Navigating the maze of small business insurance requirements can feel like a headache waiting to happen. But it boils down to something pretty simple: some insurance is required by law, and other types are just plain smart to have if you want to stay in business.

Think of it like building a house. The law requires you to have a solid foundation and structural walls—that’s your mandatory coverage. But you'd be crazy not to add a roof, windows, and locks to protect everything inside from storms or intruders. Those are your recommended, operationally essential policies.

What Insurance Does a Small Business Really Need?

When you're just starting out, you're juggling a million things. Insurance often feels like another complicated item on an endless to-do list. The trick is to separate the "must-haves" from the "should-haves." Getting this wrong can be a costly mistake, potentially wiping out your entire business after one lawsuit or unexpected disaster.

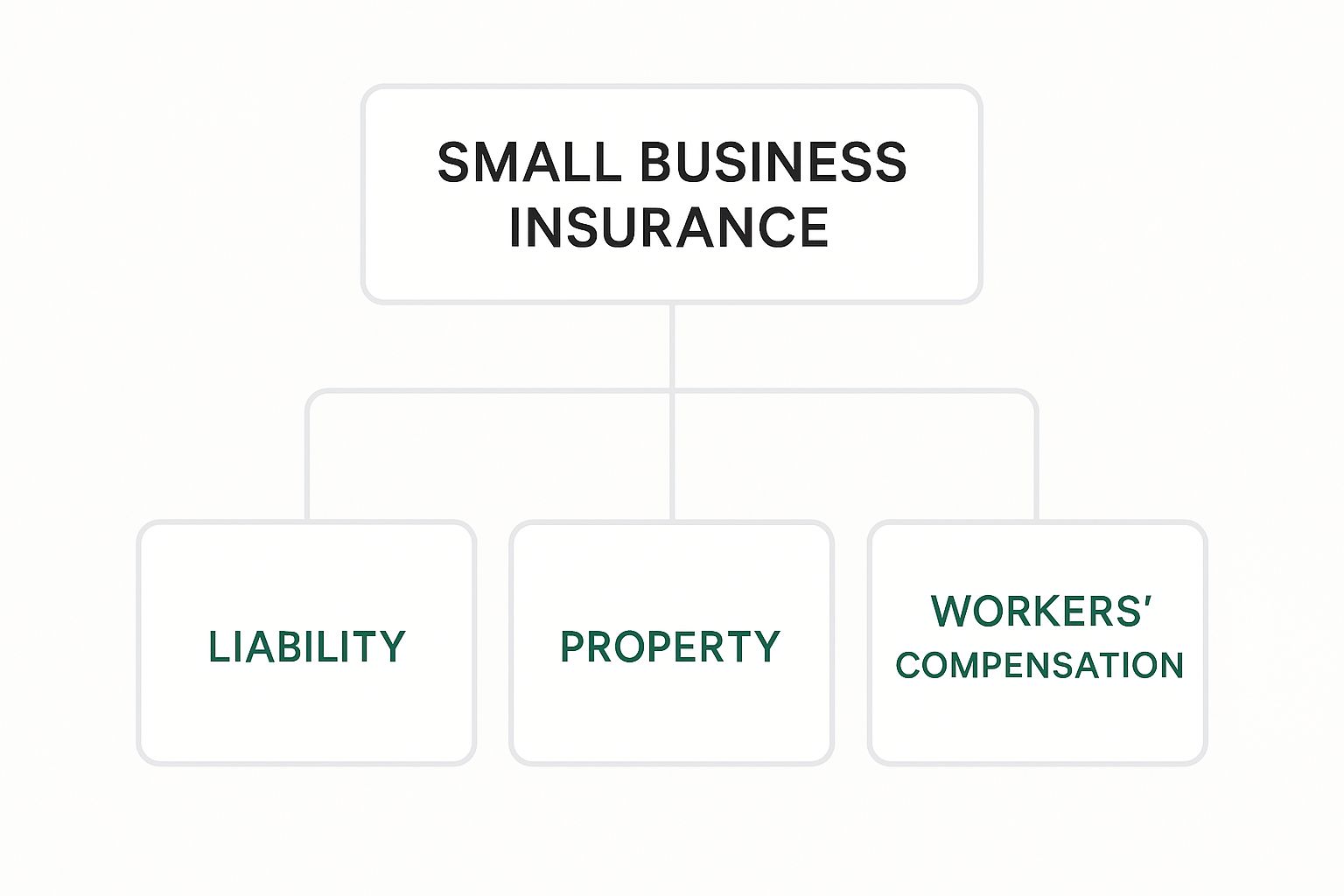

This image gives a great visual breakdown of the main insurance categories you'll encounter.

As you can see, it really comes down to three things: protecting your business from lawsuits (liability), protecting your stuff (property), and taking care of your people (employees).

Mandatory vs. Recommended Coverage: What's the Difference?

Your first job is to figure out what coverage the law demands. These rules can change dramatically based on your state, what industry you're in, and, most importantly, whether you have employees. Skipping these can land you in hot water, with fines or even forced shutdowns.

- Legally Required Insurance: This is the non-negotiable stuff. The classic example is Workers' Compensation. Most states say you need it the moment you hire your first employee. Commercial Auto insurance for company vehicles and, in some states, disability insurance also fall into this bucket.

- Operationally Essential Insurance: This is the coverage that, while maybe not required by law, is absolutely critical for survival. Without it, you're one bad day away from a financial catastrophe.

The goal isn't just to check a legal box. It's about building a real safety net that lets you sleep at night. A solid insurance plan protects what you've built, keeps the lights on after a crisis, and gives you the peace of mind to focus on growth.

To give you a quick reference, here’s a table summarizing the core policies every business owner should know about.

Quick Guide to Core Business Insurance Policies

| Insurance Type | What It Covers | Who Generally Needs It |

|---|---|---|

| General Liability | Bodily injury or property damage claims from customers or third parties. | Virtually every business, especially those with a physical location or client interaction. |

| Commercial Property | Damage or theft of your physical assets like buildings, equipment, and inventory. | Any business that owns or rents a physical space or has valuable equipment. |

| Workers' Compensation | Medical expenses and lost wages for employees injured or sickened on the job. | Businesses with one or more employees (required in most states). |

| Professional Liability (E&O) | Claims of negligence, errors, or omissions in the professional services you provide. | Consultants, accountants, architects, and anyone providing advice or services for a fee. |

| Business Owner's Policy (BOP) | A bundled package that typically combines General Liability and Commercial Property. | Most small to medium-sized businesses in lower-risk industries. |

This table is just a starting point, but it covers the foundational policies that protect most businesses from the most common risks.

The Bedrock Policies for Your Business

For almost any small business, a couple of policies form the foundation of your protection plan. The big one is General Liability Insurance. This is your first line of defense if someone claims you caused them bodily injury or damaged their property. Think of a customer slipping on a wet floor in your shop or one of your team members accidentally breaking a client's expensive equipment. General Liability steps in to cover legal fees and settlements.

Next up is Commercial Property Insurance, which protects all your physical stuff—your office or store, computers, tools, and inventory—from disasters like a fire, storm, or break-in.

Many business owners choose to bundle these two policies into a Business Owner's Policy (BOP). A BOP is often a more affordable and straightforward way to handle two of the most critical small business insurance requirements, packaging essential liability and property coverage into one convenient policy.

Understanding Legally Required Business Insurance

Some insurance policies aren't just good ideas—they're the law. Meeting these small business insurance requirements is your first, most basic step toward operating legally and protecting your company from serious trouble, like massive fines or even being forced to shut down. Think of these policies as the foundation of your entire risk management plan, mandated by law to safeguard your employees, the public, and ultimately, your business itself.

The most common—and most critical—of these is Workers' Compensation insurance. It's essentially a pact you make with your team. This policy acts as a vital safety net, covering medical bills and a portion of lost wages if an employee gets hurt or sick because of their job. In exchange for providing this no-fault coverage, your business is generally shielded from being sued by that employee over the incident.

The Cornerstone: Workers' Compensation Insurance

The second you hire your first employee, the legal clock starts ticking on your need for Workers' Comp. While the specific rules can differ between states, the requirement is nearly universal across the country. Ignoring it can bring down a world of hurt, including fines that can run into thousands of dollars for every single day you're not covered.

Shockingly, many businesses are rolling the dice. Back in 2014, about 69% of small businesses had this essential coverage. By 2018, that number had plummeted to just 47%. This growing gap in compliance leaves both companies and their workers dangerously exposed.

Trying to figure out your state’s rules can feel a bit like navigating a maze. Some states might give you a pass if you have fewer than a certain number of employees (often three or five), while others have completely different rules for high-risk industries like construction. It is absolutely crucial to check the laws in your specific state to make sure you're compliant.

Insurance for Business Vehicles

Does your business own, lease, or rent vehicles? Do your employees ever use their personal cars for work errands? If you answered yes to any of these, then Commercial Auto Insurance is another policy you're legally required to have. Here’s why: a personal auto policy will almost always deny a claim if the accident happens during a business-related activity. One fender bender on the way to a client meeting could expose your business to a lawsuit that could sink it.

Commercial Auto insurance steps in to cover liability for injuries and property damage your business vehicles might cause, as well as damage to the vehicles themselves. States set the minimum liability limits, but in my experience, it's almost always a smart move to get higher limits for real-world protection.

Key Takeaway: A personal auto policy simply won't cut it for business use. If a vehicle is being used for work—whether it’s delivering products, hauling equipment, or driving to appointments—it needs a dedicated commercial policy to cover the risks involved.

State-Specific Mandates: Disability and Beyond

Beyond those two big ones, some states have their own unique insurance requirements. A handful of jurisdictions insist that businesses provide even more protection for their employees.

- Disability Insurance: States like New York, California, and New Jersey mandate that employers provide short-term disability insurance. This policy gives employees partial wage replacement if a non-work-related injury or illness keeps them from working.

- Paid Family Leave (PFL): More and more states are also requiring PFL. This benefit provides paid time off for employees to bond with a new child or care for a family member with a serious health condition, and it's usually funded through small payroll deductions.

These legally required policies are just the starting line. Many business owners discover that bundling necessary coverages into a single plan is a smart and efficient way to handle their insurance needs. For a closer look at how that works, you can explore our guide on what is a business owner’s policy. At the end of the day, understanding and meeting these legal minimums is the first and most vital step in building a business that can withstand the unexpected.

Protecting Your Business From Common Risks

Setting aside what the law requires for a moment, some insurance policies are just plain essential. Trying to run a business without them is a high-wire act with no safety net. These coverages are the bedrock of a smart risk management plan, guarding your business against the kind of everyday mishaps and unexpected disasters that can pop up out of nowhere.

Think of these policies less as a bureaucratic chore and more as the fundamental protection for everything you've worked so hard to build.

And while they might not be legally mandatory across the board, don't be surprised if a client, landlord, or bank asks to see proof of this coverage before they'll sign a contract with you. It's a sign of professionalism and shows you’re prepared for the unexpected.

Your First Line of Defense: General Liability Insurance

Picture this: a customer takes a tumble on a freshly mopped floor in your shop. Or maybe you're a contractor, and one of your crew accidentally puts a hammer through a client's pricey custom window. These are exactly the scenarios General Liability Insurance is built for. It’s your shield against claims that your business activities caused bodily harm or damaged someone else’s property.

Without it, you’re on the hook personally for medical bills, repair costs, and—the real killer—the staggering legal fees that come with a lawsuit. A solid General Liability policy typically handles:

- Bodily Injury: Covers medical bills if a third party (like a customer) gets hurt on your property or because of your work.

- Property Damage: Pays to fix or replace property you or your team damage.

- Personal and Advertising Injury: Protects against claims of slander, libel, or copyright infringement in your ads.

- Legal Defense Costs: Takes care of attorney fees and court costs, even if the suit against you has no merit.

It's a foundational coverage, yet a 2025 analysis found that only 54% of small businesses have it. That's a huge risk, especially when you learn that 43% have been threatened with legal action and somewhere between 36% to 53% of small businesses face a lawsuit in any given year. Forgoing this policy is a massive gamble.

Protecting Your Stuff: Commercial Property Insurance

General Liability covers you when you harm others. Commercial Property Insurance, on the other hand, protects what you own. This is the policy that gets you back on your feet after a fire, a break-in, or a nasty storm wrecks your place of business.

Just stop and think about everything you need to run your business each day: your building, desks, computers, inventory, specialized tools. Now, imagine it's all gone in an instant. Commercial property coverage gives you the cash to repair or replace those critical assets, preventing a disaster from becoming a permanent shutdown.

Key Insight: A common mistake is thinking your landlord's insurance has you covered. It doesn't. The landlord's policy protects the building's structure, but it does absolutely nothing for your inventory, equipment, or any improvements you've made inside. You need your own policy for your own things.

This insurance is a must-have for any business with a physical location or valuable gear, regardless of whether you rent or own the space. Having to replace everything out-of-pocket, from merchandise to machinery, could easily sink a profitable company.

Together, General Liability and Commercial Property insurance form a powerful one-two punch against the most frequent threats your business will encounter. And as you're thinking about property and liability, it's a good idea to learn about other essential coverages. Our guide on workers compensation for small businesses is a great next step.

Is Your Business Covered for Industry-Specific Risks?

While foundational policies like general liability and property insurance are your first line of defense, they don’t cover everything. Many businesses have unique risks tied directly to their industry, and standard policies often contain exclusions for these very specific threats. Ignoring these gaps is like leaving a side door unlocked.

To be truly protected, you need to add specialized policies that act like the right tool for a very specific job.

Think of it this way: a basic toolbox is perfect for hanging a picture, but you’d never use a standard wrench to fix a delicate Swiss watch. In the same vein, a generic insurance plan won't help a financial advisor who gets sued for bad advice or a construction firm facing a costly project delay.

This is exactly why specialized coverage exists—to provide targeted protection against the distinct challenges you face every day.

Coverage for Professional Advice and Services

Does your business charge a fee for expert advice or services? If so, you carry a risk that retailers and restaurants simply don't: being sued for professional mistakes. A simple error in your work or an oversight in your process could cause a major financial loss for a client, landing you in a very expensive lawsuit.

This is where Professional Liability Insurance, often called Errors & Omissions (E&O) Insurance, comes in. It’s built specifically to handle claims of negligence, malpractice, or mistakes made while delivering your services.

- Who needs it? It's essential for accountants, architects, consultants, IT specialists, marketing agencies, and any professional providing expert guidance.

- What it covers: It helps with the staggering costs of legal defense, settlements, and judgments related to your professional work.

Without E&O insurance, a single unhappy client could put your entire business at risk, forcing you to fund a legal battle from your own pocket. For builders and contractors, a similar policy is a must-have. You can get a much deeper understanding by reading our detailed guide on builders risk insurance.

Guarding Against Digital Dangers

In our connected world, almost every business—no matter how small—handles sensitive information. We’re talking about customer credit card details, employee social security numbers, and private client data. All of this makes you a target for cybercriminals. A data breach is far more than just a tech issue; it's a financial and reputational nightmare waiting to happen.

Cyber Liability Insurance is the modern shield that protects you from the fallout of a digital attack or data breach. For any company with a website, an email list, or a payment processor, it's quickly becoming one of the most critical policies to have.

The disconnect here is dangerous. While 87% of small businesses report being concerned about cyber threats, a shocking 64% still think they're too small to be a target. The reality is that attackers often go after the easiest victims, not just the biggest ones.

A robust cyber policy can cover a whole host of expenses that would otherwise be crippling, including:

- Notifying customers whose data was compromised.

- Providing credit monitoring services for victims.

- Hiring a public relations firm to manage your reputation.

- Paying for data recovery and system restoration.

Keeping the Lights On After a Disaster

Imagine a fire, a hurricane, or even a major theft forces you to close your doors for weeks, or maybe even months. Your revenue grinds to a halt, but your bills don't. Rent, payroll, and loan payments still need to be paid. This is a critical point where many businesses are forced to close for good, even if they have property insurance to cover the physical repairs.

Business Interruption Insurance was created for this exact scenario. It replaces the income you lose while your operations are suspended due to a covered event. This allows you to meet your financial obligations and stay afloat until you're back on your feet.

As of 2025, about 33% of small businesses now carry business interruption insurance, a figure that shows a growing awareness of just how fragile day-to-day operations can be. This policy is what ensures a temporary disaster doesn't become a permanent one.

Choosing the Right Insurance Policies and Providers

Finding the right insurance isn't just about ticking boxes on a generic checklist. It's really about striking a smart balance between solid coverage, a price you can live with, and a provider you actually trust. The goal is to build a safety net that’s genuinely tailored to how your business operates day in and day out.

The first step is a good, honest look at your risks. Seriously, map out your daily operations. A construction company juggling heavy machinery and a fleet of trucks has a completely different risk profile than a graphic design studio run out of a spare bedroom.

To get the ball rolling, think about these core factors:

- Your Industry and Services: What are the unique dangers of your work? A consultant giving bad advice faces a professional liability lawsuit, while a shop owner is more worried about a customer slipping on a wet floor.

- Employee Count: The minute you hire your first employee, your small business insurance requirements change dramatically. Workers' compensation immediately becomes a critical—and usually mandatory—part of the equation.

- Revenue and Assets: How much are your tools, inventory, and property worth? Your annual revenue and the value of your assets will directly shape how high your policy limits need to be.

Decoding Your Insurance Policy

As you start getting quotes, you'll see a few terms pop up again and again. Getting a handle on them is the key to comparing apples to apples and avoiding nasty surprises when it's time to file a claim. Think of them as the three main levers you can pull to adjust your coverage and cost.

Key Insurance Terms Explained:

- Premium: This one's simple. It’s the bill you pay—monthly or yearly—to keep your insurance active.

- Deductible: This is the amount of money you have to pay out of your own pocket on a claim before the insurance company kicks in a single dollar. A higher deductible typically lowers your premium, but you have to be sure you can afford that out-of-pocket hit.

- Policy Limit: This is the absolute maximum amount the insurer will pay out for a single covered claim. If you set this limit too low, a major disaster or lawsuit could leave you paying the rest of the bill yourself, which could be financially devastating.

Your goal is to find that sweet spot: an affordable premium, a deductible you could realistically pay, and policy limits high enough to let you sleep at night. That balance is the foundation of any good insurance plan.

Finding the Right Partner

Once you’ve sized up your risks and know the basic lingo, it’s time to start shopping. You have two main paths: go directly to an insurance company that uses its own captive agents, or work with an independent agent who represents many different carriers.

An independent agent can be a massive advantage for a small business owner. They do the shopping for you, pulling quotes and comparing policies from a wide range of insurers to find the best fit for your specific needs and budget. They save you a ton of time and can often uncover deals you’d never find on your own.

Never hesitate to get multiple quotes and put them side-by-side. Look past the price tag and dig into the fine print—what’s actually covered and, just as importantly, what’s excluded. And remember, your business will change. If you find your current provider isn't keeping up, it's good to know how to switch insurance providers to keep your coverage in step with your goals. Choosing the right partner is every bit as important as choosing the right policy.

Common Questions About Business Insurance

Jumping into the world of small business insurance requirements can feel like trying to solve a puzzle with a few pieces missing. It’s completely normal to have questions when your livelihood is on the line. To help you connect the dots, we’ve tackled some of the most common questions we hear from business owners every day.

How Much Does Small Business Insurance Cost?

The honest answer? It depends. Think about buying a car—you wouldn't expect a basic sedan to cost the same as a heavy-duty work truck. Insurance works the same way; your final premium is built around your business’s specific risk profile.

Several key factors will shape what you pay:

- Your Industry: A roofing contractor faces significantly more risk on a daily basis than a graphic designer working from home. Naturally, their insurance will reflect that.

- Number of Employees: More people on your team means more potential for workplace injuries, which directly affects your workers' comp costs.

- Your Claims History: A business with a squeaky-clean record will almost always pay less than one that has filed several claims in the past.

- Where You're Located: Operating in a flood-prone coastal area or a city with high theft rates can bump up the cost of your property coverage.

As a rough ballpark, a small business might see a basic General Liability policy run anywhere from $400 to $2,000 annually. Many find great value in a Business Owner's Policy (BOP), which smartly bundles liability and property coverage, often at a better price. The only way to know your true cost is to get a quote tailored specifically to your business.

Do I Need Insurance as a Sole Proprietor?

Yes. This is probably one of the most important things to understand if you're a sole proprietor. Legally, there is no separation between you and your business—you are one and the same.

That means if someone sues your business, they're really suing you. There's no corporate veil to hide behind. Your personal assets, from your car and savings account to your home, could be used to satisfy a legal judgment.

For a sole proprietor, insurance isn’t just a line item in your budget; it’s a personal financial shield. A single lawsuit could jeopardize everything you’ve built, both in your business and your personal life.

At the very least, you should have General Liability insurance to cover claims of injury or property damage. If you provide any kind of professional advice—as a consultant, designer, or programmer—then Professional Liability (E&O) insurance is equally essential. Besides, many clients won't even work with a freelancer or contractor who can't show a certificate of insurance, so it's a must-have for winning bigger jobs.

What's the Difference Between General and Professional Liability?

This question comes up all the time, but the distinction is pretty straightforward once you think about the type of damage each one covers.

Let’s use a simple analogy. Imagine you’re a consultant working out of a small office.

General Liability Insurance Covers Physical Damage

- What it does: This is for tangible, real-world accidents. It handles claims of bodily injury to someone or damage to their property. Think of it as your "slip and fall" coverage.

- Example: A client comes to your office, trips on a rug, and breaks their arm. Your General Liability policy would step in to cover their medical costs and any legal fees if they sue.

- Another Example: You’re at a client’s office and accidentally spill coffee on their server, frying it. General Liability would pay to replace the damaged equipment.

Professional Liability Insurance Covers Financial Damage

- What it does: This is for intangible, economic harm caused by mistakes you make in your professional work. It's often called Errors & Omissions (E&O) insurance for a reason.

- Example: As a consultant, you give bad advice that directly causes your client to lose a major contract. They sue you for the financial loss. Your Professional Liability policy is designed to cover your defense and any settlement.

- Another Example: An accountant makes a typo on a tax return, resulting in hefty IRS penalties for their client. E&O insurance would handle the fallout from that mistake.

In short, General Liability is for when you cause physical harm ("I broke it"), while Professional Liability is for when your work causes financial harm ("My advice broke their business"). Grasping these core ideas is a great start, and you can explore them further in our complete guide on business insurance basics.

Car Insurance Deductible Explained Simply

Car Insurance Deductible Explained Simply Understanding Commercial Property Insurance Cost | Get the Right Coverage

Understanding Commercial Property Insurance Cost | Get the Right Coverage