the commercial policy.

- Personal Use of Business Vehicles by Non-Employees: Allowing a friend or family member to drive a company-owned vehicle for personal use is generally excluded and could void coverage in the event of an accident.

Certain high-risk business activities may also be excluded from standard commercial policies and require additional, specialized coverage. For example, a business that transports hazardous materials will likely need a specific endorsement added to their commercial policy to cover potential incidents involving those materials. Similarly, businesses operating large fleets of vehicles might require tailored coverage options.

Pros and Cons of Policy Exclusions:

While these exclusions might seem restrictive, they serve important purposes. Clear exclusions in personal policies help define the boundaries of coverage and keep costs lower for individual drivers. Commercial policy exclusions provide certainty for business operations by ensuring coverage is focused on work-related activities. However, these exclusions can also present challenges. Personal policy exclusions can leave legitimate business activities unprotected, while commercial exclusions may necessitate additional, and often more expensive, specialty coverage. A significant concern is the potential for coverage gaps during mixed personal/business use, which can occur when individuals occasionally use their personal vehicles for work-related tasks. Finally, the complexity of these exclusions can lead to misunderstandings by policyholders, resulting in unexpected claim denials.

Actionable Tips to Avoid Coverage Gaps:

- Carefully Review Policy Exclusions: Before purchasing any auto insurance policy, thoroughly review the exclusions section. Don’t hesitate to ask your insurance agent to clarify any points of confusion.

- Consider Hybrid Policies: For individuals who frequently use their vehicles for both personal and business purposes, hybrid or "business-use" policies may be a viable option. These policies bridge the gap between personal and commercial coverage, offering broader protection.

- Notify Your Insurer of Changes: If your vehicle use changes, inform your insurance company immediately. If you start using your personal vehicle for deliveries or begin driving for a ride-sharing service, you'll likely need to update your policy.

- Maintain Separate Policies for Distinct Uses: For clear-cut separation between personal and business vehicle use, maintaining separate policies is often the best approach. This ensures appropriate coverage for both activities without the risk of exclusions impacting claims.

Examples of these exclusions in action highlight their importance. Imagine a pizza delivery driver using their personal vehicle getting into an accident. Their personal policy would likely deny the claim due to the business use exclusion. Similarly, an Uber driver involved in a collision would find their personal insurance inadequate, necessitating a commercial or ride-share specific policy. Conversely, an employee using a company vehicle for a personal errand without authorization could find themselves, and their employer, facing significant liability in the event of an accident.

Choosing the right coverage – commercial vs personal auto insurance – depends entirely on how you use your vehicle. Understanding the specific exclusions and restrictions of each policy type is crucial for ensuring adequate protection and avoiding costly surprises. By carefully considering your individual or business needs and seeking professional advice when necessary, you can confidently select the right auto insurance coverage for your specific circumstances.

5. Claims Process and Documentation Requirements

When comparing commercial vs personal auto insurance, understanding the claims process and documentation requirements is crucial. The procedures, necessary paperwork, and timelines differ significantly between these two policy types. This distinction stems from the inherent differences in how vehicles are used – personal vehicles for private use and commercial vehicles for business operations. Knowing these differences upfront can save you time, money, and frustration should you need to file a claim.

Personal auto insurance claims generally follow a relatively straightforward process. The focus is primarily on the accident details, the extent of personal damages, and the associated costs for medical treatment and vehicle repairs. For example, if your family SUV is involved in a standard collision, the claim would typically involve providing details about the accident circumstances, police reports (if applicable), and damage assessments from repair shops. Personal claims often benefit from standardized processing procedures, allowing for quicker resolution, sometimes within days.

Commercial auto insurance claims, however, are significantly more complex. Because commercial vehicles are used for business purposes, the claims process requires extensive documentation related to business operations. This might include trip logs detailing routes and mileage, proof of business purpose for the trip, customer delivery verification, and even financial impact assessments demonstrating how the accident affected business revenue. Imagine a delivery truck accident. The claim would not only involve documenting the accident itself but also verifying the delivery schedule, confirming the goods being transported, and potentially assessing the financial impact of delayed or lost deliveries. Similarly, a construction vehicle claim might necessitate an equipment inventory and a detailed assessment of how the vehicle's downtime impacts ongoing projects. This complexity often leads to longer processing times for commercial claims compared to personal claims.

One key difference lies in the potential for business interruption and lost revenue claims. Commercial auto insurance recognizes that vehicle downtime can significantly impact a business's bottom line. Therefore, commercial policies often include provisions for recovering lost income and covering ongoing business expenses during the repair period. This is not typically a factor in personal auto insurance claims.

Pros and Cons:

Commercial Claims:

- Pros: Can recover business losses and interruption costs; includes specialized business claim handlers familiar with the nuances of commercial operations.

- Cons: Requires extensive documentation and verification; processing often takes longer due to complexity.

Personal Claims:

- Pros: Process typically faster and simpler; benefits from standardized processing procedures.

- Cons: May not cover all modern vehicle technology or expensive modifications; may have limited coverage overall compared to commercial policies.

Tips for a Smoother Claims Process:

- Maintain meticulous business trip logs: For commercial vehicles, detailed records of routes, mileage, and business purposes are essential.

- Keep receipts and business purpose records: Document all commercial vehicle use, including fuel purchases, maintenance records, and client-related expenses.

- Understand the claims process differences before needing to file: Familiarize yourself with the specific requirements of your commercial vs personal auto insurance policy.

- Work with experienced insurance agents: Seek guidance from agents specializing in your specific coverage type, whether it's commercial fleet insurance, private client solutions for high-value vehicles, or standard personal auto coverage. This personalized advice can be invaluable in navigating the complexities of insurance.

Learn more about Claims Process and Documentation Requirements (This article, though focused on homeowner's insurance, offers valuable insights into general claims processes and documentation.)

Understanding the nuances of commercial vs. personal auto insurance claims processes is crucial for anyone operating a vehicle for business purposes. The additional documentation required for commercial claims reflects the higher stakes involved and the potential for significant financial impact on a business. By being prepared and proactive in record-keeping, you can streamline the claims process and ensure you receive the appropriate coverage in the event of an accident.

6. Fleet Management and Multiple Vehicle Coverage

One of the most significant distinctions between commercial and personal auto insurance lies in how they handle multiple vehicles. This difference becomes particularly critical when managing a business fleet, where the complexities of insuring multiple drivers and vehicles necessitate a more robust and streamlined approach. Choosing the right type of coverage – commercial or personal – hinges on understanding these nuances and how they impact your specific needs. This is a crucial factor when comparing commercial vs personal auto insurance, particularly for businesses.

Personal auto insurance policies are designed for individual or family use, typically covering vehicles owned and operated for personal commuting, errands, and leisure activities. While multi-car discounts are often available for households insuring multiple vehicles under the same policy, these policies lack the sophisticated management tools necessary for businesses operating fleets. Each vehicle is essentially insured individually, even with a multi-car discount, requiring separate administration and potentially leading to inefficiencies when managing a larger number of vehicles.

Commercial auto insurance, conversely, offers specialized fleet management solutions that cater to the unique needs of businesses. These policies allow for centralized billing and administration, simplifying the management of multiple vehicles under a single policy. This streamlined approach saves time and resources, allowing business owners to focus on their core operations rather than navigating the complexities of individual vehicle insurance policies. Moreover, commercial fleet insurance offers comprehensive reporting and analytics, providing valuable insights into driver behavior, vehicle maintenance, and overall fleet performance. This data-driven approach can help identify areas for improvement, reduce risk, and optimize fleet operations for greater efficiency and cost savings.

The scalability of commercial fleet insurance is another key advantage. As your business grows and your fleet expands, adding new vehicles to your existing policy is a seamless process. This eliminates the need to secure separate policies for each new vehicle, significantly simplifying administration and ensuring consistent coverage across your entire fleet. Personal policies, on the other hand, are not designed for this type of scalability and can quickly become unwieldy as the number of vehicles increases.

Pros and Cons of Commercial vs. Personal for Fleet Management:

Commercial Auto Insurance:

Pros:

- Streamlined administration for multiple vehicles

- Scalable coverage as business grows

- Comprehensive fleet reporting and analytics

- Specialized fleet management tools (e.g., GPS tracking, driver monitoring)

Cons:

- Higher administrative overhead compared to individual personal policies

- Potential minimum fleet size requirements

- May be more expensive than individual personal policies for very small fleets

Personal Auto Insurance:

Pros:

- Simpler management for a small number of vehicles

- Multi-car discounts available for household vehicles

Cons:

- Lacks coordination for business vehicle needs

- Cannot efficiently handle large numbers of vehicles

- No fleet management tools or reporting

Examples:

- Commercial: A landscaping company with 15 trucks benefits from a single commercial fleet policy, streamlining administration and providing comprehensive coverage. A delivery service utilizes centralized fleet tracking and insurance management to optimize routes, monitor driver behavior, and improve overall efficiency. A small business owner with two work trucks might find separate commercial policies more cost-effective initially but should consider a fleet policy as the business grows.

- Personal: A family with three personal vehicles can leverage a multi-car discount on a single policy for their personal use.

Tips for Effective Fleet Management:

- Consider fleet policies when managing three or more business vehicles. While individual commercial policies might suffice for very small fleets, the benefits of a dedicated fleet policy become increasingly apparent as your fleet expands.

- Utilize fleet management tools. Take advantage of technologies such as GPS tracking, driver monitoring systems, and telematics to improve safety, optimize routes, and reduce operational costs.

- Negotiate fleet discounts. Insurance providers often offer discounts based on fleet size, safety records, and the implementation of driver training programs.

- Implement driver training programs. Investing in driver training can significantly reduce accidents and improve overall fleet safety, leading to lower insurance premiums.

Choosing between commercial and personal auto insurance for multiple vehicles is a critical decision, particularly for businesses. By understanding the distinct features, advantages, and disadvantages of each option, you can make an informed choice that aligns with your specific needs and supports the efficient and cost-effective operation of your vehicles. The comparison of "commercial vs personal auto insurance" becomes particularly relevant in this context, helping you navigate the complexities of insuring multiple vehicles and ensuring you have the right coverage for your situation.

7. Driver Requirements and Employee Coverage: A Key Difference Between Commercial and Personal Auto Insurance

One of the most significant distinctions between commercial and personal auto insurance lies in driver requirements and employee coverage. Understanding these differences is crucial for selecting the correct policy and ensuring adequate protection. Choosing the wrong policy can leave you exposed to significant financial risk in the event of an accident. This section delves into the specifics of driver coverage for both commercial and personal auto insurance, highlighting why this factor is a critical consideration in the "commercial vs personal auto insurance" debate.

Personal auto insurance policies are designed to cover the policyholder, their family members residing in the same household, and occasional drivers with the policyholder's permission. Adding a family member to a personal policy is typically a straightforward process. However, coverage for regular drivers outside the immediate family can be ambiguous. For instance, if a roommate or a friend regularly uses your car, they might not be covered under your personal policy, even if they have your permission. This is where the distinction between personal and commercial insurance becomes critical.

Commercial auto insurance, on the other hand, is structured to cover employees, contractors, and other authorized personnel operating company vehicles, regardless of their relationship to the business owner. This broader coverage is essential for businesses, as employee driving is often integral to their operations. Consider a construction company with 25 employees operating various vehicles, from pickup trucks to heavy machinery. A commercial policy ensures all these drivers are covered under the business insurance, protecting the company from liability in case of accidents. Similarly, a delivery service reliant on its drivers can mandate clean driving records as part of its commercial insurance policy, minimizing risk and potentially lowering premiums.

A significant aspect of commercial auto insurance is the requirement for comprehensive driver verification and ongoing monitoring. Insurers require businesses to provide details of all employees who will be driving company vehicles, including their driving history and license status. This rigorous process helps insurers assess the risk associated with the business and determine the appropriate premium. Furthermore, many commercial policies require ongoing driver monitoring, allowing insurers to track any changes in driver records, such as accidents or traffic violations. This continuous oversight allows insurers to adjust premiums accordingly and even exclude high-risk drivers to control costs. For example, if a delivery driver accumulates multiple speeding tickets, the insurance company might require the business to exclude that driver from coverage or face a significant premium increase.

While this stringent driver management might seem cumbersome, it's crucial for protecting businesses from the potential financial fallout of employee-caused accidents. This ongoing monitoring is a key differentiator when considering commercial vs personal auto insurance. Personal policies generally lack such stringent controls, making them simpler to manage for individual drivers and families but potentially leaving them vulnerable if unauthorized or high-risk individuals operate their vehicles. For example, complications can arise with personal policies when a non-family member regularly drives the insured vehicle. In case of an accident, the insurance company might deny the claim if the driver was not explicitly listed on the policy.

There are distinct pros and cons to the driver requirements of each policy type. Commercial coverage provides robust protection for businesses by covering a wider range of drivers and implementing risk management strategies through driver monitoring. This allows businesses to mitigate risk and control costs by excluding high-risk drivers. However, the ongoing driver verification and monitoring can be administratively demanding. Personal policies, while simple to manage with fewer driver changes and offering flexibility for family members, may not adequately cover non-family drivers and can become complicated by the addition of teen drivers or high-risk family members.

To effectively manage driver-related insurance matters:

- Implement driver screening and ongoing monitoring for commercial coverage: This helps maintain an accurate assessment of risk and allows for timely intervention in case of driver record changes.

- Provide driver training programs to reduce commercial insurance costs: Investing in driver safety training can demonstrate a commitment to risk reduction and potentially lower insurance premiums.

- Clearly designate authorized drivers for both commercial and personal policies: This ensures clarity regarding coverage and prevents disputes with the insurer in the event of an accident.

- Review driver additions/changes promptly to maintain proper coverage: Regularly updating driver information on both personal and commercial policies guarantees that everyone operating the vehicle is adequately insured.

By understanding the nuances of driver requirements and employee coverage, you can make informed decisions when choosing between commercial vs personal auto insurance, ensuring you have the right protection for your specific needs.

Commercial vs Personal Auto Insurance: 7-Key Aspect Comparison

| Aspect ⚙️ | Commercial Auto Insurance 🚛 | Personal Auto Insurance 🚗 |

|---|---|---|

| Implementation Complexity 🔄 | Moderate to High: Requires detailed business documentation and driver monitoring | Low: Simple setup focused on individual drivers |

| Resource Requirements ⚡ | Higher: Needs business records, trip logs, employee info, fleet management tools | Lower: Basic personal info and driving record |

| Expected Outcomes 📊 | Comprehensive business protection with high liability limits and income-generating coverage | Adequate personal asset protection with standard liability limits |

| Ideal Use Cases 💡 | Businesses with multiple vehicles, employee drivers, delivery, client transportation | Individual and family use, commuting, leisure activities |

| Key Advantages ⭐ | Extensive liability limits, fleet management, tailored to business risks, covers business equipment and cargo | Lower premiums, simpler claims, multi-car household discounts |

| Pricing and Premium Costs ⚡ | Significantly higher; based on business revenue, risk, and vehicle usage | Generally lower; based on personal driving history and demographics |

Making the Right Choice for Your Auto Insurance Needs

Understanding the nuances of commercial vs personal auto insurance is crucial for securing appropriate coverage. We've explored seven key differences, from coverage scope and liability limits to premium costs and claims processes. Mastering these concepts empowers you to choose a policy that truly protects your assets, whether you're a homeowner driving for personal use, a business owner with a fleet of vehicles, or a high-net-worth individual requiring specialized coverage. This knowledge translates directly to financial security and peace of mind, knowing you're adequately protected in any driving scenario, from everyday commutes to complex business operations. Remembering the distinctions between commercial and personal auto insurance safeguards you from potential financial risks and ensures you have the right coverage for your specific circumstances.

Choosing the right auto insurance can be complex. Wexford Insurance Solutions specializes in both commercial and personal auto insurance, offering tailored solutions for individuals, families, and businesses. Let our experts help you navigate the complexities of commercial vs personal auto insurance. Visit Wexford Insurance Solutions today for a personalized consultation and secure the right coverage for your needs.

Insuring Fine Art: Essential Tips to Protect Your Collection

Insuring Fine Art: Essential Tips to Protect Your Collection Business Interruption Insurance Cost: Complete Pricing Guide

Business Interruption Insurance Cost: Complete Pricing Guide