When an injury happens at work, the path to getting benefits is a series of well-defined steps called the workers' comp claim process. It all starts the moment you report the injury and get medical attention. From there, official forms are filed with your state's workers' compensation board and the insurance company, which launches an investigation to see if you're eligible for benefits to cover medical bills and lost wages.

The Modern Workers' Comp System: What You Need to Know

Before we jump into the play-by-play, it helps to understand that the workers' compensation system isn't frozen in time. It’s constantly evolving, influenced by everything from economic shifts and new tech to major changes in how we work. Knowing this bigger picture will help you set realistic expectations as you go through the process.

At its core, the system is designed as a "no-fault" agreement. This is a crucial concept. It means you don’t have to prove your employer did something wrong to get benefits. The flip side is that, in exchange, you typically can't sue your employer for the injury. This trade-off is the foundation of workers' comp laws across the country.

How Outside Forces Shape Your Claim

The last few years have really shaken things up. Workforce demographics and even global events have a direct impact on the frequency and cost of claims. Think about it: the pandemic led to the Great Resignation and fast-tracked the retirement of many baby boomers. These massive shifts changed the entire landscape of workers' comp, affecting both the number and types of claims filed.

So, how does this affect you directly?

- Claim Volume: An older workforce often means more claims for injuries that develop over time (like carpal tunnel or back issues), while younger employees might have more sudden, acute injuries.

- Processing Times: When insurance carriers get hit with a high volume of claims or face their own staffing issues, you can bet there will be delays. This can slow down the review of your case.

- Cost Pressures: With medical costs always on the rise, insurers are often under pressure to keep expenses down. This can sometimes lead to a much closer look at every claim that comes through the door.

This is why having a meticulously documented and well-prepared claim is more important than ever. For small business owners, the pressure is especially intense, so getting a handle on the specifics of https://wexfordis.com/2025/06/05/workers-compensation-for-small-business/ is key to managing risk.

Key Takeaway: The workers' comp system is a living, breathing ecosystem, not just a dusty rulebook. Understanding how the economy and workforce trends can cause ripples helps you anticipate hurdles and navigate the process more effectively.

The Power of Prevention: Workplace Safety

Of course, the best way to handle a workers' comp claim is to prevent it from ever happening. Smart employers know that investing in solid health and safety programs is the ultimate win-win. It keeps people safe and dramatically reduces the financial and emotional burden that comes with workplace accidents.

A strong safety culture is always the first line of defense. By implementing crucial health and safety policies, companies can proactively manage risks and cut down on incidents. Whether you're an employee or an employer, knowing this helps you approach the entire system with much more confidence.

What to Do the Moment a Workplace Injury Happens

The minutes right after you get hurt at work are chaotic and often painful. It’s easy to get overwhelmed, but what you do next can shape the entire outcome of your workers' comp claim. While your head might be spinning, you need to zero in on two things: getting medical care and reporting the incident.

Your health is, without question, the top priority. Seek medical attention immediately, no matter how minor the injury seems. I've seen too many cases where a "small" bump turns out to be a concussion or a "tweak" in the back becomes a debilitating long-term issue. Waiting not only puts your health at risk but also gives an insurance adjuster a reason to question the severity—or even the cause—of your injury later.

When you see a doctor, make one thing crystal clear: the injury happened at work. This ensures your medical records create an immediate and official link between your condition and your job. That first medical report is a foundational piece of evidence for a successful claim.

Getting the Right Medical Paperwork

Just seeing a doctor isn't the whole story; the documentation you walk away with is crucial. You're trying to build an undeniable record that connects your injury directly to your work.

Before you leave the clinic or hospital, make sure you ask the physician for:

- A written diagnosis that clearly explains what your injury is.

- Work restriction notes that spell out what you can and cannot do (e.g., "no lifting over 10 pounds" or "limited to desk work for two weeks").

- A specific note in the chart confirming the injury was sustained during work activities.

This paper trail is your best defense. It makes it significantly harder for an insurance company to argue that your injury isn't legitimate or work-related.

Officially Reporting the Injury to Your Employer

Once you’ve taken care of your immediate medical needs, your next step is to formally notify your employer. A casual mention to a coworker that you got hurt won’t cut it. You must follow your company’s official reporting procedure.

Find your supervisor, manager, or someone in HR and give them a clear, factual account of what happened. Stick to the basics: what you were doing, where you were, and how the injury occurred. Now is not the time to speculate, apologize, or admit any fault.

Reporting a sudden accident, like a fall from a ladder, is pretty straightforward. It gets trickier with injuries that develop over time, like carpal tunnel syndrome from repetitive data entry.

With a chronic or repetitive-stress injury, the clock starts ticking as soon as a doctor tells you it's work-related. That diagnosis date effectively becomes your "date of injury." If you wait to report it, you risk having your claim denied.

Every state has strict deadlines for reporting an injury. Knowing the specific rules where you live is vital. For example, understanding the workers' compensation requirements in Florida can be the difference between a successful claim and a denial. Missing that reporting window is one of the most common—and avoidable—reasons for a claim to be rejected right out of the gate.

Start Your Own Personal Log

Your employer and the insurance company will have their own files, but you need one, too. Keeping a personal log of everything related to your injury gives you control and consistency throughout the workers' comp claim process.

Your injury journal should track:

- Date and Time: Pinpoint the exact moment the incident happened.

- Location: Be specific. "The warehouse floor near aisle 3," not just "at work."

- Witnesses: Get the names and phone numbers of anyone who saw what happened.

- Symptoms: Describe your pain and other symptoms daily. Note what makes it better or worse.

This personal record becomes your source of truth. It helps you keep your story straight when talking to doctors, lawyers, and adjusters, ensuring you don't forget crucial details under pressure.

Filing Your Claim and The Investigation Phase

After you've reported the injury and gotten immediate medical attention, the workers comp claim process gets a lot more formal. This is when the official paperwork starts flying and the insurance carrier begins its investigation. Getting this part right is absolutely critical—it's the foundation that determines if your claim gets accepted, delayed, or even denied.

The first real step is filling out the official claim form. Your state might call it a "First Report of Injury" or something similar, and your employer should give it to you. This isn't just a piece of paper; it’s the legal starting point for your entire claim.

Nailing The Details on Your Claim Form

When you sit down with that form, precision is everything. Vague descriptions or incorrect details are like sending up a red flag for the insurance adjuster.

Be crystal clear about the date, time, and exact location of the injury. Use the notes from your personal log to describe precisely what you were doing and how you got hurt. Don't try to self-diagnose or, just as importantly, downplay your symptoms. Stick to the facts. Knowing how to effectively file a workers' compensation claim from the get-go helps you sidestep common mistakes that can sink your benefits before you even get started.

What to Expect from The Insurance Adjuster

Once the form is submitted, your case lands on the desk of an insurance adjuster. Their job is to investigate the claim for the insurance company and decide if it's legitimate under your state's laws.

To do this, they’ll gather information from a few key places:

- Your Doctor: They'll request all medical records tied to your injury.

- Your Employer: They'll speak with your supervisor to get their account of what happened.

- Witnesses: If anyone else saw the incident, the adjuster will likely want to talk to them.

- You: Expect a call to schedule a recorded statement. This is your chance to tell your side of the story.

It’s important to remember that the adjuster works for the insurer, not for you. While most are professional, their primary goal is to manage the claim efficiently for their company. That means you should always be honest, consistent, and careful in what you say.

Crucial Tip: Never go into a recorded statement cold. Before the call, review the notes you took about the injury. This ensures your account is accurate and consistent. Answer only what's asked, stick to the facts, and don't volunteer extra information.

The Recorded Statement: Your Formal Interview

The recorded statement is a formal interview where the adjuster will ask you questions about your job, the accident itself, your injuries, and the treatment you've received. This recording becomes a permanent part of your claim file, so clarity is essential.

You'll likely be asked things like:

- Can you walk me through how the incident happened?

- Was anyone else there who saw it?

- Have you had a previous injury to this same body part?

- What has your doctor said, and what treatment are you getting?

If you don't know the answer to something, just say so. Guessing can cause problems down the road. This is especially true for remote workers, whose injury circumstances can be less straightforward. We dive into those specific challenges in our guide on workers' comp for remote employees.

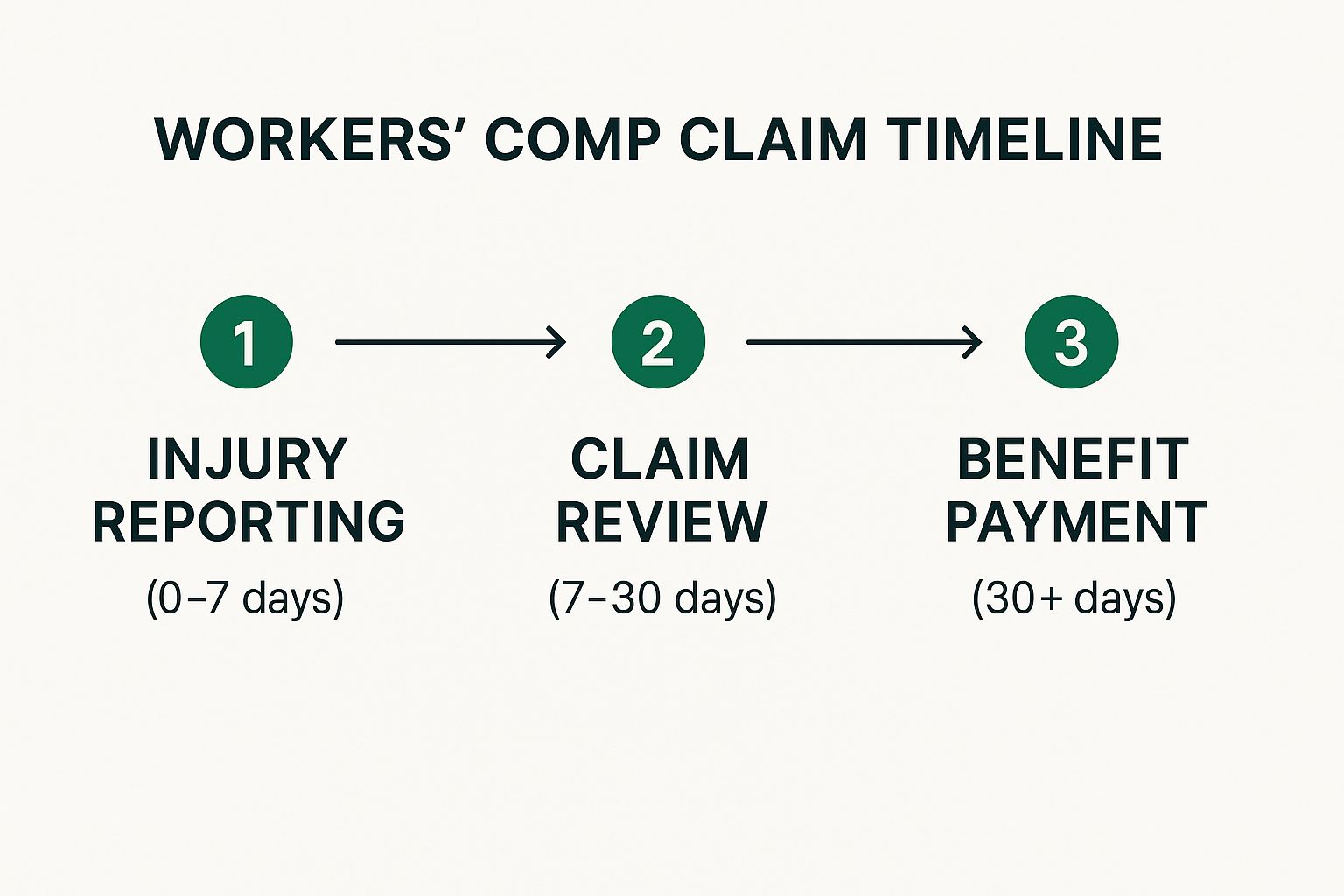

To give you a clearer picture of the process, here's a visual breakdown of the typical claim timeline.

As you can see, the initial investigation can last up to 30 days. This is a busy period where the adjuster is actively gathering all the information needed to make a decision.

To simplify this even further, let’s break down the key stages in a table.

Key Stages of a Workers Comp Claim

The workers' compensation process can feel complicated, but it follows a predictable path. This table outlines the main phases and clarifies who is responsible for what at each step.

| Stage | Employee's Role | Employer/Insurer's Role | Typical Timeframe |

|---|---|---|---|

| Injury & Report | Report injury to supervisor immediately; seek medical care. | Provide medical assistance and claim forms; report to insurer. | Within 24 hours |

| Claim Filing | Complete and submit the official claim form accurately. | Submit the First Report of Injury to the state and insurer. | 1-5 days |

| Investigation | Cooperate with the adjuster; provide a recorded statement. | Investigate the claim; gather medical records and witness statements. | 14-30 days |

| Claim Decision | Await the insurer's decision (accept, deny, or delay). | Issue a formal written decision on the claim. | Within 30-90 days |

Understanding these roles and timelines can help demystify the process and set clear expectations from the start.

The Three Potential Outcomes

After the investigation wraps up, the adjuster will make a decision. Your claim will fall into one of three buckets.

- Accepted: This is the best-case scenario. The insurer agrees the injury is work-related and will cover your medical bills and lost-wage benefits.

- Delayed: The adjuster needs more information before deciding. They might ask you to see another doctor for an "independent medical examination" (IME) to get a second opinion.

- Denied: The insurer believes your claim isn't valid and will not cover it. They are required to send you a letter explaining exactly why.

Knowing these potential outcomes helps you prepare for what’s next. While it might feel personal, it’s a standard business process. In fact, for every 100 full-time employees, about 3.1 workers' comp claims are filed each year. This just shows how common these situations are and why having a solid understanding of the investigation phase is so important for everyone involved.

Managing Your Medical Care and Benefits

Once your claim gets the green light, the game changes. You're no longer focused on proving what happened; now it’s all about managing your recovery. This is the part where you get access to the medical care and financial support that workers' comp is designed for—helping you get back on your feet. Knowing how to handle this stage is crucial for a smooth healing process.

Your recovery hinges on getting the right medical treatment. In most workers' comp systems, the insurance carrier gets a say in who provides that care. They almost always have an approved network of doctors, and you'll likely need to see one of them, at least for your initial treatment.

Navigating Your Medical Treatment

Your first job is to find the right doctor from the list the insurance company gives you. Don't just point to the first name on the page. Take a little time to do some homework. Look for specialists who have real experience with your specific injury. Honestly, having a good relationship with your doctor can make or break your recovery.

But what if you and your doctor just don't click, or you feel like your treatment isn't working? You're not stuck. Most states have rules allowing you to switch doctors or get a second opinion after a certain amount of time. This is a critical right that far too many injured workers don't even know they have. If you feel like you're not being heard or your progress has flatlined, it’s time to look into your options.

Expert Insight: Think of your medical care as the engine of your recovery. Document every single appointment, follow your doctor's instructions to the letter, and be completely open about your symptoms. This creates a clear, consistent medical record that justifies your ongoing need for benefits.

The claim process itself has a huge impact on how well you recover. It’s not just about the injury. Research shows that a worker's experience navigating the system directly correlates to their return-to-work outcome. In one national survey, 23% of injured workers called their claims experience neutral or negative, and those difficult processes were linked to worse results. On the flip side, a positive, supportive experience often meant getting back to work sooner. You can explore the research on workers' compensation statistics to see the full picture.

Understanding Your Financial Benefits

While you're recovering, workers' comp is also there to provide a financial safety net. The benefits come in a few different forms, and it’s important to know what’s what so you can manage your household budget.

The two main types you'll deal with are:

- Medical Benefits: This one is pretty straightforward. It covers 100% of all reasonable and necessary medical care for your work injury. We're talking doctor visits, hospital bills, prescriptions, physical therapy—even mileage reimbursement for driving to your appointments.

- Temporary Disability Benefits: If your injury keeps you out of work, these benefits are meant to replace some of your lost wages. They're usually calculated as a percentage of your average weekly pay (typically two-thirds) and continue until your doctor says you're ready to return.

When Recovery Reaches a Plateau

Sometimes, an injury leads to limitations that are long-term or even permanent. When your doctor decides your condition has improved as much as it's ever going to, you’ve reached what’s called Maximum Medical Improvement (MMI). At this point, the type of benefits you receive might change.

This is when you could be evaluated for permanent disability benefits.

- Permanent Partial Disability (PPD): This applies when you have a permanent impairment but can still work in some capacity. Think of a construction worker who can't lift heavy materials anymore but could transition into a supervisory role.

- Permanent Total Disability (PTD): This is reserved for the most severe cases, where an injury prevents you from ever returning to any kind of sustainable employment.

The formulas for calculating these benefits are incredibly complex and vary a lot from state to state. They usually involve impairment ratings assigned by a physician.

Getting Treatments Approved

One of the biggest headaches in the workers comp claim process can be getting the insurance carrier to approve specific treatments, like an MRI or surgery. This formal process is called utilization review. Your doctor has to send a request to the insurer, who then decides if the treatment is medically necessary.

If a request gets denied, don't panic. It's not the end of the line. You and your doctor have the right to appeal that decision. The appeal usually involves sending in more medical records and a stronger justification for why the treatment is essential for your recovery. Being a proactive partner with your doctor's office here can make all the difference in getting the care you need without long delays.

How to Handle a Claim Denial and Appeals

There's nothing more discouraging than getting a denial letter in the mail. After dealing with an injury, doctor visits, and mountains of paperwork, seeing your claim rejected feels like hitting a brick wall. But I've seen it a thousand times: a denial is rarely the final word.

Think of it less as a "no" and more as the start of a new chapter—the appeals process.

The first thing to do is read the denial notice. And I mean really read it. The insurance company is legally required to give you a specific reason for the rejection. That reason is your new roadmap.

Why Was Your Claim Denied?

Understanding the "why" is everything. Insurers aren't just throwing darts at a board; their denial points to what they see as a specific weakness in your claim. Your job now is to find that weakness and shore it up with solid proof.

Most denials boil down to a few common issues:

- Missed Deadlines: You didn't report the injury or file your claim within the strict timeframes set by your state.

- Dispute of Work-Relatedness: The insurer is arguing your injury happened off the clock or stems from a pre-existing condition.

- Lack of Medical Evidence: The doctor's notes you submitted don't clearly connect your injury to the incident at work.

- Factual Discrepancies: The claims adjuster found conflicting details between your statement, witness accounts, and what your employer reported.

Learning more about the common reasons behind insurance claim denials can help you anticipate the insurer’s arguments and build a much stronger case from the start.

Starting the Formal Appeals Process

Once you've pinpointed the reason for the denial, it's time to begin the formal appeal. This isn't a simple phone call or email; it’s a legal proceeding that requires filing official documents with your state's workers' compensation board. The denial letter itself should outline the exact steps and, most importantly, the deadline. Do not miss this deadline.

This is the moment when your meticulous record-keeping pays off. Gather everything: medical records, doctor’s notes, contact info for witnesses, and your personal log of events.

Key Takeaway: Treat your appeal like you're building a legal case, because that’s exactly what it is. The burden of proof has now shifted to you to prove the insurance company got it wrong.

The scale of this process is immense. The global workers' compensation insurance market was valued at a staggering $75.7 billion in 2021. North America alone holds a 56.65% market share, with its industry revenue projected to grow from $43.4 billion to $52.9 billion by 2025. You can see more on these global workers' compensation market trends and understand you're not alone in this.

Gathering Stronger Evidence

A denial is a clear signal that your initial evidence wasn't convincing enough. Now's your chance to fix that. One of the most powerful moves you can make is getting an independent medical examination (IME) or a second opinion from a specialist. A fresh medical report that explicitly links your condition to your job duties can completely turn a case around.

You should also circle back to any witnesses. Ask them for a formal, signed statement—an affidavit. These sworn statements carry far more legal weight than a casual mention in an initial report. Your goal is to systematically tear down the insurer's reason for denial with overwhelming evidence.

When to Hire a Workers' Compensation Attorney

You might be able to handle a simple appeal on your own. But if the denial hinges on a complex medical debate, a dispute over how the accident happened, or if the insurance company is just stonewalling you, it's time to bring in a professional.

A seasoned workers' compensation attorney knows the playbook. They understand the legal arguments, have experience gathering the right kind of evidence, and can effectively represent you at hearings. Statistics consistently show that injured workers with legal representation secure better outcomes and more substantial settlements. An attorney doesn't just help; they level the playing field.

Common Questions About The Claim Process

Diving into a workers' comp claim can feel like trying to read a map in a foreign language. Even when you think you're doing everything right, questions and "what-ifs" are bound to pop up. Let's tackle some of the most common concerns head-on to give you a clearer picture.

One of the biggest anxieties I hear about is job security. People worry that filing a claim will put a target on their back. It's a completely understandable fear, but thankfully, the law offers strong protections.

Can I Be Fired for Filing a Workers' Comp Claim?

In short, no. It is illegal for an employer to retaliate against you for filing a workers' compensation claim. This is a fundamental protection built into the system.

Retaliation isn't just about getting fired, either. It can look like:

- Being demoted to a less desirable position.

- Having your hours or pay cut.

- Facing any other kind of unfair treatment simply because you got hurt and sought the benefits you're entitled to.

If you believe you're being punished for filing a claim, start documenting everything immediately. This is a serious issue, and it's wise to speak with an attorney to understand your rights and figure out the next steps.

What if My Employer Doesn't Have Workers' Compensation Insurance?

This is a tough spot to be in. In nearly every state, it's illegal for a business with employees to operate without workers' comp coverage. But it still happens.

If your employer broke the law and doesn't have a policy, you aren't out of luck. Most states have a special fund, often called an "uninsured employers' fund," created for this exact situation. You'd file your claim with this state agency, not a private insurance company.

What's more, this scenario might open the door for you to file a personal injury lawsuit directly against your employer—an option that isn't typically available in a standard workers' comp case.

Important Takeaway: Your employer's failure to buy insurance does not erase your right to benefits. The process is different, but a state-level safety net is there to catch you.

Do I Have to See the Company's Doctor?

This is a classic point of confusion, and the answer comes down to your state's specific laws. In many places, the employer or their insurance carrier gets to choose the doctor who treats you, at least in the beginning. They'll likely send you to an occupational health clinic they have a relationship with.

But this control usually isn't permanent. After a certain amount of time, often 30 to 90 days, many states give you the right to switch to a physician of your own choosing. It's absolutely critical to know the rules in your state, because seeing an unapproved doctor could put your medical benefits at risk.

How Long Do I Have to Report a Workplace Injury?

Don't wait. Every state has a statute of limitations, which is a non-negotiable deadline for reporting your injury and filing a claim. These timeframes can vary wildly from one state to another.

You might have just a few days to tell your employer what happened, while the official deadline for filing the claim with the state board could be a year or more. The best advice I can give is to report your injury the moment it happens, or as soon as you realize you're hurt. Any delay gives the insurance company a reason to be skeptical and challenge your claim's legitimacy.

These reporting deadlines are just one piece of the puzzle. The entire claims process has a direct effect on your employer's insurance costs. To see how it all connects, you can learn more about how workers' comp experience mods affect your premium.

Getting a handle on these rules can feel like a lot, but understanding the answers to these key questions demystifies the workers' comp claim process. It equips you to be your own best advocate and ensures you're making the right moves to protect both your health and your finances.

At Wexford Insurance Solutions, we believe in making complex insurance simple. If your business needs guidance on workers' compensation or any other commercial coverage, our team is here to provide the expertise and support you need to protect your assets and your people. Visit us at https://www.wexfordis.com to learn how we can reduce your total cost of risk.

What Is an Insurance Binder Explained Simply

What Is an Insurance Binder Explained Simply Insurance Policy Management Systems: Boost Your Agency Today

Insurance Policy Management Systems: Boost Your Agency Today