A Business Owners Policy, or BOP as it's commonly known, is a smart insurance package designed specifically with small and medium-sized businesses in mind. Think of it as a starter pack for business protection. It bundles three of the most crucial coverages—general liability, commercial property, and business income—into a single, more manageable, and often more affordable policy.

What Exactly Is a Business Owners Policy?

Let's use an analogy. Imagine you're setting up a home entertainment system. You could buy the TV, the soundbar, and the streaming stick all separately. That means three different boxes, three sets of instructions, and probably a higher total cost. A BOP is the business insurance equivalent of the "home theater in a box"—it bundles the core protections you absolutely need into one convenient and cost-effective solution.

This bundled approach isn't a new gimmick; it was created to save small business owners from the headache and expense of juggling multiple, complex policies. The idea was simple: combine property and liability coverage to save entrepreneurs time and money. It’s a concept that has proven its value over time. In fact, commercial insurance lines, including BOPs, now make up nearly half of all property and casualty premiums in the U.S., a testament to their importance which you can read more about from the Insurance Information Institute.

The 3 Pillars of a Business Owners Policy

So, what's actually inside a BOP? A standard policy is built on a foundation of three distinct types of insurance. Each one acts as a shield, protecting your business from a different category of common financial risk.

A BOP is a fantastic foundational policy for most small to medium-sized businesses that don't operate in high-risk industries. Think small offices, local retail shops, and neighborhood restaurants—they are all prime candidates for a BOP.

To really understand what is in a business owners policy, let's break down the three fundamental coverages that form its core.

Core Components of a Business Owners Policy

This table summarizes the three essential protections that come standard in a BOP.

| Coverage Type | What It Protects |

|---|---|

| General Liability Insurance | This covers your business if someone else—like a customer or vendor—claims you caused them bodily injury or damaged their property. It also covers advertising-related injuries. |

| Commercial Property Insurance | This protects the physical things you own for your business. We're talking about your building, equipment, inventory, and even furniture from disasters like fire, storms, or theft. |

| Business Income Insurance | This is a lifesaver. If a covered disaster (like a fire) forces you to shut down temporarily, this helps replace the income you lose and covers ongoing expenses like rent and payroll. |

These three coverages work together to provide a solid safety net, allowing you to focus on running your business with greater peace of mind.

The Three Pillars of a BOP

So, what’s actually inside a Business Owner's Policy? Think of it as a sturdy, three-legged stool. Each leg represents a core type of insurance, and together they create a stable, comprehensive platform of protection for your company. Getting to know these three components is the key to understanding how a BOP shields your business from some of the most common financial threats you might face.

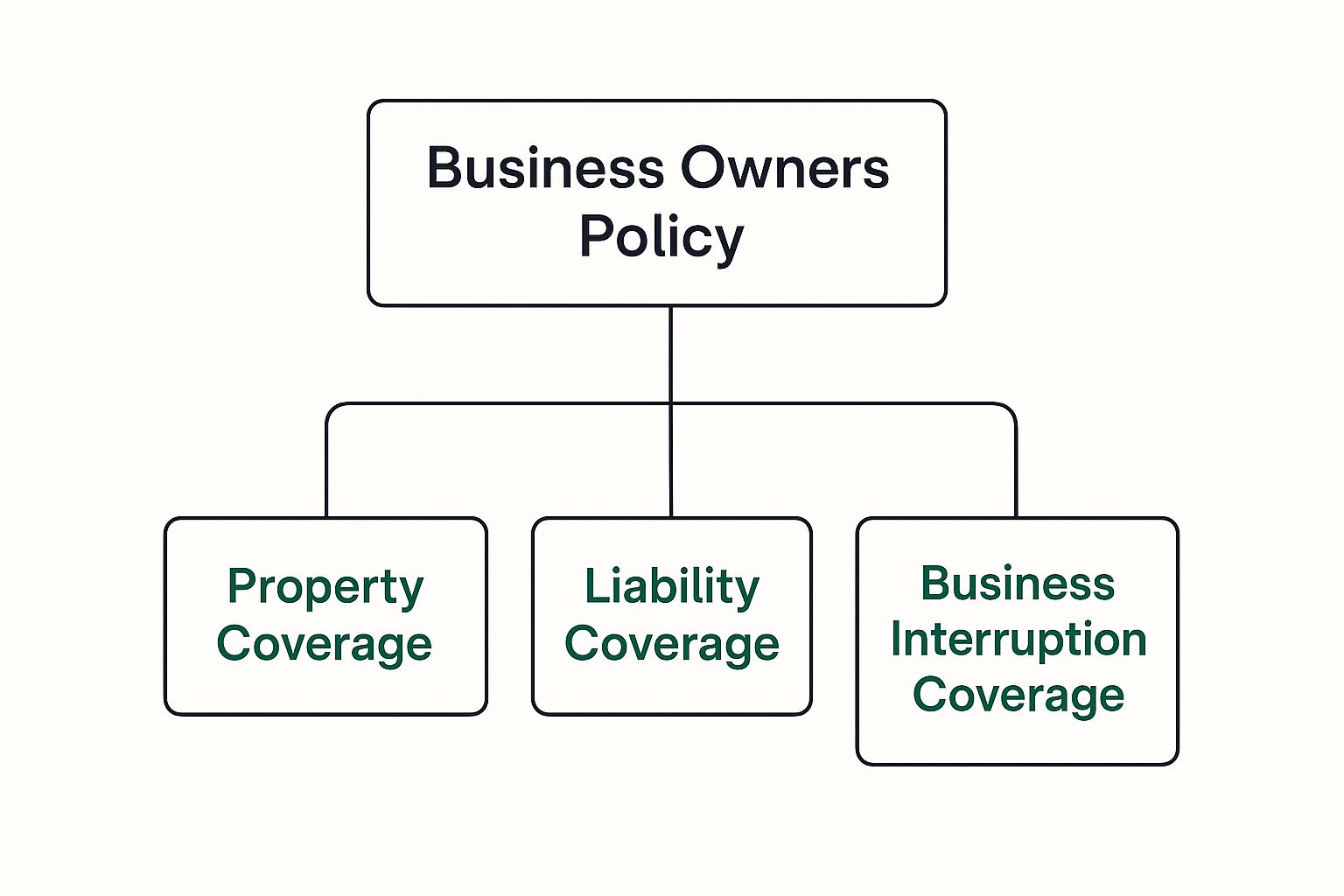

This diagram breaks down how these three essential coverages come together under one policy.

As you can see, the foundation of any BOP rests on General Liability, Commercial Property, and Business Income insurance. Let's look at what each one does.

General Liability Insurance

First up is General Liability Insurance, which is probably the one you've heard of most. This is your business’s shield against claims from the public. It’s designed to protect you if your business is blamed for causing bodily injury to someone (like a customer or a vendor) or for damaging their property.

For instance, imagine a client trips over a loose cord in your office and breaks their wrist. Your general liability coverage would be what steps in to handle their medical bills and your legal defense costs if they sue. For any business that has customers, clients, or vendors on its premises, this coverage isn't just nice to have—it's essential.

Commercial Property Insurance

The second leg of the stool is Commercial Property Insurance. This part protects all the physical stuff you need to run your business. We're not just talking about the building you work in; this covers your tools, inventory, computers, equipment, and even the desks and chairs.

Let’s say a pipe bursts overnight and floods your retail shop, ruining thousands of dollars in inventory and damaging your point-of-sale system. Commercial property insurance is what would help you pay to replace that lost stock and equipment, protecting the tangible assets you rely on every single day from disasters like fires, theft, or storms.

A Business Owners Policy is an excellent starting point for smaller businesses. Its pre-packaged nature provides a solid foundation, but it’s crucial to remember that its "one-size-fits-most" approach might not cover unique or high-level risks.

Business Income Insurance

The third and final pillar is Business Income Insurance, which you might also hear called business interruption coverage. This piece is a true financial lifesaver. If a covered disaster, like that burst pipe we just mentioned, forces you to shut down temporarily, this coverage helps replace the income you're losing.

It’s designed to help you keep paying the bills even when there’s no money coming in. It can cover ongoing expenses like:

- Employee Payroll: So you don't lose your trusted team while you're closed for repairs.

- Rent or Mortgage: To keep your physical location secured.

- Taxes and Loan Payments: Helping you stay on top of your financial commitments.

Basically, business income insurance gives you the breathing room you need to recover and reopen without digging yourself into a financial hole. When you put these three coverages together, you get the powerful, cost-effective safety net that makes a BOP such a smart choice for small business owners.

Is Your Small Business Eligible for a BOP?

While a Business Owners Policy is a fantastic tool for many, it’s not a one-size-fits-all solution. Think of it like a pre-packaged combo meal at your favorite restaurant—it’s convenient and covers the basics perfectly for most, but it won't suit someone with highly specific dietary needs.

Insurance carriers designed the BOP with a particular customer in mind: the small to medium-sized business with a relatively low-risk profile. They look at your specific situation to see if you fit the mold, weighing factors like your industry, the size of your physical workspace, and your yearly revenue. This is how they figure out your overall risk.

After all, a local coffee shop just doesn't face the same kinds of risks as a large construction company. That's why their insurance policies look so different. If your business fits neatly into that low-risk category, a BOP is often the most efficient and cost-effective way to get the protection you need.

Common Eligibility Guidelines

So, how do you know if you qualify? While the exact rules can differ a bit from one insurance provider to the next, the core criteria are pretty standard across the board. Your business is probably a great candidate for a BOP if it checks most of these boxes:

- Fewer Than 100 Employees: BOPs are built for businesses with a smaller, more manageable workforce.

- Less Than $1 Million to $5 Million in Annual Revenue: This financial benchmark is a common indicator of the business size BOPs are designed to protect.

- A Small Physical Location: Insurers typically look for businesses operating from a smaller office or storefront, often with a limit around 25,000 to 30,000 square feet.

- Operates in a Low-Risk Industry: Main street businesses like retail stores, professional offices, and small restaurants are a perfect fit. Companies in high-risk fields, like construction or nightlife, will need more specialized policies.

A Business Owners Policy is designed for convenience and efficiency. It bundles the essentials, but it's important to recognize that this structure is what creates the eligibility requirements.

Your risk profile is really the bottom line. If your business model requires exceptionally high liability limits because of the products you sell or services you offer, you’ll likely need to look beyond a standard BOP. The same goes for businesses that use a fleet of vehicles or work with hazardous materials.

And if a disaster ever does strike, forcing you to close temporarily, you’ll be glad you had a recovery strategy in place. Our guide to business continuity insurance can walk you through how to prepare for the unexpected.

The Key Advantages of a Business Owners Policy

So, why do so many small business owners lean on a Business Owners Policy? It really comes down to two big wins: serious cost savings and refreshingly simple management. A BOP isn't just another insurance policy; it's a smart financial move that makes your business more resilient.

Insurers are able to offer a lower price because they’re bundling core coverages like general liability and commercial property into a single package. Think of it like getting a combo deal at your favorite lunch spot instead of buying the sandwich, fries, and drink separately—the bundle almost always costs less. That's real money you can put right back into growing your company.

Simplified Policy Management

Beyond the bottom-line savings, a BOP cuts down on the administrative headache of managing your insurance. Instead of juggling a stack of different policies from different carriers, you've got just one.

This consolidated approach really simplifies things:

- You have one premium payment to keep track of.

- There's only one renewal date to mark on your calendar.

- You have one go-to contact when you have a question or need to file a claim.

This convenience is a huge part of its appeal. In fact, the BOP market was recently valued at USD 155.47 billion, and it's growing fast as more entrepreneurs catch on to the benefits. Projections show that growth isn't slowing down, which tells you just how many business owners depend on this model. You can find more details about the Business Owners Policy market on ResearchandMarkets.com.

By combining essential protections into one package, a BOP cuts down your costs and the time you spend on insurance paperwork. This lets you focus on what you do best: running your business.

This bundling concept isn't unique to business, either. It’s just as important for protecting your personal assets. If you have a high-value home and belongings, check out our guide on protecting your assets with high-value home insurance to see how a similar strategy can work for you.

When all is said and done, a BOP is a practical and efficient choice for any eligible business.

How BOP Costs Are Calculated and Customized

So, after figuring out what a Business Owners Policy is, the next logical question is always: "What's this going to cost me?" There's no single, off-the-shelf price for a BOP. Instead, your premium is calculated based on your business's unique risk profile. It's a bit like getting a quote for a custom suit—the final price depends on the fabric, the cut, and the specific measurements.

Insurers look at a handful of key factors to come up with your premium. Your industry is a big one. A small graphic design studio simply doesn't face the same day-to-day risks as a busy neighborhood restaurant with hot grills and heavy foot traffic. Where your business is located also plays a huge role, as being in an area prone to theft or severe weather can nudge your costs up.

Finally, they’ll consider the value of your business property, including your building and everything inside it, along with your company's past claims history. Your choices matter, too. Selecting higher coverage limits will increase the cost, while opting for a higher deductible can often bring it down.

Factors That Determine Your BOP Premium

Insurers use a specific set of variables to calculate your premium. This table breaks down the most common factors and explains why each one matters from their perspective.

| Cost Factor | Why It Matters to Insurers |

|---|---|

| Industry | Some industries (like construction or food service) have inherently higher risks than others (like consulting). |

| Location | The risk of theft, vandalism, or natural disasters like hurricanes varies significantly by geographic area. |

| Property Value | The more your building and its contents are worth, the more the insurer stands to pay out in a claim. |

| Claims History | A history of frequent claims suggests a higher likelihood of future claims, leading to higher premiums. |

| Coverage Limits | Higher limits for liability and property coverage mean more potential payout, which increases the policy cost. |

| Deductible | A higher deductible means you pay more out-of-pocket on a claim, which lowers the insurer's risk and your premium. |

Understanding these elements helps you see your business through an underwriter's eyes and gives you a clearer picture of your final insurance costs.

Making the Policy Your Own with Endorsements

A standard BOP provides a fantastic foundation, but it’s not meant to be a one-size-fits-all solution. You can fine-tune it with endorsements, which are optional coverages you can add to your policy to address risks that are specific to your operations.

Think of endorsements like adding special features to a car. The base model works perfectly well, but you might want to add all-wheel drive for snowy winters or a tow package for hauling equipment. Endorsements do the same thing for your insurance policy.

For instance, if your business handles sensitive customer data, adding data breach coverage is practically a necessity. If you offer professional advice, a professional liability endorsement (often called Errors & Omissions or E&O) can be tacked on to protect you from claims of negligence. Getting a handle on the cost of specific coverages is also key; you can learn more by reading about business interruption insurance cost in our detailed guide.

The BOP market is a cornerstone of commercial insurance, with certain segments valued at over USD 3.1 billion. This massive figure underscores how vital these policies are for small and mid-sized businesses. By getting a firm grasp on the cost factors and customization options available, you can build a policy that truly protects your business without breaking the bank.

Common Gaps in a BOP Policy

A Business Owner's Policy is an incredible starting point for most small businesses, but it's important to know what it doesn't cover. I like to think of a BOP as the foundation and frame of a house—it’s absolutely essential, but you still need to add the specialized systems like plumbing, electrical, and security.

In the same way, a BOP has certain risks that are intentionally excluded because they are so specific they require their own, dedicated insurance policy. Knowing these gaps ahead of time is critical to making sure you're not left exposed when you thought you were protected.

What's Usually Not Included

A standard BOP just wasn't built to handle every single risk out there. For more specialized or high-exposure situations, you’ll need to layer on other policies. Here are the most common things a BOP won't cover:

- Employee Injuries: If an employee gets hurt on the job, that falls under Workers' Compensation insurance. This is a separate policy that's legally required in almost every state as soon as you hire your first employee.

- Professional Mistakes: Do you give advice or provide a professional service? A BOP won't protect you if a client sues you for negligence or a costly error. For that, you need Professional Liability insurance, often called Errors & Omissions (E&O).

- Commercial Auto Accidents: Any vehicle used for your business—whether it's a delivery van or a car for sales calls—needs its own commercial auto policy. Your personal car insurance won't cover it.

- Major Natural Disasters: Most standard property insurance, including the kind in a BOP, specifically excludes damage from floods and earthquakes. You'll need to purchase separate, dedicated coverage for those kinds of events.

A BOP is designed to handle the risks that are common to nearly all small businesses. For anything more unique, regulated, or severe, you have to build out your coverage with specialized policies to create a complete safety net.

These exclusions aren't a flaw in the policy; they simply reflect that some risks are too complex for a one-size-fits-all approach. For example, the decisions made by a company’s leadership team carry their own unique liabilities, which is why many owners also look into adding management liability coverage to fill that specific gap.

Your Top BOP Questions, Answered

Alright, let's wrap this up by tackling some of the most common questions I hear from business owners trying to figure out if a BOP is the right move for them. Getting these straight can help you make a decision with confidence.

How Do I Know If I Need a BOP?

Think of it this way: if your business is on the smaller side, works in a lower-risk field, and you know you need coverage for both property and liability, a BOP is almost always your most streamlined and cost-effective bet.

But if you're running a high-risk operation, say a large construction company, or you need exceptionally high coverage limits for your assets, you’ll likely need to build a custom insurance plan from individual policies instead. A BOP just won't cut it.

Can I Add More Coverage to My BOP?

Yes, and you absolutely should as your business evolves. That's one of the best things about a BOP—it's not set in stone. You can bolt on extra protections called endorsements to cover specific risks that pop up.

For instance, standard policies don't cover everything. With digital threats on the rise, looking into options like cyber security insurance for small business is a crucial step for almost everyone these days. A yearly check-in on your policy is a great habit to get into, just to make sure your coverage is keeping up with your growth.

Key Takeaway: A BOP is a starting point, not a final destination. Regularly review and adjust your policy with endorsements to match your business's evolving risk profile.

Is a Business Owners Policy Legally Required?

In most cases, no—there isn't a state or federal law that mandates a BOP. However, your contracts often will. For example, your landlord will almost certainly require you to have general liability and property insurance before you can sign a lease for a commercial space. A BOP handily checks both of those boxes.

Figuring out business insurance can feel like a puzzle, but you don't have to solve it alone. The experts at Wexford Insurance Solutions can help you find the right coverage for your unique needs, making sure you're properly protected without spending more than you have to. Visit https://www.wexfordis.com to get a clear, competitive quote today.

Understanding General Contractor Insurance Requirements You Need to Know

Understanding General Contractor Insurance Requirements You Need to Know Decoding Business Auto Insurance Cost

Decoding Business Auto Insurance Cost