Understanding Workers' Compensation Fundamentals

Workers' compensation insurance for small businesses is often misunderstood. It's not just another expense; it's a vital safety net protecting both your employees and your business. It acts as a two-sided coin: one side supports employees after a workplace injury, and the other shields your business from potentially devastating financial repercussions. This section explores the core principles of workers' compensation, clarifying its purpose and importance for small business owners.

What Does Workers' Compensation Cover?

Workers' compensation primarily covers medical expenses arising from work-related injuries or illnesses. This includes doctor visits, hospital stays, physical therapy, and prescription medications. It also provides wage replacement for employees unable to work due to their injuries, helping maintain some income stability during recovery. Additionally, workers' compensation can cover disability benefits for permanent impairments from workplace incidents.

Work-Related vs. Personal Injuries: A Critical Distinction

Understanding workers' compensation hinges on differentiating between work-related and personal injuries. A work-related injury occurs while performing job duties, regardless of fault. For instance, a construction worker injuring their back while lifting materials is covered. An injury sustained outside of work, like a sprained ankle playing basketball, is a personal injury and is typically not covered. This distinction is crucial for determining benefit eligibility.

You might be interested in: How to master business insurance basics

Workers' Compensation and Your Overall Business Strategy

Integrating workers' compensation into your overall business protection strategy is essential. It works alongside other insurance policies, like general liability insurance, to provide comprehensive coverage. General liability protects your business from third-party claims for bodily injury or property damage, while workers' compensation protects your employees and your business from the financial impact of workplace injuries. This coordinated approach minimizes financial risk and strengthens your business's resilience.

Workers' Compensation Market Trends

Interestingly, the workers' compensation market, largely made up of small businesses, remains robust but has experienced notable shifts in coverage and costs. From 2014 to 2023, the number of covered workers peaked in 2019 at over 47 million and then fell to around 42.5 million in 2020 due to pandemic-related impacts. More detailed statistics can be found here: https://www.iii.org/fact-statistic/facts-statistics-workplace-safety-workers-comp

Addressing Common Misconceptions

Many small business owners harbor misconceptions about workers' compensation. One myth is that it's only required for large companies. In actuality, most states mandate coverage for businesses with even one employee. Another misconception is that claims always result in lawsuits. The system is designed to provide benefits without protracted litigation. Understanding these nuances is crucial for effectively navigating the complexities of workers' compensation.

Navigating Legal Requirements And State Variations

Workers' compensation insurance is essential for protecting employees and businesses, but its complexity can be daunting, especially for small business owners. The legal landscape varies considerably from state to state, making it vital to understand the specific requirements in your area. Non-compliance can result in severe penalties, potentially jeopardizing your business.

Understanding State-Specific Mandates

One of the initial challenges is deciphering your state's particular mandates. The number of employees you can hire before coverage becomes mandatory changes depending on the state. Some require it from the first hire, while others allow for three, four, or even five employees. This initial difference highlights the need to research your state's specific regulations. This also holds true for multi-state operations, which need to adhere to the rules of each state where they employ workers.

Penalties for Non-Compliance

The consequences of non-compliance are substantial, ranging from significant fines and criminal charges to personal liability for workplace injuries. This personal liability means business owners could be held responsible for medical bills, lost wages, and other injury-related expenses if they lack the necessary workers' compensation coverage. This risk alone solidifies obtaining appropriate coverage as a non-negotiable element of running a small business.

Exemptions and Voluntary Coverage

Most businesses are required to have workers' compensation insurance, but there are some exceptions. Certain industries, like agriculture or domestic work, might be exempt depending on the specific state regulations. Even if your business qualifies for an exemption, voluntary coverage can offer significant benefits. It provides the same protections as mandatory coverage, acting as a valuable safety net, particularly in higher-risk industries.

Coverage Options: State Funds, Private Insurance, and Self-Insurance

Small business owners have several options for securing workers' compensation coverage. These options include:

- State-Run Funds: Some states provide workers' compensation insurance through a state-funded program.

- Private Insurance: This is the most frequent choice, with various insurance companies offering policies adapted to different business requirements.

- Self-Insurance: Available to larger businesses with substantial financial reserves, self-insurance entails taking on the financial responsibility for all claims. This option necessitates thorough planning and careful risk assessment.

Managing Multi-State Operations

Businesses operating across multiple states face the added complexity of managing diverse workers' compensation requirements. Each state has its own set of regulations, meaning businesses must ensure compliance in every location where they have employees. Often, this involves working with an insurance broker or consultant specializing in multi-state workers' compensation.

Learn more in our article about How workers' comp experience modifiers affect your premium and bottom line.

Staying Informed and Compliant

Staying up-to-date on changes in workers' compensation laws is essential. State regulations can be subject to change, so businesses must adapt to remain compliant. Consulting with a legal professional or insurance expert is advisable to ensure your business fulfills all necessary requirements. Proactively managing workers' compensation and understanding state-specific nuances safeguards your employees, your business, and its future.

Mastering Cost Analysis And Premium Factors

Understanding the factors that influence your workers' compensation premiums is essential for managing your small business expenses. It's not a static cost, but rather a dynamic one influenced by several key elements. Let's explore the formula insurance companies use to calculate these rates.

Industry Classification Codes: A Major Cost Driver

One of the primary factors affecting premiums is your industry classification code. These codes categorize businesses based on the risks associated with their operations. For instance, a construction company, where employees work at heights, will typically have a higher code and subsequently higher premiums than a retail store. This difference stems from the statistically greater risk of workplace injuries in construction.

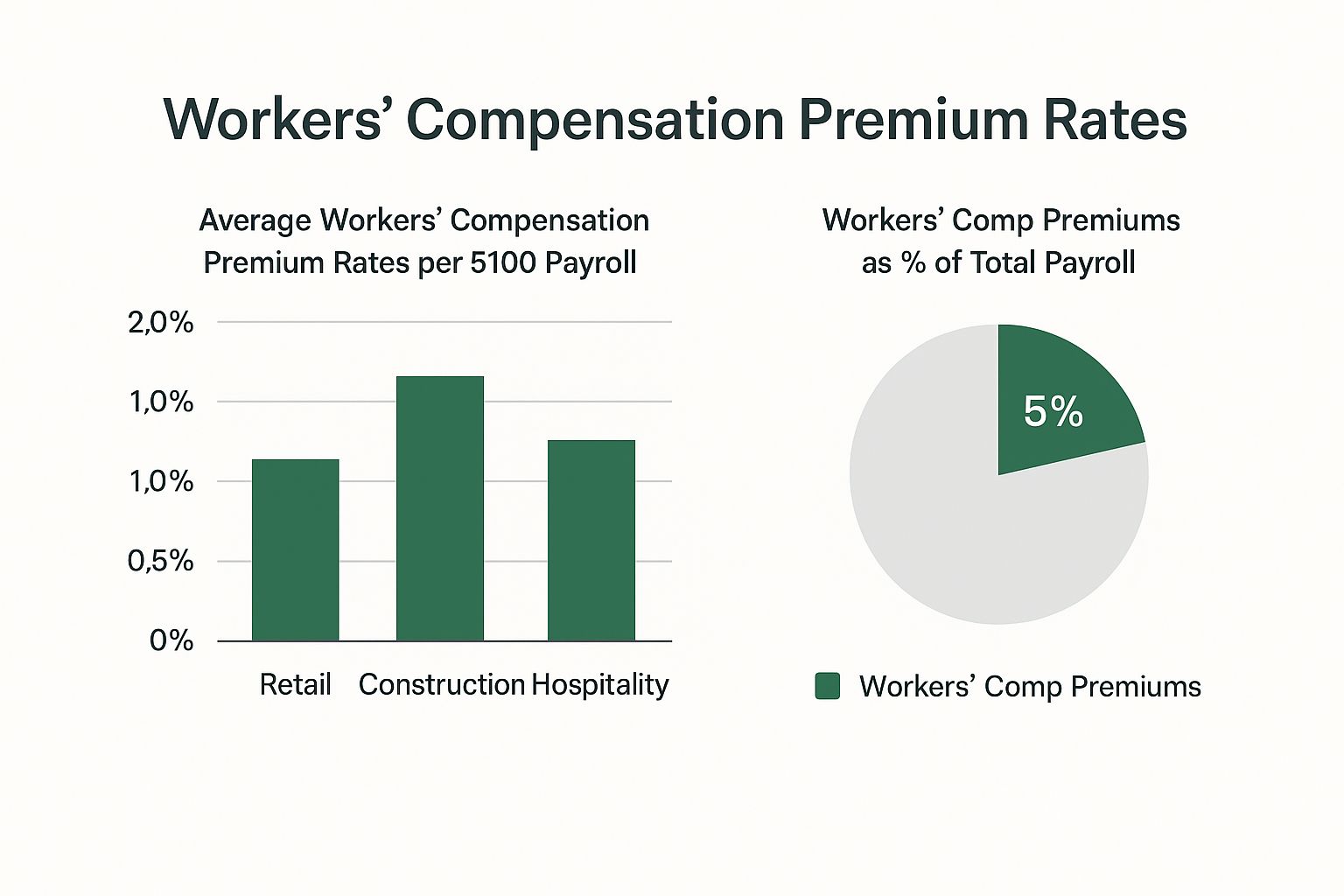

The infographic above compares average workers' compensation premiums as a percentage of payroll across various industries. It also highlights the overall proportion of payroll dedicated to these premiums. Construction, as shown, has significantly higher premium rates than retail or hospitality. Workers' compensation can represent a substantial portion of overall payroll expenses.

Claims History: The Past Impacts the Future

Your business's claims history significantly influences future premiums. A history of frequent or severe claims will likely result in higher premiums, similar to how car insurance premiums increase after accidents.

Maintaining a clean safety record, conversely, can help control your workers' compensation costs. This highlights the importance of proactive safety measures and a strong safety culture.

Payroll, Location, and Job Classifications: The Details Matter

Beyond industry and claims history, other factors affect your premiums. The size of your payroll directly correlates with the cost; a higher payroll generally means higher premiums. Job classifications within your business also matter.

A receptionist, for example, has a lower risk profile than a warehouse worker operating heavy machinery, leading to different premium contributions. Your geographical location can even influence costs due to varying state regulations and the cost of living.

To understand how these factors combine to influence your workers' compensation premiums, let's look at a detailed comparison. The following table outlines how different aspects of your business can impact your costs.

Workers Compensation Cost Factors Comparison

| Cost Factor | Impact Level | Control Level | Typical Adjustment Range |

|---|---|---|---|

| Industry Classification | High | Low | Varies widely by industry |

| Claims History | High | Medium | Up to 200% or more |

| Payroll | Medium | High | Directly proportional |

| Job Classifications | Medium | Medium | Varies by job risk |

| Location | Low | Low | Varies by state |

This table demonstrates the interplay between various cost factors and your level of control over them. While you may have limited influence over your industry classification or location, you can significantly impact your claims history through robust safety programs.

Research from 2015 to 2019 reveals a decline in both benefits paid and employers' costs relative to payroll. Across nearly all U.S. states, benefits per $100 of covered wages decreased during this period, with only Hawaii as an exception. Learn more about this topic.

Market Trends and Cost-Control Measures

The workers' compensation market constantly evolves, with industry trends impacting pricing. Staying informed about these trends helps anticipate potential cost fluctuations. For additional insights into business insurance costs, you can also read about how to understand business interruption insurance costs.

Implementing robust safety programs, providing thorough employee training, and establishing a proactive return-to-work program are essential cost-control measures. These strategies reduce claims and demonstrate a commitment to employee well-being, which can positively impact morale and productivity.

Choosing Coverage That Actually Protects Your Business

Workers' compensation insurance is a critical component of running a small business. It's not a one-size-fits-all product; what protects one business might not adequately cover another. This means careful consideration is needed to find the right coverage for your specific circumstances.

Understanding Your Basic Coverage Needs

First, understand your state's statutory requirements. These are the legally mandated minimums for workers' compensation. However, just meeting these minimums might not be enough. True protection often means going beyond the basics and exploring additional options tailored to your business needs.

Enhancing Your Protection: Beyond the Basics

Think about exceeding the basic statutory requirements to create a more robust safety net. For example, consider increased medical limits. Standard policies often have caps on coverage. If an employee suffers a serious injury, exceeding those limits could leave your business liable for significant medical costs. Independent contractor coverage is another important consideration. This protects your business if a contractor is injured while on the job.

Guaranteed Cost vs. Dividend Plans: Weighing the Trade-Offs

Next, evaluate the differences between guaranteed cost policies and dividend plans. A guaranteed cost policy has a fixed premium, making budgeting predictable. A dividend plan offers a potential return of premium if your business maintains a strong safety record. But, it can also mean higher premiums if claims increase. The choice hinges on your business's risk profile and financial strategy.

Exploring Alternative Coverage Options

Some small businesses might find alternative coverage models more beneficial. Captive insurance groups allow several businesses to pool resources and share risk, potentially lowering premiums. Self-insurance, where a business sets aside funds to pay claims directly, is another option—generally better suited for larger, financially stable companies. These options offer potential cost savings, but they are often more complex and require careful consideration.

Addressing Modern Workplace Challenges with Emerging Coverage Options

Today's work environments present new considerations for workers' compensation, like remote work and automation. Emerging coverage options address these challenges by covering employees working outside traditional office settings or those injured interacting with robotics or automated systems. Assessing these options and adapting your coverage to your business's specific circumstances helps ensure comprehensive protection.

Case Studies: Learning from Real-World Experiences

Examining real-world scenarios reveals the impact of different coverage choices. A small manufacturer with a basic policy might struggle financially after a serious accident if medical costs exceed coverage limits. However, a business with enhanced coverage, including higher medical limits and independent contractor protection, is better prepared for such an event. Learning from these cases can provide valuable guidance.

By thoroughly assessing your business's needs, exploring the range of coverage options, and evaluating potential risks, you can select workers’ compensation insurance that truly safeguards both your employees and your business. Don't just meet the minimum—ensure you're truly protected.

Building Effective Claims Management And Prevention Systems

Workers' compensation claims can be costly and disruptive for small businesses. Smart prevention strategies, combined with efficient claims management, are essential for minimizing the impact of workplace incidents, both financially and for your employees. This goes beyond simple compliance training and involves cultivating a safety-conscious environment throughout your company.

Creating a Culture of Safety

A strong safety culture begins with actively engaging your employees. Involve them in safety discussions, encourage feedback, and empower them to identify and report potential hazards. Regular safety meetings, incentive programs, and clear communication channels are all key components. Just like a strong team, everyone contributes to the well-being of the group.

Implementing Effective Safety Programs

Developing targeted safety programs tailored to your specific industry and work environment is crucial. For instance, a construction company might emphasize fall protection training, while a restaurant might focus on kitchen safety protocols. These programs should be regularly reviewed and updated to reflect evolving best practices and changing work conditions.

Establishing Efficient Incident Reporting Systems

An accessible and clear incident reporting system encourages the prompt reporting of all incidents, no matter how small. This system should be simple, confidential, and easy to use, removing any obstacles to reporting. Swift reporting allows for quick intervention, preventing minor injuries from becoming major problems and significantly reducing long-term costs associated with claims.

Responding to Injuries: Protecting Employees and Business Interests

When an injury occurs, a well-defined response protocol is essential. This includes immediate medical attention, securing the incident scene, and initiating the claims process. Maintaining open communication with the injured employee is critical, showing care and concern while gathering the necessary information.

The First 24 Hours: Critical Steps

The first 24 hours after an incident are the most important. Proper documentation, such as photographs, witness statements, and incident reports, is vital. This creates a clear record of the event, protecting both the employee and the business. Timely communication with your insurance provider is also key for a smooth and efficient claims process. Maintaining a positive relationship with the employee demonstrates support and empathy during this difficult time.

The Benefits of Return-to-Work Programs

Well-designed return-to-work programs offer advantages for both employees and employers. They promote a gradual and safe return to work, minimizing lost time and productivity, and reducing the overall cost of a claim. An employee might return to modified duties while recovering, allowing them to contribute while continuing rehabilitation. These programs can also improve employee morale and job satisfaction.

Industry Trends and Financial Performance

The workers' compensation industry has seen improvements in claim frequency and profitability, impacting small business insurance pricing. In 2023, the median accident year loss ratio was 68.6%, with the middle 50% of companies reporting ratios between 65.0% and 77.3%. This improved financial performance can lead to more stable premiums for small businesses. Find more detailed statistics here.

By prioritizing safety, streamlining claims management, and implementing proactive return-to-work programs, small businesses can effectively manage workers' compensation costs and foster a supportive and secure work environment. This protects both your employees and your bottom line. Contact Wexford Insurance Solutions today to ensure your business is adequately protected. We understand workers’ compensation for small business owners and can help you navigate the complex requirements and optimize your coverage.

Finding The Right Insurance Partner For Your Business

Securing workers' compensation insurance for your small business is a critical decision, one that extends beyond simply selecting the lowest premium. Finding the right insurance partner can significantly impact your long-term success. This involves a thorough evaluation of potential insurers based on factors such as their financial stability, claims handling reputation, and the quality of their customer service—not just during the initial policy purchase, but throughout the entire policy term.

Beyond the Premium: Key Evaluation Criteria

Focusing solely on the initial price quote can be a detrimental mistake. Similar to buying a car, the decision shouldn't be based on price alone. You would undoubtedly consider the car's reliability, safety features, and the dealership's reputation. Likewise, selecting workers' compensation insurance requires a comprehensive evaluation.

- Financial Stability: A financially secure insurer is essential, ensuring their ability to pay out claims when you need them most.

- Claims Handling Reputation: Thorough research on how efficiently and fairly an insurer handles claims is crucial. A positive reputation signifies less hassle and quicker resolutions for your business and your employees.

- Service Quality: Consider the level of support provided beyond the initial sale. Do they offer proactive assistance and respond promptly to your inquiries and concerns? Ongoing support is invaluable for navigating the complexities of workers' compensation.

Asking the Right Questions: Unveiling the True Value

Gathering insights from other business owners who have experience with different insurance providers can be incredibly valuable. Their first-hand experiences can shed light on the strengths and weaknesses of various insurers, providing a practical perspective that complements your online research.

Here are some essential questions to ask potential insurers:

- How long have you been operating?

- What are your financial ratings from agencies like A.M. Best and S&P?

- Can you provide references from other small businesses similar to mine?

- What is your claims process like, and how quickly are claims typically resolved?

- What resources do you offer to help prevent workplace injuries?

- How do you approach communication and provide ongoing support?

These questions help you gauge the insurer's experience, financial health, and commitment to providing excellent customer service. The answers you receive can often be more revealing than a simple premium quote.

Independent Agents vs. Direct Writers: Navigating Your Options

You generally have two primary options when choosing an insurance provider: independent agents and direct writers. Independent agents work with multiple insurance companies, providing a wider range of options and personalized guidance. They can assist you in comparing policies to find the best fit for your specific business needs. Direct writers, conversely, represent a single insurance company. While their expertise may be limited to their company's products, they can offer in-depth knowledge of specific policies. The best approach depends on your individual preferences and desire for a variety of choices.

Building and Maintaining Productive Relationships

After selecting an insurance partner, cultivating a positive and productive relationship is crucial. Regular communication, proactive safety measures, and prompt claims reporting contribute to a mutually beneficial partnership. This collaborative approach can often lead to lower premiums in the long run.

Decoding Policy Language: Avoiding Costly Surprises

Understanding the details of your policy is essential. Ambiguous or confusing language can result in coverage gaps and unexpected expenses. Don't hesitate to ask your insurance agent or provider for clarification on anything you find unclear. This proactive approach can help you avoid unpleasant surprises later on.

To help you make an informed decision, use the following checklist to compare insurance providers:

Insurance Provider Evaluation Checklist

Essential criteria for comparing workers compensation insurance providers to ensure you choose the best partner for your business

| Evaluation Criteria | Importance Level | What To Look For | Red Flags |

|---|---|---|---|

| Financial Stability | High | Strong financial ratings (A.M. Best, S&P, Moody's) | Consistently low ratings, negative financial news |

| Claims Handling Reputation | High | Positive reviews and testimonials, efficient claims process | Numerous complaints about slow processing or denied claims |

| Service Quality | High | Responsive communication, proactive support, helpful resources | Difficulty reaching representatives, lack of follow-through |

| Industry Expertise | Medium | Experience working with businesses in your industry | Lack of understanding of your specific risks and needs |

| Coverage Options | Medium | Variety of coverage options to meet your specific needs | Limited coverage options, pressure to buy unnecessary coverage |

| Pricing | Medium | Competitive premiums, transparent pricing structure | Hidden fees, unexplained price increases |

By carefully considering these factors, you can avoid common pitfalls and secure workers' compensation insurance that effectively protects your business. For expert advice and guidance tailored to your unique needs, contact Wexford Insurance Solutions. We specialize in workers' compensation for small businesses and are dedicated to assisting you in navigating the complexities of this vital coverage. We offer competitive pricing, exceptional customer service, and a commitment to establishing long-term relationships.

Key Takeaways

Workers' compensation insurance is essential for small businesses. Protecting your employees and your business from the financial fallout of workplace injuries requires a proactive and informed strategy. This section offers practical strategies and realistic steps you can implement right away, based on proven methods from successful small business owners, including benchmarks to track your progress and recognize improvements.

Prioritize Workplace Safety

Creating a strong safety culture is paramount. It's more than just ticking the compliance boxes; it's about actively involving employees in safety conversations, providing comprehensive training programs, and implementing effective incident reporting systems. For example, consider incentivizing employees who actively contribute to safety initiatives or suggest ways to improve workplace safety protocols. Think of it like a successful sports team – everyone plays a vital role in the team’s overall success and well-being. A safe workplace results in fewer injuries, lower claims, and reduced premiums.

Understand Your State's Requirements

Navigating the legal requirements for workers' compensation can be complicated. Every state has specific regulations, with some requiring coverage from the first hire and others having different thresholds. Overlooking these requirements can lead to severe penalties, including substantial fines and even personal liability. Consult resources like the National Council on Compensation Insurance (NCCI) or a legal professional to ensure your business is fully compliant with your state’s regulations. This proactive approach helps avoid costly penalties and guarantees adequate protection for your employees.

Control Your Costs

Managing workers' compensation costs requires a thorough understanding of the factors that influence premiums. Your industry classification code, determined by inherent risks, plays a major role. For instance, a construction company typically has higher premiums than a retail store due to the statistically higher risk of injury. However, you have more control over other factors, like your claims history. Implementing strong safety programs, providing comprehensive employee training, and establishing a proactive return-to-work program can minimize claims, demonstrating a commitment to workplace safety and positively impacting your bottom line.

Choose the Right Coverage and Partner

Selecting the right coverage is as crucial as understanding your state's requirements. While meeting the statutory minimums fulfills basic legal obligations, they might not offer sufficient protection. Consider enhanced coverage options, such as higher medical limits or independent contractor coverage, to address your specific business needs and risks.

Choosing an insurance provider based only on price can be a detrimental mistake. Look for a true insurance partner who understands your business and offers comprehensive support beyond the initial sale. Seek an insurer with a solid history of financial stability, efficient claims processing, and excellent customer service. Like choosing a reliable vendor or supplier, factors beyond cost, such as trust and dependability, are essential for a successful long-term relationship.

Plan for the Future

As your business grows and changes, so should your workers' compensation strategy. Anticipating future needs, such as expanding your workforce, incorporating remote workers, or integrating new technologies, ensures ongoing compliance and adequate coverage. Building flexibility into your insurance program accommodates growth while maintaining cost control and comprehensive protection for your most valuable asset – your employees. Regularly reviewing and updating your workers' compensation strategy, similar to adjusting your business plan, ensures it stays aligned with your current operational needs and protects your business's future.

Contact Wexford Insurance Solutions today to learn more about how we can help protect your business. Our team of experts understands the intricacies of workers' compensation and can offer customized solutions that meet your specific needs.

Business Interruption Insurance Cost: Complete Pricing Guide

Business Interruption Insurance Cost: Complete Pricing Guide Cyber Security Insurance For Small Business: Complete Guide

Cyber Security Insurance For Small Business: Complete Guide