When you're a sole proprietor, your business isn't just a job—it's you. The law sees no difference between your business assets and your personal assets. That's where general liability insurance for a sole proprietorship comes in. It’s not just another business expense; it’s the critical firewall that keeps a business mishap from turning into a personal financial disaster.

Think of it as the foundational safety net protecting you from lawsuits and claims that could otherwise come after your personal bank account.

Your Business and You Are Legally One and the Same—Get Protected

Running a sole proprietorship offers incredible freedom, but it's a bit like walking a tightrope without a net. Since there's no legal separation between you and the business, if someone sues your company, they're really suing you. Suddenly, your savings, your car, and even your house could be on the line to cover legal bills and settlements.

Don't make the mistake of thinking you're too small to face a big problem. A simple, everyday accident can quickly spiral out of control.

A Costly Accident Can Happen to Anyone

Imagine you're a freelance graphic designer meeting a client at their office. You go to plug in your laptop, trip over a cord, and spill coffee all over their server. The equipment is fried, and they lose critical data.

Next thing you know, you're hit with a lawsuit for the $15,000 server replacement plus the income they lost while their system was down. Without insurance, that entire bill comes straight out of your pocket, potentially draining your life savings. This isn't an exaggerated "what if"—it’s a real-world example of why general liability coverage is essential for survival.

Why Protection Is More Important Than Ever

More and more business owners are waking up to this reality. A recent survey showed that 92% of small business owners now carry some form of business insurance. Even more telling, the number of businesses with general liability coverage jumped from 51% to 62% in just one year. That's a clear sign that entrepreneurs are getting serious about protecting themselves.

General liability insurance acts as your financial shield. It's designed to cover legal defense costs, settlements, and court judgments if your business is accused of causing bodily injury, property damage, or advertising injury to someone else.

This coverage is what lets you operate with confidence, knowing a single mistake won't derail your entire financial life. While it’s the perfect starting point, it's also smart to understand the bigger picture of what's out there. To get a better feel for your options, you might want to look into the different commercial insurance types available. For any sole proprietor, though, this policy is the key to building a stable, long-lasting business.

What General Liability Insurance Actually Covers

To really see the value in general liability insurance for a sole proprietorship, you need to know what you’re actually paying for. It's best to think of your policy not as a single shield, but as a three-part defense system. Each part is built to protect you from a different kind of common, and potentially costly, business accident.

Once you break down these core coverages, the insurance jargon starts to make sense, and you can see how a policy would work for you in a real-world scenario. Let's unpack the three main pillars of protection that hold up your coverage.

Bodily Injury Coverage

This is the part of general liability insurance everyone thinks of first. It kicks in if your business activities, services, or even your products cause physical harm to someone else (a "third party," in insurance-speak). This coverage is non-negotiable, as the medical bills and legal fees from an injury claim can easily sink a small business.

Let’s say you're a home-based caterer. A client stops by for a tasting, trips over a cooler you left in the hallway, and breaks their wrist. Your policy would step in to handle their medical bills and cover your legal expenses if they decide to sue. Without it, you’d be on the hook for every last dollar.

Property Damage Coverage

Just like the name suggests, this part of your policy covers the cost if you accidentally damage someone else’s property while on the job. For any sole proprietor who works at a client’s home or office—think consultants, cleaners, or handymen—this protection is an absolute must-have. Accidents happen, but this coverage makes sure a simple mistake doesn't turn into a financial disaster.

Picture this: you’re an IT consultant installing a new network in an office. While moving a server rack, you lose your grip, and it smashes into a custom glass wall. The client is now demanding you pay for the $8,000 replacement. This is exactly what general liability is for. Your policy would cover the repair costs, keeping your personal assets safe.

Your policy is your first line of defense against claims that you caused physical harm to someone or damaged their property. It pays for medical bills, repair costs, and—critically—the legal fees to defend you, even if the lawsuit is baseless.

Personal and Advertising Injury Coverage

This final pillar is less about physical mishaps and more about damage to a person's reputation or intellectual property. It protects you from claims like libel, slander, copyright infringement, or using someone else's advertising idea. In an age where every sole proprietor is a marketer on social media, this coverage has become more important than ever.

Here’s a simple example: You’re a freelance graphic designer trying to build your brand. You find a cool photo online and use it in a promotional post, not realizing it was copyrighted. The photographer finds out and sues you. Your general liability policy can cover the legal costs and any potential settlement from this non-physical, advertising-related claim.

These three coverages work together to create a safety net for your business, but it's crucial to remember that every policy has its limits. If a claim is big enough to exceed your policy’s maximum payout, you could still be in trouble. That’s why many business owners also look into commercial umbrella insurance for an extra layer of protection. You can learn more about what commercial umbrella insurance is in our detailed guide.

Seeing how these pieces fit together helps you view your policy not as a mandatory expense, but as a fundamental tool for your business's survival.

How Insurance Companies Price Your Policy

Figuring out the cost of general liability insurance for a sole proprietorship isn't as simple as picking a product off a shelf. Insurance companies are essentially risk analysts. They'll look at your business from every angle to calculate a premium that perfectly matches your specific level of exposure.

Think of it as a "risk scorecard." Different aspects of your business add or subtract points, and that final score translates directly into what you pay. A higher score means more perceived risk, which leads to a higher premium. For example, a self-employed handyman working with power tools on client properties will always have a higher risk score than a virtual assistant working from a home office. Understanding what they look for demystifies your quote and shows you what parts you can actually control.

Your Industry and Perceived Risk

The single biggest factor dictating your premium is your line of work. Every profession comes with its own set of built-in risks, and insurers have decades of data on this. They know a freelance photographer is far more likely to see a claim from a guest tripping over a light stand than a graphic designer working alone at their desk.

They sort professions into different risk levels, which makes a huge difference in cost.

- Low-Risk Sole Proprietors: This bucket usually includes consultants, writers, and digital marketers. The common thread is minimal public interaction and no heavy equipment.

- Moderate-Risk Sole Proprietors: Think photographers, caterers, or cleaners. These pros are out interacting with the public and working on-site, which naturally bumps up the chances of an accident.

- High-Risk Sole Proprietors: This is where you'll find landscapers, general contractors, and other tradespeople. The physical nature of their work means a much higher potential for serious property damage or injuries.

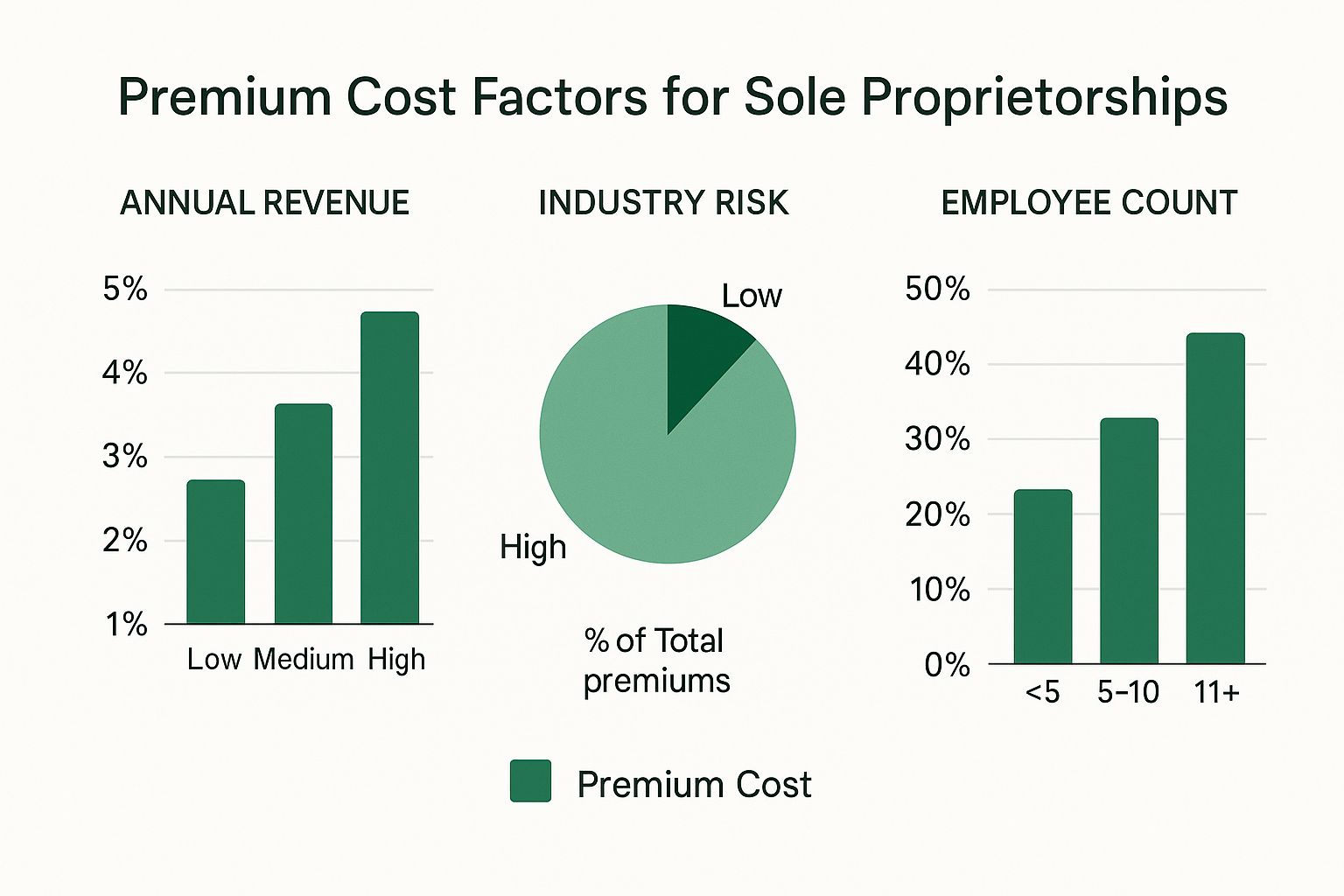

This chart breaks down how your industry and revenue directly impact the final cost of a policy.

As you can see, businesses in riskier fields don't just pay more—they make up a bigger slice of the total premiums paid, which shows just how central this factor is to the whole pricing model.

Annual Revenue and Business Location

How much money you make also plays a big part. From an insurer's perspective, higher revenue means more business activity—more clients, more projects, and simply more opportunities for something to go wrong. A business pulling in $200,000 a year is seen as having much greater exposure than one earning $40,000, and the premium will reflect that.

Your zip code matters, too. A sole proprietor in a major city might pay more than one in a quiet rural town because of higher local litigation rates, different state laws, and even higher repair costs.

Your Claims History

Finally, your track record speaks for itself. If you've filed a bunch of liability claims in the past, an insurer is going to assume you're more likely to file another one soon. It's a direct indicator of your risk profile.

A clean claims record is one of your best assets when seeking affordable insurance. It demonstrates to providers that you are a responsible business owner who actively manages and minimizes risks.

A history of frequent claims can lead to a rude awakening with sky-high premiums. In some cases, it can even make it tough to find a company willing to cover you at all. Running a safe operation isn't just good practice; it's a financial strategy that pays off year after year.

So, what does this all boil down to in dollars and cents? Costs can vary wildly, but looking at some real-world numbers gives you a solid starting point for your budget. The table below shows some typical monthly premium ranges for different sole proprietorships.

Estimated Monthly General Liability Costs for Sole Proprietors

| Profession | Typical Risk Level | Estimated Monthly Premium |

|---|---|---|

| Freelance Writer | Low | $15 – $30 |

| Photographer | Moderate | $35 – $55 |

| Handyman | High | $60 – $90 |

| Landscaper | High | $50 – $80 |

| IT Consultant | Low | $25 – $40 |

| Caterer | Moderate | $45 – $70 |

As you can see, the gap between a low-risk and high-risk profession is significant. Data from U.S. insurers shows the median annual premium is around $500, which is about $42 per month. But that average hides the details—a yoga instructor might pay as little as $12 per month, while a higher-risk HVAC contractor could easily see premiums around $63 monthly. If you want to dive deeper, you can read more about these insurance cost breakdowns and find more insights to help you plan.

Getting Your First General Liability Policy

Diving into the world of business insurance can feel a little overwhelming at first. But getting your first general liability policy is actually a pretty straightforward process once you break it down.

Think of it like getting ready for a road trip. You wouldn't just jump in the car and start driving; you’d gather your maps, check the oil, and plan your route. A little prep work upfront makes the entire process of getting insured much, much smoother.

Before you even think about calling an agent or filling out an online form, spend a few minutes getting your business details in order. This simple step will save you from scrambling for information later and helps ensure the quotes you get are genuinely accurate.

Gather Your Business Information

To give you a quote that actually fits your business, an insurance provider needs a clear picture of what you do. They’re not trying to be nosy—they just need the right data to figure out your level of risk. Having these details on hand can turn the application process from a headache into a ten-minute task.

Here’s what you’ll almost always need:

- Business Name and Address: The official name you work under and your main business location.

- Tax ID Number: For most sole proprietors, this is simply your Social Security Number (SSN). If you have an Employer Identification Number (EIN), have that ready instead.

- Annual Revenue Estimate: Your best guess at your gross income over the next 12 months.

- Detailed Business Description: Be specific about everything you do. An incomplete or vague description could get a future claim denied.

Honesty is absolutely critical here. If you’re a handyman who also does a bit of minor plumbing on the side, you have to disclose that. Trying to hide certain activities to snag a lower premium is a huge gamble that could leave you with no coverage when you need it most.

Compare Quotes From Multiple Providers

Once you've got your info organized, it’s time to shop around. Please don't just take the first quote you see! Premiums for the exact same coverage can vary wildly from one company to the next.

Look for insurers who specialize in small businesses or, even better, your specific industry. They'll have a much better handle on the unique risks you face. As you compare, make sure you're looking at policies with the same coverage limits and deductibles—this is the only way to do a true apples-to-apples comparison. It's a vital step to finding the right general liability insurance for a sole proprietorship without overpaying.

Don't let price be your only guide. The cheapest policy is rarely the best deal. Pay close attention to the insurer's reputation for customer service and how they handle claims. A slightly higher premium is often worth it for a company that will actually be there for you when things go wrong.

Review and Finalize Your Policy

After you’ve picked a provider, they’ll send over the final policy documents. Before you sign anything, take a deep breath and actually read the key sections. This isn't just boring paperwork; it's the contract that spells out your financial protection.

Focus on these three things:

- Coverage Limits: Confirm the maximum amount the policy will pay per incident (the "per occurrence" limit) and in total for the year (the "aggregate" limit).

- Exclusions: Pay very close attention to what is not covered. Things like professional mistakes or employee injuries are almost always excluded and need their own separate policies.

- Deductible: Know exactly how much you have to pay out-of-pocket on a claim before your insurance kicks in.

Finally, ask if bundling your general liability with commercial property insurance in a Business Owner's Policy (BOP) makes sense for you. If you have business equipment or a dedicated office space, a BOP can often give you better coverage for less money than buying two separate policies.

Taking these steps ensures you end up with the right protection and real peace of mind. For a deeper dive, check out our full guide on general liability insurance for sole proprietors to learn even more.

What Your General Liability Policy Will Not Cover

Knowing what a general liability insurance policy for a sole proprietorship protects is only half the story. The other, equally critical half, is understanding exactly where that coverage stops. It's a common and costly mistake to view this policy as a complete shield against every possible business mishap.

Think of general liability as your frontline defense against claims from outsiders—clients, vendors, or the public—for physical injuries, property damage, or advertising mishaps. It’s fantastic for that. But it has very clear boundaries, and many of the risks you face as a business owner fall well outside of them.

Professional Errors and Negligence

This is probably the biggest point of confusion for service-based sole proprietors. General liability is all about accidents and tangible harm, like a customer slipping on a wet floor in your office. It does not cover the financial fallout a client experiences because of a mistake you made in your professional work.

For instance, if you're a marketing consultant and your campaign advice leads to a major financial loss for your client, your general liability policy won't cover a dime of it. That’s a job for a separate policy called Errors & Omissions (E&O), also known as professional liability insurance. It’s specifically designed to protect you from claims of negligence in your professional services.

Employee Injuries

The moment you hire someone—even a single part-time assistant—your general liability policy no longer covers their injuries if they happen on the job. This is a hard-and-fast rule. Workplace injuries fall exclusively under workers' compensation insurance.

If that employee trips and breaks their arm while working for you, workers' comp is what pays for their medical treatment and lost income. Going without it doesn't just expose you to a lawsuit from the employee; you could also face steep fines and penalties from the state. You can dive deeper into the differences between employers' liability insurance vs workers' compensation to get a better handle on your responsibilities.

Your general liability policy is your shield against external claims from clients and the public. It is not designed to cover internal operational risks like employee injuries or damage to your own business assets. Recognizing these gaps is the first step toward building a complete safety net.

Other Common Exclusions

Beyond those two big ones, your standard general liability policy has a few other notable blind spots. Pinpointing these gaps is key to making sure you aren't left exposed.

Here are a few more things that are almost always excluded:

- Damage to Your Own Property: If a pipe bursts and ruins your work computer and inventory, general liability won't help you replace it. That's what commercial property insurance is for.

- Cyber Incidents: If you get hacked and your client's private data is stolen, general liability won't cover the immense costs of notifying them and dealing with the breach. You'd need a dedicated cyber liability policy for that.

- Work-Related Auto Accidents: Got into a fender bender while driving to meet a client? Your personal car insurance might deny the claim because you were using the vehicle for business. This risk requires a commercial auto policy.

Understanding these exclusions isn't about being negative; it's about being prepared. It allows you to build a smart, layered insurance strategy that truly protects the business you’ve worked so hard to create.

Common Questions from Sole Proprietors

Even after you get the basics down, you're bound to have some practical questions when you're the one running the show. Let's tackle some of the most common ones we hear about general liability insurance for a sole proprietorship.

Think of this as bridging the gap between knowing what a policy is and understanding how it actually works for you.

Do I Still Need Insurance If I Work from Home?

Yes, absolutely. This is one of the biggest misconceptions out there. Many people assume their homeowner's or renter's policy has them covered, but those policies almost always exclude business-related incidents.

If a client swings by your home office and trips over a power cord, or a courier slips on your icy porch while delivering a business package, your personal insurance won't touch it. General liability is specifically designed to fill that crucial gap, protecting you even when your business address is also your home address.

What Is the Difference Between General and Professional Liability?

The easiest way to think about it is "doing" vs. "advising."

General liability is for tangible, physical mishaps—the things you do. It covers claims for bodily injury (like the classic "slip-and-fall") or when you accidentally damage someone else's property.

Professional liability, which you'll often hear called Errors & Omissions (E&O) insurance, is all about the financial fallout from your professional services or advice—the things you know. It steps in when a client claims you were negligent, missed a critical deadline, or gave bad advice that cost them money.

General liability is for accidents in the physical world. Professional liability is for the financial consequences of your expertise. If you provide any kind of service, you probably need both.

How Do I Add a Client as an Additional Insured?

This comes up a lot, especially when you land a bigger client. They want to be sure your insurance policy also protects them from any liability stemming from the work you're doing for them. Don't worry, it's a simple process.

All you have to do is contact your insurance provider with your client’s full legal name and address. They’ll add what’s called an “additional insured endorsement” to your policy. Some insurers do this for free, while others might charge a small fee. While you're at it, it's also a good idea to understand the broader small business insurance requirements that might affect your work.

Navigating insurance is always easier with an expert guide. The team at Wexford Insurance Solutions is here to answer your questions—big or small—and help you find the exact coverage you need. Secure your peace of mind and protect your hard work. Get in touch with us.

How to Read Insurance Policy: Simplified Guide

How to Read Insurance Policy: Simplified Guide Affordable Commercial Auto Insurance – Save on Your Business Coverage

Affordable Commercial Auto Insurance – Save on Your Business Coverage