Ever wondered how long it actually takes to get insurance? The answer isn't a simple one—it can be anything from a few minutes to several weeks. Getting a basic car insurance policy can sometimes be done almost instantly, while something more complex, like life insurance, will naturally have a more involved review process.

The waiting period really boils down to the type of coverage you're after and how much digging the insurance company needs to do to assess its risk.

Your Insurance Timeline: From Minutes to Months

To get a handle on how long it takes to get insurance, you have to realize each policy moves at its own speed. Think of it like ordering at a restaurant: a cup of coffee is ready in a flash, but a gourmet meal takes time and careful preparation. It's the same with insurance.

You can often get a car insurance policy in under an hour because the data insurers need—like your driving record—is standardized and easily accessible.

But when you're insuring more complex assets or your health, the process naturally slows down. Homeowners insurance, for instance, might take a few days. The insurer needs to look at property details, assess location-specific risks (like flood zones), and may even need to schedule a home inspection before they can finalize the policy.

Why Some Policies Take Longer

The biggest time factor is the underwriting process, which is just the industry term for how insurers evaluate risk. Life insurance is the classic example of a longer timeline. A fully underwritten policy can take anywhere from a few weeks to a couple of months. This is because it usually requires a medical exam and a thorough review of your entire health history.

On the flip side, some simpler "no-exam" life insurance policies can be approved in as little as 24 hours. You can learn more about life insurance approval times to get a better sense of how these factors influence the clock.

Key Takeaway: The time it takes to get coverage is directly linked to the amount of risk the insurer has to evaluate. The more complex the risk, the longer the underwriting process.

To give you a clearer picture, let's break down the typical waiting periods for some of the most common types of insurance.

Average Insurance Approval Times by Policy Type

This table gives a general idea of what to expect when you apply for different kinds of coverage.

| Insurance Type | Typical Approval Time | Key Factors |

|---|---|---|

| Auto Insurance | A few minutes to 24 hours | Driving record, vehicle information, credit history. |

| Homeowners Insurance | 1-5 business days | Property value, location, claims history, home inspection results. |

| Renters Insurance | A few minutes to a few hours | Personal property value, location, liability limits. |

| Life Insurance (No-Exam) | 24-48 hours | Health questionnaire, prescription history, public records. |

| Life Insurance (Underwritten) | 4-8 weeks | Medical exam, lab results, physician statements, health records. |

Remember, these are just averages. Your personal situation could make the process faster or slower, but this gives you a solid starting point for planning.

Breaking Down the Three Stages of Insurance Approval

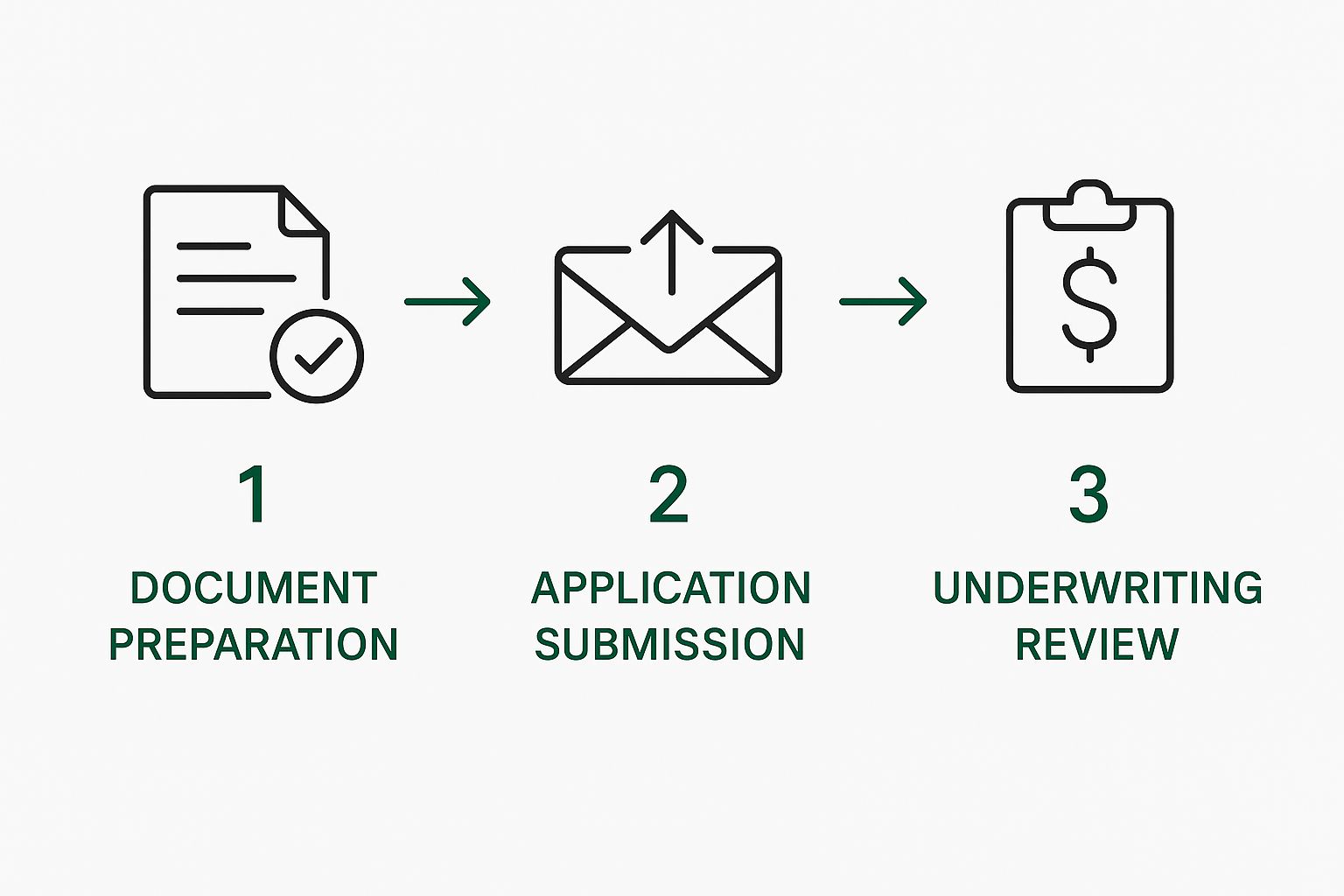

So, you've submitted your insurance application. What happens next? It might feel like your information disappears into a black hole, but it's actually entering a clear, step-by-step process. Getting a handle on these three stages will demystify the timeline and show you exactly what's happening behind the scenes.

This simple workflow lays out the journey from submission to final review.

Each phase is designed to make sure the insurer has everything they need to offer you the right coverage at a fair price. Let's walk through it.

Stage 1: Application and Documentation

This is where it all starts. You fill out the application, providing all the crucial details about who or what you want to insure. Think of this as building the foundation of a house—if it’s not solid, everything that comes after will be shaky.

Accuracy is king here. A tiny mistake or a forgotten detail can bring the whole process to a screeching halt later on. It's always best to be thorough and upfront from the get-go.

Stage 2: The Underwriting Process

Next up is underwriting, and this is really the heart of the whole operation. An underwriter is like a risk detective. Their job is to meticulously review the information you've provided and cross-reference it with other data, like your driving record, claims history, or even medical reports.

They’re putting together a complete puzzle of your risk profile to decide if they can offer you a policy and how much it should cost. For more complex policies, like those for a business, they might dig into things like management liability coverage to get the full picture. It’s no surprise this is usually the longest part of the journey.

An underwriter’s primary goal is to get a crystal-clear picture of the risk. The more complicated the risk—a high-value home, a specialized business, or a large life insurance policy—the deeper their investigation needs to go, which naturally extends the timeline.

Stage 3: Final Approval and Policy Issuance

Once the underwriter has finished their deep dive and is confident in their assessment, your application heads to the final stage: approval. This is where the insurance company makes its official call.

If you get the green light, they’ll draw up and send over your official policy documents. The moment you have those in hand, your coverage is active. You’re officially protected, and the process is complete.

Common Roadblocks That Slow Down Your Insurance Application

Ever feel like your insurance application has vanished into a black hole? You’re not alone. Several common hiccups can turn what should be a straightforward process into a frustrating waiting game. Knowing what these are ahead of time is the best way to steer clear of them.

The biggest factor, by far, is the complexity of your situation. Think about it: a standard, healthy 30-year-old applying for a basic term life policy is a simple case. But if you have a detailed medical history, underwriters have to dig deeper. They'll need to request and review records from multiple doctors, and that alone can easily tack on weeks to the timeline. The same goes for auto insurance if you have a checkered driving record; the insurer needs more time to weigh the risk.

Inaccurate or Incomplete Information

One of the most common—and most avoidable—delays comes down to simple mistakes. Your application is a legal document, and every detail matters. A typo in your name, a missing digit in your address, or an incomplete answer forces the underwriter to hit the brakes and circle back to you for clarification.

This back-and-forth, while seemingly small, can add days or even weeks to the process. Worse yet, if an insurer uncovers significant errors later on, it could be one of the reasons a future insurance claim is denied.

Key Takeaway: The best thing you can do to speed things up is to triple-check your application before you submit it. A few minutes of proofreading now can save you weeks of headaches later.

External Factors Beyond Your Control

Sometimes, the delay has nothing to do with you or your application. The insurance world is full of moving parts, and many of them can cause a slowdown.

For example, in many states, insurance companies can't just set their rates; they have to get them approved by state regulators first. This is especially true for property and auto insurance. That approval process can take weeks, and there's nothing the insurer can do to speed it up.

Other outside forces that can pump the brakes include:

- Third-Party Reports: Underwriters often have to wait on information from other sources, like medical records from your doctor's office, motor vehicle reports, or property inspection results.

- High Application Volume: Insurers get swamped during certain times of the year, like open enrollment for health insurance. More applications mean longer queues.

- Complex Underwriting: If you're insuring a high-value home, a classic car, or a niche business, the risk analysis is far more involved and naturally takes more time.

Comparing Approval Timelines Across Different Policies

So, how long does it actually take to get insured? Well, there’s no single answer. The timeline can swing from just a few minutes to well over a month, and it all comes down to what you’re trying to insure.

Think of it this way: buying auto insurance is a lot like ordering from a fast-food drive-thru. Insurers can pull your driving record and vehicle info instantly from standardized databases, run it through their system, and—voila!—you’ve got a quote and coverage in less than an hour. It’s quick and efficient because the data is easy to access.

Homeowners insurance, on the other hand, is more like having a custom suit tailored. It usually takes a few days. The insurer has to dig into the unique details of your property, consider risks specific to your location (like flood zones or wildfire danger), and might even require a physical home inspection before they can write the policy.

The Widest Timeline Gap: Life and Health Insurance

Life and health insurance are where you'll see the biggest differences in timing. You might get approved for a simple, no-exam life insurance policy in just 24-48 hours. But if you need a fully underwritten policy, you’re in for a much deeper dive. That process can easily stretch from four to eight weeks because it involves a medical exam, waiting on lab results, and a thorough review of your entire medical history.

It's a similar story for business owners looking for group health or specialized liability insurance. The underwriter has to analyze everything from company financials and employee demographics to the specific risks of your industry. If you’re a business owner, starting your search with the best commercial insurance companies can help you find carriers known for a smoother underwriting process.

Key Insight: The more complex the risk, the longer it takes to get approved. Standardized, easily accessible data makes things fast. Individual factors like your health or unique property details require a much more careful—and time-consuming—review.

To give you a clearer picture of what to expect, let's break down the typical timelines for the most common types of insurance.

Detailed Timeline Comparison Across Insurance Types

This table shows the typical steps and how long you can expect each to take, from your initial application to final approval.

| Insurance Type | Application Stage | Underwriting Stage | Total Estimated Time |

|---|---|---|---|

| Auto Insurance | 10-20 minutes | 5-30 minutes | Under 1 Hour |

| Home Insurance | 20-40 minutes | 1-4 business days | 1-5 Business Days |

| Life Insurance | 30-60 minutes | 3-8 weeks (with exam) | 4-8 Weeks |

As you can see, the difference is stark. While you can get your car covered during your lunch break, getting a life insurance policy in place is a much longer-term project that requires some patience.

Practical Tips to Speed Up Your Insurance Approval

While you can’t control every part of the insurance timeline, you have more influence than you might think. A little proactivity on your end can help you sidestep common delays and get your coverage in place much faster.

Think of it like this: the single best thing you can do is gather all your documents before you even start applying. Have everything ready—your driver’s license, social security number, property deeds, or medical records.

When you hand the underwriter a complete, accurate file right from the get-go, you eliminate the tedious back-and-forth that grinds most applications to a halt.

Your Proactive Checklist for Faster Approval

Getting organized is your secret weapon for shrinking the time it takes to get covered. Don't wait for the insurer to come asking for bits and pieces of information; have it all ready to go.

Here's how you can take control of the process:

- Be Radically Honest: It might be tempting to omit details you think will raise your rates, but don't. An underwriter who uncovers inconsistencies later will, at best, delay your application and, at worst, deny it outright.

- Respond at Lightning Speed: If your agent or the insurer requests more information, make it your top priority. Answering in hours instead of days can literally shave weeks off the underwriting timeline.

- Team Up with an Independent Agent: A good agent has seen it all. They know exactly what underwriters need and can help you submit a clean, complete application that sails through the process.

Delays aren't just an annoyance for you—they're a massive operational headache for the entire industry. In fact, underwriting inefficiencies can put billions of dollars in premiums at risk. This shows just how much a smooth application process matters to everyone involved.

Following these simple tips, especially when navigating complex policies like the best home insurance in New York, puts you in the driver's seat and makes the journey as quick and painless as possible.

Frequently Asked Questions About the Insurance Process

Even after mapping out the insurance timeline, a few practical questions always seem to pop up. Let's tackle some of the most common ones head-on so you know exactly what to expect.

Can I Get Insurance Coverage Instantly?

For some types of insurance, absolutely. Think about policies like auto or renters insurance. These are often handled by slick, automated systems that can analyze your risk profile and issue a policy in minutes. It's designed to be fast and easy.

But for bigger, more complex coverage, a human expert still needs to get involved. Life insurance that requires a medical exam or homeowners insurance for a property in a flood zone, for instance, requires careful, manual underwriting. That detailed review process just can't be automated, so instant approval isn't an option.

What Is an Insurance Binder?

Think of an insurance binder as a temporary, official stand-in for your full policy. It's a legally binding document that proves you have coverage while the final, formal paperwork is being drawn up and sent your way.

This little document is a hero in the world of real estate. Mortgage lenders won't close on a home loan without proof of homeowners insurance, and a binder provides that proof instantly. It lets the sale go through without a hitch, all while ensuring you're fully protected from day one.

What Should I Do If My Application Is Delayed?

If it feels like your application has fallen into a black hole, don't just wait and worry. The best thing you can do is get on the front foot. A polite call or email to your insurance agent or company contact to ask for a quick status update can work wonders.

More often than not, a delay is caused by something small—a missing signature, a document that didn't upload correctly, or waiting on information from someone else. A simple check-in can pinpoint the problem and get things back on track. Knowing the difference between insurance agents and brokers can also clarify who the best person is to call for a speedy resolution.

At Wexford Insurance Solutions, our independent agents know how to cut through the red tape and get you covered efficiently. Get in touch with our team today to find the right protection without the needless wait.

Financial Planning for High Net Worth: Expert Strategies & Tips

Financial Planning for High Net Worth: Expert Strategies & Tips Employers Liability Insurance vs Workers Compensation: Key Differences

Employers Liability Insurance vs Workers Compensation: Key Differences