At its heart, excess liability coverage is an extra layer of insurance that sits on top of your existing policies, like your auto or homeowners insurance. It's designed to kick in when a claim is so large that it completely exhausts the limits of your primary coverage.

Think of it as a financial backstop for a worst-case scenario, protecting your personal assets from a catastrophic lawsuit or claim that goes far beyond what your standard policies can handle.

How Does Excess Liability Really Work?

Let's use an analogy. Imagine your standard auto or home insurance policy is a bucket. This bucket can hold a specific amount of financial risk, say, $500,000 in liability coverage.

Now, picture a major car accident that results in a lawsuit against you. If the final judgment is $800,000, your bucket is going to overflow by $300,000. That's a huge shortfall.

Without any other protection, you're on the hook for that $300,000. It could mean draining your savings, selling your home, or even having your future income garnished. Excess liability coverage acts as a much bigger bucket, ready and waiting to catch that overflow and safeguard your financial future.

A Real-World Example

Let's put some real numbers to this. You're found at fault in a serious multi-car pileup. The total medical bills and property damage result in a court awarding a $1 million judgment against you. Your auto insurance has a liability limit of $500,000.

Here's how it plays out:

- Your primary auto policy pays out its full limit of $500,000.

- This leaves a remaining balance of $500,000 that you are legally obligated to pay.

- This is where your excess liability policy activates, covering the entire remaining half-million-dollar gap.

In this situation, excess liability is the crucial difference between walking away financially intact and facing potential ruin. It's a purely defensive policy that works in tandem with your existing personal liability coverage.

The table below paints a very clear picture of the financial impact with and without this critical coverage.

Liability Claim Scenario With vs Without Excess Coverage

This table shows the financial breakdown for a $1 million liability claim when you have a $500,000 primary policy limit.

| Scenario | Without Excess Liability | With $1M Excess Liability |

|---|---|---|

| Total Claim Amount | $1,000,000 | $1,000,000 |

| Primary Policy Pays | $500,000 | $500,000 |

| Excess Policy Pays | $0 | $500,000 |

| Your Out-of-Pocket Cost | $500,000 | $0 |

As you can see, the difference is stark. With an excess liability policy, you have peace of mind knowing you're protected. Without it, your personal assets are directly exposed.

How Excess Liability Works with Your Primary Policies

Think of your insurance as a team. Your primary policies—like auto or general liability—are your starting lineup, your first line of defense. Excess liability insurance is the star player on the bench, waiting for the exact moment it's needed. It doesn’t get involved in every little play; it steps onto the field only after your primary policy's limits have been completely used up.

This relationship is built on a simple but powerful concept: "following form." Most excess liability policies are designed this way, which just means they copy the playbook of your underlying policy. They cover the same things and have the same rules and exclusions. If your general liability policy covers a slip-and-fall claim, your excess policy will too, but only for the damages that go above your primary limit. It’s a seamless handoff.

What Is Drop-Down Coverage?

Some excess policies come with a fantastic feature called "drop-down" coverage. This becomes absolutely critical when you exhaust your primary policy's aggregate limit—that’s the total amount the insurer will pay out over the entire policy year. It’s easy to think of policy limits in terms of a single, massive lawsuit, but a series of smaller claims can be just as draining.

What's an Aggregate Limit? It’s the absolute maximum an insurer will pay for all covered claims during your policy term. Once you hit that cap, your primary policy is tapped out for the year.

Let’s put this into a real-world scenario. Say your business has a general liability policy with a $1 million aggregate limit. A few separate incidents during the year lead to claims that, when added up, completely exhaust that million dollars. If a fourth lawsuit is filed against you before the policy renews, your primary insurance can’t help.

This is precisely where drop-down coverage saves the day. Your excess liability policy can "drop down" to become your new primary coverage for that fourth claim, shielding your business from what could otherwise be a devastating financial blow.

This smart, layered approach is how you build a real financial safety net. By mirroring your primary policies and stepping in when aggregate limits are hit, excess liability coverage provides a powerful, coordinated defense against catastrophic loss. It’s the key to bridging the gap between what your standard policies cover and what a major lawsuit could actually cost. Performing an insurance gap analysis is a great way to identify where your own vulnerabilities might be.

Excess Liability vs. Umbrella Insurance: What's The Difference?

When you start looking at ways to add more liability protection, it’s easy to get tripped up by the terminology. Two terms that often get mixed up are excess liability and umbrella insurance. Both kick in after your primary insurance limits are maxed out, but they work very differently. Figuring out that difference is the key to picking the right shield for your assets.

Think of excess liability coverage as simply adding another layer of bricks on top of your existing insurance wall. It makes the wall taller, but it doesn't make it any wider or cover new ground. In other words, it only gives you higher financial limits for the exact same risks your underlying policies already cover.

The Scope Of Coverage Is The Key

An umbrella policy, on the other hand, does more than just raise the height. It also extends the width of your coverage, protecting you from certain risks that your standard home or auto policies might not even touch. This is the single biggest difference between them.

An umbrella policy doesn't just boost your liability limits; it can also cover claims for things like libel, slander, or false arrest—risks that are almost always excluded from a standard homeowners policy.

This broader protection is what makes umbrella insurance such a powerful tool for so many people. For example, say you were sued for something you posted online. An excess liability policy wouldn't do you any good if your primary policy doesn't cover defamation. An umbrella policy, however, often will.

Key Differences At A Glance

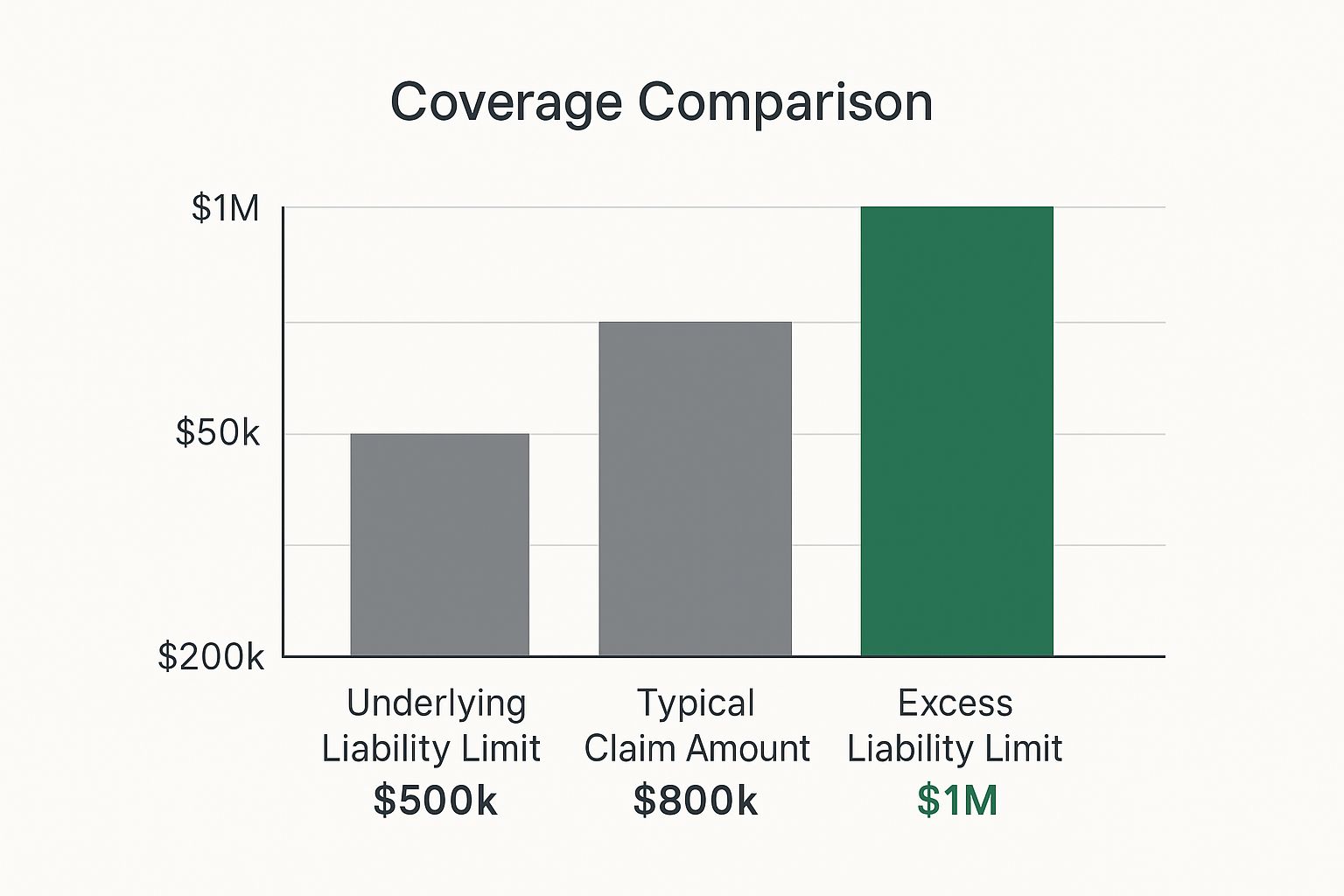

Let's quickly break down the main distinctions. The chart below gives a great visual of how excess liability simply stacks on top of your existing limits, providing more money but not more types of coverage.

As you can see, when a claim shoots past what your primary policy can handle, the excess liability coverage is there to cover that gap.

Comparing Excess Liability and Umbrella Insurance Policies

To make it even clearer, let's put these two policies side-by-side and compare their core functions.

| Feature | Excess Liability Insurance | Umbrella Insurance |

|---|---|---|

| Primary Function | Increases the dollar limit of existing coverage. | Increases limits and broadens the scope of coverage. |

| Coverage Scope | Follows the exact terms of the underlying policy. | Can cover risks not included in primary policies. |

| Best For | Individuals or businesses needing higher limits for specific, already-covered risks. | Those seeking broad protection against a wider variety of liability claims. |

At the end of the day, an umbrella policy is a versatile product designed to fill in critical gaps left by your other insurance, covering legal exposures like libel, slander, or certain defense costs that primary policies won't. This adaptability is a major reason for its popularity.

Ultimately, choosing between the two comes down to your unique situation and what risks keep you up at night. If you're concerned that a major lawsuit could blow past your current policy limits, it's time to explore your options. A good place to start is figuring out how much umbrella insurance you might need to feel truly secure.

Who Really Needs Excess Liability Coverage?

While anyone can get hit with a lawsuit, some people and businesses are just bigger targets. Their risk of facing a claim that blows past a standard insurance limit is significantly higher.

Figuring out if you're in one of these high-risk groups is a critical first step in protecting everything you've worked for. For many, this coverage isn't a "nice-to-have"—it's an absolute necessity. Making this call is a key part of effective risk management that shouldn't be overlooked.

High-Net-Worth Individuals and Families

It's a simple, unfortunate truth: the more you have, the more you stand to lose. High-net-worth individuals and families are prime candidates for excess liability coverage because their assets—real estate, investment portfolios, valuable collections—make them very attractive targets in a lawsuit.

Think about it. You host a big party at your beautiful home, and a guest is seriously injured. If the medical bills and damages hit $1.5 million, but your homeowner's policy caps out at $500,000, where does the other $1 million come from? Straight from your pocket. An excess liability policy is built for exactly this kind of scenario, kicking in to cover that massive shortfall.

Professionals in High-Risk Fields

Some jobs just come with more risk. We're talking about doctors, lawyers, architects, and contractors, who navigate situations every day where one mistake could spark a multi-million-dollar lawsuit.

For instance, a contractor could be on the hook for a catastrophic claim if a hidden structural error causes a building to fail years down the road. The damages from something like that could easily dwarf a standard general liability policy. For any business that makes or sells products, having multiple layers of financial protection is vital. You can learn more about the different commercial insurance types out there to see how they all fit together.

An excess liability policy simply picks up where your primary liability coverage leaves off. Think of it as a crucial second line of defense that activates only after your first policy is completely used up.

Business Owners and Landlords

The moment you open a business or rent out a property, your exposure to liability skyrockets. A simple slip-and-fall in your store, an injury caused by one of your products, or a dispute with a tenant can spiral into a legal battle that threatens your entire enterprise.

Imagine a small business whose delivery truck causes a major accident with serious injuries. If the claim exceeds the limits of their commercial auto policy, the business's assets are on the chopping block. An excess liability policy provides that extra financial cushion, making sure one bad day doesn't spell the end of your company. It’s a smart move to protect not just yourself, but also your employees and customers.

Why Higher Liability Limits Are More Important Than Ever

The world has gotten a lot more complicated, and frankly, a lot more litigious. The amount of liability coverage that seemed perfectly fine even ten or fifteen years ago might leave you dangerously exposed today.

This isn't just a hunch; it's a real trend called social inflation. Think of it as the rising cost of insurance claims that outpaces normal, everyday inflation. What’s driving it? A mix of things, really—from a growing public mistrust of corporations to a legal climate that often favors eye-popping settlements.

The result is that lawsuits are more common, and jury awards are getting bigger. That $500,000 liability limit on your auto or home policy that once felt like a solid safety net? A single, moderately serious accident could wipe that out in a heartbeat.

The Rising Tide of Lawsuit Costs

One of the biggest game-changers here is the rise of third-party litigation funding. This is where outside investors essentially bankroll a lawsuit in exchange for a cut of the settlement. It's big business. In fact, third-party litigation funding in the U.S. is on track to become a $31 billion industry by 2028. You can see a deeper dive into this in this analysis of excess liability trends.

With that kind of money pouring in, lawsuits can become more aggressive and drawn-out, pushing for much larger verdicts. This new reality means everyone—homeowners and business owners alike—needs to take a hard look at their financial defenses. If you're running a business, understanding these risks is non-negotiable. Our guide on business interruption insurance cost can shed more light on how to protect your operations from unexpected shocks.

In this environment, excess liability coverage is shifting from a luxury for the wealthy to an essential component of a modern financial protection plan for anyone with assets to protect.

At the end of the day, getting higher liability limits with an excess policy isn't about being paranoid. It's a smart, direct response to the world we live in now. It’s about building a strong enough financial buffer so that one catastrophic event doesn’t derail everything you've worked for.

How to Get the Right Excess Liability Coverage

Figuring out the right amount of excess liability coverage isn't just about picking a number. It's a thoughtful process of looking at what you own and what you could stand to lose, then building a financial backstop strong enough to protect it all. Think of it as tailoring a safety net to fit your specific life.

So, where do you start? The first step is to get a clear picture of your net worth. This isn't just the cash in your bank account. You need to add up everything: the equity in your home, your savings and retirement accounts, investment portfolios, any rental properties, and even your potential future earnings. That total is your baseline—it’s the minimum amount of protection you should aim for.

Start with a Solid Foundation

Before you can add an extra layer of protection, you need to make sure your primary insurance is up to snuff. Insurers won't sell you an excess liability policy unless your foundational policies, like your auto and homeowners insurance, already have a certain level of coverage.

For instance, a provider will likely require you to have at least $500,000 in liability coverage on your car insurance before they'll even consider offering you an excess policy. Pull out your current policy documents—the declarations pages—and check your limits. This is also a great opportunity to look for savings. Many people find that things like bundling home and auto insurance can lower their overall costs while making everything easier to manage.

Partner with an Insurance Pro

Once you know what you have and what you need, it's time to find the right policy. You can certainly go directly to an insurance company, but working with an independent agent can be a huge help. They have access to multiple carriers and can do the legwork for you, finding quotes from different companies to see who offers the best coverage for your situation and budget.

It's easy to get focused on the price tag, but the real value is in the details. A good agent helps you understand what's actually covered—and more importantly, what isn't—so there are no nasty surprises if you ever have to file a claim.

When you're ready to make a decision, have a list of questions ready for your agent or provider. This ensures you're confident in your choice.

- What are the exact liability limits I need on my existing home and auto policies?

- Does this policy "follow form," meaning it mirrors my primary coverage, or does it have its own separate exclusions?

- If a claim happens, how does it work? What’s the process for coordinating between my primary policy and this excess liability coverage?

Common Questions About Excess Liability

It's natural to have a few more questions once you start digging into the details of excess liability coverage. Let's tackle some of the most common ones we hear from clients.

Can I Just Buy an Excess Liability Policy on Its Own?

That's a great question, but the answer is no. You can't purchase an excess liability policy by itself. Think of it as the second story of a house—it needs a foundation to sit on.

That foundation is your primary insurance, like your auto, homeowners, or general business liability policy. Insurers require you to have that primary coverage in place first, with certain minimum limits, before they’ll even consider adding an excess policy on top.

So, How Much Excess Liability Coverage Should I Get?

There’s no magic number here; the right amount is completely tied to your personal financial picture and the risks you face. A good starting point, however, is to aim for enough coverage to protect your entire net worth.

Take a moment to tally up your assets. You’ll want to include things like:

- The equity you have in your home or other real estate

- All of your savings and investment portfolios

- Retirement accounts like your 401(k) or IRA

- Even your potential future earnings

Working with an insurance professional is the best way to get a clear picture. They can walk you through a proper risk assessment to make sure the amount you choose truly protects everything you’ve worked for.

The whole point is to build a financial fortress so high that a devastating lawsuit can't get over the walls. The biggest mistake people make is underestimating what they have to lose.

Will My Policy Cover Me if Something Happens in Another Country?

This is a critical detail, and the answer is: it depends entirely on your specific policy. Coverage for incidents that happen abroad isn't automatically included.

Some policies do offer worldwide protection, but many others have strict geographical limits. If you travel often, own property overseas, or do business internationally, you absolutely must confirm this. Read the policy details closely and talk it over with your agent to ensure you're covered, no matter where in the world a claim might arise.

Trying to piece together the right liability protection can feel overwhelming, but you don't have to figure it out alone. The experts at Wexford Insurance Solutions are here to help you understand your risks and build the right coverage plan for your assets. Contact us today for a personalized consultation and secure your financial peace of mind.

Top Insurance Claim Denial Reasons & How to Avoid Them

Top Insurance Claim Denial Reasons & How to Avoid Them Homeowners Insurance Naples Florida: Protect Your Home Today

Homeowners Insurance Naples Florida: Protect Your Home Today