You’ve worked hard to acquire beautiful things—a family heirloom watch, a stunning engagement ring, a piece of art you fell in love with. But here’s something most people don't realize until it's too late: your standard homeowners or renters insurance policy probably won't cover their full value if they're lost, stolen, or damaged.

This is where valuable personal property insurance comes in. It's a specialized type of coverage designed specifically to protect your high-value items, closing the dangerous financial gaps that standard policies leave wide open.

What Exactly Is Valuable Personal Property Insurance?

Think of your homeowners policy like a basic first-aid kit. It’s perfect for scrapes and minor bumps—covering your furniture, clothes, and everyday stuff. But if you have a serious injury, you need a surgeon with a specific set of skills and tools.

Valuable personal property (VPP) insurance is that specialist. It provides the precision coverage your most prized possessions need because standard policies have surprisingly low limits for certain categories.

For instance, a typical policy might only pay out $1,500 for all of your stolen jewelry. That’s a tough pill to swallow if your $10,000 engagement ring was in the jewelry box. A VPP policy is designed to cover the ring for its full, appraised value.

This coverage is often sold as an "endorsement" or "rider" that you add to your existing home policy, though you can sometimes buy it as a separate, standalone policy. Its entire purpose is to step in where your main policy steps off.

The Problem With Standard Coverage Limits

The core issue comes down to scope. Your standard policy is built to handle the big, common risks—your house burning down or a thief stealing your TV. It was never designed to properly insure a rare coin collection or a high-end camera.

This isn't just a niche concern. The global personal property insurance market was valued at around USD 1,163.85 billion in 2021 and is growing by over 6% each year. That number tells a story: more and more people are recognizing that their most important possessions need better protection. You can explore current market trends to see just how common this need has become.

Standard vs. Valuable Personal Property Insurance At a Glance

So, how different are these two types of coverage in practice? The table below breaks down the major distinctions between what your standard policy offers and what a dedicated VPP policy provides.

| Feature | Standard Homeowners Insurance | Valuable Personal Property Insurance |

|---|---|---|

| Coverage Basis | Actual Cash Value (depreciated) or Replacement Cost for general items. | Agreed Value, based on a recent appraisal. |

| Coverage Limits | Low, fixed sub-limits on items like jewelry (e.g., $1,500). | Covers the item's full, appraised value. |

| Covered Perils | "Named Perils" (fire, theft, wind, etc.). Many things are excluded. | "All-Risk" coverage, including accidental damage and mysterious disappearance. |

| Deductible | Standard policy deductible applies (e.g., $500 or $1,000). | Often has a $0 deductible. |

| Geographic Scope | Typically limited to your residence. | Worldwide coverage is common. |

As you can see, a VPP policy is far more robust. It offers a safety net that simply doesn't exist in a standard plan.

Key Advantages You Can't Ignore

When you boil it down, a VPP policy gives you peace of mind through a few key benefits:

- Coverage for an Item's True Worth: Your possessions are insured for what they're actually worth, based on a professional appraisal—not a low, predetermined category limit.

- Protection Against More Risks: It often covers scenarios your standard policy won't, like accidentally dropping your camera down a flight of stairs or mysteriously losing one earring from a pair.

- Little to No Out-of-Pocket Cost: Many of these policies come with a $0 deductible. If your $5,000 watch is stolen, you get a check for $5,000, period.

Ultimately, valuable personal property insurance delivers the specific, powerful protection your finest belongings deserve, ensuring a mishap doesn't turn into a major financial setback.

So, What Does Your VPP Policy Actually Cover?

Here's the most important thing to understand: a standard homeowners policy is designed to protect you from a specific list of named disasters—think fire, wind, and theft. A valuable personal property (VPP) policy flips that script entirely. It provides what we in the industry call “all-risk” coverage.

So, what does that mean in plain English? Instead of listing what is covered, an all-risk policy covers just about everything except for a handful of specific exclusions. It’s a subtle distinction, but it makes a world of difference. The things that aren't covered are usually what you’d expect, like damage from war, nuclear events, or anything you do to your own property on purpose.

This broader protection net is designed to catch all those real-life mishaps that standard policies just let fall through the cracks, giving you a much deeper sense of security.

Going Beyond the Basics

The real power of a VPP policy is how it handles situations that are almost never included in a standard home insurance contract. This is where you graduate from basic protection to genuine peace of mind.

Let's look at a couple of real-world scenarios that happen all the time:

- Accidental Damage: You're dusting a priceless antique vase, and it slips from your hands, chipping the base. Your homeowners policy almost certainly won't pay a dime for that. A good VPP policy, on the other hand, is built for exactly this kind of accident.

- Mysterious Disappearance: This is that heart-stopping moment when you realize something is just… gone. It wasn’t a clear-cut theft; it simply vanished. Maybe a diamond earring fell out while you were out to dinner, or a valuable watch went missing during a hectic day of travel. This is a classic VPP coverage scenario.

These aren't just hypotheticals. They are the kinds of frustrating and costly events that can leave you with a significant financial loss if you don't have the right coverage. For anyone with a high-value home and lifestyle, this kind of protection extends well beyond your four walls. For a deeper dive into protecting your home itself, take a look at our complete guide to high-value home insurance.

The Importance of Scheduling Your Items

Another critical piece of the puzzle is scheduling. This is simply the process of listing each of your high-value items individually on the policy, right alongside its professionally appraised value.

Scheduling is what guarantees you'll get a fair payout if you ever need to file a claim. Without it, you’re stuck with the low, generic limits in your homeowners policy—like the typical $1,500 cap for all your jewelry combined. With scheduling, each piece is insured for its true, agreed-upon worth.

Here’s what that looks like in practice: Let's say you schedule a $20,000 painting. If it’s stolen or destroyed, you are paid the full $20,000. There's no argument about depreciation, and in most cases, you won't even have to pay a deductible.

This "agreed value" approach gets rid of all the guesswork and stress at the worst possible time—right after you've suffered a loss.

Think of it this way: a standard policy lumps your valuables into one big, underinsured category. A valuable personal property insurance policy treats each one like a VIP, ensuring its unique value is recognized and fully protected. That's the core promise of a well-designed plan.

Getting Your Valuables Covered: A Step-by-Step Guide

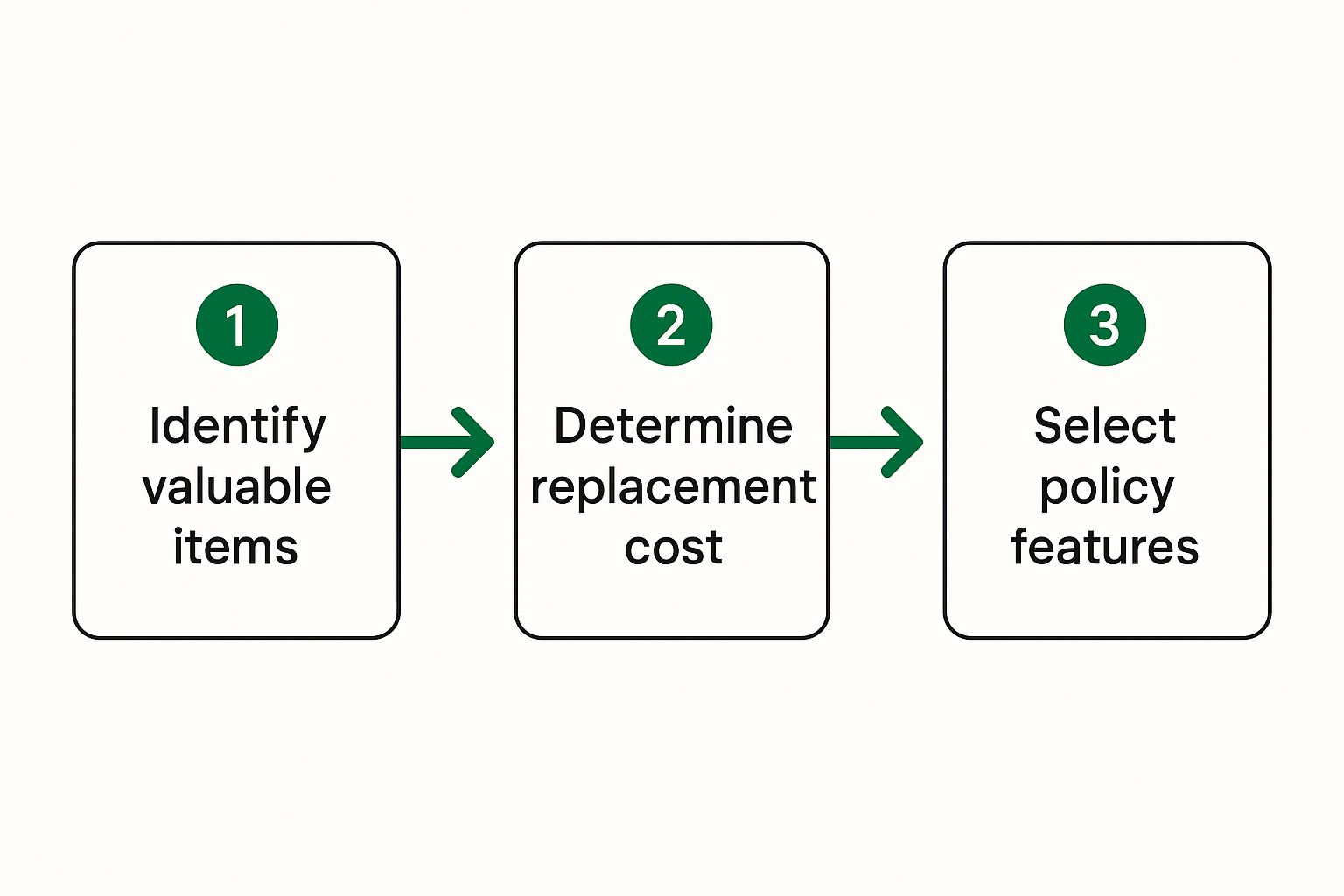

Getting the right insurance for your most prized possessions might seem daunting, but it's really just a straightforward process. Think of it less like navigating a maze and more like following a clear, three-step path. It all comes down to knowing what you have, proving what it's worth, and then choosing the right protection.

Each step naturally leads to the next, moving you from uncertainty to complete peace of mind.

Step 1: Create a Detailed Inventory

Before you can insure anything, you first need a comprehensive list of what you own. This isn't just a quick mental tally; it's about creating a detailed record of every valuable item that might need coverage beyond your standard policy.

Put on your detective hat and document everything. For each piece, you'll want to:

- Take clear photos from several different angles. Be sure to get close-ups of any unique details, signatures, or serial numbers.

- Dig up all the paperwork you have. This includes sales receipts, certificates of authenticity, and any past appraisals.

- Write a solid description covering its condition, origin, and anything else that makes it special.

This inventory is the bedrock of your policy. Trying to get coverage without it is like building a house without a foundation—a gamble you don't want to take.

Step 2: Get a Professional Appraisal

With your inventory list in hand, your next move is to get a professional appraisal. This is the official step where a qualified expert assigns a monetary value to your items, and it's the number your insurer will use to determine your coverage.

An appraisal is more than just a good idea—for most insurers, it's a must-have. It replaces guesswork with documented proof, ensuring you're compensated for an item's actual value, not some low, generic limit, if you ever need to file a claim.

Finding the right appraiser is crucial. You’ll want someone certified by a reputable group like the American Society of Appraisers or the International Society of Appraisers. This is especially true for things like fine jewelry, where an expert eye is essential. To understand this part of the process better, check out our guide to getting a jewelry appraisal for insurance. Think of this formal report as your single most important piece of evidence.

Step 3: Choose Your Policy Structure

Now for the final step: choosing how to structure your insurance. Armed with your detailed inventory and professional appraisals, you have two primary ways to secure your valuable personal property insurance.

- Add a Rider to Your Existing Policy: Often called a "floater" or an "endorsement," this option simply adds specialized coverage to your current homeowners or renters insurance. It’s a popular and convenient choice if you only have a handful of high-value items to protect.

- Purchase a Standalone Policy: If your collection is extensive or includes exceptionally valuable pieces, a standalone policy might be the smarter play. These are typically offered by specialized insurers and come with broader coverage and much higher limits than a standard rider.

So, which path is for you? It really boils down to the size and value of your collection. An independent agent can be a huge help here, laying out the pros and cons of each approach to find the best fit for your specific assets. Follow these steps, and you’ll walk away with a policy that gives you real confidence that your treasures are protected.

Common Items That Need Specialized Insurance

When you hear “valuable personal property insurance,” your mind probably jumps straight to diamond rings and famous paintings. And you're not wrong—those are definitely prime candidates. But the world of items that need this kind of specialized coverage is much bigger than most people realize.

Many of your hobbies and even professional tools are likely dangerously underinsured by your standard homeowners or renters policy. Those policies are designed to cover general stuff, not unique assets with specific risks. That's why figuring out which of your belongings fall into this special category is so critical.

Beyond the Jewelry Box and Art Gallery

Think about the gear you use for your passions or your profession. These items often carry significant value and face risks that a typical insurance policy just wasn't built to handle.

- High-End Camera Equipment: Picture a professional photographer on a remote shoot. If they accidentally drop a $5,000 lens on a rock, their home insurance probably won't do a thing. But a valuable personal property policy can protect against that kind of real-world accident, even when they're miles from home.

- Musical Instruments: Imagine a professional cellist who flies around the world for performances. Their centuries-old cello isn't just wood and strings; it's their livelihood. VPP insurance offers worldwide protection against damage, theft, and even that dreaded "mysterious disappearance" while in transit.

- Designer Handbags and Wardrobes: A carefully chosen collection of designer handbags can easily add up to a five-figure investment. If a fire happened, a standard policy would toss them into the "general contents" bucket, paying out only a fraction of what they're truly worth. Scheduling them ensures you get their full value back.

These examples really highlight why you need to look past the obvious. The things you're most passionate about often come with high-value assets that demand dedicated protection.

Identifying Your Hidden Treasures

So many people own items that qualify for valuable personal property coverage and have no idea. The trick is to think about any collection or single item that would be a huge financial headache to replace.

Here's a simple rule of thumb: If your standard policy's sub-limit for a specific category (usually around $1,500 to $2,500 for things like jewelry or firearms) wouldn't even touch the cost of replacing one item, you need to look into specialized insurance.

To help you get started, here's a look at the kinds of items that almost always need this extra layer of coverage.

Common Categories Covered by VPP Insurance

| Category | Examples | Key Coverage Consideration |

|---|---|---|

| Jewelry | Engagement rings, luxury watches, heirloom necklaces | Standard policies have notoriously low limits for theft. |

| Fine Art | Paintings, sculptures, limited-edition prints | Value can go up over time, so you'll need regular appraisals. For more on this, check out our guide to insuring fine art. |

| Collectibles | Rare coins, stamps, sports memorabilia, fine wine | Their value is all about condition and rarity, which makes a professional appraisal non-negotiable. |

| Firearms | Antique rifles, custom competition pistols, large collections | This category often has its own very low sub-limit for theft on a standard homeowners policy. |

| Antiques | Period furniture, grandfather clocks, rare books | Protection against accidental breakage is a huge benefit that standard policies just don't offer. |

Honestly, the only way to know for sure is to do a thorough inventory of your home. You might be shocked to discover how much your "stuff" is actually worth—and how much of it is underinsured. Think of this self-audit as the first and most important step toward getting the financial protection you actually need.

How Much Does Valuable Personal Property Insurance Cost?

Let's get straight to the question everyone asks: what does this peace of mind actually cost? While there's no one-size-fits-all price tag, figuring out what shapes your premium for valuable personal property insurance is more straightforward than you might think.

The cost really boils down to two things: how much your item is worth and how risky it is to insure. Think of it as a balancing act. As an item's value and the likelihood of a claim go up, so does the premium. This is how insurers arrive at a price that makes sense for the protection they're offering.

A good rule of thumb is to expect an annual cost of about $1 to $2 for every $100 of insured value. So, for that $10,000 engagement ring, you're likely looking at a premium between $100 and $200 a year. Of course, this is just an estimate—the final number will depend on a few key details.

What Determines Your Premium?

At its core, insurance is all about risk management. An underwriter’s job is to look at everything that could possibly go wrong and price the policy accordingly. Your premium is a direct reflection of that risk assessment.

Here are the main factors that will move the needle on your final cost:

- The Appraised Value: This is the big one. The higher the replacement value, the more it costs to insure. It's simple math for the insurance company—a $50,000 painting represents a much larger potential payout than a $5,000 watch.

- The Type of Item: Let's face it, some things are just easier to lose or have stolen. Jewelry is a classic example. It’s small, portable, and highly desirable, which makes it inherently riskier—and more expensive to insure—than something like a large, heavy antique sculpture.

- Your Geographic Location: Where you live and store your valuables plays a huge role. If your home is in an area with a higher-than-average theft rate or is prone to natural disasters like hurricanes or wildfires, you can expect to pay more to cover that elevated risk.

It's worth noting that insurance pricing isn't static. Globally, non-life insurance premiums saw an estimated growth of 3.9% in 2023, influenced by everything from inflation to major weather events. In some places, premium hikes have even outpaced income growth. For a deeper dive into these global trends, check out the analysis in Deloitte's 2024 insurance outlook.

How Security Measures Can Lower Your Cost

The good news is you aren't just a bystander in this process. By taking smart, proactive steps to protect your valuables, you can often earn yourself some meaningful discounts on your insurance premium.

Insurers love to see that you're a responsible partner in protecting your assets. If you can lower the odds of them ever having to pay a claim, they'll often reward you for it. Things like these can make a real difference:

- A professionally monitored home security system

- Secure storage, such as a high-quality home safe or a bank safe deposit box

- Modern fire and smoke detection systems

Proving you're serious about safeguarding your items can directly translate into lower annual premiums. This strategic thinking about protection is the same mindset you'd apply to your broader financial safety net. For example, it's just as crucial to figure out your liability exposure, which you can learn more about in our guide on how much umbrella insurance you might need.

Here is the rewritten section, designed to sound completely human-written and natural.

Let's Bust Some Common Myths About Protecting Your Valuables

When it comes to insuring your most cherished possessions, bad information can be an incredibly expensive mistake. A lot of people operate under false assumptions that leave them dangerously exposed, often without even realizing it.

Let's clear the air and tackle these myths head-on. Understanding the truth is the first step toward getting the right protection and avoiding a painful financial surprise down the road.

Myth 1: "I'm Covered, My Homeowners Policy Is Enough"

This is, without a doubt, the most common and costly myth out there. It’s easy to assume your homeowners policy has you covered for everything inside your home, but the reality is far more limited.

The Hard Truth: A standard homeowners policy does provide some coverage for personal belongings, but it has very strict, low limits for high-value items. For instance, most policies cap the payout for stolen jewelry at around $1,500. So, if your $15,000 engagement ring is stolen, you’re looking at a $13,500 gap you'd have to cover yourself.

A valuable personal property policy is built for this exact scenario. It insures the item for its full, appraised value, closing that massive coverage gap. This is a very different kind of protection than the broad liability coverage you might find in other policies. To get a better sense of how different insurance layers work, you can explore our guide on what a personal umbrella policy covers.

Myth 2: "I Don't Really Need a Formal Appraisal"

Many people think a store receipt or a quick search online is all they need to prove what something is worth. This can be a huge misstep when you actually have to file a claim.

The Hard Truth: An appraisal from a certified professional is the gold standard—it's the official proof of value your insurance company will look for. This document establishes an "agreed value," meaning the insurer agrees upfront to pay you that specific amount if the item is lost or destroyed. Without one, you're left trying to prove the item's worth after it's already gone, which puts you in a very weak negotiating position.

The Bottom Line: Think of a professional appraisal as your financial anchor. It removes any guesswork and turns your policy from a vague promise into a firm, financial guarantee. It ensures you get the full value back, no arguments.

Myth 3: "Specialized Insurance Is Just Too Expensive"

Another common roadblock is the assumption that this kind of specific coverage must be unaffordable. Collectors and owners of fine jewelry or art often skip it, thinking it's a luxury they can't justify.

The Hard Truth: The cost is almost always more reasonable than people imagine. Plus, you might be surprised to learn how market trends can work in your favor. For example, the Global Insurance Market Index recently showed that property insurance pricing fell by 6% globally in the first quarter of 2025, which continues a trend toward more favorable conditions for buyers. You can discover more insights about these global insurance trends on marsh.com.

Of course, your individual premium depends on many factors, but the broader market is becoming more competitive. When you weigh a relatively small annual premium against the devastating financial hit of losing an uninsured heirloom, the value of this protection becomes incredibly clear. It’s a small price to pay for true peace of mind.

Your Top Questions About Valuable Personal Property Insurance, Answered

Even after getting the basics down, you might still have a few lingering questions about valuable personal property (VPP) insurance. That’s perfectly normal. Let's walk through some of the most common ones to make sure you have a complete picture of how this protection really works.

How Often Should I Get My Valuables Reappraised?

This is a fantastic and crucial question. An outdated appraisal is one of the easiest ways to find yourself underinsured when you need the coverage most. Think of an appraisal as a snapshot in time—it captures your item's market value on a specific date. But markets change. The value of fine art, rare coins, and even diamonds can rise (or sometimes fall) over the years.

To stay on top of this, the general rule of thumb is to have your valuables reappraised every three to five years. For items in hotter markets, like certain luxury watches or contemporary art, you might even want to shorten that window. Keeping your appraisals current is the single best thing you can do to ensure you're paid the proper amount if you ever have to file a claim.

Are My Items Covered When I Travel?

Absolutely, and this is one of the biggest advantages of a dedicated VPP policy. Standard homeowners insurance often gets tricky with coverage once you leave your property, but VPP insurance is built for a life in motion.

Most policies offer true worldwide coverage. That means the engagement ring you wear on a trip to Paris, the high-end camera you take on a safari, or the vintage guitar you bring to a studio session are all protected. It's a level of security designed for people who don't leave their most cherished belongings locked away.

What Does the Claims Process Look Like?

While the specifics might differ slightly between insurance companies, the claims process for a VPP policy is usually refreshingly straightforward, especially if you've done your homework upfront.

- Contact Your Insurer: The moment you discover a loss, theft, or damage, get in touch with your agent.

- File a Police Report: For any theft, you’ll need to file a police report. Your insurer will ask for a copy of this report—it's a standard and necessary step.

- Submit Your Documents: This is where your good record-keeping pays off. You'll provide proof of ownership, like the original receipt, and—most importantly—the professional appraisal you used to schedule the item.

- Settle the Claim: Because you insured the item for an "agreed value," there's no haggling over its worth after the fact. Once your claim is approved, you’ll typically receive a check for the full amount it was insured for, often with no deductible to pay.

Can I Get a Discount on My Premiums?

Yes! Insurance companies love to see that you're taking proactive steps to protect your valuables. It shows them you're a lower risk, and they'll often reward you with a lower premium.

Here are a few common ways to snag a discount:

- Secure Storage: Keeping jewelry in a bank's safe deposit box or in a professional-grade, bolted-down home safe can earn you a nice rate reduction.

- Central Station Alarms: A security system that's professionally monitored for both burglary and fire tells your insurer you’re serious about loss prevention.

- Bundling Policies: You can almost always find savings by getting your VPP coverage from the same company that handles your home and auto insurance.

Taking these steps not only puts money back in your pocket but also gives you another layer of defense for the things you value most.

Protecting what you love shouldn't be a hassle. The experts at Wexford Insurance Solutions can help you assess your needs, explore your options, and craft a policy that gives you genuine peace of mind. Visit Wexford Insurance Solutions to learn more and get started today.

Vacation Home Insurance: Protect Your Second Property

Vacation Home Insurance: Protect Your Second Property Understanding Personal Liability Insurance Cost: Limit Surprises

Understanding Personal Liability Insurance Cost: Limit Surprises