So, what exactly is commercial insurance? Think of it less as a single product and more as a customized shield designed to protect your business from financial ruin. It’s the essential safety net that catches you when the inevitable risks of running a company—like accidents, property damage, lawsuits, or employee injuries—threaten to pull you under.

Understanding the Foundation of Business Protection

At its heart, commercial insurance is built on a straightforward concept: risk transfer. Every business owner juggles countless potential threats that could trigger devastating financial consequences. Instead of carrying that immense weight all on your own, you pay a manageable, predictable fee (your premium) to an insurance company.

In return for that premium, the insurer agrees to absorb specific risks for you. When a covered event happens—say, a customer slips and falls in your store or a data breach compromises sensitive information—the insurance company steps in to cover the costs, up to your policy's limits. This frees you up to focus on what you do best: running and growing your business with peace of mind.

To understand how these different policies work together, it's helpful to see them as fundamental shields against common business disasters.

The Core Protections of Commercial Insurance

| Core Protection | What It Defends Against | Real-World Example |

|---|---|---|

| Liability | Lawsuits from third parties (customers, vendors, etc.) for bodily injury or property damage. | A customer slips on a wet floor in your cafe, breaks their wrist, and sues for medical bills and damages. |

| Property | Damage or loss of your physical assets, like your building, equipment, and inventory. | A fire breaks out in your workshop overnight, destroying your machinery and stored products. |

| Workforce | Medical expenses and lost wages for employees who get sick or injured on the job. | An employee injures their back while lifting a heavy box in the stockroom and needs surgery and time off to recover. |

Each of these protections is a critical pillar. Lacking just one can leave a massive, and potentially fatal, gap in your company's financial foundation.

More Than Just an Expense—It’s a Business Tool

It's a common mistake to view insurance as just another bill to pay. In reality, it’s an active business strategy and a powerful tool for building stability and enabling growth. Why? Because a single, uninsured lawsuit can completely wipe out a small or medium-sized company.

The real job of commercial insurance is to create a firewall between your business assets and the unpredictable financial fallout from accidents, mistakes, and disasters. It converts a potentially catastrophic, unknown cost into a fixed, manageable expense you can budget for.

The global commercial insurance market is a cornerstone of the world's economy for a reason. In North America alone, property and casualty premiums—the category that includes commercial insurance—recently jumped by over 8%. This region now accounts for more than half of all global premiums, which speaks volumes about how critical this protection has become.

You can dive deeper into these figures in the global insurance market report from Allianz. This trend isn't just about numbers; it shows a growing understanding among business owners that having the right coverage isn't just a good idea—it's non-negotiable for long-term survival and success.

Breaking Down the Core Types of Business Coverage

Alright, so you get the big picture of what commercial insurance is. Now, let's pop the hood and look at the actual tools in the toolbox. Commercial insurance isn't a one-size-fits-all product; it's a suite of specific coverages, each built to shield you from a different kind of business-ending threat.

Trying to run a business without the right insurance is like captaining a ship with no lifeboats. You might be fine for a while, but one bad storm could sink the entire venture. The policies we'll cover here are the absolute essentials—the foundational protection most businesses need to operate with confidence.

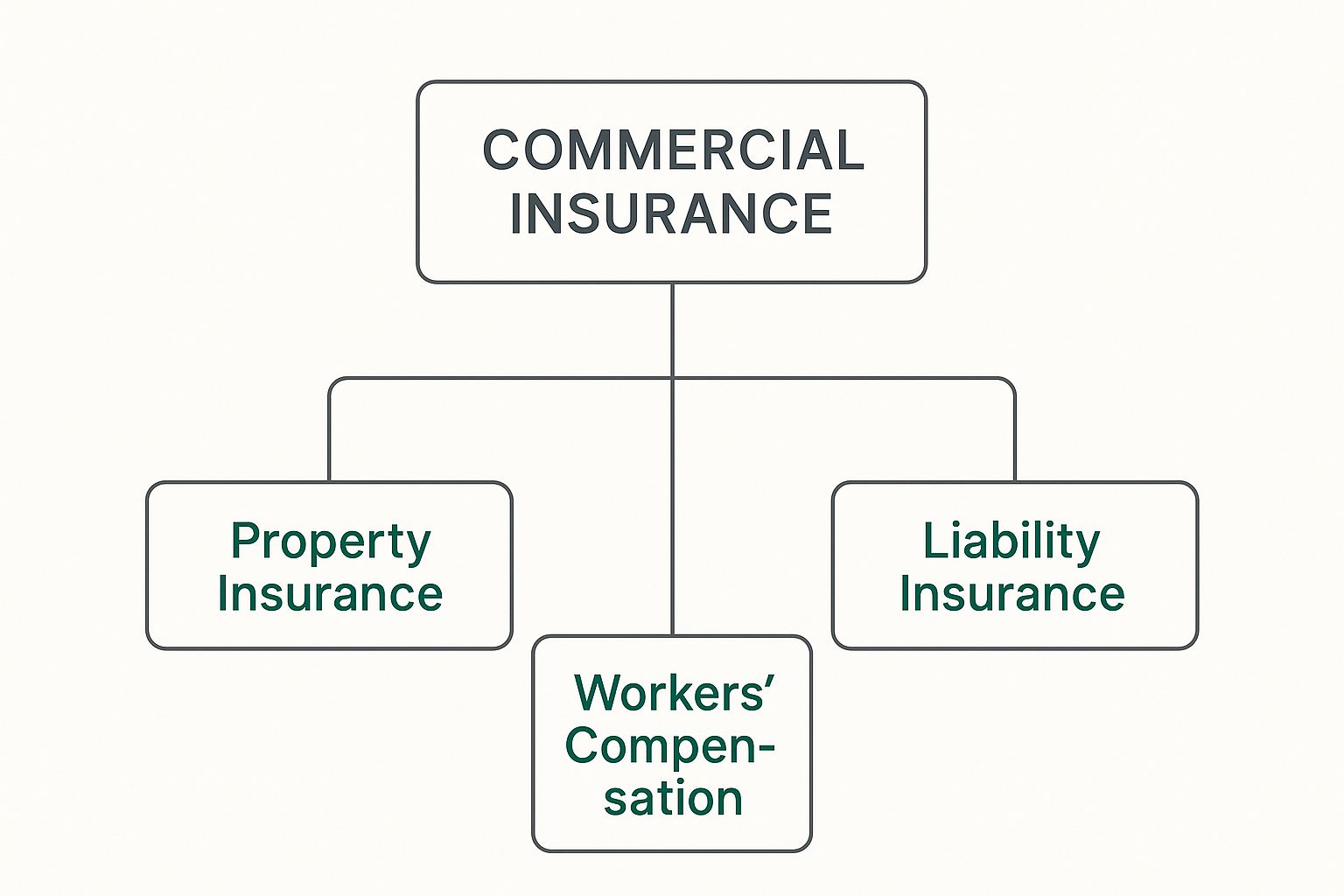

This chart illustrates how the main insurance categories act like different branches of a tree, each protecting a vital part of your business.

As you can see, it really boils down to three key pillars: protecting your stuff (Property), defending against lawsuits (Liability), and taking care of your people (Workers' Compensation).

General Liability Insurance: Your Everyday Shield

Think of General Liability Insurance as your front-line defense. It’s the policy that kicks in when your day-to-day operations cause bodily injury or property damage to someone who isn't on your payroll.

Imagine a customer slipping on a wet, unmarked floor in your shop. It’s a classic scenario, but a real risk. If they break an arm, they could sue you for everything from medical bills to lost wages. This is exactly where general liability steps in, covering legal fees and any settlements so you don't have to pay out of your own pocket.

Here's what it typically handles:

- Bodily injury to a third party (like a customer or vendor) on your property.

- Property damage your business activities cause to someone else's belongings.

- Advertising injuries, such as libel, slander, or copyright issues in your marketing.

Commercial Property Insurance: Protecting Your Physical Assets

While general liability guards you against claims from others, Commercial Property Insurance protects your own tangible assets. It's the policy that helps you rebuild and restock after a disaster like a fire, theft, or major storm hits your place of business.

Let’s say a kitchen fire breaks out in your restaurant overnight, destroying your ovens, coolers, and all your inventory. The cost to replace all that equipment and food would be staggering. Property insurance is what makes recovery possible, preventing a single disaster from shutting you down for good.

It's important to understand the concept of "perils." Some policies are "named-peril," meaning they only cover the specific risks listed in the policy. Others are "all-risk," which is broader and covers everything except for what's specifically excluded. Common exclusions like floods or earthquakes often need their own separate policies.

Professional Liability Insurance: The Expert's Safety Net

This is a must-have for any business that gives advice or provides a professional service. Also known as Errors and Omissions (E&O) insurance, it protects you when a client claims you made a mistake, were negligent, or failed to deliver on your professional duties, causing them a financial loss.

For example, a marketing consultant advises a client on a major ad campaign that ultimately flops, costing the client a fortune. The angry client could sue the consultant for bad advice. General liability won't touch this, but professional liability is designed for exactly this scenario, covering your defense costs and potential damages.

Workers' Compensation: A Pact with Your Team

If you have employees, you almost certainly need Workers' Compensation—most states legally require it. This coverage is a two-way street of protection for both your team and your business. It pays for medical care and a portion of lost wages if an employee gets sick or injured on the job.

A warehouse worker could throw out their back lifting a heavy box. Workers' comp pays for their doctor visits and physical therapy. In exchange for these guaranteed benefits, the employee typically gives up their right to sue your company over the injury, which creates a fair and predictable system for everyone involved.

Commercial Auto Insurance: Coverage for Business on the Move

Don't make the common mistake of thinking your personal auto policy covers work-related driving—it almost never does. You need Commercial Auto Insurance to properly cover the cars, trucks, or vans you use for your business. This applies to company-owned vehicles and can even extend to employees using their personal cars for work errands.

If your delivery driver causes a multi-car accident, this is the policy that will cover the liability claims and property damage. The risks are simply different, and often higher, when a vehicle is used for business, making this specialized coverage absolutely essential.

Cyber Liability Insurance: A Modern-Day Necessity

In today's world, a data breach can be just as financially crippling as a fire. Cyber Liability Insurance is designed to help your business recover from a cyberattack. It can cover the huge costs that come with:

- Notifying customers that their data was exposed.

- Providing credit monitoring services.

- Restoring systems after a ransomware attack.

- Recovering compromised data.

Considering that a staggering 43% of cyberattacks target small businesses, this is no longer a niche policy just for tech firms. It’s a core protection for any business that stores customer information.

While these are the big ones, plenty of other specialized policies exist. You can dive deeper into a more exhaustive list of commercial insurance types in our guide to find the right combination for your unique business risks.

Why Your Business Cannot Afford to Be Uninsured

It’s one thing to know the definitions of different insurance policies, but it's another thing entirely to grasp why they are absolutely non-negotiable for your business. For many entrepreneurs, insurance can feel like just another line item on the expense sheet—that is, until it becomes the one thing keeping the doors open.

Treating insurance as an optional extra is one of the most dangerous mistakes a business owner can make. In reality, it’s a foundational support beam for everything you do, from your day-to-day operations to your long-term vision for growth. Without it, you aren't just taking a risk; you're gambling with everything you've worked so hard to build.

The Foundation of Operational Survival

It only takes one unexpected event to dig a financial hole so deep that even a thriving business can't recover. Picture a small graphic design firm that gets hit with a lawsuit from a client claiming a new logo damaged their brand and led to a massive loss of income. This is a classic Errors and Omissions (E&O) claim.

Without E&O insurance, the firm would be on the hook for tens of thousands—maybe even hundreds of thousands—in legal fees and potential settlement costs. Their cash reserves could be gone in an instant, and personal assets might be next on the line. But with the right insurance, the policy steps in to cover defense costs and any judgment, allowing the firm to handle the crisis and get back to business.

For a business, facing a major lawsuit or disaster without insurance is like having a personal health crisis without medical coverage. The bills keep coming, and the financial and emotional weight can be crushing, often pushing you past the point of no return.

A Mandate for Doing Business

In many situations, the choice to get insured isn't really a choice at all. It’s a requirement set by law or by the contracts you need to sign.

- Legal Requirements: Nearly every state legally requires that businesses with employees carry Workers' Compensation insurance. If you don't, you could face hefty fines, penalties, and even criminal charges.

- Contractual Obligations: Want to lease that perfect office space? Your landlord will demand proof of General Liability insurance. Trying to land a big corporate client? They will almost certainly ask to see your Certificate of Insurance before they sign on the dotted line.

This is where understanding what commercial insurance is becomes a practical tool for success. It’s the key that unlocks professional opportunities and proves to partners, clients, and landlords that you are a legitimate, responsible, and trustworthy operation.

Building Credibility and Trust

Beyond legalities and contracts, having solid insurance coverage is a powerful signal of credibility. It tells the world you’re a serious professional who is prepared for the unexpected. Your Certificate of Insurance essentially acts as a badge of honor, showing that you have the financial stability to make things right if anything goes wrong.

This kind of assurance can be a huge advantage, helping you win bigger contracts and forge stronger professional relationships. When a potential client sees you’re insured, they see stability and professionalism, making them far more comfortable trusting you with their business. When thinking about coverage, especially for digital risks, it's smart to understand the common ways small businesses are losing to cybercrime, which a good policy can help protect against.

Protecting Your Most Valuable Asset: Your Team

At the end of the day, insurance is about protecting people. Workers' Compensation makes sure your employees get the medical care they need to recover from a workplace injury without suffering a financial crisis. This builds a safer, more supportive environment and can do wonders for team morale.

That protection also extends to your own family. For many entrepreneurs, personal and business finances are deeply intertwined, particularly in the beginning. Just as you'd protect your home with specialized coverage (a topic we cover in our guide to https://wexfordis.com/2025/06/22/high-value-home-insurance/), your business requires its own dedicated shield. A business lawsuit could easily jeopardize your personal home, savings, and financial future. Commercial insurance creates that crucial firewall, ensuring a business crisis doesn’t turn into a personal catastrophe.

Understanding Your Commercial Insurance Costs

So, what’s this all going to cost? It’s the first question every business owner asks, and the answer isn't a simple price tag. The best way to think about your commercial insurance premium is like a custom-built piece of equipment—the final cost depends entirely on the parts and pieces needed to get the job done right.

Insurers arrive at your price through a detailed process called underwriting. They’re essentially trying to predict the future, calculating the odds of you filing a claim and how much that claim might cost. The more risk they see, the higher your premium will be. Getting a handle on these factors is the key to a productive conversation with your insurance agent and understanding the real value behind your quote.

The Key Ingredients of Your Insurance Premium

No two businesses are the same, and neither are their risks. An accountant's office has a completely different set of daily hazards than a busy construction site, and insurance pricing is built to reflect that reality.

Here are the main ingredients that go into your premium:

- Your Industry: This is the big one. A roofer working at heights with heavy equipment will always have a higher risk profile than a freelance writer working from home. That difference in risk translates directly to the cost.

- Number of Employees: More people on your team means more opportunities for a workplace injury. This is a primary driver for the cost of your Workers' Compensation insurance.

- Annual Revenue: Higher revenue often points to larger operations, which can mean bigger potential losses in a liability claim.

- Claims History: Think of this like a driving record for your business. A clean history with no past claims will almost always get you a better price. On the other hand, a pattern of frequent claims signals higher risk to an insurer.

Location, Location, Location

Where you do business is just as important as what you do. If your company is in a region prone to natural disasters like hurricanes or wildfires, you can expect to pay more for property insurance. Even your specific street matters—a retail shop in a high-crime area will likely face higher rates due to the increased risk of theft.

Market trends also have a huge impact. In a recent positive shift for business owners, we've seen increased competition among insurers, which has started to drive down prices. Global commercial insurance rates dropped by an average of 4%, with property insurance leading the way with a 7% global decrease. The US experienced an even sharper drop of 9%, offering some welcome relief.

This is great news, but it also shows why it’s so important to have an agent who actively shops the market to find you the best deal.

The Bottom Line: Your insurance premium is a direct reflection of your business's unique risk profile. It’s not a one-size-fits-all price, but a calculated cost based on your industry, size, location, and history.

The Table: What Drives Your Commercial Insurance Premium

To see how specific details can move the needle on your insurance costs, let's break down a few common scenarios. The table below illustrates how different factors can either increase or decrease what you pay.

| Pricing Factor | Scenario Leading to Higher Premiums | Scenario Leading to Lower Premiums |

|---|---|---|

| Industry | High-risk work like construction or trucking | Low-risk professional services like consulting |

| Claims History | Multiple claims filed in the last 3-5 years | A clean record with no recent claims |

| Location | Operating in a flood zone or high-crime area | Located in a low-risk, secure building |

| Policy Choices | High coverage limits and a low deductible | Lower coverage limits and a high deductible |

Ultimately, these factors all feed into the underwriter's final calculation. A good safety record and proactive risk management can go a long way in keeping your premiums manageable.

Balancing Cost with Coverage

Finally, the choices you make about your policy have a direct impact on the price. The two most significant levers you can pull are your deductible and your policy limits.

A deductible is what you pay out of pocket before your insurance coverage starts. Opting for a higher deductible will lower your monthly or annual premium, but it means you're taking on more of the initial financial hit yourself if something goes wrong.

Policy limits are the maximum amount your insurance company will pay for a single claim or over the policy period. Higher limits give you a much stronger safety net but come at a higher cost.

Finding that sweet spot is everything. A cheap policy might look good on paper, but if it comes with a sky-high deductible or dangerously low limits, it could put your business in jeopardy when you actually need the help. Real protection also means having a plan for when disaster strikes, which is why it's a smart move to understand the role of business continuity insurance in our dedicated article. The goal isn’t to find the cheapest policy, but the one that delivers solid protection at a price that fits your budget.

How to Choose the Right Insurance for Your Business

Now that you've got a handle on what commercial insurance is and why it's so critical, let's move from theory to action. Choosing the right coverage can feel overwhelming, but breaking it down into a step-by-step process makes it entirely manageable. This isn’t about throwing a dart at a board; it’s about making a smart, calculated decision to safeguard your company's future.

Think of it like getting a custom suit of armor made for your business. A generic, off-the-rack set just won't do. You need to measure carefully, pinpoint your specific vulnerabilities, and make sure every piece fits just right—offering maximum protection without getting in your way. Let’s walk through how to take those measurements.

Start with a Thorough Risk Assessment

Before you can even think about policies, you have to know what you’re up against. A risk assessment is really just a structured way of identifying the unique dangers your business faces every day. It's easy to focus on major catastrophes, but don't forget the small, mundane hazards that can trip you up.

Get started by asking yourself a few honest questions:

- Property Risks: What physical things do I own? Think buildings, computers, inventory, or specialized equipment. What’s the financial hit if they’re lost to a fire, flood, or break-in?

- Liability Risks: How do I interact with customers and the public? Could someone slip and fall on my property? Is there any chance my product or service could cause someone harm or a financial loss?

- Employee Risks: Do I have a team? What's the likelihood of an on-the-job injury? Do my employees drive company cars or use their own vehicles for work-related errands?

- Business Interruption Risks: If a disaster shut my doors tomorrow, how long could we survive with no income? What would it truly cost to get back on our feet?

An unflinching look at these scenarios is the bedrock of a solid insurance plan. A consulting firm, for instance, might be most concerned about a professional liability lawsuit, while a restaurant’s biggest fear is likely a kitchen fire. Your risks are unique to you.

Understand Your Legal and Contractual Duties

Next up, you need to figure out what coverage you're required to carry. These are the non-negotiables, often dictated by state law or the contracts you sign. For example, almost every state legally requires businesses with employees to have Workers' Compensation insurance.

Likewise, a commercial landlord will almost certainly demand General Liability coverage before handing over the keys. Big clients often require proof of Professional Liability (E&O) insurance before they'll sign a contract. And if your business uses vehicles, understanding specific rules like the UK fleet insurance requirements is essential. These aren't just bureaucratic hoops to jump through—they're the fundamental protections that allow you to operate legally and professionally.

Find the Right Insurance Partner

When you're ready to start shopping, you’ve basically got two choices for professional help: a captive agent or an independent broker. A captive agent represents a single insurance company, so they can only sell you that company’s products. An independent broker, on the other hand, works with a wide range of insurers.

An independent broker is your advocate. They shop the entire market to find the best blend of coverage and cost tailored to your business. This can be a massive advantage in today's market.

The North American commercial insurance market is flush with capital right now, with the U.S. policyholder surplus sitting at over $1 trillion. This has sparked intense competition among insurers, which is fantastic news for business owners seeking better prices and more flexible options.

Compare Quotes Intelligently

With a few quotes in hand, the temptation is to just grab the cheapest one. That's a huge mistake. The least expensive policy is rarely the best value. You have to dig into the details.

Zero in on these three key components:

- Policy Limits: This is the absolute maximum the insurer will pay for a covered claim. Are the limits high enough to actually protect your assets?

- Deductibles: This is what you have to pay out-of-pocket before your insurance coverage kicks in. A lower premium often comes with a painfully high deductible.

- Exclusions: Pay very close attention to what the policy specifically does not cover. This is where dangerous gaps in protection are often hiding.

For unique risks, like those faced by your company’s leadership, it’s vital to look into specialized policies. Our guide to management liability coverage breaks these down in much greater detail.

Finally, remember that insurance isn't a "set it and forget it" purchase. Your business will grow and change, and your coverage needs to evolve right along with it. Make it a habit to review your policies with your agent at least once a year. Think of your insurance as a living part of your business strategy—one that needs regular attention to stay effective.

Common Questions About Commercial Insurance

https://www.youtube.com/embed/NwLbFxC4TPM

As we wrap up, it’s completely normal to have a few more questions rattling around. Insurance can feel like a maze, but getting clear, direct answers is the best way to feel confident about protecting your business.

We’ve pulled together some of the most common questions we hear from business owners just like you. The goal here is to cut through the jargon and give you the practical clarity you need.

What Is the Difference Between a BOP and a CPP?

This is a classic point of confusion, so let's break it down with an analogy. Think about ordering food: you can grab a pre-set combo meal, or you can order everything à la carte.

A Business Owner's Policy (BOP) is that convenient combo meal. It bundles the most common coverages—General Liability, Commercial Property, and Business Interruption—into one neat, affordable package. For many small, lower-risk businesses like a local coffee shop or a small marketing agency, a BOP is the perfect fit.

A Commercial Package Policy (CPP) is the à la carte menu. It gives you the flexibility to pick and choose individual coverages to build a policy that fits your specific, and often more complex, needs. This is the route for businesses with unique risks, like a construction company or a large-scale manufacturing plant, that need more tailored protection.

Will My Homeowners Insurance Cover My Home Business?

This is one of the most dangerous assumptions a home-based entrepreneur can make. The short answer is almost always no. Your standard homeowners policy is built to protect your personal life, not your professional one.

In fact, if you read the fine print, you'll likely find specific exclusions for any business-related activities. If a client slips and falls in your home office and decides to sue, your homeowners policy will almost certainly deny the claim. That expensive business equipment or inventory in your garage? It probably isn't covered if a fire breaks out.

You absolutely need a separate commercial insurance policy to properly protect your business assets and shield yourself from business-related lawsuits. Working from home doesn't eliminate business risks; it just changes their location.

When Do I Need a Certificate of Insurance?

Think of a Certificate of Insurance (COI) as your business's official insurance ID card. It’s a simple, one-page document that proves you have active coverage, listing your policy types, limits, and your insurance provider.

You’ll find yourself needing to show a COI in a lot of everyday business scenarios:

- Signing a lease for an office or retail space.

- Landing a new client, especially if they're a larger company.

- Applying for a business loan from a bank.

- Getting a professional license or permit from your city.

Having a COI ready to go shows you’re a serious, prepared professional and can help you lock down opportunities without any last-minute scrambles.

How Does Filing a Claim Actually Work?

The idea of filing a claim can be stressful, but the process itself is pretty logical. While the exact steps can differ slightly between insurance carriers, they all follow the same basic framework.

- Document Everything Immediately: Once the immediate danger has passed, start documenting. Take pictures, shoot video, and get the names and contact info of any witnesses. Jot down every detail of what happened while it's still fresh in your mind.

- Notify Your Insurer Promptly: Don't wait. Call your insurance agent or carrier as soon as you possibly can. Most policies include a clause about timely notification, so it's critical to act fast.

- Cooperate with the Adjuster: Your insurance company will assign a claims adjuster to your case. Their job is to investigate what happened, figure out the extent of the damage, and determine what's covered under your policy. Be open, honest, and provide them with all the documentation you gathered.

From there, your adjuster will be your guide, whether it’s coordinating repairs or helping you navigate a lawsuit. Being thorough with your documentation and maintaining clear communication are the best things you can do for a smooth claims process. Fully grasping these policies, especially when it comes to liability insurance for employees, is a cornerstone of responsible business ownership.

Understand the Cost of Airplane Insurance | Tips & Insights

Understand the Cost of Airplane Insurance | Tips & Insights What is Commercial Umbrella Insurance? Protect Your Business Now

What is Commercial Umbrella Insurance? Protect Your Business Now