So, you've just shaken hands on a new car or you're about to close on your dream home. Congratulations! In the whirlwind of paperwork, someone will inevitably ask for your "proof of insurance." But what happens when you've just agreed to the policy and the official, multi-page document is still being printed and mailed?

You can't just put everything on hold. That's exactly where an insurance binder comes into play.

Your Quick Guide to Insurance Binders

Think of an insurance binder as a temporary, legally binding stand-in for your full insurance policy. It's the official document that proves you have coverage right now, bridging the gap between your payment and the moment the complete policy packet lands in your mailbox.

This isn't just a flimsy receipt. An insurance binder carries the full legal weight of your future policy. If something were to happen—say, a fender bender on the way home from the dealership—the binder ensures you're protected. It’s the green light that allows major life transactions to proceed without delay.

Typically, this temporary coverage lasts for a specific period, often between 30 to 90 days, which gives the insurance company enough time to finalize and issue the formal policy documents.

What to Look For on Your Binder

At first glance, a binder might seem like a simple one-page summary, but it's packed with critical information. Knowing what to look for is key to confirming you have the right protection from the get-go. This is especially important when a mortgage lender or auto financing company has specific coverage requirements you need to meet.

An insurance binder provides interim coverage but becomes irrelevant once the full policy is issued, unless there’s ambiguity in the policy itself. Its primary role is to serve as a temporary placeholder, not a permanent contract.

To help you get familiar with this document, here’s a breakdown of the core components you’ll find on any standard insurance binder.

Key Components of an Insurance Binder at a Glance

This table breaks down the essential information you'll find on your binder, what each piece of information means, and why it's so important to check.

| Component | What It Means | Why It's Important |

|---|---|---|

| Named Insured | The person(s) or entity protected by the policy. | Confirms exactly who is legally covered under the policy. |

| Coverage Limits | The maximum amount the insurer will pay for a claim. | Defines the financial scope of your protection. |

| Effective Date | The exact date and time your coverage begins. | Establishes the precise start of your insurance protection. |

| Deductibles | Your out-of-pocket cost before insurance pays. | Clarifies your financial responsibility in the event of a claim. |

Essentially, the binder acts as a snapshot of your new policy. Once you receive the full policy, be sure to review it carefully to ensure it matches the terms outlined in the binder.

Why You Need an Insurance Binder

So, what's the big deal with this temporary document? In many high-stakes situations, you simply can't afford to wait days—or even weeks—for the official, multi-page policy to arrive in the mail. The insurance binder is the crucial document that bridges this gap, giving you immediate and legally recognized proof that you're covered.

Think of it as the unsung hero of major life events. It's the key that lets you finalize huge purchases and move forward with your plans without being left uninsured during a vulnerable transition. Without it, many important transactions would screech to a halt.

Securing Your New Home

Picture this: you're sitting at the closing table, ready to get the keys to your new house. But there’s a catch. The mortgage lender won’t release the loan until they see proof of homeowners insurance. This is a non-negotiable step in buying a home.

You can't exactly ask everyone to wait a week for your policy to be printed and mailed; the deal needs to close now. An insurance binder provides the instant validation the lender needs, confirming the property is protected from the moment it becomes yours. Our in-depth https://wexfordis.com/2025/06/21/guide-to-homeowners-insurance/ breaks down these requirements even further.

Driving Your New Car off the Lot

Here’s another classic scenario that plays out every day at car dealerships. You’ve just signed the papers for your dream car and can’t wait to take it for a spin. The only problem? It's illegal to drive a vehicle off the lot without having active auto insurance.

The dealership must see proof of coverage before they can hand you the keys. Your insurance binder acts as that immediate proof, allowing you to legally drive away while the formal policy documents are being finalized. It’s the piece of paper that makes the whole transaction seamless.

An insurance binder isn't just a placeholder; it's a legally binding temporary contract. It offers real proof of insurance coverage until the official, formal policy is issued and delivered.

The concept of a binder didn’t just appear out of thin air. It came about as a practical solution to a growing problem. As commerce sped up in the early 20th century, transactions demanded faster, more reliable proof of coverage than the insurance industry could traditionally provide. The binder was born out of this necessity.

At the end of the day, an insurance binder is far more than just paperwork. It's a critical facilitator. It's the document that unlocks major milestones by providing the peace of mind and legal verification needed to move forward with confidence.

Understanding the Details of Your Binder

An insurance binder might seem like just a summary, but don't be fooled. It’s a legally binding document, and every detail inside spells out exactly what your temporary coverage looks like. Getting familiar with its contents is the only way to be sure the protection you think you bought is the protection you actually have.

Think of it like getting the keys to a new car; you want to pop the hood and make sure everything is in order before you drive off the lot.

Let's break down the key parts of a binder using a real-world example: getting insurance for a new house you're buying. Each piece of information tells a crucial part of your coverage story, and getting it right from the start is non-negotiable.

Decoding Core Binder Information

First up, you’ll see the named insured. This is just the official term for the person, people, or entity legally covered. If you and your spouse are buying a home, it should list both of you, like "John and Jane Smith," so you both have the legal standing to make a claim.

Next are the coverage limits—the absolute maximum the insurance company will pay out for specific types of claims. For your new home, the binder might list $400,000 for the structure itself (dwelling coverage) and $100,000 for personal liability. It's vital that these numbers are high enough to satisfy your mortgage lender and, more importantly, to fully protect your new asset. You can find a deeper dive into these coverages in our guide explaining home insurance in detail.

Remember, a binder is a legally binding contract. The terms it outlines—from coverage limits to deductibles—are what the insurance company is obligated to honor until the full policy is issued.

Another critical number is the deductible. This is simply the amount you have to pay out of your own pocket on a claim before the insurance company starts paying. A typical home insurance deductible is $1,000. You can often lower your premium by choosing a higher deductible, but just be sure you’re comfortable paying that amount upfront if something happens.

Finally, look for the effective date. This is the exact moment your coverage kicks in. For a home closing, this date has to line up perfectly with your closing date. Any gap, even for a few hours, could leave you completely exposed.

The Final Seal of Approval

All these details are important, but one thing truly makes the binder an official contract: the agent's signature. This signature is the agent’s confirmation, on behalf of the insurer, that they have "bound" the coverage as described.

It’s the final step that turns a simple quote into real, active insurance protection. Before you walk away, always double-check that your binder is signed by an authorized agent. By confidently reading each line, you can rest easy knowing your temporary protection is rock-solid.

Insurance Binder vs. Full Insurance Policy

It's a question I hear all the time: "So, is this binder my actual policy?" It’s a great question, and the short answer is no, but they're closely related. The easiest way to think about it is like getting a ticket for a big concert. Your insurance binder is the ticket—it proves you have a seat and can get in the door. The full policy, on the other hand, is the program you get once you're inside, detailing every song, performer, and intermission.

The binder is your official summary, a legally binding placeholder. It confirms you’re covered for the big things, like property damage or liability. But the full policy document is the nitty-gritty contract. It’s where you’ll find every single exclusion, condition, and procedure spelled out in detail.

For instance, a binder won’t get into the specifics of how to file a claim or the subtle but critical differences between various types of water damage. To dive deeper into those kinds of distinctions, check out our guide on flood insurance vs. homeowners insurance.

Key Distinctions to Remember

The single biggest difference is duration. A binder is intentionally temporary. It’s designed to provide coverage for a very specific, short window of time—usually 30 to 90 days. Its whole job is to act as a bridge while the insurance company finalizes and issues your permanent policy.

A full insurance policy, in contrast, is the long-term agreement. These contracts typically last for a six-month or one-year term. Once that policy is in your hands, it completely replaces the binder. The binder has done its job, and from that point forward, the policy document is the only source of truth for your coverage.

An insurance binder acts as an interim agreement. In many states, like Montana, the law is clear: a binder provides temporary coverage but becomes void once the full policy is issued. The policy document always wins out unless there's a major ambiguity.

Insurance Binder vs. Full Policy Compared

To make it even clearer, let's look at a side-by-side comparison. The table below breaks down the fundamental differences between the temporary proof you get upfront and the permanent protection that follows.

| Feature | Insurance Binder | Full Insurance Policy |

|---|---|---|

| Purpose | Provides temporary, immediate proof of insurance. | Serves as the official, long-term insurance contract. |

| Duration | Short-term, usually valid for 30-90 days. | Long-term, typically for 6-12 month policy periods. |

| Detail Level | A summary of key coverages, limits, and parties. | A comprehensive document with all terms, conditions, and exclusions. |

| Legal Status | A legally binding temporary contract. | The final, superseding legal contract. |

This breakdown really highlights the binder's role as a placeholder. It’s a crucial tool for getting things done now, but it’s never the final word.

From Temporary Proof to Permanent Protection

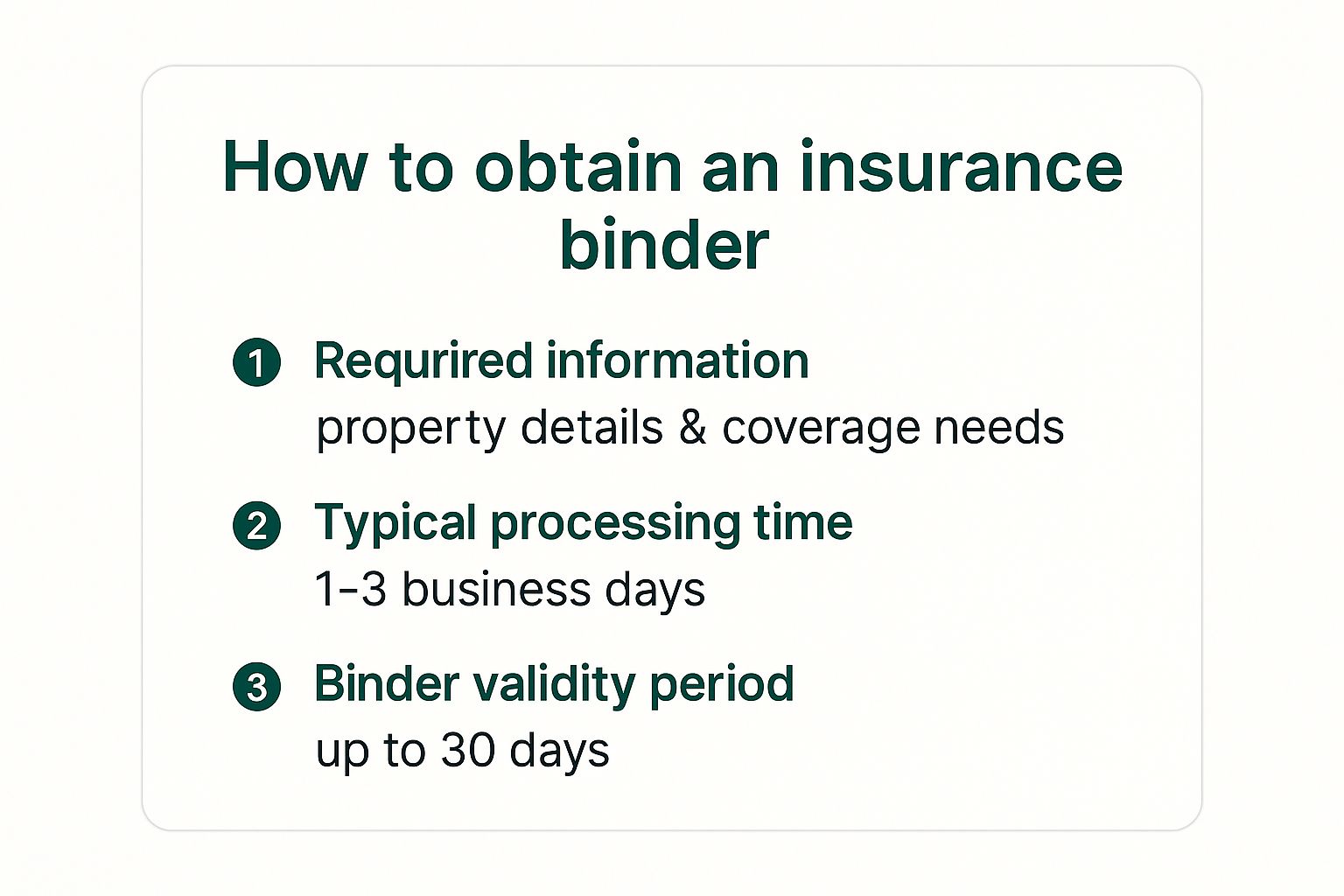

Getting a binder is a fast process because it has to be. You often need it right away to satisfy a mortgage lender when closing on a home or to drive a new car off the lot. It’s all about speed and convenience.

As you can see, the journey from applying for coverage to receiving a binder is designed to be quick and straightforward. It’s a necessary first step on the path to securing lasting peace of mind, which only comes with the full, detailed insurance policy.

When Do You Actually Need an Insurance Binder?

An insurance binder might just be a temporary piece of paper, but its role is massive. Think of it as the official green light that keeps big life moments from hitting a red light. When waiting days or weeks for a full, formal policy just isn't an option, a binder steps in to keep things moving.

There are a handful of high-stakes situations where progress would grind to a halt without this immediate, legally binding proof of coverage. From buying a home to launching a business, the binder gives you the confidence to move forward without costly delays.

Finalizing a Mortgage

You're at the closing table for your dream home, pen in hand, ready to sign the final stack of papers. But the mortgage lender has one last, non-negotiable demand: proof of homeowners insurance. They need to know their investment—your new house—is protected from the second you get the keys.

This isn’t just a friendly suggestion; it’s a hard requirement. An insurance binder is often one of the most critical required mortgage documents, acting as the stand-in until your official policy documents arrive. Your agent can usually whip one up quickly, satisfying the lender so you can close the deal without a hitch.

It's a make-or-break document for most home sales. Industry data reveals that around 80% of mortgage lenders require a binder or equivalent proof of insurance before they will fund a loan.

Driving a New Vehicle off the Lot

Here’s another classic scenario. You’ve just spent hours at the car dealership, found the perfect car, and signed all the financing paperwork. You’re ready to hit the road, but the salesperson can't legally hand over the keys until they see you have insurance.

Driving uninsured is illegal, and no dealership wants that liability. An auto insurance binder provides instant, valid proof of coverage. You can pull it up on your phone, show it to the salesperson, and they’ll let you drive your new car away, fully and legally protected from that moment on.

Signing a Commercial Lease

Business owners know this situation well. You've finally found the perfect storefront or office space for your new venture. Before the landlord will even think about signing the lease, they'll almost certainly ask for proof of general liability insurance.

This protects their property—and their own finances—if a customer gets hurt or your operations cause any damage. Handing over a binder proves you've got the necessary coverage locked in. It’s a foundational step in securing your commercial space and often ties into broader risk planning, like setting up business continuity insurance.

The binder's role in fast-moving transactions is no small thing. It’s estimated that a significant 15% to 20% of all new U.S. insurance policies start out as a binder to bridge the gap and provide immediate coverage. This just goes to show how essential they are for minimizing risk during those crucial transitional periods. You can find more great insights on this over at limit.com.

Common Questions About Insurance Binders

Okay, let's tackle some of the most common questions that pop up when you're dealing with an insurance binder. Think of this as your practical FAQ for navigating that in-between period before your official policy arrives.

How Long Is an Insurance Binder Valid For?

An insurance binder is a short-term solution. Most are valid for 30 to 90 days, and you'll always find the exact expiration date printed right on the document.

This gives the insurance company enough breathing room to do its due diligence—the underwriting process—before they send over the full, formal policy. The most important thing you can do is circle that expiration date on your calendar. If it's getting close and you still don't have your policy documents, get on the phone with your agent. You don't want to risk a gap in coverage.

Can I Actually File a Claim with Just a Binder?

Yes, you absolutely can. It's a common myth that a binder is just a flimsy piece of paper, but in reality, it’s a legally binding contract. It promises the exact same coverage that your future policy will detail.

So, if you have a car accident or a pipe bursts while the binder is active, you are fully entitled to file a claim. The insurance company must honor the terms laid out in that binder. You’d just call your agent and start the process, the same way you would with a permanent policy in hand.

An insurance binder isn't just a placeholder; it's a promise. It’s your proof that you are protected from the moment it's issued, and those terms are completely enforceable.

This is precisely why binders are so critical for things like buying a car or closing on a home—they provide immediate, legitimate proof of insurance.

Does an Insurance Binder Cost Extra?

Nope. You won't see a separate line item on your bill for an insurance binder. Its cost is simply rolled into the premium you're already paying for the policy.

Think of it like this: your first premium payment activates your coverage. The binder is the receipt you get to prove it while the official, multi-page policy document is being drawn up and mailed. It's part of the package deal, not an add-on fee.

What Happens if My Full Policy Doesn't Arrive on Time?

If you're watching the calendar and your binder's expiration date is getting dangerously close, don't panic—but do act quickly. Your first move should be to contact your insurance agent.

This is a pretty common scenario, and agents are ready for it. They can usually issue an extension to your binder, ensuring your coverage continues without a single break. The key is being proactive. A quick phone call can prevent a major headache and keep you from being unintentionally uninsured.

What if the Insurance Company Denies My Application?

It can happen. Sometimes, after the underwriting team takes a deep dive into your application, they may decide not to issue a full policy. If they do, they are legally required to send you a formal written notice of cancellation.

The good news is, your coverage doesn't just vanish overnight. The notice will give you a specific date when the coverage will end, providing a grace period to find a new policy with another carrier. This is designed to protect you from being left high and dry. If you find yourself in this boat, our guide on how to switch insurance providers can walk you through the next steps.

Does Homeowners Insurance Cover Foundation Repair?

Does Homeowners Insurance Cover Foundation Repair? A Guide to the Workers Comp Claim Process

A Guide to the Workers Comp Claim Process