Think of your insurance policy as having a yearly budget for claims. The aggregate insurance coverage is that total budget—it’s the absolute maximum amount your insurer will pay out for all covered claims during your policy term, which is typically one year.

It acts as the ultimate safety net for your business, no matter how many individual incidents pop up along the way.

Your Policy’s Total Safety Net Explained

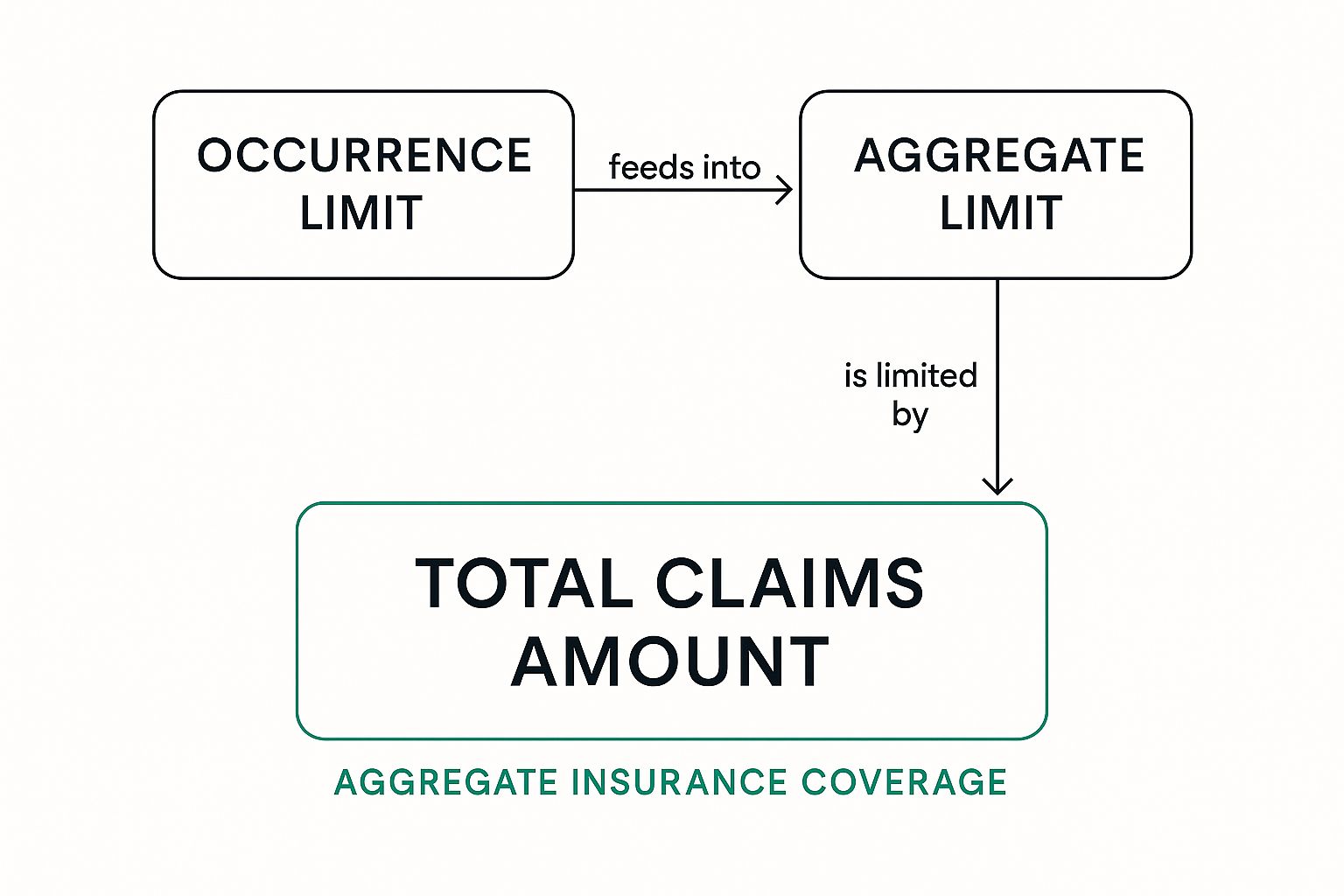

When you get a liability policy, two numbers jump out as critically important: the per-occurrence limit and the aggregate limit. It's easy to mix them up, but they serve very different functions.

The per-occurrence limit is the most your policy will pay for any single incident. On the other hand, the aggregate limit is the grand total—the ceiling for all claims combined over the entire policy year.

Let’s walk through a real-world example. Say your policy has a $1 million per-occurrence limit and a $2 million aggregate limit.

A customer slips and falls in your store. The resulting claim costs $750,000. Because this is below your $1 million per-occurrence limit, you're covered. Later that year, a product malfunction leads to a separate claim for $500,000. Again, no problem. A third incident costs $400,000.

So far, your policy has paid out $1.65 million ($750,000 + $500,000 + $400,000). You’re still safely under your $2 million aggregate limit.

But what happens if a fourth claim comes in for $500,000? Your policy has only $350,000 left in its "budget" for the year ($2 million – $1.65 million). The insurer will pay that $350,000, but you're on the hook for the remaining $150,000. Once that aggregate limit is hit—or "exhausted"—your coverage for that year is effectively done.

This structure is a fundamental part of most commercial insurance, including what you'd typically find in a business owner's policy.

This image does a great job of showing how individual claims add up and chip away at your total aggregate coverage.

As you can see, each claim payment reduces the total amount of protection you have left for the rest of the policy period.

Key Insurance Limits At A Glance

Getting these terms straight is key to managing your business's financial risk. This table breaks down the core differences between the limits you’ll see in your policy.

| Limit Type | What It Covers | Example Scenario |

|---|---|---|

| Per-Occurrence Limit | The maximum payout for a single event or incident. | A faulty installation causes a fire, leading to a $750,000 claim. This single payment is covered under the per-occurrence limit. |

| Per-Claim Limit | The maximum payout for any single claim, often used in professional liability. | A client sues your consulting firm for bad advice. The $200,000 settlement is paid under the per-claim limit. |

| Aggregate Limit | The total maximum payout for all claims during the policy term. | Your business faces three separate claims for $750k, $400k, and $900k. The total ($2.05M) is measured against your aggregate limit. |

Understanding how these limits interact helps you see the bigger picture of your coverage. It’s not just about one big event, but the cumulative impact of all events throughout the year.

The demand for this kind of comprehensive protection is on the rise. Globally, property and casualty products featuring aggregate limits grew by 7.7% in a recent year, a trend largely driven by businesses in North America. This signals just how essential business owners find this type of robust, capped protection.

Putting Aggregate Limits to the Test: A Real-World Scenario

Theory is one thing, but to really get a handle on how aggregate insurance works, it helps to see it in action. Let's walk through a year in the life of a small construction company we'll call "BuildRight Contractors" and see how their policy holds up when things go wrong.

BuildRight has a standard general liability policy. It comes with a $1 million per-occurrence limit and a $2 million general aggregate limit. In simple terms, their insurer will pay a maximum of $1 million for any single claim, but the total payout for all claims during the policy year can't exceed $2 million. That's their ultimate safety net.

The First Few Bumps in the Road

The year starts off with a fairly typical mishap. A subcontractor, while using an excavator, accidentally clips a neighbor's fence. It's a clean-cut property damage claim.

- Claim #1 (Property Damage): The repair bill comes to $50,000. This is well under the $1 million per-occurrence limit, so the policy pays it in full.

That $50,000 payout is the first withdrawal from their annual coverage bank.

Remaining Aggregate Limit: $2,000,000 – $50,000 = $1,950,000

A few months later, a second incident occurs. A visitor touring a site trips over a stray two-by-four and suffers a nasty ankle fracture. This claim is more complex, involving medical expenses and a bit of legal wrangling.

- Claim #2 (Bodily Injury): The final settlement is $150,000. Once again, it’s safely below the per-occurrence cap, so it's covered.

But that aggregate limit keeps ticking down. With every payout, their overall protection shrinks.

Remaining Aggregate Limit: $1,950,000 – $150,000 = $1,800,000

When the Drips Become a Flood

Things get complicated later in the year. BuildRight gets hit with a string of product liability claims. It turns out a batch of materials they used on several different jobs was defective, leading to a series of separate, smaller issues for multiple clients.

Individually, none of these claims are huge. But together, they add up. Let's say the total payout for all these related material-failure claims reaches a staggering $1,700,000. The policy covers them, but the cumulative effect on their aggregate limit is devastating.

Remaining Aggregate Limit: $1,800,000 – $1,700,000 = $100,000

Now, with just two months left in the policy year, BuildRight is on thin ice. Their $2 million safety net has been whittled down to a mere $100,000.

Just then, disaster strikes. A major equipment failure on a high-profile job causes $400,000 in damage to the client's existing structure.

The insurer steps in and pays out the $100,000 remaining in the aggregate limit. But that's it. The policy is officially "exhausted." BuildRight is now on the hook for the other $300,000.

This scenario is a powerful reminder that it's not always the one catastrophic event that sinks a business. A series of smaller, persistent claims can drain an aggregate limit just as effectively, leaving a company dangerously exposed when they can least afford it.

Understanding Your Policy’s Core Components

To really get a handle on what aggregate insurance coverage means for your business, you have to learn to speak the language of your policy. Don't think of it as some dense legal document; it's more like a rulebook for your financial safety net. Let's break down the key terms you'll run into in just about any standard commercial liability policy.

Getting these components right is critical. They all work together, and if you misunderstand one, you might misunderstand your entire coverage. We'll translate the most important "limits" into plain English.

Defining Your Primary Limits

At its heart, your policy revolves around a few key numbers. Each of these represents a different ceiling on what your insurance company will pay out.

-

Per-Occurrence Limit: This is the absolute maximum your insurer will pay for any single incident or claim. Imagine a fire causes $700,000 in damages. If your per-occurrence limit is $1 million, you're completely covered for that specific event.

-

General Aggregate Limit: This is the big one. It's the grand total your insurer will pay for all claims put together over your policy term, except for claims related to your products. Once you hit this number, your main coverage for general business risks is tapped out for the year.

This structure is how insurance carriers manage their own risk, which is what keeps the entire market stable. In fact, the International Association of Insurance Supervisors (IAIS) recently highlighted that the global insurance sector has maintained strong solvency, in part because aggregate coverage capacity has held up well. You can read more about these trends in the IAIS mid-year report.

Understanding Specialized Aggregate Limits

Now, it gets a little more interesting. Beyond that main general limit, most policies will have separate, dedicated aggregates for very specific types of risk. This is an incredibly important feature—it stops one kind of disaster from wiping out your entire safety net.

Key Takeaway: Think of separate aggregate limits as firewalls. They ensure a major product liability lawsuit doesn't drain the funds you might need later for a simple slip-and-fall claim.

One of the most common specialized limits you'll see is the Products-Completed Operations Aggregate.

This limit is carved out specifically for claims involving bodily injury or property damage that your products or finished work cause. For instance, if a contractor improperly wires a house and it causes a fire months later, any claims would be paid from this dedicated aggregate. This leaves your General Aggregate limit untouched for other operational risks. Having these distinct limits is a fundamental part of the various commercial insurance types designed to give businesses well-rounded protection.

Why Your Aggregate Limit Is a Critical Business Decision

Picking an aggregate limit is far more than just ticking a box on a form. It's a foundational decision that speaks directly to your company's ability to weather a storm. For the insurance carrier, that limit puts a clear, predictable cap on their total payout for the year, which is what helps keep premiums from going haywire.

But for you, the business owner, that limit is a double-edged sword. It defines the absolute maximum protection you have, but it also creates the very real risk of running out of coverage before your policy is up for renewal. Finding the right balance isn't just a good idea—it's essential for your company's long-term survival.

Protecting Assets vs. Managing Risk

A well-calculated aggregate limit is the financial shield protecting your company’s assets. When claims start rolling in, that number is what stands between a covered loss and a devastating out-of-pocket expense that could empty your bank accounts, force you to liquidate equipment, or even put you out of business.

This is your ultimate backstop against a really bad year.

The flip side is that setting this limit too low is one of the biggest gambles you can take. A "worst-case scenario" isn't always a single, headline-grabbing disaster. As we’ve seen, it can just as easily be a steady drip of smaller claims that eats away at your coverage until there's nothing left.

The real danger of a low aggregate limit is not just failing to cover a large claim, but being left with no coverage at all for the remainder of your policy term.

Think of it like the total fuel in your car's tank for a year-long road trip. If you run out of gas in July, you’re stranded. A low limit might feel like you're saving a few bucks on premiums today, but it could cost you absolutely everything tomorrow. If you're worried your primary coverage isn't enough, it’s a good time to learn more about what is excess liability coverage and how it can give you that extra breathing room.

This constant balancing act is tough, and the table below breaks down the core trade-offs you're facing.

Benefits and Risks of Aggregate Limits

| Key Advantages | Potential Risks to Consider |

|---|---|

| Asset Protection: Shields your business from financial ruin after multiple claims. | Coverage Exhaustion: A low limit can be depleted mid-term, leaving you uninsured. |

| Predictable Costs: Helps insurers manage risk, which keeps premium costs reasonable. | Uncovered Claims: Any claims filed after the limit is hit become your direct responsibility. |

| Contractual Compliance: Allows you to meet the insurance requirements of clients and partners. | Reputational Damage: Being unable to cover a claim can harm your business's credibility. |

In the end, your aggregate limit needs to be a realistic reflection of your industry’s risks, your own claims history, and your company's financial health. It's a number that deserves serious thought.

Common Misconceptions That Create Coverage Gaps

Some of the most expensive mistakes I’ve seen businesses make come from simple misunderstandings about their insurance policies. When we're talking about aggregate insurance, what you think you know can leave your business dangerously exposed. Let’s clear up a few of the most common myths so you can avoid any nasty surprises down the road.

The single biggest—and most dangerous—myth is focusing only on the per-occurrence limit. A business owner sees a $1 million per-occurrence limit on their policy and breathes a sigh of relief. They assume they're covered for any single event up to that amount, period.

That's a critical error. While your per-occurrence limit sets the max payout for one incident, the aggregate limit is the absolute ceiling for the entire policy term. A string of smaller, seemingly manageable claims can drain that aggregate bucket dry, leaving you with absolutely no coverage for whatever happens next.

Myth One: The Aggregate Limit is Just a Formality

Another common mistake is treating the aggregate limit like some theoretical number that you'll never actually hit. People often underestimate just how fast a few smaller claims can pile up.

Think about it: a couple of property damage claims, a minor injury on-site, and an issue with a product you sold. Individually, they might not seem like much, but together they can quickly eat away at a $2 million aggregate limit over a year. Ignoring this number is like driving a car without a fuel gauge—sooner or later, you're going to run out of gas.

This is exactly why conducting a thorough insurance gap analysis is so important. It helps you see if your limits truly match your real-world risks.

Key Takeaway: Your aggregate limit isn't just a suggestion. It's the hard-and-fast spending cap for your policy year. Once that money is gone, so is your coverage.

Myth Two: All Aggregate Limits Are the Same

Many business policies have more than one aggregate limit, and mixing them up can be a costly mistake. For instance, a standard policy will have a General Aggregate Limit that covers most claims related to your day-to-day operations.

But it will often have a separate Products-Completed Operations Aggregate specifically for claims arising from your finished work or products. A contractor might assume a big claim against a project they finished last year will drain their main operational coverage, but these are often entirely separate pools of money. Knowing the difference is crucial for understanding how much protection you actually have left.

This is also where broader market trends come into play. A recent global insurance market trends from Marsh report noted that global commercial insurance rates recently saw a 3% decline. Shifts like this directly influence how insurers structure policies and set these different aggregate limits.

How to Choose the Right Aggregate Limit for Your Business

Picking the right aggregate limit isn't a shot in the dark. It’s a calculated decision that could make or break your company down the road. You’re looking for the sweet spot: enough coverage to survive a catastrophic year, but not so much that you’re bleeding money on premiums for protection you don't need.

It all starts with an honest look at your business operations. A construction company's potential for liability is worlds away from a small retail boutique's. Your annual revenue also plays a huge part. The more you make, the bigger the target on your back, and the more coverage your clients will expect you to have.

Key Factors to Evaluate

Before you even get on the phone with a broker, do your homework on these key areas. Walking into that conversation prepared allows you to steer the discussion and make a decision you're confident in.

- Industry Risk Profile: What are the most common—and most expensive—claims in your line of work? Look up industry benchmarks to get a feel for what other businesses your size are carrying.

- Contractual Obligations: Dust off your client contracts. Many will spell out the minimum aggregate limits you're required to have just to be considered for a job. Miss this, and you’re out of the running before you even start.

- Claims History: What does your claims history from the last five years tell you? The past doesn't predict the future, but if you’ve had a steady stream of small claims, a higher limit is probably a smart move.

- Business Assets: Put simply, what could you lose? Add up your physical assets, cash on hand, and future income streams. Your aggregate limit needs to be high enough to shield all of that from being wiped out by a lawsuit.

Your aggregate limit is the financial firewall protecting your business assets. It must be high enough to withstand a series of claims so that one bad year doesn't become your last year in business.

For anyone who owns rental properties, a good first step is a detailed landlord insurance comparison, which can really open your eyes to how different coverage levels protect your assets.

And what happens if a major claim or a string of bad luck completely drains your general liability policy? That's when you'll be glad you considered extra layers of protection. We cover this in more detail in our guide explaining what umbrella insurance covers.

Got Questions About Aggregate Coverage? We’ve Got Answers.

When it comes to insurance, the details matter. Let's tackle some of the most common questions business owners ask about aggregate limits, so you can feel more confident about your coverage.

Does Every Insurance Policy Have an Aggregate Limit?

Not at all. You won't typically find an aggregate limit on policies that are required by state law, like workers' compensation or your standard auto liability insurance.

The reasoning is simple: these policies are in place to provide a fundamental safety net for employees and the public. Capping the total payout for the year would defeat that purpose. Aggregate limits are almost exclusively a feature of commercial liability policies.

Can I Raise My Aggregate Limit in the Middle of My Policy?

Generally, no. Your insurance company sets your premium for the year based on the risk they agreed to take on, which is directly tied to your policy limits. Changing that mid-stream isn't standard practice.

But what if your business suddenly takes off, or you land a huge project with bigger insurance requirements? That's where you can look into an excess liability or an umbrella policy. These policies are designed to sit on top of your existing coverage, giving you an extra layer of protection when you need it.

A Word of Caution: Don't wait until after a claim happens to think about your limits. By then, it's far too late. The best time to review and adjust your coverage is before you need it—either at your annual renewal or whenever your business undergoes a significant change.

What Happens When My Policy Renews?

Good news: your aggregate limit resets completely. It’s a clean slate.

The claims from the previous year don’t follow you into the new policy term. This annual reset is a critical feature, ensuring your business has a full, predictable "budget" for potential claims every twelve months.

Figuring out the right aggregate limit for your business is what we do every day. The team at Wexford Insurance Solutions can review your current coverage to make sure it truly lines up with your risks. Protect your business with a free policy review today.

What Is Key Person Insurance? Protect Your Business Today

What Is Key Person Insurance? Protect Your Business Today 8 Crucial Risk Management Best Practices for 2025

8 Crucial Risk Management Best Practices for 2025