Why Your Premiums Keep Rising (And What You Can Actually Control)

Let's face it, dealing with home insurance premiums can feel like trying to hold back the tide. Costs seem to just keep climbing, leaving you feeling powerless. But understanding why they're going up can actually put you back in the driver's seat. You can't control the weather, sure, but you can control how your insurer sees your risk. Things like your credit score and past claims, for example, make a big difference.

One of the biggest culprits is the rising number and intensity of natural disasters. These events force insurance companies to pay out more in claims, and guess who picks up the tab? Us, the policyholders. Plus, rebuilding costs are also soaring thanks to inflation and supply chain headaches. This means your premiums could be increasing even if your house hasn't been directly affected.

The overall increase in U.S. home insurance rates—a whopping 40.4% over six years—really highlights the need to be proactive about minimizing these hikes. And with casualty rates also on the rise, especially in the U.S., a clean claims history is more important than ever for keeping your premiums stable. To get a better grasp on these global insurance market trends, check out this report from Marsh. You might also find this article on defining health insurance premiums helpful: Define Health Insurance Premium.

Understanding how insurers assess risk is like having the key to unlocking lower premiums. They consider everything: your home's location, age, security systems, even your dog breed! It might seem like a lot, but this actually gives you an advantage. By focusing on the factors you can influence, you can directly impact your insurance costs. Think of it as a strategic game—you need to understand your insurer's perspective and make smart moves. This brings us to another important point: the power of home improvements.

Home Upgrades That Insurance Companies Actually Care About

So, you want to save some money on your home insurance? You're not alone! Making the right upgrades to your house can really make a difference in your premiums. But there's a secret: not all upgrades are equal in the eyes of your insurance company. That fancy new kitchen might look amazing, but it's not going to impress your insurer nearly as much as improvements that actually reduce risk.

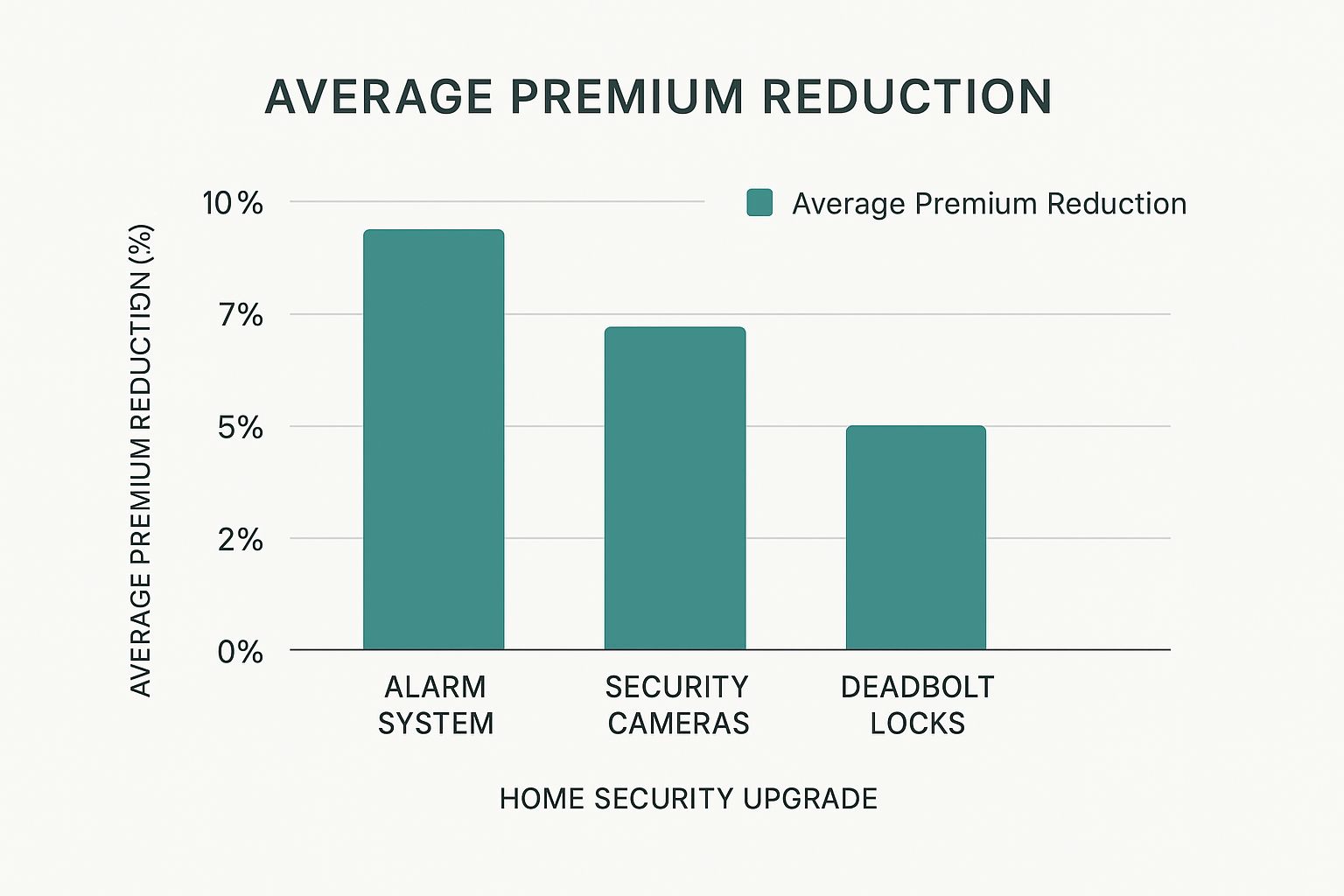

The infographic above shows how much you can typically save with some common security improvements. Alarm systems usually offer the biggest savings, followed by security cameras, then deadbolt locks. This just goes to show how much insurers value things that actively protect your home. Simple things like smoke detectors and a good security system can knock 5% to 20% off your premium depending on your insurer and where you live. Even maintaining a good credit score can help lower your premiums as it shows you're financially responsible. Learn more about potential savings here.

Think about it—would you rather shell out $5,000 for a kitchen renovation, or $200 for a smart smoke detector system that could save you a similar amount on your premiums every single year? I’ve seen this firsthand, and smaller, targeted improvements often make a much bigger impact. A friend of mine upgraded their outdated electrical system, and their insurance company gave them a surprisingly large discount.

Thinking Beyond the Obvious

Beyond the usual security upgrades, consider things that prevent water damage. Upgrading your plumbing, installing a new roof, and adding water leak detectors can actually pay for themselves over time through lower premiums. These kinds of improvements show your insurer that you’re proactive about preventing problems, making you a lower-risk customer.

Let's take a closer look at some of these security improvements and their potential impact on your insurance bill. I've put together a table summarizing typical discounts and costs:

Home Security Improvements and Potential Savings

This table compares different home security upgrades and their typical discount ranges across major insurers. It also factors in average installation costs to give you an idea of the payback period.

| Security Improvement | Typical Discount Range | Average Installation Cost | Payback Period |

|---|---|---|---|

| Burglar Alarm (Monitored) | 10% – 20% | $500 – $1,500 | 2-5 years |

| Security Cameras | 5% – 15% | $200 – $1,000 | 2-4 years |

| Smart Smoke Detectors | 5% – 10% | $100 – $300 | 1-3 years |

| Water Leak Detectors | 2% – 5% | $50 – $200 | 1-4 years |

| Deadbolt Locks | 1% – 5% | $50 – $200 | <1 year |

As you can see, even smaller investments like deadbolt locks and water leak detectors can offer a decent return in terms of premium savings. Monitored burglar alarms offer the biggest discounts, but they also come with a higher upfront cost.

Don’t Forget the Paperwork!

One last piece of advice: documentation is key. Keep all your receipts, take photos of the upgrades, and file any relevant paperwork. This way, you can easily prove to your insurance company what you've done when it’s time to renew your policy, and you’ll be sure to get the full discount you deserve.

The Hidden Credit Score Factor Most Homeowners Ignore

I'm going to let you in on a little secret about home insurance: your credit score matters. A lot. I've seen firsthand how drastically premiums can vary between two practically identical homes with the exact same coverage, all thanks to differing credit histories. It’s often a blind spot for homeowners until they’re hit with a surprise rate increase or start shopping for new coverage.

Why the connection? Well, insurance companies use your credit as a risk assessment tool. They operate under the assumption that a solid credit history reflects responsible financial habits, making you less prone to filing claims. Fair? Not always. Reality? Absolutely.

Think of it this way: two families, same house, same coverage. The family with excellent credit could be paying significantly less than the family with a lower score. This is especially true in the U.S., where homeowners with great credit (think 700+ FICO) often see lower insurance costs because they’re seen as lower risk. Want to explore this credit-insurance cost connection further? Discover more insights here.

This means actively improving your credit score can be a powerful strategy for lowering your home insurance premiums. Even a small boost can make a real difference in your wallet. It's like a long-term financial investment that pays off in multiple ways. Plus, it's something many people completely overlook, missing out on potential savings.

Boosting Your Score for Insurance Savings

So, how do you actually improve your credit when insurance is the goal? The most impactful step? Paying your bills on time, every single time. Seriously, this is the cornerstone of a good credit score. Set up auto-pay or reminders to avoid those late payment penalties that can really hurt.

Next, tackle those credit card balances. A high credit utilization ratio (the amount of available credit you’re using) can be a red flag for insurers. Ideally, keep your balances below 30% of your credit limit.

Resist the urge to open a bunch of new credit accounts all at once. This can make you appear risky. And hold onto those older credit accounts unless you absolutely have to close them. The length of your credit history is a factor, and older accounts can give your score a nice boost.

These strategies might seem small, but trust me, over time, they can lead to significant savings on your home insurance. And remember, a better credit score doesn't just help with insurance – it opens up better loan rates and other financial opportunities too.

Mastering Insurance Bundling Without Getting Burned

Bundling your insurance, like combining home and auto, is often presented as a guaranteed money-saver. But it's not always the magic solution it seems. In reality, bundling can sometimes backfire and cost you more if you're not careful. Let's explore how to make bundling work in your favor.

The most common bundle you'll encounter is home and auto insurance. It's a classic for a reason – it often does lead to discounts. Combining these policies with the same company can sometimes knock off up to 20% of your premiums. For a peek into the future of home insurance, you can explore these predictions. But don't just grab the first bundled offer you see. It's crucial to compare that bundled price with the total cost of separate policies from different insurers. You might be surprised!

Looking Beyond the Obvious Bundles

Bundling isn't limited to just home and auto. Think outside the box! Consider bundling renters or condo insurance with your auto policy. Or, if you already have home and auto bundled, think about adding an umbrella policy. Umbrella policies offer extra liability coverage, and bundling them can unlock even bigger savings. For example, a friend of mine bundled their boat insurance with their home and auto and saved a bundle (pun intended!). For more tips on bundling home and auto, you might find this helpful: Bundling Home and Auto Insurance.

To give you a clearer picture of the potential savings, take a look at this table:

Insurance Bundling Options and Savings Potential

Overview of different insurance bundle combinations and their typical discount percentages

| Bundle Type | Typical Discount | Best For | Considerations |

|---|---|---|---|

| Home & Auto | 10-20% | Homeowners with cars | Compare with separate policies |

| Renters/Condo & Auto | 5-15% | Renters or condo owners with cars | Often overlooked but valuable |

| Home & Auto & Umbrella | 15-25% | Homeowners concerned about liability | Significant savings potential |

| Home & Auto & Boat/RV | Varies widely | Homeowners with recreational vehicles | Requires specialized coverage |

As you can see, different bundles cater to different needs and offer varying levels of discounts. It pays to do your homework and find the best fit for your circumstances.

When Bundling Isn't Best

Sometimes, keeping your policies separate is the smartest move. This might be the case if you have a unique situation, like a high-value home or a history of claims. Specialized insurers might offer you better deals for individual policies than a general insurer's bundled option. I once had a client who saved hundreds by going with a high-net-worth insurer for their home and a separate company for their auto, even though they missed out on a bundling discount.

Negotiating Your Bundle

Never be afraid to negotiate! Let your insurer know you're shopping around and comparing bundled options. Sometimes, just the hint of leaving can encourage them to offer a better deal. I've saved money simply by calling my insurer and asking about any discounts I might be missing. You might be surprised at what they're willing to do to keep your business. Remember, loyalty isn't always rewarded in the insurance game. Comparing offers is the key to getting the lowest premiums, whether you bundle or not.

Shopping Smart in a Changing Insurance Landscape

The insurance market is always changing, isn't it? It's like a constantly moving target. But guess what? Savvy homeowners are using these market shifts to their advantage and snagging significantly better rates on their home insurance. There are opportunities out there now that weren't even a possibility a few years ago, especially if you're willing to do a little shopping around. Don't just stick with your current provider out of habit – loyalty doesn't always pay off in the insurance world!

Timing, as they say, is everything. Just like the housing market, insurance rates can fluctuate depending on things like competition and overall market trends. Knowing when to shop can seriously impact the rates you lock in. For example, I've noticed that insurers often offer better deals at the end of a quarter or fiscal year. They’re trying to boost their numbers by attracting new customers. Also, keeping an eye on seasonal trends—like the spike in rates during hurricane season—can help you avoid those predictable price hikes.

Who’s Offering the Best Deals Right Now?

The insurance world is getting interesting. You might be surprised to see smaller, regional insurers competing head-to-head with the big-name companies. In my experience, they're often more willing to work with you on price. They're a bit more flexible. Also, definitely check out the newer online insurers. They’re shaking things up with lower operating costs and a digital-first approach, often translating to lower premiums for you. Interestingly, as of early 2025, global property insurance rates actually dropped by 6%, with noticeable decreases in places like the Pacific and the UK. This kind of market shift puts you in a stronger position to negotiate lower premiums, whether you're sticking with your current insurer or switching to someone new. Want to dig deeper into these market trends? Explore the Global Insurance Market Index. Thinking about making a switch? This article might be helpful: How to Switch Insurance Providers.

Making Quote Comparisons Work for You

Comparing quotes is essential, of course. But it's not just about finding the lowest number. You have to make sure you're comparing similar policies. Really pay attention to the details: coverage limits, deductibles, and any extra riders. A super low price might mean you're getting less coverage, which could end up costing you way more in the long run if you ever have to file a claim. I learned this the hard way. I saved a bunch of money by switching to a smaller insurer, but I later realized my coverage wasn’t nearly as good. I actually ended up going back to my old insurer and paying a little more—it was worth it for the peace of mind.

Avoiding Costly Pitfalls

Don’t let common mistakes drive up your premiums. One major one is forgetting to tell your insurer about home improvements. Those new security features or that roof you just replaced? They could mean big discounts. Also, be honest about your home and how you use it. Giving inaccurate information can lead to higher premiums, or worse, your policy could even be canceled. And finally, don't be afraid to negotiate! Seriously, many insurers are willing to discuss lower rates, particularly if you have a good claims history. By staying informed about the market, comparing quotes carefully, and being proactive, you can find the best coverage at a price you can afford.

Fine-Tuning Your Coverage for Maximum Savings

Sometimes, the best deals on home insurance aren't about jumping ship to a whole new company. It's more about tweaking what you've already got. Think of it like tuning up your car – a few small adjustments can make a world of difference. So let's dive into some policy modifications that can really impact your costs.

Raising Your Deductible Strategically

One of the most powerful ways to lower your premium is to increase your deductible. This is the amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible usually means a lower premium.

For example, bumping your deductible from $500 to $1,000 could save you a noticeable chunk of change each year. But here’s the catch: make sure you can actually afford that deductible if something happens.

I learned this the hard way. I cranked my deductible way up to save money, and then a big storm walloped my roof. Suddenly, I was scrambling to come up with the cash. Don't make my mistake! Find a good balance between savings and what you can comfortably handle.

Evaluating Your Coverage Needs

Take a good, hard look at what your policy actually covers. Are you paying for things you don't really need?

For example, if you're not in a flood zone, you might be able to ditch the flood insurance. Or, if you have some pricey jewelry, a separate policy for those items might be smarter than lumping them in with your regular home insurance. This kind of targeted approach can often save you money in the long run.

Communicating With Your Agent

Believe it or not, your insurance agent can be a great resource for finding savings. They can point out discounts you might qualify for or suggest changes to your policy that can lower your premiums.

Don't be shy about asking questions and exploring all your options. I once stumbled upon a discount for having a security system just by chatting with my agent! You never know what you might find.

Remember, the goal is to balance saving money with having enough protection. You want to lower your premiums without skimping on the coverage you need for peace of mind. By working with your agent and really digging into your policy, you can achieve both.

Your Premium Reduction Action Plan

Okay, so you've learned a bunch about lowering your home insurance costs. Now, let's get down to brass tacks and figure out how to actually save that money. This plan will help you prioritize what works best for your situation, whether your rates just jumped up or you're just thinking ahead to your next renewal.

Prioritize Your Savings Strategies

Here's the thing: not every tip is going to be a game-changer for everyone. For example, if your credit score is already stellar, you're probably better off focusing on home improvements than trying to squeeze out a few more credit points. But, if you’ve been meaning to upgrade your security system, that could save you a decent chunk of change.

- Recent Rate Increase: If your rates suddenly shot up, your best bet is to talk to your insurer, compare quotes from other companies, and see if you can tweak your current coverage.

- Planning for Renewal: If your renewal is still a while off, you have more time to tackle things like home improvements, boosting your credit score, and looking into bundling your insurance policies.

Create a Checklist and Timeline

Trust me, a checklist is your friend. It keeps you organized and helps you see how far you’ve come. Just make a simple list of what you want to do – like installing smoke detectors or getting quotes from other insurers – and set realistic deadlines for each item. This breaks the whole process down into bite-sized pieces and makes it way less daunting.

Document Everything!

This is a big one. Keep records of any improvements you make to your home. Take photos, save receipts, and file all the paperwork. This documentation is gold when you're trying to show your insurer why you deserve a discount. I learned this the hard way when I rewired my house. Having all the documentation ready made it so much easier to get the discount I was entitled to.

Maintain Your Lower Rates

Getting your premiums down is awesome, but the real victory is keeping them down. Review your policy every year to make sure it still fits your needs and that you’re still getting all the discounts you can. Don't let those rates creep back up on you!

Communicate Effectively With Your Insurer

Don’t be shy about negotiating with your insurance company. They're often willing to work with you, particularly if you’ve been a good customer and haven’t made a lot of claims. Remember those negotiation tactics we talked about? Use them! Don't hesitate to ask for a better deal – a little assertiveness can make a big difference.

Ready to take charge of your insurance costs and lock in the best possible rates? Contact Wexford Insurance Solutions today for a personalized consultation. Our team of experts can help you navigate the confusing world of insurance and find the perfect coverage for your needs and your budget. Visit us at Wexford Insurance Solutions and start saving!

Define Health Insurance Premium: Smart Guide to Real Costs

Define Health Insurance Premium: Smart Guide to Real Costs Personal Liability Coverage Definition: Your Complete Guide

Personal Liability Coverage Definition: Your Complete Guide