When you're dealing with significant wealth, financial planning becomes a whole new ballgame. It's not just about picking stocks or saving for retirement anymore. It's a specialized field dedicated to protecting and growing substantial assets while navigating a minefield of complex challenges. This kind of planning requires a custom-built strategy to handle sophisticated tax, estate, and risk management issues that standard financial advice just doesn't touch.

What High Net Worth Financial Planning Really Means

The phrase "high net worth" might make you think of a specific dollar amount, but that number is a constantly moving target. According to Charles Schwab’s Modern Wealth Survey, the average American believes it takes around $2.3 million to be considered "wealthy."

Interestingly, with things like stubborn inflation and higher taxes, 63% of people feel that this number is always creeping upward. This feeling highlights the economic pressures that can erode even significant wealth over time. You can dive into the public's take on wealth and what's driving these perceptions in Schwab's detailed survey analysis.

Beyond Basic Financial Advice

Managing a large portfolio is fundamentally different from managing a modest savings account. Think of it this way: anyone can paddle a canoe, but it takes an experienced captain and a skilled crew to navigate a superyacht through a storm. Both are on the same water, but the superyacht needs advanced navigation, a long-term course, and a team that can handle complex challenges.

Standard financial advice is the canoe—perfectly fine for a simple trip across the lake, but totally out of its depth when the unique storms that high-net-worth individuals face start brewing.

High net worth financial planning isn't just about making your money grow. It's an all-encompassing strategy focused on smart preservation, transferring wealth across generations, and using your capital to hit ambitious personal and financial targets.

This specialized approach is critical because with great wealth comes great complexity. Every single financial move can send ripples across your entire financial life:

- Tax Implications: Selling a business without careful structuring can lead to a massive capital gains tax bill.

- Estate Planning: As your assets grow, so does the complexity of passing that wealth on to your heirs efficiently.

- Risk Management: More assets mean you're a bigger target for lawsuits and other liabilities. You can find more details in our guide on https://wexfordis.com/2025/07/28/insurance-for-high-net-worth-individuals/.

Ultimately, this level of planning shifts the focus from simply accumulating money to becoming a strategic steward of your wealth. It demands a forward-thinking mindset that anticipates both challenges and opportunities years, or even decades, down the line. Exploring different high net worth investment strategies will give you a better sense of how this works in practice.

The Pillars of a Robust HNW Financial Plan

To truly grasp what sets this level of planning apart, it helps to break it down into its core components. These pillars form the foundation of any comprehensive wealth management strategy, moving far beyond simple investment returns to create a durable, multi-generational financial structure.

| Pillar | Primary Goal | Common Strategies |

|---|---|---|

| Investment Management | Grow assets while managing risk according to long-term goals. | Diversification, alternative investments (private equity, hedge funds), tax-loss harvesting. |

| Tax Optimization | Minimize tax liabilities across all financial activities. | Tax-efficient investment vehicles, strategic charitable giving, trust structures. |

| Estate & Legacy Planning | Ensure a smooth and tax-efficient transfer of wealth to heirs. | Wills, trusts (revocable, irrevocable), gifting strategies, family foundations. |

| Risk Management | Protect assets from unforeseen events like lawsuits or disability. | Umbrella liability insurance, captive insurance, asset protection trusts. |

| Philanthropy | Align charitable goals with financial and tax planning. | Donor-Advised Funds (DAFs), private foundations, charitable remainder trusts. |

Each pillar is interconnected, and a change in one area often requires adjustments in another. This guide will walk you through these advanced concepts, giving you the knowledge you need to start building a truly resilient financial future.

Building Your Wealth Management Dream Team

Managing substantial wealth isn't a solo endeavor; it's a team sport. Trying to juggle every complex detail on your own is like a star quarterback attempting to play every single position on the field. It’s not just inefficient—it dramatically increases the risk of a costly fumble. True financial planning for high-net-worth individuals requires a synchronized, multi-disciplinary approach.

Think of it as assembling a Formula 1 pit crew. The car, which is your financial legacy, is incredibly powerful and complex. You need a crew chief—your primary wealth manager—who coordinates every specialist. This person directs the tax strategist, the estate planning attorney, and the investment specialist, ensuring they all work in perfect harmony for peak performance.

Why an Integrated Team Is Non-Negotiable

A single business decision can send ripples across your entire financial life, affecting your personal taxes, your children's inheritance, and even your philanthropic goals. For instance, selling a business you've owned for years is about more than just finding a buyer. A tax advisor has to structure the deal to minimize capital gains, while an estate lawyer needs to make sure the proceeds are woven into your legacy plan without triggering unnecessary gift taxes.

This interconnectedness is exactly why affluent investors are moving away from siloed advice. As their needs become more complex, the old way just doesn't work. A recent PwC study found that nearly 46% of wealthy U.S. investors planned to change or add new wealth management providers, signaling a clear demand for a single, comprehensive source of expertise. You can see more on what these investors are seeking in the full PwC wealth management report.

It’s even more pronounced among the ultra-wealthy. A staggering 89% now expect single-source access to specialized services beyond just investments, including lending, succession planning, and even concierge services.

This shift gets to a fundamental truth: managing significant wealth requires a team of dedicated experts who actually talk to each other and strategize together. When you’re putting your team together, it’s critical to find and engage qualified legal and financial experts.

Key Players on Your Advisory Roster

Your dream team will be unique to your circumstances, of course, but a few core roles are almost always essential. Each member brings a distinct—and vital—perspective to the table, ensuring no stone is left unturned.

-

The Wealth Manager (The Crew Chief): This is your primary point of contact and strategist. They maintain a 360-degree view of your financial life, coordinating all other specialists to ensure their advice lines up with your overarching goals. They're the conductor of your financial orchestra.

-

The Certified Public Accountant (CPA) or Tax Strategist: This expert does far more than just file your annual returns. They give you proactive advice on tax-efficient investing, charitable giving strategies, and how to structure transactions to legally minimize your tax burden.

-

The Estate Planning Attorney: This legal professional is the architect of your legacy. They draft wills, establish trusts, and build the legal framework needed to transfer your wealth smoothly and efficiently, protecting it from probate and taxes for the next generation.

-

The Investment Specialist: With a deep focus on the markets, this professional builds and manages a portfolio designed for your specific risk tolerance and growth objectives. They often bring expertise in alternative investments like private equity or real estate, which are common in HNW portfolios.

-

The Insurance Professional: Think of this specialist as your fortress builder. They analyze your exposure to all kinds of risks—from personal liability to business disruptions—and put sophisticated insurance solutions in place to protect your assets. For business owners, this expertise should extend to a thorough business continuity plan checklist to safeguard operations.

When these experts work in concert, your financial plan transforms from a collection of separate documents into a dynamic, cohesive, and powerful strategy.

Mastering Advanced Tax Optimization Strategies

For high-net-worth individuals, tax planning isn't just a yearly chore—it's woven into the fabric of every financial decision. While most people think about standard deductions come April, sophisticated financial planning for high net worth means playing chess, not checkers. It's about proactive, layered strategies that legally minimize taxes across every asset and income stream you have.

Think of it as looking at your entire financial world through a "tax-efficiency lens." The goal is simple: maximize your after-tax returns. After all, the money you keep is every bit as important as the money you earn. This requires a shift from basic tactics to more advanced, structural ways of preserving your wealth.

Moving Beyond Simple Deductions

The first real step in advanced tax optimization is changing your mindset from reactive to proactive. Instead of hunting for last-minute deductions, you build a financial framework that's inherently tax-efficient from the ground up. This means your investment, business, and estate planning decisions all need to speak the same language.

A few key strategies form the foundation:

- Tax-Loss Harvesting: This is the disciplined practice of selling an investment at a loss to strategically offset the capital gains taxes from another winner in your portfolio. It’s a smart way to reduce the tax drag that can slow down your portfolio's growth over time.

- Strategic Asset Location: This isn't about geography; it's about what type of account holds which asset. You might place high-growth stocks in a tax-free account like a Roth IRA, while putting less tax-efficient assets, like corporate bonds, into tax-deferred accounts.

- Maximizing Retirement Contributions: It sounds basic, but fully funding tax-advantaged retirement accounts like a 401(k) or SEP IRA is one of the most powerful ways to lower your taxable income today. For 2025, the 401(k) contribution limit is $23,500, plus an extra $7,500 catch-up contribution for anyone over 50.

These moves set the stage for more complex maneuvers designed to protect significant wealth from taxes. They are often central components of the comprehensive https://wexfordis.com/2025/06/18/wealth-preservation-strategies/ that ensure assets are protected and growing for the long haul.

A cardinal rule in high-net-worth tax planning is to never let the "tax tail wag the dog." A financial or investment decision has to make sense on its own merits first. Tax efficiency should be a crucial secondary benefit, not the sole reason for making a move.

Leveraging Advanced Investment Structures

As your net worth climbs, you unlock access to specialized investment vehicles and legal structures that come with serious tax advantages. These are tools specifically designed to solve the complex challenges that high-net-worth investors face.

For example, many sophisticated investors lean heavily into real estate. The asset class comes with built-in tax advantages, like using depreciation to offset rental income. Even more powerfully, 1031 exchanges allow you to sell a property and defer capital gains taxes by rolling the proceeds into a new, similar investment. Understanding these real estate tax benefits can open up incredible avenues for tax-smart growth.

Exploring Specialized Tax-Advantaged Zones

Another powerful, and often overlooked, tool involves investing in specific geographic areas that offer tax incentives to encourage economic growth. These aren't loopholes; they're programs created by Congress.

A prime example is the Qualified Opportunity Zone (OZ) program. This allows you to defer—and potentially even reduce—capital gains by reinvesting them into a dedicated Opportunity Fund.

Here’s how it works:

- Deferral: You can put off paying tax on your original capital gain until as late as December 31, 2026.

- Elimination: The real magic happens if you hold the OZ investment for at least 10 years. Any new capital gains earned from the Opportunity Fund investment itself can be completely free from federal income tax.

This is a game-changer for someone who has just sold a business or another highly appreciated asset and is looking for a home for those proceeds.

Ultimately, mastering these advanced strategies turns your tax bill from a passive drain into an actively managed part of your financial plan. By working with a team of experts, you can build a resilient, efficient financial structure that supports your goals—not just for today, but for generations to come.

Crafting Your Generational Legacy Blueprint

For high-net-worth families, financial planning isn't just about your own lifetime; it’s about architecting a legacy that will last for generations. This goes far beyond simply writing a will. We're talking about building a strategic framework to transfer wealth efficiently, minimize tax erosion, and prepare your family for the responsibilities that come with it.

Think of it this way: a basic will is like a hand-drawn map. It might point your family in the right general direction, but it doesn't account for the inevitable roadblocks—probate court, hefty estate taxes, or even family disagreements. A comprehensive estate plan, on the other hand, is your financial GPS. It anticipates the hazards and charts the most efficient, protected route for your assets to travel.

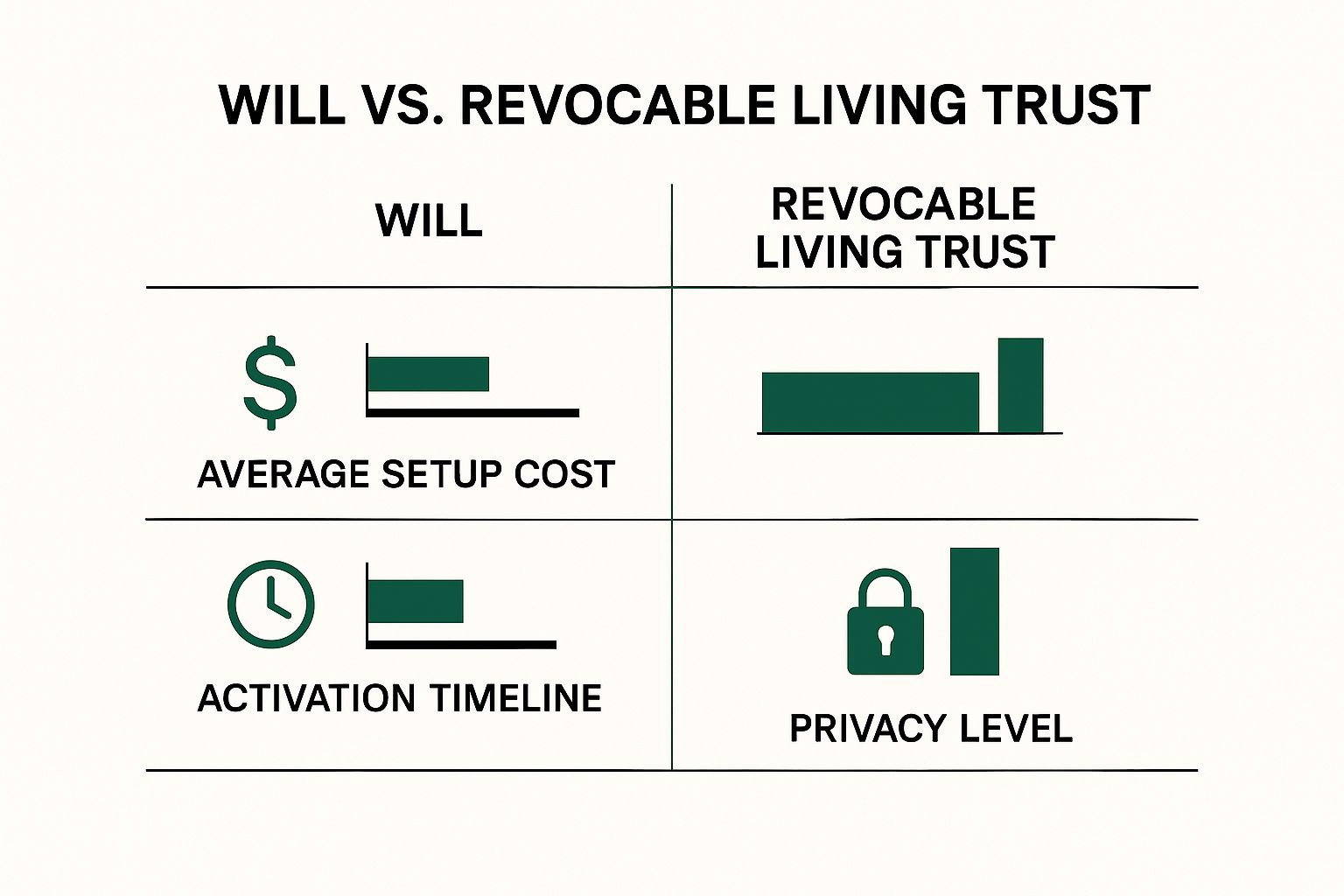

This image offers a great at-a-glance comparison between a simple will and a revocable living trust, which is a cornerstone of modern estate planning.

As you can see, while a will might seem cheaper initially, a trust provides incredible value by keeping your affairs private and completely bypassing the lengthy, public, and often costly probate process.

Advanced Tools for a Durable Legacy

When you’re dealing with a substantial estate, your legacy blueprint needs more sophisticated tools than just a standard trust. These are specialized instruments designed to solve the unique challenges high-net-worth families face, like minimizing tax friction and ensuring your wealth is distributed exactly as you intend.

Two of the most powerful strategies we often implement are:

- Grantor Retained Annuity Trusts (GRATs): A GRAT is a fantastic way to pass on appreciating assets, like company stock or real estate, to your heirs while minimizing gift and estate taxes. You place the assets into the trust and, in exchange, receive a fixed annual payment for a set term. After the term ends, any growth above a specific IRS interest rate goes to your beneficiaries completely tax-free.

- Irrevocable Life Insurance Trusts (ILITs): An ILIT is a trust created for one specific purpose: to own your life insurance policy. By moving the policy into the trust, the eventual death benefit isn't counted as part of your taxable estate. This is a game-changer, providing your heirs with a pool of immediate, tax-free cash to cover estate taxes or other expenses without being forced to sell a family business or beloved property.

To get the most out of these tools, you need careful planning and a team that’s on the same page. We explore these concepts in much greater detail in our complete guide to estate tax planning strategies.

The Looming Estate Tax Exemption Shift

Planning ahead has never been more critical. There’s a major change coming to federal law that everyone with significant assets needs to be aware of.

Right now, the federal estate tax exemption is at an all-time high. But that's about to change. In 2026, the exemption is scheduled to be cut by nearly half, dropping from over $13 million per person to an estimated $7 million.

This isn't a minor tweak. This cliff will suddenly expose many more estates to the punishing 40% federal estate tax. For families who want to preserve their wealth, this means the time to act is now. Strategies like lifetime gifting and funding trusts are more important than ever.

This is a fundamental shift that could cost an unprepared estate millions of dollars. The window to leverage today's high exemption levels is closing fast.

To help you get started, here's a look at some of the key tools available for estate planning and how they stack up against each other.

Comparison of Key Estate Planning Tools

| Tool | Primary Benefit | Key Consideration | Best For |

|---|---|---|---|

| Revocable Living Trust | Avoids probate; maintains privacy and control during your lifetime. | Assets must be properly funded into the trust to work as intended. | Nearly all HNW individuals as a foundational planning tool. |

| Annual Gifting | Simple, effective way to reduce your taxable estate over time. | Limited to an annual exclusion amount per recipient. | Systematically transferring wealth to children and grandchildren tax-free. |

| GRAT | Transfers future appreciation of assets to heirs with zero gift tax. | The grantor must outlive the trust term for it to be successful. | Highly appreciating assets like pre-IPO stock or real estate. |

| ILIT | Provides tax-free liquidity to heirs and removes policy proceeds from your estate. | You give up control and access to the policy's cash value. | Creating a fund to pay estate taxes without liquidating other assets. |

Each of these tools has a specific job to do. The real power comes from combining them into a cohesive strategy that reflects your unique family goals and financial picture.

Preparing Heirs for Stewardship

A truly successful legacy isn't just about transferring money; it’s about transferring wisdom. Preparing your heirs for the responsibility of wealth is just as crucial as any legal document you sign. Without guidance, an inheritance can quickly feel more like a burden than a blessing.

Here are a few practical steps to build a strong foundation:

- Start Early with Financial Education: You can't start too soon. Begin introducing financial concepts in an age-appropriate way to build a lifetime of financial literacy.

- Involve Heirs in Philanthropy: Let the next generation participate in your family's charitable giving. It’s a powerful way to show them how wealth can make a positive impact and instill a sense of purpose.

- Introduce Them to Your Advisory Team: Don't wait until you're gone. Gradually bring your children into meetings with your wealth manager and attorney. It demystifies the process and forges the relationships they'll need later.

- Create a Family Mission Statement: Work together to define your family's core values. This document can become a north star for future generations, ensuring the wealth is managed in a way that honors your legacy.

When you blend powerful financial instruments with intentional preparation for your heirs, your legacy blueprint becomes more than a set of instructions—it becomes a living plan that secures your family's future for generations to come.

Building a Financial Fortress for Your Assets

While growing your wealth is exciting, protecting it is what truly defines successful financial planning for high-net-worth individuals. The reality is, the more you have, the bigger a target you become for potential lawsuits, creditors, and other unexpected liabilities. Effective asset protection isn't about hiding money; it's about building a proactive, layered defense—a financial fortress—around your life's work.

Think of it like a medieval castle. You wouldn't just build a single wall and hope for the best. You’d dig a moat, erect a powerful outer wall, construct an inner wall, and secure the keep. Each layer presents a serious obstacle to any threat, and that’s precisely how we should approach protecting your assets.

The First Line of Defense: Insurance Solutions

The most fundamental layer of your protection, your financial moat, is a well-designed insurance portfolio. Standard, off-the-shelf policies are almost never enough to cover the unique risks that come with significant wealth. This is where specialized coverage becomes absolutely essential.

The cornerstone here is a high-limit umbrella liability policy. This is the policy that kicks in when the liability limits on your home or auto insurance are exhausted. A single bad car accident or an injury on your property can easily trigger a lawsuit far exceeding a standard policy, putting your personal assets squarely in the crosshairs. An umbrella policy provides millions in extra coverage for a surprisingly reasonable cost.

Many people carry some liability insurance, but HNW individuals often need coverage that extends from $5 million to over $50 million. This ensures one lawsuit doesn't tear down everything you've built.

Beyond that, other specialized policies are just as critical. Directors and Officers (D&O) insurance is a must if you serve on a corporate or non-profit board. And in today's world, cybersecurity insurance is vital to protect against the financial fallout of data breaches. To see how these policies fit together, take a look at our guide on asset protection insurance strategies.

Structural Protection with Legal Entities

Once the moat is in place, it's time to build the strong outer walls of your fortress. This involves using legal structures to create a clear separation between your personal assets and your business or real estate investments. If one area of your financial life comes under attack, the others remain untouched.

The most common tools we use for this are:

-

Limited Liability Companies (LLCs): By placing assets like rental properties or business ventures into individual LLCs, you can effectively isolate liability. If a lawsuit comes from a tenant at one property, the creditor can typically only pursue the assets within that specific LLC, not your personal home or your other investments.

-

Asset Protection Trusts: These are more sophisticated legal instruments, often set up in jurisdictions with strong, favorable laws. When structured correctly, the assets you place in these trusts are no longer legally considered yours, putting them well beyond the reach of future creditors.

Protecting Your Digital and Reputational Assets

In our hyper-connected world, your fortress needs digital walls, too. A huge part of modern financial planning for high net worth individuals now involves protecting your digital footprint and your personal reputation.

Cybercriminals are increasingly sophisticated and frequently target the affluent. This means robust security for your financial accounts, emails, and personal data is non-negotiable. This includes using complex, unique passwords, activating multi-factor authentication everywhere you can, and staying sharp against phishing scams.

Finally, don't forget that your reputation is an invaluable asset. A hit to your public image can damage business opportunities and personal relationships. Proactive reputation management, like monitoring your online presence and having a crisis plan ready, is a key part of a truly comprehensive asset protection strategy. By weaving together strong insurance, smart legal structures, and digital vigilance, you build a fortress capable of withstanding almost any threat.

Your High-Net-Worth Financial Planning Questions Answered

When you're dealing with significant wealth, the financial landscape looks different. The questions are more complex, the strategies more nuanced, and the stakes are much higher. Let's tackle some of the most common questions we hear from clients to bring some clarity to the world of high-net-worth wealth management.

How Often Should My Financial Plan Be Reviewed?

One of the biggest mistakes people make is treating their financial plan like a sculpture—something carved once and then left on display. In reality, for a high-net-worth individual, a financial plan is more like a living garden. It needs constant attention to thrive.

Think of it as the navigation chart for a long-haul flight. You wouldn't just point the plane in the right direction and hope for the best; the pilot is constantly adjusting for wind, turbulence, and air traffic. Your wealth deserves that same active, hands-on management.

At an absolute minimum, you should be sitting down for a comprehensive review once a year. This is your dedicated time to check performance, rebalance your portfolio, and make sure everything is still pointing toward your long-term goals. However, life doesn’t always wait for your annual meeting. Certain events should trigger an immediate call to your team.

Key triggers for a plan review include:

- Major Life Events: Getting married or divorced, welcoming a new child, or losing a family member can completely change your financial picture and what you want for the future.

- Significant Financial Changes: Selling a business, inheriting a substantial sum, or making a large philanthropic gift are all game-changers that require immediate adjustments.

- Legislative Shifts: When tax laws or estate tax exemptions change, you need to react quickly. These moments can either present new opportunities or introduce new risks if your plan isn't updated.

What Is the Real Difference Between a Wealth Manager and a Financial Advisor?

People often use "financial advisor" and "wealth manager" interchangeably, but for families with significant assets, the distinction is critical. Getting this right means getting the coordinated, high-level service your complex financial life requires.

A traditional financial advisor is often an investment specialist. Their primary job is to build and manage your portfolio of stocks, bonds, and other assets based on your risk tolerance and goals. They are laser-focused on making your money grow in the market.

A wealth manager, on the other hand, operates on a much broader playing field.

Think of a wealth manager as the CFO of your personal family enterprise. They aren't just managing one piece of the puzzle; their job is to see the entire board and make sure all the pieces work together.

This means a wealth manager is the central hub, coordinating every aspect of your financial world. They work hand-in-hand with your tax professionals, your estate planning attorney, and your insurance specialists. They ensure your investment decisions don’t create an unexpected tax headache, and that your business succession plan is perfectly aligned with your trust and estate documents.

For HNW individuals, this kind of integrated, 360-degree approach isn't a luxury—it's essential.

Is It Wise to Manage My Own Wealth?

The thought of managing your own wealth is certainly tempting. You cut out advisory fees and keep total control over every move. For someone with a relatively simple financial situation, going the DIY route can sometimes make sense. But when you’re dealing with the intricate web of high-net-worth finances, the risks usually eclipse the potential savings.

Managing substantial wealth isn't just about picking good stocks. It's about mastering the complex interplay of tax law, estate planning rules, risk management, and global market dynamics. Each of these is a full-time profession, and it's a monumental task for one person to become an expert in all of them.

The cost of a single misstep—like a poorly structured trust, a missed tax-saving opportunity, or an inadequate liability policy—can easily wipe out what you would have paid in advisory fees for years. And then there's the time commitment. Properly managing a complex financial life demands constant research, monitoring, and execution.

For most high-net-worth individuals, your time is your most valuable asset. It’s better spent on what you do best—whether that's running your company, enjoying your passions, or creating memories with your family. Handing over the financial heavy lifting to a dedicated team of professionals isn't giving up; it's a strategic move. It allows you to tap into deep expertise, free up your time, and make the most prudent choice for protecting and growing your legacy.

At Wexford Insurance Solutions, we specialize in creating integrated insurance and risk management strategies that form the foundation of a secure financial plan. Our expertise in private client coverage ensures that every aspect of your life—from your home and valuables to your personal liability—is protected with precision. Secure your legacy by visiting us at https://www.wexfordis.com to learn how we can help build your financial fortress.

7 Best Commercial Insurance Companies for Businesses in 2025

7 Best Commercial Insurance Companies for Businesses in 2025 How Long Does It Take to Get Insurance? Find Out Now

How Long Does It Take to Get Insurance? Find Out Now