Before you even think about shopping for quotes, you need to get crystal clear on why you're looking to switch. It's easy to get distracted by flashy ads, but the real reasons for changing your insurance company are usually rooted in major life changes or simply wanting a better deal and better service.

Knowing When It Is Time for a Change

Most people only start shopping when they get hit with a big rate hike at renewal time. That’s a great reason, of course, but it's not the only one. Waiting for that sticker shock means you might be overpaying for months or even years. The key is to recognize the signals that your policy just isn't the right fit anymore.

Sometimes, the market itself hands you an opportunity. When insurance companies get more competitive, prices tend to drop for everyone. For example, global insurance rates recently fell by 4% in a single quarter, which was part of a year-long trend. A competitive market like that is the perfect time to see if you can get more for your money.

Personal Life Changes That Impact Your Policy

Big life events are probably the most common (and important) triggers for an insurance review. When your life changes, your risks change, and your old policy can quickly become outdated or just plain wrong.

Think about it. Have you recently:

- Gotten married or divorced? This completely changes your household's assets and the number of drivers on your auto policy.

- Bought a new car or home? Your coverage needs will be drastically different.

- Moved to a new neighborhood or state? Insurance rates can swing wildly just by changing your zip code.

- Boosted your credit score? A better score can unlock significantly lower premiums.

Performance and Service Triggers

Beyond life's big moments, your day-to-day experience with your insurer matters—a lot. Did you have a frustrating claims experience? Does it feel like you can never get your agent on the phone? These are huge red flags.

It’s also worth understanding the difference between insurance agents and brokers to see if you have the right kind of expert in your corner.

The right time to switch is when your policy no longer aligns with your life, your budget, or your service expectations. Don't wait for a disaster to discover you're with the wrong company.

Getting a Handle on Your Current Insurance Policy

Before you even think about shopping for a new insurance policy, you have to get intimate with the one you have right now. It’s a common mistake to only focus on the monthly premium, but the real story is in the details—specifically, on your policy’s declarations page.

Think of this document as your personal insurance blueprint. It lays out exactly what you're covered for. Without this baseline, you can't make a true apples-to-apples comparison with new quotes. You might be tempted by a lower price, only to discover later that you’ve sacrificed critical protection, leaving you dangerously exposed.

What to Look For on Your Declarations Page

Don't let the insurance jargon scare you off. Your declarations page is just a breakdown of what you're paying for. You only need to zero in on a few key areas to understand the full picture.

Here’s what to pinpoint:

- Coverage Limits: This is the absolute maximum your insurer will pay for a covered claim. Find the limits for things like liability, property damage, and any other specific coverages. Do these amounts still feel high enough to protect your assets today?

- Deductibles: This is your out-of-pocket cost before the insurance company starts paying. A $1,000 deductible will give you a lower premium than a $500 one, but ask yourself honestly: could you comfortably write that check tomorrow if you had to?

- Endorsements & Riders: Did you add any extras? Look for things like roadside assistance, rental car reimbursement, or specific coverage for valuables. These add-ons are easy to forget but they contribute to your policy's total value.

Understanding your current coverage is the single most important thing you can do before shopping around. It’s the only way to ensure you're looking for what you actually need, not just chasing a cheaper price tag.

Getting comfortable with these concepts isn't just for personal policies; it's a core principle that applies to protecting a business, too. In fact, many of these ideas are foundational when looking into business insurance basics. Taking just a few minutes to really understand your policy empowers you to make a much smarter switch.

How to Compare New Insurance Quotes Effectively

Alright, you've reviewed your current policy and know what you have. Now for the most important part of switching insurance: getting accurate quotes so you can compare them on an even playing field.

This is where a lot of people stumble. They jump into getting quotes without having their details straight, which leads to estimates that aren't reliable. A little prep work here saves a ton of headaches later.

Before you start, pull together these key documents and pieces of information:

- Your current policy's declarations page (this is your cheat sheet!)

- Driver's license numbers for all drivers on the policy

- Vehicle Identification Numbers (VINs) for all your cars

- The primary garaging address for each vehicle

- A solid estimate of your annual mileage per vehicle

Having this info ready means you can move quickly and get quotes that truly reflect your needs, whether you're using an online tool or talking to an agent like us.

Look Beyond the Monthly Premium

It’s so easy to fixate on the lowest price, but that's often a trap. A cheap policy might hide dangerously low coverage limits or a deductible so high you'd struggle to pay it out-of-pocket after an accident.

The real goal is an "apples-to-apples" comparison. Make sure every quote you get has the exact same coverage limits and deductibles as your current policy. This is the only way to see who is actually offering a better deal for the protection you need. For a deeper dive, check out our guide on home and auto insurance comparison.

Don't let a low premium blind you to what's missing. True savings come from finding a policy that provides robust protection, excellent service, and a competitive price—not just one of the three.

To help you stay organized and compare the things that truly matter, use a simple checklist. This forces you to look at the details, not just the final number.

New Insurance Quote Comparison Checklist

| Feature | Company A Quote | Company B Quote | Company C Quote |

|---|---|---|---|

| Annual Premium | |||

| Deductible (Collision) | |||

| Deductible (Comprehensive) | |||

| Bodily Injury Liability | |||

| Property Damage Liability | |||

| Uninsured Motorist | |||

| Roadside Assistance? | |||

| Rental Reimbursement? | |||

| Customer Service Rating |

This table keeps you focused on the core components, ensuring you’re not accidentally giving up valuable protection for a few dollars in savings.

Assess the Company, Not Just the Policy

Finally, do a little digging into the insurer's reputation. How do they handle claims? A rock-bottom premium from a company with terrible customer service isn't a bargain—it's a future nightmare waiting to happen. Look up their customer satisfaction scores and check their financial strength ratings.

It’s also helpful to understand the bigger picture. According to a detailed insurance industry research from Swiss Re, global insurance premiums were recently projected to grow by just 2% in a single year. That slow growth means insurers are competing fiercely for your business, which puts you in a great position to find high-quality coverage at a fair price.

Making the Switch Without a Coverage Gap

You've done the research and picked your new insurer. Now comes the most critical part: making the actual switch. Getting this wrong can leave you with a dangerous gap in your coverage, putting everything you own at risk.

There's one golden rule I always tell my clients: Never, ever cancel your old policy until your new one is officially in force. I can't stress this enough. You need that new policy in your hand—or at least written confirmation of it—before you even think about calling your old provider.

Your new policy documents will spell out the exact date and time your coverage begins. Your job is to make sure your old policy ends on the same day, or even the day after, to be extra safe. For example, if your new car insurance kicks in on August 15th at 12:01 AM, you should schedule your old policy to terminate on August 15th. This simple overlap prevents any period where you're driving uninsured.

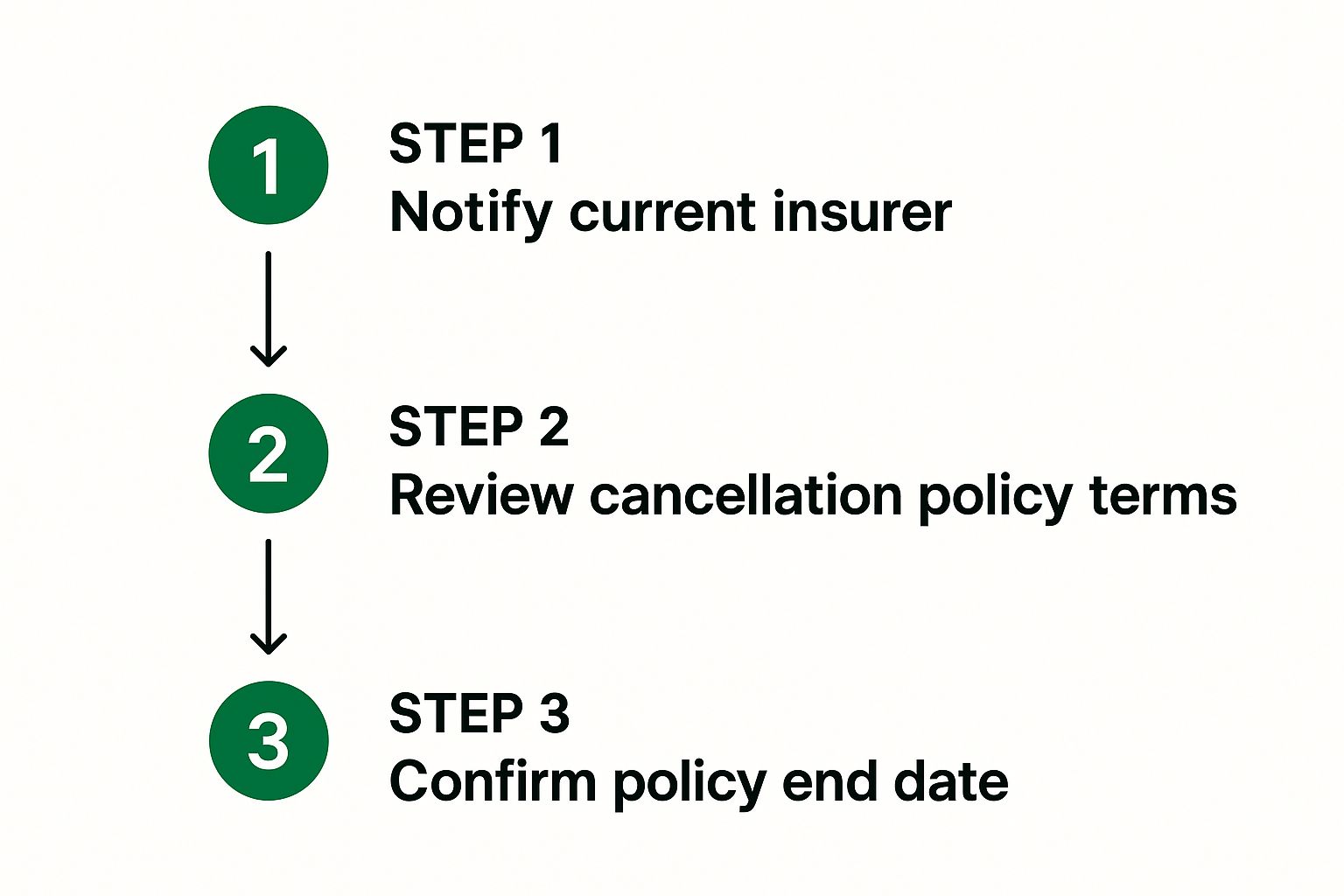

This image lays out the proper sequence for a seamless transition.

Stick to this order—get the new policy, then notify your current insurer, understand their cancellation process, and confirm the end date. It's the only way to guarantee a secure handover.

Tying Up the Loose Ends

Once you’ve started the cancellation, there are just a few administrative tasks left to handle. First, always ask your old insurance company for a written confirmation of cancellation. This piece of paper is your proof that the relationship is over and can save you a massive headache if a billing error pops up later.

Next, keep an eye out for any refund you’re due. If you paid your premium for a full term upfront, you should get a prorated amount back for the unused time. How much you get back and how quickly it arrives can vary, so it pays to follow up.

Finally, you need to inform a few other key players about your new coverage:

- Your Lender: If you have a mortgage or an auto loan, your bank needs to see your new proof of insurance as soon as possible. They won't wait.

- Your Car: Don't forget the basics. Swap out that old insurance card in your glove box with the new one immediately.

Taking care of these small details is just as important as choosing the right policy. For a deeper look into the entire process, check out our complete guide on how to change insurance companies.

Sidestepping the Common Pitfalls of Switching

Knowing the steps to switch insurance is one thing, but sidestepping the common mistakes is what really makes for a smooth transition. I've seen it happen time and time again—people make easily avoidable errors that leave them with surprise bills, weak coverage, or worse, a gap where they aren't insured at all.

The biggest trap? Chasing the lowest price, no matter what. Everyone wants to save money, but fixating only on the monthly premium can be a costly mistake. That super-low price might hide a sky-high deductible or liability limits that are dangerously insufficient.

Think about it: saving $20 a month feels great until a major accident reveals you’re on the hook for tens of thousands of dollars out-of-pocket. That’s a "bargain" that could easily lead to financial ruin.

Don't Get Tripped Up by the Details

Another place people stumble is the paperwork and follow-up. Just buying a new policy isn't the final step. You have to actively manage the transition, and that means tying up all the loose ends.

For example, forgetting to notify your mortgage lender or auto loan company about your new policy can create huge problems. They require proof of continuous coverage, and a lapse in communication can put you in violation of your loan agreement.

You also need to be crystal clear on your old insurer’s cancellation rules.

- Watch for Cancellation Fees: Some carriers will charge you for ending a policy before the term is up. Always ask about this upfront.

- Get the Facts Straight: A small error on your new application, like guessing your annual mileage instead of checking, could be grounds for a denied claim down the road.

- Avoid Double-Paying: Don't just assume your old policy is canceled. Get written confirmation to avoid paying for two policies at once.

The goal here is a seamless handover, not a financial mess. A few extra minutes spent confirming these details with both your old and new providers will ensure your switch is both smart and secure.

By keeping these common traps in mind, you can navigate the process like a pro. For a complete walkthrough, our guide on how to switch insurance providers breaks down every step you need to take.

Your Top Questions About Switching Insurance, Answered

Thinking about switching insurance providers always kicks up a few key questions. It's smart to get these sorted out first, so you can make a change with confidence, knowing you've got all your bases covered. Let's dig into what people ask most.

One of the biggest worries I hear is about credit scores. People ask, "Will shopping around for quotes hurt my credit?" The good news is, it won't. Insurance companies use what's called a "soft inquiry" to check your credit history, which is different from the "hard inquiry" used for a loan application. Soft pulls have no impact on your credit score, so feel free to compare quotes as much as you need.

Can I Switch Insurance at Any Time?

Yes, you can. A common misconception is that you're stuck with your policy until it renews, but that's not the case. You have the right to switch carriers whenever you find a better fit, whether that’s for a better rate or more comprehensive coverage.

If you cancel mid-term, your old insurance company will send you a prorated refund for any premium you've paid for but haven't used. Say you paid for a six-month policy and decide to switch after three months—you should expect to get about half of that premium back.

While you have the freedom to switch anytime, the cleanest way to do it is often right at your renewal date. This sidesteps the whole refund process and makes for a much smoother transition without any administrative headaches.

Are There Penalties for Canceling My Old Policy?

This is a big one, and you absolutely need to check before you jump ship. Most insurers are pretty flexible and won't charge you a dime for leaving. However, some do have a small cancellation fee.

This fee might be a flat rate or a small percentage of your unused premium, often around 10%. The best way to know for sure is to look at your current policy documents or just give your agent a quick call. Getting this cleared up beforehand means you can accurately calculate your real savings and avoid any nasty surprises.

Figuring all this out on your own can feel overwhelming. The team at Wexford Insurance Solutions is here to cut through the confusion, lay out your options clearly, and help you find the right coverage. Explore your options with us today.

What Does Umbrella Insurance Cover? Protect Your Assets Today

What Does Umbrella Insurance Cover? Protect Your Assets Today Understand New York Home Insurance Rates | Get the Best Deals

Understand New York Home Insurance Rates | Get the Best Deals