Let's think of commercial umbrella insurance as a financial backstop for your company. It’s an extra layer of liability protection that kicks in only when a catastrophic claim has completely maxed out your primary policies, like your general liability or commercial auto insurance. This type of coverage is often called excess liability, and its sole purpose is to protect your business assets from a lawsuit that could otherwise be financially devastating.

What Is Commercial Umbrella Insurance, Really?

To get a real handle on commercial umbrella insurance, it helps to use an analogy. Imagine your primary insurance policies—your general liability, commercial auto, and employer's liability—are like a standard first-aid kit. This kit is perfect for handling the everyday scrapes and bumps that businesses face.

But what if there's a major accident? That’s when you need a trauma surgeon. Your commercial umbrella policy is that specialist. It’s not for the small stuff; it steps in when a massive claim goes far beyond what your standard policies can handle, preventing a minor issue from turning into a financial catastrophe for your business.

How Does This "Excess Liability" Work?

The heart of an umbrella policy is providing excess liability coverage. This isn't just a concern for massive corporations; I've seen a single, unexpected lawsuit put a small, thriving business on the ropes. The first step is always to understand where you're vulnerable, and a thorough small business risk assessment is the best way to do that.

Let’s look at a real-world scenario. Say your business is hit with a lawsuit and the final judgment is for $1.5 million. If your primary general liability policy has a $1 million limit, you're on the hook for the remaining $500,000. That's a gap that can sink a company.

This is precisely where a commercial umbrella policy proves its worth. It would activate to cover that $500,000 shortfall, along with other potential costs.

What Does an Umbrella Policy Actually Cover?

An umbrella policy sits on top of your other liability policies. When those are exhausted, the umbrella can help pay for:

- Massive legal bills, including attorney fees, court costs, and expert witness retainers.

- Judgments and settlements awarded to the other party.

- Extensive medical expenses resulting from a severe injury claim.

These policies are typically sold in increments of $1 million and can go up to $15 million or even higher, depending on the carrier and your business's needs. This extra protection fits into a comprehensive risk management plan, which you can learn more about in our guide on what is commercial insurance.

To make this crystal clear, let's compare the outcome of a major lawsuit with and without an umbrella policy.

Coverage Scenario With and Without an Umbrella Policy

| Expense Category | Without Umbrella Insurance | With Umbrella Insurance |

|---|---|---|

| Lawsuit Judgment | $1,500,000 | $1,500,000 |

| Primary Insurance Payout | $1,000,000 | $1,000,000 |

| Umbrella Policy Payout | $0 | $500,000 |

| Your Out-of-Pocket Cost | $500,000 | $0 |

As you can see, the difference is stark. That $500,000 out-of-pocket expense could easily shutter a business, but with the umbrella policy, the company can continue operating.

In a world where multi-million dollar lawsuits are becoming more common, just having standard insurance policies can be a risky bet. An umbrella policy provides peace of mind, ensuring that one "worst-case scenario" doesn't destroy the business you've poured your life into building. It's a strategic move for your company's long-term health and stability.

How an Umbrella Policy Actually Works in a Claim

Theory is one thing, but to really understand what commercial umbrella insurance is, you need to see how it plays out in the real world. This is where the policy truly proves its worth.

Let's imagine a scenario. One of your delivery trucks is involved in a serious multi-vehicle pile-up on the interstate. The accident causes extensive damage to several other cars and, more importantly, severely injures multiple people. The lawsuits that follow are complicated and expensive.

The Claim Unfolds

As the legal battles begin, the bills start to pile up fast. Your primary commercial auto insurance policy, which has a $1 million liability limit, kicks in first. It starts covering the legal defense costs, medical bills, and settlement talks, just like it's supposed to.

But the situation escalates. The final, agreed-upon settlement for everyone involved—covering injuries and property damage—comes to a staggering $2.5 million. That's a huge number, but it's not unheard of in today's world. Your primary auto policy pays out its full $1 million limit, but you're still on the hook for a massive amount.

Without more coverage, your business would be personally responsible for the remaining $1.5 million. A debt like that could easily bankrupt a company, forcing you to sell off assets or shut down for good.

The Umbrella Policy Takes Over

This is the exact moment your commercial umbrella insurance springs into action. Once your primary policy has paid out every last dollar of its coverage—its underlying limit—the umbrella policy steps up to handle the rest. Think of it as your financial safety net, protecting your business from a devastating out-of-pocket expense.

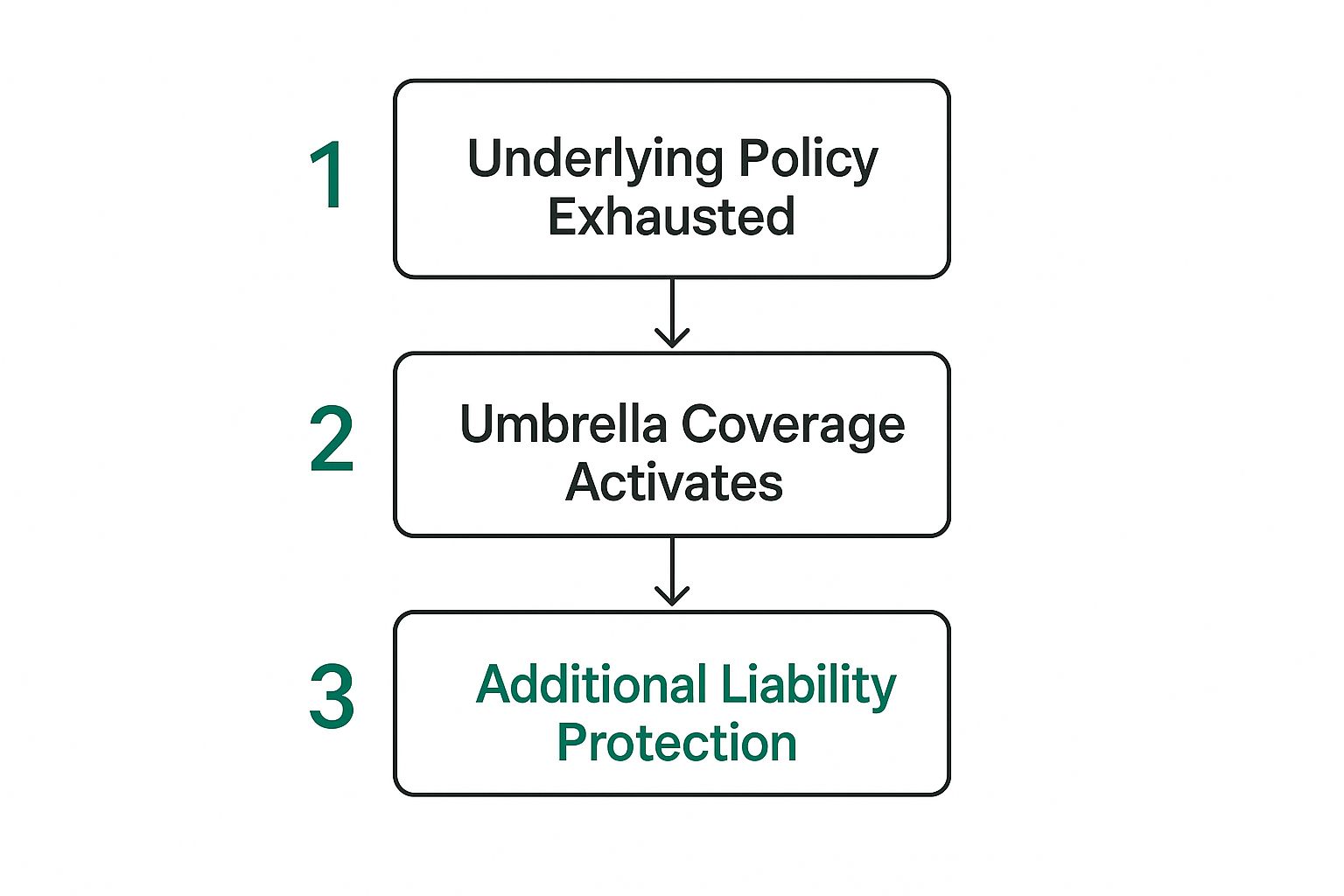

This visual shows that simple but powerful sequence.

As you can see, the umbrella coverage only gets triggered after your primary insurance has maxed out. It’s a crucial second line of defense. In our story, your umbrella policy would cover that remaining $1.5 million, making sure the claimants are fully compensated without forcing you to liquidate your business to pay the bill.

Walking through it step-by-step really shows the critical job an umbrella policy does. It isn’t for the small, everyday claims. It’s there to shield your business from those rare, catastrophic events that can blow right past your standard policy limits, saving the company you've worked so hard to build.

What an Umbrella Policy Actually Protects

It’s easy to think of commercial umbrella insurance as just a way to get higher liability limits. While that's true, its real strength is in the breadth of protection it offers. It doesn't just add more money on top of your existing policies; it builds a comprehensive shield against a much wider range of catastrophic risks.

The most straightforward job of an umbrella policy is to kick in when your primary liability policies are tapped out. Think of a major lawsuit over a bodily injury or property damage claim that blows past your general liability or commercial auto limits. Your umbrella policy steps in to cover the rest, preventing those excess costs from coming directly out of your business's bank account.

Filling the Gaps with Drop-Down Coverage

This is where umbrella policies get really interesting. Many include a powerful feature called "drop-down" coverage, which is a crucial part of what commercial umbrella insurance truly is. This feature allows the umbrella to cover claims that might be completely excluded by your primary insurance policies.

Let's say your standard general liability policy has an exclusion for claims related to libel and slander. If your business gets hit with a defamation lawsuit, that primary policy won't do a thing. But a well-designed umbrella policy can "drop down" and act as the primary coverage for that specific risk, usually after you meet a deductible known as a self-insured retention (SIR).

This broader protection can cover a whole host of risks that are often left out of standard policies, such as:

- Libel and Slander: Covering damages from things you say or write that harm someone's reputation.

- False Arrest or Imprisonment: Protecting your business if an employee wrongly detains a customer they suspect of shoplifting.

- Invasion of Privacy: Shielding you from claims related to things like improper surveillance or sharing private information.

The value of this expanded scope is why the global market for umbrella insurance is expected to hit an incredible $170.7 billion by 2031. It's becoming a non-negotiable piece of modern risk management for savvy business owners.

How This Works in the Real World

Here's a practical example. Imagine a security guard at your retail store mistakenly detains a shopper, who then sues you for false arrest. Your general liability policy might have an exclusion for this type of event. An umbrella policy with drop-down coverage would be your financial backstop, protecting your assets from a costly and unexpected legal fight.

This kind of extended coverage is absolutely vital for any business that deals with the public or operates in a higher-risk industry. For those in specialized fields where issues like security guard liability are a major concern, commercial umbrella insurance provides critical protection against claims that could otherwise be devastating.

At the end of the day, an umbrella policy does so much more than just raise your coverage limits. It intelligently fills the dangerous gaps that other policies can leave behind, making it a cornerstone of any truly resilient insurance plan. To see how it complements other policies, check out our guide to common commercial insurance types.

What Isn't Covered by Umbrella Insurance?

While a commercial umbrella policy is a fantastic safety net, it's not a magic wand that makes every business risk disappear. Thinking of it as a do-it-all policy is a common and costly mistake, one that can leave your business dangerously exposed.

Its real job is to give your existing liability policies—like general liability and commercial auto—a major boost. It doesn't replace them or fill in for other crucial types of coverage.

Think of it this way: your umbrella policy sits on top of your primary liability policies. It’s built to handle claims from third parties, but it typically won't step in for issues related to your own property, your employees, or the professional advice you give.

Common Exclusions in an Umbrella Policy

To create a truly gap-free insurance plan, you need to understand what an umbrella policy doesn't do. You'll need separate, specialized policies for these common risks, as they are almost always excluded from umbrella coverage:

- Your Own Property: If your warehouse burns down or a storm shatters your office windows, that's a job for your commercial property insurance, not your umbrella policy.

- Injured Employees: Any on-the-job injuries or illnesses fall squarely under workers' compensation insurance. An umbrella is not designed to cover your responsibilities to your own team.

- Professional Errors: Did a client sue you over bad advice or a mistake in your work? You'll need Errors & Omissions (E&O) insurance (also called professional liability) for that.

- Employment-Related Lawsuits: Claims of wrongful termination, harassment, or discrimination are handled by a specific policy called Employment Practices Liability Insurance (EPLI).

This is the key takeaway: An umbrella policy is designed to shield you from catastrophic liability claims brought by outside parties, like a customer who slips and falls or another driver in an accident. It doesn't cover your own property losses or internal company disputes.

Recognizing these boundaries is the first step toward building a complete risk management strategy. It helps you avoid false assumptions and pinpoint exactly where you might need to add another layer of protection.

For a deeper look into figuring out your business's specific needs, our guide on how much umbrella insurance you might need offers some great next steps.

How Much Does Commercial Umbrella Insurance Cost?

After understanding what commercial umbrella insurance can do, the next logical question on every business owner's mind is, "What's this going to cost me?" While there's no one-size-fits-all price tag, the good news is that this coverage is often far more affordable than people expect, especially when you consider the millions in protection it offers.

Think of the premium as a direct reflection of your company's unique risk story. Insurers don't just pick a number; they perform a detailed assessment to figure out how likely it is your business might face a massive claim.

Key Factors Influencing Your Premium

Ultimately, the price you pay is tied to your specific level of risk. For example, a small accounting firm that primarily deals with paperwork will have a much different risk profile—and a lower premium—than a large construction company operating heavy machinery on busy job sites.

Here are the main dials insurers turn when setting your rate:

- Your Industry: Businesses in higher-risk fields like construction, trucking, or manufacturing will naturally see higher premiums. The potential for a catastrophic accident is just greater.

- Business Size: This is often measured by your annual revenue and the number of employees. More activity and more people simply create more opportunities for something to go wrong.

- Claims History: A clean track record is your best friend. If you have a history of frequent or large claims, insurers will see you as a higher risk and price your policy accordingly.

- Desired Coverage Amount: This one is straightforward. A $1 million umbrella policy will cost less than a $5 million policy because the insurer is taking on less potential liability.

Your insurance carrier is essentially trying to match your premium to the potential for a "black swan" event—a rare but devastatingly expensive claim. This is where a strong safety program and a proactive approach to risk management can really pay off by helping you secure better rates.

Insurers don't just look at your business in a vacuum; they also consider what's happening in the broader insurance market. We've seen an uptick in both the number and size of large liability claims over the past several years. This trend has caused some insurance carriers to rethink their pricing, which can sometimes impact your renewal costs.

What Insurers Look At

To give you a clearer picture, here’s a breakdown of the variables insurers use to calculate what you'll pay for commercial umbrella insurance.

| Cost Factor | Why It Matters | Impact on Premium |

|---|---|---|

| Industry & Operations | High-risk sectors (e.g., construction, transportation) have a greater chance of severe accidents. | Higher Risk = Higher Premium |

| Annual Revenue | Higher revenue often means larger-scale operations and more to lose in a lawsuit. | Higher Revenue = Higher Premium |

| Number of Employees | A larger workforce increases the potential for employee-related liability incidents. | More Employees = Higher Premium |

| Past Claims History | A history of claims suggests a higher likelihood of future claims. | Clean Record = Lower Premium |

| Location of Operations | Operating in litigious regions or high-risk areas can increase potential claim costs. | Higher-Risk Area = Higher Premium |

| Coverage Limits | The more coverage you buy, the more risk the insurer takes on. | Higher Limits = Higher Premium |

Understanding these factors helps demystify the pricing process and shows where you have the most control over your costs.

Is It Worth the Investment?

Even with these variables, many small to mid-sized businesses can secure a $1 million umbrella policy for a surprisingly manageable cost. It's a small price to pay for the kind of peace of mind that lets you sleep at night.

Think of it as a critical part of your company's financial safety net, working alongside other protections like business continuity insurance to keep you resilient. When you weigh the modest premium against the astronomical, potentially business-ending cost of a major lawsuit, the value of a commercial umbrella policy becomes crystal clear.

Common Questions About Commercial Umbrella Insurance

Business insurance can feel like a maze, and when it comes to umbrella policies, a few key questions always seem to pop up. Let's clear the air and give you some straightforward answers so you can make a smart decision for your business.

Is Excess Liability the Same as Umbrella Insurance?

It’s a common mix-up, but no, they aren't the same. While they both provide extra coverage, they work in fundamentally different ways. Getting this right is crucial to knowing what you're actually protected against.

Excess liability insurance is pretty simple: it stacks right on top of a single existing policy. It gives you higher limits but mirrors the exact same terms and conditions of that one policy. Think of it like adding more fuel to your car's tank—it gives you more of what you already have, but it won't change what your car can do.

Commercial umbrella insurance is the more versatile of the two. It not only boosts your liability limits across multiple underlying policies (like general liability and commercial auto) but can also "drop down" to cover claims your primary policies won't touch. In these cases, you’d typically pay a deductible called a self-insured retention (SIR). It’s less like more fuel and more like having a spare tire—a different kind of protection for a different kind of problem.

How Much Umbrella Coverage Does My Business Need?

There’s no one-size-fits-all answer here. The right amount of coverage depends entirely on your business's unique risks. A local coffee shop simply doesn't face the same level of liability as a company that manufactures heavy machinery.

To zero in on the right number, you need to look at:

- Your Industry: High-risk fields like construction, trucking, or manufacturing naturally need higher limits.

- Your Assets: How much is your business worth? You want enough coverage to protect everything you've built if the worst happens.

- Your Revenue: Higher revenue can sometimes mean bigger projects and more at stake, which calls for more protection.

- Your Contracts: Clients often require you to carry specific, high-limit liability coverage before they’ll sign on the dotted line.

A good starting point for many small and mid-sized businesses is a policy between $1 million and $5 million. The best way to be sure, though, is to talk with an experienced broker who can help you assess your real-world exposure.

Do Small Businesses Really Need an Umbrella Policy?

Yes, absolutely. It's a huge myth that umbrella policies are just for giant corporations. In fact, you could argue small businesses need them more.

A lawsuit that goes beyond a standard $1 million general liability limit could bankrupt a small business. Unlike a large corporation, you don't have deep cash reserves to absorb a massive judgment.

An umbrella policy is an incredibly affordable way to add a massive layer of financial security. It's the safety net that ensures one catastrophic event doesn't mean shutting your doors for good.

Does an Umbrella Policy Cover My Professional Mistakes?

This is a critical distinction to understand: typically, no. A standard commercial umbrella policy is designed to give you extra protection for claims involving:

- Bodily injury to a third party

- Property damage to a third party's assets

- Personal and advertising injury (like defamation or copyright issues)

It almost always excludes claims related to your professional services. If a client sues you because of a design flaw, bad advice, or professional negligence, that falls under a separate Errors & Omissions (E&O) or Professional Liability policy.

Your umbrella policy sits on top of your foundational coverages, not your specialized professional ones. Making sure you understand what each policy covers is a cornerstone of a solid risk management plan, something we explore in our guide on what is commercial insurance.

What is Commercial Insurance? Protect Your Business Today

What is Commercial Insurance? Protect Your Business Today What Is Commercial Vehicle Insurance

What Is Commercial Vehicle Insurance