When you're an independent contractor, you wear all the hats—CEO, marketing team, and the entire workforce. That's why general liability insurance is so crucial. It's the foundational layer of protection for your whole operation, shielding you from the financial fallout of unexpected accidents, client lawsuits, and property damage. Think of it as an essential tool for your professional credibility and your financial survival.

Why You Need General Liability Insurance as a Contractor

Running your own show as a 1099 worker is all about freedom and independence, but it also means you're shouldering all the risk. You don't have the safety net of a traditional employer, so a single mishap can put both your business and your personal assets on the line. This is exactly why general liability insurance for independent contractors isn't just a good idea—it's essential.

Don't look at it as another expense. See it for what it is: a core piece of your professional toolkit, just as vital as a laptop for a freelance writer or a power drill for a carpenter. It's the safety net that catches you when things go sideways, ensuring one bad day doesn’t tank your entire career.

Facing Real-World Business Risks

The truth is, risks are everywhere for contractors, often hiding in plain sight. Imagine a client stopping by your home office and tripping over a stray power cord, leading to a nasty fall and a hospital visit. Or what if you're a freelance photographer on a shoot and you accidentally knock over an expensive antique vase in a client's home?

Without insurance, you're on the hook for every penny—the medical bills, the legal fees, the replacement costs. These aren't just hypotheticals; situations like these happen all the time. A single lawsuit could easily drain your savings and threaten the future of the business you’ve worked so hard to build.

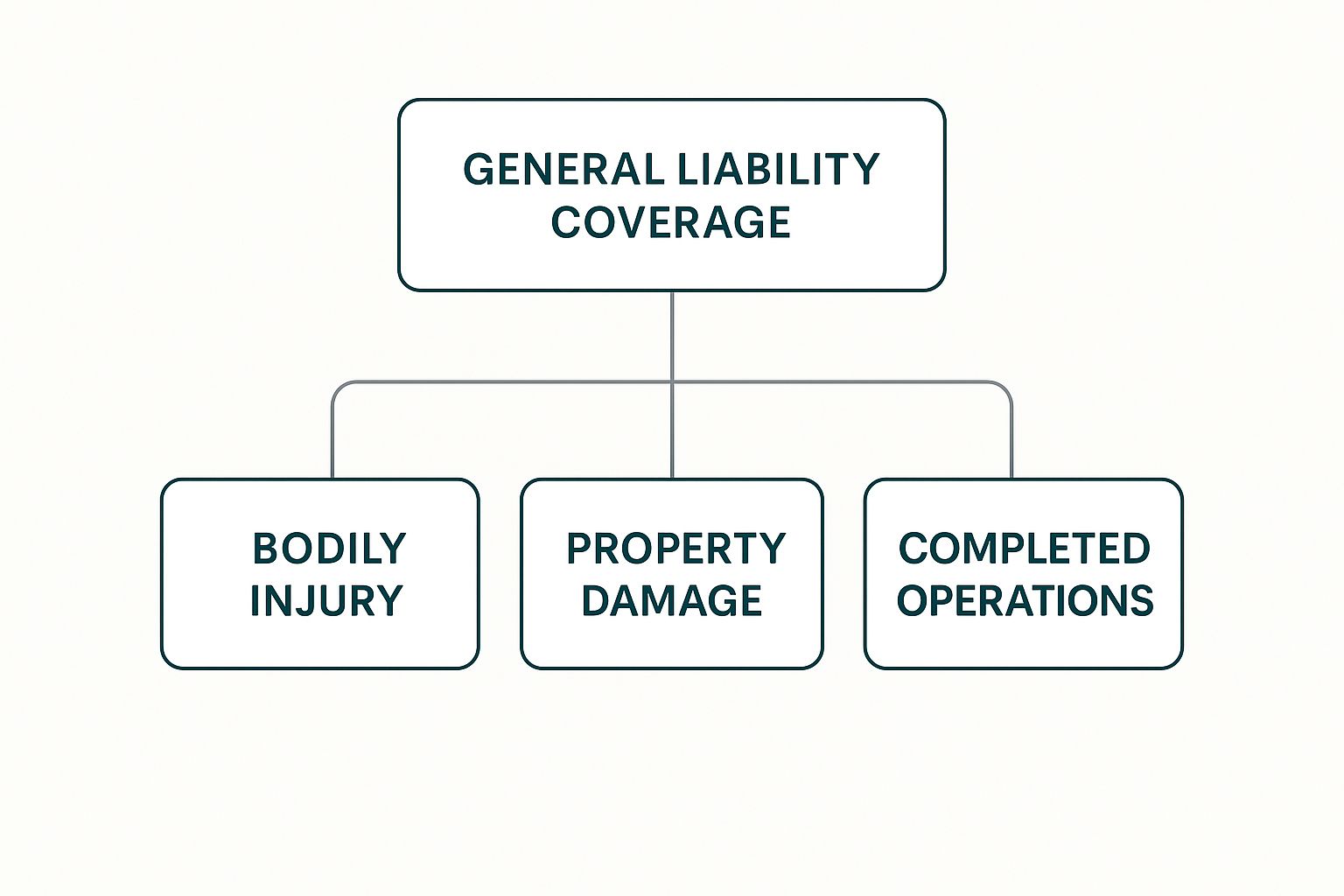

To better understand what a general liability policy covers, let's break down its core protections. This simple table illustrates how it shields you from the most common and costly risks you might face.

Core Protections of General Liability Insurance at a Glance

| Coverage Area | What It Protects You From | Real-World Example |

|---|---|---|

| Bodily Injury | Third-party injuries caused by your business operations. This covers medical bills and legal fees if you're sued. | A client slips on a wet floor in your studio and breaks their arm. |

| Property Damage | Damage you cause to someone else's property while on the job. This covers repair or replacement costs. | You spill paint on a client’s expensive rug while working as a handyman. |

| Personal & Advertising Injury | Claims of slander, libel, copyright infringement, or misappropriation of advertising ideas. | Your marketing campaign accidentally uses an image too similar to a competitor's, leading to a lawsuit. |

As you can see, this policy acts as your first line of defense, transferring the financial burden from your shoulders to the insurer. It lets you get back to work with confidence, knowing you're protected.

A Smart Investment in Your Professional Future

Getting a policy is more than just playing defense; it’s a proactive investment in your professional image. Many high-value clients and larger companies won't even consider hiring a contractor who can't show a Certificate of Insurance (COI). Lacking coverage can get you disqualified from bigger, more profitable projects right off the bat.

This is such a common requirement that it's often a standard clause in contracts. You can learn more about these client expectations in our guide on general contractor insurance requirements. Having the right policy tells potential clients you're a serious professional who knows how to manage risk.

And the cost is probably more manageable than you think. While it varies, a basic general liability policy with a $1,000,000 limit usually costs somewhere between $300 and $800 per year, depending on your line of work. Low-risk professionals might pay as little as $40-$50 per month, which is a small price to pay for such significant peace of mind. This smart investment doesn't just protect what you have—it opens doors for future growth.

Decoding Your General Liability Policy

Let's be honest—an insurance policy can feel like you're trying to read a foreign language. It's often packed with dense clauses and confusing terms. But when it comes to general liability insurance, getting a handle on the language is non-negotiable. This policy is your business's first line of defense.

Think of your policy as a protective shield with three distinct layers. Each layer is designed to guard you against a different kind of threat you might face as an independent contractor. Once you understand these core components, you'll know exactly what you’re paying for and can rest assured that you're properly protected.

The goal here isn't just to define terms, but to see how this coverage plays out in the real world.

Bodily Injury Coverage Explained

This is the most fundamental part of your policy. At its core, bodily injury coverage protects you if your work accidentally causes physical harm to someone else—like a client, a vendor, or just a member of the public. It’s crucial to remember this doesn't cover injuries to you or any employees you might have.

This coverage is built to handle the staggering costs that can come from an accident.

- Medical Expenses: It handles the immediate medical bills for the injured person.

- Legal Fees: If that person decides to sue, this pays for your defense lawyers.

- Settlements or Judgments: It covers the final bill if you're found liable and ordered to pay damages.

Here’s a classic example: You're an IT consultant working at a client's office. You leave your laptop bag on the floor, and someone trips over it, breaking their wrist. Your bodily injury coverage would kick in to pay for their medical care and any legal storm that might follow.

Property Damage Coverage in Action

The second layer of your shield is property damage coverage. This piece protects you financially if you accidentally damage, break, or destroy someone else’s property while on the job. For any contractor who sets foot on a client's site, this coverage is an absolute must-have.

Key Takeaway: General liability insurance for independent contractors is all about damage you cause to others. It won't cover damage to your own equipment or office. For that, you’d need a commercial property policy, which is often bundled into a Business Owner's Policy (BOP).

Let's make it real. A freelance photographer is at a client's home for a family portrait session. While moving a heavy light stand, it topples over and smashes a huge, antique mirror on the wall. The client is furious and wants you to pay for it.

This is exactly where your property damage coverage saves the day. It would cover the cost to repair or replace that mirror, keeping thousands of dollars in your pocket and helping to salvage the relationship with your client. You can dive deeper into these fundamentals in our article explaining the general liability meaning in more detail.

Personal and Advertising Injury Unpacked

The final layer, personal and advertising injury, is your defense against risks that are less physical but can be just as devastating. This is about protecting your reputation and covering mistakes made in your marketing and communications—something incredibly relevant today.

It typically steps in for claims involving:

- Libel or Slander: Something you wrote or said that harms someone else's reputation.

- Copyright Infringement: Using someone's photo, music, or other creative work in your ads without permission.

- Misappropriation of Advertising Ideas: Essentially, copying another business's ad campaign or slogan.

Imagine a freelance graphic designer creates a brilliant new logo for a local bakery. A few months later, a competitor sues, claiming the logo is a direct rip-off of their trademark. Without insurance, this could be a financial disaster. Your personal and advertising injury coverage would handle the legal defense and any potential settlement, protecting your business from a costly and stressful lawsuit.

What Determines Your Insurance Cost

So, you're an independent contractor, and you've hit the big question: "What's this actually going to cost me?" When it comes to general liability insurance, there's no simple price tag. The cost isn't a one-size-fits-all number; it's a premium that’s calculated specifically for you and your business.

Think of it like getting car insurance. The person with a flashy sports car and a lead foot is going to pay a whole lot more than the careful parent driving a minivan. In the same way, an insurer looks at several key factors to figure out how likely you are to file a claim. Let's break down what they look at, so you can understand what goes into your final price.

Industry and Associated Risk

The single biggest piece of the puzzle is your line of work. Insurance companies have been at this a long time, and they have mountains of data that tell them which jobs are riskier than others. A freelance writer working from a home office, for instance, has a much lower risk profile than a roofer who spends their days two stories up.

Any job that involves heavy equipment, working on a client’s property, or interacting directly with the public is naturally going to come with a higher premium. The more chances there are for someone to get hurt or for property to be damaged, the more you can expect to pay. It’s that simple.

Location and Geographic Factors

Believe it or not, where you work matters a lot. Premiums can change from one state to another, and even from city to city. Why? Some places just see more claims. This could be due to a dense population, regional weather patterns (think hailstorms or flooding), or even a local culture that's more prone to lawsuits.

A contractor in a bustling downtown area will likely face higher rates than one working in a quiet, rural town. The logic is straightforward: more people and more activity create more opportunities for things to go wrong. Insurers adjust their pricing to match these local realities.

Business Size and Payroll

The scale of your operation has a direct line to your premium. If you're a one-person show, you present a much smaller risk than a contractor who brings on subcontractors or has a few employees. Every additional person working under your business name is another potential source for an accident, which bumps up your perceived risk.

This image really breaks down where your premium dollars go.

Each of these coverages protects against a specific kind of risk, and your premium is built to cover them all.

The difference in cost can be staggering. An LLC in construction with around 20 employees might see an average annual premium of $36,746. On the other hand, a sole proprietor flying solo pays an average of just $2,422 a year. This shows just how much your industry and team size can move the needle. You can see more data on contractor insurance costs on MoneyGeek.com.

Claims History

In the world of insurance, your track record speaks volumes. If you’ve filed several claims in the past, an insurer will see you as a higher-risk client and price your policy accordingly. A clean slate, however, proves you run a tight ship and can earn you much better rates.

Pro Tip: Focusing on safety isn't just about doing the right thing—it's one of the most effective ways to control your insurance costs over the long haul. A spotless claims history is your best friend when it's time to renew your policy.

Your Chosen Coverage Limits

Finally, the amount of coverage you decide to buy directly impacts what you pay. A typical policy might include a $1 million limit per occurrence and a $2 million aggregate limit for the year. But if your client contracts require more, or if your work is particularly high-stakes, you can always purchase higher limits.

- Higher Limits = Higher Premium: More protection is great, but it also means a bigger potential payout for the insurer, so they'll charge more for it.

- Lower Limits = Lower Premium: This saves you money upfront, but you have to be absolutely sure your limits are high enough to satisfy contracts and truly protect your assets if a major claim hits.

It's all about finding the right balance between cost and comprehensive protection. And remember, general liability is designed for physical risks and reputational harm. It won't cover you for professional mistakes or bad advice. For that, you need a totally different policy. To learn more, take a look at our guide on what errors and omissions insurance is and see how it fills that critical gap.

Choosing the Right Provider and Coverage Limits

Alright, so you know what general liability insurance is. Now comes the hard part: picking the right policy. This isn't just about finding the lowest monthly payment. It’s more like hiring a silent business partner—you need someone dependable, financially solid, and ready to step up when things go wrong.

You also have to land on coverage limits that actually protect you. It’s a delicate balance. You need enough coverage to meet client demands and protect your assets, but you don't want to hemorrhage cash on a policy that’s total overkill. Let's walk through how to nail that decision.

How Much Coverage Do You Really Need

Figuring out if you need a $1 million policy, a $2 million one, or even more is one of the most critical choices you'll make as a contractor. Don't just pull a number out of thin air. A little bit of homework here ensures your policy is a real safety net, not just an expensive piece of paper.

Here’s a simple process for finding your number:

- Check Your Contracts: This is your first stop. Many clients will spell out exactly how much liability coverage you need to have before you can even start a project. This is your baseline—it's non-negotiable.

- Evaluate Your Industry's Risks: A freelance writer working from home has a vastly different risk profile than a general contractor on a busy construction site. The greater the potential for expensive property damage or serious injury, the higher your limits should climb.

- Take Stock of Your Assets: Think about what's at stake. Your policy needs to be robust enough to shield your business—and sometimes your personal assets—from a catastrophic lawsuit. A good rule of thumb is to secure enough coverage to protect everything you've worked so hard to build.

Comparing Insurance Providers Beyond Price

While cost is always a consideration, the cheapest policy is rarely the best. A low premium means nothing if the insurance company ghosts you or fights you tooth and nail on a legitimate claim. You're looking for a partner, not just a vendor.

Here's what separates the good from the bad:

- Financial Stability: How can you be sure an insurer can actually pay out a massive claim? Look up their financial strength rating from agencies like AM Best. You want to see an "A" rating or better, which signals they are on solid financial footing.

- Customer Service and Claims Process: Do some digging. Read online reviews and see what real customers are saying. Are they praising a smooth, fair claims process, or are they venting about endless delays and denied claims?

- Industry Specialization: Some insurers just get your line of work. They specialize in covering contractors in your field and have a much better handle on the specific risks you face every day.

A policy's true worth is only tested when you file a claim. A provider with a shaky reputation for claims handling can turn a bad situation into a full-blown financial crisis. You need to choose a partner you can count on.

For example, The Hartford Insurance Company is a well-known provider that offers high limits—up to $4 million in general liability—which is fantastic for contractors in high-risk fields. But, despite these strong offerings, it has received a higher-than-average number of customer complaints about its claims services. This is a perfect illustration of why you have to look past the policy limits, as you can see by exploring more insights about independent contractor insurance on Investopedia.com.

Remember, general liability is just one piece of the puzzle. For more complete protection, especially if you have partners or a board of directors, it's wise to also look into management liability coverage to protect your leadership team from different kinds of operational risks.

Other Essential Insurance Policies Every Contractor Should Consider

General liability is the foundation of your business's protection. It's the policy that handles those "slip-and-fall" incidents and accidental property damage claims that can happen on any job. But your business faces more than just physical risks. To build a truly secure operation, you need more than just a solid foundation; you need a complete structure.

Think of it like this: your general liability policy is the concrete slab your business is built on. It's non-negotiable. But that slab won't keep the rain out or protect your work from bad advice. For that, you need to add walls, a roof, and other protections. Let's look at the other key policies that round out your coverage.

Professional Liability Insurance for Your Advice and Expertise

While general liability covers what you physically do, professional liability insurance covers what you know and advise. You'll often hear it called Errors and Omissions (E&O) insurance, and it's your lifeline when a client claims your professional services caused them a financial loss.

This is absolutely critical for any contractor offering advice, consultation, or design services. If a client sues you because they believe your work was negligent, contained errors, or simply failed to deliver the promised results, your general liability policy won't cover a dime. E&O is built specifically for these kinds of professional disputes.

Consider these real-world scenarios:

- An IT consultant’s software recommendation leads to a system crash, costing the client thousands in lost sales.

- A marketing contractor’s new campaign fails to deliver, and the client sues to recoup their ad spend.

- An architect’s blueprint has a measurement error that requires expensive rework during the building phase.

In all these examples, the damage is financial, not physical, and stems directly from your professional expertise. Professional liability steps in to handle the legal defense costs and potential settlements, shielding your assets from claims against your work quality.

Commercial Auto Insurance for Your Business Vehicle

If you drive a vehicle for work—and that includes your personal car used for business errands—your personal auto policy probably won’t cover you. Nearly all personal policies have a "business use exclusion," which creates a huge and often overlooked gap in your protection.

Key Takeaway: A personal auto policy might cover your commute to a single office, but the moment you start driving between client sites, hauling tools, or making deliveries, you've crossed into business use. That’s where you need commercial auto insurance.

This policy covers liability and damage from accidents that happen while you're working. Without it, a simple fender bender on the way to a job site could leave you holding the bill for all the damages and injuries, a potentially ruinous financial blow.

Workers' Compensation When You're a Team of One

It’s a common misconception that workers' compensation insurance is only for companies with a payroll. While that's its primary purpose, there are a couple of very good reasons why a solo contractor should have it.

First, clients and state laws may require it. Many larger companies won't even consider hiring a contractor who doesn't carry their own workers' comp policy. It’s their way of making sure they aren't on the hook if you get injured on their property.

More importantly, this policy can protect you. Your personal health insurance can, and often will, deny claims for work-related injuries. And your general liability policy never covers your own bodily injury. If you get hurt on the job, workers' comp is the one policy designed to pay your medical bills and replace a portion of your lost income while you recover. With the average workers' comp claim costing over $42,000, it's a smart investment in your own financial and physical health.

How to Handle an Insurance Claim

Having a general liability policy is smart, but knowing what to do when something actually goes wrong is what really counts. When an incident occurs, things can get chaotic fast. A clear, simple plan can turn a moment of panic into a manageable process.

Let's walk through exactly how to manage your policy and handle a claim, from the proactive steps you can take today to the critical actions required in the immediate aftermath of an accident.

Prove Your Professionalism with a Certificate of Insurance

Long before you ever have to think about a claim, you'll need to prove you have coverage. That’s where a Certificate of Insurance (COI) comes in. Think of it like your business's insurance ID card—it's a straightforward, one-page summary of your policy details, including coverage types, limits, and effective dates.

Most clients, especially for larger projects, will require a COI before you even start work. It gives them peace of mind, showing them you’re a professional who has taken the right steps to protect everyone involved. Getting one is easy; just ask your insurance provider. They can typically email you a digital copy in minutes.

Pro Tip: Clients often ask to be named as an "additional insured." This is a completely standard request that extends your liability coverage to protect them from claims arising from your work. Your insurer can add them to your policy and issue an updated COI without any fuss.

Your Immediate Post-Incident Checklist

When an accident happens, your immediate response is everything. With adrenaline pumping, it can be tough to think straight, which is why having a checklist ready is so valuable. The goal is simple: document everything thoroughly while protecting yourself from a legal standpoint.

Here’s what you need to do right away:

-

Prioritize Safety First: Before you do anything else, make sure everyone is okay. If someone is injured, call for medical help immediately. Your top priority is to prevent any further harm.

-

Document Everything Meticulously: Grab your phone and take photos and videos of the scene from every angle. Document any property damage, the conditions that might have contributed to the incident, and any visible injuries. Visual evidence is incredibly powerful. Also, write down your account of what happened as soon as possible while the memory is fresh.

-

Gather Information, Not Fault: Get the names, contact information, and insurance details from everyone involved, including any witnesses. This is critical: do not admit fault. Don't apologize or say anything that could be interpreted as accepting blame. Stick to the facts and let the insurance adjusters do their job later.

-

Notify Your Insurer Promptly: Call your insurance agent or provider as soon as you can, even if you're not sure a claim will be filed. Policies have rules about timely reporting, and waiting too long could put your coverage at risk. They will assign a claims adjuster who will guide you through the rest of the process.

Following these steps will set you up for a much smoother claims experience. It’s also important to remember what this policy doesn't cover. For instance, if a claim arises from a mistake in your professional advice rather than a physical accident, that's a different kind of risk. You can learn more by understanding professional liability insurance for contractors and its critical difference from general liability.

Frequently Asked Questions

Jumping into the world of business insurance can feel like learning a new language. As a contractor, you have enough on your plate without trying to decipher confusing policy details. Let's clear up some of the most common questions we get about general liability insurance.

Do I Still Need General Liability Insurance If I Have an LLC?

Yes, you absolutely do. This is probably the single most common point of confusion for new business owners, but it's critical to understand the difference.

An LLC (Limited Liability Company) is a legal shield for your personal life. It builds a wall between your business and your personal assets, like your home, car, and savings account. If your business goes under, an LLC helps protect your personal stuff from creditors.

But that's where its protection ends. If someone sues your business, the LLC itself is on the line. General liability insurance is what protects the business's assets—its bank accounts, equipment, and future—by covering legal defense costs and settlement payments. Think of it this way: the LLC protects you, and insurance protects your LLC.

Can My Client Require Me to Have a Specific Amount of Insurance?

They sure can, and it happens all the time. It’s a standard business practice for clients to protect themselves by outlining insurance requirements right in your contract. Don't be surprised if a contract requires a minimum of $1 million in general liability coverage; it's a very common figure.

Pro Tip: Keep an eye out for clauses that ask you to name the client as an "additional insured" on your policy. This means your insurance would also cover them if they get sued for something that was your fault. It's a normal request, but you need to be aware of it before signing on the dotted line.

What Is the Difference Between General and Professional Liability?

This is another big one. The easiest way to remember the difference is to think about the type of damage. General liability is for physical oopsies, while professional liability is for financial blunders tied to your expert advice.

-

General Liability Insurance: This is for "slip-and-fall" scenarios. A client trips over your toolbox and breaks an arm? That's general liability. You accidentally knock over an expensive vase while working in a client's home? General liability again. It's all about bodily injury and property damage.

-

Professional Liability Insurance: Often called Errors & Omissions (E&O) insurance, this covers the financial fallout from your professional services. If you're a web developer and a site you build has a security flaw that costs your client thousands, that's a professional liability claim. It’s for mistakes, bad advice, or failing to deliver on a promised service.

Many contractors end up needing both. You could easily face a situation where a client trips over your laptop (general liability) right before you deliver a project that contains a critical error (professional liability).

You don't have to figure all this out on your own. The team at Wexford Insurance Solutions specializes in helping contractors find the right protection without breaking the bank. Get your personalized quote today and build a business that's ready for anything.

Your Guide to a Commercial Property Insurance Calculator

Your Guide to a Commercial Property Insurance Calculator Your Guide to Consultants Insurance Coverage

Your Guide to Consultants Insurance Coverage