Think of it this way: you wouldn't use a standard car cover to protect a multi-million dollar classic Ferrari. It just wouldn't fit, and it certainly wouldn't offer the right kind of protection. That’s precisely why a typical insurance policy falls short for high-net-worth individuals. Your risks aren't just bigger; they're in a completely different league.

Why Standard Insurance Is Not Enough For You

Once you've accumulated significant wealth, the intricacy of your assets and lifestyle quickly outpaces what a standard insurance plan was ever designed to handle. A regular home or auto policy is built for the average person, with rigid limits and exclusions that can leave you with massive, often hidden, vulnerabilities. It's a fundamental mismatch of both scale and scope.

These off-the-shelf policies operate on assumptions that simply don't hold up for affluent families. They assume a certain home value, a basic level of personal liability, and a limited set of personal belongings. Relying on them creates a dangerously false sense of security.

The Problem With Standard Coverage Limits

The most glaring issue is the ceiling on coverage. A standard homeowner's policy often caps personal property coverage at a set percentage of the home's value, maybe 50%. For someone with extensive collections of fine art, high-end jewelry, or a designer wardrobe, that's rarely enough.

Liability is an even bigger worry. A standard policy might provide $300,000 to $500,000 in liability coverage. For a high-net-worth individual—who can be a magnet for lawsuits—that amount is a drop in the bucket. It could be wiped out by legal fees alone, putting your personal assets directly in the line of fire.

A major liability claim can threaten more than just what you own today; it can jeopardize your future earnings and the legacy you're building. True high-net-worth insurance is designed to be a financial fortress around your wealth, not just a flimsy fence.

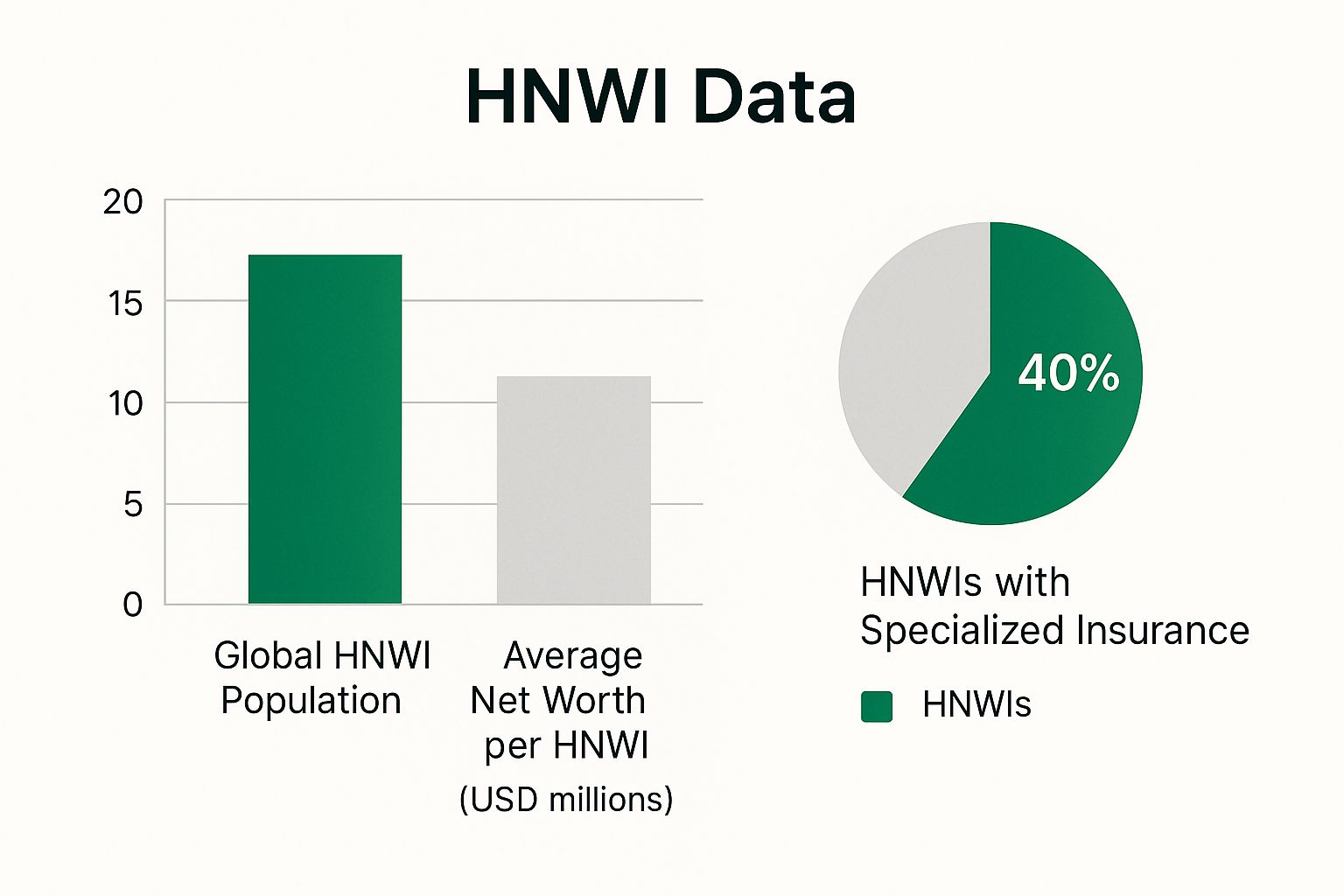

This image highlights a worrying trend: even as the number of affluent individuals grows, many haven't updated their insurance to match their success.

The data shows a clear disconnect. While wealth is increasing, a surprising number of people still depend on inadequate, mass-market insurance, leaving a critical gap in their financial protection.

To put it in perspective, here's a quick comparison of the two approaches.

Standard vs. HNW Insurance: A Quick Comparison

This table clearly shows the key differences between a standard insurance policy and one built for the needs of high-net-worth individuals.

| Feature | Standard Insurance | High Net Worth Insurance |

|---|---|---|

| Coverage Limits | Capped at lower, predefined amounts. | High, flexible limits; often $50M+ liability. |

| Asset Valuation | Based on actual cash value (depreciated). | Agreed value or replacement cost for unique items. |

| Liability Scope | Basic personal liability, many exclusions. | Worldwide coverage, includes libel, slander, board service. |

| Property Coverage | Limited for valuables like art, jewelry, wine. | Specialized floaters and blanket coverage for collections. |

| Service & Claims | Handled by a call center. | Dedicated agent, white-glove claims service. |

As you can see, the differences aren't just in the details—they represent a completely different philosophy of protection.

Beyond Coverage Gaps To A Different Class Of Risk

The problem with standard policies goes deeper than just dollar amounts. It's about the very nature of the risks you face. Affluent lifestyles come with exposures that standard insurance carriers simply aren't equipped to understand, let alone cover.

- Unique Assets: How does a standard policy properly value a temperature-controlled wine collection, a classic car, or a commissioned sculpture? The short answer is, it can't. This often leads to frustrating disputes and underpayment when you need to make a claim.

- Lifestyle Risks: Things like frequent international travel, employing domestic staff (nannies, housekeepers), and serving on non-profit boards all introduce unique liability risks. These are the kinds of activities that are often specifically excluded from standard policies.

- Reputation Management: If you face a public lawsuit or personal crisis, specialized HNW policies can include coverage for public relations experts to help protect your personal and professional reputation—a priceless benefit.

This isn't a niche concern; the market for this level of protection is significant. The High-Net-Worth Household Insurance Market was valued at USD 46.25 billion recently and continues to grow, showing just how critical this protection is.

Ultimately, standard insurance treats your valuable assets like easily replaceable commodities. For a closer look at how truly personalized protection is built, you might want to read our detailed guide on private client insurance. A proper insurance strategy for successful individuals acknowledges that your assets are unique, your risks are complex, and your need for robust protection is absolute.

Building Your Comprehensive Asset Protection Portfolio

When you have significant assets, putting together the right insurance feels less like buying a product and more like building a custom fortress. Each policy is a stone, carefully chosen and placed to guard against a specific threat. A truly comprehensive portfolio isn't just a stack of documents; it's a living defense system where every piece reinforces the others.

The aim is to create a seamless shield that protects every corner of your life, from the house you call home to the passions you pour your time into. This means looking past standard, off-the-shelf policies and embracing coverage engineered for the true scale and complexity of your world.

Protecting Your Primary Residence And More

For most affluent families, a home is far more than just a place to live. It’s a major asset, often filled with custom architectural details, high-end finishes, and unique features. A standard homeowner's policy, which simply calculates a basic replacement cost, will almost always fall short.

This is where high-value homeowners insurance makes a world of difference. It offers guaranteed replacement cost, a feature that ensures your home will be rebuilt to its original standard, even if the cost to do so exceeds your policy limit. This is absolutely critical after a widespread disaster, when labor and material costs can skyrocket unexpectedly.

Think of it this way: Standard insurance gives you enough money to rebuild a house. High-value insurance gives you the resources to rebuild your house, exactly as it was, regardless of market volatility. That distinction is the bedrock of real financial recovery.

This superior coverage doesn't stop at the main structure. It typically includes higher limits for landscaping, guesthouses, and other detached structures. It also provides for loss of use, ensuring you can maintain your family's standard of living while your home is being restored.

Safeguarding Your Passions with Collections Insurance

Your wealth isn't just in real estate or the stock market. For many, significant capital is invested in collections—fine art, rare wines, classic cars, or antique furniture. Standard insurance policies treat these passions with indifference, placing low, strict caps on their value. A priceless painting might be treated like any other piece of furniture.

That's why specialized collections insurance, sometimes called a valuable articles floater, is non-negotiable. These policies provide specific, itemized coverage for your most cherished possessions.

The key benefits are game-changers:

- Agreed Value Coverage: You and the insurer agree on an item's value upfront. In the event of a total loss, you receive that exact amount, no questions asked. This completely sidesteps any arguments about depreciation or current market value after a disaster.

- Worldwide Protection: Your collection is covered whether it’s hanging on your wall, in transit to a gallery, or on loan for an exhibition.

- Broad Peril Coverage: These policies protect against a much wider range of risks, including things like accidental breakage, which standard plans almost always exclude.

This kind of focused protection makes sure the assets you're most passionate about are properly secured. After all, proper asset protection insurance means covering all your bases, from your home to your hobbies. To learn more, check out our guide on how to create a holistic asset protection insurance strategy.

The Ultimate Shield: Personal Excess Liability

If there’s one indispensable component in a high-net-worth portfolio, it’s personal excess liability insurance. You probably know it as an umbrella policy. This is the coverage that provides an extra, massive layer of liability protection on top of your existing home and auto policies. It is your ultimate defense against a catastrophic lawsuit that could otherwise decimate your wealth.

Imagine a guest is seriously injured on your property, or you're found at fault in a major car accident. If the judgment blows past your primary liability limit of, say, $500,000, this policy kicks in. It covers the rest, up to its limit, which can easily be $50 million or even more.

It also broadens your protection, covering claims for libel, slander, and wrongful eviction—risks your underlying policies typically won't touch. Of course, insurance is just one piece of the puzzle; safeguarding physical assets often requires advanced security systems. For total peace of mind, you might also explore tailored security solutions for your property.

Specialized Coverage for Unique Assets

Finally, a truly bulletproof portfolio must account for the unique risks that come with specific high-value assets. This often includes:

- Agreed Value Auto: For collector cars, this guarantees you receive the vehicle's pre-determined value, not its depreciated "book" value, after a total loss.

- Watercraft Insurance: Specialized policies for yachts and boats cover complex marine risks like environmental damage, wreck removal, and Jones Act claims for crew members.

- Aviation Insurance: Essential for private aircraft owners, this covers not only the aircraft's hull but also the immense liability associated with flying.

By layering these specialized policies, you're not just buying a handful of plans—you're architecting a cohesive strategy. Each element works in concert with the others to build a formidable barrier, ensuring your lifestyle and legacy are protected from every conceivable angle.

How Life Insurance Can Preserve Your Wealth

Most people see life insurance as a simple safety net. For those with significant wealth, however, it’s a completely different animal. It becomes a sophisticated financial instrument—one of the most effective tools for preserving wealth, planning for taxes, and ensuring your legacy passes smoothly to the next generation. This isn't just about replacing income; it's about protecting everything you've worked so hard to build.

Think of a well-designed life insurance policy less like a standard contract and more like a private financial vault. It’s meticulously engineered to protect and grow your assets, making sure they land in your heirs' hands with minimal erosion from taxes. This shift in thinking is the first step to unlocking its real power within a high-net-worth financial plan.

This isn't just a niche strategy; it's a global trend. The market for high-net-worth international life insurance is booming, with annual new business sales recently hitting £41 billion. That's a staggering 25% jump from the previous year, highlighting just how much affluent families rely on these sophisticated wealth planning tools.

Providing Critical Estate Liquidity

Perhaps the most immediate and vital role life insurance plays for wealthy families is providing liquidity. When a large estate is passed down, it can trigger a massive estate tax bill that’s due in cash—usually within nine months. This deadline can create a serious financial squeeze.

Without enough cash on hand, your heirs could be forced into making painful decisions. They might have to sell off prized assets that aren't easily converted to cash, like the family business, a real estate portfolio, or cherished heirlooms. These are often fire sales, done under pressure and at a fraction of their true value, just to satisfy the tax man. A lifetime of work can be dismantled in a matter of months.

A life insurance death benefit, which is generally received income-tax-free, provides an immediate and predictable cash infusion. This allows your heirs to pay estate taxes and other final expenses without having to touch the core assets of the estate, preserving the family business and other legacy assets for generations to come.

This pre-planned liquidity is the key to a smooth transfer of wealth. It acts as a financial shock absorber, soaking up the impact of taxes and expenses so the estate you built can be passed on intact.

The Power of Tax-Advantaged Growth

Beyond providing cash for taxes, certain types of life insurance create a powerful environment for tax-advantaged growth. Policies like Private Placement Life Insurance (PPLI), for instance, operate almost like a private investment account shielded inside an insurance wrapper, allowing a broad range of assets to grow within the policy.

This offers two huge advantages:

- Tax-Deferred Growth: Investments inside the policy compound over time without the drag of annual income or capital gains taxes. This can dramatically boost long-term returns compared to a standard taxable brokerage account.

- Tax-Free Access: With the right structure, you can often access funds from the policy tax-free through loans or withdrawals. And, of course, the death benefit itself passes to your beneficiaries completely tax-free.

This structure makes it an incredibly efficient vehicle for long-term wealth accumulation, shielding assets from taxes while you're alive and upon your death.

Equalizing Inheritances and Fulfilling Promises

Life insurance also shines as a brilliant tool for making sure inheritances are divided fairly, especially when an estate is dominated by a single, indivisible asset like a family business.

Imagine one of your children is deeply involved in the family business and is the natural successor, while two others have built careers elsewhere. Leaving the business to all three could be a recipe for conflict and poor management. Instead, you can use a life insurance policy to give the other two children a cash inheritance equal to the value of the business.

This strategy fosters fairness and family harmony.

- The child in the business receives the asset they are best suited to run.

- The other children receive a liquid inheritance of equivalent value.

- The family's legacy remains intact, free from potential disputes.

By using these policies strategically, you can ensure your final wishes are carried out with precision and care. If you're interested in going deeper on these topics, our guide offers many more wealth preservation strategies. Life insurance is far more than just a component of planning; it's a foundational pillar.

Covering Unique Risks with E&S Insurance

So, what happens when your risks are so specific or so large that standard insurance companies just won't touch them? This is a common hurdle for successful families, whose assets and lifestyles don't fit into the neat, pre-defined boxes of everyday insurance.

The answer lies in a specialized corner of the industry: Excess & Surplus (E&S) lines insurance.

Think of the E&S market as the "custom builder" of the insurance world. While standard insurers are mass-producing policies for common risks, E&S carriers are the master craftspeople. They design bespoke solutions for situations that are too complex, too large, or simply too unusual for the mainstream market. This isn't "substandard" coverage; it's a sophisticated marketplace for sophisticated clients.

When The Standard Market Says No

Standard insurance carriers, often called "admitted" carriers, have to play by a strict set of rules. State regulations dictate the exact policies they can offer and the rates they can charge. This structure works perfectly well for predictable risks like a typical family home, but it leaves them with very little room to adapt to unique circumstances.

The E&S market, on the other hand, is made up of "non-admitted" carriers. They have the freedom to design policies and set rates based on the specific risk right in front of them, without those rigid constraints. This flexibility allows them to step in and provide crucial protection when admitted carriers have to step away.

The E&S market is where creative risk solutions are born. It’s where you turn when you need to insure a coastal estate in a hurricane zone, get liability coverage for a private family foundation, or protect a home in a high-risk wildfire area.

This freedom is more critical than ever. As the insurance environment gets tougher, finding certain types of coverage in the standard market has become much more difficult. This has pushed more complex risks into the E&S sector, which has seen explosive growth as a result.

Recently, direct written premiums in the E&S market soared to a record $115.1 billion—a 16.8% increase in a single year. You can learn more about how market trends are impacting ultra-high-net-worth individuals from this detailed analysis.

Why The Affluent Rely On E&S Lines

For high-net-worth individuals, the E&S market delivers two things that are absolutely essential: capacity and customization.

Capacity is about getting incredibly high coverage limits—the kind that standard insurers simply can't or won't offer. This is non-negotiable when you're protecting assets valued in the tens or even hundreds of millions.

Customization is about getting the right kind of coverage. E&S policies are often "manuscripted," meaning they are drafted from the ground up, specifically for you.

Here are a few real-world situations where E&S insurance becomes a necessity:

- Valuable Collections: Covering a one-of-a-kind art or jewelry collection that far exceeds the limits of a standard policy.

- Unique Properties: Insuring a historic home with irreplaceable architecture or a property with major exposure to natural disasters like floods or earthquakes.

- Complex Liability: Building layers of liability protection that go far beyond what a standard umbrella policy provides, often reaching into the tens of millions.

These high-limit liability policies are a critical part of a strong financial defense. To better understand your own needs, you can explore our guide on how much umbrella insurance you might need to properly shield your assets.

Ultimately, E&S insurance bridges the gap where the standard market simply can't go, providing the tailored solutions needed to protect extraordinary lifestyles and assets.

The Real Value of White-Glove Service and Risk Management

When we talk about superior insurance for high-net-worth families, the policy document is just the beginning. While strong coverage is the non-negotiable foundation, the real difference-maker is the hands-on, concierge-level service and expert risk management that come along with it.

This isn’t about calling an 800 number and getting a claim ID. It’s about having a dedicated partner whose main job is to prevent losses from ever happening in the first place. You aren’t just buying a product; you’re gaining a team of specialists invested in protecting your assets and, just as importantly, your peace of mind. This is what transforms insurance from a simple safety net into a proactive shield.

More Than a Policy, It's a Partnership

The most experienced high-net-worth insurance carriers know that your life is unique and can't be handled by a one-size-fits-all approach. Instead of a faceless claims department, you get a dedicated claims concierge. When something goes wrong, this individual becomes your single point of contact, coordinating everything from damage appraisals to hiring vetted artisans for complex repairs.

Let's imagine a worst-case scenario: a water pipe bursts, damaging a custom-finished wall and a valuable piece of art hanging on it. Your concierge doesn't just write a check. They source a specialized art restorer, find a contractor who can perfectly replicate the wall's unique finish, and manage the entire project from start to finish. This level of service is designed to minimize disruption and ensure every last detail is restored to its pre-loss condition.

The core philosophy behind white-glove service is simple: Your time is your most valuable asset. A premium insurance partner manages the complexities of a claim so you can focus on your family and business, confident that everything is being handled to the highest possible standard.

Proactive Risk Management Services

They say the best service is the one you never have to use. That's precisely why premier insurers offer a whole suite of complimentary risk consultations. These services are designed to spot and neutralize threats long before they can cause a loss, and they are a cornerstone of any modern insurance strategy for successful families.

These aren't generic checklists; they are deeply personal evaluations of your specific risks. These consultations often include:

- Home Security Audits: An expert will walk your property to assess its physical security—everything from locks and alarm systems to lighting and landscaping—and provide practical recommendations to deter potential intruders.

- Wildfire Mitigation Advice: If you own property in an at-risk area, specialists can guide you on creating defensible space, choosing fire-resistant building materials, and even deploying private firefighters if a threat becomes imminent.

- Collections Management: Get professional advice on everything from proper lighting and climate control for fine art to secure transportation for your wine or jewelry collections to protect them from damage or theft.

- Cybersecurity Assessments: With digital threats becoming more sophisticated, experts can review your personal cybersecurity habits and help shield your family from online fraud, identity theft, and ransomware attacks.

These proactive measures are a huge part of the value you receive. They show a commitment not just to paying claims, but to actively helping you avoid them altogether.

A Holistic Approach to Your Financial Well-Being

This kind of comprehensive risk management should fit seamlessly into your broader financial world. For instance, the strategic use of life insurance trusts is a critical tool for protecting your legacy from creditors and unnecessary taxes. Understanding how these pieces all fit together is vital, which is why learning more about estate tax planning strategies provides a more complete view of your asset protection needs.

Ultimately, picking the right insurance partner means looking past the premium and the policy limits. It’s about judging the depth of their service and their dedication to proactive risk management. This white-glove approach ensures that your complex life is understood, your assets are actively protected, and you have a dedicated team ready to spring into action whenever you need them. It's the difference between merely having insurance and being truly insured.

How to Choose Your HNW Insurance Partner

Choosing the right partner to safeguard your assets isn't just another financial task—it's one of the most critical decisions you'll make. This is about far more than just comparing premium quotes. You're looking for a trusted advisor, a true fiduciary who will build a long-term relationship with you, not just complete a transaction.

Your first step? Focus your search on an independent broker who specializes exclusively in insurance for high-net-worth individuals. Think of this person as your personal Chief Risk Officer, not just an agent. Their real value comes from their deep experience, direct access to elite insurance carriers, and a proven process for managing complex risks.

Vetting Your Potential Advisor

A broker who spends their days writing standard home and auto policies simply won't have the specialized knowledge or market access you require. You need a professional who is intimately familiar with the unique challenges that come with significant wealth.

When you sit down with a potential advisor, don't hesitate to ask tough, specific questions. This is your chance to see if they truly understand your world or if they're just trying to land a big account.

Your relationship with your insurance advisor should be just as confidential and collaborative as the ones you have with your wealth manager and attorney. They are a core member of your personal advisory team, all working together to protect every facet of your financial life.

Key Questions for Your Broker Interview

Come to the meeting ready to dig into their process and expertise. A genuine expert will appreciate your thoroughness and welcome the opportunity to demonstrate their value.

- What's your process for understanding my risk profile? A great answer will go far beyond a standard application. They should be asking about your international travel, domestic staff, non-profit board memberships, and valuable collections. It should feel like a comprehensive diagnostic.

- Which specialized HNW carriers do you work with? They should be able to instantly name top-tier carriers known for their white-glove service, like Chubb, PURE, AIG Private Client, and Cincinnati, and describe their direct relationships with them.

- How do you handle truly unique risks? Their ability to navigate the Excess & Surplus (E&S) lines market is a must. This is where coverage for one-of-a-kind assets or unusual liability scenarios is found.

- How will you collaborate with my other advisors? Look for an answer that shows a proactive, team-based approach. They should be eager to connect with your wealth manager, CPA, and attorneys to ensure your insurance strategy perfectly complements your financial and estate plans.

In the end, you're hiring a partner for the long haul. You want someone who offers sharp advice, isn't afraid to challenge your assumptions, and shows a clear, unwavering commitment to protecting everything you've worked so hard to build. That’s the real mark of a top-tier HNW insurance professional.

Common Questions About High-Net-Worth Insurance

Even after getting the big picture, you're bound to have specific questions. It's completely normal. Let's tackle some of the most common ones that come up when people are trying to figure out the right insurance for their assets.

How Is the Value of My Unique Assets Determined?

This is one of the most important questions, and the answer really highlights the difference between standard insurance and a high-net-worth policy. With regular policies, if you have a claim, the payout is often based on "actual cash value"—what the item is worth today, after depreciation. That’s not how it works here.

Premier carriers use an agreed value approach for things like fine art, vintage cars, or custom jewelry. It's a much more reassuring process:

- Upfront Appraisal: Before the policy even starts, you, your insurer, and often a specialized appraiser will determine exactly what your item is worth.

- Locking It In: That specific value is written directly into your policy. It's set in stone.

- Guaranteed Payout: If you suffer a total loss, you get that exact, pre-agreed amount. No last-minute arguments about depreciation or what the market is doing.

This simple shift ensures you’re compensated for what your treasured assets are truly worth, not just what a formula says they're worth after a loss.

Should I Work With a Broker or Go Directly to an Insurer?

You can go directly to some insurance companies, but working with an independent broker who lives and breathes the high-net-worth world is almost always the better move. Think of them less as a salesperson and more as your personal risk advisor.

A specialized broker brings a few key advantages to the table:

- Access to the Entire Market: They have deep relationships with all the top-tier carriers, including niche players in the Excess & Surplus (E&S) market you can't access on your own. This means more options and better solutions for you.

- Your Personal Advocate: A broker works for you, not for the insurance company. Their loyalty is to you, which is critical when you’re applying for coverage and especially if you ever need to file a claim.

- The 30,000-Foot View: A great broker sees the whole chessboard. They understand how your insurance strategy needs to connect with your wealth management, tax planning, and estate goals, making sure everything is aligned.

The right broker is like the quarterback for your personal risk management. They coordinate with your entire team—your financial advisor, your attorney, your family office—to build a seamless, protective wall around your assets. You just don't get that level of dedicated, unbiased expertise by going direct.

How Often Should I Review My Insurance Portfolio?

Your life isn't static, so your insurance coverage shouldn't be either. Plan on a full, comprehensive review with your broker at least once a year. That said, some life events should have you picking up the phone right away.

Give your advisor an immediate call if you are:

- Buying a new home, vacation property, or a high-value car.

- Acquiring significant new art, jewelry, or other collectibles.

- Hiring new domestic staff, like a household manager, nanny, or groundskeeper.

- Starting a major home renovation that increases its value.

- Joining the board of a nonprofit organization.

Staying on top of these reviews is the best way to prevent dangerous coverage gaps from quietly opening up as your life and assets grow.

Navigating the world of high-net-worth insurance is complex, but you don't have to do it alone. At Wexford Insurance Solutions, our specialists offer the expert guidance and access to elite carriers needed to build an asset protection plan that truly fits your life. Contact us today to secure the peace of mind you deserve.

Commercial Insurance Types: Essential Coverage for Your Business

Commercial Insurance Types: Essential Coverage for Your Business Errors and Omissions Insurance for Consultants | Complete Guide

Errors and Omissions Insurance for Consultants | Complete Guide