Finding the best home insurance in New York isn’t always about finding the absolute cheapest rate. It’s a balancing act. You need solid coverage that won’t let you down, but at a price that makes sense.

While big names like State Farm, Allstate, and NYCM Insurance often get high marks for financial strength and customer service, the "best" policy is deeply personal. It really hinges on where you live, what your home is worth, and your specific needs. This guide will walk you through finding that perfect fit in the Empire State.

Your Guide to Home Insurance in New York

Let's be honest, trying to lock down the right home insurance in New York can feel like a massive chore. But it doesn't have to be.

New York throws a lot at homeowners. We’ve got coastal storm risks on Long Island, feet of snow upstate, and wild property value swings in every borough. A cookie-cutter policy just won't do the job here. Getting the details right is what separates a useless piece of paper from real financial protection.

Think of this guide as your personal roadmap. We're going to cut through the noise and focus on what actually matters for insuring a home in New York.

What This Guide Covers

Forget the confusing insurance-speak. We're diving into the practical stuff that empowers you to make a smart choice. By the time you're done reading, you’ll have the confidence to pick a policy that fits your life and your budget.

Here’s what we’ll tackle:

- Decode Policy Jargon: We'll break down what terms like "dwelling coverage," "liability," and "endorsements" really mean for your wallet.

- Identify Regional Risks: You'll see why flood insurance is non-negotiable for coastal properties and why sewer backup coverage is a lifesaver for older homes.

- Find Actionable Savings: I'll share some proven ways to lower your premiums without cutting corners on the coverage you truly need.

Choosing home insurance isn't just about satisfying your mortgage lender. It's about building a financial safety net you can count on when things go wrong. A good policy is peace of mind.

At the end of the day, the process is much easier when you can compare home insurance quotes and know exactly what you’re looking at. This guide will give you that clarity, making sure your home is ready for whatever New York has in store.

Understanding Your Core Home Insurance Coverage

Looking at a home insurance policy for the first time can feel like trying to read a different language. All the jargon and clauses can be overwhelming. But at its heart, a good policy is just a protective shield for your biggest asset. Think of it as a collection of different defenses, each designed to guard a specific part of your financial life.

Let's pull back the curtain on what's really inside a standard policy. Knowing what each piece does is the key to making sure you're truly protected and not leaving yourself exposed.

Dwelling Coverage: Rebuilding Your Home

This is the big one. Dwelling coverage is the part of your policy that pays to rebuild or repair the physical structure of your house if it gets damaged. We're talking about the walls, the roof, the foundation, and anything permanently attached to it, like your kitchen cabinets.

Imagine a nasty storm barrels through and a tree crashes through your roof. Dwelling coverage is what you'll rely on to pay the contractors to fix that damage and make your home whole again. It’s absolutely critical to get this number right—you need enough coverage to completely rebuild your house from scratch at today's labor and material costs, not what you paid for it years ago.

While the average annual premium in New York is $1,229—quite a bit less than the national average of $2,423—this number can swing wildly depending on your home's value. For example, a policy for a smaller home with $100,000 in dwelling coverage might run about $640 a year, whereas a larger home needing $750,000 in coverage could see premiums closer to $3,489.

Personal Property Coverage: Protecting Your Stuff

If dwelling coverage protects the container, personal property coverage protects the contents. This is for all the stuff you own inside your home—your furniture, clothes, electronics, kitchenware, you name it.

If a pipe bursts and floods your basement, ruining your entertainment center and couch, this is the coverage that helps you replace it all. The best way to make sure you have enough is to do a quick home inventory. Just walk through your house with your phone, take a video, and jot down what it would cost to replace everything. It’s a simple step that can save you a massive headache later. For a more detailed look at policy options, you can see how home insurance is explained in our comprehensive guide.

Liability Coverage: Shielding You from Lawsuits

This is your financial bodyguard. Personal liability coverage steps in to protect you if someone gets hurt on your property and decides to sue. It could be as simple as a guest tripping on a rug or the mail carrier slipping on an icy patch on your walkway.

Liability is easily one of the most underrated parts of a homeowners policy. A lawsuit can wipe you out financially. This coverage is your first and best line of defense, covering legal fees and potential settlements so you don't have to.

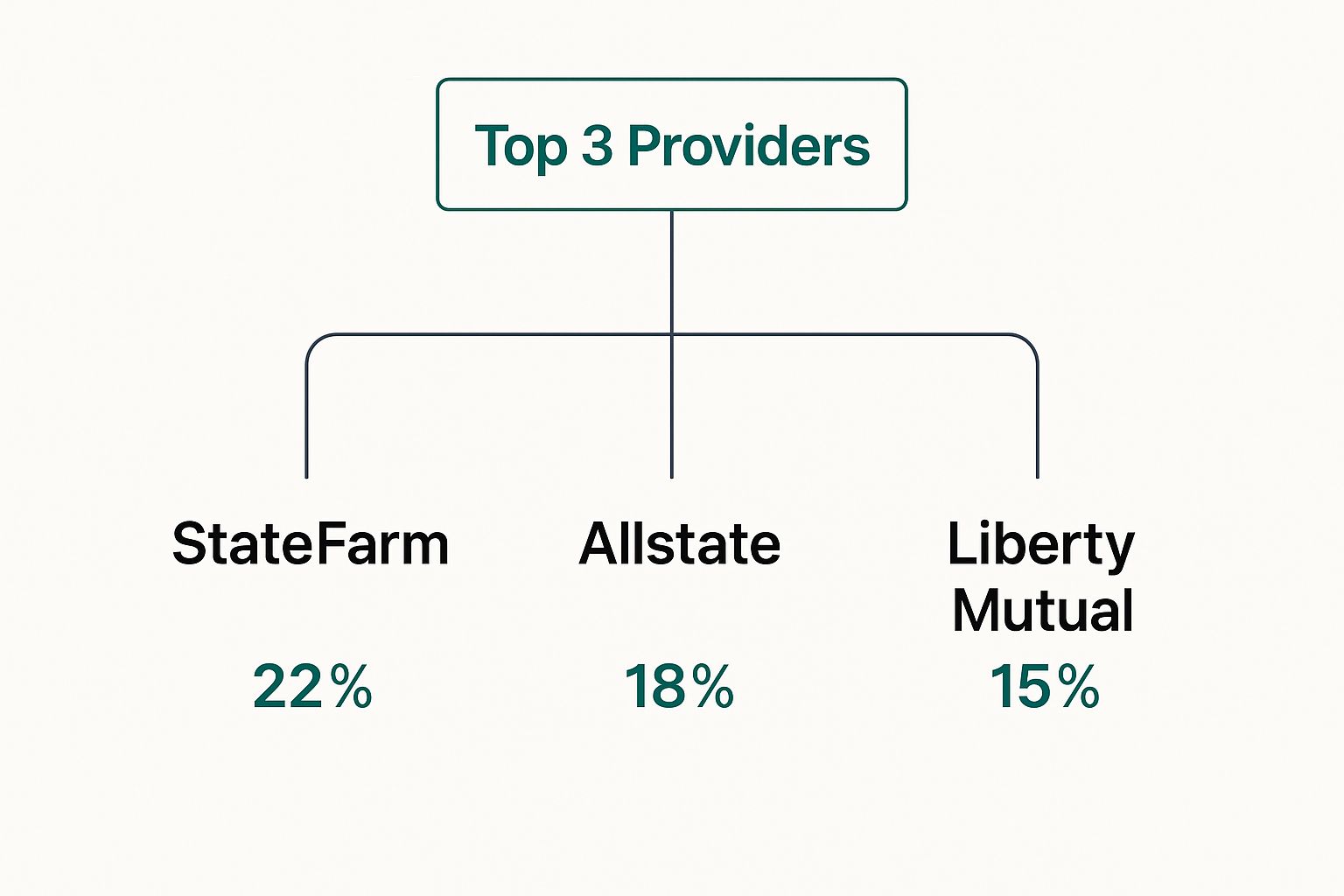

The chart below shows the market share of some of the major home insurance carriers in New York, giving you an idea of the key players in the state.

As you can see, a handful of large insurers dominate the market, which can impact everything from pricing to the types of policies available in your area.

Additional Living Expenses: Covering You When You're Displaced

Finally, there’s Additional Living Expenses (ALE), sometimes called loss of use coverage. If a covered disaster, like a fire, makes your home unlivable, this part of your policy helps pay for the extra costs of living somewhere else while repairs are being made.

This isn't just a blank check, but it covers the difference between your normal expenses and your temporary ones. This can include:

- Rent for a temporary apartment or home

- Hotel bills if your displacement is short-term

- Extra food costs from having to eat out

- Other reasonable expenses like laundry or pet boarding

ALE coverage is the safety net that keeps your life on track financially, even when your home is temporarily out of commission.

To put it all together, here’s a quick snapshot of how these coverages work in the real world.

Breaking Down a Standard New York Home Policy

Here's a simple look at the core coverages in a typical homeowners policy and what each one actually protects.

| Coverage Component | What It Really Protects | A Real-World Example |

|---|---|---|

| Dwelling | The physical structure of your house—roof, walls, foundation. | A windstorm blows shingles off your roof, and this coverage pays for the repairs. |

| Personal Property | Your belongings inside the house—furniture, electronics, clothes. | A thief breaks in and steals your laptops and jewelry; this helps you replace them. |

| Liability | Your financial assets from lawsuits if someone is injured on your property. | A guest slips on your wet kitchen floor, breaks their arm, and sues you for medical bills. |

| Additional Living Expenses (ALE) | The extra costs to live elsewhere if your home is uninhabitable. | A fire forces you out of your home for two months, and this pays your hotel and restaurant bills. |

Ultimately, a well-structured policy is about peace of mind. By understanding these four core components, you're in a much better position to choose the right protection for your family and your home.

Essential Coverage for New York Homeowners

A standard home insurance policy is a great starting point, but let’s be honest—New York’s weather doesn’t play by standard rules. From coastal storms hammering Long Island to heavy snowmelt flooding the Hudson Valley, the Empire State throws a lot at homeowners.

Think of your basic policy as a good, all-weather jacket. It works most of the time. But when a nor'easter or a flash flood hits, you’re going to need more than just a jacket to stay protected. Those extra layers come in the form of endorsements, which are specific add-ons that tailor your policy to the real risks you face. This is how you move from having an insurance policy to having the right one for your corner of New York.

The Absolute Necessity of Flood Insurance

Let's clear up the single most common—and costly—misconception in home insurance: standard policies do not cover damage from flooding. It’s a hard truth that trips up countless homeowners every year. Whether it's a storm surge, an overflowing river, or rapid snowmelt, water damage from the ground up requires a completely separate policy.

And this isn't just a concern for those with oceanfront views. The data shows that an estimated 30% of flood claims in New York come from areas not even designated as high-risk flood zones. A few inches of water is all it takes to cause tens of thousands of dollars in damage.

You generally have two ways to get this vital protection:

- The National Flood Insurance Program (NFIP): This is the federal government's program, and it's where most people get their flood coverage.

- Private Flood Insurance: A growing number of private insurance companies now offer their own flood policies, which can sometimes provide higher coverage limits and more customized options.

Your home doesn't need to be on the beach to be at risk. A home near a small creek, at the bottom of a hill, or in an area with poor drainage can be just as vulnerable. Flood insurance is one of the most important investments a New York homeowner can make.

Tackling Water Damage from the Inside Out

While flood insurance handles water coming from the outside, what happens when the problem starts inside your own pipes? A standard policy might cover a sudden pipe burst, but it often draws the line at gradual leaks or, worse, a sewer backup.

This is where a water backup and sump pump overflow endorsement proves its worth. This inexpensive add-on covers the messy and expensive damage caused when water backs up through your drains or when your sump pump gives out during a storm. If you have a finished basement or live in an older home, this isn't just a nice-to-have; it's essential.

Specialized Policies for Unique New York Homes

New York is full of unique properties that don't quite fit the standard single-family home mold. It's crucial to know what kind of policy your specific home needs.

Co-op and Condo Insurance (HO-6)

If you own a co-op or a condo, the building's master policy covers the structure and common areas—the roof, the hallways, the lobby. But it does nothing for your personal space. For that, you need an HO-6 policy. It's designed specifically to protect:

- Your personal belongings (furniture, clothes, electronics)

- Interior structures like your kitchen cabinets, hardwood floors, and any renovations you’ve done

- Personal liability in case someone is injured in your unit

- Loss assessments if the condo board bills all owners for a major repair

Coverage for Historic Homes

Owning a piece of history is a special kind of pride, but insuring it is a special kind of challenge. A standard policy's payout might not be enough to restore a historic home's unique character—think plaster walls, custom millwork, or stained-glass windows.

Specialized policies or endorsements for historic homes are designed to cover the true cost of rebuilding with period-appropriate materials and craftsmanship. This ensures you can restore your home's legacy and protect its unique value. The first step is always to sit down and assess your personal risks to see which of these coverages are smart investments for your situation.

What Determines Your Home Insurance Rate

Have you ever looked at your home insurance premium and wondered, "Where did they get this number?" It’s not just pulled out of thin air. Insurance companies are essentially professional risk assessors, and your premium is the result of a detailed calculation based on your home, your location, and even you.

Think of it like putting together a puzzle. The insurer gathers all these little pieces of information to build a clear picture of how likely it is you'll need to file a claim. The more risk they see in that picture, the higher your premium will be. Once you understand what those puzzle pieces are, you're in a much better position to control your costs.

Your Home's Unique Profile

The first and most obvious place an insurer looks is your house itself. They're trying to predict potential issues based on its physical makeup. A brand-new house, for example, usually gets a better rate because its plumbing, wiring, and foundation are fresh and less likely to cause problems.

Here are the key things they zero in on:

- Age and Construction: An older home might have wiring that's not up to modern code, which is a fire risk. The materials matter, too. A solid brick house will almost always be cheaper to insure than a wood-frame one because it stands up better to fire.

- Roof Condition: Your roof is your home's shield against the elements. A new, sturdy roof is a massive plus in an insurer's eyes. An old, worn-out one? That's a red flag for potential water damage claims down the line.

- Protective Devices: This is where you can be proactive. Simple things like smoke detectors and fire extinguishers can shave a little off your premium. A monitored security system or smart water shut-off valves can lead to even bigger discounts.

Location and Environmental Risks

Where you live matters. A lot. A home located two blocks from a fire station in a low-crime suburb is a fundamentally different risk than one in a remote area or a neighborhood with a high theft rate.

Insurers dig into the specifics of your address. If you're on the coast of Long Island, for instance, your rate will account for the higher risk of hurricanes and wind damage. Even something as simple as having a fire hydrant on your street corner can help lower your premium, since it means a fire can be put out faster.

Your insurance premium isn't just about your house; it's a reflection of local, regional, and even national trends. Knowing this helps explain why rates can change even if you haven't done anything differently.

It's also crucial to realize that New York insurance rates don't exist in a vacuum. When major disasters strike anywhere in the U.S., it impacts the entire industry. With natural catastrophe losses soaring past $100 billion for the third time in four years, the cost of rebuilding is skyrocketing due to inflation and supply chain issues. Those costs inevitably get passed on to homeowners everywhere.

Personal Factors and Claims History

The final piece of the puzzle is you. Your personal habits and history give an insurer clues about how likely you are to be a responsible homeowner.

Your claims history is a big one. If you’ve filed several claims in the past three to five years, you're going to look like a higher risk. This is why it often makes sense to pay for small repairs yourself instead of filing a minor claim that will stay on your record. To get a better handle on this, you can learn more about the homeowner insurance claim process in our detailed guide.

Another factor that surprises many people is their credit-based insurance score. This isn't your FICO score, but it is derived from your credit history. Decades of data have shown a strong correlation between financial responsibility and a lower likelihood of filing claims. Simply put, maintaining good credit can directly lead to a lower home insurance bill.

Smart Ways To Lower Your Insurance Costs

Knowing what goes into your home insurance rate is one thing, but actually doing something about it is where the real power lies. And the good news? You have far more control over that final number than most people realize.

It’s not about finding some secret loophole. It’s about making smart, proactive choices that can chip away at your premium without compromising the protection your family and home deserve. Think of it like a home improvement project for your finances—a little effort now can pay off big time down the road.

Bundle Your Policies For Immediate Savings

This is probably the easiest and fastest win you can get. If you have your home insurance with one company and your auto insurance with another, you’re almost certainly leaving money on the table.

Insurers reward loyalty. By bundling your home and auto policies with the same carrier, you can often unlock a multi-policy discount that slashes 10% to 20% off both premiums. It’s a no-brainer. You save money and simplify your life with one less bill to manage. It's the first thing we look at when helping a client find savings.

Bundling is more than just a discount; it’s a relationship-builder with your insurer. When you have multiple policies, you become a more valued client, which can sometimes lead to better service and more flexibility down the line.

Of course, the overall condition of your home plays a role, too. Staying on top of repairs shows an insurer you're a responsible homeowner. For example, understanding the importance of home maintenance is a great way to start thinking like an underwriter—a well-cared-for home is simply less risky to insure.

Adjust Your Deductible Wisely

Your deductible is the amount you pay out-of-pocket before the insurance company steps in to cover the rest of a claim. Think of it as your "skin in the game." It’s a classic trade-off: a higher deductible means a lower premium.

How much lower? Bumping your deductible from $500 to $1,000 could cut your premium by as much as 25%. The trick is to find your sweet spot. You need to choose a deductible you could comfortably write a check for tomorrow without causing financial stress. Don't set it so high that it’s scary, but don't keep it so low that you’re overpaying every single month.

Invest In Home Safety And Security

At its core, insurance is all about risk. The less likely your home is to have a claim, the less you'll pay in premiums. By installing protective devices, you’re actively reducing that risk, and insurers will often reward you for it with some nice discounts.

Here are a few upgrades that insurers love to see:

- Monitored Security Systems: An alarm that automatically notifies the police or fire department is a big one. This alone can earn you a discount of 5% or more.

- Smoke and Carbon Monoxide Detectors: You have them already, but making sure they're modern and hard-wired can sometimes move the needle.

- Water Leak Detectors: These smart gadgets are becoming huge. Since non-weather-related water damage is one of the most common claims, preventing a burst pipe or slow leak is a massive win for both you and the insurer.

- Storm Shutters or Reinforced Roofing: Living in New York means dealing with coastal storm risks. Beefing up your home's defenses against wind and hail can lead to significant savings.

For a more comprehensive look at trimming your costs, our guide on how to lower home insurance premiums gets into even more detail.

Popular Home Insurance Discounts in New York

Insurance carriers in New York offer a whole menu of discounts beyond the big ones we've already covered. Here's a quick look at some of the most common ways to save. It's always worth asking your agent which ones you might be eligible for.

| Type of Discount | Typical Savings Potential | How to Qualify |

|---|---|---|

| Multi-Policy (Bundling) | 10% – 20% | Insure your home and auto with the same company. |

| Protective Devices | 5% – 15% | Install smoke detectors, burglar alarms, or water leak sensors. |

| Claims-Free History | 5% – 10% | Go a certain number of years (usually 3-5) without filing a claim. |

| New Home | Up to 20% | Your home was built within the last 10-15 years. |

| Loyalty Discount | 5% – 10% | Stay with the same insurance company for several consecutive years. |

| Non-Smoker | Up to 5% | All residents of the household are non-smokers. |

| Gated Community | 5% – 10% | Live in a community with controlled access and security patrols. |

By combining a few of these strategies—bundling your policies, choosing the right deductible, and taking advantage of discounts—you can put together a top-tier New York home insurance policy at a price that actually fits your budget.

Finding the Right Insurance Company for You

When you're looking for home insurance in New York, it’s tempting to just grab the cheapest quote and call it a day. But that's a huge mistake. The real value of an insurance policy isn't the price you pay; it's the peace of mind knowing you have a reliable partner who will be there when you need them most.

After all, a rock-bottom price is worthless if the company ghosts you after a storm or denies a perfectly valid claim. A little bit of homework now can save you from a world of hurt later.

Evaluating an Insurer's Strength and Service

So, how do you look past the price tag? It comes down to two critical factors: the company's financial health and its track record with customers. A great policy on paper means nothing if the insurer can't actually afford to pay out claims after a major disaster hits.

First, check their financial stability rating. Think of this as the company's financial report card. Independent agencies like A.M. Best grade insurers on their ability to pay claims, and you'll want to see an "A" rating or higher. This is a strong sign that they have their house in order.

Next, dig into their customer satisfaction scores. You're not the first person to buy a policy from them, so see what others have experienced. Resources like the J.D. Power U.S. Home Insurance Study are a great starting point. Even better is the National Association of Insurance Commissioners (NAIC) Complaint Index. This tool shows how many complaints a company gets relative to its size. A score below 1.00 is what you’re looking for—it means they get fewer complaints than the average insurer.

A Step-by-Step Guide to Shopping Around

Finding the right policy isn’t a one-and-done deal. To truly find the best fit for your home, you need to be methodical.

Here’s a simple framework to get a true apples-to-apples comparison:

- Gather Your Info: Before you make any calls, get your home's details together. You'll need its square footage, the year it was built, the age of the roof, and info on any recent upgrades to things like plumbing or electrical systems.

- Get Multiple Quotes: Don't stop at one. Aim for at least three to five quotes from a mix of insurers—think big national brands, smaller regional companies, and an independent agent.

- Compare Policies Side-by-Side: This is key. Don't just glance at the premium. Line up the quotes and make sure the dwelling coverage limits, deductibles, and any extra coverages (endorsements) are the same. A cheaper quote often comes with a much higher deductible or leaves out protections you really need.

Choosing an insurance company based solely on price is like choosing a surgeon based on who offers the biggest discount. You want to prioritize reliability and expertise, because when you need them, you need them to be the best.

The Advantage of an Independent Agent

Feeling overwhelmed? That’s perfectly normal. Navigating the world of insurance can be confusing, and this is where working with an independent agency like Wexford Insurance Solutions makes all the difference.

Unlike a "captive" agent who works for just one company, an independent agent works for you.

We have access to a wide variety of carriers, which means we can do the shopping for you and bring the best options to the table. More importantly, we offer personalized advice to help you cut through the jargon, understand the fine print, and find a policy that truly fits your life—not just a one-size-fits-all plan.

For a deeper dive into the fundamentals, check out our complete guide to homeowners insurance. An agent simplifies your search, helping you make a decision based on overall value, not just the initial cost.

Got Questions About New York Home Insurance? We’ve Got Answers.

Even after you’ve done your homework, a few specific questions always seem to pop up. It’s completely normal. Let's tackle some of the most common ones we hear from homeowners all over New York.

Is Hurricane Insurance A Separate Policy?

This is a big one, and the short answer is no—there's no single policy called "hurricane insurance."

Your protection from a hurricane actually comes from a couple of different places. Your standard home insurance policy will typically cover the damage from the wind. However, you'll want to check for a specific hurricane deductible, which is usually a higher amount that kicks in only for named storms.

Here's the critical part: the flood damage that often comes with these storms is not covered by your standard policy. For that, you absolutely need a separate flood insurance policy.

How Much Liability Coverage Do I Really Need?

Most policies start you out with $100,000 in liability coverage, but frankly, that’s often not enough these days. A good rule of thumb is to carry enough liability insurance to cover everything you own—your house, your savings, your investments. Your entire net worth.

For most people, we recommend a minimum of $300,000 to $500,000. If your assets exceed that, it's smart to look into an umbrella policy. This gives you an extra layer of protection on top of what your home and auto policies already provide.

Think of liability coverage as a shield for your financial future. A single accident on your property could lead to a lawsuit that exceeds basic coverage limits, putting everything you've worked for at risk.

Can An Insurer Cancel My Policy After A Claim?

They can, but their hands are tied by regulations. An insurance company can decide not to renew your policy if you file too many claims in a short time—think three or more claims within a three-year window. This is exactly why it sometimes makes more sense to pay for small repairs yourself rather than file a claim.

But they can't just cancel you in the middle of your policy term for filing one legitimate claim, especially if it's from a major storm. New York state has specific rules in place to protect homeowners from being dropped unfairly.

Does My Policy Cover Dog Bites?

Usually, yes. The liability part of your home insurance is what covers dog bites. The catch is that some companies have what’s known as a "breed blacklist." They might refuse to cover certain breeds like Pit Bulls or Rottweilers, or they'll charge you a much higher premium.

The most important thing is to be honest with your insurer about your pets from day one. If you don't tell them you have a dog and an incident happens, they could have grounds to deny the claim entirely.

Navigating all these details is so much easier when you have an expert in your corner. At Wexford Insurance Solutions, our job is to find the right coverage for your unique New York home, so there are no surprises when you need it most. Let's talk and get you a clear, personalized plan.

Find your policy at https://www.wexfordis.com

Homeowners Insurance Naples Florida: Protect Your Home Today

Homeowners Insurance Naples Florida: Protect Your Home Today 7 Best Commercial Insurance Companies for Businesses in 2025

7 Best Commercial Insurance Companies for Businesses in 2025