Let's cut right to it: coinsurance in property insurance is a clause in your policy that says you must insure your property for a specific percentage of its total value. Typically, this is 80% or 90%.

If you hit that magic number, your insurer covers your claim in full (up to your policy limits, of course). But if you fall short, you get hit with a financial penalty and have to pay a chunk of the loss yourself.

What Is Coinsurance in Property Insurance

The word "coinsurance" trips a lot of people up. Many assume it works just like health insurance, where you always share the cost of a claim with the insurance company. That’s not how it works here. In property insurance, think of it less as a cost-sharing partnership and more as a coverage promise you need to keep.

This clause is the insurance company's tool to make sure property owners buy enough coverage. Without it, someone might be tempted to insure a $1 million building for just $200,000, gambling that a total loss is a long shot. This is called underinsurance, and it messes up the whole system, leading to unfair premium rates for everyone.

The Purpose Behind the Clause

At its core, the coinsurance clause is all about keeping insurance pricing fair. By making everyone insure their property to a certain value, insurers can spread the risk more evenly and calculate premiums that actually make sense. It’s a mechanism that encourages everyone to be responsible with their coverage.

Here’s the key thing to remember: the coinsurance clause really comes into play with partial losses. We're talking about a kitchen fire or major roof damage from a storm—things that happen far more often than a building burning to the ground. If your property is underinsured when one of these partial losses occurs, you effectively become a "co-insurer," meaning you'll be on the hook for a portion of the repair costs yourself. And this can happen even if the damage amount is well below your policy limit.

Coinsurance isn't a punishment for having a claim. It's a penalty for being underinsured when you have a claim. Getting that distinction is the first step to properly protecting your investment.

Navigating Different Policy Types

This concept isn't just for one type of policy; it applies across the board, from standard commercial property insurance to more specific coverages. To really get a handle on how a potential claim payout would be affected, it's a good idea to explore your options and even start comparing landlord insurance policies to see how the terms differ.

While each policy might have its own quirks, the fundamental principle of insuring to value remains the same. Now that we have the foundation down, we can dig into the actual formula and see how the numbers play out.

How the Coinsurance Clause Actually Works

A lot of property owners get tripped up by coinsurance because it feels like a bait-and-switch. But it isn't about splitting the bill on every claim. Instead, think of it as a penalty that only kicks in when your property is underinsured. It's a conditional agreement you have with your insurer.

Let's try an analogy. Imagine a concert promoter offers a sweet deal: if you buy at least eight tickets for your group of ten, you get a big discount on each one. If you only buy six, you don't just pay full price for those six—you lose the special rate entirely and might even get hit with an extra fee.

The coinsurance clause works a lot like that. Your policy states you must "buy" a certain amount of coverage—usually 80% or 90% of your property's value. Nail that, and your insurer pays your claim in full (up to your policy limit, of course). Miss the mark, and you face a penalty that shrinks your payout.

The Key Components You Need to Know

This whole concept rests on four critical pieces. Getting a handle on each one is the key to seeing the full picture and avoiding a nasty surprise after a claim.

- Property's Replacement Cost Value (RCV): This is the big one. It’s not what you paid for the property or what it would sell for today. It’s the cold, hard cost to rebuild it from the ground up with similar materials and quality at current prices.

- Coinsurance Percentage: This is the magic number in your policy, most often 80%. It’s the minimum coverage you have to carry in relation to your property’s RCV.

- Insurance Required: This is just simple math: Property RCV x Coinsurance Percentage. If your building has an RCV of $1 million and an 80% clause, you must carry at least $800,000 in coverage.

- Insurance Carried: This is the actual coverage limit on your policy—the number on your declarations page.

The whole idea behind this is fair risk-sharing. It ensures the premiums everyone pays are in line with the real risk, especially for partial losses. This is standard practice across the U.S. property insurance market, where policies often require 80% to 100% coverage of a property's replacement cost. As experts at MDD.com explain, failing to hit this number means your claim payout gets proportionally slashed.

Why Partial Losses Are the Real Concern

This is the most important thing to remember: the coinsurance penalty usually bites you on partial losses, not total ones. Think about it—a kitchen fire, a burst pipe, or major roof damage from a storm are way more common than a building burning to the ground.

A coinsurance penalty can turn a manageable $50,000 repair into a significant financial burden, all because the property was insured for $350,000 instead of the required $400,000.

Let’s say a fire causes $100,000 in damage. That's well under your policy limit, so you'd think you're covered, right? Not so fast. If you failed to meet your coinsurance requirement, the insurer will run a penalty formula, and you’ll only get a fraction of that $100,000.

You're left paying the rest out of pocket, which can be a financial nightmare. This surprise gap can even impact your ability to pay for a hotel or rental, a topic we cover in our guide to homeowners insurance loss of use coverage. Understanding this is absolutely critical to making sure your policy actually does its job when you need it.

Calculating The Coinsurance Penalty Step By Step

Now that we’ve covered the why behind coinsurance, let's get into the how. The formula itself can look a little intimidating on paper, but it’s actually a pretty straightforward calculation.

At its heart, the math is designed to figure out your payout if your coverage falls short. Let's break it down so you can see exactly how it works.

The Coinsurance Formula Explained

Here’s the formula insurers use to calculate your payout when a coinsurance penalty applies:

(Amount of Insurance You Have / Amount of Insurance You Should Have) x Amount of Loss = Your Payout

It seems simple enough, but let's quickly unpack each part of that equation.

- Amount of Insurance You Have: This one's easy. It's the coverage limit listed right on your policy's declarations page—the total amount of insurance you purchased.

- Amount of Insurance You Should Have: This is the minimum coverage your policy’s coinsurance clause requires. To find it, you just multiply your property's full replacement cost by the coinsurance percentage (for example, $1,000,000 Value x 80% Coinsurance = $800,000 Required).

- Amount of Loss: This is the total bill to repair or replace everything that was damaged in a covered event, like a fire or major storm.

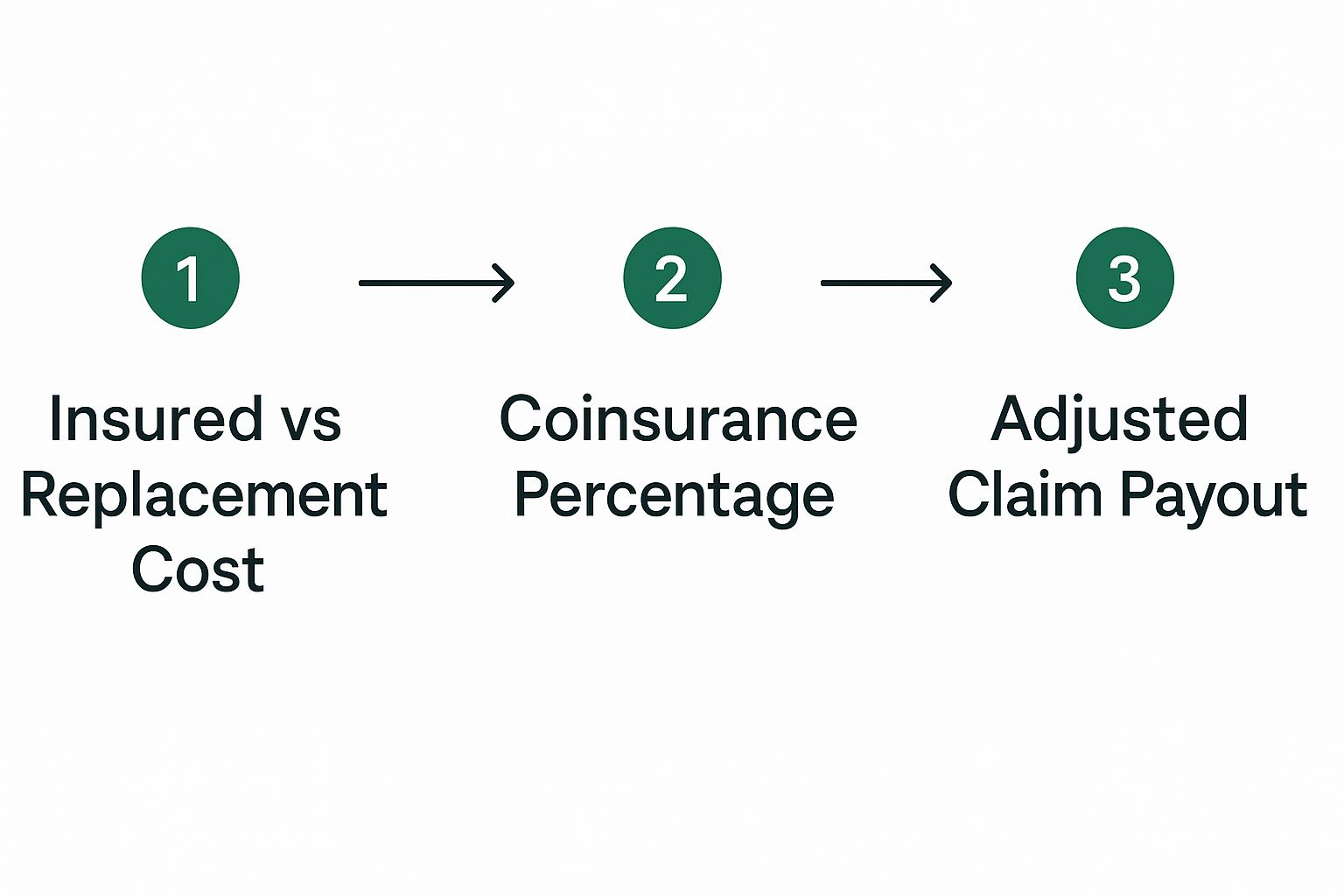

This visual gives you a clear picture of how those numbers fit together to determine what you'll get from the insurance company after a claim.

As you can see, the ratio between what you have and what you should have is the key factor that adjusts your final payout.

A Real-World Calculation Example

Let’s run the numbers with a realistic scenario. Imagine you own a commercial building with a replacement cost value of $1,000,000. Your property insurance policy includes a standard 80% coinsurance clause.

-

Find Your Required Coverage: First, we need to figure out the minimum insurance you should be carrying.

- $1,000,000 (Property Value) x 80% (Coinsurance Clause) = $800,000 (Insurance Required)

-

Check Your Actual Coverage: After digging out your policy, you see you only insured the building for $600,000. That leaves you underinsured by a hefty $200,000.

-

Calculate the Payout After a Loss: A fire tears through one wing of the building, causing $200,000 in damage. Now, we just plug everything into the formula.

- ($600,000 / $800,000) x $200,000

- 0.75 x $200,000 = $150,000

The insurance company will cut you a check for $150,000 (before your deductible). You’re now on the hook for the remaining $50,000 out of your own pocket—all because the property wasn't insured to its required value.

This table shows a couple of different scenarios to really drive the point home.

Coinsurance Penalty Calculation Example

This table shows how the penalty works with different levels of coverage for a $1,000,000 property with an 80% coinsurance clause and a $200,000 loss.

| Scenario | Property Value | Coinsurance % | Insurance Required | Insurance Carried | Amount of Loss | Formula [(Carried/Required) x Loss] | Insurer Payout | Your Out-of-Pocket Cost |

|---|---|---|---|---|---|---|---|---|

| Fully Insured | $1,000,000 | 80% | $800,000 | $800,000 | $200,000 | ($800k/$800k) x $200k | $200,000 | $0 (plus deductible) |

| Partially Insured | $1,000,000 | 80% | $800,000 | $700,000 | $200,000 | ($700k/$800k) x $200k | $175,000 | $25,000 (plus deductible) |

| Underinsured | $1,000,000 | 80% | $800,000 | $600,000 | $200,000 | ($600k/$800k) x $200k | $150,000 | $50,000 (plus deductible) |

As you can see, the closer you are to meeting the requirement, the smaller your financial burden will be after a claim.

Ensuring Your Property Value Is Accurate

The entire coinsurance calculation hinges on one thing: an accurate property valuation. If that number is too low, you could be underinsured and not even know it.

To get a solid handle on your property's full replacement cost, using a real estate square footage cost estimator is a great place to start. Getting this number right is the bedrock of a sound insurance plan.

It's a crucial part of the whole picture, which we talk about more in our guide on https://wexfordis.com/2025/08/05/how-to-choose-home-insurance/. Taking this step helps you avoid the penalty and ensures you get the full payout you're counting on.

Real-World Coinsurance Scenarios

The formula is one thing, but seeing how a coinsurance clause plays out in real life is what really makes the concept click. It’s surprisingly easy for property owners to get tripped up, turning what should be a straightforward claim into a major financial headache.

Let’s walk through a couple of common situations where policyholders were caught off guard. These stories bring the abstract idea of coinsurance to life and show the painful consequences of not keeping your coverage up to date.

The Business Owner and the Major Renovation

Meet Alex, a bakery owner whose business was finally taking off. He decided to reinvest in his success, pouring $150,000 into a massive renovation. He added a beautiful state-of-the-art kitchen and expanded the dining area.

Amid the excitement of construction and growing sales, Alex forgot one crucial phone call: the one to his insurance agent. His building, originally valued at $500,000, was now worth $650,000. His policy had a standard 80% coinsurance clause, meaning he needed to be insured for at least $520,000 ($650,000 x 0.80). But his policy limit was still stuck at $400,000.

A few months later, disaster struck. An electrical fire caused $100,000 in damage. Alex filed his claim, thinking his $400,000 limit was more than enough to cover it. That's when the adjuster brought out the coinsurance formula:

- ($400,000 Carried / $520,000 Required) x $100,000 Loss = $76,923

Instead of a check for the full $100,000, Alex only received $76,923 (before his deductible). He was suddenly on the hook for the remaining $23,077—a costly lesson on the importance of updating your coverage after any significant property improvement.

The Homeowner in a Booming Market

Now, let's look at Sarah. She bought her home five years ago for $400,000 and insured it for that amount. Since then, her neighborhood has become a hot spot. A surge in demand and soaring construction costs pushed the actual replacement cost of her home up to $600,000.

Her policy’s 80% coinsurance clause meant she now needed $480,000 in coverage. But like many homeowners, she hadn't revisited her policy, which was still set at the original $400,000. When a nasty hailstorm ripped through and caused $50,000 in damage, she learned she was underinsured.

The math was simple but brutal:

- ($400,000 Carried / $480,000 Required) x $50,000 Loss = $41,667

Sarah had to come up with the $8,333 difference out of her own pocket. This is a classic case of "passive underinsurance," where inflation quietly erodes your coverage without you even realizing it.

Coinsurance isn't just a business problem. Homeowners are just as vulnerable, especially in markets where construction and labor costs are on the rise. An annual policy review is your best defense against getting hit with an unexpected penalty.

Property vs. Health Coinsurance: A Quick Clarification

It’s really important to know that property coinsurance is completely different from the health insurance version, even though they share the same name.

- Health Insurance Coinsurance: This is your share of the cost. After you meet your deductible, you might pay 20% of every doctor's bill, and the insurance company pays 80%. It's a cost-sharing model.

- Property Insurance Coinsurance: This is a penalty that only gets triggered if you fail to carry enough insurance. If your coverage meets the required percentage of the property's value, the clause never even comes into play.

Mixing these two up can lead to some dangerous assumptions about what your policy covers. Remember, some major risks, like flooding, are almost never included in a standard policy. You can learn more about that in our guide comparing flood insurance vs. homeowners insurance. Understanding these details is the key to building a truly solid financial safety net.

How to Avoid the Coinsurance Penalty

Knowing about the coinsurance penalty is one thing, but making sure it never affects you is another. Thankfully, avoiding it isn't about crossing your fingers and hoping for the best—it's about smart, proactive policy management. With the right approach, you can guarantee your property is properly protected and that you’ll get the full payout you expect after a loss.

Think of it as routine maintenance for your financial safety net. You wouldn't let your roof fall into disrepair, and you shouldn't let your insurance coverage become outdated. A little bit of attention now can prevent a small oversight from turning into a massive, unexpected bill when you need to file a claim.

Because of this cost-sharing rule, underinsuring your property can slash your claim payment by thousands of dollars. It’s a harsh lesson in the importance of meeting your coinsurance requirement. You can find more analysis on this topic over at the Number Analytics blog.

Regularly Appraise Your Property Value

The absolute best way to avoid a coinsurance penalty is to know what it would actually cost to rebuild your property. We're talking about its replacement cost value (RCV), not its market value or what you originally paid for it. RCV is the real-world price tag for materials and labor to build it all back from the ground up, today.

Construction costs and the real estate market are always on the move. A property valuation that was spot-on three years ago could leave you dangerously underinsured now.

Here are the critical times to get a professional appraisal:

- After Major Renovations: If you've put on an addition, gutted the kitchen, or made any other significant upgrades, your property's value has shot up. Your coverage needs to follow suit.

- In a Volatile Market: When inflation or supply chain snags cause building costs to spike, your old coverage limits become obsolete almost overnight.

- Every 3-5 Years: As a simple rule of thumb, getting a fresh appraisal periodically keeps your insurance in sync with reality.

Insure for Replacement Cost, Not Actual Cash Value

When you’re setting up your policy, you’ll typically run into two valuation methods: Replacement Cost Value (RCV) and Actual Cash Value (ACV). Making the right choice here is absolutely crucial.

- RCV is designed to cover the full cost to repair or rebuild your property with similar materials, with no deduction for age or wear and tear.

- ACV pays you the replacement cost minus depreciation. An old roof might be worth very little under an ACV policy, leaving you to foot most of the bill for a new one.

Always choose RCV coverage. It’s designed to do exactly what the coinsurance clause requires: insure your property for what it would cost to make you whole again. Choosing ACV practically guarantees you'll fall short of your coinsurance requirement.

Consider an Agreed Value Endorsement

For many property owners, the simplest and most effective way to sidestep the coinsurance penalty entirely is to add an agreed value endorsement to their policy. This handy provision puts the coinsurance clause on pause for the policy term.

Here’s how it works:

- Valuation: Before the policy starts, you and your insurer agree on the property’s value, usually based on a professional appraisal.

- Agreement: You then agree to insure the property for 100% of that pre-determined value.

- Waiver: In exchange, the insurance company waives the coinsurance clause. If a partial loss happens, they won't run a coinsurance calculation, even if the actual cost to rebuild has gone up.

This approach offers total clarity and peace of mind, especially for complex commercial properties or unique homes where valuation isn't straightforward.

Proactive management of your policy is key to avoiding penalties. Below is a table comparing a few common strategies to ensure you remain adequately covered.

Strategies to Manage Coinsurance Requirements

| Strategy | How It Works | Best For | Potential Cost |

|---|---|---|---|

| Regular Appraisals | Hire a professional appraiser every 3-5 years to determine the current replacement cost and adjust coverage limits accordingly. | All property owners, especially in fluctuating construction markets. | Moderate (Cost of the appraisal itself). |

| Inflation Guard Endorsement | An automatic policy feature that increases your coverage limit by a set percentage (2-4%) each year to keep pace with inflation. | Policyholders who want a simple, "set-it-and-forget-it" way to maintain coverage. | Low (Typically a small addition to the premium). |

| Agreed Value Endorsement | You and the insurer agree on the property's value upfront and insure it to 100% of that amount, waiving the coinsurance clause. | Owners of commercial properties, historic homes, or unique structures. | Higher (Premiums are based on 100% of the value, which may be more than the minimum required). |

Each strategy has its place, but the goal is always the same: to ensure your coverage is sufficient before a loss ever occurs.

Taking these steps transforms your policy from a potential minefield into a reliable asset. This clarity can make all the difference during the often-stressful homeowner insurance claim process.

Answering Your Top Coinsurance Questions

Even after you get the hang of the formula, coinsurance can still feel a little tricky. It’s natural to have questions, especially when you start thinking about how it applies to your specific property. A few "what-if" scenarios can really make you wonder if you’re truly covered.

Let’s dive into some of the most common questions we hear from property owners. Getting these details straight can be the difference between a smooth claims process and a painful financial surprise.

What Happens If My Property Is a Total Loss?

This is a great question and a huge point of concern for many people. It’s easy to assume that if you’re underinsured, a coinsurance penalty will bite you no matter what. But that’s not how it works for a total loss.

If your property is completely destroyed—say, by a fire that levels the entire building—the coinsurance clause is typically off the table. In that catastrophic scenario, the insurance company will simply pay out the policy limit you purchased. The penalty is really designed for partial losses.

Think of it this way: the penalty exists to make sure you're paying a fair premium for the risk of smaller, more common claims. When everything is gone, the game changes, and the focus shifts to the maximum amount of coverage you bought.

So, you can breathe a little easier knowing a total loss won't be made worse by a coinsurance calculation.

How Does My Deductible Fit into the Coinsurance Calculation?

Your deductible absolutely comes into play, but it’s crucial to know when. It's the very last step in the process, applied after any coinsurance penalty is calculated.

Here’s the order of operations:

- First, the coinsurance penalty is applied. The insurer calculates what they owe based on how much coverage you had versus how much you were required to have. This determines the adjusted payout for your claim.

- Then, your deductible is subtracted. The final check you receive is that adjusted amount, minus your deductible.

This means you’re on the hook for both the penalty (if there is one) and your deductible. For instance, if a $50,000 penalty lowers your claim payout to $150,000, and you have a $5,000 deductible, the insurer’s final payment to you will be $145,000.

How Can I Be Sure My Property Value Is Accurate?

This is the single most important thing you can do to sidestep a coinsurance penalty. Guessing or relying on an old purchase price is a recipe for disaster.

The gold standard is hiring a professional appraiser. They’ll give you an independent, detailed report on your property’s replacement cost. That number gives you a solid, defensible foundation for your insurance coverage, which is especially important for commercial buildings.

Your insurance agent is another key resource. They have access to sophisticated tools that can estimate replacement costs by factoring in:

- Local construction and labor costs in your specific area.

- The types of building materials used (brick, wood frame, etc.).

- Unique property features, like custom millwork or specialized systems.

The key is to review this value regularly—at least once a year or after any significant renovation. Staying on top of this is a fundamental part of managing all the commercial insurance types that protect your business.

Is It Possible to Get Rid of the Coinsurance Clause?

Yes, in many situations, you can. The best way to do this is by adding an agreed value endorsement to your policy. It’s a fantastic option for property owners who want total clarity and peace of mind.

With an agreed value endorsement, you and your insurer agree on the property’s value before the policy starts, usually based on a recent appraisal. As long as you insure the property for 100% of that agreed-upon amount, the coinsurance clause is simply waived for the policy term.

This completely removes the risk of a coinsurance penalty on a partial loss. No surprise calculations, no arguments over value after a claim. It's a powerful tool, especially for unique or historic properties where calculating replacement cost can be tough.

At Wexford Insurance Solutions, we believe in making insurance make sense. If you still have questions about coinsurance or want to make sure your property is properly valued and protected, our team is here to help. Visit us at https://www.wexfordis.com to get a comprehensive review of your policy today.

Financial Planning for Business Owners

Financial Planning for Business Owners 8 Common Insurance Claim Denial Reasons to Know in 2025

8 Common Insurance Claim Denial Reasons to Know in 2025