Switching insurance companies might seem like a hassle, but it's often a smart financial move. The key is to do it right: first, take a close look at your current policy. Then, shop around for quotes from a few different insurers to find a better deal. Most importantly, make sure your new policy is active before you cancel the old one. This simple rule prevents any risky gaps in your coverage.

Done correctly, the process is surprisingly straightforward and can unlock significant savings and better protection for what matters most.

Knowing When It's Time for a Change

It's easy to stick with the same insurance company year after year out of habit. But life changes, and your insurance should change with it. While a surprise premium hike is what gets most people to start shopping, that’s just one of many signs that it might be time for a switch.

Think about the major milestones in your life. Did you just get married, buy your first home, or hand the car keys to a newly licensed teenager? These are huge moments, and they completely change your insurance needs. The policy that was perfect for you as a single renter probably isn't going to cut it now that you have a mortgage, a spouse, and new assets to protect.

When Your Wallet or Your Patience Runs Thin

Beyond big life events, sometimes it just comes down to dollars and cents—or plain frustration. If you're hit with a steep rate increase at renewal time without a clear reason, that's your cue to see what else is out there.

This becomes especially true as your financial picture grows more complex. You might start building more assets and find yourself wondering, how much umbrella insurance do I need? Asking that question can be an eye-opener, revealing that your current company might not offer the robust protection you now require.

Poor customer service is another deal-breaker. If filing a claim feels like a battle or you can't get a straight answer from a customer service rep, why stick around? The same goes for outdated technology. An insurer that doesn't have a simple app or a modern client portal can make managing your policy feel like a chore.

Your insurance should adapt to your life, not the other way around. If you constantly feel that your policy is out of sync with your needs, or the service you receive is subpar, that's your cue to seek a better alternative.

Checking the Pulse of the Market

It's not just about your personal situation; the insurance industry itself is always evolving. New products and more competitive pricing are constantly emerging, driven by demographic shifts and growing consumer demand.

A recent Allianz Global Insurance Report 2025 highlights this growth, pointing to a more competitive market that ultimately benefits you, the customer. With more options available than ever before, you have the power to find coverage that truly fits your life and your budget.

Use this checklist to quickly identify if your current situation warrants a search for a new insurance provider.

Checklist: Reasons to Switch Your Insurer

| Life Event or Reason | Why It Matters for Your Insurance |

|---|---|

| Significant Premium Increase | Your rates went up without a clear cause (like a claim or ticket). |

| Major Life Change | You got married, divorced, bought a home, or had a baby. |

| New Driver or Vehicle | Adding a teen driver or a new car changes your risk profile. |

| Poor Customer Service | The claims process was difficult, or agents were unhelpful. |

| Coverage Needs Evolved | Your assets have grown, and you now need more liability or umbrella coverage. |

| Better Rates Elsewhere | A competitor is offering the same or better coverage for less money. |

| Bundling Opportunities | You could save by combining your home and auto policies with a new insurer. |

If you've checked off one or more of these boxes, it’s a strong signal that it’s time to start shopping. Recognizing these triggers is the first step in learning how to change insurance companies effectively.

Figuring Out What You've Already Got

Before you even think about shopping for a new insurance policy, you have to get a crystal-clear picture of your current one. The key to this whole process is a single document: your policy's declarations page.

Think of it as the condensed, "cheat sheet" version of your entire policy. It's usually the first page or two and lays out all the critical details. It might look like a bunch of numbers and jargon at first glance, but it’s the only way to establish a solid baseline for comparing new quotes. Without it, you're just guessing.

The Most Important Numbers to Find

Your declarations page is where you'll find the three big-ticket items that define your coverage. Let's break down what they actually mean.

- Premium: This one's easy. It's the price you pay for your policy—monthly, every six months, or once a year.

- Deductible: This is your share of the cost when you file a claim. If you have a $500 deductible and your car needs $3,000 in repairs after an accident, you pay the first $500, and the insurance company handles the remaining $2,500. A higher deductible usually gets you a lower premium, but it means you're on the hook for more upfront if something happens.

- Coverage Limits: This is the absolute maximum your insurer will pay for a specific claim. For car insurance, you'll see separate limits for injuring someone else (bodily injury) or damaging their property. For home insurance, you'll see limits for rebuilding your house, replacing your stuff, and liability protection.

These limits are a huge deal. Let’s say your auto liability limit is $100,000, but you cause an accident that results in $150,000 in medical bills for the other driver. Guess who’s responsible for that extra $50,000? You are. This is exactly why getting the limits right is so important.

Don't just fixate on the premium. Your deductibles and coverage limits are the real heart of your policy. A cheap plan with skimpy limits is a disaster waiting to happen.

Using This Info to Set Your Benchmark

Once you've pulled these numbers from your declarations page, you have your official benchmark. This is the standard against which you'll measure every single quote you get.

You'll quickly see why this is so critical. A competing insurer might offer you a quote that's $50 a month cheaper—but did they secretly raise your deductible from $500 to $1,500 to get you that price? It’s a classic move.

The goal isn't just to pay less. The goal is to get better value. That might mean getting the same coverage for less money, or it might mean getting more coverage for the same price. This is especially true for business owners who need to keep their business auto insurance cost in check while ensuring their vehicles and drivers are fully protected.

By doing this homework first, you put yourself in the driver's seat. You can instantly tell when a quote is a genuine improvement and when it's just a cheap imitation of the protection you already have.

How to Compare Insurance Quotes Like a Pro

Alright, you’ve got your current policy details laid out. Now comes the part where your effort can really pay off. Learning how to properly shop for new insurance is the key to finding a better deal without sacrificing protection. Your goal isn't just to get quotes; it's to gather the right quotes from the right places.

You've got a few different avenues to explore, and honestly, each has its place.

- Captive Agents: Think of agents for big names like State Farm or Allstate. They work for one company, so they know its policies backward and forward. The catch? They can only sell you what their one company offers.

- Independent Agents: This is where we come in. An independent agent or agency, like Wexford Insurance Solutions, partners with multiple insurance carriers. This gives us the freedom to shop around for you, comparing a wide range of policies to find what truly fits your situation.

- Online Comparison Sites: These websites are fast and can give you a quick snapshot of prices from several insurers at once. While they're convenient for a baseline, they often lack the human touch needed to make sure the coverage is genuinely what you need.

For the most thorough search, I usually recommend a blended approach. Let an independent agent do the heavy lifting, and maybe run your numbers through an online site to see if the pricing is in the same ballpark. It’s a great way to double-check the market.

Gathering Your Information for Accurate Quotes

To get quotes you can actually compare, you have to give everyone the exact same information. It’s a bit like a science experiment—the only thing you want to change is the insurance company providing the quote.

Before you make a single call or click, get these details together:

- Your current policy's declarations page: This is your absolute best friend in this process. It has all the coverages you need to match.

- Personal info: Full names, birthdates, and driver's license numbers for everyone on the policy.

- Vehicle details: The year, make, model, and Vehicle Identification Number (VIN) for every car.

- Home details: The property address, square footage, and major construction details (like a brick or frame exterior).

Having this ready not only makes everything go faster but it also ensures the quotes you get are accurate. No one likes getting a great lowball quote only to find it doubles once the real information is entered.

Analyzing Quotes Beyond the Bottom-Line Price

This is where you put on your expert hat. The cheapest quote is rarely the best deal. I’ve seen it a hundred times: a low price that hides dangerously low coverage limits or a sky-high deductible that would be a financial disaster in a real claim.

A savvy shopper knows that true value lies in the balance of cost, coverage, and service. Never sacrifice essential protection for a slightly lower monthly premium.

When the quotes start rolling in, don't just glance at the price. Set them up side-by-side, maybe in a simple spreadsheet. Compare each new quote directly against your current policy. Are the coverage limits and deductibles identical? If a new quote is a lot cheaper, you need to find out why. Did they slash your liability protection? Did they drop an important endorsement you rely on?

Next, look past the numbers and investigate the company itself. Check out customer service ratings and claims satisfaction scores from reputable sources. A cheap policy from an insurer known for fighting claims isn't a bargain—it's a gamble. The insurance market is always shifting, and recent trends can create real savings for consumers. For example, global commercial insurance rates recently saw a decrease, a shift that can trickle down and benefit personal line shoppers. You can see detailed data on these trends in the Marsh Global Insurance Market Index.

Finally, always ask about bundling. Combining your home and auto policies with one insurer is one of the easiest and most effective ways to save. It's not uncommon to see discounts of 15-25%, a significant chunk of change for coverage you already need.

Making the Switch Without a Coverage Gap

So, you've done the homework, compared quotes, and found a clear winner. Excellent. But now comes the most critical part of the process: timing the switch perfectly. Getting this wrong can create a lapse in coverage, a dangerous gap that could become a financial and legal nightmare.

The golden rule is incredibly simple, but I've seen people get it wrong. Never, ever cancel your old policy until your new one is officially in effect. Don't just go by a verbal confirmation. Wait until you have the new policy declaration page or your new insurance ID cards in hand. Tangible proof is what matters.

Locking in Your Start and End Dates

Before you even think about picking up the phone to cancel your old plan, your first move is to lock in the exact start date and time of your new policy. For car insurance, this is typically 12:01 AM on your chosen start date. Get this confirmed in writing.

Once that date is set in stone, then you can confidently contact your current insurance company. You're not just calling to cancel on the spot. You need to be specific. Request a future-dated cancellation that aligns perfectly with your new policy's start date. This precision is the key to preventing any gaps or even a costly overlap.

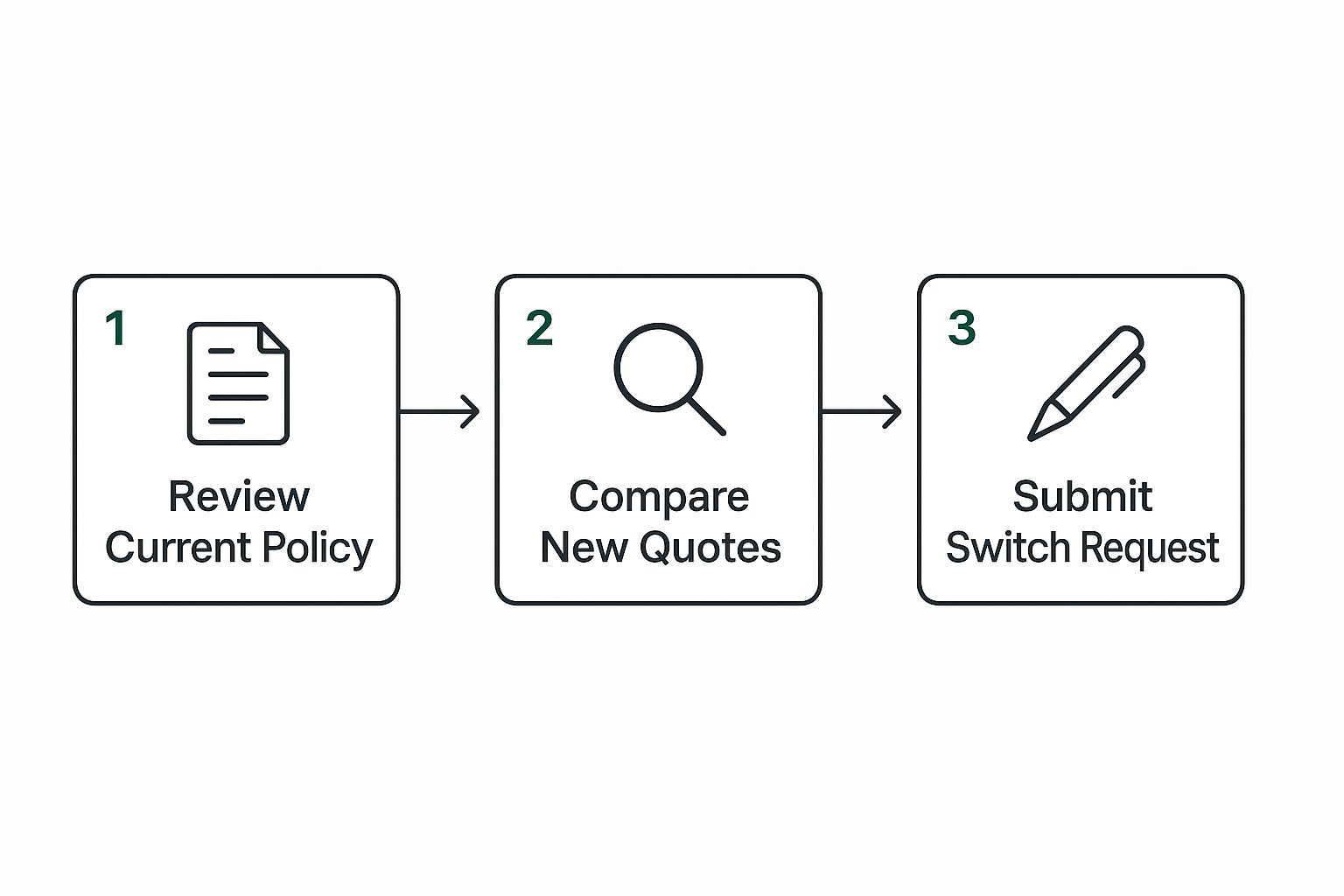

This is the basic flow from review to a successful switch:

As you can see, it’s a straightforward, sequential process. It’s all about understanding what you have, knowing what you need, and then taking clear, decisive action.

When you make that cancellation call, don't forget to ask about any potential refunds. If you prepaid your premium for a full six or twelve-month term, you're almost certainly owed a prorated refund for the unused portion. Some companies might have a small cancellation fee—it's always worth asking so you know what to expect.

A coverage lapse, even for a single day, can have severe consequences. If you have an auto loan or mortgage, your lender will be notified, which can lead to them force-placing expensive insurance on your behalf. More importantly, if an accident happens during that gap, you are 100% personally liable for all damages.

The Real Dangers of a Coverage Gap

Even a brief lapse is a huge red flag to insurance carriers. It can haunt you with higher premiums for years because you're suddenly seen as a higher-risk customer. Depending on where you live, states can also impose hefty fines or even suspend your driver's license for being uninsured.

All of this hassle can be avoided with just two well-timed phone calls.

If you're worried about identifying other potential holes in your protection, our guide on conducting a professional insurance gap analysis is a great place to start. Following this timeline ensures you get all the benefits of your new, better policy without taking on any of the risk.

Finalizing Your New Insurance Policy

You've done the hard work of comparing quotes and have chosen a new insurance company. That's a huge step, but don't celebrate just yet. There are a few key administrative tasks you need to button up to make your new coverage official and active.

The first, and most critical, step is making your initial premium payment. Your new policy isn't real until the insurer has your money. Seriously—no payment, no coverage. Whether you’re paying online, over the phone, or mailing a check, get this done right away. Procrastinating here can create a last-minute scramble and potentially leave you without coverage.

Sealing the Deal with Signatures

Along with that first payment, you'll need to sign the official application. Most modern insurers make this easy with e-signatures, letting you handle it from your phone or computer in a matter of minutes. Some might still send you physical paperwork to sign.

Either way, take a moment to read through everything one last time before you put your name on it. Check that all the details are correct. This signature is your formal agreement to the policy's terms, and it’s what turns the quote into a binding contract.

It's interesting to see how the insurance world is changing to meet customer needs. The 2025 Global Insurance Outlook by EY highlights that as Millennials become a dominant consumer group, top insurers are using technology to offer more customized and user-friendly experiences. When you're making a switch, it pays to find a provider that embraces these modern, flexible options. You can read more about these industry shifts in the full EY outlook report.

Notifying All Interested Parties

Okay, so your policy is signed and paid for. You're almost there. The last crucial step is to let any third parties with a financial stake in your property know about the change. If you have a loan, this part is absolutely mandatory.

- For auto insurance: Your car loan provider or leasing company needs to be informed immediately. They must be listed as the lienholder on your new policy declarations page.

- For home insurance: Your mortgage company is the top priority. They must be listed as the mortgagee to protect their investment in your home.

Dropping the ball here can have serious consequences. If your lender doesn't have proof of insurance, they can—and will—buy their own expensive policy and charge you for it. This is called "force-placed insurance," and it's a headache you want to avoid. The easiest way to handle this is to simply ask your new agent or insurer to send the new proof of insurance directly to your lender.

You can find more practical advice like this in our complete guide on how to switch insurance providers.

Finally, grab your new insurance ID cards and stash them in your car and wallet. With these last few items checked off, your new policy is officially locked in, active, and ready to go.

Answering Your Questions About Switching Insurers

Even with a clear game plan, it's natural to have a few lingering questions about changing insurance companies. I hear the same concerns from people all the time, so let's walk through them. Getting these answers will help you make the switch with total confidence.

Will I Get a Refund if I Cancel My Old Policy Early?

Yes, in almost all cases. If you've paid your premium for a full six or twelve-month term upfront, you're entitled to a prorated refund for the time you didn't use. It’s your money, after all.

One thing to watch out for, though, is a potential cancellation fee. Some companies call this a "short-rate" fee, and it’s a small charge for ending the policy before its natural expiration. When you call your old insurer to cancel, just ask them directly about their refund process and any fees. That way, there are no surprises.

Does Switching Insurance Hurt My Credit Score?

This is a huge myth, and the simple answer is no. Shopping for new insurance and making a switch does not directly impact your FICO score.

Insurers in most states use something called a credit-based insurance score to help set your rates. When they pull this information, it’s a "soft inquiry." This is completely different from the "hard inquiry" a lender makes when you apply for a mortgage or car loan. Soft inquiries don't lower your credit score.

The only financial impact you should see from switching is a positive one—more money in your pocket from lower premiums. Your credit report itself will not take a hit.

How Often Should I Shop Around for New Insurance?

I always tell my clients to get in the habit of reviewing their policies and getting fresh quotes at least once a year. Your renewal period is the perfect trigger. You should also make it a point to shop around after any significant life change.

What counts as a major event?

- Getting married or divorced

- Buying a new car or home

- Adding a new driver to your policy (especially a teenager!)

- A significant change in your financial situation

Life doesn't stand still, and your insurance needs won't either. A great guide to homeowners insurance can also help you pinpoint when your property's needs have evolved. You can explore our guide to homeowners insurance to see what other factors should prompt a policy review. Staying proactive is the key to always having the best rate.

Can an Insurer Refuse to Cancel My Policy?

Absolutely not. You have the right to cancel your insurance policy whenever you want, for any reason. A company cannot legally force you to stay with them.

However, you do have to follow their rules to make it official. This nearly always involves a signed, written request specifying your exact cancellation date. This isn't just red tape; it creates a formal record that protects you from any confusion about when your old coverage actually stopped.

You don't have to sort through the complexities of insurance on your own. The experts at Wexford Insurance Solutions are here to be your guide. We do the comparison shopping for you to find the right coverage at the best price. Let us handle the legwork so you can enjoy the savings and the confidence that comes with being properly protected. Get in touch with us today!

10 Proven Wealth Building Strategies for 2025

10 Proven Wealth Building Strategies for 2025 Business Continuity Plan Checklist: 8 Essential Steps for 2025

Business Continuity Plan Checklist: 8 Essential Steps for 2025