When you're shopping for home insurance, it's easy to fixate on the annual premium. But the real goal is to find the best value, not just the lowest price. This means digging into the details of each quote—the coverage limits, the deductibles, and the insurer's reputation—to make sure your biggest asset is actually protected.

Why Comparing Home Insurance Quotes Is Essential

Think of a home insurance quote as more than a price tag; it's a detailed proposal for how a company will financially protect your home. Not comparing quotes properly is like buying a car based only on its color—you might love the shade of blue, but you could miss a serious engine problem hiding under the hood. The whole point is to find a policy that gives you solid coverage without breaking the bank.

This is especially important because the insurance market is always changing. Things like local weather risks (hurricanes, wildfires), rising construction costs in your area, and even the number of insurers competing for your business can cause prices to swing wildly from one year to the next.

Beyond the Bottom Line Price

Chasing the absolute cheapest quote is a classic mistake, and it can be a costly one. A rock-bottom premium often comes with hidden trade-offs that can leave you exposed right when you need your insurance the most.

These compromises often look like this:

- High Deductibles: That low premium might be tied to a deductible so high that filing a small or medium-sized claim just isn't worth it.

- Insufficient Coverage: The cheapest option might not offer enough dwelling coverage to completely rebuild your home if it's destroyed, leaving you to cover a massive shortfall.

- Policy Exclusions: Budget policies tend to have a longer list of what they won't cover. Common problems like a sewer backup might be excluded unless you buy a specific, and often expensive, add-on.

A quote comparison is your due diligence. It’s how you confirm you’re getting the right protection from a company you can count on, saving you from a world of financial stress when you have to file a claim.

A Growing and Competitive Market

The insurance industry is anything but static, which makes regular quote comparisons a smart financial habit. The global home insurance market was valued at $269.92 billion in 2024 and is expected to hit nearly $628.52 billion by 2034, growing at an annual rate of 8.82%. All that growth fuels competition, which means new discounts and better policy features are hitting the market all the time.

Ultimately, learning how to properly compare home insurance quotes is a core skill for any homeowner. It's the only way to be sure your policy truly fits your needs and your budget. For a refresher on what goes into a policy, our guide that explains home insurance in simple terms is a great place to start. Getting that foundational knowledge down is the first step to making a decision you can feel good about.

Breaking Down a Home Insurance Quote Piece by Piece

If you really want to compare home insurance quotes like a pro, you have to know how to read them first. Every quote is a blueprint for your financial safety net, and the only way to make a smart call is to understand what each part actually means. Think of it like a recipe—you need to know the ingredients to judge the final dish.

A quote isn't just one big price tag. It's a collection of different coverages, each designed to protect a specific part of your home and life. Let's pull these core pieces apart so you can look at any quote with complete confidence.

Dwelling Coverage: The Foundation of Your Policy

This is the big one. Dwelling Coverage (Coverage A) is the maximum amount your insurance company will pay to rebuild or fix your house after a covered disaster, like a fire or a major storm.

A huge mistake people make is mixing this number up with their home's market value. They’re two totally different things. Your dwelling coverage needs to reflect the replacement cost value (RCV)—what it would actually cost to rebuild your home from scratch at today's prices for materials and labor. Just because your home’s market value is low doesn’t mean you can skimp here, especially if local construction costs are high.

Key Insight: Always, always make sure your dwelling coverage is based on current local rebuilding costs, not what Zillow says your house is worth. Underinsuring the structure of your home is one of the most devastating financial mistakes you can make.

The entire home insurance market is built around this core protection. Dwelling coverage absolutely dominated the global market in 2024, commanding a massive 71.1% share. As construction costs keep climbing, this number will only become more critical. You can dig into more data on home insurance market trends to see how these dynamics play out.

Personal Property Coverage: Protecting All Your Stuff

Next up is Personal Property Coverage (Coverage C). This is the part of your policy that pays to replace your belongings if they get stolen, damaged, or destroyed. We're talking about everything from your couch and TV to your clothes and kitchen gadgets.

Most of the time, this coverage is calculated as a percentage of your dwelling coverage, usually somewhere between 50% and 70%. So, if your home is insured for $400,000, you might have around $200,000 for your personal belongings. It's a good idea to do a quick mental inventory of your stuff to see if that's enough. If you have expensive jewelry, art, or other collectibles, you'll likely need a separate rider to make sure they're fully protected.

Liability and Medical Payments: Your Financial Shield

Your quote will also spell out your liability and medical payments coverage. These are incredibly important, as they protect you financially if someone gets hurt on your property and you're held responsible.

Here’s a quick look at how they work:

- Personal Liability (Coverage E): This kicks in to cover legal bills and damages if you or a family member are sued for injuring someone or damaging their property. A standard policy might start at $100,000, but most experts I talk to strongly recommend carrying at least $300,000 to $500,000.

- Medical Payments to Others (Coverage F): This is for smaller claims. It covers minor medical bills if a guest gets hurt in your home, no matter who was at fault. The idea is to quickly resolve small incidents and hopefully prevent them from turning into a big lawsuit.

Getting a handle on these individual components is the essential first step. It turns a confusing page of numbers into a clear proposal, giving you the power to properly compare home insurance quotes and pick the one that truly has your back.

A Practical Framework for Quote Comparison

Getting a few home insurance quotes is the easy part. The real work starts when you sit down to figure out what you’re actually getting for your money. To truly compare home insurance quotes, you need a system—a way to look past the flashy annual premium and see the substance underneath. Without one, it’s all too easy to grab the cheapest option only to find it's full of holes when you need it most.

Think of it as creating a level playing field. You’re going to look at each quote through the same lens, making sure you’re comparing apples to apples. This process helps you spot where one policy gives you rock-solid protection and another leaves you dangerously exposed.

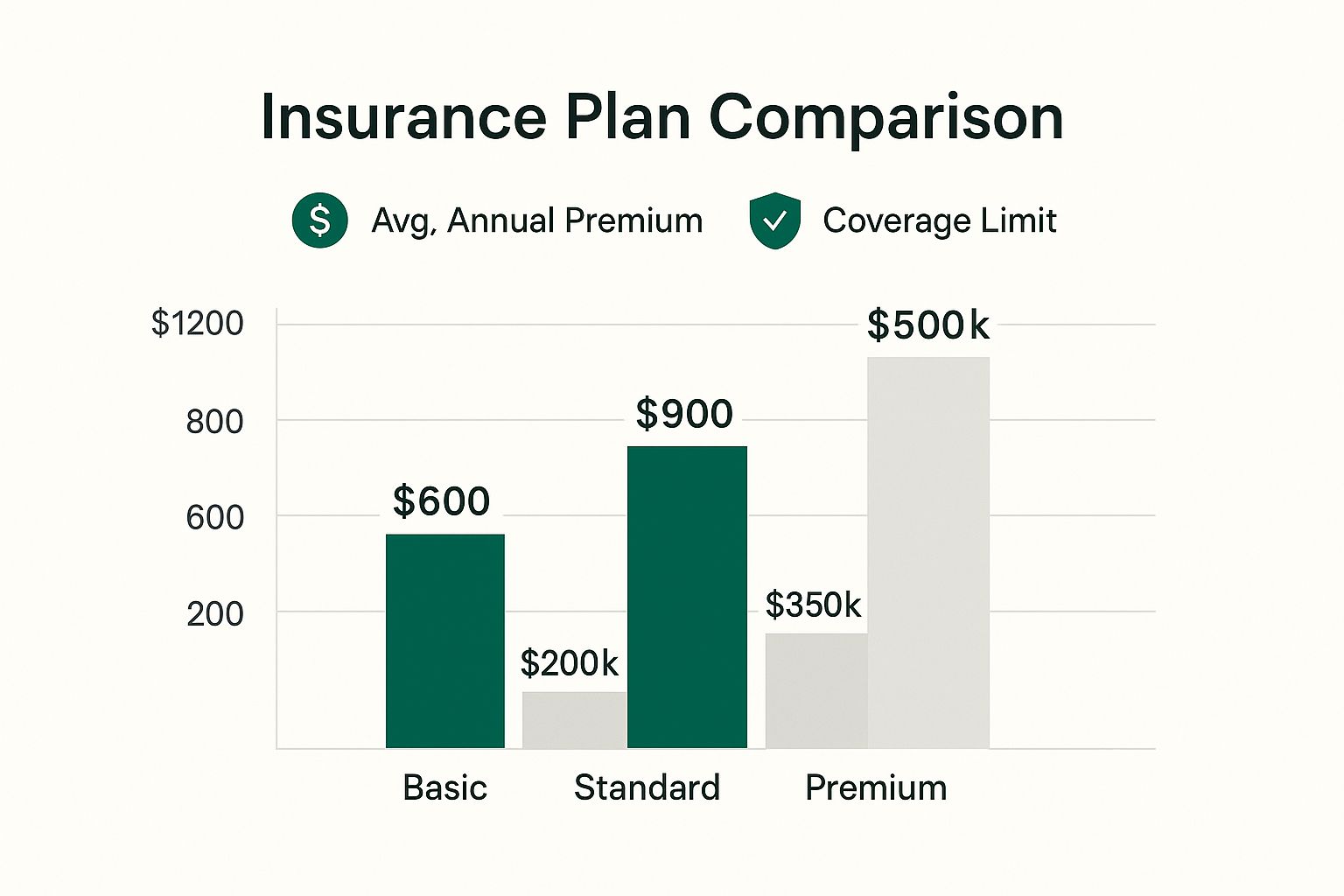

This chart is a great visual for a core concept in insurance: you get what you pay for. Higher premiums almost always mean more robust financial protection.

As you can see, doubling your premium might feel steep, but it can provide more than double the financial safety net for your home's structure. It's a fundamental trade-off every homeowner has to weigh.

Step 1: Standardize Coverage Limits for a Fair Fight

Before you even think about the price tag, your first job is to line up the core coverage limits. A $900 policy with $300,000 in dwelling coverage isn't directly comparable to a $750 policy offering only $200,000. The cheaper quote isn't a better deal; it's an entirely different product with less protection.

Start by adjusting each quote so the main coverages are identical.

- Dwelling Coverage (Coverage A): This is your anchor. Make sure every quote provides enough money to completely rebuild your home from the ground up.

- Personal Property (Coverage C): Pick a consistent percentage for all quotes, like 70% of your dwelling coverage. This ensures you're comparing policies that protect your belongings equally.

- Liability (Coverage E): Choose a liability limit you're comfortable with and apply it across the board. Most experts I talk to recommend at least $300,000 to $500,000.

Once these numbers match, you can finally start looking at the price. You’ll often find that the quotes are much closer in cost than they first appeared.

Step 2: Analyze Deductibles and Their True Cost

Your deductible is what you have to pay out of pocket before your insurance coverage starts paying. It's no secret that a lower premium often comes with a higher deductible. This might save you a bit each year, but it shifts more financial risk onto your shoulders if you ever need to file a claim.

Let’s look at a real-world example:

- Quote A: $1,200 annual premium with a $1,000 deductible.

- Quote B: $950 annual premium with a $2,500 deductible.

At first glance, Quote B looks great—you’re saving $250 a year. But if a pipe bursts, you'll have to come up with an extra $1,500 on the spot. You’d have to go six years without a single claim just to break even on that choice.

A higher deductible can be a smart move, but only if you have a healthy emergency fund ready to go. If a surprise $2,500 bill would throw your finances into a tailspin, the peace of mind from a lower deductible is worth the higher premium.

Step 3: Scrutinize Exclusions and Endorsements

The fine print is where cheap policies often show their true colors. You can have two quotes with identical coverage limits, but one might be swiss cheese while the other is a fortress, all thanks to exclusions and endorsements (add-on coverages).

When you compare home insurance quotes, you have to dig into how they handle common problems that are frequently excluded. For instance, is water backup from a clogged drain or failed sump pump included automatically? Or is it an extra endorsement you have to buy? One insurer might build it in, while another charges an extra fee, changing the overall value of the policy.

Side-by-Side Home Insurance Quote Comparison Framework

To pull it all together, I find that a simple table is the best way to see everything at once. It forces you to look beyond the premium and evaluate the true value of each offer.

Here’s a sample comparison using three fictional quotes to show you what I mean.

| Comparison Criteria | Quote A (Budget Insurer) | Quote B (Mid-Tier Insurer) | Quote C (Premium Insurer) |

|---|---|---|---|

| Annual Premium | $950 | $1,250 | $1,500 |

| Dwelling Coverage | $350,000 (RCV) | $350,000 (RCV) | $350,000 (Guaranteed RCV) |

| Deductible | $2,500 | $1,000 | $1,000 |

| Water Backup | Not Included (+$80/yr) | Included (up to $5,000) | Included (up to $10,000) |

| Customer Service Rating | 2/5 Stars | 4/5 Stars | 5/5 Stars |

This kind of organized comparison makes the decision much clearer. Quote A is the cheapest up front, but you're taking on a high deductible and a critical coverage gap. Quote C costs more, but for a homeowner who values peace of mind, its superior protection and service make it a much stronger choice.

Choosing Your Deductible and Premium Strategy

When you start to compare home insurance quotes, you'll immediately face a critical trade-off: your deductible versus your premium. It's a classic financial seesaw. If you agree to a higher deductible—the amount you pay out-of-pocket on a claim—your annual premium will drop.

This isn't just about picking numbers. It’s about crafting a risk management strategy that fits your life. You need to get real about your personal finances to find that sweet spot where the premium is affordable, but the deductible won’t send you into a financial tailspin if disaster strikes.

Aligning Your Deductible with Your Finances

The first thing to look at? Your emergency fund. This is the bedrock of your decision. If you have a healthy savings account, a higher deductible might be a smart financial move. If your cash reserves are thin, a lower deductible is the safer bet.

Let’s walk through two very different situations:

-

Scenario 1: The Robust Emergency Fund: Imagine a homeowner with $10,000 stashed away for a rainy day. They could easily choose a $2,500 deductible to save $300 a year on their premium. It's a calculated risk they can afford to take, making those annual savings a worthwhile reward.

-

Scenario 2: The Limited Cash Flow: Now, think about a homeowner living paycheck-to-paycheck. For them, a sudden $2,500 expense would be a catastrophe. In this case, paying a bit more each year for a $1,000 deductible isn't just an expense—it's buying crucial peace of mind.

Crucial Takeaway: The allure of a lower premium is strong, but never pick a deductible you can't realistically pay tomorrow. It should be an amount you can cover without derailing your entire budget.

If you're looking for other ways to bring down your annual costs, our guide on how to lower home insurance premiums has some great tips that won't compromise your protection.

External Factors That Influence Your Premium

While your deductible is a lever you can pull, other powerful forces are at play that are largely out of your hands. It’s important to know what they are when you compare home insurance quotes.

Your home's location and its exposure to regional climate risks are huge. If you live in an area prone to hurricanes, wildfires, or tornadoes, your premiums will naturally be higher. Insurers use complex risk models that can make rates vary significantly, even between neighboring zip codes.

Global market trends also trickle down to your policy. For instance, 2025 data showed a slight dip in insurance rates in many parts of the world, driven by a competitive market. Even though the U.S. market was mostly flat, it shows how connected everything is. Of course, these trends can shift in an instant. A severe hurricane season can send reinsurance costs soaring, and those costs inevitably get passed on to homeowners.

At the end of the day, your strategy for balancing your deductible and premium is a deeply personal one. By weighing your own financial reality against these broader market forces, you can land on a choice that delivers both solid protection and genuine affordability.

How to Vet an Insurer's Reputation and Service Quality

When you compare home insurance quotes, it’s easy to get fixated on the price tag. But let's be real—a cheap policy from a shaky company isn't a bargain, it's a gamble. An insurance policy is just a promise, and you need to be sure the company behind it has a track record of keeping its promises when it counts.

Think about it this way: a slightly higher premium from a top-rated carrier is often the smarter financial move. You're not just buying coverage; you're buying confidence that you'll have a partner, not an adversary, when you're navigating a crisis.

Finding Trustworthy Third-Party Data

To get a true picture of an insurer, you have to look past the slick commercials and marketing promises. The real story is found in independent, third-party data. These organizations dig into everything from an insurer's financial health to how happy customers are after they file a claim.

Here are the gold-standard sources I always recommend checking:

- State Departments of Insurance: Nearly every state keeps a public database of consumer complaints against insurers. A company with a high number of complaints for its size is waving a giant red flag.

- J.D. Power: This well-known research firm releases annual studies on customer satisfaction. They score companies on everything from the initial quote process to handling claims, giving you a clear window into what it’s actually like to be a customer.

- AM Best: This is the big one for financial stability. AM Best issues Financial Strength Ratings (FSR) that grade an insurer's ability to pay its claims over the long haul. You should be looking for a company with an “A” rating or higher—this shows they have the financial muscle to be there for you down the road.

An insurer's reputation is built on its actions during its customers' worst moments. Prioritizing a company with strong, independently verified ratings for both financial stability and claims satisfaction is non-negotiable for protecting your largest asset.

What to Look For in Reviews and Ratings

As you sift through this information, look for patterns. A couple of bad reviews are inevitable for any business. But if you see dozens of people complaining about the same thing—like slow payouts or terrible communication—that points to a much bigger, systemic problem.

Pay special attention to comments about the claims process. Are people consistently mentioning lowball settlement offers? Do they talk about adjusters who are impossible to get on the phone? These are the details that separate a good insurer from a bad one.

You also want an insurer who is upfront about what isn't covered. For example, a standard home policy has major gaps, especially when it comes to water damage. It’s critical to understand the difference between flood insurance vs homeowners insurance, because a regular policy won't touch damage from a flood. A quality insurer will be crystal clear about these limitations.

In the end, investigating an insurer’s reputation is just as vital as comparing coverage limits and deductibles. It’s the only way to ensure that attractive quote is backed by a company that will actually show up for you when you need them most.

Uncovering Hidden Discounts to Maximize Your Savings

After you've lined up your quotes with matching coverages and checked out the insurers' reputations, there's one last, crucial step: hunting down discounts. This is where you can really start to see the numbers drop. Insurers love to reward homeowners who are proactive about reducing risk, and those rewards can shave a surprising amount off your annual premium without compromising your protection.

Here’s a pro tip: never assume a quote automatically includes every discount you’re eligible for. More often than not, you have to ask. Getting comfortable with asking, "Are there any other discounts I might qualify for?" is a simple but powerful way to get the best possible deal.

Common Discounts You Should Always Ask About

Many of the most common discounts are tied directly to home safety features and responsible maintenance. When an insurer sees you’ve made these upgrades, they see you as a lower-risk client, and that's when the savings kick in.

Next time you're on the phone with an agent, make sure to bring these up:

- Home Security Systems: A professionally monitored alarm for fire or theft is a big one. It can often lead to a solid discount.

- Newer Roof: This is a huge factor. A new roof is much less likely to be damaged in a storm, so insurers are often willing to lower your premium.

- Upgraded Utilities: If you've modernized your home’s electrical, plumbing, or heating systems, you’ve reduced the risk of fire and water damage. Let your agent know.

- Good Credit Score: Like it or not, many insurers use a credit-based insurance score to set rates. A strong credit history can translate into a better premium.

- Claims-Free History: Haven't filed a claim in a few years? That's a great sign of a low-risk homeowner, and you should be rewarded for it.

Key Takeaway: Discounts aren't just random perks. They're direct reflections of how risky your property is to insure. The more you do to protect your home, the more you can save.

The Bundling Strategy: Is It a Real Deal?

You've probably seen the ads for bundling your home and auto insurance. It's one of the most heavily promoted discounts out there, and for good reason—it can often knock 5% to 25% off both policies. It’s a fantastic way to save, but you have to do your homework.

The catch is that sometimes a bundle is just clever marketing. An insurer might offer a fantastic auto rate that masks a weak, overpriced home policy, or vice-versa. You have to look at the total cost and, just as importantly, the individual coverages. Is the combined price truly lower than what you could get by picking the best home policy from one company and the best auto policy from another?

We actually have a whole guide that breaks this down. For a closer look, check out our article on bundling home and auto insurance. It’ll help you see past the marketing hype to figure out if you're getting genuine value or just a deal that hides weaker coverage.

Common Questions When Comparing Home Insurance Quotes

Even after you've done the research, a few questions always seem to surface right as you're about to make a final decision. Getting these last few details ironed out is often the key to feeling truly confident in the policy you choose.

Think of this as the final check-in. Let's walk through some of the most common questions we hear from homeowners, so you can move forward knowing you've covered all your bases.

How Often Should I Re-Shop My Home Insurance?

As a rule of thumb, it’s smart to compare home insurance quotes at least once a year, usually about 30-45 days before your current policy renews. This gives you a fresh look at the market and ensures your rate is still competitive.

However, life changes are an even more important trigger to get new quotes. Certain events can completely change your insurance needs or your risk profile in the eyes of an insurer.

- Major Home Renovations: If you've added a room or finished a basement, your home's value has increased. Your coverage needs to increase with it.

- Installing a New Roof: This is a huge deal for insurers. A new roof significantly lowers the risk of wind and water damage, which often translates into a hefty discount.

- A Bump in Your Credit Score: Many carriers use a credit-based insurance score to set rates. Improving your credit can directly lead to lower premiums.

Will Getting Multiple Quotes Hurt My Credit Score?

Absolutely not. Shopping for home insurance quotes will have zero impact on your credit score. When an insurance company pulls your credit history, it’s what's known as a "soft inquiry."

These soft pulls are only visible to you on your credit report; they aren't factored into your score and aren't seen by lenders. So, get as many quotes as you need to feel comfortable. There's no penalty for being a savvy shopper.

The entire point of a quote is to gather information without any commitment or penalty. Go ahead and shop around—your credit rating is completely safe from the "hard inquiries" that happen when you apply for a new loan or credit card.

Is the Cheapest Policy Ever the Best Choice?

It's tempting, but the cheapest policy is almost never the best value. A rock-bottom price is usually a red flag, often signaling dangerously high deductibles, low coverage limits, or a long list of things the policy won't cover (exclusions). It saves a few bucks upfront but can leave you financially exposed when you need it most.

The real goal isn't to find the lowest price, but the best protection for your money. You want solid coverage from a carrier with a great reputation, all at a fair price. If one quote is dramatically lower than the others, be skeptical—it probably means you're sacrificing something important. For a closer look at what makes a policy truly comprehensive, our guide to homeowners insurance is a great resource.

Difference Between Insurance Agent and Broker: Key Facts

Difference Between Insurance Agent and Broker: Key Facts Commercial Insurance Types: Essential Coverage for Your Business

Commercial Insurance Types: Essential Coverage for Your Business