Understanding What Drives Your Cyber Insurance Premium

Cyber liability insurance costs can often seem confusing. However, understanding the factors that influence your premium can help you make smarter decisions. Just like auto insurance considers your driving history, cyber insurance assesses your digital risk profile. Several key factors contribute to the final cost.

Key Factors Affecting Your Premium

Your industry is a primary factor influencing your cyber insurance premium. Some sectors, like healthcare and finance, handle very sensitive data. This makes them attractive targets for cybercriminals. As a result, these industries often pay higher premiums.

The size of your company and its annual revenue also play a significant role. Larger organizations with higher revenues typically store more valuable data, presenting a larger potential target and greater financial risk for insurers.

Your cybersecurity measures directly impact your premium. Investing in robust security systems, regular employee training, and comprehensive incident response plans shows insurers you're proactive about risk management. This proactive approach can often lead to lower premiums. For instance, implementing multi-factor authentication (MFA) is frequently required for coverage and significantly reduces your risk. You might be interested in: What does cyber insurance cover?

The Impact of Coverage Choices

The coverage choices you select also influence the cost. Higher coverage limits and lower deductibles offer greater financial protection in the event of a cyberattack. However, this increased protection naturally comes with higher premiums.

This principle is similar to other types of insurance. More coverage translates to a higher cost. Carefully consider your business's specific needs and risk tolerance when selecting coverage options.

It's important to understand the changing cyber insurance market. Global cyber liability insurance premiums reached approximately $15.3 billion in 2024. Interestingly, this represents less than 1% of the total property and casualty insurance market, suggesting potential for future growth. For more detailed information, see the Munich Re Cyber Insurance Report. Understanding these market trends can give you insight into potential future changes in cyber insurance pricing.

The Real Factors That Shape Your Insurance Cost

Understanding the factors that influence your cyber liability insurance premiums is essential for making informed decisions. These factors extend beyond just the size of your business and delve into the specifics of your operational procedures and security measures.

Industry, Company Size, and Revenue

The industry you operate in plays a significant role in determining your cyber liability insurance cost. Certain sectors, such as healthcare and finance, naturally face higher risks due to the sensitive data they manage. For example, healthcare organizations are frequently targeted by ransomware attacks because of the vital nature of patient data and their potential willingness to pay to restore access quickly. This elevated risk level leads to higher premiums for these sectors.

Additionally, the size of your company, measured by annual revenue and number of employees, directly impacts your insurance costs. Larger companies typically store more valuable data and present a larger attack surface, making them more appealing targets for cybercriminals. This larger risk profile results in higher premiums compared to smaller businesses.

Security Posture and Underwriting

Your company's security posture is a major factor in determining your cyber liability insurance cost. Insurers evaluate your risk through detailed security questionnaires, vulnerability assessments, and proof of compliance certifications, such as those offered by the International Organization for Standardization (ISO).

Investing in robust security measures, like multi-factor authentication, intrusion detection systems (IDS), and regular employee training, demonstrates a commitment to mitigating risk and can often lead to lower premiums.

These security assessments are a critical component of the underwriting process. The information you provide allows insurers to accurately assess your risk level and establish an appropriate premium. Providing accurate and complete information during underwriting is vital for securing the correct coverage at a fair price. Misrepresenting your security measures could lead to a claim denial in the event of a breach.

Claim Trends and Costs

The cost of cyber liability insurance is influenced by the frequency and severity of cyberattacks, with certain industries and attack types dominating claims. According to Munich Re's "Cyber Insurance – Risks and Trends 2025" report, four attack types—ransomware, scams, supply chain compromises, and data breaches—account for most losses. Ransomware leads cyber claims, targeting manufacturing primarily and healthcare secondarily. Business interruption (BI) accounts for 51% of total costs following a cyber incident, representing the most significant expense for both insurers and policyholders. Find more detailed statistics here.

Controllable Factors and Cybersecurity Investments

The good news is that many factors affecting your cyber liability insurance cost are within your control. Proactive cybersecurity investments can significantly reduce your premiums.

-

Employee Training: Regular security awareness training helps employees recognize and avoid phishing scams and other social engineering tactics. This reduces the risk of human error leading to a security breach.

-

Advanced Threat Detection: Implementing robust threat detection systems, such as intrusion detection and prevention systems, can identify and mitigate threats early, minimizing potential damage and costs.

-

Incident Response Plan: A well-defined incident response plan enables a swift and effective response to cyberattacks. This limits the impact and speeds up recovery, which insurers view positively.

By demonstrating a strong commitment to cybersecurity, you can not only strengthen your defenses but also secure more favorable insurance rates. Investing in cybersecurity is a strategic investment in both protecting your business and lowering your cyber liability insurance cost.

How Your Industry Affects Your Premium

Your industry plays a significant role in determining your cyber liability insurance cost. Insurers recognize that different industries face varying levels of cyber risk and adjust premiums accordingly. For example, healthcare organizations often pay higher premiums than consulting firms due to the sensitive nature of patient data they handle, making them attractive targets for breaches.

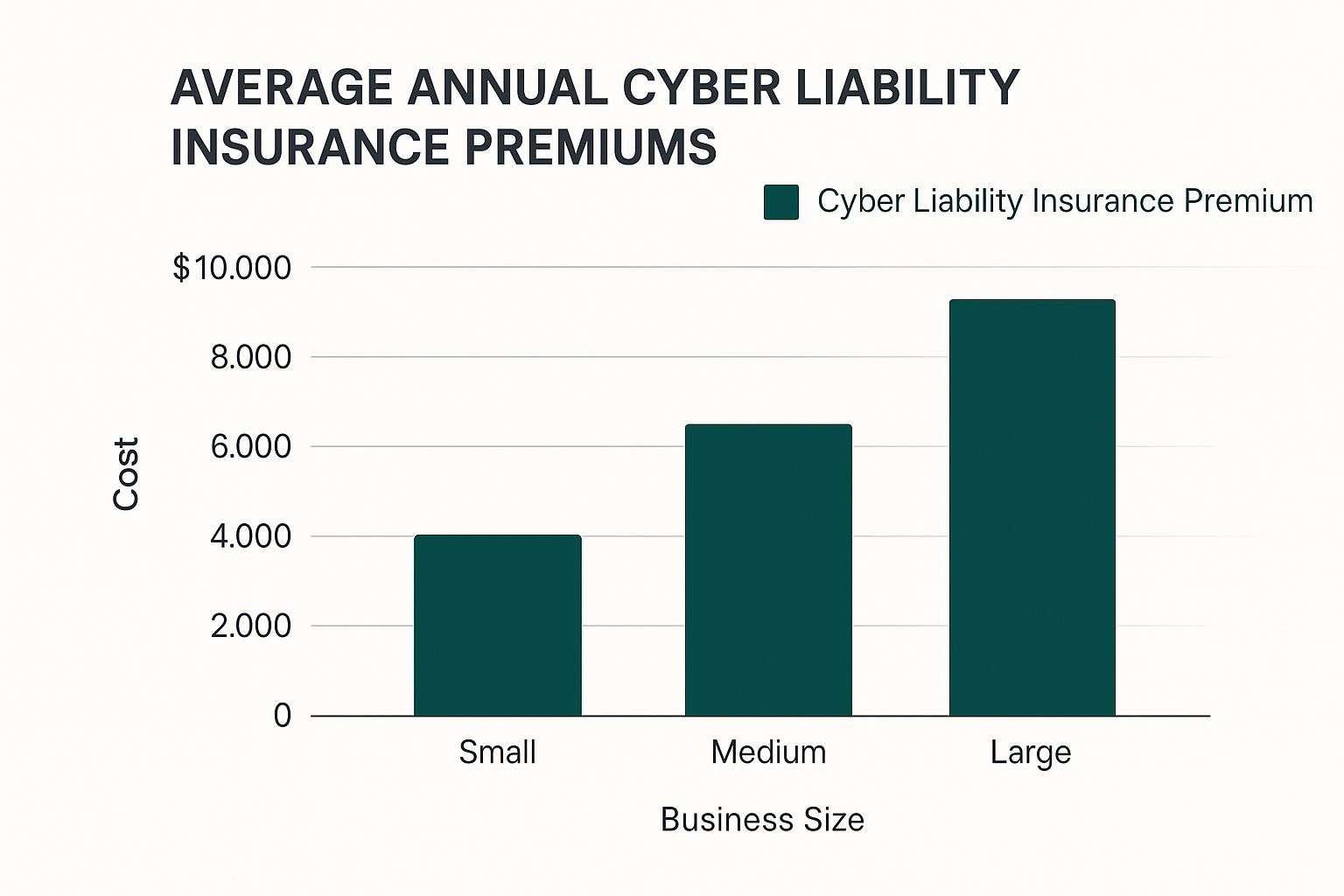

The infographic above illustrates the average annual cyber liability insurance premiums for small, medium, and large businesses. Premiums increase with company size, reflecting the larger data volume and the greater potential financial impact of a cyberattack on bigger organizations.

Industry-Specific Risks and Regulations

Several factors contribute to these industry-specific differences in cyber liability insurance costs. Regulatory requirements play a key role. Heavily regulated industries like healthcare and finance must comply with stringent regulations such as HIPAA and PCI DSS. These regulations mandate specific security measures and impose significant penalties for non-compliance, increasing potential financial liabilities from a cyberattack.

The type of data handled within each industry also significantly influences premiums. Highly sensitive healthcare data is valuable to cybercriminals, resulting in higher premiums for healthcare providers. Similarly, financial institutions handling vast amounts of financial data are also prime targets, impacting their insurance costs.

To provide a clearer picture of these industry variations, let's examine the average premiums and key risk factors for several sectors:

Cyber Insurance Cost By Industry Sector

| Industry | Average Annual Premium | Key Risk Factors | Common Coverage Limits |

|---|---|---|---|

| Healthcare | $10,000 – $50,000+ | HIPAA compliance, ransomware attacks, patient data breaches | $1 million – $5 million+ |

| Finance | $5,000 – $25,000+ | PCI DSS compliance, fraud, wire transfer fraud | $1 million – $5 million+ |

| Retail | $3,000 – $15,000+ | E-commerce vulnerabilities, point-of-sale breaches, customer data theft | $500,000 – $2 million+ |

| Manufacturing | $2,000 – $10,000+ | Ransomware attacks, operational disruption, intellectual property theft | $500,000 – $2 million+ |

| Technology | $4,000 – $20,000+ | Data breaches, software vulnerabilities, denial-of-service attacks | $1 million – $3 million+ |

Note: These figures are averages and can vary significantly based on factors like company size, security posture, and coverage limits.

This table summarizes the average annual premiums, key risk factors, and common coverage limits across various industries. As shown, healthcare and finance typically face higher premiums due to stricter regulatory requirements and the sensitive data they manage.

Emerging Risks and Industry Trends

Emerging risks also impact industry pricing models. The surge in ransomware attacks, especially targeting the manufacturing sector, has driven up premiums within that industry. Increasingly interconnected supply chains introduce new vulnerabilities. An attack on one supplier can disrupt entire industries, influencing insurance costs across the board.

The technology sector, while deeply involved in cybersecurity, faces unique challenges. Rapid technological advancements create new vulnerabilities, and the increasing reliance on cloud computing introduces additional risks. These factors influence premium calculations for technology companies.

Managing Industry-Specific Risks

Managing sector-specific cyber risks is crucial for optimizing your premium, regardless of your industry. Implementing robust security measures, employee training programs, and incident response plans demonstrates a proactive approach to risk management. This commitment to cybersecurity can often lead to lower premiums. Additionally, partnering with an experienced insurance broker can help you navigate the complexities of cyber liability insurance and secure the right coverage at a competitive price. Understanding how your industry impacts your cyber liability insurance costs is essential for making informed decisions and safeguarding your business.

Smart Coverage Choices That Control Your Cyber Liability Insurance Cost

Managing your cyber liability insurance cost effectively requires a strategic approach. It's not just about finding the lowest premium; it's about understanding how different coverage options impact both your costs and the protection you receive. This understanding empowers you to make informed decisions that balance affordability with comprehensive security.

First-Party vs. Third-Party Coverage

A key factor in controlling your cyber liability insurance cost is understanding the difference between first-party and third-party coverage. First-party coverage addresses direct losses your business incurs from a cyberattack. This can include expenses related to data recovery, business interruption, and cyber extortion.

For instance, if ransomware cripples your operations, first-party coverage helps with system restoration and compensates for lost revenue.

Third-party coverage, on the other hand, protects your business from claims made by others as a result of a cyber incident originating from your systems. This includes legal defense costs, settlements, and any resulting regulatory fines.

Imagine a data breach exposing your customers' sensitive information; third-party coverage helps manage the subsequent legal and regulatory challenges. The balance you strike between these two coverage types significantly influences your overall cyber liability insurance cost.

Coverage Limits and Deductibles

Your cyber liability insurance cost is also heavily influenced by the interplay of coverage limits and deductibles. Coverage limits define the maximum amount your insurer will pay for a covered claim. Higher limits offer greater protection but also lead to higher premiums.

Think of it like selecting a container to collect rainwater; a larger container holds more but also costs more.

Deductibles represent the amount you pay out-of-pocket before your insurance coverage begins. A higher deductible typically lowers your premium, but it also increases your initial financial burden in the event of an incident. Carefully evaluating your risk tolerance and financial resources is essential when setting your deductible.

Customizing Your Policy for Optimal Value

Optimizing your cyber liability insurance cost often involves customizing your policy to address your specific risks. Collaborating with an insurance broker can help you identify essential coverages and eliminate unnecessary additions. A small business with a limited online presence likely doesn't need the same coverage as a large e-commerce platform.

Distinguishing between crucial protections and optional extras is vital for cost control. While some coverages like data breach response are fundamental, others may be less important depending on your specific business model and risk profile. This tailored approach ensures adequate protection without overspending on features you don't need. Understanding these details helps you effectively manage your cyber liability insurance cost and maximize value.

Proven Strategies To Lower Your Premium

Lowering your cyber liability insurance cost doesn't mean sacrificing essential protection. Savvy business owners use key strategies to secure better rates, and you can too. This section reveals those insider tactics, empowering you to reduce your premiums year after year.

Leverage Cybersecurity and Risk Management

One powerful approach to minimizing your cyber liability insurance cost involves cybersecurity certifications and risk management programs. Obtaining recognized certifications, such as those from the International Organization for Standardization (ISO), demonstrates a commitment to robust security practices. Implementing a comprehensive risk management program signals proactive risk mitigation, a factor highly valued by insurers. These measures can translate into significant premium reductions during policy negotiations. You might be interested in: Cyber Security Insurance for Small Business.

Strategic Security Investments

Not all security investments are created equal when it comes to lowering insurance costs. Some improvements offer a higher return in premium reductions. For example, employee training programs focused on security awareness are viewed favorably by insurers. Equipping your team to identify and avoid phishing scams and other social engineering tactics significantly reduces your risk profile. Investing in advanced threat detection systems also demonstrates proactive security, which can earn substantial discounts.

Bundling, Timing, and Broker Relationships

Several practical tactics can further help lower your cyber liability insurance cost.

- Bundling: Bundling your cyber liability policy with other business insurance often unlocks package discounts.

- Timing: Strategic timing of your policy renewal can also influence pricing. Avoiding renewal during peak cyberattack seasons might secure more favorable rates.

- Broker Relationships: Working closely with an experienced insurance broker provides valuable insights into the insurance market. Brokers can identify hidden discounts and negotiate effectively on your behalf.

Documenting Security Improvements

Simply implementing security improvements isn't enough; you must effectively document them to insurers. Clearly outlining your security enhancements, including certifications, training programs, and system upgrades, demonstrates your commitment to risk reduction. This allows insurers to accurately assess your improved risk profile and reward you with lower rates. For example, a company that invests in multi-factor authentication (MFA) and documents its implementation thoroughly will likely see a more significant premium reduction than one that merely mentions MFA.

Avoiding Costly Mistakes

Certain mistakes can lead to unnecessarily high cyber liability insurance costs. Misrepresenting your security posture during the underwriting process can result in claim denial later. Failing to keep your security measures up-to-date negates their positive impact on premiums. By avoiding these common pitfalls and proactively strengthening your security posture, you benefit both your risk profile and your bottom line. This translates to a more secure business and potentially lower cyber liability insurance cost.

What's Coming Next In Cyber Insurance Pricing

The cyber insurance market is constantly evolving. Understanding emerging trends is crucial for managing your cyber liability insurance costs. Several factors influence the future of cyber insurance pricing, from evolving threats to technological advancements. Keeping up with these changes can help you prepare and potentially secure better rates.

The Rise of AI and Advanced Risk Modeling

Artificial intelligence (AI) and machine learning are transforming how the insurance industry assesses and prices cyber risks. These technologies allow insurers to analyze massive datasets, identifying patterns and predicting vulnerabilities with increased accuracy. This results in more sophisticated underwriting. For businesses with strong security, this can mean more accurate risk assessments and potentially lower premiums. However, those with weaker security may see higher premiums as AI uncovers hidden risks.

Emerging Risks and Their Impact on Pricing

The types of cyber threats businesses face are also changing, impacting future cyber liability insurance costs. Increased reliance on cloud computing introduces new security challenges, while the expanding Internet of Things (IoT) creates a larger attack surface. Supply chain attacks, where hackers target vendors or suppliers to gain access, are also on the rise. These emerging risks are being incorporated into pricing models. Businesses that proactively address these vulnerabilities are more likely to secure favorable rates. Learn more in our article about Business Interruption Insurance Cost.

New Coverage Requirements and Evolving Needs

As the cyber threat landscape evolves, so will coverage requirements and business needs. New regulations and industry standards may require specific security measures, influencing insurance premiums. For example, a greater focus on data privacy and stricter regulations could increase costs for businesses handling sensitive information. The increasing sophistication of cyberattacks may also necessitate new types of coverage. Preparing for these changes is vital for managing your cyber liability insurance cost effectively in the future.

Positioning Your Organization for Favorable Rates

In this dynamic environment, proactive steps can help you secure favorable cyber liability insurance costs:

-

Invest in robust cybersecurity: Implementing strong security measures, like multi-factor authentication, intrusion detection systems, and regular security assessments, shows a commitment to mitigating risk.

-

Develop a comprehensive incident response plan: A well-defined plan enables a fast and effective response to cyberattacks, limiting their impact and potentially reducing insurance claims.

-

Stay informed about emerging threats: Staying current on the latest cybersecurity trends and best practices allows you to proactively address new vulnerabilities.

-

Partner with an experienced insurance broker: A broker can provide valuable market insights, help you navigate evolving coverage requirements, and negotiate the best rates.

By taking these steps, you can strengthen your cybersecurity posture and strategically manage your cyber liability insurance cost in the years to come.

To understand projected market trends, take a look at the table below:

The following table provides insights into the projected market growth and cost trends for cyber liability insurance.

| Year | Market Size | Average Premium Change | Key Drivers |

|---|---|---|---|

| 2024 | $20 Billion | +15% | Increased cyberattacks, stricter regulations |

| 2025 | $25 Billion | +20% | Emerging risks (IoT, cloud), AI-driven underwriting |

| 2026 | $32 Billion | +25% | Supply chain attacks, demand for broader coverage |

| 2027 | $40 Billion | +22% | Focus on data privacy, new security standards |

This table highlights the anticipated growth of the cyber insurance market and the upward trend in premiums. Key drivers, such as increasing cyberattacks and the emergence of new risks, contribute to these projections. Understanding these factors is essential for budgeting and planning your cyber insurance strategy effectively.

Making Your Best Investment Decision

Cyber liability insurance is more than just an added expense; it's a crucial investment in your business's future. This section will guide you in making informed decisions about your coverage, examining costs and offering frameworks for confident decision-making.

Calculating the True Value of Cyber Insurance

To understand the value of cyber liability insurance, you first need to assess your potential risks. Consider the financial fallout of a data breach: legal representation, regulatory fines, notification expenses, and the potential damage to your reputation and customer trust. Cyber insurance mitigates these potentially devastating costs. While premiums might seem significant, they're often dwarfed by the expense of recovering from a serious cyberattack. This means a higher premium with more comprehensive coverage can be a wiser long-term investment.

Evaluating Quotes and Asking the Right Questions

When comparing cyber insurance quotes, don't simply opt for the cheapest option. A checklist can be invaluable:

- Coverage Limits: Do the limits adequately cover potential losses, including legal fees, regulatory fines, and business interruption costs?

- Deductibles: What deductible is manageable for your business if you need to make a claim?

- Exclusions: Scrutinize what the policy doesn't cover. Are there exclusions that could leave your business vulnerable?

- Incident Response Services: Does the policy include access to incident response specialists to help manage a breach?

Asking key questions will further clarify your choices:

- What is the insurer's experience with cyber claims in your specific industry?

- What is their claims procedure, and what is the average claim resolution time?

- Are there any cybersecurity prerequisites that could impact your premium or coverage?

Be wary of red flags such as overly broad exclusions or ambiguous policy wording. A reputable insurer will offer clear and comprehensive details.

Ongoing Policy Management

Cyber insurance isn't a set-it-and-forget-it purchase. Regularly review your coverage needs as your business expands and the cyber threat landscape changes. For instance, expanding into new markets or handling more sensitive data will likely necessitate adjusting your coverage. Use your insurance provider as a resource for insights into best practices and emerging threats. Many insurers provide tools and guidance to enhance your overall cybersecurity.

Securing Optimal Protection

Smart decisions about cyber liability insurance are essential in today's business world. By calculating your potential exposure, thoroughly evaluating quotes, and actively managing your policy, you can secure the best protection at a cost that fits your business needs. Take the next step towards complete cyber protection. Contact Wexford Insurance Solutions at https://www.wexfordis.com for expert advice and customized cyber liability insurance solutions to protect your business from evolving threats.

What Does Cyber Insurance Cover? Essential Insights

What Does Cyber Insurance Cover? Essential Insights Understanding General Liability Meaning: A Quick Guide

Understanding General Liability Meaning: A Quick Guide