Think of home insurance as a financial backstop for your biggest investment. At its heart, it's a straightforward agreement: you pay a regular fee, called a premium, to an insurance company. In return, they promise to help you financially if your house or your stuff inside gets damaged or destroyed by a covered event.

It's more than just a smart idea. For most homeowners, it's a non-negotiable part of getting a mortgage.

What Is Home Insurance and Why You Need It

Imagine your home insurance policy as a specialized emergency fund you don't have to save up yourself. Instead of stashing away hundreds of thousands of dollars for a "what if" scenario, you pay a much smaller, manageable premium. If a disaster like a fire, a burst pipe, or a major storm strikes, the insurance company steps in to cover the massive costs of rebuilding or making repairs.

This isn't a luxury—it's a cornerstone of responsible homeownership. Without that protection, a single bad day could erase your life's savings and leave you paying a mortgage on a pile of rubble. It’s the buffer between you and financial catastrophe.

The Three Pillars of Protection

A standard home insurance policy isn't just one thing; it's a package deal that protects three vital areas of your life. Think of these as the core pillars holding up your financial security.

Before we dive deeper, here's a quick look at what a standard policy is built to protect.

Core Pillars of Home Insurance Protection

| Area of Protection | What It Covers |

|---|---|

| Your House (Dwelling) | The physical structure—walls, roof, floors, and even built-in appliances. |

| Your Belongings (Personal Property) | Everything inside, from your sofa and TV to your clothes and kitchenware. |

| You (Liability) | Financial protection if someone is accidentally injured on your property and decides to sue. |

This bundled approach provides a comprehensive shield. The growing awareness of this need is why the global home insurance market is projected to expand from USD 293.72 billion in 2025 to over USD 628.52 billion by 2034.

Your home is more than just a building; it's the center of your life and likely your largest financial investment. Insuring it properly is one of the most important financial decisions you will ever make.

Ultimately, having the right policy brings an incredible amount of peace of mind. To learn more about the nuts and bolts, our complete guide to homeowners insurance is a great next step.

Breaking Down Standard Home Insurance Coverage

A standard home insurance policy can feel like a dense legal document, but it's really just a collection of different protections bundled together. The best way to understand how it all works is to walk through a real-world scenario.

Let's imagine a small fire breaks out in your kitchen while you're cooking dinner. You put it out quickly, but not before it does some real damage. Your cabinets are charred, the walls are black with soot, and that expensive stand mixer on the counter is now a melted hunk of plastic. This is precisely the moment your insurance policy kicks in, with each part designed to handle a specific aspect of the mess.

Dwelling Coverage: The Foundation of Your Policy

First up is Dwelling Coverage, which you'll often see listed as "Coverage A" on your policy documents. This is the core of your insurance, covering the physical structure of your house itself. A good rule of thumb is that it protects anything that would stay put if you could hypothetically flip your house upside down and give it a good shake.

In our kitchen fire scenario, dwelling coverage is what would pay to:

- Tear out and replace the burned cabinets and countertops.

- Repair and repaint the soot-stained walls and ceiling.

- Fix the flooring that got warped by the water used to extinguish the flames.

This is, by far, the biggest piece of your home insurance pie. In fact, dwelling coverage accounted for roughly 71.1% of the entire global home insurance market in 2024. As events like wildfires and major storms become more common, the importance of this coverage is only growing. You can dig deeper into these trends and what they mean for the home insurance market.

Personal Property Coverage: Protecting Your Stuff

Next, let's talk about Personal Property Coverage, or "Coverage C." This is for all the things that would fall out if you shook your house—your furniture, electronics, clothes, and kitchen gadgets. It’s what helps you replace the personal belongings that turn your house into a home.

Following that kitchen fire, your personal property coverage would help you buy:

- A brand new stand mixer to replace the one that was destroyed.

- A new set of pots and pans to replace those ruined by the intense heat.

- Other damaged items, like the curtains that absorbed all that smoke or a small kitchen rug.

Key Takeaway: Dwelling coverage rebuilds the house, while personal property coverage replaces your belongings inside it. Getting this distinction straight is the first step to truly understanding how your policy protects you.

Liability and Additional Living Expenses

But what happens if a friend was visiting when the fire started and inhaled some smoke? That’s where Liability Coverage (Coverage E) steps in. This protects your finances if someone is injured on your property and you're found legally responsible. It helps cover their medical expenses and your legal defense costs if they decide to sue. It’s a crucial shield against accidents that can happen to anyone.

Finally, you can't exactly live in your house while the kitchen is a construction zone. This is why policies include Additional Living Expenses (ALE), also known as "Coverage D." It covers the reasonable costs you incur from having to live somewhere else temporarily. This could mean paying for a hotel room, a short-term apartment rental, or even the extra cost of dining out since you no longer have a kitchen. It's designed to keep a disaster from completely upending your day-to-day life.

Understanding Common Policy Exclusions

A home insurance policy gives you a powerful sense of security, but it’s just as important to understand its limits. Knowing what your policy doesn’t cover can save you from a nasty financial shock right when you need help the most.

Think of your standard policy like a first responder trained for specific emergencies—sudden and accidental events. It’s fantastic for things like a kitchen fire, a break-in, or a heavy branch crashing through your roof. But it was never designed to be an all-encompassing safety net for absolutely everything that can go wrong with a house.

Gaps in Standard Coverage

Some major disasters are almost always left out of a standard homeowners policy. This isn't an insurer trying to pull a fast one; it's because these events are so massive and widespread that they require a completely different kind of insurance structure.

The big ones you'll see excluded are:

- Floods: Any damage from rising water is a no-go. This includes hurricane storm surges, overflowing rivers, and even flash floods from heavy rain.

- Earthquakes: Shaking, landslides, sinkholes, and any other kind of earth movement are also standard exclusions.

- Maintenance Issues: Problems that crop up over time from wear and tear or neglect aren't covered. Your policy won't pay for a leaky faucet that slowly led to mold damage.

- Sewer Backup: If water or sewage backs up through your drains and floods your basement, you'll need a special add-on to cover the cleanup.

Crucial Insight: Your policy is there for the sudden catastrophe, not for predictable problems or gradual decay. It's meant to protect you from a pipe that bursts unexpectedly, not the mold that grew from a slow drip you didn’t fix for months.

Why Are These Excluded?

It really comes down to concentrated risk. A single hurricane or earthquake can damage thousands of homes in the same area at the same time. If that kind of event were covered under standard policies, the sheer volume of claims would bankrupt most insurance companies.

By separating these massive, location-specific risks, insurers can keep standard home insurance affordable for everyone else.

This means if you live in a high-risk area, you have to be proactive. It's on you to purchase separate, specialized policies to fill these critical gaps. Our guide on flood insurance vs. homeowners insurance is a great resource that breaks down why you often need both. Securing this separate coverage is the only way to be truly protected from some of nature's biggest threats.

How Your Home Insurance Premium Is Calculated

Ever stared at your home insurance bill and wondered, "Where did they get this number?" It's not just pulled out of thin air. Insurance companies are essentially professional risk assessors, and they meticulously build a "risk profile" for your home to figure out the likelihood you’ll file a claim. That likelihood is what determines your premium.

Think of it less as a single price and more as the result of dozens of small calculations. Some factors are about the house itself, others are about where it's located, and a few are about the choices you make as the homeowner. Every piece of information helps the insurer paint a picture of how much risk they're taking on.

Key Factors That Shape Your Premium

So, what are the big-ticket items that drive your costs? It mostly boils down to the home's physical traits and its surrounding environment. Insurers zero in on things that have historically led to more frequent or expensive claims.

For instance, a brand-new house with modern wiring and plumbing is going to look a lot less risky than a 100-year-old home with its original systems. The new build is simply less likely to suffer from issues like frayed electrical wires or bursting pipes, which are classic—and costly—sources of claims.

Here are a few other major factors insurers look at:

- Location: Is your home in an area known for hurricanes, wildfires, or tornadoes? Living in a high-risk zone means you'll pay more. Even something as simple as how close you are to a fire hydrant can nudge your premium up or down.

- Construction Materials: Homes built with fire-resistant materials like brick or stone almost always cost less to insure than a standard wood-frame house. It's all about reducing the risk of a total loss from a fire.

- Roof Age and Condition: An old, worn roof is a huge liability in a storm. On the flip side, a new, impact-resistant roof can often earn you a pretty nice discount.

- Claims History: If you’ve filed several claims in the past few years, an insurer will see you as more likely to file another one. This unfortunately leads to higher rates.

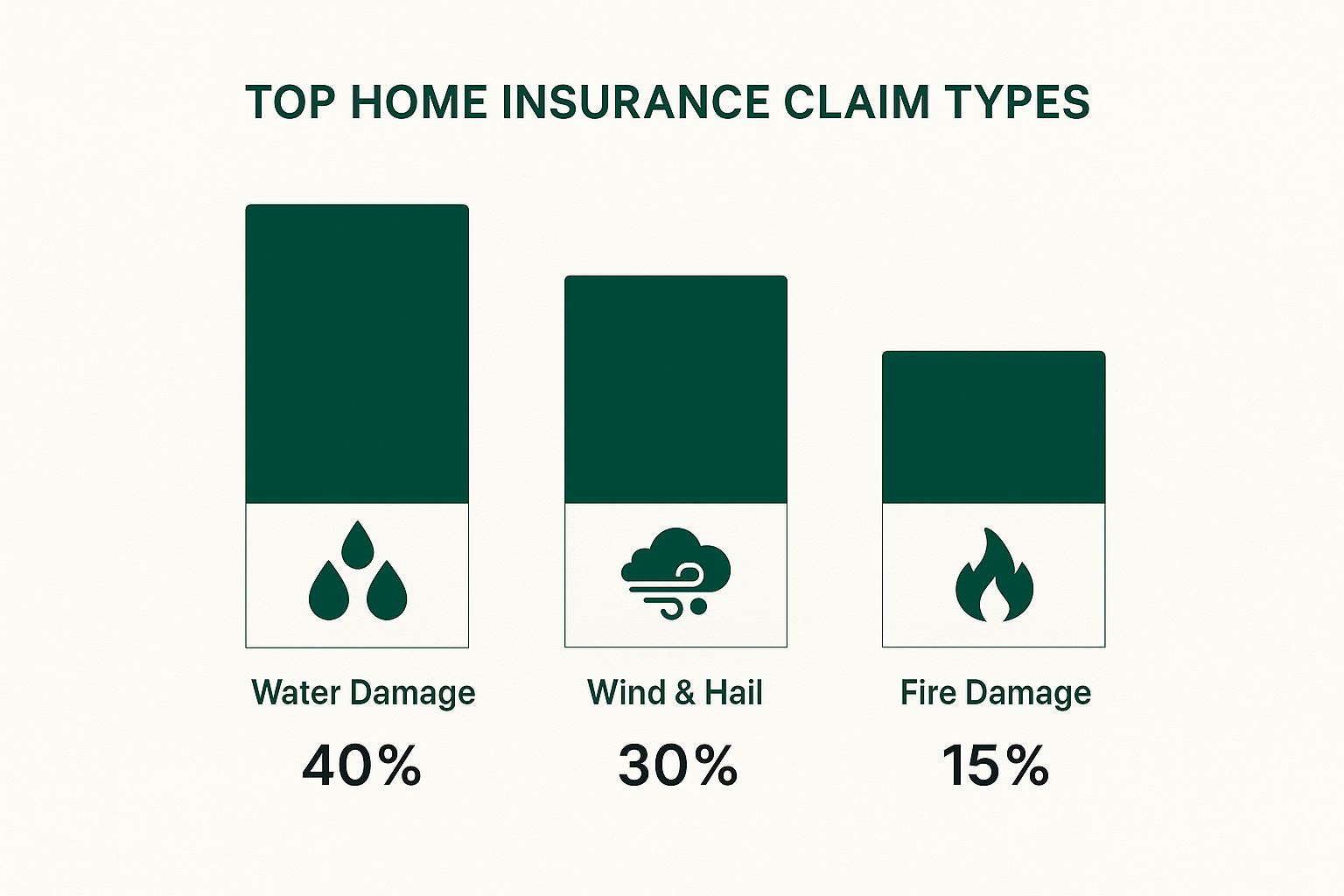

These elements give insurers a good idea of what kind of claims they might have to pay out. This visual breaks down the most common types of home insurance claims by how often they happen.

As you can see, water damage is by far the biggest headache for homeowners and insurers alike. This really underscores why things like the age of your plumbing and the condition of your roof are such a big deal.

To give you a clearer picture, let's look at how different factors can push your premium up or down.

How Different Factors Influence Your Insurance Premium

| Factor | Low Premium Impact | High Premium Impact |

|---|---|---|

| Location | Low-risk area, close to fire services | Prone to natural disasters (hurricanes, fires) |

| Roof Age | New, impact-resistant materials | Over 15-20 years old, standard shingles |

| Construction | Brick, stone, or other fire-resistant materials | Standard wood frame construction |

| Claims History | No claims in the last 3-5 years | Multiple recent claims |

| Deductible | High ($2,500+) | Low ($500 or $1,000) |

| Safety Features | Monitored alarm, smoke detectors, water sensors | No protective devices installed |

This table is a great cheat sheet, but it's important to remember that every insurer weighs these factors a bit differently.

How Your Choices Impact Your Cost

While you can't exactly pick up your house and move it out of a hurricane zone, you still have a surprising amount of control over your premium. The choices you make when setting up your policy are hugely important.

The most direct lever you can pull is your deductible. This is simply the amount of money you agree to pay out-of-pocket on a claim before your insurance company starts paying.

A Simple Rule of Thumb: The higher your deductible, the lower your premium. By taking on more of the initial financial risk yourself, you lower the insurer's potential payout, and they pass those savings on to you.

Just by increasing your deductible from $500 to $2,500, you could easily save hundreds of dollars a year. It’s a trade-off, of course—you're balancing a lower annual cost against a higher one-time expense if something actually goes wrong.

On top of that, installing protective devices can also chip away at your bill. Insurers love to see features that actively reduce risk, such as:

- Monitored home security systems

- Centrally-monitored smoke and fire alarms

- Automatic water shut-off sensors

Taking these steps shows the insurance company you’re serious about preventing losses, which makes your home a more attractive risk to cover. If you're looking for more ways to save, our guide on how to lower home insurance premiums has plenty of other practical tips. Understanding these levers is the key to finding that sweet spot between great coverage and a price that fits your budget.

A Step-By-Step Guide to the Claims Process

Dealing with damage to your home is overwhelming. The last thing you need is a confusing claims process on top of it all. But knowing the right steps to take when something goes wrong can make a world of difference. It helps to think of filing a claim less as a battle and more as a structured conversation to get the support you’ve been paying for.

First things first: safety. If you're facing an immediate hazard like a gas leak or downed power lines, get everyone out and call 911 immediately. Your property comes second to your well-being.

Once everyone is safe, your next job is to stop the problem from getting worse.

In insurance-speak, this is called "mitigating damages." It’s a fancy term for taking common-sense steps to protect your home from further harm. For instance:

- A storm smashes a window? Board it up to keep the rain out.

- A pipe bursts? Find that main water valve and shut it off, fast.

- The roof took a beating? Get tarps over the damaged areas to stop water from leaking into the house.

Your insurance company expects you to do this. If you don't take these reasonable precautions, they could argue that any subsequent damage isn't their responsibility, potentially complicating your claim.

Notifying Your Insurer and Documenting Everything

With the immediate danger handled, it's time to call your insurance company. Their 24/7 claims hotline should be on your policy documents or their website. Have your policy number handy and be ready to give a clear, simple rundown of what happened.

Now, while you're waiting for them to get back to you, it's time to switch into documentation mode. This is probably the single most important part of the whole process. Your mission is to build a rock-solid record of all the damage.

Crucial Tip: Don’t throw anything away—not yet. Damaged belongings are proof of your loss. Tossing them before an adjuster sees them can seriously undermine your claim.

Go on a photo and video spree. Take wide shots to capture the scope of the damage, then get close-ups of specific problems. If you can, start putting together a home inventory. This is just a list of what was damaged or destroyed, along with details like the brand, how old it was, and what you think it would cost to replace. Digging up old receipts or credit card statements for big-ticket items is pure gold here.

Working with the Claims Adjuster

Once your claim is filed, the insurer assigns a claims adjuster to your case. Their role is to investigate what happened, figure out what your policy actually covers, and calculate the cost of the repairs. They’ll schedule a time to come out and see the damage for themselves.

Make sure you’re there for that inspection. Walk them through the property, point out damage they might overlook, and be ready to answer their questions. Hand them copies of all your documentation—the photos, videos, and inventory list. The more organized you are, the more smoothly things tend to go. For an even more detailed walkthrough, you can review our complete guide on the homeowner insurance claim process.

After the visit, the adjuster will send you a settlement offer. This document breaks down the repair estimates and states the final amount the insurance company will pay out after subtracting your deductible. Go over it with a fine-tooth comb. If the numbers seem off or you have questions, don't hesitate to speak up and negotiate.

How to Choose the Right Home Insurance Policy

Alright, you've learned the ins and outs of home insurance. Now comes the real test: picking the right policy. Think of it less like a final exam and more like making a smart investment in your peace of mind. This isn't just about finding the cheapest plan—it's about getting the right protection for your biggest asset.

The first, most crucial step is to figure out how much coverage you actually need. People often mistake their home's market value for its rebuilding cost, but they're completely different things. You need enough dwelling coverage to rebuild your home from scratch at today's prices for materials and labor.

Look Beyond the Premium Price

It’s easy to get fixated on the annual premium, but that number is only one piece of the puzzle. A low price can hide surprisingly thin coverage. The single most important detail to compare is whether a policy offers Replacement Cost Value (RCV) or Actual Cash Value (ACV).

- Replacement Cost (RCV): This is what you want. It pays to repair or replace your damaged home and belongings with new items of similar quality.

- Actual Cash Value (ACV): This option pays you what your stuff was worth right before it was damaged. It’s the replacement cost minus depreciation. That 10-year-old roof or sofa won’t be worth much, leaving you to pay the difference out of pocket.

Opting for an ACV policy just to save a few bucks on your premium can backfire spectacularly. When a real disaster hits, RCV is what truly helps you recover. ACV often leaves you with a huge financial shortfall.

Do Your Homework and Find Discounts

Once you know the coverage levels you need, it's time to shop for an insurer. Check their financial strength ratings from agencies like AM Best and see what real customers say about their claims experience. A cheap policy from a company that’s a nightmare to deal with is no bargain at all.

Don't be shy about asking for discounts. Insurers offer savings for all sorts of things, from having a security system to installing a new roof. One of the biggest discounts usually comes from bundling your policies together. You can learn more in our guide on bundling home and auto insurance.

Finally, always get multiple quotes. The home insurance market is huge—in 2025, the basic homeowners insurance segment alone is valued at USD 145.19 billion, not to mention all the other types for landlords and condo owners. You can see more data on home insurance market segmentation at metastatinsight.com. With so much variety, getting several quotes is the only way to ensure you're getting the best value for your specific home and needs.

Your Home Insurance Questions, Answered

Alright, even after you've got a handle on the fundamentals, a few practical questions almost always pop up. Let's tackle some of the most common ones head-on to clear up any lingering confusion and make sure you feel confident.

How Much Home Insurance Do I Really Need?

This is a big one. For your house itself (the dwelling), you need enough coverage to rebuild it from the ground up at today's prices—not what you paid for it or what it might sell for. Think about the current cost of labor and materials.

When it comes to your belongings, a solid starting point is aiming for coverage that's about 50-70% of your dwelling coverage. For liability, don't even consider less than $300,000. If you have savings, investments, or other significant assets, you'll want to aim even higher to protect them.

What Is Replacement Cost vs. Actual Cash Value?

These two terms can make a world of difference in a claim. Replacement Cost (RCV) is what you want. It pays to replace your damaged property with brand-new items of similar quality, no questions asked about how old your stuff was.

Actual Cash Value (ACV), on the other hand, pays you for what your property was worth the second before it was destroyed. It's the replacement cost minus a deduction for age, wear, and tear.

Choosing an ACV policy might save you a few bucks on your premium, but it could leave you with a massive financial gap when you actually need to rebuild or replace your things.

Will Filing a Small Claim Increase My Premium?

More than likely, yes. Filing a claim for a minor issue often triggers a rate increase when your policy renews. You could also say goodbye to any "claims-free" discount you've enjoyed for years.

Because of this, it's often smarter to handle smaller repairs out of your own pocket. Think of your insurance as a safety net for the big, financially devastating events, not a maintenance plan for minor hiccups.

Figuring out the ins and outs of home insurance can feel like a puzzle, but you don't have to solve it alone. The experts at Wexford Insurance Solutions are pros at helping you find that sweet spot between great coverage and a fair price. You can get your own personalized quote by visiting their website at https://www.wexfordis.com.

Risk and Analytics: Transforming the Insurance Industry

Risk and Analytics: Transforming the Insurance Industry Car Insurance Deductible Explained Simply

Car Insurance Deductible Explained Simply