Receiving a denial letter from your insurance company can be disheartening, frustrating, and financially devastating. You pay your premiums diligently, expecting a safety net when you need it most, only to find it pulled away. The reality is that millions of claims are denied each year across all types of policies, from personal auto and homeowners to complex commercial liability. These rejections often stem from reasons that seem hidden within the policy's fine print.

Understanding the 'why' behind these rejections is the first and most critical step toward preventing them. This comprehensive guide will demystify the most common insurance claim denial reasons, providing a clear roadmap to help you secure the coverage you've paid for. We'll explore everything from simple documentation errors and policy lapses to complex coverage exclusions, equipping you with the knowledge to challenge a denial or, better yet, avoid one altogether.

Navigating the dense language of a policy can be a significant hurdle. To better understand the intricacies of your insurance policy and potential pitfalls leading to denials, consider utilizing an AI-powered healthcare policy analyzer which can help decipher complex terms. Being an informed policyholder is your best first defense against a rejected claim.

1. Incomplete or Missing Documentation

One of the most frequent yet preventable insurance claim denial reasons is simply failing to provide a complete and accurate set of supporting documents. Insurance carriers operate on a foundation of verifiable facts. Without the required paperwork, they cannot validate the circumstances of the loss, assess the extent of the damages, or confirm that the event is covered under your policy terms. This administrative hurdle can stop a legitimate claim in its tracks before it's even evaluated on its merits.

Think of your claim submission as building a case; each document is a piece of evidence. For an auto accident claim, a missing police report leaves a critical gap in the official narrative. For a property damage claim from a burst pipe, the absence of detailed photos or repair estimates makes it impossible for the adjuster to quantify the financial impact. This isn't about distrust, it's about process. The insurer has a contractual and regulatory obligation to verify every claim's legitimacy.

Key Documentation Statistics

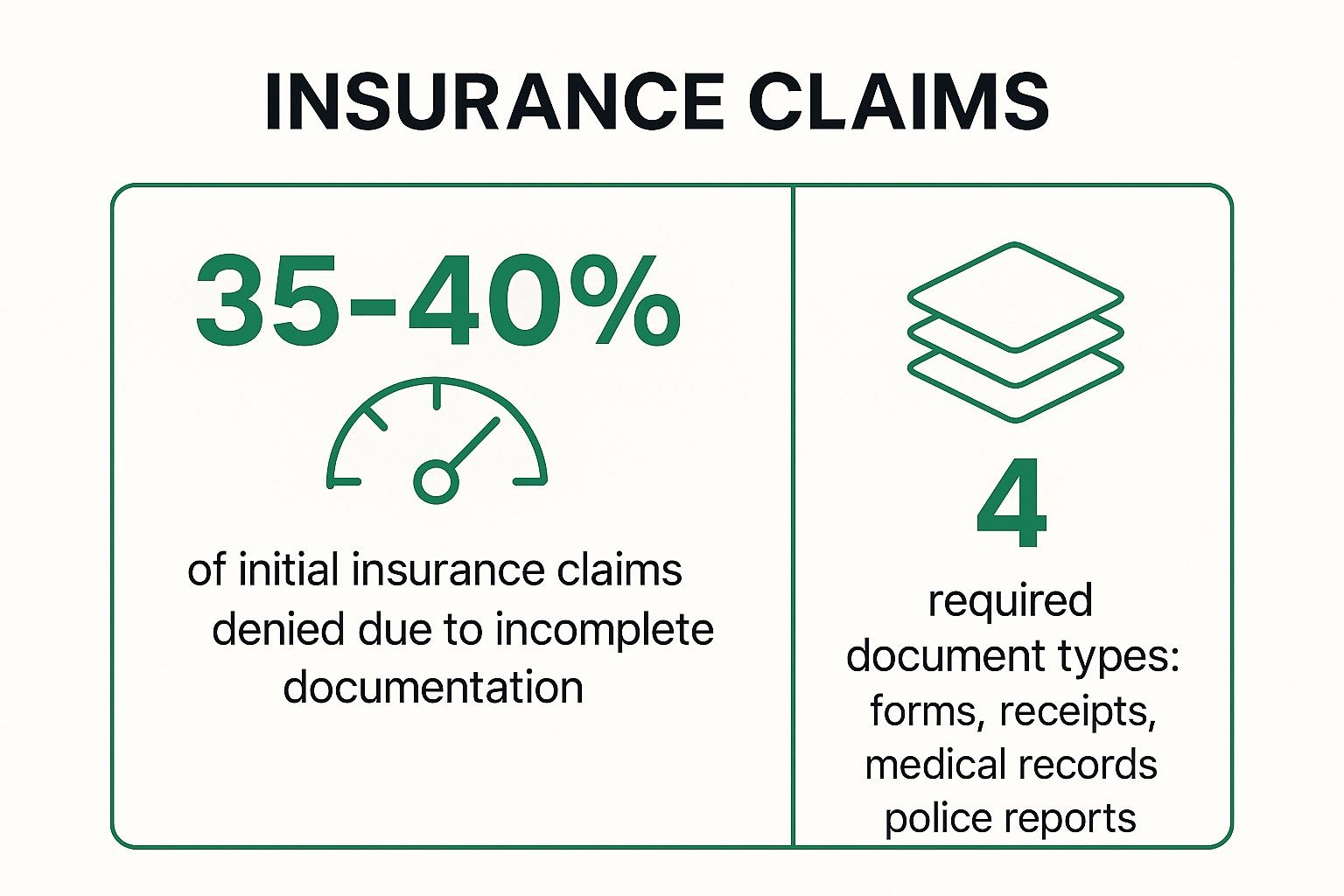

The following infographic highlights just how common this issue is and what core documents are typically required.

This data underscores a crucial point: a significant portion of initial denials are not due to a lack of coverage but to simple administrative errors that the policyholder can often prevent.

Actionable Tips to Avoid This Denial

To ensure your claim is processed smoothly, adopt a proactive and organized approach from the very beginning.

- Create a Claim Checklist: Before you even need to file a claim, create a simple checklist for each of your policies (auto, home, health). List the likely required documents, such as contact information for all parties, photos/videos, receipts for valuable items, and police or medical report numbers.

- Document Everything Immediately: At the scene of an accident or as soon as you discover property damage, use your smartphone to take extensive photos and videos from multiple angles. Capture both wide shots and close-ups of the damage.

- Keep a Communication Log: Note every interaction with your insurance company, including the date, time, name of the representative, and a summary of the conversation. Follow up verbal agreements with a confirmation email to create a paper trail.

- Confirm Receipt: After submitting your documents, call or email your adjuster a few days later to confirm they have received everything and to ask if anything else is needed. This simple step can prevent weeks of delays.

By meticulously preparing and organizing your documentation, you address one of the most common insurance claim denial reasons head-on, significantly improving the odds of a swift and successful resolution. Understanding potential gaps in your coverage is also vital; you can learn more by conducting an insurance gap analysis to ensure you have the right protection in place.

2. Pre-existing Conditions or Exclusions

One of the most fundamental insurance claim denial reasons stems from the explicit terms written into your policy contract: exclusions. Every insurance policy contains a list of specific events, conditions, or circumstances that it will not cover. A claim for something that existed before the policy took effect (a pre-existing condition) or for an event explicitly listed as an exclusion will be denied, not on a technicality, but because the policy was never designed to cover that specific risk.

Understanding these limitations is crucial. For instance, a standard homeowner's policy almost always excludes damage from floods, requiring a separate policy for that peril. In health insurance, while the Affordable Care Act (ACA) prevents denials for pre-existing conditions on compliant plans, some non-ACA or short-term plans may still enforce such clauses. Similarly, using your personal vehicle for commercial purposes like ridesharing without the proper endorsement is a common exclusion in auto policies. This isn't an insurer being difficult; it's them enforcing the agreed-upon terms of the contract you purchased.

Common Policy Exclusions

The following list highlights some of the most common exclusions found across different types of insurance policies.

- Home Insurance: Flood, earthquake, normal wear and tear, intentional damage, and pest infestations.

- Auto Insurance: Commercial use of a personal vehicle, racing, intentional acts, and regular maintenance.

- Health Insurance (non-ACA plans): Conditions diagnosed or treated before the policy's effective date.

These exclusions are standard because they represent risks that are either too large, too predictable, or require specialized coverage.

Actionable Tips to Avoid This Denial

Navigating policy exclusions requires diligence during the purchasing process, not just at the time of a claim.

- Read the Exclusions Section First: Before you sign, go directly to the "Exclusions" or "What Is Not Covered" section of the policy document. This is arguably the most important part of the contract.

- Disclose Everything Accurately: During your application, be completely transparent about pre-existing health conditions, the intended use of your vehicle, or unique features of your property. Hiding information can lead to a denial based on misrepresentation.

- Ask About Riders or Endorsements: If you identify an exclusion that concerns you (like flood damage or using your car for business), ask your agent about purchasing a rider or endorsement. This is an add-on that provides coverage for a specific, otherwise excluded, risk.

- Get Clarification in Writing: If any policy language seems ambiguous, ask your insurance agent for a written explanation. This creates a record of the clarification that can be referenced later if needed.

By proactively understanding what your policy doesn't cover, you can avoid surprises and ensure you have the right protection. This is a critical step in preventing one of the most clear-cut insurance claim denial reasons.

3. Policy Lapse or Non-Payment of Premiums

One of the most clear-cut insurance claim denial reasons is a lapse in coverage due to non-payment of premiums. Insurance is a contract where the insurer provides coverage in exchange for timely premium payments. If you stop paying, the insurer's obligation to cover your losses ceases. This can lead to a devastating denial, as an accident or loss that occurs even one day after a policy has lapsed will not be covered, leaving you entirely responsible for the financial fallout.

This denial isn't a matter of interpretation; it's a contractual certainty. For example, if a homeowner misses several premium payments and their policy is officially cancelled, a subsequent fire damage claim will be denied. Similarly, an auto accident that happens after a policy has lapsed for non-payment means the driver has no coverage for liability or vehicle repairs. This is a purely administrative denial that has nothing to do with the validity of the event itself.

The Cost of a Lapsed Policy

The consequences of a policy lapse extend beyond a single denied claim. It can lead to higher premiums in the future, as insurers view a history of non-payment as a higher risk. In some cases, such as with auto insurance, it can also lead to legal penalties for driving without mandatory coverage. The financial impact of an uncovered loss combined with these long-term penalties underscores the importance of maintaining continuous coverage.

Actionable Tips to Avoid This Denial

Preventing a coverage lapse is entirely within your control. Implementing simple, consistent payment practices is key to ensuring your protection remains active when you need it most.

- Set Up Automatic Payments: The most effective way to prevent missed payments is to authorize automatic debits from your bank account or credit card. This "set it and forget it" approach eliminates the risk of human error or forgetfulness.

- Keep Contact Information Updated: Ensure your insurer always has your current mailing address, email, and phone number. This guarantees you will receive renewal notices, payment reminders, and critical lapse warnings.

- Understand Your Grace Period: Most policies include a grace period, a short window of time after a premium is due during which you can pay without a lapse. Know exactly how long this period is and what the terms are for reinstatement if you miss it.

- Act on Lapse Notices Immediately: If you receive a cancellation or lapse notice, do not ignore it. Contact your insurer immediately to make a payment and confirm your policy has been reinstated without any gap in coverage.

Maintaining an active policy is fundamental to your financial security. Just as important is understanding all the financial components of your policy, including learning what coinsurance is in property insurance, to avoid unexpected out-of-pocket costs.

4. Fraudulent or Suspicious Claims

While most policyholders are honest, insurance fraud is a massive industry problem, costing tens of billions of dollars annually. Consequently, insurers have developed sophisticated systems and investigative processes to detect and deny fraudulent claims. A claim that contains material misrepresentations, exaggerations, or outright fabrications is not just a reason for denial; it can lead to severe legal consequences, including policy cancellation and criminal prosecution. This represents one of the most serious insurance claim denial reasons.

Insurers use a combination of data analytics, background checks, and on-the-ground investigations to flag suspicious activities. Red flags can include things like a history of frequent claims, reporting damage that appears pre-existing, or providing conflicting accounts of an incident. For example, a homeowner claiming a brand-new entertainment system was stolen when it was actually an old model, or a driver in a minor fender-bender claiming severe, debilitating injuries, will likely trigger an in-depth review.

It is crucial to understand that even minor exaggerations can be categorized as fraud. The insurer's duty is to indemnify you for your actual, verifiable loss, not to provide a financial windfall.

Actionable Tips to Avoid This Denial

Maintaining transparency and integrity throughout the claims process is the best way to avoid being flagged for suspicion and ensure your legitimate claim is paid.

- Be Truthful and Precise: Always provide completely accurate information on all claim forms and in all communications. Never guess at details; if you don't know something, say so.

- Do Not Exaggerate Losses: Document your actual damages with receipts, photos, and professional estimates. Inflating the value of stolen items or the severity of damage is a direct route to a denial and fraud investigation.

- Maintain Detailed Records: Keep meticulous records related to the claimed items, including original purchase receipts, manuals, and photographs taken before the loss occurred. This provides a clear, verifiable history of ownership and value.

- Cooperate Fully with Investigators: If your claim is selected for a special investigation, cooperate fully and provide any requested information promptly. A cooperative attitude demonstrates good faith and can help resolve any questions the insurer may have.

By approaching the claims process with honesty and thorough documentation, you eliminate any basis for suspicion. This not only prevents a denial based on fraud but also protects you from potentially serious legal and financial repercussions, making it a critical consideration among all potential insurance claim denial reasons.

5. Failure to Meet Policy Requirements or Conditions

Beyond just paying your premiums, your insurance policy is a contract with specific duties and conditions you must uphold. A frequent yet overlooked category of insurance claim denial reasons stems from a policyholder's failure to meet these obligations. These conditions are not suggestions; they are prerequisites for coverage. Insurers include them to mitigate risk and ensure a baseline level of responsibility from the insured party.

Think of these requirements as the ground rules of your coverage. For example, a homeowner's policy might mandate that you maintain functional smoke detectors. If a fire occurs and an investigation reveals the detectors were disabled or had dead batteries, the insurer could deny the claim, arguing that your failure to meet this condition directly contributed to the extent of the loss. Similarly, a commercial auto policy may require regular vehicle maintenance logs. Failing to produce these after an accident could lead to a denial.

Common Policy Conditions

Policies across different insurance types include a variety of conditions. Here are a few common examples that can trip up policyholders:

- Prompt Notification: Most policies require you to report a loss "promptly" or within a specific timeframe. Waiting too long to file can jeopardize the insurer's ability to investigate, leading to a denial.

- Duty to Mitigate: After a loss, you have a responsibility to take reasonable steps to prevent further damage. For instance, after a pipe bursts, you should turn off the water and cover exposed belongings to prevent more harm.

- Cooperation Clause: You are required to cooperate with the insurer's investigation. This includes providing requested documents, giving statements, and allowing inspections of the damaged property.

- Maintenance and Safety Requirements: As mentioned, this can include anything from maintaining smoke detectors and security systems to completing required safety inspections for commercial equipment.

Actionable Tips to Avoid This Denial

Staying compliant with your policy's terms is crucial for ensuring your claims are honored. Here’s how to stay on top of your obligations.

- Review Your Policy Annually: Don't just file your policy away. Schedule a yearly review with your agent to go over key conditions and responsibilities. This is especially important when you renew or compare home insurance quotes to understand any new terms.

- Create a Maintenance Log: For any requirements related to upkeep (e.g., HVAC servicing, alarm testing, vehicle inspections), keep a detailed log with dates, actions taken, and receipts. This creates a verifiable record of your compliance.

- Report Incidents Immediately: Even if you are unsure whether you will file a claim or if the damage seems minor, notify your insurance agent right away. This satisfies the prompt notification clause and protects your rights.

- Ask for Clarification: If any part of your policy is unclear, ask your agent to explain your obligations in plain language. Document their explanation in an email for your records.

By treating your insurance policy as an active agreement with clear responsibilities, you can prevent this common denial and ensure your coverage is there when you need it most.

6. Treatment Not Medically Necessary or Experimental

A common and often frustrating hurdle in health insurance is having a claim denied because the treatment is deemed not "medically necessary" or is classified as "experimental." This is one of the more complex insurance claim denial reasons as it involves clinical judgment. Insurers rely on established medical guidelines, peer reviews, and federal approvals to determine if a procedure or medication is a standard, effective treatment for a specific condition.

This type of denial isn't necessarily a judgment on your doctor's recommendation but a decision based on the insurer's internal policies and interpretation of medical evidence. For example, a claim for a brand-name drug may be denied if a clinically effective generic version is available. Similarly, an advanced cancer therapy not yet approved by the FDA might be considered experimental, even if it shows promise. The insurer must balance providing care with managing costs and ensuring treatments are proven to be safe and effective.

How Medical Necessity is Determined

Insurers evaluate treatments against their own clinical policies, which are often based on guidance from medical associations and regulatory bodies. The decision-making process typically involves these steps:

This structured review process is designed to ensure that coverage decisions are consistent and based on evidence, but it can sometimes lead to denials for newer or less common treatments.

Actionable Tips to Avoid This Denial

Navigating these denials requires a proactive partnership with your healthcare provider to build a strong case for the necessity of your treatment.

- Request Pre-Authorization: For any non-emergency, expensive, or unusual procedures, have your doctor's office submit a pre-authorization request. This process gets the insurer's approval before you receive the treatment, confirming it's covered and preventing a surprise denial.

- Provide Detailed Medical Justification: Work with your doctor to ensure the claim submission includes a detailed letter of medical necessity. This letter should explain your specific diagnosis, treatments you've already tried, and why the recommended procedure is the most appropriate next step.

- Appeal with Supporting Evidence: If your claim is denied, file an appeal. Supplement your appeal with additional evidence like peer-reviewed medical studies, a second opinion from another specialist, or a detailed statement from your physician.

- Understand Your Plan's Criteria: Request a copy of your insurer's specific clinical policy guidelines for your condition. Understanding the exact criteria they use to define medical necessity can help you and your doctor tailor your appeal more effectively.

By understanding the insurer's perspective and proactively documenting the need for your care, you can effectively challenge these complex insurance claim denial reasons. Just as with medical equipment, understanding the fine print is key; you can learn about the importance of specialized coverage to see how specific policy terms matter.

7. Out-of-Network Provider Usage

Navigating health insurance networks is a frequent source of frustration and a common cause for insurance claim denial reasons. Health insurance plans, like HMOs and PPOs, contract with specific doctors, hospitals, and specialists to create a "network" of providers. When you use these in-network providers, you receive care at a pre-negotiated, lower rate. Venturing out-of-network often means the insurer will cover a much smaller portion of the bill, or in some cases, deny the claim entirely.

This denial isn't a commentary on the quality of care you received; it's a strict contractual matter. Your policy explicitly outlines the financial consequences of seeking out-of-network care. For instance, a patient might choose a highly-rated surgeon for a procedure without realizing they are not in their plan's network, leading to a denial of the entire claim. Similarly, seeking mental health therapy from an out-of-network therapist can result in having to pay for all sessions completely out-of-pocket, as these services are often tightly managed within network constraints.

Key Considerations for Network Coverage

Understanding your plan's specific rules is the best defense against this type of denial. The difference in cost can be staggering, and a denial can leave you responsible for the full, non-discounted cost of a medical service. This is one of the most financially impactful insurance claim denial reasons a policyholder can face.

Actionable Tips to Avoid This Denial

To prevent unexpected medical bills and claim rejections, you must be diligent about managing your healthcare providers and understanding your plan’s limitations.

- Verify Network Status Every Time: Don't assume a provider is in-network, even if you've seen them before. Networks change. Before scheduling any appointment, call the provider’s office and use your insurance company’s online provider directory or customer service line to confirm their current network status.

- Understand Your Out-of-Network Benefits: Some PPO plans offer partial coverage for out-of-network care, but it comes with a separate, much higher deductible and coinsurance. Know these figures so you can make an informed financial decision if you choose to go out-of-network.

- Request Pre-Authorization: If you must see an out-of-network specialist, contact your insurer beforehand to request a pre-authorization or a network gap exception. If you can prove that no in-network provider can offer the necessary specialized care, the insurer may agree to cover it at an in-network rate.

- Know Emergency Room Rules: In a true emergency, you should go to the nearest hospital. The Affordable Care Act requires insurers to cover emergency services at in-network rates. However, be aware that ancillary services, like those from a consulting specialist at the ER, may still be billed as out-of-network.

By proactively managing your healthcare choices within your plan’s network, you can avoid a costly denial. Just as you manage your primary residence, managing your health coverage requires attention to detail; understanding related coverages, like what you can learn about homeowners insurance loss of use coverage, provides a holistic view of your personal risk management.

8. Claim Filed After Statute of Limitations

One of the most unforgiving insurance claim denial reasons is filing your claim after the legally mandated deadline has passed. Both your insurance policy and state laws impose strict time limits, known as statutes of limitations, for reporting and filing a claim. If you miss this window, the insurer has the right to deny the claim automatically, regardless of its legitimacy or the severity of the loss. This is a hard-and-fast rule designed to ensure claims are investigated while evidence is still fresh.

The clock starts ticking from the moment the loss occurs or, in some cases, from when the damage could have been reasonably discovered. For instance, a slow, hidden water leak that causes mold might have a different timeline than a sudden fire. Missing this deadline is not a negotiation point; it is a legal barrier. Insurers rely on these statutes to protect themselves from defending against stale claims where evidence has degraded and memories have faded, making a fair assessment nearly impossible.

Understanding Key Timelines

The specific time limit varies significantly based on the type of claim, your policy language, and state law. For example, a personal injury claim after a car accident may have a two-year statute of limitations in one state but three years in another. A claim for property damage under a homeowner's policy might need to be reported "promptly" with a lawsuit filed within one year of the denial. Understanding these nuances is critical.

A common point of confusion is the difference between the duty to provide "prompt notice" to the insurer and the legal statute of limitations for filing a lawsuit. Missing the initial notice period can jeopardize your claim just as much as missing the final legal deadline.

Failing to act within these prescribed timeframes is a common and irreversible misstep that leads to a definitive denial.

Actionable Tips to Avoid This Denial

Staying ahead of deadlines requires diligence and an immediate response when a potential loss is identified.

- Report Potential Claims Immediately: Even if you are unsure of the full extent of the damage, notify your insurance carrier as soon as you discover a potential loss. This official notification establishes a date of record and starts the formal claims process.

- Document the Discovery Date: As soon as you find damage, take photos and write down the date and time of discovery. This is crucial for claims where the loss was not immediately obvious, like slow water leaks or occupational illnesses.

- Understand Policy-Specific Limits: Do not rely on general knowledge. Read the "Duties After a Loss" section of your specific policy to understand your contractual obligations for reporting. Note any deadlines mentioned.

- Consult Professionals for Complex Cases: For claims involving delayed onset of damages, professional liability, or complex injuries, consult with a qualified attorney. They can provide clarity on the applicable statute of limitations in your jurisdiction and protect your right to file.

Top 8 Insurance Claim Denial Reasons Comparison

| Reason for Claim Denial | Implementation Complexity 🔄 | Resource Requirements 💡 | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Incomplete or Missing Documentation | Moderate: Gathering varied documents | High: Requires multiple document types | High denial rate (35-40% initial claims) | All insurance types needing proof | Preventable with preparation; clear steps |

| Pre-existing Conditions or Exclusions | Low: Clearly stated in policies | Moderate: May need medical underwriting | Moderate denial due to exclusions | Health, property, auto insurance | Allows affordable premiums; clear terms |

| Policy Lapse or Non-Payment of Premiums | Low: Simple enforcement of payment status | Low: Payment tracking systems | 15-20% of denials; coverage loss risk | All types where premium payment is critical | Clear, predictable denial reason |

| Fraudulent or Suspicious Claims | High: Uses advanced analytics & investigations | High: Specialized investigation units | Strong fraud prevention; legal consequences | All insurance types vulnerable to fraud | Protects system integrity; reduces premiums |

| Failure to Meet Policy Requirements or Conditions | Moderate: Varies by policy and insurer | Moderate: Requires policyholder cooperation | Denial from technical/non-compliance | Policies with safety, maintenance, reporting | Encourages risk reduction; clear policies |

| Treatment Not Medically Necessary or Experimental | Moderate: Medical review & appeals required | Moderate: Peer review & documentation | Denial of unnecessary or experimental treatments | Health insurance claims | Controls costs; promotes proven care |

| Out-of-Network Provider Usage | Moderate: Network management and verification | Moderate: Provider network data | Partial or full denial; higher patient costs | Health insurance with network restrictions | Cost control; incentivizes in-network care |

| Claim Filed After Statute of Limitations | Low: Fixed legal deadlines enforcement | Low: Date tracking | Denial regardless of claim merit | All insurance types with filing deadlines | Ensures prompt reporting; legal closure |

Turning a Denial Into an Approval: Your Next Steps

Navigating the complexities of an insurance claim can feel daunting, but a denial is not a final verdict. It is a critical juncture where knowledge and preparation become your most powerful assets. Understanding the common insurance claim denial reasons we've explored, from simple documentation errors to complex policy exclusions, transforms you from a passive policyholder into an empowered advocate for your own interests.

The journey from filing a claim to receiving a payout is paved with details. Whether it's a policy lapse due to a missed payment, a claim filed outside the statute of limitations, or a dispute over what constitutes a "medically necessary" treatment, each denial reason carries a lesson. The primary takeaway is this: proactive policy management and meticulous record-keeping are your best defense against a denial.

From Understanding to Action

Empowerment begins with understanding your policy before you need it. This means regularly reviewing your coverage, understanding its limitations, and knowing your responsibilities as a policyholder. When a loss occurs, your immediate actions can significantly influence the outcome.

- Document Everything: From the initial incident to every phone call with your insurer, create a detailed paper trail. Note dates, times, names, and a summary of the conversation.

- Respond Promptly: Insurers operate on strict timelines. Respond to all requests for information or documentation as quickly and completely as possible to avoid delays that can lead to denials.

- Know Your Rights: Every policyholder has the right to appeal a decision. Your denial letter is a starting point, not an endpoint. It must legally state the specific reason for the denial, referencing the exact policy language used to make the decision.

The Power of Professional Advocacy

For high-value or complex claims, such as those involving commercial auto fleets, specialized private client assets, or professional liability, the stakes are significantly higher. In these scenarios, interpreting dense policy language and negotiating with seasoned adjusters requires specialized expertise. This is where professional guidance becomes invaluable.

An experienced advocate can scrutinize the insurer's reasoning, identify potential misinterpretations of the policy, and build a compelling, evidence-based case for your appeal. They ensure your claim is presented in the strongest possible light, leveraging industry knowledge to challenge unfair denials and navigate the appeals process effectively. Remember, knowledge is your shield and persistence is your sword. A denial is simply the first step in a conversation, and with the right approach, you can turn that "no" into the approval you deserve.

Don't let a complex denial derail your financial security. If you're facing challenges with a claim or want to ensure your coverage is structured to prevent them, the experts at Wexford Insurance Solutions can help. Our team specializes in advocating for clients and turning denied claims into successful outcomes. Visit us at Wexford Insurance Solutions to learn how we can champion your case.

8 Common Insurance Claim Denial Reasons to Know in 2025

8 Common Insurance Claim Denial Reasons to Know in 2025 What Is Excess Liability Coverage and Why You Need It

What Is Excess Liability Coverage and Why You Need It