When you file an insurance claim, the time it takes to get paid can range from just a few days to several months. A simple, clear-cut car insurance claim might wrap up in a week or two. On the other hand, a complex homeowners claim with major damage or a liability dispute could easily stretch on for months.

Understanding the Insurance Claim Timeline

Think of the insurance claim process like ordering food. A simple coffee order is ready in minutes. A five-course meal for a party of ten? That takes a lot more time, coordination, and careful preparation. Your insurance claim works the same way—its timeline depends entirely on what type of claim it is and how complicated the situation is.

It’s important not to confuse this with the time it takes to get an insurance policy in the first place, which you can learn more about here: https://wexfordis.com/2025/08/24/how-long-does-it-take-to-get-insurance/. The journey from filing a claim to getting a check involves several distinct stages, and knowing what they are helps set the right expectations from the start.

Timelines Vary by Insurance Type

Every type of insurance has its own typical processing speed. The life insurance industry, for example, has gotten much faster over the years. These days, a remarkable 72% of life insurance claims are processed within just 10 business days. Claims that don't need a deep dive into medical records average about 7 days, while those requiring a full medical review take closer to 28 days.

To keep things transparent, many insurance companies use formal Service Level Agreement (SLA) templates that outline their commitment to processing claims within a specific timeframe. These documents help manage expectations and show you exactly what the insurer is promising.

Average Insurance Claim Timelines at a Glance

To give you a clearer picture, I've put together a table with some ballpark estimates for common insurance claims. Keep in mind these are just averages—your experience could be faster or slower depending on the specifics.

| Claim Type | Simple Claim (Average Time) | Complex Claim (Average Time) |

|---|---|---|

| Auto Insurance | 1-3 Weeks | 4-8+ Weeks |

| Homeowners Insurance | 2-4 Weeks | 2-12+ Months |

| Renters Insurance | 1-2 Weeks | 3-6 Weeks |

| Health Insurance | 5-45 Days | 2-3+ Months |

| Life Insurance | 1-4 Weeks | 4-8+ Weeks |

As you can see, a "simple" claim with clear facts and minimal damage gets resolved much quicker than a "complex" one involving disputes, extensive investigations, or multiple parties.

The 4 Core Stages of Every Insurance Claim

No matter what you're claiming for—a small fender bender or major damage to your home—every insurance claim follows a pretty standard path. Knowing what this journey looks like can take a lot of the mystery out of it, so you’ll always know where you stand and what’s coming next.

Think of it as a roadmap with four main stops.

Your first step is to officially report what happened. In the industry, this is called the First Notice of Loss (FNOL), and it's simply the moment you let your insurer know you need to make a claim. Getting this done quickly is key, as any delay here will push back the entire timeline right from the start.

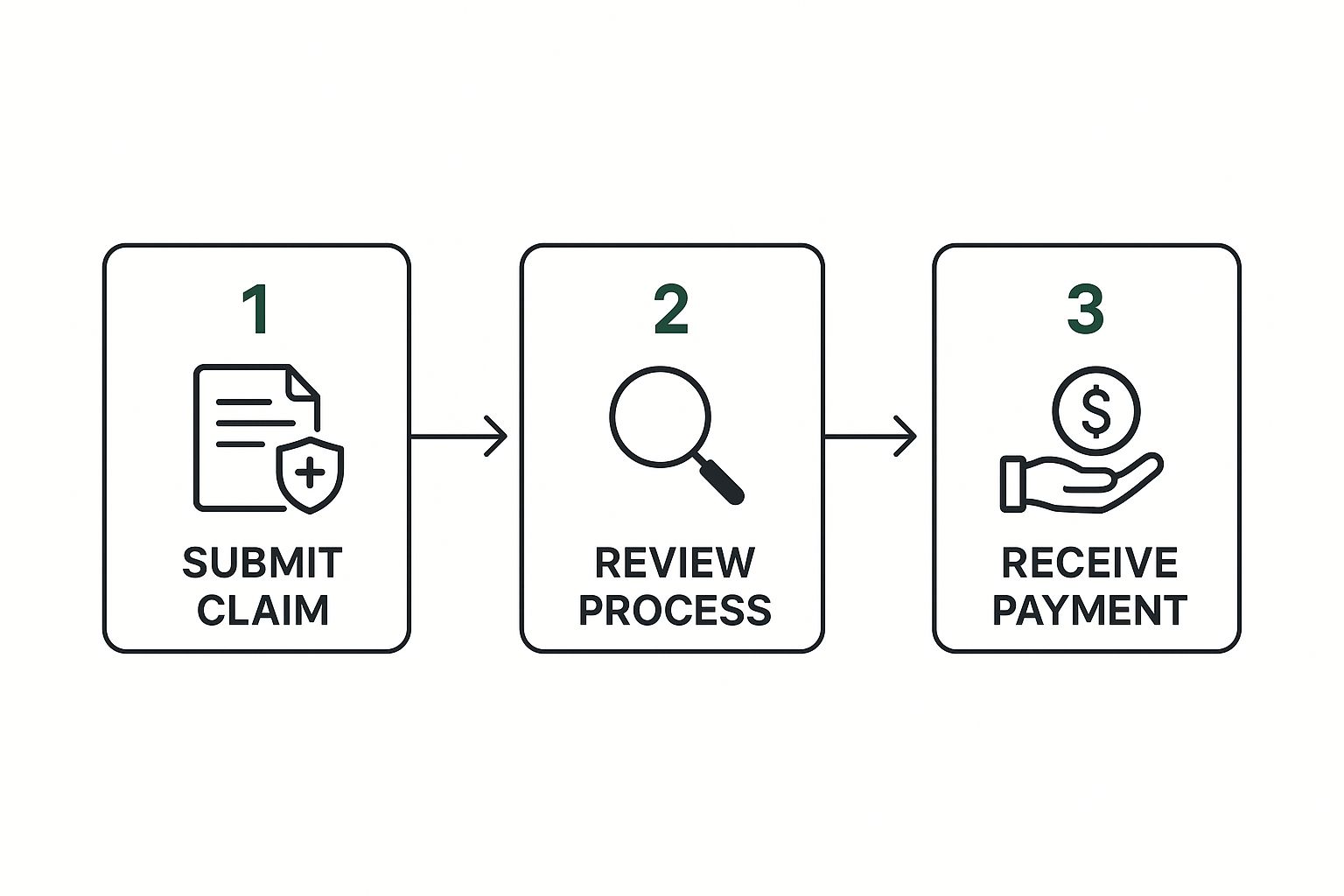

This infographic breaks down the journey into its most basic steps.

It shows you the flow from the moment you submit your report all the way to getting paid, giving you a bird's-eye view of the entire process.

Investigation and Damage Review

Once your claim is filed, an adjuster gets assigned to your case and the investigation stage begins. Their role is to be a fact-finder. They'll dig into your report, look at any photos you sent, chat with witnesses, and piece together the full story of what happened and who’s at fault.

From there, the claim moves into the damage review phase. This is where the adjuster, or maybe a specialized appraiser, figures out the full extent of the loss. This could mean:

- Looking over your car at the auto body shop.

- Walking through your home to see property damage firsthand.

- Going through medical bills and records if you were injured.

The whole point is to put a dollar figure on your loss, based on all the evidence and what your specific policy covers.

How thorough this investigation needs to be is one of the biggest factors affecting your timeline. A straightforward claim with clear evidence will sail through much faster than one with conflicting stories or complicated repairs.

Resolution and Final Payment

Finally, you've reached the resolution stage. At this point, the insurance company takes all the information they’ve gathered and makes a final call on your claim. They'll come back to you with a settlement offer based on their evaluation of the damages.

If you agree to the amount, the last step is for them to issue the payment. Once you accept that settlement, your claim is officially closed, and the process is complete.

Why Some Insurance Claims Get Delayed

It’s frustrating when your claim feels like it's stuck in limbo. While every insurance company wants to close files quickly, a few common speed bumps can turn a straightforward process into a long wait. Knowing what these are can help you set realistic expectations and even prevent some delays.

Often, the simplest things cause the biggest holdups. A claim file with incomplete or inaccurate information is one of the most frequent culprits. If your adjuster is missing a key photo, a police report number, or the correct contact info for a witness, they have to hit pause. They can't move forward until they hunt down those missing pieces, which easily adds days or weeks to the clock.

The same goes for communication. If your adjuster calls with a quick question and can’t get a hold of you for a few days, your file just sits on their desk waiting.

External Factors Beyond Your Control

Sometimes, the delay has nothing to do with you or your claim. A massive hailstorm, wildfire, or hurricane can flood an insurance company with thousands of claims all at once. This creates an enormous backlog that even the most efficient teams struggle to clear, stretching out the timeline for everyone in the affected area.

This has become a growing issue. On average, property insurance claims now take about 32.4 days to resolve. For claims tied to a specific disaster, that average climbs to 34.2 days.

The complexity of the incident also plays a huge role. A multi-car pileup, for instance, is far more complicated than a simple fender bender. It involves a tangled web of investigations and negotiations between multiple insurance carriers to figure out who was at fault, which is a notoriously slow process.

Internal Reviews and Fraud Investigations

Insurers also have their own internal checks and balances that can add time. If something about your claim seems unusual or raises a red flag, it will likely be flagged for a special investigation to rule out potential fraud. While this is a necessary step for them, it adds another layer of scrutiny and time to your claim.

If a long review ends in a denial, don't assume it's over. Understanding the common insurance claim denial reasons is the first step in building a strong appeal and fighting for the payout you're entitled to.

At the end of the day, a lot of different factors—from simple paperwork errors to major natural disasters—can affect your claim’s timeline. Recognizing these potential hurdles is key to navigating the process smoothly.

How Technology Is Making Claims Faster

Gone are the days of playing phone tag and waiting weeks for an adjuster to finally show up. Technology is shaking up the old-school insurance industry, and one of the biggest wins for customers is how it's slashing the time it takes to get a claim sorted out. Many of the slow, manual steps are being replaced by much quicker digital tools.

Think about the first step: reporting the claim. Instead of a mountain of paperwork, you can now pull out your phone, open an app, and upload photos of the damage right from the scene. This simple change means an adjuster can start their review almost immediately, sometimes getting you an initial estimate within hours. That’s a world away from the days-long wait we used to see.

Automation and Artificial Intelligence

A lot of this new speed comes from Artificial Intelligence (AI). For straightforward claims—think a simple fender bender with clear photos—automated systems can now review the details and approve the claim in just a few minutes. This is a game-changer. It also frees up the human adjusters to put their skills to work on more complicated situations that really need a person's judgment.

The investment in this tech is massive. The global market for AI in insurance claims is expected to hit USD 2,761 million, growing by a whopping 18.30% each year. This isn't just a trend; it's a fundamental shift in how the industry operates.

This blend of AI and automation also brings a ton of transparency to the process. With digital portals and mobile apps, you can get real-time updates on your claim's status. No more wondering what's going on. That visibility alone can make a stressful situation much easier to handle.

These advancements aren't just about moving faster; they're also about getting it right. By sifting through huge amounts of data, AI helps make sure claim payouts are fair and consistent, which is a good thing for everyone involved.

Using these modern tools effectively is central to how we work. You can learn more about our approach to insurance data analytics and how it helps us fight for our clients. By leaning into this technology, the whole claims journey feels less like a waiting game and more like a clear, interactive process.

Your Checklist for a Smoother Claim Process

While you can’t control every single thing an insurance company does, you have more power over the claims timeline than you might think. A little preparation and a proactive approach can be the difference between a quick payout and a drawn-out headache. Think of it like building a case—the more organized you are from the start, the faster you’ll get to the finish line.

The first and most critical step? Report the incident immediately. The stopwatch on your claim doesn't even start until your insurer knows what happened. Delaying that first call, known as the First Notice of Loss (FNOL), just pushes back every single step that follows.

Document Everything Meticulously

Right after a loss, your smartphone is your best friend. Before you move or clean up a single thing, take an exhaustive number of photos and videos of the damage. I mean everything. Get wide shots to show the context of the room or area, then move in for detailed close-ups of the specific damage.

Next, get yourself a dedicated claim file. It can be a physical folder or a digital one on your computer—whatever works for you. Just make sure it holds:

- Your Claim Number: You'll need this for every single conversation. Keep it front and center.

- Photos and Videos: Your complete visual proof of the damage.

- Receipts: For any money you spend out-of-pocket, like for temporary repairs to prevent more damage or for hotel stays if your home is unlivable.

- A Communication Log: Keep a simple running list of every call and email. Note the date, time, and a quick summary of what was discussed.

This kind of detailed record-keeping cuts down on the endless back-and-forth that drags claims out. For a more in-depth look at managing property claims, our guide on the homeowner insurance claim process is a great resource to make sure you've got all your bases covered.

Stay Engaged and Responsive

Once an adjuster is assigned to your case, how quickly you respond is key. If they call with a question or email asking for a document, make it a priority to get back to them that same day if possible. A few days of delay on your end can mean your file gets buried under a pile of others on their desk.

Be patient but persistent. It's completely reasonable to follow up with your adjuster if you haven't heard anything in a week. A polite email asking for a quick status update keeps your claim top of mind.

Finally, take a few minutes to pull out your policy and review the basics. Knowing your coverage limits and deductibles ahead of time means you can have much more productive conversations with your adjuster and helps you set realistic expectations for the outcome.

What To Do When You Disagree With The Outcome

Getting a low settlement offer or an outright denial can feel like a punch to the gut. But it's important to remember this isn't the end of the road. The insurance company’s first decision is just that—a first decision. You absolutely have the right to push back on an outcome you feel is unfair.

Your first move is to file a formal appeal directly with the insurer. This isn't just about making an angry phone call; it’s a strategic process. You’ll need to draft a professional letter that clearly outlines why you're disputing their assessment and, crucially, attach any new evidence that supports your side of the story.

Building a Stronger Case for Your Appeal

A successful appeal boils down to solid evidence and clear communication. You can't just say you disagree—you have to prove why their conclusion was wrong. Think of it as building a case, with you as the chief advocate for your claim.

Here’s how to construct a compelling argument:

- Bring in Fresh Evidence: Did their contractor lowball the repair costs? Get a second or even third estimate from an independent professional. Is the dispute over a medical issue? A detailed report from a specialist can make all the difference.

- Use Their Own Rulebook: Go back to your policy documents. Pinpoint the exact language that covers your loss and directly contradicts their reason for the denial or low offer.

- Create a Paper Trail: Keep a detailed log of every single phone call, email, and document you send. Meticulous records are your best friend in a dispute.

Often, a lowball offer isn't malicious—it's just based on incomplete information. An adjuster might have missed hidden water damage, for example. Presenting them with a detailed report from your own expert is often all it takes for them to re-evaluate and raise the offer.

Exploring Other Paths to a Fair Settlement

What if your internal appeal goes nowhere? Don't worry, you still have cards to play. A common next step is mediation, where a neutral third party steps in to help you and the insurer find some common ground. It’s often much quicker and less costly than heading to court.

Another powerful ally is a public adjuster. These pros work for you, not the insurance company. They’ll take over the entire process, from reassessing the damage to negotiating directly with the insurer to get you the payout you’re actually owed.

Finally, understanding why your claim was denied in the first place is key. Arm yourself with knowledge by reading our guide on common insurance claim denial reasons. It can help you spot the weak points in the insurer's argument and build a much stronger appeal.

Got Questions? We've Got Answers

When you're facing an insurance claim, a lot of questions can start swirling around. It's completely normal. Let's walk through a couple of the most common ones we hear from policyholders so you can feel more in control of the situation.

Will Filing a Claim Make My Rates Go Up?

This is the big one, isn't it? The honest answer is, it might. An at-fault accident claim is more likely to trigger a premium increase at renewal time than a claim for something you couldn't control, like a hail storm that damaged your roof.

Insurers don't just look at one incident in isolation; they consider your entire claims history. A single, isolated claim, especially if it's your first, might not have any impact at all. It really comes down to the type of claim and your history as a policyholder.

How Often Should I Be Calling for Updates?

You want to stay on top of things, but you don't want to become a nuisance. We get it. A good rule of thumb is to touch base with your assigned adjuster about once a week.

This simple check-in is enough to keep your claim on their radar and show you're engaged in the process. It strikes the perfect balance between being proactive and letting them do their job.

What's a "Reservation of Rights" Letter?

If you get one of these in the mail, don't panic. It's a standard letter from the insurance company saying they're investigating your claim but reserve the right to deny it later if they discover it's not covered by your policy. Think of it as a procedural step, not a red flag.

At Wexford Insurance Solutions, we're here to provide the expertise and support you need to navigate the claims process with confidence. Find out how our team can advocate for you at WexfordIS.com.

Employers Liability Insurance vs Workers Compensation: Key Differences

Employers Liability Insurance vs Workers Compensation: Key Differences What Is Commercial Auto Insurance? A Complete Guide

What Is Commercial Auto Insurance? A Complete Guide