A business continuity risk assessment is your game plan for figuring out what could go wrong and how badly it could hurt. We're talking about everything from cyberattacks and natural disasters to a key supplier suddenly going out of business. It's the essential first step in building a business that can take a punch and keep going. This isn't just about ticking a box for compliance; it's the very foundation of organizational resilience.

Why a Risk Assessment Is Your Business's Best Defense

Think about trying to sail a ship through a storm-filled sea without a map. You'd be guessing, reacting to every wave and gust of wind, and hoping for the best. That’s how a lot of businesses operate—they wait for a crisis to hit before they do anything about it.

A business continuity risk assessment (BCRA) is that map. It lets you see the potential storms on the horizon long before you're in the middle of them. It helps you understand their potential strength and gives you the information you need to either steer clear or prepare the ship to handle the impact. This simple shift in perspective moves your entire company from a reactive, panicked state to a proactive and prepared one.

From Guesswork To Strategic Foresight

Without a proper assessment, you’re just guessing what the biggest threats are. A formal BCRA takes that guesswork out of the equation and replaces it with real, data-driven insights. It gives you the power to make smart decisions that truly protect your people, your reputation, and your revenue. The idea is to have answers to the hard questions before a crisis forces you to find them.

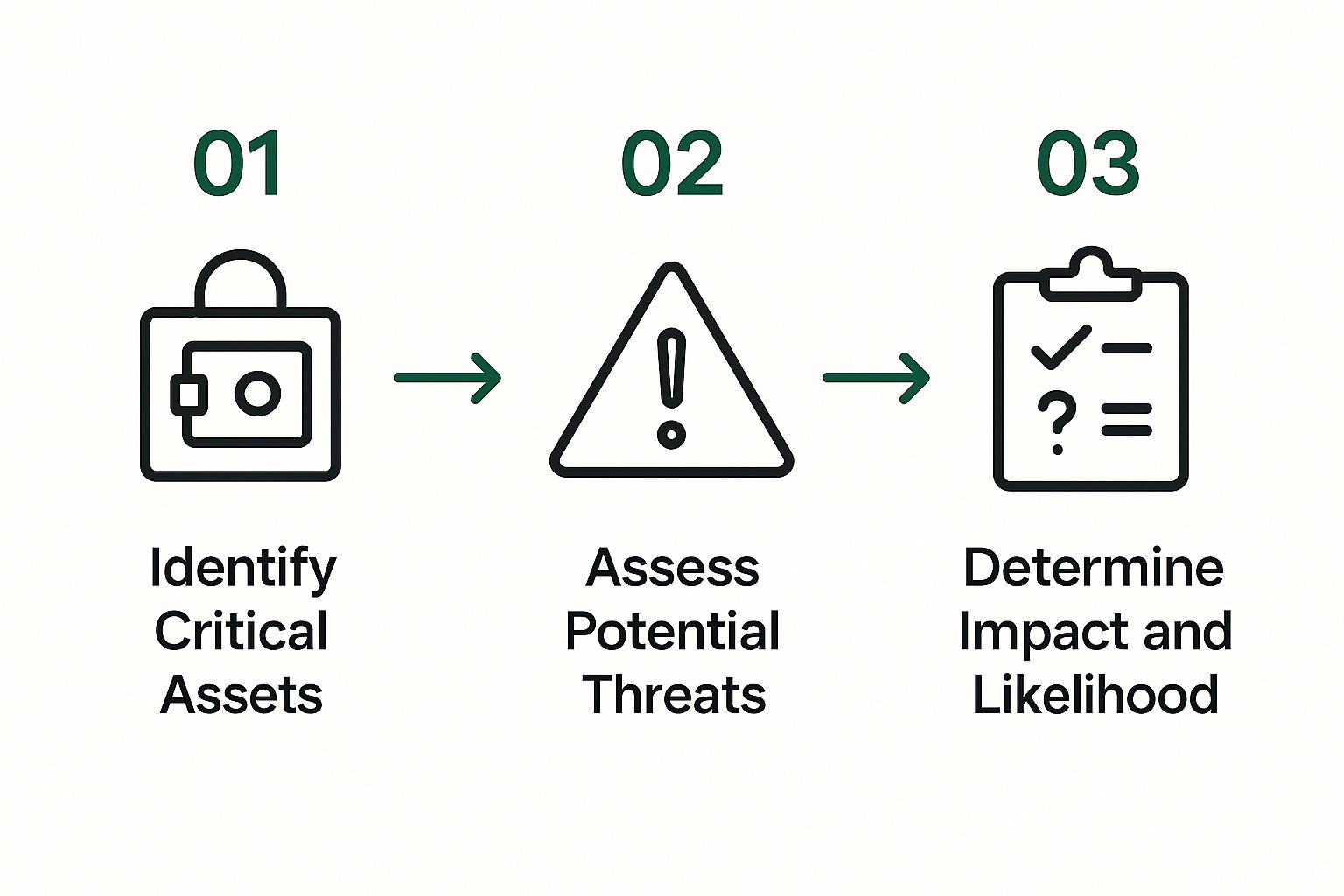

This structured process breaks down into a few key activities:

- Identifying Threats: Systematically listing out all the specific events, both internal and external, that could disrupt your operations.

- Analyzing Vulnerabilities: Taking an honest look at your own company to find the weak spots in your technology, processes, or people.

- Calculating Impact: Putting a number on the damage. What would the financial, operational, and reputational cost be if one of these threats actually happened?

A business continuity risk assessment turns vague worries into concrete, manageable problems. By putting numbers to potential disruptions, it gives you a clear, prioritized roadmap for investing your time and money where it matters most.

Protecting Against a Cascade of Failures

Today's businesses are incredibly interconnected. A problem in one department can create a domino effect that ripples through the entire company. A single supplier failing can stop your production line cold, which then craters your sales figures and damages the trust you've built with customers. That's why understanding concepts like supply chain disruption management is no longer optional.

The BCRA process helps you trace these connections. It allows you to spot those critical single points of failure and build in redundancies so that one problem doesn't bring down the whole house. It’s the bedrock for all other https://wexfordis.com/2025/09/17/risk-management-best-practices/ and ensures your defenses are as deep and connected as the threats you face.

Breaking Down the Core Components of a BCRA

To really get a grip on business continuity, you have to understand that a risk assessment isn't just one big task. Think of it more like a three-legged stool. If any one of those legs is wobbly or missing entirely, the whole thing comes crashing down.

These three core pieces—Threat Identification, Vulnerability Analysis, and Impact Analysis—are designed to work in tandem. They build on each other, turning vague anxieties about "what if" into a concrete, actionable roadmap for staying afloat. Let's dig into how each one plays its part.

Identifying Potential Threats

First things first, you have to look outside your four walls and figure out what could possibly go wrong. This is the Threat Identification stage. A threat is basically any event, internal or external, that could throw a wrench in your operations, damage your assets, or harm your people.

It’s a bit like being a business meteorologist. You’re scanning the horizon for storms, but you're not just looking for the obvious stuff like blizzards or floods. You’re also watching for economic downturns, sophisticated cyberattacks, or even the sudden departure of a key executive.

To make sure you don't miss anything, it helps to group potential threats into a few buckets:

- Natural Disasters: Think floods, earthquakes, wildfires—anything that could physically compromise your locations.

- Technical Failures: This covers everything from a simple power outage to a catastrophic server failure or a crippling software bug.

- Human-Caused Events: This includes both malicious acts like theft or a data breach and simple human error.

- Supply Chain Disruptions: What happens if a critical supplier suddenly goes bankrupt or a major shipping route gets blocked?

The goal here is to brainstorm a comprehensive list of every plausible disruption. Don't edit yourself at this stage. If it could happen, it goes on the list. This is the foundation for everything that follows.

Analyzing Your Weak Points

Once you have a list of what could happen, it's time to turn the magnifying glass inward. This is Vulnerability Analysis, where you pinpoint the chinks in your armor—the specific weaknesses a threat could exploit. A vulnerability is an internal weak spot that makes you susceptible to harm from a threat.

If a hurricane is the threat, your vulnerability might be that your office is located in a flood plain and you have no backup generator. The storm is the outside force, but your lack of preparedness is the internal vulnerability.

A threat is what can happen to you. A vulnerability is why it would hurt you so much. The intersection of these two is where real risk lives.

This process requires brutal honesty. For instance, if the threat is a key supplier going out of business, your vulnerability might be that you source 90% of a critical component from them with no vetted alternative. Uncovering these weak points is absolutely essential for building a solid defense.

Measuring the Potential Damage

The final piece of the puzzle, Impact Analysis, connects the dots. This is where you calculate the real-world consequences if a threat manages to exploit one of your vulnerabilities. It answers the all-important "so what?" question for every risk scenario.

An impact analysis typically measures the fallout in a few key areas:

- Financial Impact: How much revenue would you lose? What about regulatory fines or repair costs?

- Operational Impact: How much downtime would you face? Would productivity grind to a halt? Could you still serve your customers?

- Reputational Impact: How would this affect customer trust or your brand's image in the market?

Let's go back to our supplier example. The threat is them shutting down. The vulnerability is your over-reliance. The impact? A complete halt in production, potentially costing $1 million in lost sales per week and causing irreversible damage to your customer relationships.

This analysis is what allows you to prioritize. A risk with a catastrophic impact demands immediate attention, while one that's just a minor headache can be lower on the list. This clarity is what transforms your assessment into a truly effective continuity plan. You can use our business continuity plan checklist to see how these insights translate into concrete action items.

The recent past offers a stark lesson in why this is so critical. The COVID-19 pandemic led to an estimated 100,000 U.S. small businesses closing their doors for good, a devastating reminder of what happens when systemic shocks meet inadequate planning.

A 5-Step Framework for Your Risk Assessment

Knowing the moving parts of a business continuity risk assessment is one thing, but actually putting it all together is a different ballgame. To get from theory to practice, you need a clear, repeatable process. This five-step framework is your roadmap, breaking the entire assessment down into manageable stages that take you from initial planning to a final, strategic action plan.

Think of it as a recipe. If you follow each step in order, you’ll get a consistent and thorough result every time. It turns what feels like a massive undertaking into a structured, achievable project.

Step 1: Define Your Scope and Goals

Before you can start hunting for risks, you have to draw the boundaries. What parts of the business are you actually looking at? Are you zeroing in on a single critical department, one specific office, or the entire organization? This first step, called scoping, is crucial for keeping the project from spiraling out of control.

Defining your scope is like plugging a destination into your GPS before you start driving. Without it, you could waste time analyzing risks that are totally irrelevant to your core operations while completely missing the ones that could sink you. Be specific about what’s in-bounds and, just as importantly, what’s out.

Once you’ve set your scope, get crystal clear on your goals. Are you trying to check a box for a regulatory requirement? Prepare for a specific threat, like a hurricane or major cyberattack? Or are you simply aiming to make the business more resilient overall? Your goals will dictate the depth and focus of the entire assessment.

Step 2: Pinpoint Critical Business Functions

Let's be honest—not all business functions are created equal. Some are absolutely essential for survival, while others could be put on pause for a few days with minimal fallout. This step is all about identifying those "must-have" operations through a Business Impact Analysis (BIA).

A BIA is just a systematic way of figuring out how a disruption would actually affect your business. It forces you to answer the tough questions:

- Which processes bring in the most money?

- What functions are we legally or contractually obligated to perform?

- Which operations do our customers see, and which ones would do the most damage to our reputation if they failed?

For an e-commerce company, the website, payment gateway, and warehouse operations are non-negotiable. On the other hand, the marketing team’s long-term content planning could probably wait a week without the company imploding. The BIA gives you the hard data you need to prioritize where to focus your recovery efforts.

This process makes sure you’re spending your time and money protecting the parts of your organization that truly matter first.

Step 3: Analyze Threats and Vulnerabilities

Now that you know what's most important, you can start thinking about what could realistically break it. This step is about brainstorming potential threats—things like power outages, cyberattacks, or a key supplier going bust—and then identifying your internal vulnerabilities, which are the weak spots that let those threats do real damage.

For each critical function you identified in the BIA, ask yourself: what could make this fail? If your customer service relies on a cloud-based phone system (a critical function), a big threat is a widespread internet outage. A vulnerability in that scenario might be having no backup way for your team to communicate, like a dedicated cell phone plan.

The core of risk analysis is understanding the relationship between impact and likelihood. A high-impact, high-likelihood risk is an urgent priority, while a low-impact, low-likelihood risk can be addressed later.

This is where you move from vague worries to specific, documented scenarios. It connects the dots between a potential event and the part of your business it would hurt the most, giving you a clear picture of your risk landscape.

Step 4: Assess Current Controls and Gaps

No business is starting from scratch. You already have some protective measures in place, whether you call them that or not. These are your controls—the policies, procedures, and tech you use to manage risk. This step is about taking a hard look at those existing controls and figuring out if they’re actually effective.

For example, you probably have data backups as a control against a ransomware attack. But the real questions are:

- How often are we actually running these backups?

- Are they stored somewhere safe, like off-site or in a separate cloud environment?

- Have we ever tried to restore from them to make sure they work?

Answering these questions honestly will reveal your risk gaps—the difference between the protection you have and the protection you actually need. A gap appears when a control is weak, outdated, or just plain missing. This analysis points you directly to where you need to make improvements.

To help visualize and prioritize these findings, teams often use a risk matrix. It's a simple but powerful tool for classifying risks based on how likely they are to happen and how bad the damage would be.

Sample Risk Matrix for Prioritization

This table illustrates a standard risk matrix used to classify and prioritize identified risks based on their likelihood of occurrence and potential impact on business operations.

| Impact Level | Low Likelihood | Medium Likelihood | High Likelihood |

|---|---|---|---|

| High | Medium Risk | High Risk | Critical Risk |

| Medium | Low Risk | Medium Risk | High Risk |

| Low | Low Risk | Low Risk | Medium Risk |

By plotting each identified risk on a matrix like this, you can quickly see which issues demand immediate attention (the "Critical Risk" items) and which can be managed over a longer timeframe.

Step 5: Document Findings and Create an Action Plan

The final step is to pull everything together into a formal document and—most importantly—create a real action plan. A risk assessment that just sits on a shelf is a complete waste of time. Your final report should clearly lay out the risks you found, their potential impact and likelihood, and the control gaps you need to fix.

This is where you see a big difference between companies of different sizes. Recent research shows that only 30% of small businesses have a formal continuity strategy, compared to 73% of large corporations. Even more concerning, an alarming 56% of all businesses have no defined process for checking if their third-party vendors are prepared for a disaster. You can explore more of these business continuity statistics to see how others are handling these challenges.

Your action plan is your roadmap to a more resilient business. It should be a prioritized list of recommendations. For each major risk gap, define specific, measurable, achievable, relevant, and time-bound (SMART) steps to close it. This is how you turn your assessment from a report into a real-world plan for survival.

Applying Industry Frameworks and Best Practices

When you're conducting a business continuity risk assessment, there's absolutely no need to start from a blank page. Instead of reinventing the wheel, you can stand on the shoulders of giants by adopting established industry frameworks and standards. Think of them as a proven path to building real organizational resilience.

These frameworks are like a professional blueprint for a skyscraper. Sure, you could try to design it yourself, but using a plan from experienced architects ensures you don’t forget a critical support beam. Frameworks like ISO 22301 for business continuity or the NIST Cybersecurity Framework provide that same level of battle-tested reliability. They turn complex principles into practical, actionable steps.

Demystifying Key Industry Standards

ISO 22301 is widely considered the international gold standard for Business Continuity Management Systems (BCMS). It offers a comprehensive model for planning, implementing, and constantly improving your continuity efforts. Following its principles helps ensure your program is not only effective but also globally recognized.

The NIST Cybersecurity Framework, while its name points to cyber threats, offers an incredibly valuable structure that complements any business continuity assessment. It logically breaks down risk management into five core functions: Identify, Protect, Detect, Respond, and Recover. This progression helps you organize your thinking and make sure you’ve covered all the bases—from proactive defense to post-incident recovery.

To get the most out of these frameworks, it's a good idea to delve into various risk assessment methodologies and find the approach that truly fits your company's specific needs and industry.

Battle-Tested Best Practices for Success

Beyond the formal standards, there are several unwritten rules that seasoned risk managers swear by. These are the practical insights that take an assessment from a theoretical exercise to a strategic tool that actually works. Ignoring them can sink even the most well-structured plan.

Here are a few non-negotiable best practices that make all the difference:

- Secure Executive Buy-In: Your assessment absolutely needs a champion in the C-suite. Without leadership support, getting the necessary budget, resources, and cooperation from other departments is a losing battle. You need to frame this as protecting revenue and reputation, not just another compliance cost.

- Involve Cross-Functional Teams: Business continuity is not just an IT problem. It’s an everyone problem. Bring people in from operations, finance, HR, and legal to get a 360-degree view of risks and dependencies. This kind of collaboration is what uncovers the hidden vulnerabilities a single department would almost certainly miss.

- Integrate Supply Chain Vulnerabilities: Your business is only as resilient as your weakest link, and often, that link is a supplier. A thorough assessment has to look beyond your own four walls to evaluate the risks posed by critical third-party vendors. It's a step many organizations unfortunately overlook.

Fostering a Culture of Resilience

At the end of the day, a document on a shelf can't protect you. The real goal is to build a culture of resilience, where every person in the organization understands their role in keeping the business running. This is where regular drills, testing, and training are absolutely indispensable. Running tabletop exercises and simulations builds crucial "muscle memory" for your response teams.

These exercises test your plan against realistic scenarios, revealing gaps and weak spots before a real crisis hits. They transform a static plan into a living, breathing part of your company's DNA. This proactive approach is what separates companies that just survive a disruption from those that actually emerge stronger.

The most effective business continuity programs are not one-time projects but ongoing processes. They are woven into the fabric of the organization, continuously updated and improved through regular testing and real-world feedback.

This cycle of continuous improvement is critical. In 2023, a staggering 93% of organizations experienced a data breach tied to business disruptions. However, companies with active business continuity management saw a 60% improvement in operational resilience. Having the right financial safety nets, like adequate business continuity insurance, is another crucial piece of this holistic strategy.

Common Pitfalls to Avoid in Your Assessment

Running a business continuity risk assessment is a fantastic move for securing your company's future. But even the best plans can go sideways if you fall into a few common traps. Knowing what not to do is just as important as knowing what to do. Otherwise, your assessment becomes just another piece of paper for the compliance binders instead of the powerful strategic tool it should be.

One of the biggest mistakes I see is treating the assessment as a one-and-done project. You can't just check it off the list. The world of risk isn't static—new technologies, market shifts, and emerging threats are constantly changing the game. A report that just sits on a shelf is completely useless when a real crisis hits.

The Dangers of Working in a Silo

Another classic misstep is handing the whole thing off to the IT department and calling it a day. Yes, technology is a massive piece of the continuity puzzle, but it’s just one piece. To build real, lasting resilience, you need to see the entire picture, and IT simply doesn't have the full view.

When you isolate the assessment to a single department, you miss out on crucial insights from teams like operations, HR, finance, and legal. Operations folks know the day-to-day workflows inside and out. HR understands the people-related risks. Finance can tell you exactly what a disruption will cost you.

A business continuity risk assessment that lacks cross-functional input is like trying to solve a puzzle with half the pieces missing. It guarantees an incomplete and inaccurate picture of your true vulnerabilities.

By not bringing these key people to the table, you're not just getting a skewed view of risk—you’re also missing a golden opportunity to get everyone on board with the continuity plan that comes out of it.

Overlooking Your Supply Chain Risks

In today's interconnected business world, your company’s resilience is completely tied to your partners' resilience. It’s shockingly common for organizations to focus only on their internal risks and completely forget about the vulnerabilities hiding in their network of third-party vendors. Your internal security might be as tight as a drum, but that won't matter much if a critical supplier with flimsy defenses gets taken down.

This oversight can be absolutely devastating. Picture this: your main software provider has a massive data breach, or the only company that supplies your raw materials gets hit by a natural disaster. Just like that, their crisis is now your crisis.

To head this off, your assessment has to dig into your supply chain. This means:

- Vendor Due Diligence: Get a good, hard look at the continuity plans of your most important vendors before you sign anything.

- Regular Risk Reviews: Don't just check on them once. Make it a point to re-evaluate their security and preparedness every single year.

- Clear Contractual Obligations: Your contracts need to spell out exactly what they're responsible for if a disruption on their end impacts your business.

This is non-negotiable, especially when a vendor is handling your sensitive customer or company data. A breach on their side can lead to massive regulatory fines and a damaged reputation for you. A solid data breach response plan has to account for incidents that start with your partners.

By sidestepping these common mistakes, your business continuity risk assessment becomes more than just a document. It becomes a living, breathing shield that actually protects your business.

Using Technology to Sharpen Your Risk Assessment

Trying to run a modern business continuity risk assessment with spreadsheets is like using a paper map in the age of GPS. Sure, you might get there eventually, but it's slow, full of potential wrong turns, and can't adapt when the road ahead changes unexpectedly. Technology is what turns this static, backward-looking exercise into a dynamic, real-time defense system.

Modern tools offer a serious upgrade. Dedicated Business Continuity Management (BCM) software takes care of the heavy lifting—automating everything from gathering data to tracking the progress of your mitigation plans. Instead of manually chasing down department heads for updates, the system handles it, centralizing everything in one place.

This frees up your team to focus on what really matters: making smart strategic decisions instead of getting buried in paperwork. The right platform can sift through a mountain of data and present you with clear, actionable insights, helping you connect the dots and spot emerging threats much faster.

The Power of Automation and Intelligence

Where things get really interesting is when you bring advanced analytics and threat intelligence into the mix. AI-driven platforms don't just sit there waiting for you to input data; they actively scan the horizon for external risks. Think geopolitical instability, severe weather forecasts, or the latest cyber threats. The software then connects those external events to your organization's specific vulnerabilities.

This creates an early-warning system that a manual process could never hope to replicate. For instance, AI can run predictive models for different risk scenarios, showing you potential outcomes before they happen. We explore a similar concept in our guide on how businesses are using insurance data analytics to get ahead of risks. It’s all about shifting from a reactive posture to a proactive one, allowing you to tweak your plans before a threat ever becomes a crisis.

Cloud Solutions and Data Recovery

Cloud technology has also become a cornerstone of modern resilience. It provides the kind of robust, scalable, and reliable infrastructure you need for effective data recovery. When a disruption hits, having your critical systems and data securely backed up in the cloud can be the difference between a few hours of downtime and a few weeks of chaos.

A software-driven approach to your BCRA turns it from a periodic report into a living defense. It empowers you to manage risk proactively, respond to incidents faster, and build true organizational resilience.

This isn't just a niche idea; it's a widely recognized best practice. In fact, around 78% of IT managers now view cloud computing as essential for strengthening their disaster recovery capabilities. It's a clear signal that the industry is moving toward tech-based resilience, and you can read more about these continuity and resilience trends from FusionRM.com. By embracing these tools, you ensure your risk assessment is just as agile and adaptive as the threats you’re preparing for.

Got Questions About Risk Assessments? We’ve Got Answers.

Even with the best plan in place, putting a business continuity risk assessment into practice always brings up a few questions. Let's tackle some of the most common ones I hear from business owners to clear up any confusion and help you get it right.

How Often Should We Be Doing This?

Think of your risk assessment as a recurring check-up, not a one-and-done task. You should conduct a full-scale assessment at least annually. It’s also a good idea to run one anytime your business goes through a major change, like opening a new location or switching over your core IT systems.

That said, some parts need a closer watch. Your Business Impact Analysis (BIA), for example, is best reviewed every quarter. This ensures you always have an up-to-date picture of your most critical operations and what they depend on.

What’s the Difference Between a Risk Assessment and a BIA?

This is a great question, and the distinction is vital.

Imagine a risk assessment as a security guard patrolling your property. They're looking for potential threats (like someone trying to climb a fence) and checking for vulnerabilities (like an unlocked gate). The goal is to spot what could go wrong before it does.

A Business Impact Analysis (BIA), on the other hand, figures out which assets inside the property are the most valuable. It answers the question, "If a threat gets through, what will the damage be?" This helps you prioritize what to protect and which operations need to get back online first.

Simply put: a risk assessment looks at the causes of a potential disruption, while a BIA measures the consequences. You absolutely need both, but they serve two very different functions.

Is a Formal Assessment Really Necessary for a Small Business?

Yes, without a doubt. In fact, for a small business, it’s arguably even more important. A large corporation might have deep pockets to weather a storm, but smaller companies often don't have that luxury. A 2020 study revealed just how unprepared many small firms are, and a single unexpected event can easily become a fight for survival.

A simplified, focused assessment gives a small business a clear roadmap. It helps you use your limited resources to protect what truly keeps the lights on, giving you the resilience to not just survive a crisis, but come out stronger.

Navigating risk is complex, but the right partner makes all the difference. At Wexford Insurance Solutions, we specialize in creating customized commercial insurance plans that protect your business from the unexpected. Learn how we can safeguard your operations by visiting us at https://www.wexfordis.com.

Engagement Ring Insurance Cost Explained

Engagement Ring Insurance Cost Explained Hired and Non Owned Auto Insurance: Essential Coverage for Your Business

Hired and Non Owned Auto Insurance: Essential Coverage for Your Business