When it comes to insurance for general contractors, there’s no magic number or single policy that covers everything. Your specific needs really boil down to your state's laws, the demands of your client contracts, and the sheer complexity of the projects you take on.

That said, every contractor's insurance portfolio is built on a solid foundation. Most in the industry call it the 'Big Three': General Liability, Workers' Compensation, and Commercial Auto. Think of these as the non-negotiable starting point for protecting your business.

What Insurance Do General Contractors Actually Need?

It’s helpful to think of your insurance policies less like a frustrating expense and more like your professional toolkit. You wouldn't show up to a job site with only a hammer, right? You need different tools for different tasks. Insurance works the same way.

Each policy is a specialized tool designed to handle a specific type of risk. For instance, a client tripping over a power cord on your site is a completely different problem than one of your crew members getting hurt while framing a wall. The first incident falls under General Liability, while the second is a clear-cut Workers' Comp issue. Without the right coverage for each scenario, you’re left paying out-of-pocket, which can be financially devastating.

The Core Insurance Toolkit

Your essential insurance requirements are built around those three core policies. They're designed to tackle the most frequent and costly risks you face on a daily basis. Getting a handle on what each one does is the first real step toward building a reliable safety net for your company.

- General Liability Insurance: This is your primary defense when someone claims your business caused them bodily harm or damaged their property. If a visiting homeowner gets hurt on your site or your crew accidentally damages the neighbor's fence, this is the policy that kicks in.

- Workers' Compensation: In nearly every state, this is a legal must-have if you have employees. It covers medical bills and lost wages for your crew if they get injured on the job. In exchange for providing this coverage, it generally protects you from being sued directly by the injured worker.

- Commercial Auto Insurance: Don't make the mistake of thinking your personal car insurance will cover you. Any trucks, vans, or even cars used to haul tools, transport materials, or move your crew need a dedicated commercial auto policy.

A huge mistake I see contractors make is thinking this 'Big Three' is all they'll ever need. While they form a crucial foundation, most projects will require more specialized protection. Things like theft of materials from a job site or damage from a fire during the build aren't typically covered by these policies.

This is where you have to look beyond the basics. The core policies handle liability and your people, but they don't protect the actual structure you're being paid to build. For that, you need a completely different tool. You can learn more about how builder's risk insurance works to protect the physical project itself.

Core Insurance Policies for General Contractors

To quickly recap, these are the essential coverages every GC needs in their back pocket. The table below breaks down what each policy is for and who it's meant to protect.

| Insurance Type | What It Covers | Who It Protects |

|---|---|---|

| General Liability | Bodily injury and property damage to third parties (clients, visitors, etc.). | Your business from lawsuits and financial loss due to accidents. |

| Workers' Compensation | Medical expenses and lost wages for employees injured on the job. | Your employees and your business from related lawsuits. |

| Commercial Auto | Liability and physical damage for vehicles used for business purposes. | Your business from accidents involving company vehicles. |

Having these three policies in place is the bare minimum for running a professional and legally compliant contracting business. Now, let's dive a little deeper into how each one works.

Demystifying General Liability Insurance

Think of general liability insurance as the concrete foundation for your business's entire protection plan. You have other policies for your crew or your trucks, but general liability is what shields you from the everyday, public-facing risks of just doing business. It’s your front-line defense when someone claims your work caused them bodily harm or damaged their property.

Let's make this real. Imagine a client drops by your job site to see how things are coming along. They trip over a stray power cord and break their wrist. That’s it. Without general liability insurance, your business is on the hook for their medical bills, lost wages, and any legal battle that follows. A single, simple accident could financially cripple a smaller contracting business.

This is exactly where general liability steps in. It's designed to cover the legal fees, settlements, and medical payments up to your policy limit, stopping a mishap from turning into a full-blown financial disaster.

What Does General Liability Actually Cover?

At its heart, a contractor's general liability policy is built to handle three main kinds of risk. Once you get these, you’ll see the practical value behind all the policy jargon.

- Third-Party Bodily Injury: This is the classic slip-and-fall scenario. It covers injuries to anyone who isn't your employee, whether they're on your job site or hurt by something related to your operations.

- Third-Party Property Damage: This kicks in when your work accidentally messes up someone else's stuff. For instance, if one of your subs backs a truck into the neighbor's brand-new fence, this coverage pays to fix it.

- Personal and Advertising Injury: This one is less about physical damage and more about reputational harm. It covers things like slander, libel, or even copyright infringement if you accidentally use a protected image in your marketing.

Getting these basics down is non-negotiable. For a much deeper dive into the fine print, our guide on the meaning of general liability breaks it down even further. It’s a crucial read for any contractor who wants to be truly confident in their coverage.

Decoding Your Policy Limits

When you look at a general liability quote, you'll see phrases like "per occurrence" and "aggregate" limits. These aren't just industry fluff—they dictate the absolute maximum your insurance company will pay out.

- Per Occurrence Limit: This is the most your policy will pay for any single incident or claim. A $1 million limit is pretty standard.

- Aggregate Limit: This is the total grand maximum the policy will pay out over the entire policy period (usually a year), no matter how many claims you have. It's often double the occurrence limit, so you'll commonly see a $2 million aggregate.

A great way to think about it is like a bank account. The "per occurrence" limit is the maximum amount you can write a single check for. The "aggregate" limit is the total balance in your account for the whole year. Once you've spent it all, the account is empty, and the policy won't pay another dime.

The Completed Operations Hazard

One of the most vital—and frequently misunderstood—parts of a contractor’s policy is completed operations coverage. This is what protects you from claims that pop up long after you’ve packed your tools, cashed the final check, and moved on.

Picture this: you build a beautiful new deck for a client. A year later, a railing you installed fails, and someone gets hurt. Even though you haven't been on that property for months, your business is still on the hook. Completed operations coverage is designed specifically for these delayed-reaction disasters. It's an absolute must-have that extends your protection far beyond the project's end date.

This kind of forward-thinking coverage is more important than ever. Industry forecasts show that premiums for general liability are expected to increase by 5% to 15% in 2025. These hikes are fueled by more cautious underwriting and the rising costs of claims, making it critical for contractors to get ahead of their risks. To get a better handle on what's coming, check out this detailed 2025 insurance marketplace forecast.

Common Gaps and How to Fill Them

A standard general liability policy is a powerful tool, but it's not a magic wand. It comes with built-in exclusions that can leave you with dangerous blind spots. One of the biggest for contractors is the faulty workmanship exclusion.

In plain English, this means if you install a cabinet incorrectly and it has to be torn out and redone, the cost of fixing your own mistake isn't covered. The policy is there to pay for the damage your mistake caused—like if the faulty cabinet fell and smashed the client's expensive countertop—not to pay you to do the job right the second time.

The good news is that you can often buy endorsements, which are like small add-ons to your main policy, to plug these holes. By teaming up with an insurance agent who really knows the construction world, you can pinpoint your unique risks and add the right endorsements to make sure your coverage is truly solid. That’s how you get real peace of mind.

The Critical Role Of Workers' Compensation

While general liability insurance looks outward to protect you from claims by clients or the public, workers' compensation looks inward. It’s designed to protect your most valuable asset: your people.

Think of it as a two-way shield. For your employees, it’s a crucial safety net, covering their medical expenses and a portion of their lost wages if they get hurt on the job. For your business, it’s a powerful line of defense against lawsuits. In most situations, when an employee accepts workers' comp benefits, they give up their right to sue your company over that specific injury. This legal trade-off is often called the "exclusive remedy," and it’s a cornerstone of modern workplace safety laws.

For general contractors, this coverage isn't just a good idea; it's a core component of your general contractor insurance requirements. In almost every state, the minute you have employees—even just one—you are legally required to carry workers' compensation.

More Than Just A Legal Obligation

What happens if you don't? The consequences can be severe, ranging from crippling fines and stop-work orders to, in some cases, criminal charges. But looking past the legal hammer, having this coverage is simply the mark of a professional and responsible operation. It shows your crew that you’re committed to their well-being.

The exact rules, however, are anything but uniform. They can change dramatically from one state to the next. For instance, our guide on workers' compensation requirements in Florida digs into the specific regulations there, highlighting how even the definition of an "employee" can differ. It's absolutely vital to know the rules where you work.

Your commitment to safety isn't just about doing the right thing; it has a direct and measurable impact on your insurance costs. A safer job site literally translates to lower premiums, making safety a powerful tool for managing one of your biggest expenses.

The insurance world even has a specific metric to grade your performance: the Experience Modification Rate, or "eMod."

Your Safety Report Card: The E-Mod Score

The easiest way to understand your eMod is to think of it as a safety report card for your business. It's a number that directly compares your company’s claims history to the industry average for other businesses of a similar size and type.

Here’s how it breaks down:

- An eMod of 1.0 is the baseline—it means your claims history is perfectly average.

- An eMod below 1.0 is a good grade. It shows you're safer than average, and you’ll get a credit or discount on your workers' comp premium.

- An eMod above 1.0 is a bad grade. It means you're considered riskier, and you'll have to pay a debit or surcharge.

This isn't just about saving a few bucks. The financial swing can be huge. For a contractor paying a $100,000 annual premium, an eMod of 0.80 could result in a $20,000 discount. But an eMod of 1.20 would add a $20,000 surcharge. This creates a powerful financial incentive to build and document a rock-solid safety culture on every project.

The High Cost of Misclassification

One of the biggest financial landmines a general contractor can step on is worker misclassification. In an attempt to slash costs, some contractors try to classify their employees as independent contractors (or 1099 workers) to dodge paying for workers' compensation and payroll taxes.

This is a high-stakes gamble that almost never pays off. State and federal agencies have very strict tests to determine who is truly an independent contractor and who is an employee. Getting caught triggers a cascade of costly consequences:

- Back Premiums: You'll be on the hook for all the workers' comp premiums you should have been paying all along.

- Heavy Fines: Expect government agencies to levy punishing fines for breaking the law.

- Total Liability: If a misclassified worker gets injured, you could be held personally liable for every dollar of their medical bills and lost income—without the "exclusive remedy" protection that insurance provides.

Making sure your team is classified correctly and that every true subcontractor carries their own insurance isn't just ticking a box. It's fundamental risk management that protects the financial health and integrity of your business.

Building a Complete Insurance Safety Net

General liability and workers' compensation are the absolute bedrock of your insurance plan. But stopping there is like trying to build a house with only a hammer and a saw—you've got the essentials, but you're missing the specialized tools needed for a truly professional and secure job.

Think about it. Your basic policies are great for handling slips, falls, and employee injuries. What they don't cover are the unique, high-stakes risks that pop up on every project. A fire during a build, theft of your expensive gear, or a massive lawsuit that rockets past your liability limits can leave catastrophic financial holes in your business.

This is why experienced contractors build a broader safety net. By layering in a few more specific coverages, you protect more than just your liability—you protect your assets, your work-in-progress, and the future of your company.

Protecting the Project Itself with Builder’s Risk

Picture this: you're just weeks away from handing over the keys to a huge renovation project. Then, you get a call in the middle of the night. A fire has ripped through the job site, wiping out months of hard work and tens of thousands of dollars in materials. Your general liability policy won't touch this, as it’s designed to cover damages to other people's property, not the project you're actively building.

That’s the exact gap Builder’s Risk insurance is made to fill.

Think of Builder's Risk as property insurance for a structure that isn't finished yet. It protects your financial stake in the building and the materials on-site from things like fire, theft, vandalism, and harsh weather while construction is underway.

It's no surprise that project owners and lenders almost always require this. It's their guarantee that if a disaster strikes mid-project, the money will be there to clean up the mess and start again. For you, it means a single bad event doesn't have to spell financial ruin.

Guarding Your Gear with Inland Marine Insurance

Your tools and equipment are the lifeblood of your business. They're also constantly on the move—from your shop to the job site, then to the next one. So, what happens when a thief makes off with your truck full of tools? Your standard commercial property policy probably won't cover it; that coverage usually ends the moment your property leaves your main business address.

This is where Inland Marine insurance steps in. Don't let the name fool you—it has absolutely nothing to do with water. It's a specific type of property coverage designed to protect your business assets while they're in transit or stored somewhere temporarily, like a job site.

It's built to cover things like:

- Contractor's Tools and Equipment: Everything from your hand tools to larger machinery like skid steers.

- Materials in Transit: Protects supplies on their way to the job before they're installed.

- Leased or Rented Equipment: Often a requirement when you rent that expensive excavator for a project.

Without it, you're essentially self-insuring every single tool the second it leaves your shop. The out-of-pocket cost to replace stolen or damaged gear can bring your operations to a dead stop.

The Last Line of Defense: An Umbrella Policy

Every contractor has a "what if" scenario that keeps them up at night. A multi-vehicle pileup caused by one of your work trucks, or a catastrophic injury on your site, could easily trigger a lawsuit that blows past the $1 million or $2 million limit on your general liability or auto policy. When that happens, the rest comes directly out of your business and personal assets.

This is where a Commercial Umbrella Liability policy becomes your ultimate financial shield. It sits on top of your other liability policies (like GL and auto) and kicks in with extra funds only when their limits are exhausted. A typical umbrella policy adds another $1 million to $5 million—or even more—in liability protection.

For what it costs, it's one of the smartest buys you can make, giving you critical peace of mind against a company-ending lawsuit.

This comprehensive approach is more important than ever. The construction industry is seeing a significant project backlog, which directly impacts insurance needs. For example, the Associated Builders and Contractors (ABC) reported an average backlog of 8.4 months in late 2024. Longer project timelines mean your exposure to risks also gets longer, making it vital that every policy—from builder’s risk to your umbrella—is built to last. You can find more details on how project backlogs are shaping insurance in the 2025 construction outlook.

How Contracts and State Laws Define Your Coverage

Your insurance coverage isn't something you just pick out of a catalog. It’s actually dictated by two powerful forces that shape your business: the laws in your state and the contracts you sign.

Think of it as a two-level system. First, you have to meet the legal minimums set by your state just to operate. But to land the jobs you really want, you’ll need to meet the much higher standards your clients demand in their contracts. Fulfilling both of these general contractor insurance requirements is absolutely essential to running a compliant and successful business.

State Licensing Board Minimums

State laws are the starting point—the absolute baseline. Almost every state has a licensing board that requires a minimum amount of insurance before they'll hand you a general contractor's license. This is all about providing a basic safety net for the public.

But here’s the thing: these legal minimums are all over the map. What gets you by in Alabama won't even scratch the surface of what’s needed in California. This is exactly why a one-size-fits-all insurance policy just doesn't work in this industry.

For example, look at how different things are from state to state:

- California: You'll need a $25,000 contractor bond and proof of workers' compensation. While the state doesn't mandate general liability, good luck finding a client who won't require it.

- Alabama: For any project over $50,000, you’re required to have general liability insurance and must pass both a trade exam and a business and law exam.

- Alaska: General liability and workers' comp are required, but your specific license type (like a residential endorsement) will dictate what else you need.

One of the biggest mistakes a contractor can make is thinking the state minimum is all they need. It isn't. State requirements are designed to protect the public from a disaster, not to protect your business from the financial fallout of a lawsuit or the unique risks of a complex project.

When Client Contracts Demand More

This is where the rubber really meets the road. While state law sets the floor, client contracts build the rest of the house—and they almost always build it with much higher standards. If you want to bid on a serious commercial or high-end residential project, you have to meet the insurance demands spelled out in the contract.

These contract clauses nearly always ask for more, including:

- Higher Liability Limits: Your state might not even require general liability, but a commercial client will almost certainly demand limits of at least $1 million per occurrence and a $2 million aggregate.

- Additional Insured Status: This is a classic. You'll have to add the project owner to your policy as an "additional insured," which protects them if someone sues them over work you performed.

- Specific Endorsements: Contracts often call for specialized coverage. If you're doing design-build work, for instance, you'll likely need professional liability coverage. It’s a completely different beast from general liability, and it's crucial to get the details right by understanding professional liability insurance for contractors.

Let’s walk through a real-world scenario. Imagine you're bidding on a new retail storefront. The developer's contract clearly states you need a $2 million general liability limit, a $5 million umbrella policy, and must name them as an additional insured. To even get your foot in the door, you need a Certificate of Insurance (COI) that proves you have this coverage. If your policy only meets the state's bare-bones minimums, your bid is dead on arrival.

To give you a clearer picture of how these requirements can vary, the table below shows a few examples. Notice how different the minimums are, which highlights why you can't make assumptions.

Sample State General Contractor Insurance Requirements

| State | Minimum General Liability Limit (Example) | Surety Bond Requirement (Example) |

|---|---|---|

| Florida | Varies by license type; e.g., Certified GCs need $300k bodily injury, $50k property damage | Required; amount based on credit score (e.g., $10,000 – $20,000) |

| Nevada | Varies by license monetary limit | Required; amount ranges from $1,000 to $500,000 based on license type and limit |

| Oregon | $500,000 per occurrence for residential; $1M combined single limit for commercial | Required; amount varies by license type (e.g., $10,000 – $75,000) |

| Arizona | No state-mandated GL, but required by nearly all contracts | Required; amount based on projected gross volume (from $5,000 to $100,000) |

As you can see, relying on a single national standard is impossible. The rules change the moment you cross a state line.

The ultimate lesson here is simple but critical: every single contract is its own beast. Always, always review the insurance section with your insurance professional before you sign anything. It’s the only way to be sure you're not just compliant with the law, but also fully prepared to land the jobs you truly want.

Your Top Questions About Contractor Insurance, Answered

When you're running a construction business, you've got a million things on your plate. It's no surprise that questions about insurance requirements pop up all the time. Getting the right answers is key to protecting your company, staying compliant, and landing the jobs you want. Let's dig into some of the questions I hear most often from contractors.

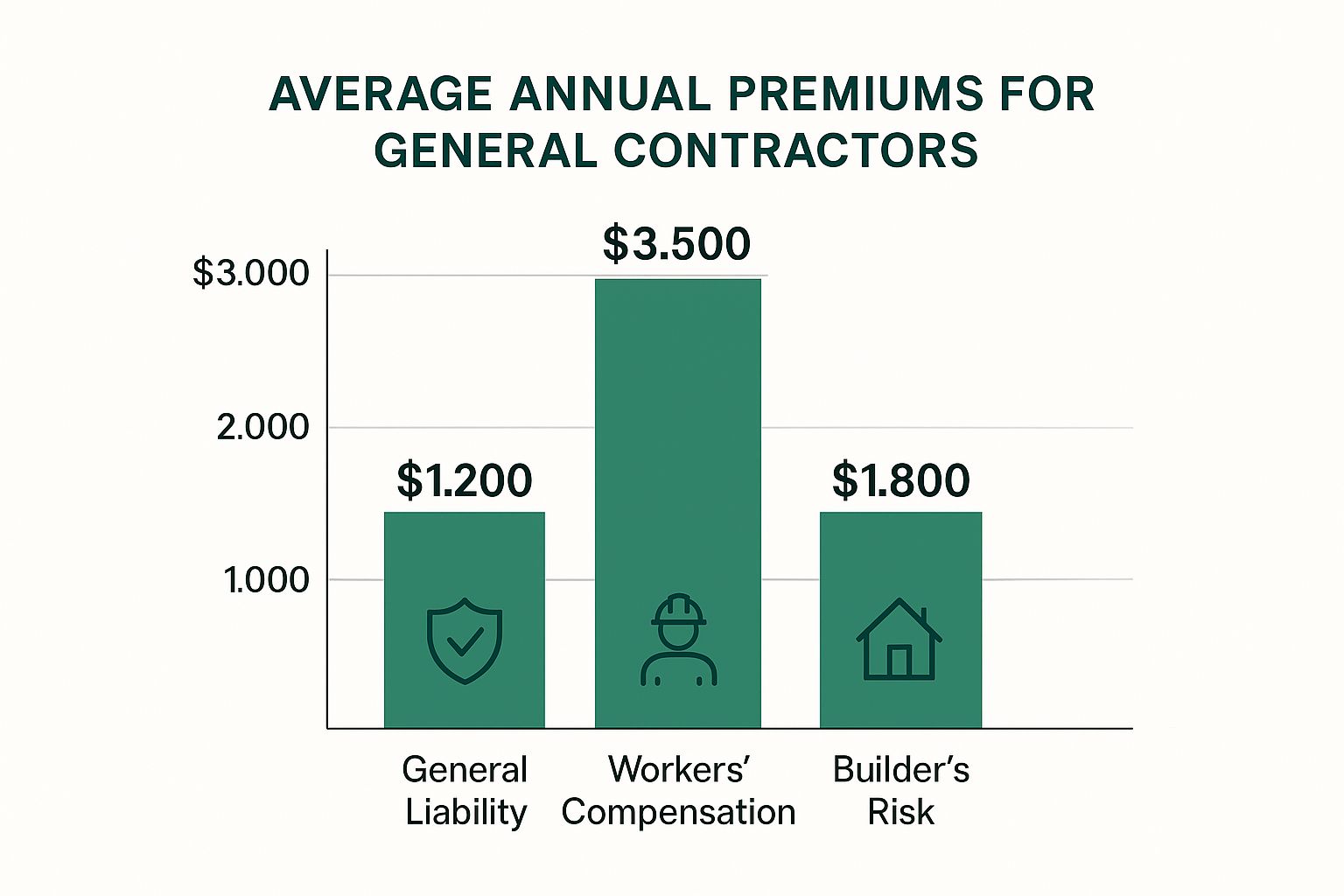

This chart gives you a quick look at what you can generally expect to pay per year for the core coverages.

As you can see, workers' comp is often the biggest piece of the puzzle. It's a powerful reminder that keeping your job sites safe isn't just good practice—it has a direct impact on your bottom line.

How Much Is This Going to Cost Me?

I wish I could give a simple number, but there's no "one-size-fits-all" price for contractor insurance. The cost is entirely specific to your business and what you do.

Think of it like this: your premium is a reflection of your risk. A solo handyman doing small residential jobs will have a much different risk profile—and a much lower premium—than a large firm building commercial high-rises. Your annual revenue, payroll, claims history, and even the state you work in are all major factors. For instance, a small operation might spend a few thousand dollars a year, while a bigger company could easily see costs in the tens or even hundreds of thousands.

The only way to know for sure is to get a quote built around your unique operations.

Do I Still Need Insurance If I Only Use Subs?

Yes, you absolutely do. This is one of the most common—and riskiest—misconceptions in the industry. Even if you hire out every bit of the physical work, you are still the one in charge. In the eyes of your client and the law, the buck stops with you.

Your general liability policy is your first line of defense. It's what protects your business if one of your subcontractors makes a costly mistake or if someone gets hurt on the site.

Don't just get your own policy; make it a non-negotiable rule to get proof of insurance from every single subcontractor you bring on a job. You need to collect their Certificate of Insurance (COI) and make sure they have their own solid general liability and workers' comp coverage.

Doing this pushes the risk down to the responsible party. It's a simple step that protects your company and keeps your own insurance record clean from claims that had nothing to do with you.

What Exactly Is an "Additional Insured Endorsement"?

An additional insured endorsement is a small change to your general liability policy that has a huge impact. It officially extends your insurance coverage to protect another party—usually the project owner or the general contractor who hired you.

Clients require this because it protects them from lawsuits that arise from your work. Imagine your crew accidentally damages the property next door. The owner of that property isn't just going to sue you; they'll likely sue your client as well.

If your client is listed as an additional insured on your policy, your insurance company has a duty to step in and defend them. It’s a standard clause in almost every construction contract and a fundamental way risk is managed on projects. This becomes even more critical on specialized jobs, where you might need to understand the nuances of high-value home insurance for a luxury build.

What’s the Difference Between Being Bonded and Insured?

This one trips a lot of people up, but it's a critical distinction. While both are often required for a job, insurance and bonds do completely different things.

- Insurance: This is a contract between you and an insurance company. Its purpose is to protect your business from financial ruin after an accident or mistake. If there's a covered claim, the insurance company pays for the damages.

- Surety Bonds: This is a three-way guarantee between you (the principal), your client (the obligee), and a surety company. Its purpose is to protect your client by guaranteeing you'll do what you promised.

A Performance Bond guarantees you'll finish the job, while a Payment Bond guarantees you'll pay your suppliers and subs. If you fail on either front, the surety company steps in to pay your client. But here's the key difference: you then have to pay the surety company back, every single penny.

Put simply: insurance protects you, and a bond protects your client.

Getting a handle on general contractor insurance requirements is a must for any successful construction business. At Wexford Insurance Solutions, our experts specialize in creating insurance plans that shield you from risk and make sure you're covered for every legal and contractual need. Get in touch today to build a smarter safety net for your business.

Understanding Personal Liability Insurance Cost: Limit Surprises

Understanding Personal Liability Insurance Cost: Limit Surprises What Is a Business Owners Policy? Your Complete Guide

What Is a Business Owners Policy? Your Complete Guide