Let's get straight to the question on every business owner's mind. For many small businesses, the average commercial property insurance cost falls somewhere between $1,000 and $3,000 per year. But that's just a ballpark figure—the actual number can swing dramatically based on your unique circumstances.

Think of it like getting car insurance. A reliable sedan parked in a secure garage in a sleepy suburb is going to be far cheaper to insure than a high-performance sports car navigating the streets of a major city. The same logic applies to your business property.

What Determines Your Commercial Property Insurance Cost?

Trying to find a one-size-fits-all price for commercial property insurance is a fool's errand. Insurers don't just pull a number out of a hat; they're more like risk detectives, meticulously piecing together a profile of your specific operation. The final premium you're quoted is a direct result of their investigation.

When you understand what they're looking for, you gain the power to influence that final number. Let's break down the key drivers that shape your premium.

To give you a clearer picture, here’s a quick overview of the main elements insurers evaluate when calculating your commercial property insurance cost.

Key Drivers of Your Insurance Premium

| Cost Driver | Why It Matters | Real-World Example |

|---|---|---|

| Construction & Building Value | The materials and age of your building directly impact its resilience to damage like fire or wind. | A modern, steel-frame building with a new roof will cost less to insure than an older, wood-frame structure. |

| Occupancy & Industry | What you do inside the building defines your operational risk. | An administrative office has a much lower risk profile than a restaurant with deep fryers or a woodworking shop. |

| Protection & Security | Proactive safety measures show insurers you're serious about preventing losses. | Installing a monitored fire and burglar alarm system or a modern sprinkler system can lead to significant discounts. |

| Location & Exposure | Where your property is located determines its exposure to external threats, both natural and man-made. | A property in a coastal flood zone or an area with high crime rates will face higher premiums than one in a low-risk zone. |

These factors are the foundation, but the story doesn't end there. The specific coverages you select and your business's past claims history also play a huge role. To get a handle on the baseline coverages you might need, our guide on small business insurance requirements is a great place to start.

Key Takeaway: Your insurance premium isn't an arbitrary fee. It's a carefully calculated price based on a deep analysis of your business's specific risks—from the bricks and mortar of your building to the nature of your daily work.

By understanding how these pieces fit together, you can start to see where you have control. Pinpointing your high-risk areas allows you to take smart, actionable steps to manage and, hopefully, lower your insurance costs over the long haul.

How Insurers Calculate Your Risk Profile

Ever wondered how an insurance company comes up with the price for your commercial property policy? It’s not just a number pulled out of a hat. Insurers use a detailed, time-tested framework to figure out your business's specific level of risk. It’s a process that boils down to a simple acronym: COPE.

COPE stands for Construction, Occupancy, Protection, and Exposure. These are the four cornerstones that underwriters use to build your risk profile, which in turn determines what you'll pay for coverage. Think of it as the insurer's roadmap to understanding your business. Once you know what they're looking for, you can start to see your property through their eyes—and spot opportunities to manage your costs more effectively.

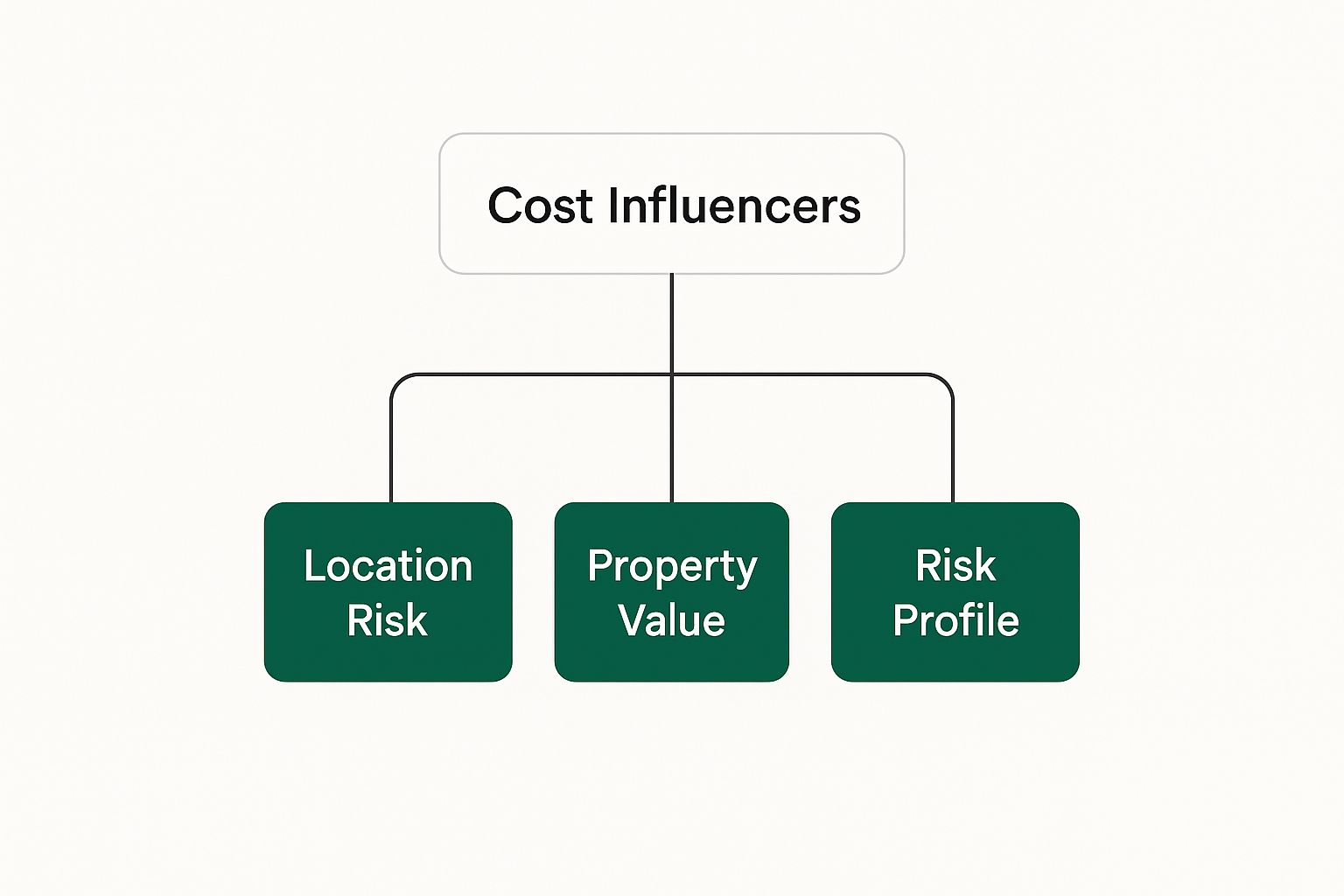

This image gives you a bird's-eye view of the major factors that influence your premium, with the COPE elements right at the heart of the calculation.

As you can see, your risk profile works hand-in-hand with your property's value and location to directly shape that final number on your policy. Let's break down what each of these factors really means.

Construction: What Your Building Is Made Of

First up is Construction. This is all about the physical stuff—the literal nuts and bolts of your building. Insurers want to know how well your property will hold up against common threats like fire, wind, or even heavy snow.

It's common sense, really. A modern building with a steel frame and concrete walls is considered "fire-resistive" and will get a much better rate than an older, wood-frame structure that could go up in smoke. Likewise, a brand-new roof is a lot more appealing to an underwriter than one with aging, curled shingles that could be torn off in a strong windstorm.

Key construction details they look at include:

- Building materials: Is it a wood frame, masonry, non-combustible steel, or top-tier fire-resistive concrete?

- Building age: Older buildings can be charming, but they often hide outdated wiring or plumbing, which signals a higher risk.

- Roof condition: The age, material, and upkeep of your roof are huge factors in protecting against weather damage.

Occupancy: What Happens Inside Your Building

Next, insurers look at Occupancy, which is just a formal way of asking, "What do you do in there?" The risk profile for a quiet accounting firm is worlds apart from that of a busy restaurant with deep fryers and open-flame cooking.

Think about it from their perspective. A retail store with constant foot traffic has a much higher chance of a slip-and-fall claim than a small office. A manufacturing plant that uses heavy machinery or stores flammable chemicals presents a significant fire and liability hazard. Your day-to-day operations are a massive piece of the puzzle.

Expert Insight: When it comes to occupancy, an insurer’s main focus is the level of hazard. A woodworking shop, with all its sawdust and flammable finishes, will always be seen as a higher risk than a law office—even if they're located in identical buildings. What you do inside truly defines the risk.

Protection: How You Safeguard Your Property

This brings us to Protection. This part of the assessment is all about the proactive steps you take to prevent or minimize losses. Insurers love to see business owners who invest in safety, and they often reward them with meaningful discounts on their premiums.

Installing a monitored fire and burglar alarm system sends a clear signal that you’re serious about protecting your assets. And a commercial-grade sprinkler system? That’s one of the single most effective ways to lower your insurance costs, as it can stop a small fire from becoming a catastrophic one.

Some of the most effective protection measures are:

- Fire suppression: Sprinkler systems, properly maintained fire extinguishers, and centrally monitored fire alarms.

- Security systems: Monitored burglar alarms, surveillance cameras, and high-quality locks.

- Proactive maintenance: Keeping your electrical, plumbing, and HVAC systems in top shape.

Today's insurers use advanced analytics to precisely price the impact of these protective measures. To get a better sense of how data is changing the game, you can dive into our guide on the role of risk and analytics in modern insurance.

Exposure: External Risks Beyond Your Control

Finally, there's Exposure. This covers all the external threats that are largely out of your hands but still impact your property. It’s all about what’s happening around you.

Is your business located next door to a chemical plant or another high-hazard operation? Is your property in a designated flood zone or a region prone to wildfires? Even if your own business is a model of safety, these neighboring risks can drive up your premium. On the flip side, being close to a fire hydrant and a well-regarded fire station can actually work in your favor and lower your costs.

After a few very tough years for business owners, the good news is that the market is starting to stabilize. While rate hikes often topped 20% recently, most businesses with a clean claims history are now seeing more manageable single-digit increases.

Where You Are and When You Buy: Market Conditions and Location

While the specifics of your building are a huge part of the puzzle, your commercial property insurance cost is also at the mercy of powerful forces you can’t control. Think of these as the macro-level factors: the overall health of the insurance market and the simple, unchangeable fact of your property's address.

Honestly, these external factors can have just as much impact as the most advanced fire suppression system you could install. Your premium isn't just a number; it’s a reflection of a much bigger economic picture that's always in flux.

The Ebb and Flow: Hard vs. Soft Insurance Markets

The insurance industry moves in cycles, a lot like the stock market. These are known as "hard" and "soft" markets. Getting a feel for which cycle we're in can explain why your rates might jump (or even drop) even when nothing about your business has changed.

-

Soft Market: This is a buyer's paradise. Insurers are doing well, flush with capital, and hungry for new business. That competition drives premiums down, broadens coverage, and makes them more flexible on terms. It's the best time to be shopping for a policy.

-

Hard Market: Now, picture the opposite. A hard market is a seller's market, often triggered by a string of massive, costly disasters like a season of destructive hurricanes or widespread wildfires. These events drain insurers' bank accounts. With less cash on hand, they get cautious. Underwriting gets tougher, premiums shoot up, and they might even stop covering certain risks entirely.

Here's the frustrating part: even if your business is thousands of miles from any disaster, you'll still feel the pinch of a hard market. When insurers pay out billions for claims in one area, they often have to raise rates across the board to rebuild their financial stability.

Why Your Business Address Is Everything

If market conditions are the "when," your location is the "where"—and it's a non-negotiable, foundational piece of your insurance premium. At its core, an insurer's job is to predict the odds of you filing a claim, and geography is one of their most trusted crystal balls.

It’s just common sense. A boutique shop on the Florida coast faces a completely different set of risks than an identical store in Ohio. The Florida business has to worry about hurricanes and storm surges, while the Ohio business might be more concerned with blizzards or tornadoes.

Key Takeaway: Insurers aren't just guessing. They use highly sophisticated catastrophe (or "CAT") models that crunch decades of data on earthquakes, floods, wildfires, and hail for specific geographic zones. Your property's address pins it on their map, setting an immediate baseline for your premium.

This location-based risk goes beyond Mother Nature, too. Underwriters also look at:

- Crime Rates: Is your property in an area with high rates of theft, burglary, or vandalism? Your premium will reflect that.

- Nearby Hazards: Being located next to a chemical plant or even a fireworks factory will naturally increase your perceived risk.

- Fire Protection: On the flip side, proximity to a well-equipped fire station and reliable hydrants can work in your favor and lower your costs.

After a tough period of steep rate hikes, there's some good news. The market is showing signs of stabilizing. A recent commercial insurance pricing survey from Willis Towers Watson found that while overall commercial insurance rates grew by 5.3% in the first quarter, the increase for property insurance specifically was minimal—a welcome change from the double-digit jumps of the recent past.

These large-scale events can disrupt your operations even if your own building is untouched, which is why other coverages are so important. You can learn more about how to protect your income stream by reading our guide on business interruption insurance cost.

Ultimately, the broader market and your spot on the map set the stage for your insurance costs before an underwriter even begins to look at what your building is made of.

Choosing Coverage That Balances Cost and Protection

When it comes to commercial property insurance, the cheapest policy is rarely the best one. The real art is in striking the right balance between what you pay each month and the financial shield your business has when disaster strikes. The specific coverages you select are the levers you pull to find that sweet spot.

Think of it like choosing a meal plan. You can pick the basic, set menu with a few specific options, or you can opt for the all-you-can-eat buffet that covers just about everything. In the insurance world, we call these "named-peril" and "all-risk" policies.

- Named-Peril Policy: This is your set menu. It only covers losses from the specific dangers, or "perils," explicitly listed in the policy—things like fire, theft, or wind damage. If it's not on the list, you're on your own.

- All-Risk Policy: This is the buffet. It covers damage from any and every peril unless it’s specifically excluded in the fine print. Common exclusions are major events like floods, earthquakes, or acts of war.

A named-peril policy might have a lower sticker price, but an all-risk policy provides far more comprehensive protection. That broader coverage can be a business-saver when something truly unexpected happens.

Replacement Cost vs. Actual Cash Value

Another huge decision is how your policy pays you back after a loss. This choice directly affects your premium, but more importantly, it determines how well you can actually recover. You’ll generally face two options.

Actual Cash Value (ACV) pays you for what your damaged property was worth at the moment it was destroyed. It’s simply the replacement cost minus depreciation. For instance, if a fire takes out your five-year-old office computers, ACV only gives you what those used machines were worth, which is nowhere near enough to buy new ones.

Replacement Cost Value (RCV), on the other hand, pays the full amount needed to replace your damaged property with new items of similar kind and quality. There’s no deduction for depreciation. Yes, RCV policies cost a bit more, but they are often the only way to get your business back up and running without digging deep into your own pockets.

The Bottom Line: Paying a slightly higher premium for Replacement Cost Value can be the difference between a temporary setback and a permanent closure. It’s what gives you the actual funds to rebuild and re-equip your business completely.

Filling the Gaps with Essential Add-Ons

Even a great all-risk policy has its limits. Depending on your location and what your business does, you'll likely need to bolt on a few extra coverages—known as endorsements or riders—to plug any holes. These add-ons tackle specific risks that could otherwise be financially catastrophic.

Some of the most critical add-ons to consider are:

- Business Interruption Insurance: Honestly, this is one of the most important coverages a business can have. If a disaster forces you to close your doors for a while, this insurance replaces lost income and covers ongoing expenses like rent and payroll, keeping you afloat until you can reopen.

- Flood or Earthquake Insurance: Standard policies almost universally exclude damage from floods and earthquakes. If your business is in a high-risk zone for either, you absolutely need to purchase this coverage separately.

- Sewer Backup Coverage: Damage from backed-up sewers and drains is another very common exclusion. This inexpensive rider can save you from an incredibly messy and surprisingly expensive cleanup.

Taking a hard, honest look at your specific vulnerabilities is the key to building a policy that truly protects you. A great way to do this is by performing a detailed insurance gap analysis to find any dangerous holes in your current coverage. By strategically choosing your coverages and add-ons, you can create a policy that gives you peace of mind without forcing you to pay for protection you don't actually need.

Actionable Ways to Lower Your Insurance Costs

While you can't change your property's location or broad market trends, you are absolutely not powerless when it comes to your commercial property insurance cost. Think of it like this: insurers want to partner with safe, responsible businesses. By actively reducing your property's risk, you're essentially proving you're a good partner, which often gets rewarded with better rates.

These aren't just quick fixes. They're ongoing strategies that can lead to real, year-over-year savings. Let's dig into some of the most effective ways you can take control of your premiums.

Bolster Your Building’s Defenses

The most hands-on way to lower your insurance cost is to make your property physically tougher and more secure. These upgrades directly target what insurers call "Protection" in their risk assessments. Every improvement you make reduces the odds of a claim, and that’s music to an underwriter’s ears.

Here are a few high-impact upgrades to consider:

- Fire Suppression Systems: Installing a modern, monitored sprinkler system is one of the single biggest moves you can make. It can stop a fire in its tracks, preventing a total disaster and often earning you a hefty discount on your premium.

- Monitored Security Alarms: A system that automatically calls the police or fire department is a huge deterrent for criminals and a massive risk-reducer.

- Updated Utilities: Let's be honest, old wiring is a terrifying fire hazard. Upgrading your electrical, plumbing, and HVAC systems gets rid of a major, often invisible, threat.

- Roof Maintenance: Your roof is the building's first line of defense against the elements. A well-kept roof (or a brand new one) can prevent the kind of water damage that leads to expensive claims.

Even smaller steps add up. Things like installing better deadbolts, adding security cameras, or applying shatter-resistant film to windows all contribute to a safer profile. Just be sure to document every single upgrade to share with your insurance provider at renewal time.

Good news for business owners: the wider insurance market might be on your side. After years of increases, global commercial insurance rates have started to dip. A recent Marsh Global Insurance Market Index report, for example, noted a 3% average decrease in global commercial premiums—the third quarter in a row of falling rates. As insurers get more competitive, the safety improvements you make could have an even bigger impact. You can dive into the full report on these market shifts and what they mean for your commercial property insurance cost at Insurance Journal.

Fine-Tune Your Policy and Your Partnerships

Physical upgrades are crucial, but don't stop there. How you structure your policy and who you choose to work with can make a huge difference in what you pay.

One of the oldest tricks in the book is to adjust your deductible. A deductible is simply the amount you pay out of pocket before your insurance coverage starts. If you raise your deductible from, say, $1,000 to $2,500, you’re telling the insurer you'll handle the smaller stuff yourself. In return, they'll almost always lower your premium. This is a smart move if you have enough cash on hand to comfortably cover that higher amount if a minor claim pops up.

Finally, never underestimate the value of having a pro in your corner. Working with an independent insurance broker can be a total game-changer. Unlike an agent who works for just one company, an independent broker works for you. They can take your policy to the entire market, shopping around to find that perfect sweet spot of great coverage at a fair price. A yearly policy review with your broker is a must—it ensures your coverage keeps up with your business and that you're not leaving money on the table.

How Filing a Claim Affects Your Future Rates

It’s tempting to think of your commercial property insurance as a financial safety net you can use anytime disaster strikes. While that’s true, it’s also important to understand that your claims history directly impacts your future commercial property insurance cost. Insurers don't just look at your building; they look at your track record.

Think of it like your personal car insurance. One freak accident might not send your rates through the roof, but a pattern of fender benders tells your insurer you're a risky driver. The same logic applies here. A history of frequent, small claims can be a huge red flag for underwriters, signaling that your business might be more prone to losses than others.

This doesn't mean you should be afraid to use your policy. That’s what it’s for! When a fire, a major storm, or a significant theft happens, filing a claim is absolutely the right move. The key is knowing when to lean on your coverage and when it’s smarter to handle minor issues out-of-pocket.

The Impact of Claims on Your Premiums

It’s simple: a business with a clean claims record is seen as a lower risk. This often translates to better premiums when it’s time to renew. On the flip side, a history of frequent or expensive claims tells insurers you're more likely to cost them money in the long run, and your rates will reflect that.

Insurers generally focus on two key parts of your claims history:

- Frequency: How often are you filing claims? Believe it or not, several small claims can be more alarming to an underwriter than one large one because it suggests ongoing problems with risk management.

- Severity: This is all about the dollar amount of your claims. A single, massive claim will definitely get an insurer's attention, but it's often treated as a one-off event. A pattern of recurring losses is a much bigger concern.

A significant claim will almost certainly cause a rate increase. For instance, a major fire leading to a $250,000 payout will instantly make your property a higher risk in your carrier's eyes. But even a string of small $1,500 claims for minor vandalism can trigger steep hikes or, in some cases, even a notice of non-renewal.

Strategic Insight: The trick is to weigh the cost of a minor repair against the potential long-term increase in your insurance premium. Paying for a broken window yourself might save you from a rate hike that costs you far more over the next three to five years.

Making the Right Call

Before you pick up the phone to file a claim, stop and ask a few questions. First, is the cost to fix the damage significantly more than your deductible? If a repair costs $1,200 and your deductible is $1,000, filing a claim just to get a $200 check is rarely a good financial decision.

Next, think about the loss itself. Was this a freak accident, or is it part of a pattern? If you keep filing claims for the same type of issue, your insurer will see it as a sign of unmanaged risk that needs to be addressed.

Getting a handle on the potential financial fallout is critical. You can get a clearer picture of how different risk factors—including claims—affect your rates by using a detailed commercial property insurance calculator to model different scenarios. By making smart, strategic decisions about when to file, you can protect your long-term insurability and keep your costs from spiraling out of control.

Frequently Asked Questions About Insurance Costs

When you’re trying to pin down commercial property insurance, a lot of the same questions tend to pop up. Getting straight answers is the first step to feeling confident about the coverage you choose and what it actually means for your budget.

Let's cut through the noise and tackle some of the most common questions I hear from business owners. The goal here is to give you clear, practical insights you can use right away.

What’s a Typical Insurance Cost for a Small Business Property?

Honestly, there's no magic number, but a good ballpark figure for many small businesses in low-risk spots is somewhere between $1,000 and $3,000 per year. Think of that as your baseline.

From there, the price is really a reflection of your specific situation. A retail shop with a ton of high-value inventory will pay more than a simple office. The same goes for a business in a hurricane zone or one with lots of foot traffic. Your industry, the total replacement cost of your building and its contents, and your past claims history are what really move the needle on your final cost.

Will My Commercial Property Insurance Go Up Every Year?

While it’s not a given, you should probably expect your rates to tick up over time. Often, these increases are driven by things completely out of your hands. For example, inflation makes it more expensive to rebuild, so your coverage amount (and premium) needs to keep pace. We also see rates adjust when an entire region's risk profile changes, like if an area starts experiencing more frequent wildfires or floods.

But don't assume you're just along for the ride. You have more control than you might realize.

Key Takeaway: You can actively push back against rate hikes. Keeping a clean claims record is huge. So is investing in proactive safety measures, like modern fire alarms or security systems. And when renewal time comes around, having an independent broker shop your policy can often uncover more competitive rates, especially in a soft market.

Is It Possible to Get Coverage in a High-Risk Area?

Yes, but you'll have to go about it differently, and it will definitely cost more. If your property is sitting in a zone known for hurricanes, wildfires, or other major catastrophes, many standard insurance companies might just say "no thanks" or offer a quote so high it makes your head spin.

This is where you need to tap into specialty insurance markets. We're talking about surplus lines carriers, which are built to handle these kinds of unique or high-stakes risks. In some cases, you might even look at state-run insurance pools, which often act as the insurer of last resort. Having a seasoned independent broker in your corner is non-negotiable here; they know how to navigate these less-traveled paths.

How Much Does My Type of Business Affect the Cost?

Your industry is one of the biggest pieces of the puzzle. Insurers have decades of data that tell them which types of businesses are more likely to file a claim. A quiet accounting office, for instance, is seen as a much lower risk than a busy restaurant with deep fryers and open flames, or a woodshop full of sawdust and power tools.

In short, what you do every day directly shapes how risky you look to an insurer, and your premium will be a direct reflection of that.

Trying to figure out commercial property insurance can feel overwhelming, but you don't have to go it alone. The experts at Wexford Insurance Solutions are here to help you find that sweet spot between solid protection and a manageable cost, ensuring your business is secure without breaking the bank. Schedule a consultation today to review your policy and uncover potential savings.

Small Business Insurance Requirements Explained

Small Business Insurance Requirements Explained Decoding Professional Liability Insurance Cost

Decoding Professional Liability Insurance Cost