So, what exactly is auto rental business insurance? At its core, it’s a specific type of coverage built to protect your fleet and your business from the one-of-a-kind risks that come with renting vehicles to the public. It’s not the same as the commercial auto policy you might use for your work truck. This is something different.

It’s designed to handle high-stakes situations like a renter’s carelessness, vehicle theft, or accidents involving other people. Ultimately, it’s the key to keeping your business financially sound when the unexpected happens.

Why Your Rental Business Needs Specialized Insurance

Trying to run a car rental business without the right insurance is like walking a tightrope without a net. It’s a huge gamble. Your standard commercial auto policy just wasn't built to handle the unique dangers you face every time you hand a set of keys to a customer. This isn't just about checking a legal box; it's about building a financial fortress around your entire operation.

Think about it for a moment. A personal auto policy covers one person. A commercial auto policy covers your employees driving company cars for work-related tasks. But auto rental business insurance has a much trickier job. It has to cover your liability for the car itself and for whatever the renter—a complete stranger—does with it. That gap is where the real risk lives, and only specialized coverage can properly fill it.

The High Stakes of Inadequate Coverage

If you don't have the right policy, a single accident could be financially devastating. Picture this: one of your renters causes a massive multi-car pile-up. A standard commercial policy would almost certainly deny the claim because the vehicle was part of a rental transaction. That would leave your business on the hook for lawsuits, medical bills, and property damage that could easily soar into the six or even seven figures.

The core function of auto rental business insurance is to transfer this immense, unpredictable risk from your company's balance sheet to an insurance carrier equipped to handle it. It’s the difference between a manageable incident and a business-ending catastrophe.

This specialized coverage is so essential that the global car rental insurance market is expected to jump from $17.5 billion to over $30.2 billion by 2032. This isn't just a random number; it shows a growing understanding across the industry of just how serious the financial risks of renting out vehicles have become.

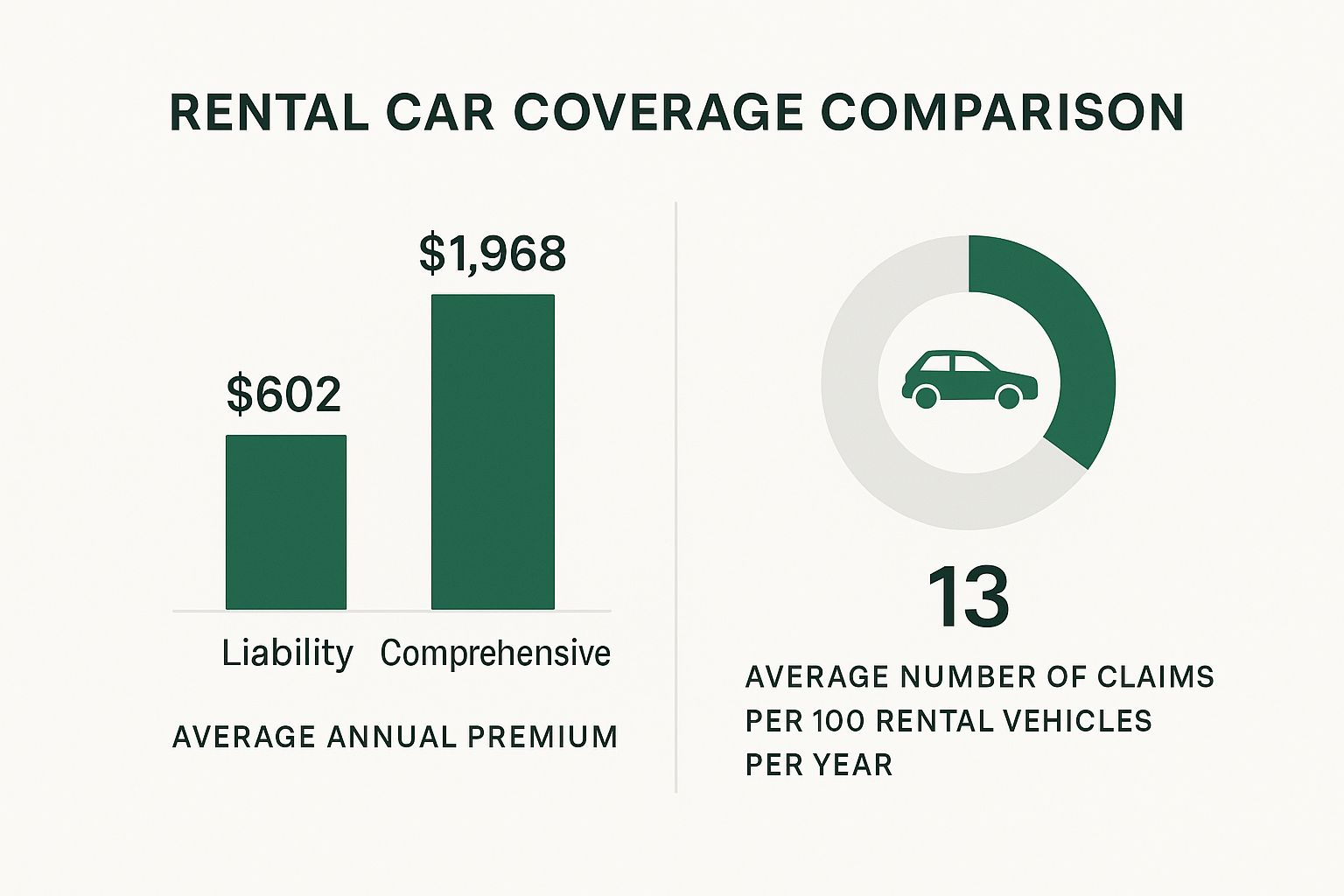

As you can see, the data makes a clear case. While the premiums for proper rental coverage are higher, the sheer volume of claims per vehicle screams just how high-risk this business truly is. Skimping on coverage just isn't worth the risk.

Comparing Your Insurance Options

To really understand why specialized insurance is non-negotiable, it helps to see how the different auto policies stack up against each other. It’s a common misconception that a simple business owner's policy (BOP) is enough. While a BOP is a great foundation for any business, it won't touch the specific auto liability you have. You can learn more about what is a business owner's policy to see how it fits into your overall protection plan, but it's not a substitute.

Let's break down the key differences to make it crystal clear.

Insurance Types at a Glance: Personal vs. Commercial vs. Rental

| Insurance Type | Primary Purpose | Key Limitation for Rental Businesses |

|---|---|---|

| Personal Auto | Covers an individual's private vehicle for non-commercial use. | Excludes any business or for-profit activity, including renting the vehicle out. |

| Commercial Auto | Covers vehicles used by a business's employees for work-related tasks. | Typically excludes coverage when a vehicle is rented to a member of the public (a bailee). |

| Rental Auto | Specifically designed to cover vehicles owned by a business and rented to customers. | The only policy type that properly addresses third-party liability and physical damage during a rental period. |

This simple comparison shows why trying to shoehorn your rental business into a personal or standard commercial policy is a recipe for disaster. Each policy is designed for a specific purpose, and only rental auto insurance is built to handle the realities of your business.

Decoding Your Core Insurance Policies

Trying to understand your auto rental business insurance can feel like learning a new language. The terms are specific, the stakes are incredibly high, and the fine print is everything. Let's break down these essential policies into plain English so you know exactly what you’re buying to protect your fleet and your business's future.

Think of your insurance not as one single thing, but as a bundle of different coverages, each with its own job. They all work together to create a solid safety net. Getting this foundational mix right is the single most important step you can take to build a business that can handle the inevitable bumps in the road.

Liability Insurance: The Financial Shield

Liability coverage is the bedrock of your entire insurance program. It’s a massive financial shield that stands between your business and potentially bankrupting third-party claims. If a renter gets into an accident and injures someone or damages their property, this is the policy that steps up to pay for it.

Without it, you’re on the hook for medical bills, legal fees, and massive settlements. These costs can easily spiral into the hundreds of thousands—or even millions—of dollars. Every state mandates minimum liability limits, but aiming for just the minimum is playing with fire. One serious accident could blow right past those limits, putting your entire business on the line.

Collision and Comprehensive: Your Asset Protection Plan

While liability protects you from claims others make, what about protecting your own cars? That’s where Collision and Comprehensive coverage comes in. This pair is your fleet's dedicated asset protection plan, making sure you can get your vehicles repaired or replaced after something goes wrong.

- Collision Coverage: This pays to fix your rental car if it's damaged in a crash, whether it's with another vehicle, a pole, or a guardrail. It kicks in no matter who was at fault.

- Comprehensive Coverage: This handles damage from just about everything else. Think of it as the "life happens" policy that covers things like theft, vandalism, fire, hailstorms, or a tree limb falling on a parked car.

Together, these two are vital for protecting the value of your most important assets. They keep your operation humming by ensuring a damaged car gets back on the road quickly without you having to drain your cash reserves.

The need for strong coverage is more apparent than ever. With travel booming, rental car damage claims are up. More than 60% of these claims actually come from incidents outside a renter’s direct control, like weather or dings in a parking lot. The average repair bill now hovers around $1,169 per claim, a figure that keeps climbing thanks to inflation and the expensive tech in modern cars.

Contingent Liability: The Critical Safety Net

This is where rental insurance gets a little more specialized. Contingent Liability is a crucial backup plan that kicks in when a renter’s own insurance coverage falls through. You'll have renters who decline your insurance, insisting they’re covered by their personal auto policy or a credit card benefit.

But what if their policy has expired? Or their limits are too low for the damage caused? Or their insurance company denies the claim? This is precisely when Contingent Liability activates, filling that dangerous gap and protecting your business from being left exposed. It's a secondary layer of defense, and frankly, it’s non-negotiable.

It’s also important to recognize that these coverages are unique to the rental industry. The policy you need for a fleet of rental cars is fundamentally different from a standard business auto policy. If you want to dig into the details, you can learn more about commercial vs. personal auto insurance right here. Getting this distinction right is key to being properly protected.

Navigating State Laws and Legal Requirements

Getting the right auto rental business insurance isn't just a smart business move; it’s a legal necessity. When you run a rental company, you're not just dealing with customers and cars—you're navigating a maze of state-specific laws. Ignoring them isn't just risky; it's a surefire way to face crippling fines and legal challenges that could easily put you out of business.

Think of state laws as the ground floor of your entire operation. You can't build anything without it. Every state sets its own minimum liability limits, which is the absolute least amount of coverage you must carry for accidents your renters cause. It's easy to look at that number and think, "Great, that's all I need." But that's a dangerous game. One bad accident can blow past those minimums in a heartbeat, leaving your business on the hook for the difference.

Understanding Your Liability Exposure

The legal world for rental companies is a bit different, mainly because of something called vicarious liability. In simple terms, this legal concept can sometimes make a vehicle's owner (that's you) responsible for what the driver does. While federal laws have stepped in to help, the rules can still get tricky and vary wildly from one state to the next.

A crucial piece of federal law here is the Graves Amendment. It generally protects rental companies from being sued for a renter's negligence, as long as the company itself wasn't negligent or involved in any wrongdoing. But don't think of this as a get-out-of-jail-free card.

The Graves Amendment doesn't let you off the hook for your own responsibilities. Courts will still scrutinize your maintenance logs, how you handle recall notices, and whether you screen renters properly. This federal shield actually highlights just how important it is to run a tight ship.

The Power of an Ironclad Rental Agreement

Your rental agreement is far more than just paperwork. It's a powerful legal tool and one of your best defenses against risk. This contract needs to be crystal clear, spelling out exactly who is responsible for what when it comes to insurance. It’s your first line of defense when something goes wrong.

A rock-solid rental agreement must clearly state:

- Who provides the primary insurance coverage for the rental.

- What happens if the renter's insurance turns out to be fake or not enough to cover the damages.

- The renter's explicit acceptance of responsibility for any damage, loss, or claims from others.

- Rules that forbid certain uses, like taking the car off-road or letting unauthorized people drive it.

This document draws a clear line in the sand, legally shifting certain responsibilities to the renter. Without it, you’re inviting a costly and confusing fight over who pays after an accident. This is also true if you face a shutdown for other reasons. For instance, if a fire closes your office, you might look into the cost of business interruption insurance to keep paying bills. But for day-to-day liability, your rental agreement is king.

Compliance Is Not a DIY Project

Figuring out the legal fine print for your auto rental business insurance policy isn't something to tackle on your own over a weekend. The laws change, and what was compliant last year might not be this year. The stakes are simply too high to guess.

Bringing in professionals isn't a luxury; it's essential for survival.

- An Insurance Broker: You need someone who lives and breathes the rental car industry. A specialist broker knows the unique state requirements and works with insurance carriers who actually understand your business.

- A Legal Advisor: Have an attorney draft your rental agreement and review it regularly. This is how you ensure your contracts are strong, enforceable, and give you every bit of protection the law allows.

At the end of the day, staying compliant is an active job. It takes constant attention, expert advice, and seeing legal requirements not as a hassle, but as a core part of a healthy, sustainable business.

Understanding What Drives Your Insurance Costs

Have you ever stared at an insurance premium and just wondered where that number comes from? For auto rental business insurance, the price isn't just pulled out of thin air. Think of insurers as detectives. They meticulously piece together clues about your operation to predict the chances of a future claim.

Understanding how they think is your biggest advantage. It shifts you from being a passive price-taker to an active manager of your insurance costs. When you know what drives the price, you suddenly have the power to influence it.

Your Fleet Composition and Value

Let's start with the most obvious factor: the cars themselves. The makeup of your fleet is the single biggest driver of your premium. Insurers look at this from a few different angles, each telling a piece of your risk story.

A fleet of 10 reliable economy sedans rented to vacationing families is a world away from a fleet of 10 high-performance sports cars rented out in a dense city. The risk profiles couldn't be more different.

Here’s what they’re looking at:

- Vehicle Type and Value: This one's straightforward. High-end luxury cars, sports cars, and big SUVs simply cost more to repair or replace. That directly bumps up the cost of your comprehensive and collision coverage.

- Vehicle Age: This is a double-edged sword. Newer cars often have advanced safety features that can prevent accidents, which is great. But those same sophisticated electronics and sensors make even minor repairs much more expensive.

- Fleet Size: More cars on the road mean more exposure to potential incidents. A larger fleet naturally leads to a higher overall premium, all else being equal.

Simply put, insuring a basic Honda Civic is a lot cheaper than insuring a brand-new Porsche 911. That same logic scales across your entire fleet. The more valuable your "inventory" is, the more it's going to cost to protect it.

Location and Operational Radius

Where you do business matters. A lot. A rental agency based in a quiet, rural town faces a completely different set of daily risks than one in the heart of a chaotic city like Miami or Los Angeles.

Insurers dig into geographic data to size up risks like traffic density, crime rates (especially auto theft), and even common weather patterns like hailstorms or hurricanes.

This is a huge reason why the North American market is so complex. The market itself is valued at a staggering $52.45 billion, largely because of the high demand in major urban centers. All that activity concentrates the risk, which in turn shapes insurance strategies for the entire region. You can get more details from this report on the car rental insurance market.

Your operational radius—how far you let renters drive your vehicles—also comes into play. A business with a tight 50-mile limit has a much more predictable risk profile than one that allows adventurous cross-country road trips.

Your Business History and Practices

Finally, insurers look right at you. Your track record and internal controls are powerful predictors of future claims. A business with a history of frequent accidents will always pay more than a competitor with a spotless record. It's that simple.

They'll also put your renter screening process under a microscope. Do you enforce strict age requirements? Do you run motor vehicle reports (MVRs) to check for spotty driving records? Having robust screening protocols tells an underwriter that you're serious about preventing problems before they start, which can earn you better pricing.

If you want to dig deeper into these calculations, our guide on understanding business auto insurance cost offers some great additional context.

To really see how this plays out, let's look at two hypothetical businesses side-by-side.

How Business Profile Affects Insurance Premiums

This table illustrates just how much these factors can swing your premiums.

| Factor | Business A (Lower Risk) | Business B (Higher Risk) |

|---|---|---|

| Fleet | 15 economy sedans and minivans | 10 luxury SUVs and sports cars |

| Location | Suburban town with low traffic | Major downtown city center |

| Driver Screening | MVR checks and minimum age of 25 | Minimum age of 21, no MVR checks |

| Claims History | One minor claim in three years | Five claims in three years, two major |

| Estimated Premium | Lower | Significantly Higher |

As you can see, every decision—from the cars you buy to the customers you rent to—directly shapes your risk profile and, ultimately, what you'll pay for your auto rental business insurance.

Proactive Risk Management to Lower Premiums

Understanding what drives your insurance costs is one thing; actively working to lower them is another entirely. This is where you pivot from simply buying auto rental business insurance to becoming a hands-on manager of your own risk. Don't think of this as just another expense—these are smart investments in your business's future. When you prove to insurers that you're a lower-risk partner, you can directly influence your premiums and give your bottom line a healthy boost.

Taking these proactive steps shows you’re serious about protecting your fleet and stopping claims before they happen. It sends a powerful message to underwriters that you run a tight, professional operation, which almost always leads to better pricing.

Implement Rigorous Driver Screening

Your first and best line of defense is making sure only qualified, responsible people get behind the wheel of your cars. A flimsy screening process is basically an open invitation for trouble, and insurers know this. On the other hand, a robust process is a tell-tale sign of a well-run business.

Start by setting firm, non-negotiable standards for every single renter. This is ground zero for controlling your risk exposure.

Your screening protocol should include:

- Minimum Age Requirements: Most operators set the bar at 25 years old. This simple filter can dramatically cut down on accidents, as younger drivers are statistically a much higher risk.

- Motor Vehicle Report (MVR) Checks: Always pull an MVR before you hand over the keys. This report is a window into a driver’s history, showing violations, DUIs, and license suspensions. Modern software can even automate this for you.

- Valid License Verification: Use technology to quickly confirm a driver's license is both valid and not a fake. It’s a simple check that can stop a disaster of a rental before it even begins.

By weeding out high-risk drivers before they become your problem, you are actively preventing future claims. This is one of the most impactful strategies for making your business more attractive to an insurance carrier.

Leverage Telematics and GPS Technology

In the rental world, your vehicles are your biggest assets, and they're always on the move. Thankfully, modern tech gives you the power to watch over and protect them like never before. Installing telematics and GPS devices across your fleet is a total game-changer for risk management.

Think of it as having a digital supervisor in every car. These systems feed you a stream of valuable data that can slash costs and prevent losses. Insurers love seeing this technology in place because it directly tackles two of their biggest worries: reckless driving and vehicle theft.

Here’s how it helps:

- Theft Recovery: If a car gets stolen, GPS tracking gives you and law enforcement its exact location, massively boosting the odds of a quick recovery. A successful recovery means no expensive total-loss claim.

- Driver Behavior Monitoring: Telematics can flag issues like excessive speeding, hard braking, and aggressive acceleration. This data lets you spot and address risky driving, potentially stopping an accident before it occurs.

- Geofencing Alerts: You can create virtual perimeters and get an instant alert if a vehicle crosses an authorized boundary, like a state line or international border, which may violate your rental agreement.

A small investment in GPS trackers can pay for itself many times over through fewer theft claims and even direct insurance discounts.

Maintain a Meticulous Maintenance Program

A well-maintained vehicle is a safer vehicle. Period. A detailed, provable maintenance program is another key signal to insurers that you put safety and asset protection first. It shows you're actively working to prevent accidents caused by mechanical failures, like worn-out brakes or bald tires.

Your program needs to be more than just the occasional oil change. It should be a structured, documented process with regular, thorough inspections and proactive repairs. This doesn't just keep your customers safe; it also shields you from claims of negligence. If an accident does happen, having meticulous maintenance records can be your ace in the hole, proving you upheld your duty of care and shoring up your legal defense.

How to Choose the Right Insurance Partner

Picking an insurance provider for your auto rental business insurance isn't just about checking a box—it's about finding a true partner. It's tempting to jump on the cheapest quote, but in this industry, that's almost always a mistake. You need someone who genuinely gets the unique headaches of the rental world, from tricky vicarious liability laws to the unpredictable nature of your customers.

Think of it this way: you're not just buying a policy. You're hiring an expert advisor who should be your first phone call when something goes wrong. A great partner can mean the difference between a minor hiccup and a business-ending catastrophe.

Questions to Ask Potential Brokers

Before you sign on the dotted line, you need to interview any potential broker. This isn't just a formality; you're putting a key member of your team in place. The quality of their answers will tell you everything you need to know about their expertise and whether they can truly support your business.

Here are a few critical questions to get the conversation started:

- Experience with Rental Fleets: How many auto rental companies do you actually work with? Can you describe your experience with a fleet our size?

- Carrier Relationships: Which insurance carriers do you partner with that specialize in the rental car space? Many standard insurers won't touch this market.

- Claims Handling Process: If we have a major claim, what's your role? You want an advocate who fights for you, not someone who just hands you an 800 number.

- Risk Management Support: Beyond just selling me a policy, what do you offer to help us reduce our risks and keep our premiums down in the long run?

Choosing the right partner means looking beyond the premium. Scrutinize the policy's exclusions, deductibles, and the financial strength rating of the underlying insurance carrier. A low price from an unreliable carrier is a risk you can't afford.

Beyond the Price Tag

A solid insurance plan protects more than just your vehicles; it protects your entire business from grinding to a halt after a major event. While your primary auto policy is crucial, it's smart to think about what happens if your business can't operate for a while. You can learn more about protecting your income with options like business continuity insurance to see how different coverages fit together.

Ultimately, this decision comes down to confidence. You're trusting this person or agency with the financial security of everything you've built. Take your time to find a specialist who will provide rock-solid protection and expert advice for years to come.

Got Questions? We've Got Answers

When you're running a car rental business, insurance questions come up all the time. It's a complex world, but understanding the details is key to protecting your assets. Let's tackle some of the most common questions we hear from operators every day.

How Does Supplemental Liability Insurance Work?

Think of Supplemental Liability Insurance (SLI) as a safety net you can offer your customers right at the rental counter. It's an optional add-on that boosts their liability protection, often up to $1 million, way beyond the basic state-required minimums that are baked into the rental rate.

So, why is this so important for your business? When a renter opts for SLI and then causes a serious accident, the SLI policy steps up to pay for the injury and property damage claims first. This keeps your own primary business insurance from taking the hit, which is fantastic for maintaining a clean claims record and keeping your premiums from creeping up.

Am I Responsible for My Renter's Personal Belongings?

In a word, no. Your auto rental business insurance is built to cover two things: your vehicle and the liability that comes with someone driving it. It doesn't cover the renter's laptop, luggage, or any other personal items they leave inside.

The best practice here is to be crystal clear. Make sure your rental agreement has a straightforward clause stating you are not responsible for any lost, stolen, or damaged personal property. This one small step can head off a world of headaches and customer disputes down the road.

What's the Difference with Peer-to-Peer Car Sharing?

The insurance game for peer-to-peer (P2P) platforms like Turo is a completely different animal compared to a traditional rental operation. Instead of one straightforward commercial policy covering your fleet, P2P insurance is more of a patchwork quilt.

Here’s how it typically breaks down:

- The Car Owner's Policy: This is the base layer, but nearly every personal auto policy has an exclusion for commercial use—like renting the car out for money.

- The Platform's Policy: This is where the real coverage comes from. Companies like Turo or Getaround provide a commercial policy that only kicks in during the rental period. It covers liability and damage, usually with a few different levels of protection for the renter to choose from.

- The Complications: This layered system can create some tricky gray areas and potential gaps in coverage. It's why some states have passed specific laws to regulate P2P car sharing and why a few platforms have even pulled out of certain markets—the insurance puzzle was just too hard to solve.

For your traditional rental business, you have a single, consistent commercial policy that you control. With P2P, coverage is a blend of different policies, which can introduce more risk and uncertainty.

Figuring out these details is what we live and breathe. At Wexford Insurance Solutions, our specialty is crafting the right insurance strategy for your specific business, making sure you're covered from every angle. See how we can protect your fleet by visiting us at https://www.wexfordis.com.

Decoding Business Auto Insurance Cost

Decoding Business Auto Insurance Cost Your Guide to a Commercial Property Insurance Calculator

Your Guide to a Commercial Property Insurance Calculator