Why Your Small Business Is In The Crosshairs

Many small business owners believe they're too insignificant to attract the attention of cybercriminals. This couldn't be further from the truth. In reality, small businesses are increasingly becoming a prime target for hackers. Through conversations with affected business owners and cybersecurity experts, we'll explore why this is happening.

Limited Resources, High Stakes

One of the main reasons small businesses are attractive targets is their limited resources. Think of it this way: a burglar is more likely to target a house with a simple lock than one with a sophisticated security system. Similarly, small businesses often operate with smaller IT budgets and may not have dedicated cybersecurity personnel. This makes implementing strong security measures a challenge, leaving them vulnerable. Overworked staff juggling multiple responsibilities may also lack the time or training to spot sophisticated phishing attacks or other social engineering tactics.

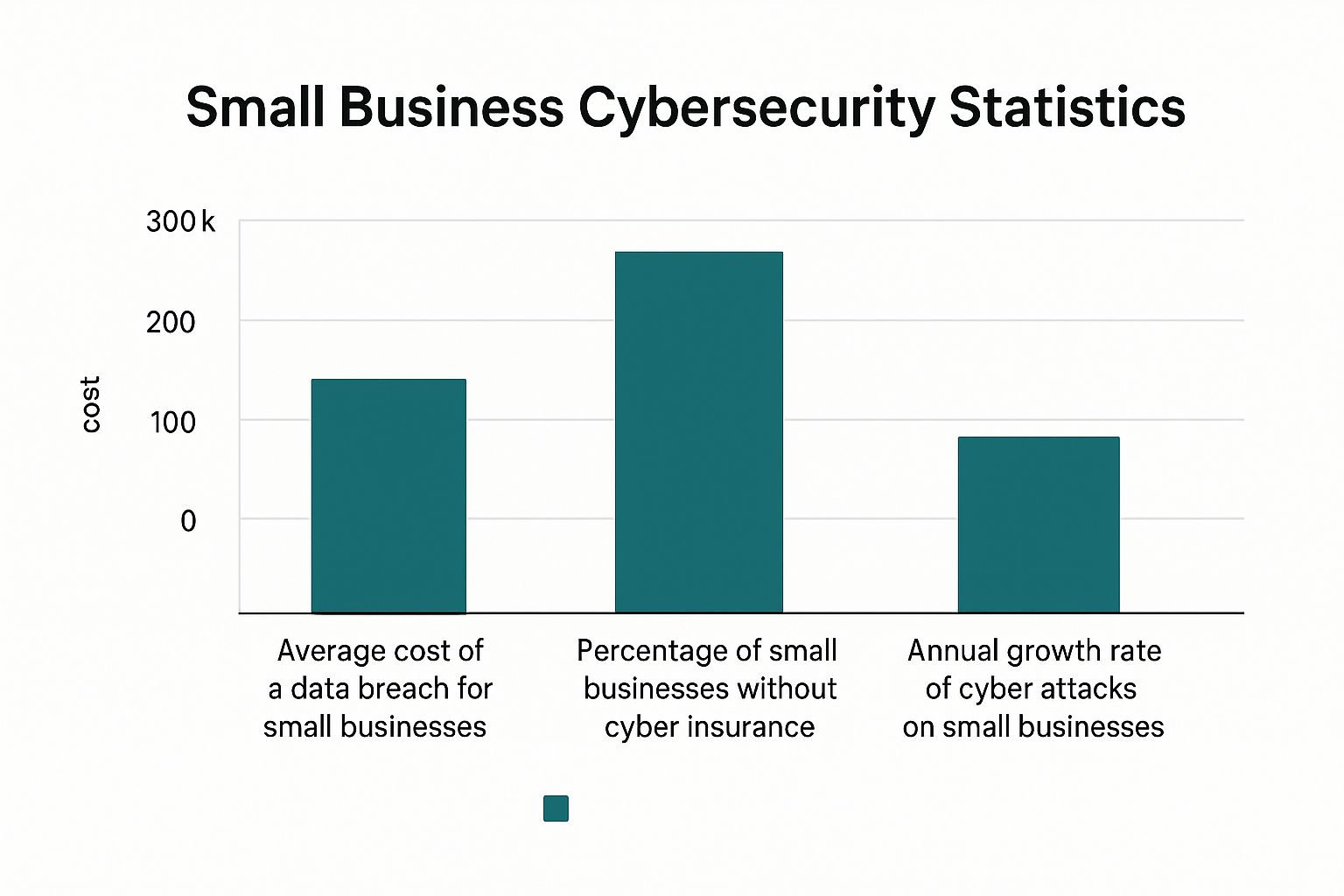

The infographic below visualizes the difficult situation small businesses face with cyberattacks. It compares the average cost of a data breach, the percentage of businesses without cyber insurance, and the annual growth rate of these attacks.

As the infographic highlights, the financial consequences of a data breach can be devastating, especially when combined with the low adoption rate of cyber security insurance and the increasing number of attacks.

The following table provides a further breakdown of these alarming statistics:

Small Business Cyber Attack Statistics Breakdown

Key statistics showing the disproportionate targeting of small businesses by cybercriminals

| Attack Type | Small Business Target Rate | Average Financial Impact | Recovery Timeframe |

|---|---|---|---|

| Phishing | 43% | $150,000 | 6-12 months |

| Ransomware | 30% | $250,000 | 3-6 months |

| Malware | 20% | $100,000 | 1-3 months |

| Denial of Service | 7% | $50,000 | 1-2 weeks |

These figures underscore the vulnerability of small businesses. They are increasingly targeted due to their often limited security. In 2023, 43% of all cyberattacks were aimed at small businesses, indicating that hackers see them as easier targets than larger corporations. This vulnerability is worsened by the fact that many small businesses lack dedicated IT teams or substantial cybersecurity budgets. A sobering 60% of small businesses that experience a cyberattack close within six months due to the financial and reputational damage. Learn more about these alarming trends here.

The Devastating Impact

The ramifications of a cyberattack can be devastating for a small business. Beyond the immediate financial losses from ransom payments or recovery efforts, there are long-term consequences. Reputational damage can erode customer trust, making it difficult to acquire new business. Downtime caused by an attack can disrupt operations, leading to lost revenue. For many small businesses, a single cyberattack can be the difference between survival and closure. This is why proactive cybersecurity measures, including cyber security insurance, are essential for survival.

The Dangerous Insurance Gap Most Businesses Ignore

Small businesses are increasingly vulnerable to cyberattacks. But how are they protecting themselves? A worrying trend is emerging: a significant gap in cyber security insurance coverage. This leaves many companies dangerously exposed to financial and operational ruin if an attack occurs.

One of the most alarming statistics is the low coverage rate. Currently, only 17% of small businesses have cyber security insurance. This is despite the growing threat of cyberattacks, which are becoming more frequent and more expensive. In 2024, small businesses paid an average of $330,000 in ransoms. More detailed statistics can be found here. Without insurance, a breach can be financially devastating.

Why This Gap Exists

Several misconceptions contribute to this dangerous gap. Many small business owners think they are too small to be targeted. They fail to realize that hackers often prefer easier targets. Some also assume their general business insurance covers cyberattacks. This is often not the case, leading to severe financial consequences when an attack does happen.

Another common reason for not having coverage is the perceived high cost of cyber security insurance. However, this overlooks the potentially catastrophic costs of recovering from a cyberattack without insurance. Data recovery, legal fees, and reputational damage can quickly exceed the cost of premiums. For more information on related costs, see our guide on business interruption insurance costs.

The Reactive Approach

Many small businesses also take a reactive approach to cyber security insurance. Almost half of the companies that do have insurance purchased it after experiencing a cyberattack. This is like buying fire insurance while your building is on fire. By the time a business realizes the need, it's often too late.

This reactive approach not only leaves individual businesses vulnerable, but also contributes to systemic risk across entire industries. When many businesses in a sector lack cyber security insurance, a successful attack on one uninsured business can easily spread to others, impacting the entire supply chain. This interconnectedness makes proactive protection essential. You might be interested in: Our article about business insurance basics.

Navigating The Cyber Insurance Market Like A Pro

The cyber insurance market can be a complex landscape to navigate. However, understanding the factors influencing costs and adopting a strategic approach can empower small business owners to secure the right coverage at a reasonable price.

Decoding the Price Swings

Cyber insurance premiums have seen significant volatility. Between 2021 and 2022, a surge in ransomware attacks led to premium increases as high as 79% in a single quarter. However, the market began to stabilize and even soften by late 2023 and into 2024. Reports indicate a 6% decrease in global cyber insurance prices in early 2024, attributed to improved cybersecurity practices and increased market competition. Market conditions clearly play a crucial role in pricing, as detailed further in this report on cyber insurance trends.

Regional and Industry Factors

Location and industry also influence cyber insurance premiums. Businesses in regions with high cybercrime rates or those operating in sectors handling sensitive data often face higher costs. This is due to insurers' risk assessments, which take these factors into account.

Security Improvements That Matter

Investing in robust cybersecurity measures can significantly impact premiums. Insurers often offer lower rates to businesses that implement security measures such as multi-factor authentication, regular security awareness training, and strong data backup and recovery systems. These practices demonstrate a proactive approach to risk management, making a business a more attractive prospect for insurers. For more background on business insurance, check out this article about business insurance basics.

Shopping Smart for Cyber Insurance

Whether securing a new policy or renewing an existing one, a strategic approach is essential.

- Compare quotes from multiple insurers: Gathering quotes from several insurers allows for a comprehensive comparison of coverage options and pricing.

- Understand your coverage needs: A thorough risk assessment helps determine the specific coverage required to address your business's unique vulnerabilities.

- Review policy exclusions carefully: Understanding what is not covered is crucial. Some policies exclude specific types of attacks or losses.

- Negotiate terms: Don't hesitate to negotiate with insurers to obtain the best possible terms and pricing.

- Time your purchase: Strategic timing can potentially secure better rates, particularly during periods of market stability or decline.

- Document your security measures: Providing documentation of your cybersecurity practices can highlight your commitment to risk mitigation and potentially lead to premium reductions.

To help illustrate the cost variations, let's look at a sample premium comparison:

The following table provides a general overview of cyber insurance costs for different business sizes. Actual premiums can vary based on specific risk factors and chosen coverage options.

Cyber Insurance Premium Comparison By Business Size

| Business Size | Annual Revenue Range | Basic Coverage Cost | Comprehensive Coverage Cost | Deductible Range |

|---|---|---|---|---|

| Micro | < $1 Million | $500 – $1,500 | $1,000 – $3,000 | $1,000 – $5,000 |

| Small | $1 Million – $10 Million | $1,500 – $5,000 | $3,000 – $10,000 | $2,500 – $10,000 |

| Medium | $10 Million – $50 Million | $5,000 – $15,000 | $10,000 – $30,000 | $5,000 – $25,000 |

As shown in the table, premiums generally increase with business size and revenue. Comprehensive coverage provides greater protection but comes at a higher cost. The deductible represents the amount you'll pay out-of-pocket in the event of a claim.

By understanding the dynamics of the cyber insurance market and proactively investing in robust cybersecurity, small business owners can secure the necessary protection at a price that aligns with their budget and risk tolerance.

Building Your Cyber Insurance Coverage Strategy

Not all cyber security insurance policies are the same. Understanding your business's specific needs can save you money while ensuring you have the right protection. This involves a strategic approach to evaluating coverage types and understanding how they work together.

Essential Coverage Types

A robust cyber security insurance policy includes a combination of essential coverage types. Let's break down these key components:

-

First-Party Coverage: This type of coverage addresses your direct financial losses after a cyberattack. Think of it as covering damage to your house after a fire. Here are some examples:

- Data Breach Response Coverage: This covers the immediate costs following a breach, such as notifying affected customers, offering credit monitoring services, and conducting forensic investigations.

- Business Interruption Coverage: This compensates for lost income and operating expenses if a cyberattack forces your business to temporarily close. Downtime can significantly impact your bottom line, making this coverage essential.

- Cyber Extortion Coverage: This covers the costs associated with ransomware attacks. This can include ransom payments (if advised by experts) and the expenses involved in negotiating with hackers. This coverage is critical given the increasing prevalence of ransomware.

-

Third-Party Coverage: This protects your business from lawsuits filed by others if a cyber incident impacts their data or systems because of your business. This is like covering the damage to your neighbor's house after a fire that started on your property. Key examples include:

- Network Security Liability: This coverage addresses legal defense costs and settlements if a client sues you because their data was compromised due to a security flaw in your network.

- Privacy Liability: This protects you if you’re sued for violating privacy regulations, such as the GDPR or CCPA, after a data breach.

Optional Coverage Enhancements

In addition to the essential coverage types, several optional enhancements can provide additional protection based on your specific business needs and risk profile:

- Reputational Harm Coverage: This helps mitigate damage to your brand image after a cyberattack. It can cover public relations and marketing efforts to rebuild trust with your customers.

- Crime Coverage: This protects against losses from fraudulent activities like social engineering or employee theft. This is particularly important for e-commerce businesses and those in industries susceptible to fraud.

For more information about managing other business risks, you might be interested in: Our article about workers' compensation for small businesses.

Building a Comprehensive Strategy

Creating the right cyber security insurance strategy requires understanding your business's unique vulnerabilities. A thorough risk assessment can identify your most critical assets and the potential impact of different types of cyberattacks. This analysis will help determine appropriate coverage amounts and any necessary optional enhancements. A well-defined strategy is not about buying the most expensive policy; it's about securing the right protection for your specific business needs and budget. It's about finding the right balance between cost and comprehensive coverage.

Getting Approved and Securing Better Rates

Getting cybersecurity insurance for a small business isn't just about filling out an application. It's about showing the insurer that your business is a worthwhile risk. This means demonstrating your commitment to cybersecurity and presenting your business in the best possible light.

Understanding the Underwriter's Perspective

Insurance underwriters assess risk. They want to see you're taking cybersecurity seriously. This isn't about checking boxes; it's about implementing effective security measures. For example, simply stating you have Multi-Factor Authentication (MFA) isn’t enough. You need to provide documentation outlining its implementation across your systems and user accounts. Similarly, employee training should be documented with records of completed training sessions and materials used.

Key Security Measures That Impress Insurers

Certain security measures carry significant weight with insurers. These include:

- Multi-Factor Authentication (MFA): Implementing MFA across all systems—email, cloud services, and administrative accounts—demonstrates a strong commitment to access security.

- Regular Security Awareness Training: Consistent training programs educate employees on identifying phishing emails, social engineering tactics, and other cyber threats. Documentation of these programs is vital.

- Robust Data Backup and Recovery Systems: Regularly backed-up data ensures business continuity if a ransomware attack or data loss occurs. Provide details about backup frequency, storage location, and recovery testing procedures.

- Incident Response Plan: A well-defined plan outlines procedures for handling a cyberattack. This includes steps for containment, eradication, recovery, and communication.

- Vulnerability Scanning and Penetration Testing: Regular scans identify system weaknesses before exploitation. Penetration testing simulates real-world attacks to assess your defenses.

- Data Encryption: Encrypting sensitive data, both in transit and at rest, adds an extra layer of protection.

- Strong Password Policies: Enforcing strong passwords and regular password changes helps prevent unauthorized access.

Documentation and Security Assessments

Preparing the necessary documentation is key to a successful application. This might include:

- Network Diagrams: Visual representations of your network infrastructure help insurers understand your systems and security measures.

- Security Policies and Procedures: Documented policies demonstrate your commitment to security best practices.

- Inventory of Software and Hardware: A detailed inventory helps identify potential vulnerabilities and ensures all systems are patched and up-to-date.

- Security Assessment Reports: Reports from independent security assessments offer an objective evaluation of your security posture.

Common Application Mistakes and How to Avoid Them

Several common mistakes can hinder your application or lead to higher premiums:

- Incomplete Applications: Ensure all sections are completed thoroughly and accurately.

- Lack of Documentation: Provide supporting documentation for all security measures.

- Misrepresenting Security Practices: Be honest about your security posture. Insurers will verify your claims.

- Ignoring Recommendations: Addressing security gaps identified by insurers shows a proactive approach to risk management.

Presenting Your Business as a Preferred Risk

By demonstrating a proactive and comprehensive approach to cybersecurity, you can position your small business as a preferred risk, potentially securing lower premiums and a smoother approval process. This means showcasing your commitment to security, providing detailed documentation, and addressing any identified vulnerabilities. Remember, investing in cybersecurity isn’t just about getting insurance; it’s about protecting your business from the potentially devastating consequences of a cyberattack. For more information on business insurance strategies, see our article on business insurance basics.

Choosing Your Insurance Partner Wisely

Selecting the right cyber security insurance provider for your small business is a critical decision. It's not just about finding the cheapest policy; it's about finding a partner who will stand by you when a cyberattack happens. This requires careful consideration of several key factors that go beyond just the price tag.

Beyond the Premium: What Really Matters

When you're evaluating cyber security insurance companies, there are several critical aspects to focus on. These will help ensure you have the right coverage and support when you need it most.

-

Claims Handling Speed: A swift response after an incident is essential. How quickly does the insurer process and pay claims? A slow process can worsen the financial strain of a cyberattack. Look for providers known for efficient claims handling.

-

Financial Stability: You need an insurer that can deliver on its promises. Is the insurance company financially sound? A financially unstable insurer might struggle to pay out large claims, potentially leaving you uncovered. Research the insurer’s financial ratings and stability.

-

Customer Support Quality: During a cyber incident, responsive and helpful customer service is invaluable. Is the customer service easy to reach and effective? Look for providers with a strong reputation for excellent customer service.

Red Flags and Exclusions: Protecting Your Business

Understanding the details of your policy is vital. Be aware of these potential red flags that could leave your business vulnerable:

-

Vague Policy Language: Ambiguity in a policy can lead to disputes when you file a claim. Ensure the policy clearly defines covered incidents and what is excluded.

-

Broad Exclusions: Exclusions are specific situations or types of attacks not covered by the policy. Review these carefully to make sure the policy provides adequate protection for your business.

-

Limited Coverage Amounts: Does the coverage amount align with your potential losses from a cyberattack? Insufficient coverage could leave your business financially exposed.

Traditional vs. Specialized: Finding the Right Fit

The cyber security insurance market offers a choice between traditional insurers and specialized cyber insurance companies. Each has its pros and cons.

-

Traditional Insurers: These companies often offer broader coverage options and established reputations. However, they may lack specific expertise in cyber incidents.

-

Specialized Cyber Insurers: These providers possess in-depth knowledge of cyber threats and offer tailored coverage. However, they may have higher premiums or more stringent underwriting requirements.

Consider your business’s unique needs, risk tolerance, and budget when choosing between a traditional or specialized insurer.

Negotiating Terms: Getting What You Need

Don't hesitate to negotiate the terms of your policy with the insurer. This can help you get the best possible coverage for your business.

-

Lowering the Deductible: The deductible is what you pay out-of-pocket before your insurance coverage begins. Negotiating a lower deductible can reduce your financial burden in the event of a claim.

-

Expanding Coverage: If specific areas of coverage are critical for your business, negotiate to have them included in the policy.

-

Clarifying Exclusions: If you're unsure about any exclusions, request clarification in writing to avoid potential disputes later.

Choosing the right cyber security insurance partner requires thorough research, careful evaluation, and proactive negotiation. By prioritizing claims handling speed, financial stability, quality customer support, and understanding policy details, you can select a partner who will provide reliable support when you need it most. At Wexford Insurance Solutions, we help small businesses navigate these complexities and secure the right cyber security insurance to protect their future. Learn more about cyber liability insurance from Wexford.

Key Takeaways

Protecting your small business from cyber threats demands a proactive and informed approach to cyber security insurance. This section offers key takeaways to help you navigate the complexities of cyber insurance, focusing on practical advice and actionable steps.

Understanding Your Cyber Risk Profile

Before exploring insurance options, it's essential to understand your specific vulnerabilities. Consider factors like the types of data you handle, your reliance on online systems, and the potential financial impact of a cyberattack. For instance, a business handling sensitive customer data faces higher risks and needs more comprehensive coverage than a business operating primarily offline. This assessment is the foundation of a sound cyber insurance strategy.

Choosing the Right Coverage

Cyber security insurance for small businesses isn't one-size-fits-all. Policies vary significantly in coverage types and amounts. Focus on essential coverage such as data breach response, business interruption, and cyber extortion. These core components address the immediate and long-term costs associated with a cyberattack, from notifying affected customers to recovering lost income.

Beyond the essentials, consider optional enhancements tailored to your risk profile. Reputational harm coverage can help rebuild your brand image after an incident, while crime coverage protects against losses from fraudulent activity. The right combination of essential and optional coverage ensures comprehensive protection.

The Application Process: Proving Your Worth

Securing cyber security insurance involves more than just completing an application. Insurers assess your risk profile, and demonstrating a strong security posture is critical for approval and favorable rates. Implementing measures like multi-factor authentication (MFA), regular security awareness training, and robust data backup systems are not only good security practices but also factors insurers look for. Clearly and thoroughly documenting these measures is crucial for presenting your business as a low-risk client.

Selecting a Reliable Insurance Partner

Choosing the right insurance provider goes beyond comparing premiums. Consider factors like claims handling speed, financial stability, and the quality of customer support. A reliable partner will provide swift and effective support during a stressful incident. Researching insurers, reading reviews, and asking questions about their claims process can help you make an informed decision.

Key Considerations Summarized

The following table summarizes key aspects of obtaining cyber security insurance for your small business:

| Aspect | Key Takeaway | Actionable Step |

|---|---|---|

| Risk Assessment | Understand your specific vulnerabilities | Conduct a thorough assessment of your data, systems, and the potential financial impact of a cyberattack. |

| Coverage Types | Choose coverage that aligns with your risks | Prioritize essential coverage and consider optional enhancements based on your needs. |

| Application Process | Demonstrate a strong security posture | Implement and document key security measures like MFA, training, and data backups. |

| Insurance Partner | Select a reliable and responsive provider | Research insurers, read reviews, and inquire about their claims handling process. |

Protecting Your Business: Taking Action Today

Cyberattacks are a growing threat to small businesses. Don't wait until it's too late. At Wexford Insurance Solutions, we understand the unique challenges small businesses face in securing affordable and effective cyber security insurance. We offer tailored solutions designed to meet your specific needs and budget. Contact us today for a consultation and let us help you protect your business from cyber threats. Get a free quote now!

Workers Compensation for Small Business: Owner's Essential Guide

Workers Compensation for Small Business: Owner's Essential Guide What Does Cyber Insurance Cover? Essential Insights

What Does Cyber Insurance Cover? Essential Insights