An insurance policy management system is essentially the digital backbone of an insurance company. It’s the software platform where insurers manage the complete journey of a policy, from the first quote all the way through underwriting, billing, and eventually, claims. Think of it as the central operating system for an agency, keeping every crucial function in sync.

What Is a Policy Management System, Really?

Picture an insurance agency trying to operate without a central system. You'd have underwriters digging through mountains of paper files, customer service reps hunting for policy details scattered across dozens of spreadsheets, and the billing team manually chasing down payments. It would be pure chaos—inefficient, frustrating, and a recipe for mistakes.

This is precisely the headache that insurance policy management systems were designed to cure.

At its core, this software creates a single, reliable source for all policy information. It breaks down the walls between departments that older, fragmented processes created. Instead of critical data being trapped in separate silos, it’s all stored, updated, and accessed from one unified platform. This move from manual chaos to a centralized digital hub is what makes modern insurance operations possible.

From Filing Cabinets to a Central Hub

The journey of policy management really tells the story of technology's impact on the industry. It all started with meticulous records kept in giant filing cabinets. Then came the first wave of clunky, on-premise software—a step up, but these early systems were often inflexible, a nightmare to update, and rarely played well with other tools.

Today's systems are a world apart. Most are now cloud-based, which gives insurers incredible flexibility, the ability to scale up or down as needed, and the power to connect with other software seamlessly. They automate the grunt work, deliver deep insights through data analytics, and provide agents and customers alike with instant access to the information they need. This has transformed policy management from a simple administrative task into a powerful tool for driving growth and keeping customers happy.

A modern insurance policy management system doesn't just hold data; it actively orchestrates the entire policy lifecycle. It connects the dots between underwriting, billing, claims, and customer service, making sure every step is coordinated, tracked, and handled as efficiently as possible.

To make this more concrete, the table below breaks down how these systems support each stage of a policy's life.

Core Functions of a Modern Policy Management System

| Lifecycle Stage | Key Functions Handled by the System | Primary Benefit |

|---|---|---|

| Quote & Application | Captures applicant data, generates quotes based on predefined rules, and manages online application submissions. | Faster quoting and a smoother customer onboarding experience. |

| Underwriting & Rating | Automates risk assessment, applies rating algorithms, flags exceptions for manual review, and enforces underwriting guidelines. | Consistent, accurate risk pricing and reduced manual effort for underwriters. |

| Policy Issuance | Generates all necessary policy documents, dec pages, and forms, then delivers them to the policyholder digitally or via print. | Dramatically speeds up the time it takes to get a policy in the customer's hands. |

| Billing & Collections | Manages premium invoicing, processes various payment types (credit card, ACH), and handles automated payment reminders. | Improved cash flow, fewer missed payments, and less administrative overhead. |

| Endorsements & Renewals | Processes mid-term policy changes (e.g., adding a vehicle), and automates the renewal workflow, including re-rating and notifications. | Simplified policy servicing for both agents and customers. |

| Claims Processing | Integrates with claims systems to provide adjusters with immediate access to policy details and coverage information. | Faster claims validation and a more seamless experience for the claimant. |

As you can see, the system isn't just a passive database. It's an active participant, automating and streamlining the critical tasks that keep the business running smoothly and efficiently from start to finish.

What to Look for: Key Features of a Great Policy Management System

So, what actually makes an insurance policy management system tick? It's all about the core components—the features that do the heavy lifting. Think of these not as a random collection of tools, but as a set of interconnected gears that work together to make your entire operation run smoothly.

Each feature is designed to tackle a specific part of a policy's life, from the first quote to the final renewal. They turn tedious, manual jobs into slick, automated workflows. Let's dig into the essential features you'll find in any top-tier system.

Automated Underwriting and Rating Engine

The underwriting desk is where the magic—and the math—happens. It’s where you assess risk and put a price on a policy. Traditionally, this meant an underwriter sifting through paperwork and crunching numbers, a process that could drag on for days.

A modern system throws that old model out the window with a powerful underwriting and rating engine. This is essentially a digital rulebook. When an application comes in, the system instantly runs the data against your pre-set guidelines. It can evaluate risk factors, calculate the exact premium, and flag any unusual cases that need a human expert to review.

For instance, a standard auto policy application can fly through the system in minutes. The engine checks the driver's history and vehicle details, then spits out an accurate, ready-to-bind quote. This frees up your experienced underwriters to focus on the complex, high-value policies where their judgment truly matters.

Centralized Policy Issuance and Document Management

Once a policy gets the green light, you have to create and deliver the official documents. A solid policy management system handles this entire process automatically. It generates everything—from the declarations page to the full policy booklet—ensuring every document is accurate and compliant.

Better yet, the system acts as a digital filing cabinet for every piece of paper related to a policy. Endorsements, renewal notices, and client emails are all stored securely and tied directly to the policyholder's file.

A robust document management feature eliminates the chaos of lost paperwork and creates a single source of truth. When a client calls, anyone on your team can pull up their complete history in seconds and give them a fast, informed answer.

This kind of centralization is quickly becoming the industry standard. The global market for this type of software is expected to balloon from USD 2.6 billion in 2024 to an incredible USD 5.5 billion by 2033. It’s clear proof that the industry is moving toward platforms that simplify operations and keep all data in one place.

Integrated Billing and Collections Module

Let's be honest: managing premiums is what keeps the lights on. An integrated billing and collections feature automates this entire financial cycle, cutting down on administrative headaches and improving your cash flow. It can handle everything from sending invoices and processing payments to chasing down overdue accounts.

A good billing module should include:

- Flexible Payment Options: Support for credit cards, bank transfers (ACH), and automated recurring payments.

- Automated Invoicing: No more manually creating and sending bills. The system does it on schedule.

- Commission Tracking: Automatically calculates and tracks what you owe your agents for every policy sold.

- Reporting and Analytics: Gives you a clear, real-time view of your accounts receivable and payment patterns.

This level of automation doesn't just save countless hours; it drastically reduces the human errors that can creep into manual billing, making for a much smoother financial experience for your clients.

Self-Service Customer and Agent Portals

Putting information directly into the hands of your clients and agents is a game-changer. A self-service portal is a secure website where policyholders can log in and manage their accounts 24/7, without ever having to call your office.

From their portal, a customer can:

- Check their coverage details and view policy documents.

- Pay a bill or update their payment method.

- Instantly print an ID card or a certificate of insurance.

- Start a claim or report a life change, like buying a new car.

An agent portal works the same way, giving your producers on-the-go access to their book of business, commission statements, and sales reports. These portals slash the number of routine phone calls your team has to field, freeing them up to focus on building relationships and solving bigger problems. For customers, this convenience is a huge deal, especially when they're exploring how to switch insurance providers for a better experience.

By weaving these features together, an insurance policy management system creates an operation that is unified, efficient, and laser-focused on the client. It’s the foundation for real, sustainable growth in a competitive market.

How Modern Policy Management Drives Growth

Upgrading to a modern insurance policy management system isn't just about new software. It's a genuine shift in how your agency works, competes, and grows. It takes old-school industry headaches—like clunky manual tasks, disjointed client interactions, and slow reactions to market trends—and turns them into real opportunities.

The benefits aren't just theoretical. They show up in your bottom line, in stronger client relationships, and in your ability to plan for the future.

Think of it this way: a powerful policy platform acts as the engine for your agency's growth, and it runs on three core cylinders. Let’s break down how each one—boosting efficiency, elevating the customer experience, and unlocking strategic insights—drives real-world success.

Boosting Operational Efficiency

The first thing you'll notice is how much smoother your daily operations become. We've all been there: drowning in manual data entry, chasing paperwork, and digging for information. These tasks are massive time sinks. Automation takes them off your team's plate, freeing them up to focus on what actually matters—advising clients and building relationships.

This shift has a direct impact on your costs. When you automate workflows for quoting, issuance, and renewals, you're cutting down the hours spent on each policy. Just as importantly, you're minimizing the risk of expensive human errors. Fewer mistakes in data entry or compliance checks mean fewer financial write-offs or regulatory headaches down the road.

By automating routine processes, an insurance policy management system doesn't just make your team faster—it makes them more effective. It removes the friction from internal workflows, allowing for smoother collaboration and a more productive work environment.

Imagine a system that automatically flags an application falling outside underwriting rules and sends it straight to a senior underwriter. That’s a perfect example. It stops a potentially problematic policy in its tracks and ensures your top talent is focused exactly where their expertise is needed most.

Elevating the Customer Experience

Today’s clients expect everything to be fast, convenient, and transparent. A modern system gives you the tools to deliver on that promise. Features like 24/7 self-service portals let clients access policy documents, make payments, or print ID cards on their own schedule, not just during your office hours.

This kind of instant access is now the standard, and meeting that expectation is key to keeping clients happy and loyal. When someone can get a quote in minutes or adjust their coverage online, they feel empowered and valued. Faster, more organized responses during a claim or a simple inquiry build the kind of trust that keeps them coming back.

Beyond just managing policies, many modern systems integrate tightly with or include powerful insurance claims processing solutions. This ensures the client has a smooth, consistent experience from the moment they buy a policy to the moment they need to use it.

Unlocking Strategic Growth

This might be the most powerful benefit of all: the ability to turn your agency’s data into a strategic weapon. A centralized system is a goldmine of business intelligence, capturing every interaction, policy detail, and client data point in one place. For the first time, you can step back and see the entire picture of your book of business.

This data-driven view lets you make smarter, more confident decisions. By analyzing trends, you can pinpoint your most profitable products, identify underserved client groups, or get ahead of emerging market risks. Our guide on insurance data analytics dives deeper into how you can turn these insights into a serious competitive edge.

This analytical power also makes you more nimble. With a flexible system, you can develop and launch new products much faster, tweaking rates and rules without waiting on a massive IT project. That agility is crucial for keeping pace with a market that never stands still. It's no surprise the market for life insurance policy administration systems alone is projected to jump from USD 3.27 billion in 2024 to over USD 6.1 billion by 2032, a clear signal of the immense value the industry sees in these capabilities.

Choosing the Right System for Your Business

Picking the right insurance policy management system is one of the most important decisions you'll make for your agency. It's not just a software purchase; it’s a choice that will fundamentally shape your day-to-day work, your customer relationships, and your ability to grow. The real challenge is to tune out the marketing noise and focus on what your business truly needs—not just for today, but for the next five years.

The best way forward is to be methodical. It all starts with taking a hard, honest look at how you operate right now. Where are the hang-ups? What manual tasks are eating up your team's valuable time? Knowing your specific pain points is the first step to finding a system that actually fixes them.

Start with a Thorough Needs Analysis

Before you even think about scheduling a demo, you need a detailed blueprint of your requirements. Think of it as creating a custom yardstick to measure every potential system against. Without one, you'll get lost in a sea of impressive features, unable to tell the difference between a "nice-to-have" and an absolute must-have.

This isn't a job for one person. Get everyone who will touch the system involved—your underwriters, your customer service reps, your agents on the ground. Ask them: What are your biggest daily frustrations? What would make your job easier and let you get more done?

A few key areas you absolutely must document are:

- Lines of Business: Make a comprehensive list of every type of insurance you offer, from simple auto policies to complex, specialized commercial lines. The system has to be able to handle the unique rules and paperwork for every single one.

- Operational Bottlenecks: Get specific about where things get stuck. Is quoting a painfully slow process? Does issuing a new policy involve too many steps? Is tracking commissions a chaotic mess?

- Future Growth Goals: Think about where you want your agency to be in five years. Are you planning to expand your footprint, add new insurance products, or double your team? The system you choose has to be able to grow with you, not hold you back.

On-Premise vs. Cloud-Based Systems

One of the first big forks in the road is deciding on the deployment model. This choice has a ripple effect on everything from your upfront costs and setup time to your ongoing maintenance and how you access the platform. Your two main options are the traditional on-premise software and the modern cloud-based solutions, often called Software-as-a-Service (SaaS).

An on-premise system means you buy the software and install it on your own servers at your office. You own everything—the hardware, the software, and the responsibility for maintaining it. A cloud-based system, on the other hand, is hosted by the vendor. You access it through the internet, and you typically pay a subscription fee for the service.

To help you weigh the options, here’s a quick comparison:

On-Premise vs. Cloud-Based Policy Management Systems

| Consideration | On-Premise System | Cloud-Based (SaaS) System |

|---|---|---|

| Initial Cost | High (Requires purchasing servers and software licenses) | Low (Subscription-based, no hardware purchase needed) |

| Maintenance | Your IT team handles all updates, security, and backups | Vendor manages all maintenance, updates, and security |

| Accessibility | Limited to office network unless a VPN is set up | Accessible from anywhere with an internet connection |

| Scalability | Scaling requires purchasing new hardware and licenses | Easily scalable; just adjust your subscription plan |

| Implementation | Can be a lengthy, complex installation process | Faster and simpler deployment, often ready in weeks |

Ultimately, the choice depends on your agency's budget, IT resources, and long-term goals. While on-premise offers more direct control, most modern agencies are leaning toward the flexibility and lower overhead of cloud-based systems.

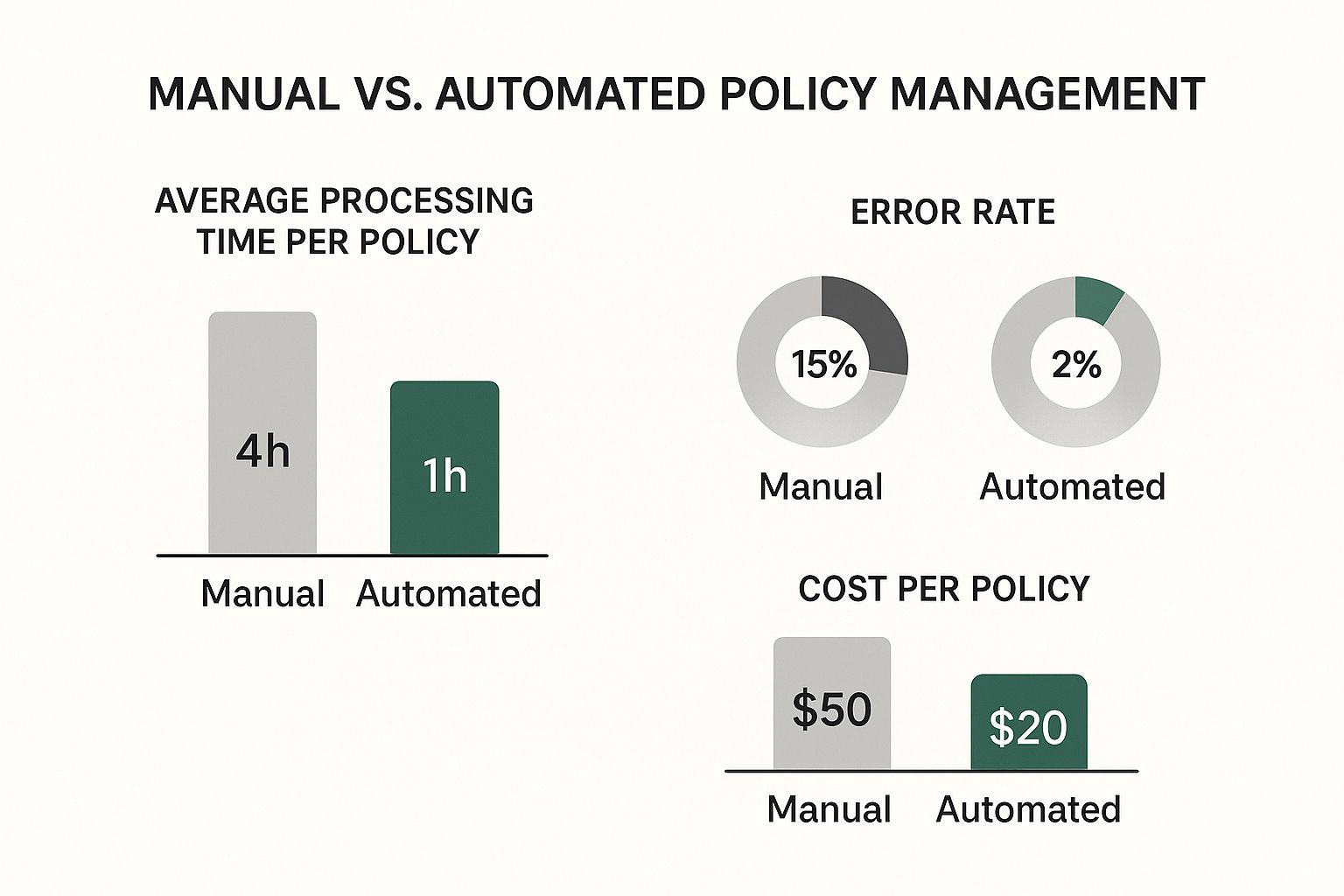

This next image really drives home the efficiency gains you can expect when moving from old-school manual work to a modern, automated system.

The numbers speak for themselves. Automation can slash policy processing time by a massive 75% and drop the error rate from a concerning 15% all the way down to just 2%. That’s a game-changer.

Crucial Questions to Ask Potential Vendors

Once you’ve narrowed down your list of potential vendors, it’s time to start asking the tough questions. You're not just buying software; you're entering into a long-term partnership. The answers you get will tell you a lot about their technology, their commitment to your data's security, and how they’ll support you when things go wrong.

Don't be afraid to dig deep. A vague or evasive answer to a direct question is a major red flag.

Here are some essential questions to have ready:

- Scalability: How does your system handle growth? What's the process if we want to add more users, bring on new lines of business, or just handle a higher volume of policies?

- Integration Capabilities: How well does your software play with others? Do you have an open API we can use to connect to our existing CRM or accounting software?

- Security and Compliance: What specific steps do you take to protect our clients' sensitive information? How do you keep the system updated with the constantly changing state and federal insurance regulations?

- Data Migration: Tell me about your data migration process. What kind of help will you provide to get all of our existing policy data out of our old system and into yours?

- Training and Support: What kind of training do you include for our team? When something goes wrong, what are your support hours, and what's your average response time?

- Product Roadmap: What are you working on? What new features or big improvements can we expect to see in the next 12-18 months?

Getting clear answers on compliance is especially vital if you handle specialized policies. For example, the complexities of management liability coverage require a system that’s nimble enough to keep up with evolving legal standards. A good vendor will be able to explain exactly how their platform meets those specific needs.

Taking the time to do this research and make a well-informed choice now is what sets your agency up for a more efficient, profitable, and less stressful future.

The Future of Policy Management with AI

While modern insurance policy management systems have certainly made agency life easier, the next chapter is already being written, and it’s powered by Artificial Intelligence (AI) and Machine Learning (ML). These aren't just incremental upgrades. They're fundamentally changing how insurers understand risk, connect with customers, and even predict what's coming next.

We're moving away from simply keeping records and toward actively anticipating outcomes and tailoring every interaction.

Think about it. An underwriting process that actually gets smarter with every single policy it handles. AI algorithms can sift through mountains of data, catching subtle risk patterns a human might overlook. The result? Sharper, more competitive pricing.

This predictive muscle isn't just for underwriting, either. It’s also a game-changer for fraud detection and keeping clients happy. An AI-driven system can instantly flag a claim that shares characteristics with known fraudulent activity, potentially saving millions. On the flip side, it can analyze customer behavior to pinpoint who might be thinking of leaving at renewal time, giving you a chance to step in with a personal touch to keep their business.

The Rise of Hyper-Personalization and Automation

The real magic of AI in policy management is its ability to create insurance that feels like it was made just for one person. By pulling in data from Internet of Things (IoT) devices—think car telematics or smart home sensors—the old static annual policy starts to look outdated.

Instead, we can offer dynamic coverage that flexes and adapts based on real-time behavior. This is a huge piece of the larger digital transformation in insurance, where technology helps build more responsive, customer-first businesses. It’s a win-win: policyholders get fairer prices based on their actual risk, and insurers get a much clearer picture of their portfolios.

AI and ML are turning insurance policy management systems from reactive record-keepers into proactive strategic partners. They provide the intelligence needed to not just respond to the market, but to anticipate and shape it.

This shift toward intelligent automation is pouring fuel on the industry’s fire. The global life insurance policy administration systems market, valued at USD 6.5 billion in 2024, is expected to explode to over USD 20.3 billion by 2034. That kind of growth shows just how serious the industry is about adopting smarter tech.

Predictive Analytics and Intelligent Communication

Beyond crunching numbers, AI is also changing the conversation. The development of the voice AI agent is a fascinating look into the future, where policy management systems could handle routine questions and services on their own. This could mean 24/7 support for simple inquiries, freeing up your human agents to focus on the complex, advisory conversations where they shine.

This next generation of insurance policy management systems will be all about intelligence. Here are a few key advancements we're seeing:

- Predictive Churn Models: Pinpointing at-risk customers with incredible accuracy to boost retention rates.

- Dynamic Risk Assessment: Using live data to constantly re-evaluate and adjust policy risk.

- Automated Claims Adjudication: Processing straightforward, low-risk claims almost instantly to get money into policyholders' hands faster.

- Personalized Product Recommendations: Suggesting the right coverage at the right time as a client's life changes.

This isn't science fiction anymore; it’s the logical next step. By embracing AI, insurers are building systems that are not only more efficient but also smarter, more predictive, and deeply in tune with the unique needs of every single policyholder.

Common Questions About Policy Management Systems

Even when you see the potential, diving into the world of insurance policy management systems raises some very practical questions. How long is this really going to take? Is our data actually safe? And will this thing even talk to the other tools we rely on every day? These aren't just minor details—they're the crucial concerns every agency owner has before making a big move.

Let's tackle these head-on. The best way to feel confident about this kind of change is to get straight answers to the tough questions. Here’s what we hear most often from agency managers and what you really need to know.

What Is the Typical Implementation Time?

This is always one of the first questions, and the honest answer is: it depends. The timeline for getting a new system up and running hinges on a few big variables—how complex the software is, the size of your agency, and how much data you need to bring over from your old spreadsheets or legacy system.

For a smaller agency adopting a fairly standard cloud-based system, you could be looking at a launch in as little as 3 to 6 months. But for a large, multi-location agency that needs heavy customization and has years of complex data to migrate, the project could easily stretch from 12 to 24 months.

To make this manageable, most insurers will opt for a phased rollout. They'll launch the most critical functions first—like policy administration or billing—to start seeing benefits right away, then add other modules over time.

The key takeaway is that "go-live" isn't a single, fixed date for everyone. A well-planned project, clear goals, and a responsive vendor are the most important ingredients for a timely and successful launch.

This methodical approach also prevents your day-to-day operations from grinding to a halt. For instance, analyzing early data from a new system can give you a much clearer picture of complex metrics, like the average business interruption insurance cost. That’s a powerful insight you can gain long before the entire project is finished.

How Do These Systems Handle Compliance and Security?

For anyone in the insurance game, security and compliance aren't just checkboxes; they're the foundation of the business. You simply can't compromise on them. Modern policy management systems are built from the ground up with this in mind. These aren't just add-on features—they're baked into the core architecture.

When it comes to regulatory compliance, these systems typically include:

- Automated Rule Engines: These are designed to ensure every policy you issue automatically follows the latest state and federal regulations, taking the guesswork out of compliance.

- Comprehensive Audit Trails: Every click, change, and note is logged. This creates an airtight record you can pull up for internal reviews or when the regulators come knocking.

- Granular Access Controls: You get to decide exactly who can see or change sensitive client data, locking it down from anyone who doesn't have a need to know.

On the security side, top-tier platforms use powerful encryption to protect your data, both when it’s flying across the internet and when it’s sitting on a server. If you go with a cloud-based solution, you also inherit the world-class security of the provider—think physical data center security, advanced firewalls, and 24/7 threat monitoring that would be impossible for a single agency to replicate on its own.

Can a Policy Management System Integrate with Other Software?

Absolutely. In fact, if it can't, you should walk away. A modern system's ability to connect with your other tools is one of its most valuable traits. No agency uses just one piece of software, and your core platform shouldn't operate on an island. The whole point is to create a connected tech environment, not another data silo.

Most leading systems today are built with an API-first approach. Think of an API (Application Programming Interface) as a universal translator that lets different software programs talk to each other securely and share information automatically.

This is what allows your policy management platform to connect seamlessly with other essential tools, like:

- Customer Relationship Management (CRM) systems, giving you a complete 360-degree view of your clients.

- Accounting Software for automating everything from commission tracking to financial reporting.

- Third-Party Data Providers that can pull in external information for faster, more accurate underwriting and rating.

When you're vetting vendors, make it a point to ask about their APIs. A system that plays well with the technology you already use will save you a world of hurt and deliver far more value in the long run.

At Wexford Insurance Solutions, we leverage technology to provide our clients with a seamless and secure insurance experience. If you're ready to see how a modern approach to policy management can benefit your business or personal coverage, contact us today for a personalized consultation at https://www.wexfordis.com.

A Guide to the Workers Comp Claim Process

A Guide to the Workers Comp Claim Process What Does Umbrella Insurance Cover? Protect Your Assets Today

What Does Umbrella Insurance Cover? Protect Your Assets Today