When you hear the term "car insurance deductible," what comes to mind? For a lot of people, it's just another piece of insurance jargon. But in reality, it's one of the most important parts of your policy you can control.

Simply put, your deductible is the amount of money you agree to pay out-of-pocket for a claim before your insurance company steps in to pay the rest. Think of it as your share of the repair bill.

What Is a Car Insurance Deductible?

Let’s get straight to it. A car insurance deductible isn’t as complicated as it sounds. The easiest way to think about it is like a co-pay at the doctor's office. You pay that initial, fixed amount first, and then your health insurance covers the larger bill. Your auto insurance deductible works the exact same way for getting your car fixed.

When you set up your policy, you get to choose your deductible amount, which typically falls somewhere between $250 and $1,000, though some people go higher. If you get into an accident and need to file a claim for damage to your car, you'll pay that deductible amount directly to the body shop. After that, your insurer takes care of the rest of the bill. It's a straightforward partnership.

The Role of Your Deductible

So, why do deductibles even exist? From the insurance company's perspective, they serve two main purposes. First, it’s a form of cost-sharing. Having to pay a few hundred dollars yourself means you have some "skin in the game," which naturally encourages you to be a more careful driver.

Second, it helps filter out minor claims. If everyone filed a claim for every tiny scratch or ding, the administrative costs would be huge, and that would drive up premiums for all of us. This is a fundamental piece of the puzzle that determines how your policy is priced.

A car insurance deductible represents the portion of a claim that the insured must pay before the insurer covers the remainder. It's a strategic choice that directly influences both premium costs and your personal financial risk in an accident.

This relationship between your deductible and your premium is a classic trade-off you need to weigh. Let's look at how that plays out.

Deductible vs Premium Quick View

The table below gives you a quick snapshot of how choosing a different deductible directly impacts your wallet—both now and after a potential claim.

| Deductible Amount | Effect on Monthly Premium | Your Out-of-Pocket Cost Per Claim |

|---|---|---|

| $250 | Highest Premium | $250 |

| $500 | Medium Premium | $500 |

| $1,000 | Lower Premium | $1,000 |

| $2,000 | Lowest Premium | $2,000 |

As you can see, the higher you set your deductible, the lower your regular insurance bill will be.

For example, simply bumping your deductible from $500 to $1,000 can often lower your collision and comprehensive premiums by 15% to 30%. It’s a significant savings, but it means you're accepting more of the immediate financial risk if an accident happens. These core principles are the same whether you're managing a personal policy or exploring the differences in commercial vs personal auto insurance.

How Your Deductible Works After an Accident

It’s one thing to understand the definition of a deductible, but seeing how it actually works in a real-world claim is where the concept really clicks. So, what happens when you have to file a claim? Let's walk through the process, step-by-step, to see where your deductible comes into play.

Think of it this way: your deductible is your financial stake in the claim. It’s not a fee you pay to the insurance company, but rather the portion of the repair bill you’re responsible for before their money kicks in.

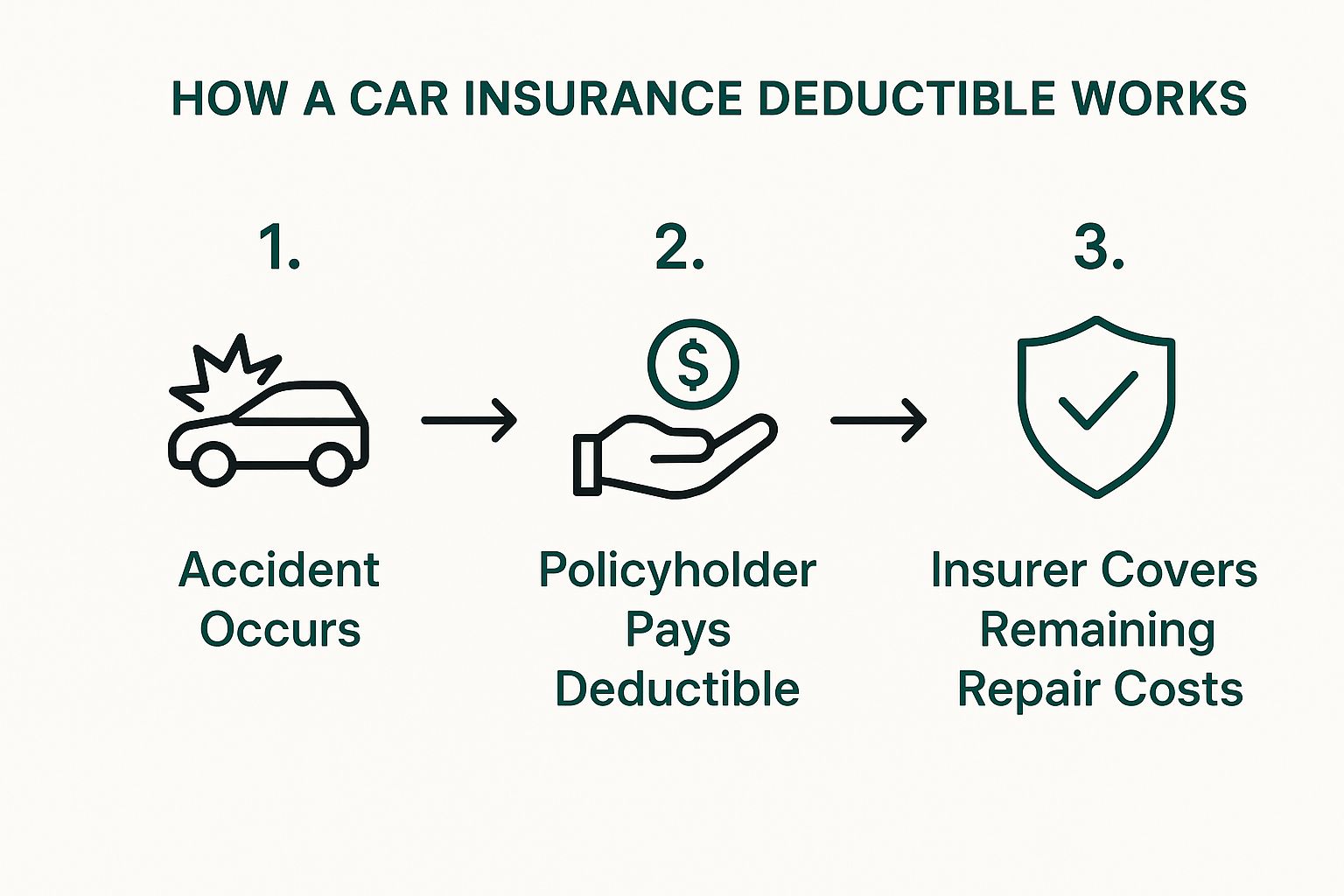

This simple infographic gives you a quick visual breakdown.

As you can see, your out-of-pocket payment is the first piece of the puzzle. Once you've covered your part, your insurer steps in to handle the rest of the bill.

Scenario One: A Minor Fender Bender

Let's start with something common. Imagine you misjudge the distance and back into a pole in a crowded parking lot. Ugh. Now you've got a dented bumper and a cracked taillight. Your trusted mechanic gives you an estimate for the damage: $1,400.

Your policy has a $500 collision deductible. Here's the play-by-play:

- You File the Claim: First, you report the accident to your insurer, and they approve the $1,400 estimate from the shop.

- You Pay the Shop: When your car is ready for pickup, you pay your $500 deductible directly to the body shop.

- Insurance Pays the Rest: Your insurance company then sends the remaining $900 straight to the shop to settle the bill.

You paid your share, the insurer paid theirs, and your car is back on the road. The process is pretty straightforward.

Scenario Two: A Major Collision

Now for a more serious situation. You’re in a multi-car pile-up on the freeway, and your car has taken a serious hit. The repair shop estimates the damages at a whopping $8,500. This is exactly why you have collision coverage.

Your deductible is still $500.

- You Pay Your Part: Just like with the fender bender, your financial role is limited to your deductible. You’ll pay the first $500 of that $8,500 repair bill.

- Insurance Covers the Bulk: Your insurer handles the other $8,000. That massive payment is the reason you have insurance—to protect you from financially devastating events.

This is where your deductible choice becomes so critical. Opting for a higher deductible can lower your monthly premium, but you have to be absolutely certain you can comfortably pay that amount out-of-pocket after a major wreck. Your deductible is the predictable cost in an unpredictable world; your insurance policy is your shield against everything beyond it.

Understanding Different Types of Deductibles

When you first glance at a car insurance policy, it’s easy to think of the deductible as just one number. But that’s a common misconception. In reality, your policy is more nuanced, and you actually have different deductibles for different types of coverage. Knowing how this works is the key to fine-tuning your policy and managing your costs effectively.

The two main deductibles you’ll need to decide on are for your Collision and Comprehensive coverages. While they both exist to protect your own car from damage, they kick in for completely different situations.

Collision vs. Comprehensive: A Simple Breakdown

Let's break it down. Think of Collision coverage as your financial backup for accidents where you hit another object. This is most often another vehicle, but it also applies if you hit a stationary object like a telephone pole, a fence, or even a building. If an accident is your fault, this is the part of your policy that pays to fix your car once you’ve paid your deductible.

Comprehensive coverage, on the other hand, is for pretty much everything else. It covers damage that isn't caused by a traditional collision. This bucket includes a whole host of unfortunate, non-driving-related incidents.

- Theft: Your car gets stolen.

- Vandalism: Someone keys your paint job or smashes a window.

- Weather Events: A nasty hailstorm leaves dents all over your roof, or a heavy windstorm drops a tree branch onto your hood.

- Animal Collisions: A deer darts out in front of you on a dark road.

- Fire: An electrical short causes a fire under the hood.

- Falling Objects: Rocks or debris fall from an overpass and hit your car.

Because these two coverages protect against very different risks, you can set separate deductible amounts for each one. This is where you can get strategic. For instance, many drivers opt for a lower comprehensive deductible, say $250 or $500, because claims for things like a cracked windshield are fairly common and relatively cheap to fix. At the same time, they might choose a higher $1,000 deductible for collision to keep their premium down, essentially betting on their own safe driving.

What About Liability Coverage?

Here’s a critical point that trips a lot of people up: liability coverage almost never has a deductible. This is the portion of your policy that pays for the injuries and property damage you cause to other people when you’re at fault in an accident. Your insurance company covers these costs from the very first dollar, right up to your policy’s limits.

Key Insight: Your deductible only comes into play when you make a claim for damage to your own car through your Collision or Comprehensive coverage. It doesn't apply when your insurance is paying for someone else's car or medical bills.

This setup is a fundamental part of how insurance is designed to protect consumers within the massive global auto insurance market, which is valued at roughly $1.3 trillion. In states with higher insurance costs, drivers frequently raise their deductibles to get their premiums down to a more manageable level. To see how this plays out in a specific market, take a look at our guide on finding affordable car insurance in Florida. As data analytics get more sophisticated, this ability to customize deductibles is gaining traction worldwide.

The Financial Seesaw of Deductibles and Premiums

Think of your car insurance deductible and your premium as two ends of a financial seesaw. When one goes up, the other has to come down. This inverse relationship is the most powerful tool you have for controlling your insurance costs, but making a smart decision means understanding why it works. It’s not just some arbitrary rule; it’s a core principle of how insurance companies manage risk.

From the insurer's perspective, a higher deductible means you're agreeing to take on a larger share of the initial financial risk. Let's say you have a $1,000 deductible. If you get a dent that costs $800 to fix, you won't file a claim because you’d be paying the entire bill yourself anyway. This simple fact discourages small, frequent claims, which are surprisingly expensive for insurers to process.

By choosing a higher deductible, you’re basically telling your insurer, "I'll handle the small stuff, but I need you for the big, expensive disasters." They reward you for accepting this greater personal risk by giving you a lower premium.

Quantifying the Savings

This isn't just about a few dollars here and there; the savings can be significant. Moving from a very low deductible to a more moderate one often gives you the biggest bang for your buck. But just how much can you actually save?

The table below gives you a general idea of the premium reduction you might see when you raise your deductible.

Deductible Increase vs Potential Premium Savings

| Deductible Increase | Typical Premium Reduction Range | Best For |

|---|---|---|

| $250 to $500 | 15% – 30% | Drivers seeking a balance between lower premiums and a manageable out-of-pocket cost. |

| $500 to $1,000 | 7% – 28% | Financially stable drivers who can comfortably cover a $1,000 expense and want to maximize premium savings. |

| $1,000 to $2,000 | 2% – 15% | Owners of older, less valuable cars or those with a robust emergency fund. |

As you can see, that first jump from $250 to $500 can slash your costs pretty dramatically. Pushing it higher continues to provide savings, though often with diminishing returns. To get even more out of your policy, you can look into other discounts. For instance, our guide on the benefits of bundling home and auto insurance walks you through another great way to lower your overall costs.

A higher deductible signals to your insurer that you are a lower-risk partner in the policy agreement. It’s a strategic choice that directly lowers your ongoing costs by reducing the insurer's potential payout on smaller claims.

This strategy is more important than ever as insurance costs keep changing. While the sharp premium hikes of 16.5% we saw in 2024 have thankfully slowed, rates are still climbing due to rising repair costs and other market pressures. You can read more about how auto insurance rates are changing in 2025 on PR Newswire. To counter this, insurers are actively encouraging higher deductibles to keep policies affordable. Balancing this seesaw correctly is your best move for long-term financial health.

How to Choose the Right Deductible for You

Alright, now that we've broken down what a deductible is and how it works, let's get to the important part: figuring out the right number for you. This isn’t about just chasing the lowest possible premium. It's a strategic decision, a balancing act between what you pay every month and what you could realistically shell out if you had to file a claim.

Choosing your deductible really boils down to asking yourself three honest questions.

Your Personal Deductible Checklist

Before you land on a number, take a moment to walk through this simple checklist. Your answers will steer you toward the deductible that makes the most sense for your wallet and your peace of mind.

- The Emergency Fund Test: If you had to write a check for the deductible amount tomorrow, could you do it without derailing your budget or going into debt? If a $1,000 deductible would send you into a financial tailspin, you’ll want to look at a lower, more manageable number.

- Your Car’s Value: Take a hard look at what your car is actually worth today. It doesn't make much sense to pay higher premiums for a super-low deductible on an older car that isn't worth a whole lot. For some vehicles, the extra cost of that low deductible over a year could be a significant chunk of the car's total value.

- Your Personal Risk Tolerance: Are you someone who drives cautiously on quiet back roads, or are you navigating a chaotic city commute every day? Your daily driving habits, and frankly, how much risk you’re willing to shoulder yourself, play a huge role in this decision.

These three points cut through all the insurance jargon and get right to the heart of what matters for your specific policy.

Finding Your Driver Persona

To make this even more practical, let's look at a few common driver profiles. See which one sounds most like you—it can be a great starting point for building your own deductible strategy.

-

The Cautious Commuter with a New Car

You’ve got a newer, more valuable car and a healthy emergency fund saved up. You’re a safe driver, but you want excellent protection just in case. A moderate $500 deductible is often a perfect fit here. Your premium stays affordable, but you know a claim won't be a catastrophic expense. -

The Budget-Conscious Driver

Your main goal is keeping monthly bills low. Your car is dependable, but it’s not fresh off the lot. A $1,000 deductible is probably your best bet. You’ll see some real savings on your premium, which is great for your monthly cash flow. Just make sure you have that grand stashed away in case you need it. -

The Owner of an Older, Paid-Off Car

Your trusty car’s market value is on the lower side—maybe just a few thousand dollars. In this case, you might look at a high deductible like $1,500 or even $2,000. Some people in this situation even consider dropping collision and comprehensive coverage altogether, because the cost may no longer justify the potential payout.

Key Insight: Your deductible isn't just an arbitrary number on a policy document. It's a direct reflection of your personal financial plan, tying together your savings, your car's worth, and your comfort level with risk.

This same personalized thinking applies when protecting any of your valuable assets. The way you approach insuring your daily driver is completely different from, say, covering a unique collection. You can see how this plays out by reading our guide on insuring fine art.

When you start connecting these insurance concepts to your actual life, a confusing choice becomes an empowered, confident decision.

Clearing Up Common Deductible Misconceptions

https://www.youtube.com/embed/AwVUA15hNs0

When it comes to car insurance, a few stubborn myths can cause a lot of confusion and even lead to some expensive mistakes. Your deductible is often right at the heart of these misunderstandings. Let’s tackle the most common ones head-on so you can feel completely confident about your policy.

One of the biggest misconceptions is that you have to "pay your deductible to the insurance company." That's not how it works at all. Your deductible is simply your share of the repair cost, which you'll almost always pay directly to the auto body shop.

Your insurance company then steps in to cover the rest of the bill. It’s your contribution, not some fee you send to your insurer.

Myth 1: You Always Pay a Deductible After an Accident

This is a really common belief, but it’s flat-out wrong. You only pay a deductible when you file a claim for damage to your own vehicle under your collision or comprehensive coverage.

You will not pay a deductible in these situations:

- Another driver is at fault, and their insurance is covering your repairs.

- You are filing a claim directly against the other person’s liability policy.

- The claim is only for liability coverage (meaning, damage you caused to someone else's car or property).

Your deductible only comes into play when you’re fixing your own car.

Myth 2: A Lower Deductible Is Always Better

Sure, a lower deductible means you'll pay less out of your own pocket if you have an accident, but that doesn't automatically make it the "better" choice for everyone. This idea completely ignores the other side of the financial equation: your premium.

A low deductible almost always means you'll be paying a higher premium month after month. Over a few years, that extra cost can easily add up to more than you would have saved on a single claim. The right choice is all about balancing what you could comfortably pay after an incident with what you're willing to pay on an ongoing basis. This kind of financial thinking is a key part of managing risk, and it applies to other policies, too—for instance, understanding why renters insurance is important also sheds light on smart financial protection.

Your deductible is a strategic tool. The "best" one is the one that aligns with your personal financial situation, risk tolerance, and the value of your vehicle.

By busting these myths, you get a much clearer picture of how car insurance deductibles really work. And that clarity is the first step toward making smarter decisions for your policy and your wallet.

Your Top Car Insurance Deductible Questions, Answered

Alright, we've covered the fundamentals, but car insurance really comes to life in those specific "what-if" moments. Let's tackle some of the most common questions drivers have about their deductibles so you know exactly what to expect when it counts.

What Happens to My Deductible if My Car Is Totaled?

Even when a car is declared a total loss, your deductible is still part of the equation. Your insurance company will first figure out your car's actual cash value (ACV)—what it was worth right before the crash.

From there, they'll subtract your deductible from that ACV and cut you a check for the remaining amount.

For instance, if your car’s ACV was $10,000 and you have a $1,000 deductible, your final payout would be $9,000. That money is then yours to put toward a new vehicle.

Do I Have to Pay a Deductible if an Accident Isn’t My Fault?

Usually, no. If another driver is clearly at fault and their insurance company accepts full responsibility, their policy should cover 100% of your damages. In this scenario, you'd file a claim directly against their liability coverage, and your own deductible wouldn't even come into play.

Sometimes, though, things get complicated. If the at-fault driver is uninsured, or if there's a dispute over who caused the accident, you might choose to pay your own collision deductible just to get your car repaired without waiting. Your insurance company will then work to get that money back from the other party in a process called subrogation. If they succeed, you get your deductible refunded.

Final Takeaway: The question of who pays the deductible almost always comes down to who is determined to be at fault for the accident.

Can I Change My Deductible Amount?

Absolutely. You have the flexibility to change your deductible at any point—you don’t have to wait for your policy to renew. Just give your insurance agent a call to adjust your collision and comprehensive deductible amounts.

Remember, any change you make will immediately impact your premium. If you raise your deductible, your rate goes down. If you lower it, your rate goes up. It's a useful lever you can pull anytime your financial picture or comfort with risk changes.

Figuring out the ins and outs of car insurance can feel overwhelming, but you're not on your own. The team at Wexford Insurance Solutions is here to offer personalized advice and help you strike the perfect balance between coverage and cost. Get a clear, competitive quote today by visiting https://www.wexfordis.com.