When you're navigating the world of insurance, one of the first questions you'll face is whether to work with a broker or an agent. Though the terms are often used interchangeably, they represent two very different roles. The most important distinction boils down to a simple question: who do they work for?

The answer is critical. An insurance broker works for you, the client, while an insurance agent works for one or more insurance companies. This fundamental difference in allegiance shapes their entire approach, from the advice they give to the policies they can offer.

Insurance Broker vs. Agent At a Glance

Think of an insurance agent as a representative of the insurer. They can be a captive agent, meaning they exclusively sell policies for a single company (like State Farm or Allstate). Or, they might be an independent agent who represents a handful of different insurers. Either way, their primary role is to sell you a policy from their curated list of partners.

A broker, on the other hand, is your personal advocate in the insurance marketplace. They aren't tied to any specific insurer. Their job starts with understanding your needs, risks, and goals, and then they scour the entire market to find the best-fitting coverage for you.

If you find yourself unhappy with your current provider, a broker is your best bet for finding a better deal. They can objectively compare options without being tied to a single company's products. You can learn more about this in our guide on how to switch insurance providers. This difference in who they represent directly influences the breadth of options and the nature of the advice you receive.

The most significant differentiator is legal allegiance. A broker has a fiduciary duty to act in your best financial interest, while an agent's primary loyalty is to the insurance company they represent.

To make this even clearer, let's break down the key differences in a quick comparison.

Quick Comparison Insurance Broker vs Agent

This table offers a straightforward look at how brokers and agents stack up against each other across the most important factors.

| Key Difference | Insurance Broker | Insurance Agent |

|---|---|---|

| Who They Represent | You, the client | One or more insurance companies |

| Loyalty & Duty | Fiduciary duty to the client's best interests | Contractual duty to the insurance company |

| Market Access | Access to policies from many different insurers | Limited to the products of the company/companies they represent |

| Advisory Role | Provides impartial advice based on the whole market | Provides advice on their company's specific product offerings |

| Policy Options | Offers a wide range of choices and customization | Offers a narrower, more specialized set of choices |

Ultimately, understanding these distinctions helps you decide which professional is better equipped to meet your specific insurance needs.

Understanding Their Professional Roles

To really get to the heart of the broker vs. agent difference, you have to look at how they're set up to work. An insurance agent is a direct line to an insurer, working with a specific set of products. Think of them as a specialist in what their particular company—or companies—can offer.

Their job is to match your needs to the policies they have in their toolkit. This model is all about deep product knowledge, just within a more limited selection.

The Agent's World: Captive vs. Independent

Insurance agents generally fall into two camps, and it's a key distinction.

- Captive Agents: These professionals work for just one insurance company, like a State Farm or Allstate agent. They know their company's policies inside and out. If you're already set on a specific brand, a captive agent can be the most direct route to getting a policy.

- Independent Agents: An independent agent partners with a handful of different insurance companies. This gives you more options than a captive agent, but their choices are still confined to the insurers they have a contract with. They work to find you the best fit from within that portfolio.

If you're curious about the day-to-day work and sales process of an agent, this guide on how to sell life insurance as a modern agent provides some great real-world context.

The Broker's Mandate: Your Personal Advocate

Now, let's flip the script. An insurance broker works for you. They aren't tied to any insurer and have no allegiance to a particular product line. Their entire focus is on representing your best interests in the wide-open insurance market.

A broker’s process starts with a deep dive into your personal or business risks. With that understanding, they shop the entire market, gather quotes from numerous carriers, and negotiate the best possible terms for you. To juggle all these moving parts, brokers often use sophisticated insurance policy management systems to keep everything running smoothly.

The core of a broker's role is providing tailored, unbiased advice. Their primary objective is to secure the most suitable and competitive coverage available, regardless of the carrier, ensuring your interests are the top priority.

Legal Duties and Client Loyalty: Who’s Really on Your Side?

When you’re deciding between a broker and an agent, the single most important distinction comes down to one question: Who do they legally work for? This isn't just a technicality; it’s the bedrock of your entire relationship and defines where their loyalty lies.

At the heart of this is a legal concept called fiduciary duty.

An insurance broker has a fiduciary duty to you, the client. This is a powerful legal and ethical standard that obligates them to act in your best financial interest, period. They have to put your needs ahead of their own and ahead of the insurance company’s. Their job is to find you the right coverage, no matter which carrier offers it or how much they get paid.

An agent, on the other hand, is loyal to the insurance company they represent. While they absolutely have professional standards and a duty to treat you fairly, their primary legal obligation is to the insurer. Think of them as a representative of the carrier, not a representative of you.

Who Truly Represents You?

This difference becomes crystal clear when you need impartial advice. A broker is your advocate, legally bound to assess your unique risks and find the best solution in the entire market.

An agent’s advice, while often excellent, is naturally confined to the products and policies their specific company sells.

A broker's fiduciary duty legally requires them to act in the client's best interest. An agent's primary obligation is to the insurance company they represent.

This legal framework exists to protect you. When you choose who to work with, you're also choosing their allegiance. Understanding this is the first real step in figuring out who should manage your insurance portfolio.

Making the right choice is critical, and our guide on how to choose an insurance broker offers more detailed steps. When dealing with complex risks or high-value assets, having someone with a legal duty to protect your interests isn't just a benefit—it's essential.

Comparing Market Access and Policy Options

When you're choosing between a broker and an agent, what you're really deciding is how much of the insurance market you want to see. An insurance broker is like your personal shopper for policies, with access to products from a huge range of different insurance companies.

This wide-open access is a game-changer if your needs are anything but standard. Maybe you own a business that requires specialized liability coverage, or your home doesn't fit the typical mold. In these cases, a broker can dig through the offerings of countless carriers to find that one niche policy that’s a perfect fit. They live in the fine print, comparing terms to find the absolute best coverage. Of course, to make that comparison meaningful, you need to know what you’re looking for. Our guide on how to read an insurance policy is a great place to start.

A broker’s true value lies in their independence. They aren’t tied to one company's product catalog, which frees them up to find the most competitive rates and comprehensive coverage tailored to you.

The Agent's Focused Selection

Working with an insurance agent, particularly a captive agent, feels quite different. They can only offer you products from the single company they represent. It's a much more focused conversation.

This can be a perfectly fine route if your insurance needs are straightforward or if you already have a strong loyalty to a specific brand. The downside? You might be leaving a better, more affordable policy on the table from another carrier without even knowing it.

This very point is the core difference between broker and agent insurance. The global market for insurance brokers and agents was valued at roughly USD 436 billion in 2023 and is expected to keep climbing. A big reason for that growth is the flexibility brokers bring by sourcing policies from the entire market to meet complex client needs.

Ultimately, everyone wants to manage their expenses. For those in specialized industries, like trucking, looking into practical ways to reduce your truck insurance costs highlights just how much policy structure can affect the bottom line. While an independent agent offers a happy medium with a handful of carrier options, a broker truly opens the door to the entire marketplace.

Real-World Scenarios for Choosing a Broker vs. Agent

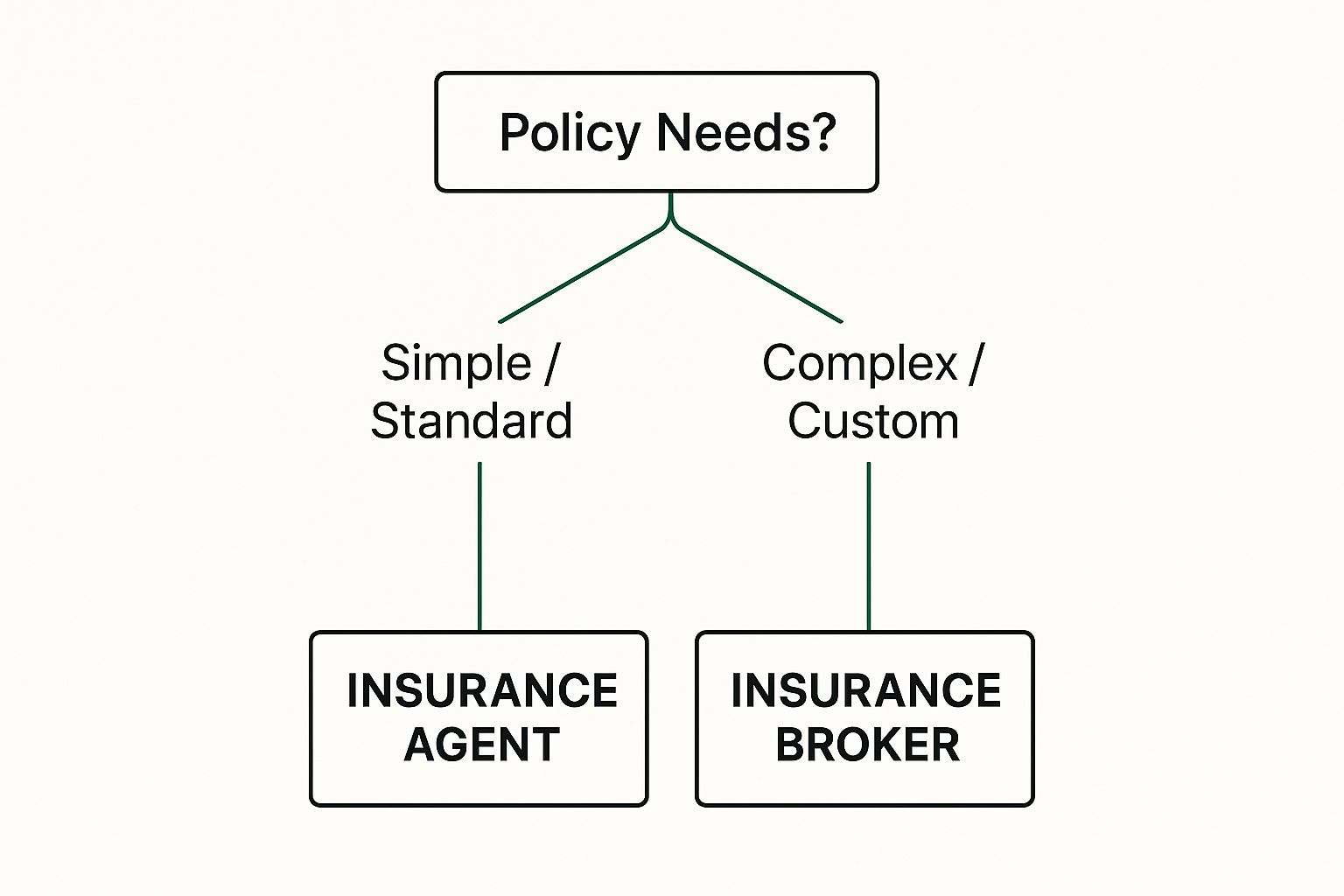

The theory is helpful, but seeing these roles in action really clarifies the choice. Ultimately, whether you need a broker or an agent often boils down to how complex and unique your insurance needs are.

Let’s start with a tech startup launching a new app. This isn't a simple, one-policy situation. The company needs a whole suite of coverage: general liability, errors and omissions (E&O), workers' compensation, and maybe even directors and officers insurance. This is a classic case for an insurance broker. A broker can dive deep into the startup's specific risks, tap into specialized insurance markets, and piece together a comprehensive package from several different carriers, making sure no dangerous gaps are left uncovered.

When an Agent Is the Right Choice

Now, let's switch gears. Think about a recent college grad who just bought their first car. Their needs are pretty standard—a basic auto policy that meets state laws and doesn't break their budget. For them, walking into the office of a captive or independent agent from a major insurer is usually the quickest and easiest route.

That agent will know their company's products inside and out, including all the available discounts (like for good students or safe drivers) and bundling deals. When your needs are straightforward, like a standard auto or homeowners policy, an agent provides a direct path to a solid solution without the broad market survey a broker performs. It’s an efficient process that gets the driver on the road, fully insured, in no time.

The core of the decision comes down to complexity. If your situation is intricate, specialized, or high-risk, a broker’s access to the entire market is a huge advantage. If your needs are standard and you prefer dealing with a familiar brand, an agent is the more direct and efficient choice.

The insurance world is constantly evolving to cover new threats, and this is another area where brokers really shine. For instance, the demand for cyber insurance has exploded, driven by alarming trends like the over 200,000 cyber crimes reported in India in early 2022 alone. A broker is perfectly positioned to educate clients on these emerging risks and hunt down specialized policies that a single-company agent might not even have access to.

You can learn more about how the industry is shifting and read the full research on the insurance broker and agents market to see where things are headed.

To make it even simpler, here are a few common scenarios to help you decide which professional is the right fit for you.

Decision Guide: When to Choose a Broker or an Agent

Use these scenarios to decide which insurance professional best fits your situation.

| Your Insurance Need | The Better Choice | Reasoning |

|---|---|---|

| Buying standard auto or home insurance | Agent | Agents offer deep knowledge of one or a few insurers' products, making the process fast and efficient for common coverage needs. |

| Starting a business with unique liability risks | Broker | A broker can access niche markets and craft a customized insurance portfolio from multiple carriers to cover all your specific exposures. |

| You have a perfect driving record and standard needs | Agent | A captive agent can quickly apply all of their company's best discounts, giving you a competitive rate directly from a trusted brand. |

| Needing high-risk coverage (e.g., flood, earthquake) | Broker | Brokers specialize in finding coverage for unusual or high-risk situations that many standard insurers won't cover. |

| You want to bundle multiple policies with one company | Agent | Agents are experts at packaging their company's home, auto, and life insurance policies to maximize discounts and simplify your billing. |

| Securing specialized professional liability insurance | Broker | For roles like doctors or architects, brokers have the expertise to find policies that cover the specific risks of your profession. |

Choosing the right professional sets you up for success. An agent is your go-to for straightforward, brand-specific solutions, while a broker is your advocate for complex needs requiring a market-wide search.

Frequently Asked Questions About Brokers and Agents

When you're trying to figure out the insurance world, a few questions pop up time and time again. Let's clear up some of the most common ones about brokers and agents so you can move forward with confidence.

Does Using an Insurance Broker Cost More?

It’s a common misconception, but no, you don't pay a broker a separate fee. Brokers earn their living from a commission paid by the insurance company you end up choosing.

This commission is already factored into the policy's premium, meaning there's no extra bill for you. In fact, because a good broker has their finger on the pulse of the entire market, they can often find you a better deal than you'd find on your own, actually saving you money in the long run.

How Is an Independent Agent Different From a Broker?

This is a subtle but crucial difference. While both independent agents and brokers can offer policies from multiple insurance companies, their fundamental allegiance is completely different. An independent agent has contractual agreements with specific insurers—they represent the company.

A broker, on the other hand, represents you. That's the key. Their legal and ethical obligation is to act in your best interest, not the insurance company's.

This decision tree gives you a great visual for when to choose one over the other based on your specific situation.

As you can see, an agent is often a perfect fit for straightforward needs, whereas a broker really shines when your situation is complex and demands a more tailored solution.

Who Is Better for Handling Insurance Claims?

While either can help you file a claim, this is where a broker's role as your advocate truly comes into play. Since their primary duty is to you, they'll go to bat for you, negotiating with the insurer to make sure everything is handled fairly and promptly.

Their goal is to see you get the settlement you deserve, which is also a critical factor during the insurance policy renewal process, where your claims history can have a big impact.

At Wexford Insurance Solutions, we pride ourselves on being that trusted partner. We bring the independent expertise you need to make sense of even the most complex insurance decisions. Contact us today for a personalized consultation.

What Is Fiduciary Liability Insurance? Key Facts You Need to Know

What Is Fiduciary Liability Insurance? Key Facts You Need to Know How to Switch Insurance Companies and Save Money

How to Switch Insurance Companies and Save Money