When you hear "New York," you probably think "expensive." But when it comes to home insurance, the reality might just surprise you.

On average, New York home insurance rates are about $1,229 per year. That's a number that often makes homeowners do a double-take, especially when you realize how much lower it is than the national average.

What To Expect From New York Home Insurance Rates

Think of New York's insurance market like its geography. The premium for a quiet home in the Finger Lakes is a world away from what you’d pay for a brownstone in Brooklyn or a coastal house on Long Island. While averages are a decent starting point, they don’t tell the whole story.

Your specific rate is a unique recipe with many ingredients. The statewide average is a bit misleading because it blends the sky-high costs of dense urban areas with the much lower rates found in sleepy suburban towns and rural counties.

Why Averages Are Just The Beginning

Knowing the average is one thing, but understanding the range of potential costs is what really matters. In fact, research shows that the difference between the cheapest and most expensive quotes for the same home in New York can be a whopping $1,429. That number alone should tell you how critical shopping around really is.

Let's take a closer look at the numbers.

New York Home Insurance Rates At A Glance

Here’s a quick summary of how New York stacks up against the rest of the country.

| Metric | Annual Premium |

|---|---|

| New York State Average | $1,229 |

| National Average | $2,423 |

| Potential Premium Range in NY | Up to $1,429 Difference |

The gap is striking, isn't it? As of 2023, New Yorkers paid nearly $1,200 less than the typical American homeowner. Despite what you might hear about rising costs, the state as a whole remains relatively affordable for home insurance. You can get more details on how these rates are calculated from sources like MoneyGeek.com.

The single most powerful tool a homeowner has is comparison shopping. Simply accepting the first quote you receive could mean leaving hundreds, or even thousands, of dollars on the table each year.

To really figure out what you'll pay, you have to look past the big-picture numbers and focus on the details that insurers care about. These are the big three:

- Your Exact Location: Your zip code is a huge factor. It tells insurers about local risks, from crime rates to the likelihood of a nasty nor'easter.

- Your Home's Details: The age of your home, its construction materials (brick vs. wood frame), and the condition of the roof all paint a picture of its risk profile.

- Your Chosen Insurer: Every company has its own secret sauce for calculating rates. One insurer might penalize you for an old roof while another gives you a discount for a new security system. This is why quotes vary so much.

Before we dig deeper into these factors, it helps to know who the key players are. Our guide to the best home insurance in New York is the perfect place to start your search.

Why Your Zip Code Shapes Your Premium

When an insurance company looks at your application, your zip code isn't just a mailing address—it's the single most important piece of the puzzle. Think of it as the foundation upon which your entire premium is built. Everything from local crime statistics to the likelihood of a blizzard is tied directly to where your home is.

This is why New York home insurance rates can feel like a tale of two different states. A policy for a house in a quiet upstate town like Ithaca might cost just a fraction of what someone in a dense Brooklyn neighborhood pays for the exact same coverage. The risks are simply worlds apart.

Urban Density And Its Unique Risks

In places like New York City, insurers see a cluster of risk factors that naturally drive up costs. For starters, higher property values mean any claim—whether it's from a fire or a burst pipe—is going to be far more expensive to settle. The sheer volume of people also translates to higher rates of theft and vandalism.

On top of that, the very nature of city living brings its own set of challenges. Insuring a co-op or condo means underwriters have to weigh complex factors like the building's overall condition, shared walls, and the potential for damage to spread quickly from one unit to another.

Between 2020 and 2023, insurance premiums for apartment buildings with 50 or more units more than doubled in Brooklyn, while Manhattan and Queens saw increases of over 50%. This spike shows just how intense the pressure is on urban insurance markets, far outpacing national trends. You can read more about what's driving these soaring city rates and how it's hitting property owners.

Regional Threats Beyond The City

Geography's influence on your premium extends well beyond the five boroughs. Every region in New York has its own distinct risk profile that insurers have to bake into their pricing.

- Long Island's Coastal Exposure: Homes along the coast face a constant threat from hurricanes, nor'easters, and flooding. The potential for catastrophic wind and water damage makes insuring these properties inherently more expensive.

- Upstate's Winter Weather: Head north, and the risks change completely. Heavy snowfall can lead to roof collapses from ice dams, and frigid temperatures raise the odds of pipes freezing and bursting, causing major water damage.

Your home insurance rate is a direct reflection of your location's story. An insurer is essentially betting on how likely it is that your home will face a costly claim, and your zip code tells them the odds.

In the end, your address gives an underwriter a detailed snapshot of risk. It tells them about the local fire department's response time, the age of surrounding homes, and how often severe weather claims pop up in your area. This is why two homeowners with identical houses can see drastically different New York home insurance rates just a few counties apart.

What Really Drives Your Home Insurance Rate?

While your zip code gives insurers a starting point, it's the specific details of your home and your personal history that truly shape your final premium. Think of insurance companies as professional risk assessors—every piece of information they gather helps them calculate the odds of you needing to file a claim.

It's a lot like how a car's safety features affect its insurance cost. A modern car loaded with airbags, anti-lock brakes, and a reinforced frame is going to be cheaper to insure than a vintage model without those protections. The same principle applies to your house. Every single element, from the roof to the foundation, helps build its overall risk profile.

Your Home’s Unique Story

Insurers take a hard look at the physical nuts and bolts of your home to gauge how well it can stand up to common threats like fire, high winds, and water damage. For example, an older home with its original knob-and-tube wiring is a much bigger fire hazard than a brand-new build with a modern electrical panel and circuit breakers.

Here are a few of the key property details that directly impact your New York home insurance rates:

- Age and Construction: Older homes can have outdated plumbing and electrical systems, which raises the chances of a major (and expensive) claim. The materials matter, too—a solid brick home often gets a better rate than a wood-frame one simply because it’s more fire-resistant.

- Roof Condition: The age and material of your roof are huge factors. A new roof with durable architectural shingles can handle a storm far better than a 20-year-old one with curling, brittle shingles. To an insurer, a new roof means lower risk.

- Heating System: How you heat your home matters. A modern, well-maintained furnace is seen as much safer than an old oil tank in the basement or a wood-burning stove, both of which come with higher risks of fires or leaks.

- Foundation Integrity: The stability of your home's foundation is non-negotiable for insurers. Foundation problems are notoriously expensive to fix, making this a top concern during underwriting. It's crucial to understand what your policy covers, and you can learn more in our guide on whether homeowners insurance covers foundation repair.

How Your Personal Profile Fits In

It’s not just about the house itself. Insurance carriers also consider your personal history to get a sense of your overall risk level. These factors give them a window into how you handle your responsibilities, both financially and as a property owner.

An insurance score isn't the same as a credit score, but your credit history heavily influences it. Carriers have found a strong link between how someone manages their finances and the likelihood they'll file an insurance claim.

These are the personal details that often move the needle on your premium:

- Insurance Score: New York law allows insurers to use a credit-based insurance score when setting your rate. A solid history of paying bills on time and managing debt responsibly usually translates into a lower premium.

- Claims History: If you’ve filed several claims in the past few years, you can expect to pay more. Insurers see a pattern of claims as a red flag that you might file more in the future.

- Safety and Security Devices: Taking steps to protect your home can pay off with real discounts. Installing smoke detectors, a central burglar alarm, or even just good deadbolt locks shows an insurer you're proactive, which helps lower their risk and your rate.

How National Trends Impact Your Local Policy

It’s tempting to think your home insurance premium is a hyper-local thing, a number cooked up based solely on your house and your ZIP code. While those local details are absolutely a huge part of the equation, what happens across the country plays a much bigger role than most people realize.

A hurricane in Florida or a wildfire in California doesn’t just stay there. The financial fallout ripples across the entire insurance industry, and those waves can and do wash up on New York's shores, impacting your rates.

Think of it like this: all the insurance companies contribute to one massive, nationwide pot of money. When a major disaster strikes, insurers have to pay out billions in claims, draining that pot in a hurry. To keep the whole system afloat, they have to refill it. How? By adjusting premiums for everyone, even for homeowners in states like New York that weren't directly hit.

The Hidden Player: Reinsurance

To really get why a storm in Miami can raise your bill in Albany, you need to understand something called reinsurance. It’s a simple but powerful concept: reinsurance is just insurance for insurance companies.

Your insurance provider buys its own policy from a massive, often global, reinsurance company. This protects them from catastrophic losses, like the kind that happen after a huge natural disaster. So, when a reinsurer has to pay out billions for hurricane damage, they turn around and raise their prices for all their clients—the insurance companies you know. Your insurer, now facing higher costs, has little choice but to pass some of that increase on to you.

It sounds strange, but it's true: a hurricane making landfall in Miami can make your home insurance policy in Albany more expensive. That’s the interconnected nature of the modern insurance market. Reinsurance is a global business, so even international disasters can eventually nudge your local premiums upward.

A Nationwide Squeeze On Premiums

This is a big reason why homeowners everywhere are feeling the pressure. Across the U.S., home insurance costs have been climbing relentlessly, jumping by an average of 20% nationwide in just the two years before 2024. You can find more details on how national trends are surging insurance costs on nar.realtor.

This isn't just a random spike. It's driven by a perfect storm of factors: more frequent and severe weather events, inflation driving up the cost of lumber and labor for repairs, and insurance carriers simply becoming more cautious about the risks they're willing to take on.

So, when you see your premium go up, remember that it's not just a New York story. It's a reflection of a much larger market correction as the entire industry adapts to a new reality of risk, both from the climate and the economy. It helps explain the frustrating reality of why your rates can climb even if you’ve been a perfect customer and never filed a claim.

Practical Ways To Lower Your Home Insurance Bill

Knowing what drives your premium is one thing, but actually doing something about it is where the real savings begin. While you can't change your zip code, you have far more control over your New York home insurance rates than you might realize. A few smart moves can shave a surprising amount off your bill without leaving you underinsured.

Think of it like giving your policy a financial checkup. Just like you'd go through your budget to find places to save, you can look at your coverage and find opportunities to trim the fat, ensuring you're paying for what you actually need.

Smart Policy Adjustments

Some of the most direct ways to cut costs involve simple tweaks to the structure of your policy itself. These are the levers you can pull to immediately see a difference in your premium.

- Raise Your Deductible: This is the amount you pay out of pocket on a claim before your insurance company starts paying. If you increase your deductible from $500 to $1,000, for example, you're taking on a little more of the initial risk. In return, your insurer will almost always lower your premium.

- Bundle Your Policies: If you have your auto insurance with one company and your home insurance with another, you're probably leaving money on the table. Most carriers offer a significant discount—often between 10% and 25%—for bundling home and auto policies together. It's an easy win that also simplifies your life.

- Review Your Coverage Limits: Life changes, and so should your insurance. Take a hard look at your policy every year. Are you still paying for extra coverage on valuables you sold? Are your personal property limits higher than they need to be? Don't pay for protection you no longer need.

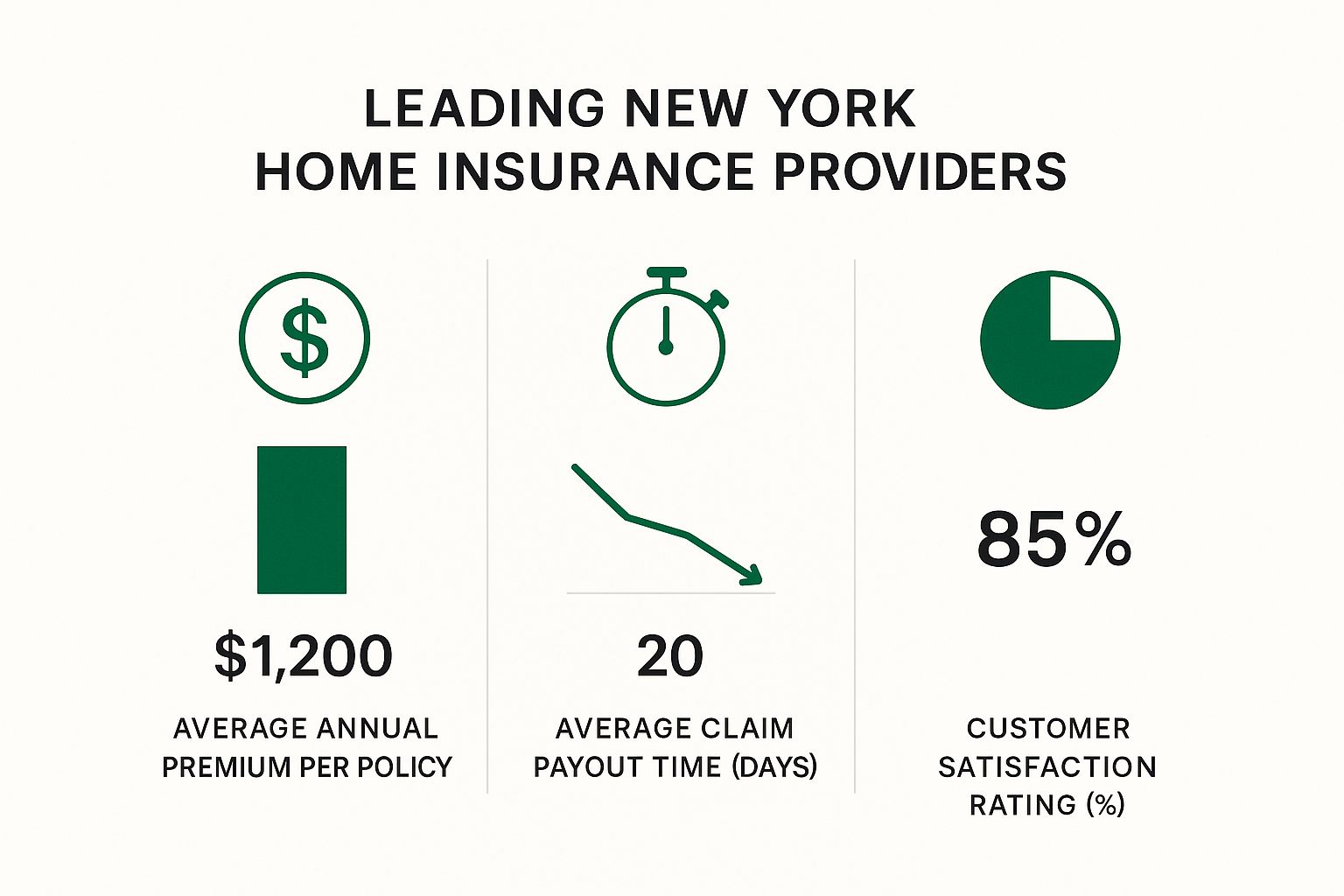

This breakdown shows how some of New York's top providers stack up on cost, claim handling, and what customers think of them.

As you can see, the cheapest policy doesn't always come from the company with the best service. It’s all about finding that sweet spot between a price you can afford and a company you can trust.

Proactive Home Improvements

Making your home safer and more resilient isn't just a good idea—it can directly translate into lower insurance premiums. Insurance companies love homeowners who take steps to prevent claims from happening in the first place.

"Every discount you qualify for is a piece of your risk that an insurer is willing to write off. Asking your agent for a full discount review is one of the quickest and easiest ways to find savings you might be missing."

If you're planning some home projects, consider these upgrades. And don't forget to tell your insurance agent about them when you're done!

- Upgrade Your Utilities: Old electrical wiring, outdated plumbing, and aging heating systems are common culprits for fires and water damage. Modernizing them drastically cuts that risk, and insurers often reward it with a discount.

- Install Protective Devices: Things like centrally monitored smoke detectors, security systems, and automatic water shut-off valves show you're serious about protecting your home. In coastal areas, even adding storm shutters can make a difference.

- Reinforce Your Roof: When it's time for a roof replacement, opting for stronger, impact-resistant materials can earn you a hefty credit, particularly in parts of the state that see nasty weather.

Finding ways to save can feel like a lot to juggle. This table breaks down some of the most effective strategies by what's involved, the savings you can expect, and how much work it takes on your end.

Effective Ways To Reduce Your NY Home Insurance Premium

| Strategy | How It Works | Potential Savings | Effort Level |

|---|---|---|---|

| Increase Your Deductible | You agree to pay more out-of-pocket for a claim, reducing the insurer's risk. | 5% – 20% | Low |

| Bundle Home & Auto | Insure both your home and car(s) with the same company for a multi-policy discount. | 10% – 25% | Low to Medium |

| Improve Home Security | Install centrally-monitored fire and burglar alarms to prevent theft and damage. | Up to 20% | Medium |

| Strengthen Your Home | Upgrade roofing, windows, or utilities to better withstand storms and system failures. | 5% – 15% | High |

| Improve Your Credit Score | A better credit history can lead to a lower "insurance score" and better rates. | Varies Significantly | High (Ongoing) |

| Shop Around Annually | Compare quotes from multiple insurance companies to ensure you have the best rate. | Can be 20%+ | Medium |

Each of these steps puts you more in control of your premium. You can start with the low-effort items and work your way up to bigger projects over time to maximize your savings.

The Power of Shopping Around

Finally, the single most powerful tool you have is your ability to shop around. Never assume that the rate you have now is the best one out there. The insurance market is incredibly competitive, and the company that was cheapest last year might not be this year.

Make it a habit to get quotes from at least three different carriers every year or two. This is the only way to know for sure that you aren't overpaying. For an even more detailed look, you can explore our complete guide on how to lower home insurance premiums to find more actionable strategies.

How to Navigate the New York Insurance Market

Finding the right coverage at a fair price doesn’t just happen—you have to make it happen. If there's one thing to take away, it's this: in a market as complex as New York's, being an informed, proactive homeowner is the best tool you have for managing your New York home insurance rates.

This is about more than just grabbing the lowest quote. It means truly understanding the risks specific to your area, knowing what details about your home are driving your premium up or down, and actively looking for discounts. Your goal shouldn't be to find the cheapest plan, but the smartest one for your home and family.

Your Action Plan for Finding the Best Policy

When you start comparing quotes, you'll quickly realize it's not all about the bottom-line annual premium. To do a real side-by-side comparison, you need to dig a little deeper.

Here’s what to look for in every offer:

- Coverage Limits: Is the dwelling coverage high enough to completely rebuild your home from the ground up if the worst happens? Have you checked if the personal property limits are enough to replace your belongings?

- Deductible Amount: This is what you'll pay out-of-pocket before insurance kicks in. A tempting low premium might be hiding a deductible that's way too high for your emergency fund to handle.

- Company Reputation: Look up customer service reviews and claim satisfaction scores. A cheap policy from a company that fights you during a crisis isn't a bargain; it's a liability.

The real goal here is to strike that perfect balance between cost, coverage, and your confidence in the insurance carrier. Never sacrifice essential protection just to save a few dollars.

One of the most effective ways to simplify this and often save money is by bundling your policies. We break down exactly how this works in our guide on home and auto insurance comparison, which can lead to big savings and make your life a whole lot easier.

Your New York Home Insurance Questions, Answered

Getting your head around home insurance can feel like a chore, and it's natural to have questions. Let's tackle some of the most common ones we hear from homeowners all over New York to help clear things up.

Why Did My Rates Go Up If I Never Filed a Claim?

This is easily one of the most frustrating things a homeowner can experience. You’ve been a model customer with a perfect claims history, yet your bill goes up. What gives?

The reality is that your individual record is only one piece of the puzzle. Insurance rates are often influenced by broad trends that have nothing to do with you personally. Think about the rising cost of lumber and labor, or an increase in severe storms across the state—these factors drive up the potential cost of future repairs for everyone, and insurers adjust their rates to prepare for that risk.

It’s a bit like your grocery bill. You might be a savvy shopper, but if the cost of fuel to transport food goes up, everyone pays a little more for a gallon of milk. In the same way, widespread events increase the overall cost for the entire insurance pool.

Here's something every New Yorker should know: a standard homeowners policy does not cover damage from flooding. This is a massive gap in coverage, especially if you live near the coast, a river, or even just a low-lying area. You have to buy flood insurance separately, either through the National Flood Insurance Program (NFIP) or a private company.

How Much Home Insurance Coverage Do I Really Need?

This is where many people get tripped up. The right amount of coverage has nothing to do with what you could sell your house for. Instead, it’s all about replacement cost.

Replacement cost is what it would take to rebuild your home from scratch, on your current property, using similar materials at today's prices. For your personal belongings, a good rule of thumb is to aim for coverage that's between 50% and 70% of your dwelling coverage limit.

Figuring out the exact replacement cost is crucial, and it’s best to work with an experienced agent to get an accurate calculation. As you explore your options, it's always smart to compare home insurance quotes to see how different carriers price their policies and what they include.

At Wexford Insurance Solutions, our job is to bring you clarity and help you find the right protection for your home and family. Get your personalized insurance review today!

How Do You Switch Insurance Companies? The Easy Guide

How Do You Switch Insurance Companies? The Easy Guide How to Read Insurance Policy: Simplified Guide

How to Read Insurance Policy: Simplified Guide