At its core, the difference between employers liability insurance vs workers compensation is pretty straightforward. Workers' compensation is a no-fault system designed to cover an employee's medical bills and lost wages right after a workplace injury. On the other hand, employers liability insurance protects the business itself if it gets sued for negligence that allegedly caused the injury.

You can think of workers' comp as the immediate, primary safety net for the employee. Employers liability is the secondary safety net, but for the company's finances.

Workers Comp vs Employers Liability The Core Difference

Even though these two coverages are almost always sold together in a single policy, they play very different roles. Workers' compensation is often called the "grand bargain" between a company and its team. In exchange for giving up their right to sue, employees get guaranteed, prompt benefits for on-the-job injuries, no matter who was at fault.

That’s where employers liability insurance—often called "Part Two" of a workers' comp policy—comes in. It activates when an employee believes the "grand bargain" doesn't apply and files a lawsuit anyway, claiming the employer's negligence was the root cause of their injury. These situations are exceptions to the rule, but they happen, and this coverage pays for the legal defense and any potential damages.

At a Glance How Each Policy Protects You

To really spell it out, here’s a simple breakdown of what each policy handles and how it works. This table shows you exactly where one coverage ends and the other begins, highlighting their distinct places in your risk management plan.

| Aspect | Workers' Compensation | Employers' Liability |

|---|---|---|

| Primary Purpose | Covers employee medical costs and lost wages for work-related injuries, regardless of who's at fault. | Protects the business from lawsuits filed by employees who claim the employer's negligence caused their injury. |

| Legal Requirement | Required by law in nearly every state for companies with employees. | Generally not a separate legal mandate, but almost always included with a workers' compensation policy. |

| Claim Trigger | An employee gets hurt or sick because of their job. | An employee (or their family) sues the employer for damages that fall outside standard workers' comp benefits. |

| Who It Pays | Directly pays medical providers for treatment and the injured employee for lost wages. | Pays for the company's legal defense, court fees, and any settlements or judgments awarded. |

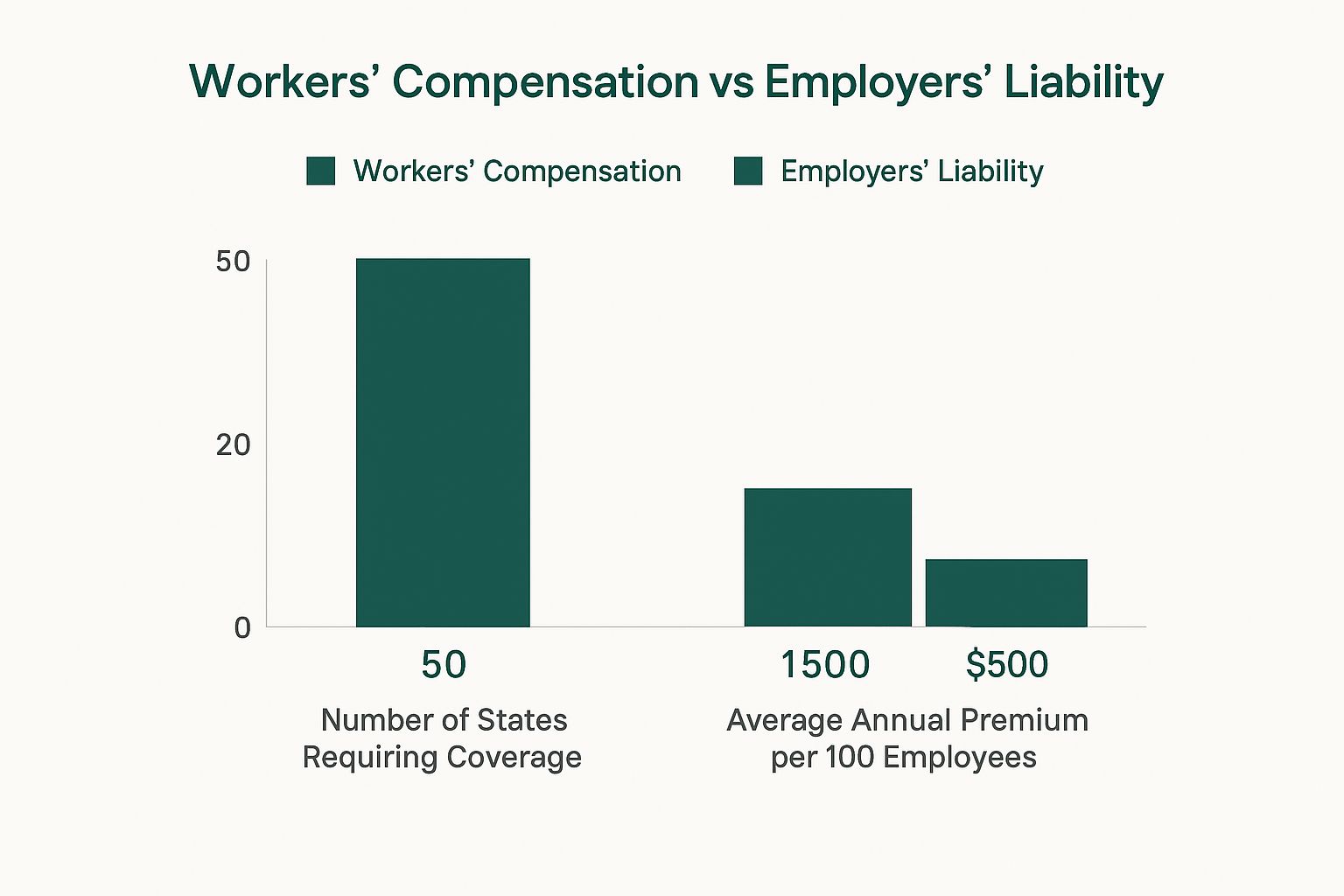

This table lays out the fundamental differences, but a visual can help, too.

As you can see, workers' compensation is a near-universal requirement, while its counterpart handles a different—but just as critical—financial risk.

For a deeper dive into meeting these obligations, our guide on workers' compensation for small business offers some essential insights. Getting a handle on both types of coverage is the only way to make sure your business is truly protected from every angle.

How Each Type of Workplace Injury Coverage Works

To really get a handle on workplace injury coverage, you have to see workers' compensation and employers liability insurance as two different tools for two different problems. They work in tandem, but each one kicks in under very specific circumstances. Let's pull back the curtain on how they actually function day-to-day.

At its core, workers' compensation is built on a "grand bargain." It's a no-fault system, which means when an employee gets hurt on the job, they receive guaranteed benefits without having to prove anyone was to blame. In return for this quick, reliable coverage, the employee gives up their right to sue the employer over the injury.

The whole point is to make the process administrative, not adversarial. An injury happens, a claim is filed, and the policy starts paying out state-mandated benefits. No courtrooms, no lengthy legal battles.

The Mechanics of Workers Compensation Benefits

Workers' comp isn't just a one-off payment. It’s a suite of benefits designed to get an employee healthy and back on their feet. The main pillars of coverage almost always include:

- Medical Care: This is the big one. It covers everything from the initial ER visit and surgery to ongoing physical therapy and prescriptions.

- Lost Wage Replacement: If an employee is out of work recovering, the policy provides a portion of their regular paycheck to help them stay afloat. The exact percentage is set by state law.

- Rehabilitation Services: Sometimes, an injury prevents an employee from returning to their old job. Vocational rehab can help them learn new skills for a different role.

- Disability Benefits: For injuries with long-term or permanent consequences, this benefit provides compensation for the lasting loss of function.

This no-fault setup ensures people get the care they need right away. But that "grand bargain" has its limits, and that’s precisely where the second layer of protection comes into play.

How Employers Liability Insurance Activates

Think of employers liability insurance as "Part Two" of your coverage. It's a classic liability policy, meaning it doesn't get triggered automatically. It only activates when a lawsuit is filed.

This happens when an employee—or their family—believes their case falls outside the standard workers' comp system. They aren't just filing a claim; they're alleging the employer's negligence was a direct cause of the injury, and they’re taking you to court over it.

Here's a simple way to keep them straight: Workers' compensation is an administrative benefits system that pays for recovery. Employers liability is a legal defense shield that pays for lawsuits.

These two policies truly are two sides of the same coin. Workers' comp provides the immediate, no-fault medical and wage benefits, while employers liability steps in to handle the immense costs that come with negligence claims. Luckily, most workers' compensation policies automatically bundle in employers' liability, giving you a pretty comprehensive safety net.

When an employers liability claim is initiated, the process looks completely different. It's all about lawyers, legal proceedings, and proving or disproving fault. The policy is specifically designed to pay for the high costs of that fight.

Coverage under an employers liability policy typically foots the bill for:

- Attorney's fees and court costs

- Expenses for investigating the claim

- Out-of-court settlements

- Judgments or damages awarded by a court

This coverage is absolutely critical. A single lawsuit, even an unfounded one, can be financially devastating for a small or medium-sized business. To make sure you're properly covered, it's wise to work with one of the best commercial insurance companies to ensure your policy limits are high enough for your unique risks. Knowing how both systems work empowers you to handle any workplace incident with confidence, protecting both your people and your business.

A Detailed Comparison of Coverage Triggers and Limits

Knowing the basic purpose of each policy is a great starting point. Now, let’s dig into how employers liability insurance and workers' compensation actually function day-to-day by comparing how claims get started, what the law requires, and how the money works. These are the details that really show the practical differences and highlight why you truly need both for solid risk management.

The biggest difference is what kicks off a claim—the claim trigger. Workers' compensation operates on a no-fault basis. It’s simple: if an employee gets sick or injured while doing their job, the policy is triggered. The moment the injury happens, the process begins, and it doesn't matter who was to blame.

On the flip side, employers liability insurance only springs into action when there's a lawsuit. It doesn’t respond when an employee gets hurt; it responds when that employee, or even their family, sues the business, claiming the company’s negligence led to the injury. This is an adversarial process from the get-go, entirely focused on proving fault.

The Divergent Paths of the Claims Process

You really can't overstate how different the claims processes are. One is built for getting things handled administratively, while the other is designed for a legal fight.

A workers' comp claim typically follows a very clear, state-regulated procedure:

- Injury and Report: An employee is injured and tells their manager.

- Claim Filing: The employer submits a "First Report of Injury" to their insurance carrier.

- Benefits Administration: The insurance company starts paying for approved medical care and lost wages directly, just as the state law requires.

The whole system is set up to be fast and efficient, getting the employee the help they need without a lot of drama.

An employers liability claim, however, is a much heavier lift, full of legal hurdles:

- Lawsuit Filed: The business is formally served with a lawsuit alleging negligence.

- Insurer Notification: The employer immediately contacts their insurance carrier about the lawsuit.

- Legal Defense: The carrier hires and pays for a legal team to defend the business against the suit.

- Litigation or Settlement: This stage can involve lengthy investigations, depositions, and courtroom battles, often ending in a negotiated settlement or a judge's ruling.

The core difference is stark: workers' compensation manages an injury, while employers liability manages a lawsuit. One is about care and recovery; the other is about defense and financial liability.

Statutory Requirements and Legal Mandates

Another crucial distinction lies in the legal footing of each coverage. State governments see workers' compensation as a non-negotiable protection for employees, and they mandate it accordingly.

While the U.S. Department of Labor provides a national framework, the specific rules are set at the state level.

As this screenshot shows, workers' compensation is a state-run program, cementing its role as a required safety net for the workforce.

What this means for almost every business with employees is that having workers' comp isn't a choice—it's the law. Skipping it can lead to some serious consequences, like huge fines and even criminal penalties. For a real-world example of these rules in action, our guide on workers' compensation requirements in Florida breaks down what a state-specific mandate looks like.

Employers liability insurance, by contrast, isn't usually required by law on its own. It's almost always included as "Part Two" of a standard workers' compensation policy. While you're not legally forced to have it, it's an industry-standard inclusion because it plugs the exact legal holes that workers' comp is designed to leave open.

Understanding Financial Limits and Payouts

The way these two policies pay out is also completely different, reflecting their unique jobs. Workers' compensation benefits are set by statutory limits. In plain English, state law determines exactly how much is paid for medical bills and lost wages and for how long. There isn't a traditional policy "limit"; the insurance has to pay whatever the law dictates for a covered claim.

Employers liability insurance works more like a typical liability policy with very specific dollar limits. You’ll often see these limits written as three numbers, like $100,000/$500,000/$100,000. Here’s what that means:

- $100,000 Bodily Injury by Accident: This is the most the policy will pay for any one employee injured in a single accident.

- $500,000 Bodily Injury by Accident: This is the total amount the policy will pay for all employees who are injured in the same accident.

- $100,000 Bodily Injury by Disease: This is the per-employee maximum the policy will cover for a work-related sickness or disease.

These limits are incredibly important. A negligence lawsuit can demand damages for things like "pain and suffering," which can result in awards far higher than what workers' comp would ever pay. It's common for businesses, especially those in high-risk fields, to buy much higher limits—often $1 million or more—to protect themselves from a financially devastating lawsuit.

Real Scenarios Where Each Coverage Is Critical

It's one thing to understand the textbook definitions of employers liability insurance versus workers' compensation, but it's another thing entirely to see how they play out in the real world. These abstract policy terms click into place when you connect them to situations that could easily happen at your own business.

Workers' comp is your frontline defense for the more common workplace incidents—the sprains, falls, and injuries that are an unfortunate part of doing business. Employers liability, however, is the coverage that kicks in for the more complex, and often more financially devastating, situations. These are the scenarios that fall outside the "grand bargain" of no-fault workers' comp benefits. They almost always involve a lawsuit alleging your company was negligent, creating a legal fight where your liability coverage becomes your primary shield.

Let's walk through a few examples to see exactly when this crucial protection comes into play.

The Third-Party-Over Action

One of the most frequent triggers for an employers liability claim is what’s known as a third-party-over action. This is a legal chain reaction: an injured employee sues a third party, and that third party turns around and points the finger back at you, the employer. Workers' comp alone won't touch this.

Scenario: An operator at your manufacturing plant suffers a severe hand injury because a piece of equipment malfunctioned.

- Workers' Comp Response: Your policy steps in right away to cover their medical treatments and a portion of their lost wages.

- The Lawsuit: The employee then files a lawsuit against the equipment manufacturer, arguing the machine was defectively designed.

- The Third-Party-Over Action: Here's the twist. The manufacturer files its own lawsuit against your company. They allege you failed to properly maintain the equipment or provide adequate safety training, and that your negligence was the real cause of the injury.

Without employers liability insurance, you’re footing the bill for the entire legal defense against the manufacturer's lawsuit. Your policy is what pays for the attorneys and any settlement or court-ordered judgment.

Consequential Bodily Injury Claims

Sometimes, the fallout from a workplace injury extends beyond the employee. If a family member suffers their own health crisis as a direct result of the employee's accident, it can lead to a consequential bodily injury lawsuit.

These claims bring a critical risk into focus: your legal responsibility can extend to the families of your employees. A standard general liability policy won't cover this, but your employers liability coverage will.

Scenario: A construction worker takes a serious fall and is left permanently disabled. The shock and ongoing stress of the situation cause his spouse to suffer a heart attack.

- Workers' Comp Response: The injured worker's medical care, rehab, and long-term disability benefits are all covered.

- The Lawsuit: The spouse's attorney files a lawsuit directly against your construction firm. They seek damages for her own medical bills and emotional trauma, arguing it was a direct consequence of the negligence that led to her husband's fall.

This is a completely separate legal action from the employee’s injury, and only employers liability insurance is built to respond to it.

Dual-Capacity Lawsuits

A dual-capacity lawsuit happens when an employer wears more than one hat in their relationship with an employee. This most often occurs when your company is also the manufacturer of a product the employee uses, or you own the property where the injury took place.

Scenario: Your company manufactures a specific industrial solvent. An employee working in your own packaging facility develops a severe respiratory illness from daily exposure to the solvent's fumes.

- Workers' Comp Response: The policy covers the employee's medical treatments for the illness.

- The Lawsuit: The employee then sues you—not as their employer, but as the manufacturer of an unsafe product. They are suing you in your "dual capacity."

In this situation, the employee argues that your legal duty goes beyond that of a typical employer and includes the responsibilities of a product manufacturer. Your employers liability policy is what would defend you against this unique and often expensive type of lawsuit.

These scenarios prove that even with solid policy limits, some claims can be exceptionally large. For those situations, it's wise to understand what excess liability coverage is and how it provides another layer of financial protection on top of your primary policies.

Global Perspectives on Employer Liability

While the U.S. has a clear distinction between employers liability and workers' compensation, it’s just one way of approaching a universal problem. Looking at how other countries handle workplace injuries can give you a much richer understanding of why our system works the way it does.

Many developed nations, especially across Europe, don’t rely on private insurance policies. Instead, they’ve woven employee protection into their national social security systems. Workplace injuries are treated less as an individual company's liability and more as a societal responsibility that every business contributes to.

Contrasting Social Insurance and Private Models

The philosophy is fundamentally different. In the American system, we have the "grand bargain"—employees give up the right to sue for most work-related injuries in exchange for guaranteed, no-fault benefits. European models, on the other hand, often centralize compensation through government-run bodies.

In places like Germany or France, the conversation isn't about avoiding lawsuits; it's about making sure every employer pays their fair share into a collective safety net. This approach spreads the financial risk across the entire economy. A single catastrophic injury won’t bankrupt a small business because the cost is absorbed by the larger system.

The global view reveals a spectrum of approaches, from the U.S. model's focus on individual employer liability to European systems emphasizing collective, state-managed social insurance for all workers.

This also explains why employers liability coverage is so tightly bundled with workers' comp here. Since American law leaves the door open for employees to sue under certain circumstances (like gross negligence), businesses need that extra layer of legal defense. In many social insurance systems, where legal action against employers is much more restricted, this type of coverage simply isn't necessary.

A Look at International Funding and Structure

How these systems are paid for also provides a sharp contrast. Internationally, the funding for occupational accident insurance can vary quite a bit, but many European countries use a contribution-based model. Employers pay a set percentage of their payroll into a national fund.

You can find more details about how these occupational accident insurance systems compare on oshwiki.osha.europa.eu, but a good example is seen in countries like Austria and Belgium. Historically, their premium rates have hovered around 0.5% to 1.4% of payroll.

This is a world away from the U.S. model, where your premium is calculated based on your specific risk factors—your industry, your safety record, and your claims history. Their system funds a national program; ours prices the risk for each individual business.

Ultimately, studying these global frameworks shows that everyone is aiming for the same goals: protecting workers while keeping businesses afloat. The American approach, with its dual coverage, is a unique solution shaped by our own legal traditions. It balances guaranteed benefits with the right to sue for negligence. As you shore up your company's risk management, it helps to understand how your policies fit into this broader global context. To get a full picture of business protections, our guide on the primary types of commercial insurance is a great place to start.

Choosing the Right Integrated Protection Strategy

Turning your knowledge of employers liability and workers' compensation into a real-world defense is all about strategy. It isn’t a matter of choosing one policy over the other. The real goal is to weave them together into an integrated system, creating a seamless shield that protects your business from all sides—from a routine workplace injury to a messy negligence lawsuit.

This all starts with taking a hard, honest look at your business's specific risks. Your industry, the number of people on your payroll, and the nature of your day-to-day work all play a huge role in figuring out the right level of coverage. A construction firm with crews on high-risk job sites has a completely different risk profile than a small accounting office, and their insurance strategies need to reflect that.

Building Your Risk Management Framework

To put together a strategy that actually works, you have to ask the right questions. Don't just settle for an off-the-shelf policy. Work closely with your insurance broker to build a package that truly fits your operational footprint. This hands-on approach is the best way to ensure your coverage is strong enough to handle your actual risks.

A solid framework means looking at a few key areas:

- Industry-Specific Risks: What are the most common injuries or lawsuits in your line of work? High-hazard industries like manufacturing or transportation naturally need higher liability limits.

- Contractual Obligations: Take a look at your client contracts. Do they demand specific insurance limits? Falling short here could lead to a breach of contract claim on top of everything else.

- Employee and Contractor Mix: How is your workforce structured? Managing risk goes beyond your direct employees. A crucial piece of any integrated strategy is properly managing your outside help. Looking into effective contractor management software options can be a smart move to lower liability risks tied to non-employees.

Key Questions for Your Insurance Broker

When you sit down with your insurance pro, don't go in empty-handed. Having a checklist ready helps you guide the conversation and ensures you get a policy that gives you real protection. The main goal is to confirm your workers' compensation and employers liability policies are perfectly in sync.

Use these questions to get the ball rolling:

- Confirming Your Limits: Are my current employers liability limits—say, $1M/$1M/$1M—enough for the kind of lawsuit settlements we see in my industry?

- Understanding Exclusions: What specific situations or types of claims are completely excluded from my policy? I need to know where the gaps are.

- Third-Party Action Coverage: If we get pulled into a third-party-over action, does my policy cover all the legal bills?

- State-Specific Nuances: Are there any monopolistic state fund rules or other local regulations that change how these two policies work together in my state?

The best protection strategy doesn't see workers' compensation and employers liability insurance as two different products. Instead, it treats them as two critical parts of a single, unified risk management system. This integrated mindset is the key to avoiding expensive coverage gaps.

Frequently Asked Questions

It's natural to have questions when you're sorting through the details of workplace insurance. Let's tackle some of the most common ones that business owners run into when figuring out the difference between employers liability and workers' compensation.

Can An Employee Still Sue Me If I Have Workers' Compensation?

The short answer is yes, they can. While workers' compensation is usually the "exclusive remedy"—which means an employee agrees to receive no-fault benefits in exchange for not suing—there are some critical exceptions to this rule.

An employee might still bring a lawsuit if they can argue their injury resulted from your company's intentional actions or gross negligence. This is exactly where employers liability insurance steps in. It's designed to handle the legal defense bills and any damages awarded in that kind of lawsuit.

Is Employers Liability Insurance Automatically Part of My Workers' Comp Policy?

In most states, yes. Employers liability coverage is often referred to as "Part Two" of a standard workers' compensation policy, so it's typically bundled right in. This gives you a single package covering both no-fault benefits and potential lawsuits.

But there’s a big catch. If you operate in a monopolistic state—that’s North Dakota, Ohio, Washington, and Wyoming—you have to buy workers' compensation directly from a state fund. These state-run policies do not include employers liability, meaning you’ll have to purchase that coverage separately from a private insurer.

You absolutely have to know your state's specific rules. Just assuming you're covered can leave a massive, expensive hole in your risk management plan.

What Factors Go Into Setting My Insurance Premiums?

Insurers look at several key things to figure out the cost of your combined workers' comp and employers liability policy. They're essentially trying to gauge your business's specific level of risk. The biggest factors are:

- Your Industry: High-risk fields like construction or manufacturing will always face higher premiums than, say, a quiet office environment.

- Total Payroll: The more people on your payroll, the higher the potential exposure. This drives the premium up.

- Claims History: Your track record with workplace injuries is a huge deal. A clean safety record with few claims can definitely help you get a better rate.

Many of these questions are rooted in the legal side of being an employer. For a solid primer on your responsibilities, this guide to complying with employment laws is a great resource. Nailing the fundamentals is the first step to creating a safe and compliant business.

Figuring out the fine print of employers liability and workers’ compensation is where expert guidance makes all the difference. The team at Wexford Insurance Solutions specializes in building protection plans that cover your business from all sides. Contact us today to ensure your coverage is seamless and complete.

How Long Does It Take to Get Insurance? Find Out Now

How Long Does It Take to Get Insurance? Find Out Now How Long Does the Insurance Claim Process Take? Find Out Now

How Long Does the Insurance Claim Process Take? Find Out Now