When you start looking into business auto insurance, the first question on your mind is probably, "What's this going to cost me?" It's a fair question, but the answer isn't a simple one-size-fits-all number.

On average, you can expect to pay anywhere from $1,200 to $2,400 per year for each standard car, van, or light truck in your fleet. But that's just a starting point. For businesses with higher-risk vehicles, like heavy-duty trucks, premiums can easily climb past $15,000 annually. This huge range just goes to show how much prices can fluctuate based on your specific situation.

What Does Business Auto Insurance Really Cost?

Figuring out the exact cost of your business auto insurance isn't like picking an item off a menu. Think of it more like a custom-built machine. The final price tag—your premium—is assembled piece by piece, based entirely on the level of risk an insurer takes on to cover your unique operations.

This cost isn't set in stone, either. It’s tied to a market that’s always in motion. We've seen some pretty significant rate hikes in recent years, largely because claims are becoming more frequent and a lot more expensive to settle. To give you an idea, rates jumped by around 9% to 9.8% in just the first half of a recent year alone as insurers struggled with underwriting losses.

Understanding the Cost Tiers

To get a clearer picture of where your business might land on the pricing spectrum, it helps to break things down into tiers. After all, a solo accountant who occasionally drives their sedan to meet a client is a world away from a construction company operating a fleet of dump trucks. The risks just don't compare.

The table below gives you a snapshot of potential annual costs per vehicle. Use it as a starting point to see which profile sounds most like your business and to understand what pushes costs from one tier to the next.

Estimated Annual Business Auto Insurance Cost Per Vehicle

This table provides a snapshot of potential annual insurance costs per vehicle, highlighting the factors that place a business in different cost brackets.

| Cost Tier | Estimated Annual Premium | Common Business Profile |

|---|---|---|

| Low | $900 – $1,800 | A real estate agent or a consultant using their personal-style vehicle for work errands. They have a clean driving record and don't rack up a lot of miles. |

| Medium | $1,800 – $3,500 | A local catering company or florist with a small fleet of vans. They operate within a specific area and transport goods, but not hazardous materials. |

| High | $4,000 – $8,000 | An electrician or plumber with a customized work van. It’s loaded with expensive tools and equipment, and they cover a wider service territory. |

| Very High | $9,000 – $20,000+ | A construction business or a long-haul trucking company. They use heavy vehicles like dump trucks or semis and often transport heavy or hazardous materials across long distances. |

As you can see, the specific vehicle is just one part of the equation. What really shapes your premium is the entire story behind its use.

Key Takeaway: Your premium isn't just about the vehicle itself. It's about the whole picture: what it is, where it’s going, what it’s carrying, and who is behind the wheel.

It's also worth remembering that business auto insurance is rarely a standalone policy. For most small businesses, it’s one component of a broader commercial insurance strategy. Many owners find it makes sense to bundle this coverage with other essential protections. To see how this can work for you, check out our guide on what is a business owner's policy.

The Hidden Factors Driving Your Premium

Ever look at your business auto insurance premium and wonder where that number actually comes from? It’s not just pulled out of a hat. Insurers are essentially professional risk assessors, and your final price is the result of a very detailed calculation.

Think of it like building a risk profile for your business. Every piece of information you provide helps the insurer piece together a puzzle. They're trying to predict two things: the likelihood of an accident and the potential cost if one happens. Let's pull back the curtain on the key factors they scrutinize.

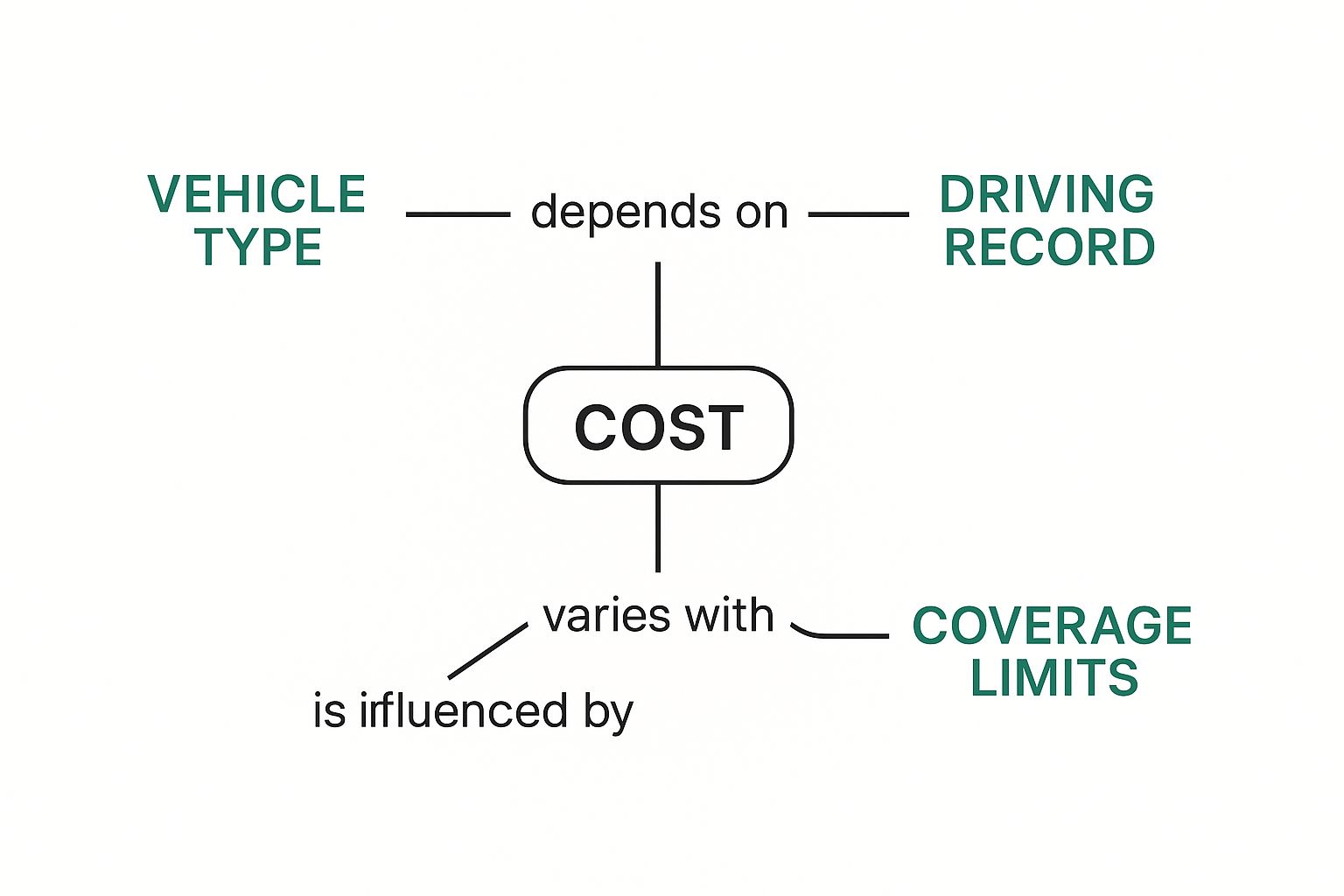

This infographic breaks down the core elements that have the biggest impact on what you'll pay.

As you can see, the vehicles you use, the people who drive them, and the coverage you select are all intertwined. These are the big three, but the real story is in the details of each.

The Vehicle Itself

It probably comes as no surprise that the type of vehicle you need to insure is a huge piece of the puzzle. A heavy-duty dump truck simply has the potential to cause a lot more damage than a small sedan used for sales calls. Logically, it costs more to insure.

Insurers dig into a few specific details about your vehicles:

- Weight and Size: Heavier and larger vehicles almost always mean higher premiums. Their sheer mass increases the potential for serious damage and injury in a collision.

- Use and Customization: Is it a simple passenger van, or a work truck loaded with expensive, permanently installed equipment like ladder racks or tool chests? The more specialized and valuable the vehicle, the more it will cost to repair or replace—and to insure.

- Cargo: What you're hauling is just as important as what you're driving. Transporting office supplies is a much lower risk than hauling hazardous materials or heavy construction equipment.

The Driver Behind The Wheel

A vehicle is only as safe as the person driving it. That's why insurers put so much weight on the driving records of every single person who gets behind the wheel of your company cars. A team of drivers with clean records is your best asset for keeping costs down.

An employee with a history of accidents or a string of speeding tickets is a massive red flag to an underwriter. To them, it's not a question of if that person will have another accident, but when.

This is precisely why so many smart businesses have strict hiring standards for drivers and invest in ongoing safety training. It’s a direct investment in lower, more stable insurance premiums over the long haul.

Where and How You Drive

The environment your vehicles operate in plays a surprisingly large role in your rates. A catering business that makes local deliveries in a quiet suburb faces a completely different set of risks than a courier service navigating the chaos of a dense city center all day.

Insurers pay close attention to your radius of operation—basically, how far your vehicles typically travel from your home base. A wider radius usually means more miles on the road, more exposure to different traffic patterns, and a higher chance of being in an accident. That increased exposure directly translates to what you'll pay for business auto insurance.

While a vehicle accident is a major disruption, it’s not the only thing that can halt your operations. To learn more about protecting your revenue from other unexpected shutdowns, you might find our guide on business interruption insurance cost helpful.

Your Chosen Coverage Limits

Finally, the amount of coverage you buy has a direct, dollar-for-dollar impact on your premium. It can be tempting to choose the lowest possible limits to save a few bucks, but this is a classic case of being penny-wise and pound-foolish. Commercial auto policies need much higher liability limits than your personal car insurance—often starting at $1 million.

That $1 million figure isn't just for show. Accidents involving commercial vehicles can lead to catastrophic claims that involve massive property damage, extensive medical bills, and drawn-out lawsuits. Higher limits create a vital financial firewall, protecting your business assets from being wiped out by a single bad day on the road. The more protection you purchase, the more the policy will cost, but the peace of mind is often worth every penny.

How Your Industry Shapes Your Insurance Bill

When an insurer puts together your quote for business auto insurance, they're looking at more than just the vehicle itself. They're looking at the world your vehicle operates in—your industry. A construction company's pickup truck and a real estate agent's sedan present two completely different risk profiles, even if they happen to be the exact same make and model. This industry context is a massive driver of your final premium.

It’s all about the nature of the work. A florist’s delivery van, for instance, typically makes short, predictable trips carrying lightweight flower arrangements. Now, compare that to a contractor's truck. It's often loaded with heavy equipment, expensive tools, and raw materials, heading to chaotic job sites through rough terrain or congested city streets. The odds of a serious, costly accident are just fundamentally higher for the contractor, and their insurance rate will reflect that reality.

High-Risk Versus Low-Risk Industries

Insurers don't guess; they use a mountain of data to group industries by risk. This isn't a personal judgment on how you run your company—it's a statistical reality based on the claims history of thousands of businesses that operate just like yours. This is a key reason why simply relying on a personal policy is a non-starter for business use. You can get a full breakdown in our guide comparing commercial vs. personal auto insurance.

Here’s a general look at how insurers see different sectors:

- Higher-Risk Industries: Think construction, long-haul trucking, passenger transport (like taxis and shuttles), and any business that moves hazardous materials. These fields are defined by heavy vehicles, long hours behind the wheel, and high-value or dangerous cargo—all factors that increase the potential for a major claim.

- Lower-Risk Industries: This bucket usually includes businesses in sales, consulting, real estate, and other professional services. Their vehicle use is often limited to standard passenger cars making occasional trips to client meetings, without hauling anything specialized or risky.

Key Insight: Your premium isn't just about your personal driving record. It’s heavily influenced by the collective claims history of your entire industry. You’re being rated as part of a group that shares similar operational risks.

The Impact of What You Haul

What's inside your vehicle is just as critical as where it's going. Carrying a box of marketing flyers is one thing. But if you're transporting flammable chemicals, expensive tools, or heavy machinery, the potential financial fallout from an accident skyrockets.

This is why your insurance application gets so specific about cargo. The insurer needs to know exactly what they're covering in a worst-case scenario. This focus on risk is part of a wider industry trend. According to a Deloitte analysis of global insurance markets, commercial insurance premiums recently climbed by an average of 3.9% in real terms as carriers adjust to rising claim costs.

At the end of the day, your industry sets the baseline for your business auto insurance cost. You can’t change the business you're in, but knowing how insurers view it helps make sense of your premium. More importantly, it underscores just how critical it is to manage the risks you can control, like hiring safe drivers and keeping your vehicles in top shape.

Real-World Costs From Businesses Like Yours

It’s one thing to talk about risk factors and coverage limits in theory. But what does business auto insurance actually cost for businesses on the ground? Seeing how these pieces fit together for real companies makes the abstract numbers much more concrete.

Let's step away from the hypotheticals and look at a few common business scenarios. By exploring these profiles, you can get a much clearer picture of what your own premiums might look like. See if one of these stories sounds a lot like your own operation—it’s a great way to ballpark your potential costs.

H3: The Solo Electrician

Imagine Alex, a self-employed electrician. He operates out of a single, well-maintained cargo van that he uses to get to job sites, mostly within a 50-mile radius of his home. His van isn't just a vehicle; it's a mobile workshop, customized with permanent shelving and carrying roughly $10,000 worth of tools and supplies.

- Key Factors: Alex has a squeaky-clean driving record, which is a huge plus. However, the van's custom build-out and the valuable equipment inside increase its replacement cost. Driving to various construction sites, which can be chaotic environments, also adds a bit of risk.

- Coverage: He needs a $1 million liability limit to satisfy the requirements of the general contractors he works with. He also wisely includes comprehensive, collision, and specific coverage for his permanently installed equipment.

- Estimated Annual Premium: For a profile like Alex's, a typical business auto policy would likely cost somewhere between $3,800 and $5,500 per year.

H3: The Small Catering Company

Now let's look at a small catering business, "Creative Catering," run by Maria. Her company depends on a fleet of three vehicles: two standard cargo vans for delivering food and a passenger car for her sales manager to meet with clients. Most of her drivers have great records, but one had a minor at-fault accident about two years ago.

The company's operations are local, staying within a 25-mile radius, but the vans are equipped with specialized refrigeration units.

Why This Matters: Even one minor accident from a couple of years back can bump up the premium for the entire fleet. Insurers view past incidents as a sign of potential future risk, and that risk gets factored into the price for every vehicle on the policy, not just the one involved in the accident.

- Key Factors: The main cost drivers here are the number of vehicles, that one past accident on their record, and the specialized refrigeration equipment.

- Coverage: Like Alex, Maria goes with a $1 million liability limit. She also adds non-owned auto coverage, a smart move for any business where an employee might occasionally use their personal car for a work-related errand.

- Estimated Annual Premium: The total annual cost to insure all three vehicles would probably fall in the $7,500 to $11,000 range.

H3: The Regional Delivery Service

Finally, think about a regional delivery service that runs a fleet of ten light-duty box trucks. These vehicles are on the road six days a week, covering a 150-mile radius and spending a lot of time on major highways. The company has a formal driver safety program, which is a major point in its favor.

- Key Factors: The sheer size of the fleet, the high mileage, and the constant highway driving are significant risk factors. That said, their documented safety program is a powerful negotiating tool that helps bring the cost down.

- Coverage: Given the nature of their business, they absolutely need a $1 million liability policy. They also carry cargo insurance to protect the value of the goods they're transporting for clients.

- Estimated Annual Premium: For a fleet of this scale, the total business auto insurance cost could easily be between $45,000 and $70,000 a year.

Business Auto Insurance Cost Scenarios

To put it all together, let’s compare these businesses side-by-side. The table below shows how different risk profiles and vehicle needs lead to vastly different insurance costs.

| Business Type | Number of Vehicles | Primary Risk Factors | Estimated Annual Premium |

|---|---|---|---|

| Solo Electrician | 1 Cargo Van | Valuable equipment, job site travel, vehicle customization | $3,800 – $5,500 |

| Small Catering Co. | 3 (2 Vans, 1 Car) | Multiple drivers, prior minor accident, refrigerated equipment | $7,500 – $11,000 |

| Regional Delivery | 10 Box Trucks | Large fleet size, high annual mileage, highway driving | $45,000 – $70,000 |

As you can see, there's no single price tag for business auto insurance. The final cost is a direct reflection of your specific operational risks, from the number of vehicles on the road to the miles they travel each day.

Smart Strategies to Lower Your Insurance Costs

Knowing what drives your business auto insurance cost is one thing, but actively lowering it is where the real savings happen. The good news? You have more control over your premiums than you might think. By being proactive and smart, you can show insurers that your business is a lower risk, which almost always leads to better rates.

Think of it as a three-part strategy: managing your drivers, maintaining your fleet, and making savvy choices with your policy. Each step sends a powerful message to your insurance provider that you're serious about safety and responsibility. Let’s get into the practical tactics you can use right away.

Master Your Driver Management

Your drivers are your biggest asset, but from an insurance company's point of view, they're also your biggest variable. A solid driver safety program isn't just about checking a box for compliance; it's one of the most effective ways to cut your long-term insurance expenses. In fact, a formal program can slash accident rates by up to 15%, and that's a number that gets an underwriter's attention.

Here's what a strong driver safety program looks like in the real world:

- Set Strict Hiring Standards: This is non-negotiable. Always run Motor Vehicle Reports (MVRs) on every potential hire and have firm, clear rules about what makes for an acceptable driving record.

- Implement Ongoing Training: Don't just train new hires. Regular refreshers on defensive driving, navigating bad weather, and the real dangers of distracted driving help build a true culture of safety.

- Enforce a Zero-Tolerance Policy on Distracted Driving: Create a strict, written policy against using phones or other devices behind the wheel. This one rule can have a massive impact on your accident risk.

The Power of Proof: When you can hand an insurer a file showing documented driver training and a history of clean MVRs for your team, you aren't just telling them you're a safe company—you're proving it with cold, hard data.

Optimize Your Fleet and Operations

How you take care of your vehicles is just as important as who's driving them. An insurance company looks at a well-maintained fleet and sees a well-run, lower-risk business. This goes way beyond just keeping the trucks clean; it’s about operational discipline.

This is a perfect place to use technology to your advantage. Telematics devices, for example, monitor driving habits like hard braking, sharp acceleration, and speeding. They provide undeniable proof of how safely your fleet is operating. Many insurers offer significant discounts, often between 10% and 30%, for businesses that use this technology well.

On top of that, simply having a documented maintenance schedule shows you're committed to preventing accidents caused by equipment failure. It’s the small details like these that, when added up, build a compelling case for a lower premium.

Make Savvy Policy Choices

Finally, you can directly steer your business auto insurance cost by being strategic with your policy itself. The trick is to strike the right balance between having great protection and keeping it affordable.

One of the most direct ways to do this is to increase your deductible. When you agree to pay more out-of-pocket if a claim happens, your premium goes down. Another smart move is bundling your auto policy with other business insurance, like general liability, which can unlock multi-policy discounts of up to 15%. Just as you manage other operational risks, it is important to understand how different types of coverage protect your assets. For broader protection, you can explore our guide on understanding personal liability insurance cost. Chatting with your agent regularly to review your coverage also ensures you're not paying for protection you don't really need anymore.

Common Questions About Insurance Costs

Even after you get a handle on the main factors, a few specific questions always seem to pop up about business auto insurance costs. Let's walk through some of the most common ones I hear from business owners. Think of this as a quick Q&A session to clear up any lingering confusion so you can feel confident about your policy.

Does My Personal Auto Policy Cover Business Use?

This is a big one, and the answer is almost always no. It's probably the most common (and dangerous) misconception out there. Your personal auto policy contains what’s known as a “business use exclusion.”

What that means in the real world is if you get into an accident while doing anything for work—driving to a client's office, dropping off supplies, or even just heading to a job site—your personal insurer has grounds to deny the claim completely. Relying on it leaves your business wide open to a huge financial hit. You absolutely need a dedicated business auto policy to protect your company's assets.

What Is the Real Difference Between Business and Commercial Auto Insurance?

Honestly, for most small businesses, there isn't much of a practical difference. People use the terms "business auto" and "commercial auto" interchangeably all the time, and that's usually fine.

That said, insurance carriers do see them a bit differently behind the scenes:

- Business Auto Insurance: This is what most people think of. It covers standard vehicles like cars, pickup trucks, and vans that you use for your job.

- Commercial Auto Insurance: This is a wider umbrella. It covers all the same vehicles as a business auto policy, plus the heavy-duty and specialized stuff like dump trucks, semi-trucks, or tow trucks.

Don't get too hung up on the terminology. Your agent will figure out the right policy type based on the vehicles you actually own and use.

How Much Can I Actually Save with a Telematics Program?

The savings are very real. Most businesses that commit to a telematics program see their premiums drop by anywhere from 10% to 30%. It works because it takes the guesswork out of the equation for the insurance company.

Insurers love data that proves you’re a low risk. When you use a telematics device to track and report safe driving habits—like smooth acceleration, avoiding hard braking, and staying within speed limits—you're handing them concrete proof that your fleet is safe. That data gives them a solid reason to lower your business auto insurance cost.

Will a Higher Deductible Always Reduce My Premium?

Yes, a higher deductible will always result in a lower premium. It's a direct trade-off. Your deductible is simply the amount you agree to pay yourself on a claim before the insurance company steps in.

When you take on more of that initial financial risk, you lower the insurer's potential payout. They reward you for that with a cheaper rate. The trick is finding that sweet spot—a deductible high enough to lower your premium but low enough that you could actually afford to pay it without causing a cash-flow crisis if an accident happens. For contractors, getting these details right is especially important, as you can see in our guide to general contractor insurance requirements.

Figuring out the ins and outs of business insurance doesn't have to be something you tackle alone. The experts at Wexford Insurance Solutions are here to give you clear answers and find the right coverage that protects your business without breaking the bank. Get your personalized quote today.

What Is a Business Owners Policy? Your Complete Guide

What Is a Business Owners Policy? Your Complete Guide Auto Rental Business Insurance: Protect Your Fleet Today

Auto Rental Business Insurance: Protect Your Fleet Today