Cyber security risk management is all about getting ahead of the curve. It’s a strategic, ongoing effort to identify, assess, and control threats to your organization's digital crown jewels. This isn't just about installing antivirus software and calling it a day; it's a continuous process of finding your weak spots and building a smart, layered plan to defend them.

What Is Cyber Security Risk Management

Think of it this way: building a fortress is more than just stacking stones to make high walls. An experienced commander studies the landscape, anticipates where an enemy might strike, and develops a defense-in-depth strategy. Cyber security risk management is that strategic commander for your digital assets.

Leaving those digital assets unguarded is like leaving the main gate of your fortress wide open. The threats are very real and relentless. A cyberattack happens somewhere in the world every 39 seconds, and cybercrime is on track to cost businesses a staggering $9.5 trillion in 2024. Small and medium-sized businesses are prime targets, with 61% reporting they were hit by a cyberattack in 2023. You can dig deeper into these cyber security statistics to see just how serious the situation is.

Ultimately, strong risk management is not a one-and-done project. It’s a living, breathing cycle that adapts as new threats pop up, allowing you to make informed, intelligent decisions to protect your data, your finances, and your hard-earned reputation.

The Foundation of Digital Defense

A solid risk management program is the bedrock of your entire security posture. It’s what separates a coordinated, resilient defense from a chaotic, reactive scramble. Without this foundation, your security efforts will always be a step behind the attackers.

This structured approach is designed to answer fundamental business questions:

- What are our most critical digital assets?

- What are the most significant threats we face?

- How would a successful breach actually affect our business operations?

- What’s the smartest, most cost-effective way to defend ourselves?

By answering these, security stops being just an "IT problem" and becomes a core business strategy that aligns protection directly with your company's goals.

The Four Pillars of Cyber Security Risk Management

At its core, cyber security risk management is a cycle. It's a simple but powerful four-stage process where each step informs the next, creating a loop of continuous improvement that helps you stay ahead of attackers.

An effective risk management plan is proactive, not reactive. It anticipates potential threats and prepares defenses before an incident occurs, rather than scrambling to clean up the damage afterward. This shift in mindset is the single most important factor in building true cyber resilience.

These four pillars are the essential framework for any successful strategy. They provide a clear, repeatable path for identifying what matters most and protecting it effectively.

| Pillar | Objective | Key Activities |

|---|---|---|

| 1. Identify | Gain a complete picture of your digital environment and potential threats. | Create inventories of hardware, software, and data. Pinpoint vulnerabilities, internal threats, and external attack vectors. |

| 2. Assess | Analyze and prioritize the risks you've identified. | Evaluate the likelihood of an attack and the potential business impact (financial, reputational, operational). Rank risks from most to least critical. |

| 3. Treat | Decide on and implement a strategy to handle prioritized risks. | Apply security controls (mitigate), buy cyber insurance (transfer), formally acknowledge the risk (accept), or change a business process (avoid). |

| 4. Monitor | Continuously track your defenses and the evolving threat landscape. | Review security controls, conduct regular vulnerability scans, and update risk assessments to ensure your strategy remains effective over time. |

By consistently cycling through these four stages—Identify, Assess, Treat, and Monitor—you create a security program that doesn't just react to yesterday's threats but is prepared for tomorrow's. This is the engine that drives a truly resilient organization.

How to Choose the Right Risk Management Framework

Once you’ve committed to getting serious about cyber security risk management, you need a plan. Frameworks give you that plan. Think of them as different blueprints for building a secure house—while the end goal is always a safe structure, the design, materials, and final inspection can look very different.

Picking the right framework is one of the most important decisions you'll make early on. It brings structure to your program, creates a common language for everyone involved, and lays out a clear roadmap of controls and best practices. Without one, you're just reacting, leaving gaps an attacker will inevitably find.

NIST: The Flexible and Adaptable Blueprint

The NIST Cybersecurity Framework (CSF) is like getting a customizable blueprint from a world-renowned architect. Developed by the U.S. National Institute of Standards and Technology, it was first created for critical infrastructure but has since been adopted by organizations of all sizes, all over the world, because of how adaptable it is.

The NIST CSF isn’t a rigid rulebook you have to follow word-for-word. Instead, it offers a set of desired outcomes and activities grouped into five core functions: Identify, Protect, Detect, Respond, and Recover. This approach lets you pick and choose the specific controls that make sense for your industry, your company’s size, and your unique risk appetite.

This framework is an excellent choice for organizations that:

- Want a voluntary, guidance-based approach instead of a strict, one-size-fits-all mandate.

- Need to align their security practices with widely recognized U.S. standards.

- Prioritize a flexible structure that can grow with the business and adapt to new threats.

Because it's a set of guidelines and not a formal certification, implementing NIST is all about demonstrating due diligence and genuinely improving your security posture. It’s about building a stronger house, not just getting a piece of paper that says it's up to code.

ISO 27001: The Global Standard for Certification

If NIST is the flexible blueprint, then ISO/IEC 27001 is the blueprint for a home that needs to pass an exacting international inspection to earn a globally recognized seal of approval. ISO 27001 is an international standard that specifies the requirements for establishing, implementing, and continually improving an Information Security Management System (ISMS).

Unlike NIST, the main driver for adopting ISO 27001 is often to achieve formal certification. This involves a rigorous audit by an accredited third party who verifies that your ISMS meets every single requirement of the standard.

Achieving ISO 27001 certification sends a powerful message to partners, customers, and regulators. It provides independent verification that your organization takes security seriously and has implemented a comprehensive, world-class system to manage cyber security risk.

This framework is the go-to choice for companies that:

- Operate on an international stage and need to prove compliance to global partners.

- Must meet specific contractual or regulatory requirements that mandate certification.

- Want a powerful marketing tool to build trust and gain a competitive advantage.

The road to ISO 27001 is definitely more demanding and structured, but the payoff is an official certification that acts as a universal symbol of security excellence.

Making the Right Choice for Your Organization

So, which blueprint is right for you? The decision boils down to your company's specific goals, resources, and what your stakeholders expect. It's not about which framework is "better" in a vacuum, but which one is the best fit for your unique situation.

To figure this out, ask yourself a few key questions:

- Do we need certification? If you have contracts on the line or you operate in a market where certification gives you a clear business edge, ISO 27001 is the logical path.

- What are our resources? NIST is often more approachable for smaller teams or those just starting out, thanks to its flexibility and the fact that you don't have to pay for a mandatory audit.

- Who is our audience? If your primary audience is the U.S. government or you’re in critical infrastructure, NIST is the default. If you need to prove your security chops to a global audience, the international recognition of ISO 27001 is invaluable.

Ultimately, both frameworks offer exceptional guidance for building a strong cyber security risk management program. Your choice will simply define the path you take to build, maintain, and prove the resilience of your digital fortress.

Your 5-Step Cyber Security Risk Assessment Process

Think of a risk assessment as the foundational detective work for your entire cyber security risk management program. It’s where you methodically uncover the hidden dangers lurking in your digital environment. This isn't about guesswork; it's a systematic search for clues that tells you what your most valuable assets are, who might be after them, and how they might try to get in.

By following a clear process, you move from just reacting to incidents to proactively anticipating them. The five steps below give you a repeatable framework for turning abstract threats into concrete, manageable problems.

Step 1: Frame the Investigation

Before any detective starts gathering evidence, they first have to define the crime scene. In a risk assessment, we call this the scoping phase. You have to set clear boundaries for your investigation to make sure you're focusing your time and energy where it truly matters.

What exactly are you trying to protect? Is it a single department, a critical business application, or your entire organization's network? Defining the scope is crucial. It prevents the assessment from spiraling into an endless, unfocused task and sets the stage for a targeted and effective review of your security posture.

Step 2: Gather Your Clues

With your "crime scene" defined, it's time to identify your valuables and the potential suspects. This boils down to two key activities: asset identification and threat identification.

First, you need to take a detailed inventory of your "crown jewels"—the data, systems, and hardware that are absolutely essential for your business to function.

Next, you have to figure out what threats could actually target those assets. Threats come in many shapes and sizes, and understanding the difference is a cornerstone of good risk management.

- Malicious Actors: This is the obvious one. It includes external hackers, organized crime syndicates, and even internal threats, like a disgruntled employee with the keys to the kingdom.

- Accidental Errors: Never underestimate human error. An employee unintentionally clicking a phishing link or misconfiguring a cloud server can cause just as much chaos as a deliberate attack.

- System Failures: Sometimes, things just break. Critical software bugs, hardware malfunctions, or unpatched systems create openings that attackers are all too happy to exploit.

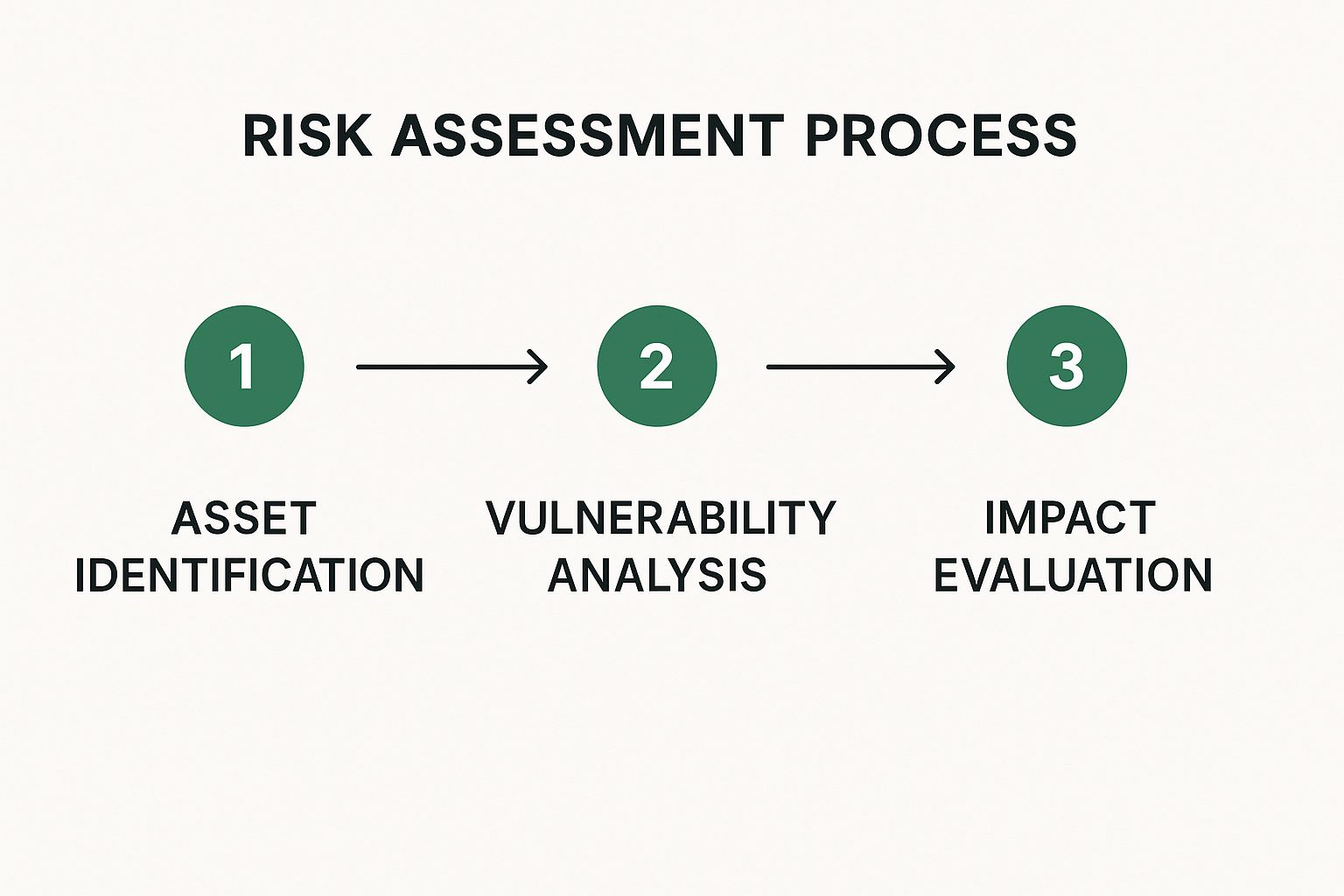

This infographic gives a great high-level view of how these initial stages flow into the later steps of analysis and evaluation.

As you can see, there’s a logical progression: identify what you have (assets), find its weak spots (vulnerabilities), and finally, determine what's really at stake (impact).

Step 3: Analyze the Evidence

Now that you've gathered your clues—your assets and the threats they face—it's time to connect the dots. This analysis step is all about identifying the specific vulnerabilities that a threat could exploit to cause harm. A vulnerability is simply a weakness in your defenses.

For instance, a key asset might be your customer database. A threat could be a ransomware gang. The vulnerability? An unpatched software version on the server hosting that database, which the gang knows exactly how to exploit. The goal here is to draw a clear line from your asset, through its weakness, to the threat.

Step 4: Determine Likelihood and Impact

This is the critical triage stage where you decide which cases are most urgent. For every risk you've identified (a specific threat exploiting a specific vulnerability), you need to evaluate two key factors: likelihood and impact.

Likelihood is just what it sounds like: how probable is it that this will actually happen? Impact, on the other hand, measures the damage—financial, reputational, and operational—if it does.

A low-likelihood, low-impact risk (like a brief power flicker in an office with backup generators) is a low priority. But a high-likelihood, high-impact risk (like a ransomware attack on your primary financial system) is a five-alarm fire that demands immediate attention.

A simple way to prioritize is to multiply likelihood by impact to get a risk score. This quick calculation turns a long, overwhelming list of problems into an actionable plan, making sure you focus your limited resources on the threats that pose the greatest danger.

Step 5: Document Your Findings

The final step is to create a formal risk assessment report. This isn't just bureaucratic paperwork; it’s your definitive case file. This document details your findings, your analysis, and most importantly, your prioritized list of risks. It becomes the blueprint for the next stage: risk treatment.

This report is essential for communicating the reality of your security posture to leadership and other stakeholders. It gives them the hard evidence they need to make informed decisions about budget and resources for your cyber security risk management efforts.

This process must be ongoing. After all, the Cyber Risk Index (CRI) averaged 36.3 in 2024, indicating a medium level of risk for most organizations. Despite regulatory improvements, no region has managed to achieve a low-risk status, with sectors like education remaining especially vulnerable. You can explore more about these global risk trends to see how different industries are faring.

Choosing Your Risk Treatment Strategy

So, you've done the hard work of assessing your risks, and now you have a prioritized list of what could go wrong. The natural next question is, "Now what?" This is where we move from assessment to action—the risk treatment stage.

You wouldn’t use the same approach for every problem. The right strategy hinges on the risk's potential damage versus what it would cost you to fix it. It's a classic cost-benefit analysis, but for your company's digital health.

There are four primary ways to handle a risk. Let's break down each one.

1. Mitigate: Reduce the Threat

Risk mitigation is what most people think of when they hear "cybersecurity." This is the hands-on approach where you actively implement controls to make a risk less likely to happen or less damaging if it does. Think of it as putting up storm shutters before a hurricane—you’re taking direct action to reduce the potential harm.

Common mitigation tactics include:

- Installing and fine-tuning firewalls.

- Enforcing multi-factor authentication (MFA) on all important accounts.

- Running regular security training so your team can spot phishing emails a mile away.

- Patching software vulnerabilities the moment updates are available.

Mitigation is your go-to strategy when a risk is significant, but the cost of the fix is well worth the protection it provides.

2. Transfer: Share the Burden

Some risks carry a financial punch that’s just too big for your organization to absorb on its own. For these high-stakes threats, you can transfer a portion of the financial fallout to someone else. The most common way to do this is by purchasing cyber insurance.

It’s like buying flood insurance for a house in a low-lying area. You pay a premium, and in return, an insurance company agrees to cover the devastating costs if a flood occurs. A solid cyber liability policy works the same way, covering expenses from a data breach like incident response, legal fees, and regulatory fines.

Transferring risk is ideal for those high-impact, low-probability events that could otherwise bankrupt you. For some assets, having the right policy is a crucial layer of defense, much like how specialized plans such as high-value home insurance protect unique physical property.

3. Accept: Acknowledge and Monitor

Believe it or not, sometimes the best action is no action at all. Risk acceptance is a deliberate, informed decision to live with a risk as-is. This only makes sense when the potential damage is minimal and the cost to fix it would be disproportionately high.

Important: Risk acceptance isn't the same as burying your head in the sand. It’s a formal decision, documented and signed off on by leadership, that acknowledges the risk and concludes that resources are better spent elsewhere.

For instance, you might find a minor software bug in an internal tool that only a couple of people use. Fixing it could take a developer a week. In that scenario, you might formally accept the risk, note it down, and focus on bigger fish.

4. Avoid: Steer Clear Entirely

Finally, there's avoidance. Some risks are so dangerous or unmanageable that the only logical move is to sidestep them completely. This involves changing a business process or scrapping an initiative to eliminate the risk altogether. It's the equivalent of deciding not to build your dream home in a known tornado alley.

Imagine your team wants to use a new, unproven software vendor. After a quick review, you discover their security is a mess. To avoid a potential supply chain nightmare, you make the call to walk away and find a more secure partner. It can be a tough business decision, but it's the right one when the risk is just too great to take on.

Comparing Risk Treatment Strategies

Choosing the right path requires weighing the specifics of each risk against your company's resources and risk tolerance. To help clarify, here’s a breakdown of the four strategies.

| Strategy | Action | When to Use It | Example |

|---|---|---|---|

| Mitigate | Implement controls to reduce likelihood or impact. | The risk is significant, and the cost of controls is reasonable. | Installing a firewall and enforcing multi-factor authentication. |

| Transfer | Shift the financial burden to a third party. | The risk has a high financial impact but a low probability. | Buying a comprehensive cyber liability insurance policy. |

| Accept | Formally decide to take no action. | The risk's impact is low and costs more to fix than it's worth. | Not fixing a minor bug in a non-critical internal application. |

| Avoid | Eliminate the risk by changing business activities. | The risk is too severe to manage through any other means. | Deciding not to partner with a vendor that has poor security. |

Ultimately, a strong risk management program will use a blend of all four strategies. The goal is to make smart, intentional decisions that protect your business without stifling its ability to grow and innovate.

Managing Your Supply Chain Cyber Risks

A solid cyber security risk management program has to look beyond your own four walls. You might have built a digital fortress, but what about the businesses you rely on every day? In our interconnected world, your security is only as strong as the weakest link in your supply chain. A trusted partner's security gap can quickly become your most dangerous—and most expensive—blind spot.

This isn’t just a theoretical problem; it's a primary way attackers get in. Recent global cybersecurity outlook findings show that over 54% of large organizations point to supply chain vulnerabilities as their biggest hurdle to becoming cyber resilient. The challenge is even tougher in the public sector, where 49% say they just don't have the skilled cybersecurity staff to manage these complex third-party relationships.

Ignoring these inherited risks is like meticulously locking your front door while leaving a side window—one your neighbor controls—wide open. Attackers know this. They actively exploit those trusted relationships to bypass even the strongest defenses.

Building a Third-Party Risk Management Program

This is where a formal Third-Party Risk Management (TPRM) program comes in. It’s the process that moves your approach from assumption to assurance, making sure your partners and vendors live up to the same security standards you set for yourself. A successful program really boils down to three core activities.

First, you need to conduct rigorous due diligence. Before you even think about signing a contract, you have to thoroughly vet a potential vendor’s security posture. This goes way beyond a simple questionnaire. Ask for hard evidence, like recent audit reports, security certifications, and proof of their security controls.

Next up are strong contractual agreements. Your contracts must spell out security responsibilities and expectations in plain language. These legally binding documents should clearly outline:

- Specific security controls the vendor must have in place.

- Requirements for how they handle and protect your data.

- Your right to audit their security practices.

- Clear protocols and timelines for notifying you of a breach.

These clauses create accountability and give you legal footing if a partner's mistake leads to a security incident that hits your company. This is a critical piece of the puzzle for keeping your operations running, a topic we explore further in our article on business continuity insurance.

The Importance of Continuous Monitoring

Finally, a TPRM program is never "one and done." Your vendors' security posture can change overnight, so ongoing monitoring isn't just a good idea—it's essential.

A vendor who is secure today may not be secure tomorrow. Continuous monitoring ensures that the trust you've placed in your partners remains justified over the entire lifecycle of your relationship.

This means you need a plan for periodic reassessments. It also means keeping an eye out for any publicly disclosed breaches involving your vendors and maintaining an open, honest line of communication about security. When you start treating your supply chain as a true extension of your own organization, you strengthen the entire business ecosystem against attacks that prey on trust.

The Strategic Role of Cyber Insurance

After you've done everything you can to identify, assess, and mitigate threats, a hard truth remains: some risks are just too financially devastating to handle on your own. This is where cyber insurance finds its place in your cyber security risk management program.

It’s a common misconception to see it as a substitute for solid security practices. It's not. Instead, think of it as a strategic tool for risk transference.

The best analogy is health insurance. You eat well and exercise (your security controls), but you carry a policy for a major, unforeseen medical emergency. Cyber insurance serves the same purpose—it's your financial backstop for a severe data breach that might otherwise sink your business. A good policy can take a potentially business-ending catastrophe and turn it into a manageable crisis.

Understanding Policy Coverage and Exclusions

Not all cyber insurance policies are created equal, and the devil is always in the details. A well-chosen policy can be a lifeline, but a poor one can leave you exposed right when you need it most. With the cost of breaches soaring—data breaches cost healthcare organizations an average of $9.77 million—underwriters are getting much stricter.

A truly comprehensive policy should cover the essentials you'll need in a real crisis:

- Incident Response: This helps pay for forensic experts to investigate the breach, PR firms to handle reputational damage, and services to notify affected customers.

- Business Interruption: This covers lost income and ongoing expenses while your operations are down because of a cyber attack.

- Legal and Regulatory Fees: This helps with the costs of legal defense, potential settlements, and hefty fines from regulators under laws like GDPR or HIPAA.

Just as important is knowing what isn't covered. Common exclusions include pre-existing vulnerabilities found after the fact, acts of war (a murky area with state-sponsored attacks), or failing to maintain the security standards you agreed to in your policy. For smaller companies, navigating these options is vital, and a detailed guide on cyber security insurance for small business can offer some much-needed direction.

How Good Risk Management Lowers Your Premiums

Insurance carriers are in the business of pricing risk. Before they’ll even give you a quote, they’re going to conduct their own risk assessment of your company. This is where having a mature cyber security risk management program really pays off, literally.

A strong, documented security posture is your best negotiation tool. When you can prove to underwriters that you are a lower-risk client, you unlock better coverage terms and more competitive premiums.

Insurers need to see that you’ve got the fundamentals locked down. They'll ask for evidence of things like multi-factor authentication across your systems, consistent security training for employees, and a formal incident response plan. By showing them you take security seriously, you prove you're a responsible partner, not just another liability.

Ultimately, insurance is the final layer of a complete risk strategy, transferring the financial impact of those worst-case scenarios you simply can't eliminate.

Answering Your Cyber Risk Management Questions

Even with a solid plan, putting cyber security risk management into practice always brings up questions. It's one thing to read about the theory; it's another to get your hands dirty. Let's tackle some of the most common questions that pop up for business leaders and IT pros alike.

Think of your risk management strategy not as a static document, but as a living part of your business. It needs regular attention to stay relevant and effective. You wouldn't rely on a medical check-up from five years ago, and you can't let your risk assessment gather dust on a shelf.

How Often Should We Conduct a Risk Assessment?

There's no magic number here, but a good rule of thumb is to perform a comprehensive, formal risk assessment at least once a year. That's the bare minimum. The real answer is: you need to reassess whenever something significant changes in your business.

Think about these common triggers for a fresh assessment:

- Major Technology Changes: Rolling out a new CRM, migrating your infrastructure to a new cloud provider, or launching a new app.

- Business Structure Shifts: A merger, an acquisition, or even a major internal restructuring can dramatically alter your assets and threat profile.

- After a Security Incident: A breach is a painful but powerful teacher. It gives you brand-new, real-world data on your actual vulnerabilities.

- New Regulatory Requirements: When new regulations like updated SEC disclosure rules or industry-specific data laws emerge, you have to assess your new compliance risks.

The whole point is to make sure your risk assessment mirrors your business today. An outdated assessment is almost worse than having none at all because it creates a dangerous false sense of security.

Risk vs. Vulnerability: What Is the Difference?

People often use these terms as if they mean the same thing, but the distinction is critical for getting risk management right.

A vulnerability is simply a weakness or a gap. Picture an unlocked door on your office building. On its own, the unlocked door isn't causing any harm; it's just a condition, a state of being.

A risk is the potential for something bad to happen when a threat takes advantage of that vulnerability. In our example, the risk is that a burglar (the threat) spots the unlocked door (the vulnerability) and uses it to get inside and steal your equipment (the impact).

Here's the simple formula: Risk = Threat x Vulnerability x Impact. You need all three for a risk to truly exist.

How Can Small Businesses Afford Risk Management?

This is a big one. Many small business owners think robust risk management is a luxury reserved for giant corporations with bottomless budgets. Thankfully, that's a myth. It's not about spending a fortune; it's about scaling the process to fit your size and budget.

Small businesses can get the ball rolling with several affordable, high-impact steps:

- Start with the basics. Create a simple asset inventory in a spreadsheet.

- Lean on free, world-class resources from organizations like NIST or the Cybersecurity & Infrastructure Security Agency (CISA).

- Master the fundamentals: enforce strong password policies, enable multi-factor authentication everywhere you can, and stay on top of software updates.

The first steps are often the most powerful. Just start by identifying your "crown jewels"—the data, systems, or processes your business absolutely cannot function without. Then, brainstorm the most likely ways they could be compromised. This simple exercise is the bedrock of a practical and affordable risk management program.

Trying to navigate the maze of cyber risks and insurance can feel overwhelming. At Wexford Insurance Solutions, our job is to make it simple. We help you build a resilient strategy to protect your business from the financial fallout of a cyber incident. Learn how our cyber liability solutions can strengthen your overall risk management plan.