Understanding Business Interruption Insurance Cost Basics

Let's break down the sometimes confusing topic of business interruption insurance costs. This vital coverage protects your business from financial hardship after unexpected events. Understanding the costs involved is the first step to making smart decisions about your coverage. This means knowing what factors determine your premium and how various coverage options impact your bottom line.

Key Cost Drivers of Business Interruption Insurance

Several key factors influence the cost of your business interruption insurance. The waiting period, the time between the incident and when coverage kicks in, is crucial. A longer waiting period often means a lower premium. However, it also means a longer period without financial support. This is a trade-off you'll need to carefully consider.

Your coverage limits also play a significant role. Higher limits offer greater protection, but come with higher premiums. Finding the right balance between protection and affordability is essential.

How your policy calculates potential losses is another important factor. There are two main approaches: gross earnings and actual loss sustained. Gross earnings coverage estimates potential losses based on your past revenue. Actual loss sustained coverage considers expenses you can reduce or eliminate during the interruption. This difference significantly impacts both your premium and potential payout. Learn more about this and other insurance basics in our article about Business Insurance Basics.

How Insurers Assess Risk

Insurers use various factors to assess your business's risk. Your industry plays a significant role. A manufacturing plant with complex machinery faces different risks than a home-based consulting business, for instance.

Your location also matters. Businesses in areas prone to natural disasters generally have higher premiums. Finally, your business's unique characteristics, such as your revenue, number of employees, and safety measures, are considered. All these factors combined determine your specific premium.

Practical Examples and Policy Structure

Understanding how these factors interact is crucial for making wise coverage decisions. A business with substantial financial reserves might choose a longer waiting period to lower premiums. A business with highly specialized equipment, however, might prioritize higher coverage limits. The structure of your policy directly impacts both cost and the protection it provides. By understanding the cost basics, you can ensure you’re getting the right coverage at a price that makes sense for your business.

What Actually Drives Your Business Interruption Insurance Cost

Understanding the factors that influence your business interruption insurance cost empowers you to make informed decisions and potentially lower your premiums. These costs aren't arbitrary; they're calculated based on a careful assessment of your business's unique risk profile.

Industry, Location, and Business Characteristics

Your industry classification significantly impacts your premium. Manufacturing operations, with their complex machinery and potential for large-scale disruptions, typically face higher costs than service-based businesses.

Similarly, businesses located in disaster-prone areas naturally incur higher premiums due to the increased likelihood of interruptions. For example, a coastal restaurant faces a higher risk of hurricane damage than an inland accounting firm.

Insurers also scrutinize various other business characteristics. Your revenue size directly correlates with potential losses, thus impacting your premium. The number of employees and the complexity of your operations also factor into the calculation.

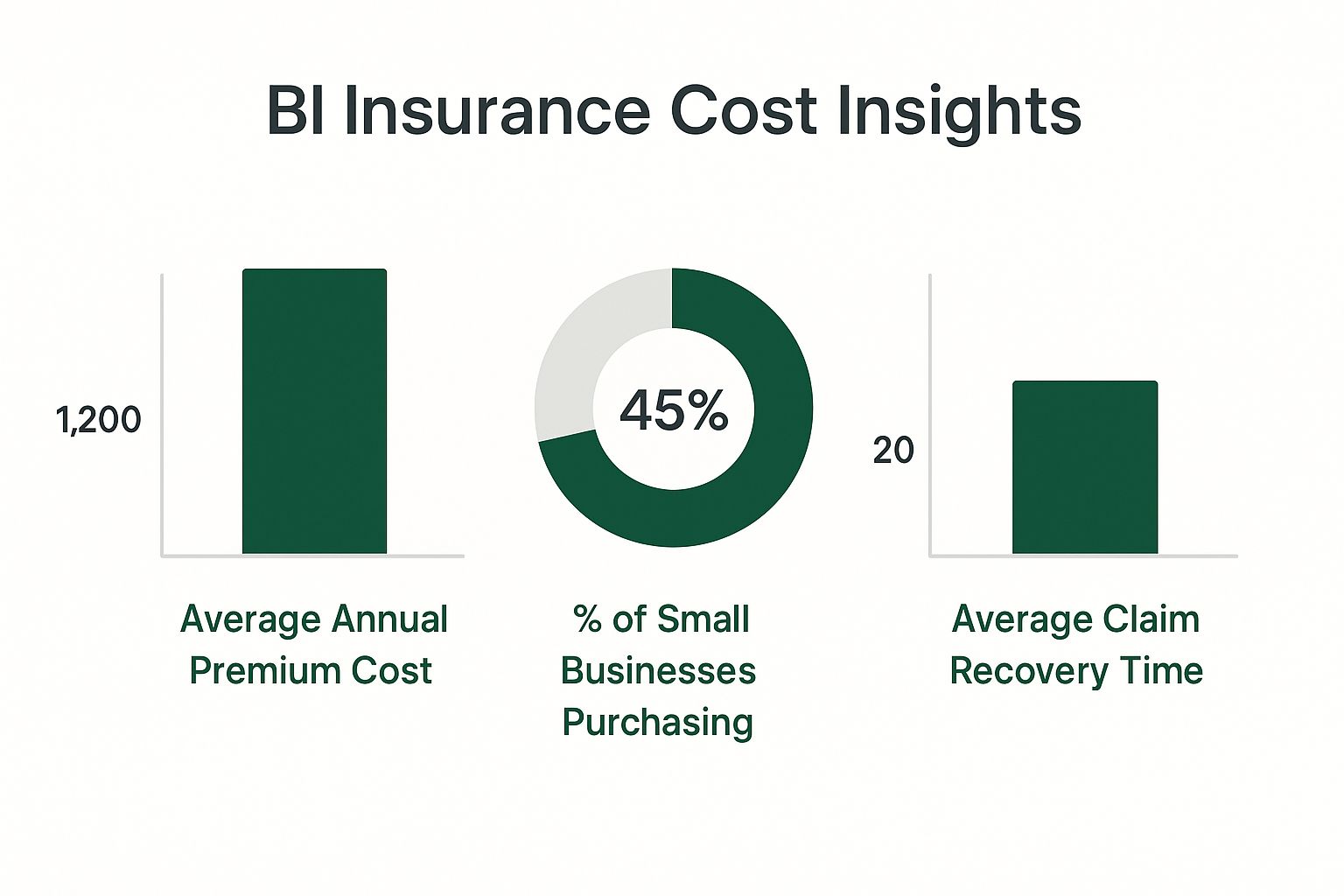

The infographic below visually represents some key business interruption insurance cost insights, including average annual premiums, purchase rates among small businesses, and average claim recovery times.

This data highlights the current landscape of business interruption insurance. It illustrates the average costs businesses face, how many are actively protecting themselves, and the typical duration of recovery after a claim. These insights provide a valuable benchmark for understanding your own potential costs and the importance of preparedness.

Claims History, Financial Stability, and Safety Measures

Just like personal insurance, your claims history affects your business interruption insurance cost. Frequent claims can lead to higher premiums. Conversely, a clean record can demonstrate lower risk and potentially qualify you for discounts.

Your business's financial stability also plays a role. Insurers view financially sound businesses as less risky, as they're more likely to weather disruptions and resume operations quickly.

Furthermore, existing safety measures can significantly influence your premium. Investing in fire suppression systems, robust security measures, and comprehensive disaster recovery plans can signal a lower risk profile and potentially reduce your costs.

Proactive risk management not only protects your business but can also improve your insurance affordability. The cost of business interruption insurance is significantly influenced by factors such as industry type, number of employees, and geographical risk exposure. Businesses located in areas prone to natural disasters often face higher premiums. Learn more about business interruption insurance insights.

To help illustrate how these factors impact premiums, let's look at the following comparison:

Business Interruption Insurance Cost Factors Comparison

A detailed breakdown of how different business characteristics impact insurance pricing

| Risk Factor | Low Risk Impact | Medium Risk Impact | High Risk Impact | Premium Increase % |

|---|---|---|---|---|

| Industry | Service-based business (e.g., accounting) | Retail store | Manufacturing plant | 0-50% |

| Location | Inland, low crime rate | Suburban, moderate crime rate | Coastal, high crime rate | 0-75% |

| Revenue | < $1 million | $1-5 million | > $5 million | 0-25% |

| Claims History | No claims filed | 1-2 claims filed in 5 years | >2 claims filed in 5 years | 0-100% |

| Safety Measures | Advanced security and disaster recovery plan | Basic security measures | No safety measures in place | 0-50% |

This table showcases how different levels of risk across various factors can lead to significant premium increases. A business with multiple high-risk factors could see their premium increase substantially.

Understanding Your Risk Profile

By understanding these key drivers of business interruption insurance costs, you gain valuable insights into how insurers assess your business's risk. This understanding empowers you to take control of your risk profile.

Implementing appropriate mitigation strategies can ultimately influence your insurance costs. This proactive approach to risk management can lead to significant savings and ensure you have the right coverage at a price that makes sense for your business.

Industry-Specific Business Interruption Insurance Costs

Business interruption insurance costs are not uniform. The price varies considerably based on the industry in which a business operates. This is because different industries face unique risks and potential disruptions.

Understanding Industry Risk Profiles

When setting premiums, insurers analyze the vulnerabilities of various industries. For example, restaurants and hotels, often face higher business interruption insurance costs. These businesses depend heavily on their physical location and consistent customer traffic. This makes them vulnerable to events like fires, natural disasters, and even temporary closures due to health code violations. Such incidents can quickly stop operations and severely impact revenue.

On the other hand, tech companies, particularly those with strong remote work capabilities, might find better pricing. This is due to their reduced reliance on physical locations and increased flexibility in maintaining operations during disruptions. Their vulnerability is vastly different from industries dependent on physical premises.

Examples of Industry-Specific Considerations

Consider a manufacturing plant. A fire causing significant equipment damage could lead to a long shutdown, impacting production, order fulfillment, and ultimately, revenue. As a result, manufacturers usually have higher business interruption insurance costs to account for this potential for substantial losses. Conversely, a consulting firm working primarily remotely might experience less severe financial repercussions from a similar event, resulting in lower premiums.

This does not mean that service-based businesses are immune to disruptions. A law firm, for instance, is highly dependent on access to client data. A cyberattack or data breach could significantly disrupt its operations and ability to generate income. This highlights how the nature of the disruption, and not just the industry itself, contributes to the cost of business interruption insurance.

Emerging Business Models and Industry Trends

The rise of e-commerce and remote services presents interesting pricing scenarios in the business interruption insurance market. While these business models offer increased flexibility and resilience to certain disruptions, they also face new vulnerabilities, such as cyberattacks and supply chain disruptions. Insurers are constantly adapting their pricing models to reflect these evolving risk landscapes.

Industry trends also play a critical role in determining business interruption insurance costs. For example, increased reliance on global supply chains introduces new vulnerabilities. Disruptions in one part of the world can swiftly impact businesses far removed geographically. This interconnectedness has made accurately assessing and pricing business interruption risks increasingly complex, influencing premium rates across many sectors. Understanding these industry-specific details allows businesses to make informed decisions about their coverage needs and manage their business interruption insurance costs effectively.

Current Market Trends Affecting Business Interruption Insurance Costs

The cost of business interruption insurance isn't fixed. It fluctuates based on market trends that constantly reshape how insurers assess and price risk. Understanding these trends helps you make informed decisions about your coverage, allowing you to anticipate cost changes and adjust your policy accordingly.

Supply Chain Vulnerabilities and Cyber Risks

Global supply chains are increasingly vulnerable, and this vulnerability significantly impacts business interruption insurance costs. Disruptions in one region can ripple across entire industries, causing unexpected closures and financial losses. Insurers have recognized this interconnectedness and are re-evaluating their risk assessments, often leading to higher premiums for businesses dependent on complex supply chains.

Cyberattacks also pose a substantial threat. Data breaches, ransomware attacks, and other cyber incidents can severely disrupt operations, leading to significant financial losses from downtime and recovery expenses. As a result, insurers are increasingly factoring cyber risks into their business interruption insurance pricing models.

Global Disruptions and Increased Demand

Major global events, such as the COVID-19 pandemic, have underscored the importance of business interruption insurance. These widespread disruptions significantly impacted businesses across various sectors, highlighting the need for financial protection against unexpected events. The subsequent surge in demand has influenced both innovation in coverage and, in some cases, increased costs as insurers adapt to the changing risk landscape.

The global business interruption insurance market is experiencing substantial growth, fueled by factors like the increasing frequency and severity of natural disasters, cyberattacks, and pandemics. The market is projected to reach approximately $250 billion by 2033, reflecting the growing demand for this type of insurance. Find more detailed statistics on the business interruption insurance market here.

Adapting Insurance Strategies

Businesses are adapting their insurance strategies to navigate this evolving market. This includes carefully assessing their risk exposures, implementing strong risk management practices, and exploring new coverage options. For instance, some businesses are adding specific endorsements to their policies to cover emerging risks, such as cyberattacks and supply chain disruptions.

New Risk Factors and Coverage Enhancements

As the business world changes, so do the risk factors considered in business interruption insurance pricing. Insurers increasingly consider factors like climate change risks, political instability, and reputational damage in their calculations.

At the same time, coverage enhancements are becoming more prevalent. Options for extended periods of indemnity and broader definitions of covered perils are now more common. Understanding these changes is crucial for businesses to secure adequate protection in today's dynamic environment.

By staying informed about current market trends and proactively adapting your insurance strategy, you can effectively manage your business interruption insurance costs and ensure adequate protection for your business. This proactive approach will help safeguard your business's financial stability when facing unforeseen challenges.

Calculating Your Business Interruption Insurance Needs

Accurately calculating your business interruption insurance needs is a critical aspect of protecting your business. Overestimating coverage can lead to unnecessarily high premiums, while underestimating can leave your business financially vulnerable after a covered event. This guide provides practical steps for determining the right coverage level.

Understanding Your Financial Data

The foundation of calculating your business interruption insurance needs lies in your financial records. Gather your profit and loss statements, tax returns, and payroll records. These documents will help you determine your gross earnings, providing a clear picture of your business's revenue generation.

Also, identify your operating expenses. These are the essential costs required to run your business, such as rent, utilities, salaries, and loan payments. Some expenses may decrease during a business interruption, while others will remain constant. Understanding these distinctions is crucial for accurate coverage calculations.

Projecting Potential Losses and Maximum Indemnity Period

Once you have a firm grasp of your financial data, the next step involves projecting potential losses. Consider the following scenarios:

- Realistic Loss Scenarios: What types of events could disrupt your business operations? These could include fire, natural disasters, cyberattacks, or other unforeseen circumstances.

- Duration of Interruption: How long would it take for your business to recover from each scenario? This timeframe determines your maximum indemnity period, which is the maximum duration your insurance will cover. Choosing a realistic timeframe is essential for full financial recovery.

For instance, a restaurant significantly damaged by a fire may require several months to rebuild and reopen, while a consulting business operating primarily online may resume operations much faster after a similar event.

Accounting for Seasonal Fluctuations and Growth

If your business experiences seasonal variations in revenue, it's essential to factor these fluctuations into your calculations. Ensure your coverage reflects peak earning periods, providing adequate protection during your most profitable times.

Furthermore, consider your growth projections. Your business interruption insurance should not only cover current revenue but also account for anticipated future growth. This proactive approach prevents being underinsured as your business expands.

Avoiding Common Calculation Mistakes

When calculating business interruption insurance needs, businesses sometimes make critical errors that can have significant consequences. Common mistakes include:

- Underestimating the Maximum Indemnity Period: Choosing a period that's too short leaves your business exposed if the recovery takes longer than anticipated.

- Overlooking Continuing Expenses: Failing to account for expenses that continue during an interruption, such as loan payments or rent, can lead to inadequate coverage.

- Not Accounting for Seasonal Fluctuations: Basing calculations solely on average monthly revenue when your business experiences peak seasons can result in insufficient coverage during those crucial periods.

Business Interruption Coverage Calculation Worksheet

To help you calculate your coverage needs, we've provided a worksheet to guide you through the process.

A practical framework for calculating appropriate coverage limits based on business financials

| Business Component | Monthly Amount | Annual Total | Coverage Multiplier | Recommended Coverage |

|---|---|---|---|---|

| Gross Earnings | $50,000 | $600,000 | 1.2 | $720,000 |

| Operating Expenses (Fixed) | $10,000 | $120,000 | 1.0 | $120,000 |

| Operating Expenses (Variable) | $5,000 | $60,000 | 0.5 | $30,000 |

| Projected Growth (Annual) | 10% | |||

| Total Recommended Coverage | $870,000 |

This table offers a simplified example. It's crucial to adjust the amounts and multipliers based on your specific financial data, risk assessment, and anticipated recovery time. A detailed analysis of these factors will help determine your appropriate business interruption insurance cost. By carefully considering these factors and avoiding common pitfalls, you can determine the appropriate level of coverage to protect your business's financial future. This proactive approach enables you to navigate unforeseen challenges with confidence.

Proven Strategies To Reduce Business Interruption Insurance Costs

Smart business owners know that managing business interruption insurance costs requires a proactive strategy. Instead of accepting the first quote they receive, they actively look for ways to optimize their premiums without compromising necessary coverage.

Business Continuity Planning and Security Upgrades

A solid business continuity plan is essential for reducing insurance costs. This plan details how your business will maintain critical operations during an interruption, demonstrating to insurers that you’re prepared for unexpected events. A comprehensive plan that includes alternative work locations, data backups, and communication protocols can significantly lower your risk profile.

Investing in updated security systems can also lead to premium discounts. Fire suppression systems, burglar alarms, and robust cybersecurity measures show a commitment to minimizing potential risks. This proactive approach protects your assets and signals a lower likelihood of interruptions to insurers, reducing your business interruption insurance cost.

Financial Management and Strategic Deductibles

Good financial management practices can also positively impact your insurance premiums. Maintaining organized financial records and healthy cash flow assures insurers of your business’s resilience and ability to recover quickly after disruptions. This financial stability can often result in lower insurance costs.

Selecting the right deductible is another key strategy. A higher deductible means you’ll assume more financial responsibility if you need to file a claim. This can substantially reduce your annual premiums, but it’s important to ensure you have the financial capacity to cover the deductible if a disruption occurs. It's a balance between risk and reward – higher risk initially, but potentially greater long-term savings on business interruption insurance costs.

Discount Opportunities and Policy Bundling

Many insurers offer various discount opportunities that businesses sometimes miss. These might include discounts for implementing specific safety measures, maintaining a claims-free history, or bundling multiple insurance policies. Be sure to ask about all available discounts.

Policy bundling can also generate substantial savings. Combining your business interruption insurance with other commercial policies, such as property or liability insurance, often results in a lower overall premium than purchasing each policy individually. Many successful businesses use this strategy to manage their insurance costs effectively. You might be interested in: How Much Umbrella Insurance Do I Need?

Policy Optimization and Proactive Claims Management

Regular policy optimization is vital for controlling your business interruption insurance cost. As your business grows and changes, so do your coverage needs. Review your policy annually to ensure it aligns with your current operations and risk profile. This prevents overpaying for unnecessary coverage or having gaps in your protection.

Finally, proactive claims management can help maintain favorable pricing. Promptly reporting claims and fully cooperating with the insurance company demonstrates responsible risk management. This can positively affect your claims history, contributing to lower premiums in the future. By using these strategies, you can effectively manage your business interruption insurance costs and ensure your business has the financial protection it needs. This balanced approach allows you to navigate uncertainties with confidence, knowing you’re getting the most value from your insurance investment.

Getting Quotes And Making Smart Coverage Decisions

Armed with a deeper understanding of business interruption insurance cost factors, you're now ready to secure the right coverage at a competitive price. This involves careful preparation, strategic quote comparisons, and knowing how to negotiate effectively.

Preparing for Insurance Quotes

Before contacting insurers, gather essential financial and business documents. This includes profit and loss statements, tax returns, payroll records, and details of your business operations. Having this information readily available streamlines the quoting process. It also allows insurers to accurately assess your risk profile. Preparing a detailed business continuity plan also helps. Showcasing your preparedness for potential disruptions can positively influence your premium costs.

Here’s a summary of what you’ll need:

- Financial Records: Prepare profit and loss statements, tax returns, and payroll information.

- Business Operations: Document your processes, dependencies, and recovery strategies.

- Continuity Plan: Demonstrate your preparedness for potential disruptions.

This organized approach will save you time. It also provides insurers with the necessary information to assess your specific needs, potentially leading to more accurate and favorable quotes.

Comparing Quotes Effectively

When evaluating quotes, look beyond just the premium price. Carefully compare policy terms, coverage limits, waiting periods, and exclusions. A lower premium might come with reduced coverage or a longer waiting period. This could prove costly in the event of an actual interruption. For example, a policy with a lower premium but a longer waiting period might not provide timely financial support when you need it most.

Here's a checklist for comparing quotes:

- Coverage Limits: Ensure they align with your potential losses.

- Waiting Period: Consider the trade-off between cost and the time it takes for coverage to begin.

- Exclusions: Understand what events are not covered and how they might impact your business.

- Policy Terms: Scrutinize the fine print to fully grasp the scope of coverage and any limitations.

Understanding these nuances helps you select a policy that offers adequate protection without overpaying for unnecessary features. Further reading: Commercial vs. Personal Auto Insurance.

Negotiating Coverage and Pricing

Don't hesitate to negotiate with insurers. Just as with other business expenses, there's often room for negotiation in business interruption insurance costs. Highlighting your risk mitigation efforts can strengthen your negotiating position. Examples include robust security systems and well-defined disaster recovery plans.

Consider these negotiation tactics:

- Emphasize Risk Mitigation: Showcase your proactive efforts to reduce potential disruptions.

- Compare Quotes: Use competing quotes to leverage better terms and pricing.

- Ask About Discounts: Inquire about available discounts based on safety measures, claims history, or bundled policies.

- Clarify Policy Language: Ensure you fully understand the terms and conditions before finalizing the policy.

By being a well-informed and proactive consumer, you can secure the appropriate business interruption insurance coverage that aligns with your business needs and budget.

Secure Your Business with Wexford Insurance Solutions

Navigating the complexities of business interruption insurance can be challenging. Wexford Insurance Solutions offers expert guidance and personalized service. We help you secure the right coverage at a competitive price. We specialize in tailoring solutions to meet the unique needs of businesses like yours. Visit us today for a comprehensive assessment and a customized plan that protects your business from unforeseen interruptions.

Commercial vs Personal Auto Insurance: 7 Key Differences Explained

Commercial vs Personal Auto Insurance: 7 Key Differences Explained Workers Compensation for Small Business: Owner's Essential Guide

Workers Compensation for Small Business: Owner's Essential Guide