Understanding General Liability Meaning Through Real Stories

Imagine Sarah, the owner of a popular bakery. A customer slips on a wet floor and is injured. Suddenly, Sarah is faced with medical bills, potential legal action, and a whole lot of stress. This is where general liability insurance steps in. It’s like a financial safety net for your business, protecting you from the unexpected costs of accidents and claims.

Let's break down what general liability insurance actually means, using real-world examples. Think about a freelance consultant who accidentally damages a client's expensive laptop during a meeting. Or picture a small bookstore owner dealing with a lawsuit after a faulty bookshelf collapses and injures a customer. These are precisely the kinds of situations general liability insurance is designed to cover.

These stories show how general liability coverage works in practice. It's not just a theoretical concept; it's a practical tool that can save your business from financial ruin. And it's a big deal in the insurance world. By 2025, the general liability insurance market is projected to reach US$338.82 billion in gross written premiums. Discover more insights about the general liability market. Understanding this coverage is vital for any business owner. Knowing its value is a proactive step towards safeguarding your business's future.

The Three Protection Pillars Every Business Owner Must Know

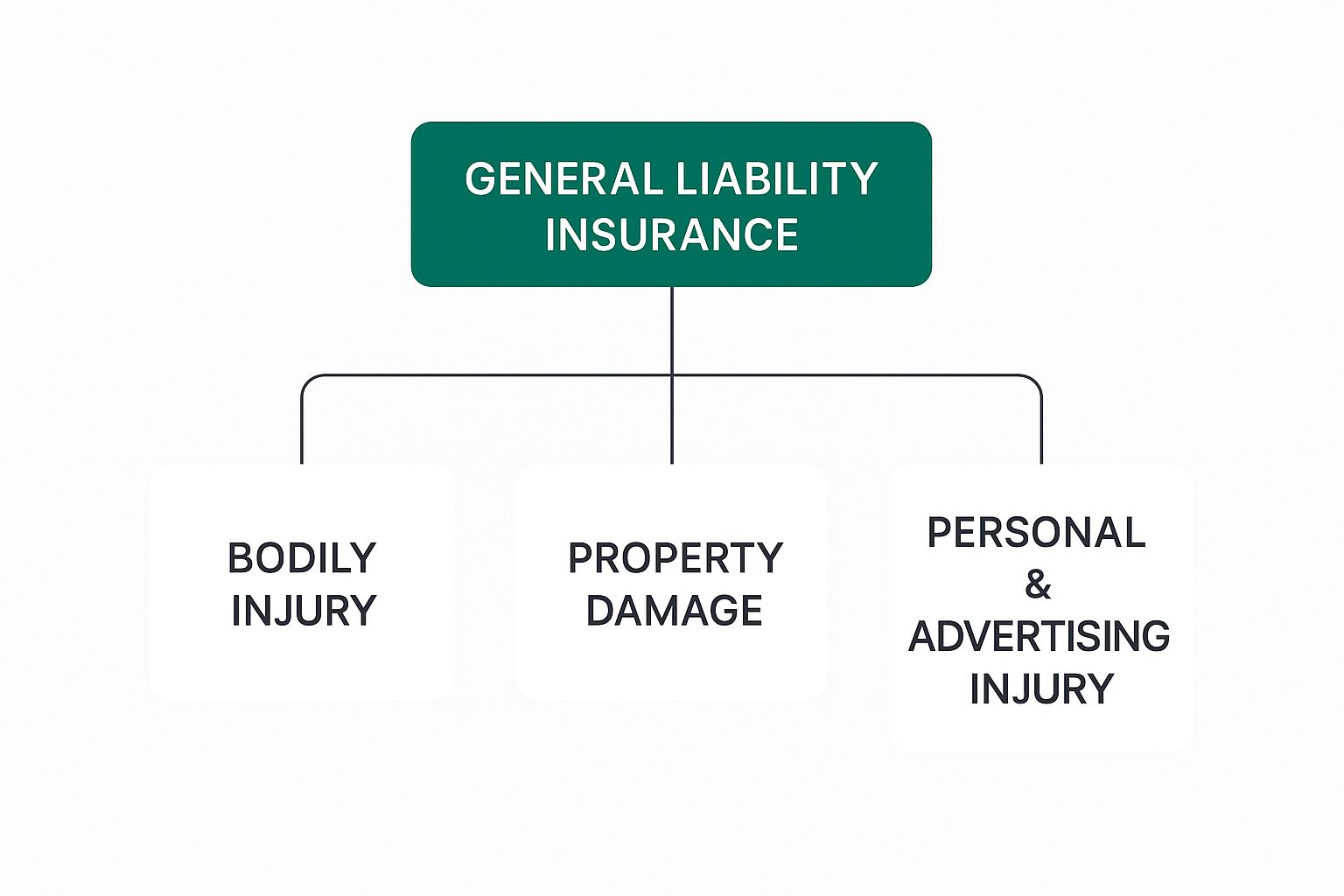

Understanding general liability insurance doesn't have to be a headache. Think of it as building a secure fortress around your business. Every strong general liability policy rests on three essential pillars, each designed to protect you from different kinds of risks. It's like having a triple-layered security system.

This infographic gives you a visual overview of these three key areas: bodily injury, property damage, and personal & advertising injury. They work together to create a comprehensive safety net, shielding your business from a variety of common incidents. Let's delve into each one.

Bodily Injury

Imagine a customer walking into your store and slipping on a wet floor. Ouch! This is where the bodily injury pillar comes in. It covers medical expenses, lost wages, and other related costs if someone gets hurt on your property or because of your business operations.

This protection extends beyond your physical location. For example, if your delivery driver causes an accident while on duty, your general liability insurance could help cover the injured party's expenses and any potential lawsuits. It's like having a first-aid kit for your business, ready to address unexpected injuries.

Property Damage

The second pillar, property damage, covers situations where your business accidentally damages someone else's belongings. Picture a contractor accidentally putting their foot through a client's ceiling, or a delivery driver backing into a customer's mailbox.

This coverage helps pay for repairs or replacement of the damaged property. This can prevent a minor mishap from turning into a major financial burden for your business. It's like having a handyman on call to fix accidental damage caused by your operations.

Personal & Advertising Injury

This third pillar often gets overlooked, but it's just as important. Personal & advertising injury coverage protects your business from claims of libel, slander, copyright infringement, and other reputational damage.

In today's digital age, where information spreads quickly and reputations are fragile, this protection is more vital than ever. Think of it as a shield against attacks on your business's good name. It can help cover legal defense costs and any resulting settlements or judgments.

To better understand these coverage pillars, let's look at the table below:

General Liability Coverage Pillars Breakdown

Comparison of the three main coverage areas, what they protect against, and common claim examples

| Coverage Pillar | What It Protects | Common Claim Examples | Typical Coverage Limits |

|---|---|---|---|

| Bodily Injury | Medical expenses, lost wages, and other costs associated with injuries sustained on your property or due to your operations. | Slip and fall accidents, injuries caused by defective products, accidents involving company vehicles. | $500,000 to $2 million per occurrence |

| Property Damage | Costs associated with damage to someone else's property caused by your business operations. | Accidental damage to a client's building during renovations, damage to a customer's car during delivery. | $500,000 to $2 million per occurrence |

| Personal & Advertising Injury | Legal costs and damages related to claims of libel, slander, copyright infringement, and other reputational harms. | A competitor suing for defamation, a claim of false advertising. | $500,000 to $1 million per occurrence |

This table summarizes the key aspects of each coverage area, offering a clear comparison of what they protect against and providing realistic claim examples. Typical coverage limits are presented as a general guideline; however, the actual limits can vary depending on your specific policy and insurer. It's essential to carefully review your policy documents to understand the full extent of your coverage.

Who Really Needs This Coverage (The Honest Assessment)

If your business interacts with the outside world at all, chances are you need general liability insurance. This holds true even if you're a home-based graphic designer or a consultant working remotely. It's a common misconception that a small business or home-based operation is somehow exempt from the risk of lawsuits. Unfortunately, that's just not the reality.

Let's paint a couple of pictures. Imagine a wedding photographer, in the midst of capturing a precious moment, accidentally trips and damages some very expensive equipment. Or picture a plumbing contractor, working diligently on a client's bathroom renovation, who inadvertently causes water damage. These scenarios, while different, both highlight the need for general liability insurance and the protection it provides.

Even businesses that appear low-risk can face unexpected issues. Think about a freelance writer accused of copyright infringement, or a consultant who accidentally deletes a client's crucial data. Situations like these can quickly escalate into costly legal battles, no matter how small your business is. For a broader look at business insurance, check out our guide on business insurance basics.

It's important to take an honest look at your own potential risks. Weigh the potential cost of a lawsuit against the cost of coverage. General liability insurance gives you peace of mind, allowing you to focus on running your business, knowing you have a safety net. It's not about eliminating risk altogether, but about managing it wisely. Choosing the right coverage empowers you to handle the unexpected and safeguard your business's future.

Real Coverage Scenarios That Make Everything Click

Understanding general liability insurance becomes much clearer with real-world examples. Let's say a food truck owner faces a claim after a customer has an allergic reaction. The insurance company would investigate the ingredients, the preparation, and the customer's known allergies. They're trying to figure out if the business was at fault. This shows how general liability insurance can protect against the unexpected.

Imagine a yoga instructor whose client slips and falls during class, resulting in a lawsuit. The investigation would likely examine the studio's safety precautions, the instructor's guidance, and what the client was doing at the time. This illustrates how general liability insurance acts as a financial safety net. Each claim is carefully examined based on its unique facts.

The world of insurance is always evolving. The general liability insurance market, for instance, has seen some big swings recently. Some industries, like construction and hospitality, often pay higher premiums. This is because their work involves more inherent risks. Learning about these trends can help businesses prepare for potential cost increases. Learn more about trends in the general liability insurance market.

What if a consultant accidentally deletes a client's important files? General liability insurance might not cover this type of situation. This is why it's important to know the limits of your coverage. Understanding what your policy doesn't cover is just as crucial as knowing what it does cover.

Coverage Gaps That Catch Business Owners Off Guard

Understanding what general liability insurance means is like knowing the rules of a game. But just as important is understanding what those rules don’t cover. Many business owners are surprised to find certain risks aren't covered by their general liability policy. These gaps can be costly. It’s like thinking you have a complete set of tools, only to discover you're missing a crucial wrench when you need it most.

Common Exclusions and Why They Exist

Imagine your general liability policy as a sturdy safety net. Exclusions are like the holes in that net. One common exclusion is professional liability. General liability covers accidents, not professional mistakes. If a consultant gives faulty advice leading to financial losses for a client, that’s not an accident; it falls under professional liability. For a deeper dive into this area, check out: Understanding Professional Liability Insurance for Contractors. Similarly, cyber incidents such as data breaches require separate cyber liability coverage. General liability deals with tangible, physical events, not digital ones. Think of it this way: general liability protects your storefront from a slip-and-fall, while cyber liability protects your online store from a hacker.

Another frequently overlooked exclusion is employment-related claims. Issues like wrongful termination or discrimination are handled by employment practices liability insurance. General liability typically deals with claims from third parties (customers, vendors, etc.), not issues arising from your own employee relationships.

To help visualize these common exclusions, let’s take a look at the table below:

Common General Liability Exclusions and Solutions

Overview of typical exclusions, why they exist, and alternative coverage options

| Exclusion Type | What's Not Covered | Why It's Excluded | Alternative Coverage |

|---|---|---|---|

| Professional Liability | Errors and omissions in professional services (e.g., faulty advice, malpractice) | General liability covers accidents, not professional negligence. | Professional Liability Insurance (Errors & Omissions Insurance) |

| Cyber Liability | Data breaches, cyberattacks, online defamation | General liability focuses on physical events, not digital risks. | Cyber Liability Insurance |

| Employment Practices Liability | Wrongful termination, discrimination, harassment | General liability covers third-party claims, not employee disputes. | Employment Practices Liability Insurance (EPLI) |

This table highlights the key differences between what general liability covers and what requires separate, specialized coverage. Knowing these distinctions helps avoid unpleasant surprises down the line.

Bridging the Gaps: Additional Coverage Options

Addressing these coverage gaps is like patching the holes in your safety net. It usually involves purchasing separate policies or adding endorsements (like adding extra features) to your existing general liability policy. For instance, a consultant needs professional liability insurance, while a retailer with an online store should consider cyber liability coverage. These additional layers of protection ensure your business is ready for a wider range of potential issues.

Finding the right balance between thorough coverage and your budget is like choosing the right ingredients for a recipe. You want the best possible outcome without overspending. Prioritizing your insurance investments based on your specific business risks is essential. A good insurance broker can guide you through these decisions, helping you create a custom plan that fits your needs and your budget. They're like experienced chefs who know the best combinations for success.

Smart Shopping Strategies for the Right Protection

Getting the right general liability insurance isn't a race to the lowest price. It's more like finding the perfect pair of shoes. Sure, those cheap flip-flops might be tempting, but they won't offer much support when you're hiking a mountain. Similarly, a bargain-basement insurance policy might leave your business exposed when you need it most. You need a policy that fits your business like a glove.

Assessing Your Needs and Coverage Limits

First, take a good look at your business and the risks it faces. A bakery faces different challenges than a bungee jumping company, right? Where you work matters too. A home-based business has different needs than a bustling retail store.

Think about your annual revenue, the number of employees you have, and how often you interact with customers. All of these factors influence your risk profile. Understanding this helps you figure out the right coverage limits so you're adequately protected but not paying for coverage you don't need. If you’re feeling lost, a professional advisor can offer valuable guidance.

Decoding Deductibles and Policy Structures

Deductibles are another important piece of the puzzle. A higher deductible usually means lower premiums – like paying less upfront for your insurance. But it also means you'll pay more out of pocket if you need to make a claim. Finding the right balance is key.

There are also different ways insurance policies are structured. Occurrence-based coverage is like a time capsule – it protects you for anything that happens during the policy period, even if the claim comes in much later. Claims-made coverage, on the other hand, protects you for claims filed during the policy period, no matter when the actual incident occurred. Think of it like a snapshot of the present. The best choice depends on the nature of your business. You might be interested in: Business Interruption Insurance Cost.

Insider Tips and Negotiation Strategies

Don’t be shy about talking to insurance professionals. They can offer valuable insights, pointing out potential pitfalls and suggesting questions to ask insurers. And remember, you can negotiate! Shopping around and comparing quotes from different insurers is like comparing prices at different grocery stores. It can save you money and help you find the perfect policy.

The insurance industry is constantly evolving. It's predicted that the liability insurance market will grow by 5.7% each year from 2025 to 2032, driven by advancements in technology that allow for better risk assessment and more personalized solutions. Discover more insights on the future of liability insurance.

Just as your business grows and changes, so should your insurance. Regularly review your coverage and make adjustments as needed. This proactive approach ensures you always have the right fit, protecting your business without breaking the bank.

Your Action Plan for Better Business Protection

Now that you know what general liability insurance is and why it's so important, let's talk about building a solid protection plan for your business. This isn't about grabbing the first policy you find; it’s about finding the right coverage for your specific needs. Think of it like choosing the right wrench for a bolt – a crescent wrench won’t do the job of a socket wrench.

Assessing Your Business Risks

The first step is taking an honest look at the risks your business faces. Do you have a physical store where a customer could slip and fall? Do you handle client property that could accidentally get damaged? Understanding your potential liabilities is like laying the foundation of a house – crucial for everything that comes after. Try creating a checklist of all your business activities and jot down the possible risks each one presents.

Finding the Right Insurance Partner

Next, it’s time to ask the right questions. When you’re talking with insurance agents, don’t just focus on the price. Ask about their experience with businesses similar to yours, what their claims process looks like, and how they handle disputes. A knowledgeable agent can be your greatest ally, guiding you through the process. Watch out for red flags like vague answers or pressure to buy quickly.

Understanding Policy Details

Once you have a policy in hand, don't just skim it – really understand it. Make sure you're clear on your coverage limits, your deductibles, and most importantly, what’s not covered. Are you protected for bodily injury, property damage, and personal and advertising injury? Is it occurrence-based or claims-made coverage? These details might seem small, but they can have a big impact.

Adapting to Change

Remember, your business is constantly evolving, and your insurance coverage should keep pace. Review your policy every year, or whenever your business goes through significant changes. This ensures your protection remains adequate as your business grows and changes.

Protect your business with the right general liability insurance. Contact Wexford Insurance Solutions today for a personalized consultation. Get a quote from Wexford Insurance Solutions.

Cyber Liability Insurance Cost: Protect Your Business Today

Cyber Liability Insurance Cost: Protect Your Business Today Liability Insurance for Employees: Essential Protection Tips

Liability Insurance for Employees: Essential Protection Tips