Owning a home in Naples is an absolute dream. But let's be honest, figuring out the right homeowners insurance in Naples, Florida, can feel like a maze, especially with the high costs and unique risks we face here. This guide is designed to cut through that confusion and give you a clear roadmap to protect your slice of paradise.

Why Naples Home Insurance Is So Complicated

Living in Naples gives you a front-row seat to a sun-drenched, coastal lifestyle. The trade-off? Navigating the incredibly tricky world of homeowners insurance. Your policy isn't just another bill—it's the critical shield standing between your home and the unique risks that come with living in this beautiful part of Florida.

So, what makes it so tough? It's really a perfect storm of factors. Our proximity to the Gulf of Mexico means a constant, heightened threat from hurricanes. That reality brings a whole different set of insurance needs to the table, like mandatory windstorm protection and separate, often hefty, hurricane deductibles. This environment has made our local insurance market one of the most volatile and expensive in the entire country.

Distinguishing Between Key Protections

One of the biggest misunderstandings I see from homeowners is assuming their standard policy covers everything. It absolutely does not. Specifically, damage from storm surge and rising water—a major threat here—is only covered by a separate flood insurance policy.

In a low-lying coastal community like Naples, this distinction is crucial. You can get a more detailed look at the differences between flood insurance and homeowners insurance to fully grasp what each one does.

Your homeowners insurance policy is your first line of defense, but without the right add-ons and a clear understanding of its limitations, you could be left financially exposed when disaster strikes.

My goal here is to help you move from feeling uncertain to feeling confident. By breaking down why our rates are so high and what coverage is absolutely essential, you can start making smart, informed decisions. Think of this guide as your go-to resource for protecting your most valuable asset.

You'll walk away with a clear understanding of:

- The main reasons behind our high insurance premiums.

- The specific coverages that are non-negotiable for anyone living in Naples.

- How to find your way through a challenging and constantly shifting insurance market.

So, Why Is Naples Home Insurance So Expensive?

If you've just seen an insurance quote for a home in Naples, you might be experiencing a bit of sticker shock. It's a common reaction. The high cost isn't arbitrary; it’s a direct reflection of the unique risks that come with living in our beautiful corner of Southwest Florida.

Think of your insurance premium as a contribution to a shared pool of money set aside for emergencies. In a place like Naples, where the risk of a major hurricane is always on the horizon, that pool needs to be much deeper to cover potentially widespread damage. This "shared risk" is the biggest reason your policy costs what it does.

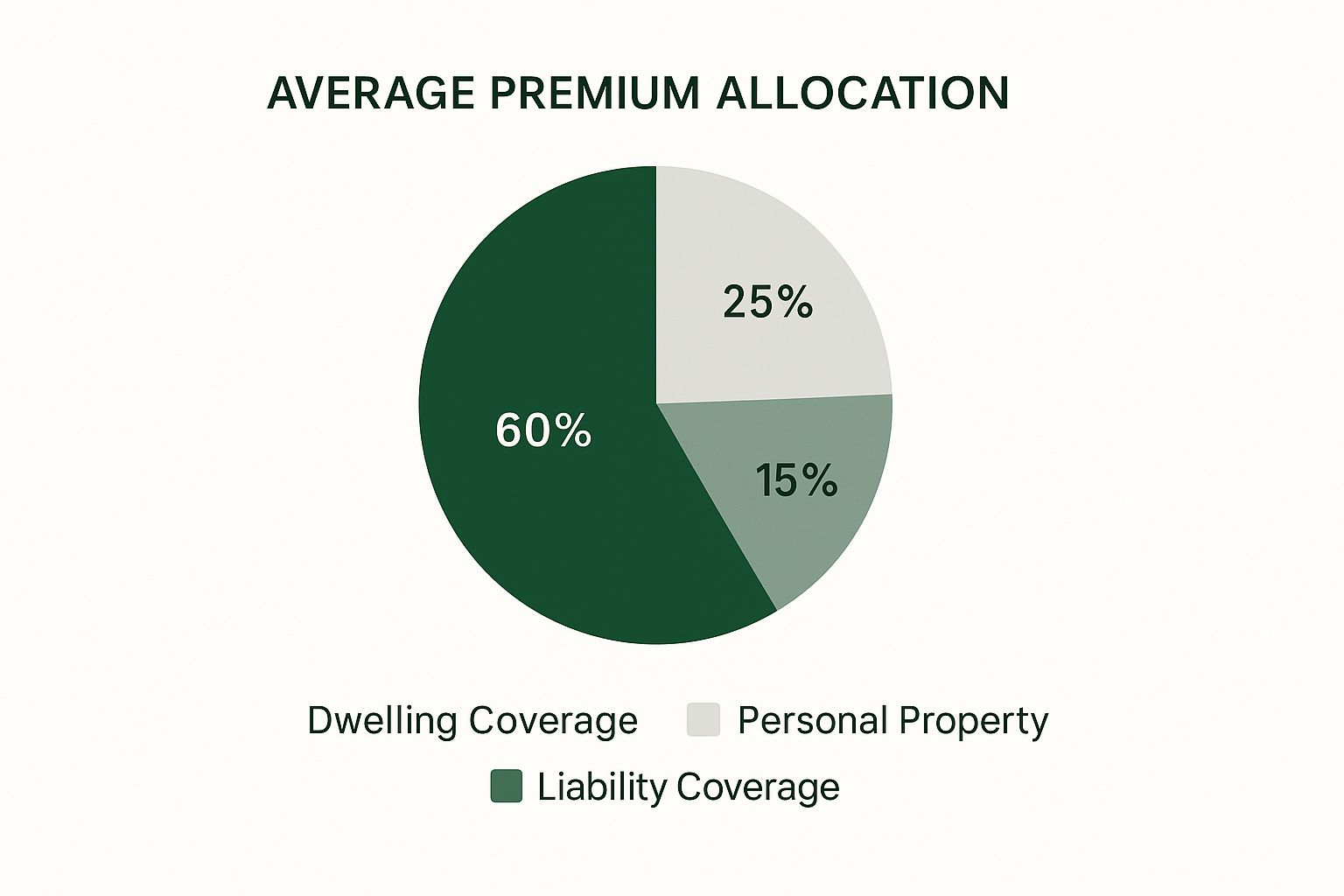

This chart breaks down where your premium dollars typically go. It gives a clear picture of what you're actually paying for.

As you can see, the lion's share—around 60%—is earmarked for Dwelling Coverage. This is the core of your policy, representing the funds needed to rebuild your home from the ground up if the worst happens.

Location, Location, Devastation

When it comes to insurance costs, nothing matters more than your address. Naples' prime location on the Gulf Coast places it right in the crosshairs during hurricane season. Insurance companies use incredibly complex computer models to predict the odds of a major storm, and our region consistently lights up as a high-risk zone.

But it’s not just about the wind. Storm surge and flooding are powerful, destructive forces that insurers take very seriously. A home's elevation and its distance from the coast are huge factors. A house just a few blocks from the beach will almost always cost more to insure than an identical home located further inland on higher ground.

The data really drives this point home. The average annual premium for homeowners insurance in Naples, Florida, on a $150,000 house is about $3,714. That number skyrockets to roughly $6,431 for a $300,000 property and can hit $8,607 for a $450,000 home. This shows how quickly risk and replacement cost compound. You can explore more data on Naples insurance costs to see how these figures stack up.

The value of your home is a major factor in what you'll pay for coverage. The table below shows just how dramatically premiums can climb as home values increase in the Naples area.

Estimated Annual Home Insurance Premiums in Naples by Home Value

| Home Value | Estimated Average Annual Premium | Notes |

|---|---|---|

| $250,000 | $5,350 | Represents a common starting point for condos or smaller single-family homes. |

| $500,000 | $9,010 | Reflects the premium jump for mid-range homes, which have higher replacement costs. |

| $750,000 | $12,670 | Premiums increase significantly as properties enter the higher-value market. |

| $1,000,000+ | $16,500+ | Luxury homes face the highest premiums due to substantial rebuilding expenses and risk. |

As the numbers illustrate, a higher home value means a higher potential claim for the insurer, leading directly to a more expensive premium for the homeowner.

It's All in the Details of Your Home

Beyond your location, the specific characteristics of your house play a massive role. Insurers dig into the details to figure out how well your home might survive a major storm.

- Age and Construction: Older homes, especially those built before Hurricane Andrew prompted stricter building codes in 1992, are viewed as riskier. A modern home built with reinforced concrete stands a much better chance against high winds, which often translates to a lower premium.

- Roof Condition and Shape: Your roof is your home's first line of defense. Its age, material, and even its shape are critical. A new, hip-shaped roof (which slopes down on all four sides) is far more aerodynamic and performs better in a hurricane than an older gable roof.

- Wind Mitigation Features: This is where you can take back some control. Equipping your home with hurricane shutters, impact-resistant windows, and a reinforced garage door can earn you serious discounts on your premium.

At the end of the day, an insurer's logic is simple: the stronger and more resilient your home is, the lower the odds they'll have to pay out a massive claim. Every wind-resistant upgrade you install is a direct investment in lowering their risk—and your annual cost.

The Elephant in the Room: The Florida Insurance Crisis

Finally, some of the biggest drivers of your insurance costs are completely out of your hands. The entire state is caught in a tough spot often called an "insurance crisis," and the fallout directly impacts your premium.

A huge piece of this puzzle is reinsurance. You can think of it as insurance for insurance companies. After getting hit with billions in claims from recent storms, reinsurers have hiked their prices for Florida carriers. That extra cost gets passed directly down to policyholders like you.

On top of that, years of runaway litigation and claims fraud have scared many national insurance carriers out of the state altogether. With less competition, the remaining companies have more leverage to charge higher rates. While new laws are trying to fix this, it will take time for the market to stabilize. Understanding this bigger picture helps explain why finding affordable homeowners insurance in Naples, Florida, has become such a headache.

Essential Coverage for Protecting Your Naples Home

When you buy homeowners insurance in Naples, Florida, you’re not just checking a box for your mortgage company. You're getting a detailed recovery plan for when disaster strikes. Think of it less like a single shield and more like a suit of armor—each piece is designed to protect a different part of your life and home. Getting to know these individual components is the only way to be sure you're truly covered.

A standard policy, often called an HO-3, is built around a few core coverages. Each one plays a critical role in protecting you from financial ruin.

Dwelling and Personal Property Coverage

The absolute bedrock of any policy is Dwelling Coverage. This is what pays to rebuild or repair the actual structure of your house—the walls, the roof, the foundation—if it gets damaged by something like a fire or hurricane. The key here is to insure for the cost to rebuild, not what you could sell your house for.

Then there's Personal Property Coverage. This protects everything inside your home: your furniture, clothes, electronics, and all the other stuff that makes a house a home. This amount is usually set as a percentage of your dwelling coverage, often between 50% and 70%.

A common mistake is just guessing the value of your personal belongings. Take an afternoon to create a home inventory—it can be a real eye-opener and ensures you have enough coverage to replace everything if the worst happens.

Liability and Additional Living Expenses

Personal Liability Protection is another piece you can't live without. It protects you financially if someone gets hurt on your property and you're found to be at fault. This coverage can handle their medical bills and your legal fees, stopping a lawsuit from wiping out your savings. For those with more to protect, it’s worth looking into https://wexfordis.com/2025/08/19/what-is-excess-liability-coverage/ for an extra layer of security.

Finally, Additional Living Expenses (ALE) coverage becomes your lifeline if a covered disaster makes your home unlivable. It helps pay for a hotel or rental, meals, and other essentials while your home is being put back together, letting your family maintain some sense of normalcy.

Critical Coverages for Naples: Wind and Water

Living in Naples means a standard policy just won't cut it. You need specialized protection against our biggest coastal threats. The two that demand your full attention are windstorms and flooding, and they require a specific strategy.

Windstorm Coverage is almost always part of a Florida policy, but it comes with a major catch: the hurricane deductible. This isn't a flat dollar amount like your normal deductible. It’s a percentage of your home's total insured value, usually from 2% to 10%. On a $500,000 home, a 5% deductible means you're on the hook for the first $25,000 of hurricane damage.

It's crucial to remember this only kicks in when the National Weather Service officially names a storm.

The Absolute Necessity of Flood Insurance

Let me be crystal clear on this point: your standard homeowners insurance policy does not cover flood damage. Not from storm surge, not from overflowing canals, and not from torrential rain that soaks the ground.

Given our low elevation and proximity to the Gulf, a separate flood insurance policy is non-negotiable. You have to buy it separately, either from the National Flood Insurance Program (NFIP) or a private carrier. And don't wait—there's almost always a 30-day waiting period before the policy takes effect. You can't buy it when a storm is already brewing.

This high risk of living in paradise comes at a cost. Insurance premiums in Naples are some of the highest in Florida, driven by hurricane exposure and a tough market. In 2025, the average premium for a Naples home with $300,000 in dwelling coverage is a staggering $9,319 per year, worlds away from the U.S. average of $2,584.

The high construction standards in some areas can also influence risk and insurance needs. Learning about Naples gated community insights for protected homes can give you an idea of how modern building practices aim to mitigate storm damage. Ultimately, a solid protection plan involves layering all these essential coverages to create a safety net strong enough for the realities of life in Southwest Florida.

Navigating the Tricky Florida Insurance Market

If you’re trying to find homeowners insurance in Naples, Florida, you've probably realized it's not as simple as it used to be. You're stepping into a market that's in serious turmoil. What you're hearing on the news about a statewide "insurance crisis" isn't just noise—it's the reality that directly affects your ability to find affordable coverage.

The bottom line is that your options have shrunk, a lot. In recent years, many big-name national insurance companies have packed up and left Florida or drastically scaled back their business here. This exodus kills competition. With fewer players in the game, the remaining companies feel less pressure to offer attractive rates, and the basic law of supply and demand takes over, pushing costs up for everyone.

Why Are Insurers Fleeing Florida?

Insurance companies aren't leaving on a whim. It’s a calculated business decision driven by skyrocketing risks and runaway costs that have created a perfect storm for homeowners.

The most obvious culprit is the weather. Hurricanes Ian and Irma hit Southwest Florida hard, leaving behind billions of dollars in claims. Payouts of that magnitude drain an insurer's bank account, making them extremely cautious about taking on more risk in a hurricane-prone state.

On top of that, Florida’s legal scene was, for a long time, a major headache for insurers. Widespread litigation and claims fraud made the cost of doing business here incredibly high. While the state has passed new laws to fix these problems, it’s going to take a while before we see the market truly stabilize.

It's simple math for the insurance companies. When the potential loss from a single hurricane is far greater than the premiums they can collect, staying in the market just doesn't make financial sense.

What is Citizens Insurance?

With private companies pulling back, Citizens Property Insurance Corporation has become a household name. Created by the state, Citizens is the "insurer of last resort," providing a policy for homeowners who can't find one anywhere else. While it serves as a critical safety net, its explosive growth is a clear signal of just how unhealthy the private market has become.

A policy with Citizens has its own quirks. Coverage limits are often tighter, and it isn't always the most affordable option. The state's ultimate goal isn't to grow Citizens, but to use it as a temporary fix while working to lure private insurers back into the market.

How Recent Changes Affect Your Premiums

Understanding this bigger picture is key, because it’s the reason your rates are what they are. This crisis has sent premiums through the roof. Some homeowners in Naples are now looking at an average annual cost of $5,376 for $300,000 in dwelling coverage—well over double what people pay in the rest of the country. You can find more details about these statewide insurance rate hikes on dontgethittwice.com.

Recent laws are aimed at calming the market by reining in litigation and making Florida more attractive to insurers again. The hope is that these reforms will eventually bring more competition and stability to pricing. Insuring different types of properties adds another layer to the challenge; our guide to vacation home insurance dives into the specifics for secondary homes. For now, getting the right coverage requires a good dose of patience and a clear-eyed view of the forces at play.

Proven Strategies to Lower Your Insurance Premiums

While the major factors driving up homeowners insurance in Naples, Florida, are out of your hands, you have more control than you might think. By making some smart improvements and strategic choices, you can directly influence how much you pay each year. This is your game plan for taking back control and finding real savings.

Think of it from the insurance company's perspective: they are constantly calculating risk. The less risky your home appears, the less you'll pay. Every proactive step you take signals that your property is a safer bet, especially when a hurricane is brewing in the Gulf.

Fortify Your Home with Wind Mitigation

The single most powerful way to slash your insurance costs in Naples is through wind mitigation. This simply means strengthening your home to better withstand high winds—the number one concern for any Florida insurer. Once you've made these upgrades, a certified inspector can verify them, which is your key to unlocking some serious discounts.

Here are the key features that insurers look for:

- Hurricane Shutters or Impact-Resistant Windows: This is non-negotiable. Protecting every opening is the first line of defense against wind breaching your home and causing catastrophic roof failure.

- Reinforced Roof-to-Wall Connections: These are essentially metal clips or straps that anchor your roof trusses securely to the walls. They make the whole structure far more resilient against the powerful uplift forces of a hurricane.

- A Secondary Water Resistance Barrier: Think of this as a backup plan. It’s an extra layer of protection under your shingles that helps stop water from getting in if the main roofing material gets damaged.

- A Stronger Roof Deck Attachment: It might sound small, but using longer nails spaced closer together to secure the plywood of your roof deck can make a massive difference in its ability to hold on during a storm.

These aren't just minor fixes. They are fundamental upgrades that directly impact how your home will perform when it matters most, and that performance translates directly into lower premiums.

Adjust Your Deductibles Wisely

Another powerful lever you can pull is your deductible—the amount you agree to pay out-of-pocket before your insurance kicks in. When you opt for a higher deductible, you're telling your insurer that you're willing to share more of the initial risk.

For instance, bumping your standard deductible from $1,000 to $2,500 can often lead to a significant drop in your annual premium. It's a trade-off, of course. You're taking on more potential upfront cost in an emergency in exchange for lower regular payments. The key is to pick a deductible you know you can comfortably afford if you ever need to file a claim.

Choosing a higher deductible is a calculated financial decision. You have to balance the appeal of lower premiums against your real-world ability to cover that out-of-pocket expense when disaster strikes.

Bundle and Secure for More Savings

Beyond beefing up your home's structure, a few other practical tactics can help you chip away at that premium. Insurance carriers love loyal, low-risk customers, and they often have discounts to reward them.

One of the easiest wins is bundling your policies. If you insure both your home and your cars with the same company, you can often get a multi-policy discount that’s quite substantial. It also simplifies your life while saving you money.

Installing safety and security devices can also unlock more discounts.

- Monitored Security Systems: An alarm system that automatically notifies the police or fire department makes your home a less attractive target for thieves and can lower your premium.

- Smoke and Carbon Monoxide Detectors: These basic devices reduce the risk of fire and other dangers, which every insurer sees as a positive.

- Water Leak Detection Systems: Smart home gadgets that can automatically shut off your water main if a leak is found are becoming a popular way to earn a discount.

Each of these steps shows you're a responsible homeowner, which reduces the odds of you filing a claim. For a deeper dive into this topic, explore our complete guide on how to lower home insurance premiums. By combining these strategies, you can build a strong case for a much better rate on your homeowners insurance in Naples, Florida.

Finding the Right Insurance Policy and Provider

Shopping for homeowners insurance in Naples, Florida, isn't just about finding the lowest price. It's about finding a trustworthy partner who will have your back when a hurricane is bearing down. The cheapest policy on paper is worthless if the company ghosts you or buries you in paperwork when you need to file a claim.

The real goal is to strike that perfect balance: robust coverage that truly protects you, a premium that fits your budget, and a company with a rock-solid reputation for service. This takes a little legwork, but doing your homework now will save you a world of headaches later. Getting your ducks in a row first is always a smart move, and knowing how to organize your finances for better money management can make the whole process feel less overwhelming.

Gather and Compare Your Quotes

First things first, you need to get several quotes. Never settle for the first offer you see. Casting a wider net gives you a much clearer picture of what the market looks like for a home like yours.

You've got a couple of ways to do this:

- Captive Agents: Think of agents from places like State Farm or Allstate. They are experts on their company's products, which is great, but they can only sell you what that one company offers.

- Independent Agents: These agents are your free agents. They work with a whole portfolio of different insurance companies, allowing them to shop the market for you to find the best policy and price for your specific situation.

Once you've got a few quotes in hand, it's time to line them up and see what you’re really looking at. Our guide on how to compare home insurance quotes walks you through this step-by-step, making sure you don’t miss any of the fine print.

The single most important part of this process is making sure you're comparing "apples-to-apples" coverage. That much cheaper quote might look tempting, but it could have a sky-high hurricane deductible or dangerously low liability limits that leave you financially exposed.

Look Under the Hood: Vet the Insurance Provider

A great price from an unreliable company is a recipe for disaster. Before you even think about signing, you need to do a little digging into the insurer’s financial health and its reputation, especially how it treated its customers after past Florida hurricanes.

Here are the critical questions to get answers to:

- What’s your financial stability rating? You're looking for ratings from independent agencies like A.M. Best. An "A-" rating or higher is a good sign that the company has deep enough pockets to pay out a flood of claims after a major storm.

- How do you handle claims after a major hurricane? Get specific. Do they bring in extra adjusters from out of state? What’s their typical response time? Search online for reviews from people who went through Hurricane Ian with them—their experiences are gold.

- What’s your non-renewal policy? Some companies get skittish and start dropping customers after they file a claim. You want to partner with a carrier that’s in it for the long haul, not one that will cut you loose when you need them most.

To help you organize this, here's a simple checklist you can use when comparing potential insurers.

Policy Comparison Checklist for Naples Homeowners

Use this checklist to compare quotes from different insurance providers, ensuring you evaluate not just the cost but the critical coverage details and company reputation.

| Comparison Point | Insurer A | Insurer B | Insurer C |

|---|---|---|---|

| Annual Premium | |||

| Hurricane Deductible | |||

| Other Peril Deductible | |||

| Dwelling (Coverage A) | |||

| Liability (Coverage E) | |||

| Flood Insurance Included? | |||

| Wind Mitigation Credits | |||

| A.M. Best Rating | |||

| Customer Reviews |

By filling this out for each quote, you'll get a much clearer, side-by-side view that goes way beyond just the premium. This is how you make an informed choice and find a policy that truly protects your home and your peace of mind.

Your Top Questions About Naples Home Insurance, Answered

When you're dealing with homeowners insurance in a place like Naples, it's natural to have a few questions. Let's tackle some of the most common ones that come up.

Is Flood Insurance Really Necessary?

In a word: yes. It's a common and costly misconception that your standard home policy covers flood damage. It doesn't.

Whether it’s storm surge from the Gulf or just a torrential downpour inland, any damage from rising water is specifically excluded. For anyone living in a low-lying coastal area like Naples, a separate flood insurance policy isn't just a good idea—it's essential for protecting your home.

Can You Explain the Hurricane Deductible?

Think of it as a different set of rules for a specific kind of disaster. Unlike your standard deductible (a flat dollar amount), the hurricane deductible is a percentage of your home's total insured value, usually ranging from 2% to 10%.

It only kicks in when there's damage from a storm officially named by the National Weather Service. So, if your home is insured for $500,000 and you have a 5% hurricane deductible, you’re responsible for the first $25,000 of repairs.

Picking your hurricane deductible is a balancing act. A higher percentage will lower your yearly premium, but it also means you'll face a much larger bill out-of-pocket if a major storm hits.

Could My Insurer Drop My Policy After I File a Claim?

Unfortunately, yes, this can happen. After a large claim, an insurance company might see your property as a higher risk and decide not to renew your policy. This is precisely why it pays to do your homework on an insurer's reputation and their history in the volatile Florida market before you buy a policy.

What Happens if My Insurance Company Just Leaves Florida?

When an insurer decides to pull out of the state, they can't just vanish overnight. They're required to give you plenty of advance notice, which gives you time to shop for a new policy.

If you find that private insurers aren't willing to offer you a policy, you're not out of options. Florida has a safety net called Citizens Property Insurance, which is a state-run program designed to be the insurer of last resort.

Getting the right coverage shouldn't feel like navigating a maze. The team at Wexford Insurance Solutions has been helping Naples homeowners find clarity and build solid protection plans for years. If you're ready for some straight answers, visit us at https://www.wexfordis.com and let's get started.

What Is Excess Liability Coverage and Why You Need It

What Is Excess Liability Coverage and Why You Need It Finding the Best Home Insurance New York

Finding the Best Home Insurance New York