Thinking about switching insurance companies? It's a smart move that can save you a surprising amount of money or get you much better coverage. The whole process really comes down to four simple steps: review your current policy, shop around for new quotes, buy the new policy, and then cancel the old one. Following this order is crucial to make sure you're never without coverage.

Knowing When It's Time for a Change

The real trick isn't just knowing how to switch, but when. Most people start shopping when they see their renewal premium has jumped, but that's not the only reason to look around.

Life changes are a huge trigger. Did you just buy a new car or a new house? Get married? These events completely change your insurance needs, making it the perfect time to get fresh quotes and see if your current company can still offer the best deal.

Then there's the service side of things. If you've ever had a miserable experience filing a claim or feel like you can never get a straight answer from your agent, that’s your sign. You're paying for peace of mind, not a headache. Sometimes, you just outgrow your insurer. Maybe you started a home business or acquired some expensive jewelry, and they don't offer the specialized coverage you now need.

Keep an Eye on the Market

The insurance world is always in motion. Rates go up and down based on things far outside your control, creating little windows of opportunity. For example, global insurance rates actually dropped by about 4% in the second quarter of 2025, which continued a trend of softening premiums. When the market is like that, it's a fantastic time to see what's out there. You can get a feel for these trends from resources like Marsh's Global Insurance Market Index.

I always tell my clients the sweet spot for shopping for new insurance is about 30 to 45 days before your current policy renews. This gives you plenty of breathing room to compare offers without feeling pressured.

Understanding the insurance policy renewal process is the key to a clean break. While you can switch carriers any time you want, timing it with your renewal date is the smoothest way to do it. You'll sidestep any potential cancellation fees and make the whole transition much cleaner.

Get Your Ducks in a Row Before You Shop

Making a clean break from your old insurer and moving to a new one is all about good prep work. Before you dive into getting quotes, pulling together the right documents first will save you headaches and make the whole process much faster.

Your most valuable tool here is your current policy's declarations page. Think of it as the CliffsNotes for your insurance—it lays out your coverage limits, deductibles, and exactly what you're paying. This is the baseline you'll use to make sure you're comparing apples to apples with any new offers.

Have Your Information Ready

To make the quoting process a breeze, you’ll want to have a few key details handy. Scrambling to find this stuff while on the phone with an agent is no fun for anyone.

- Vehicle Identification Numbers (VINs) for every car you need to insure.

- Driver's license numbers for all drivers who will be on the policy.

- A recent copy of your driving records and any claims history you have.

If you're dealing with business insurance, the paperwork gets a bit more involved. It’s a good idea to understand what a loss run report is, as it’s essentially a claims history for your business that any new insurer will definitely ask for.

Give Your Current Coverage a Quick Reality Check

With your declarations page in hand, take a moment to really look at it. Chances are, your life isn't the same as it was when you first bought that policy. The real question is: does your coverage still fit?

Maybe you did a big kitchen remodel last year that added $50,000 to your home's value. Is your old dwelling coverage high enough to protect that investment? Or perhaps your teenager just got their license, which is a classic reason to re-evaluate your liability limits.

The goal isn't just to copy and paste your old policy. This is your chance to patch up any holes and make sure your coverage truly reflects where you are today. You're shopping for the policy you need now, not just a cheaper version of the one you have.

Doing this quick review up front gives you a clear picture of what you're looking for, which makes comparing quotes infinitely more productive.

Comparing Insurance Quotes The Smart Way

Alright, you've got your current policy details handy. Now for the main event: getting new quotes. The real trick here isn't just to chase the lowest number you can find. It's about getting the best possible value for your hard-earned money.

There are a few ways to tackle this. You could go directly to an insurance carrier's website, use a quick online comparison tool, or partner with an independent agent.

Going direct is simple but puts you in a silo with only one company's options. Online tools are fast, but they often miss the little details that can make a big difference in your coverage. An independent agent, however, does the heavy lifting for you, comparing offers from multiple carriers to find coverage and discounts you might never have found on your own.

Look Beyond The Premium Price

I've seen it a hundred times: someone jumps on a quote that's a few bucks cheaper, only to find out they've given up critical protection. The lowest price is almost never the best deal.

When the quotes start rolling in, it's time to put on your detective hat and make sure you're comparing apples to apples. Here’s what you should be zeroing in on:

- Coverage Limits: Is the new quote offering the same liability and property damage limits you have now, or is it a step down? You don't want to find out you're underinsured after an accident.

- Deductibles: Pay close attention to this number. A lower premium often hides a much higher deductible, meaning you'll pay more out of pocket when you file a claim.

- Extra Perks: Does the new policy include valuable add-ons like rental car reimbursement or roadside assistance? Sometimes these are bundled in, other times they're extra.

- Discounts: Make sure all your potential discounts are applied. Things like a clean driving record, a home security system, or bundling policies can add up. A detailed home and auto insurance comparison is the best way to see where you’re saving.

It also helps to benchmark against industry averages. For example, if you're insuring a recreational vehicle, understanding the average boat insurance costs can give you a solid frame of reference.

Remember that an insurance policy is a contract. You're buying a promise that the company will be there for you when something goes wrong. A rock-bottom price from a company with poor claims service isn't a bargain—it's a risk.

To keep your head straight, nothing beats a simple comparison chart. It cuts through the marketing fluff and lays out the cold, hard facts side-by-side.

Insurance Quote Comparison Checklist

Use this checklist to line up the quotes you receive. This lets you see exactly what each company is offering and spot any major differences in coverage or cost at a glance.

| Feature | Company A Quote | Company B Quote | Company C Quote |

|---|---|---|---|

| Annual Premium | $1,850 | $1,675 | $1,920 |

| Liability Limits | 100/300/100 | 50/100/50 | 100/300/100 |

| Collision Deductible | $500 | $1,000 | $500 |

| Comprehensive Deductible | $500 | $1,000 | $500 |

| Roadside Assistance? | Yes | No | Yes |

Looking at this example, Company B seems like the cheapest option upfront. But a closer look reveals their liability limits are half of the others, and the deductibles are double. Suddenly, that "deal" doesn't look so great if you actually need to use it. This is exactly why a direct comparison is so crucial.

Making the Switch Without a Gap in Coverage

You’ve done the research and picked your new insurer. Awesome. Now comes the most critical part: making the actual switch. It’s all about timing. If you mess this up, you could find yourself in a really tight spot with a gap in your coverage.

The cardinal rule is simple: Do not cancel your old policy until your new one is officially active.

Think of it like a relay race. Your new policy needs to take the baton the exact moment your old one lets go. If your current auto insurance ends at 12:01 AM on June 1st, your new policy has to kick in at 12:01 AM on June 1st. No exceptions. A gap of even a few hours can be financially devastating if an accident happens.

Lock in Your New Policy First

Before you even think about calling your old company, you need to get everything squared away with the new one. This means making it official and legally binding.

Here’s what you need to do:

- Sign on the dotted line. Go over the application one last time and sign it.

- Pay up. Coverage doesn’t start until you’ve made that first payment. Make sure you get a receipt.

- Get proof. Ask for your new insurance cards or an insurance binder. If you're not sure what is an insurance binder, it’s basically a temporary document that proves you have coverage until the full policy paperwork arrives.

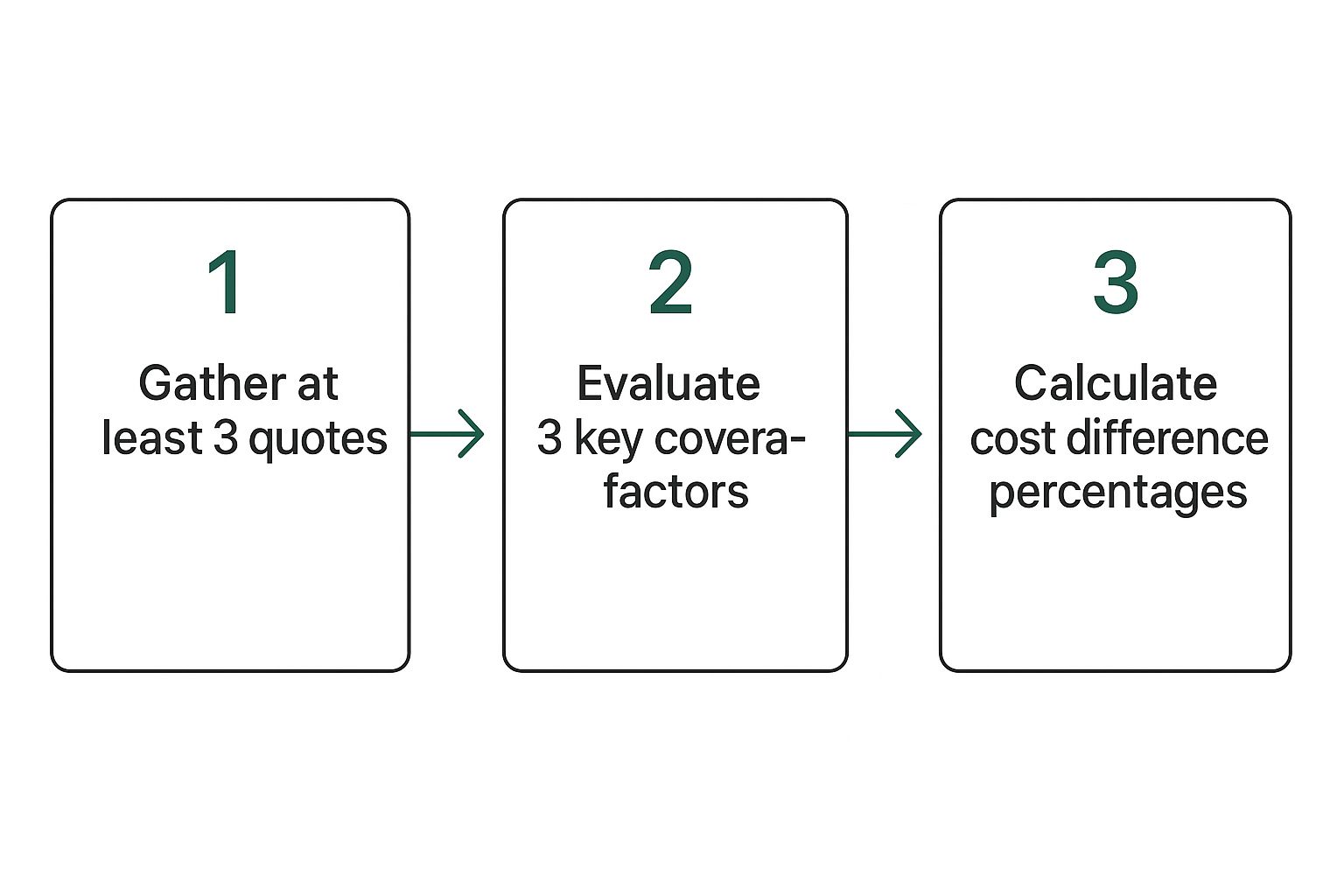

This infographic breaks down the evaluation process that gets you to this point.

Seeing the steps laid out like this really helps reinforce that choosing a new policy is a deliberate process, not just a frantic search for the lowest price.

Once you have proof of your new, active policy in hand, then you can move on to the next step.

How to Properly Cancel Your Old Policy

It's time to break up with your old insurer. A phone call is a good way to get the ball rolling, but you absolutely need to follow up in writing. An email or a formal letter creates a paper trail that protects you from any "misunderstandings" about automatic renewals or surprise bills down the road.

Be specific. Tell them you wish to cancel your policy on a certain date—the same date your new one started.

The difference between what's insured and the actual economic cost of a disaster is called the protection gap. Globally, this gap is expected to reach a staggering $1.86 trillion by 2025. This problem gets worse when people are uncertain or don't trust the process, which is why a seamless, no-gap switch is so important for your own financial safety.

After you've sent your written notice, circle back to confirm the cancellation. Don't forget to ask about a pro-rated refund if you paid your premium in advance. You're likely owed some money back.

Following these steps carefully ensures you switch companies without a hitch, keeping you and your assets protected the entire time.

Tying Up Loose Ends and Notifying Everyone

You've done the hard part and your new policy is officially active. Great! But you're not quite across the finish line yet. The last piece of the puzzle is making sure everyone who needs to know about your new insurance is in the loop. This final communication step is crucial for preventing some major administrative headaches down the road.

First things first, circle back with your old insurance company. You need to get written confirmation that your old policy is canceled. Don't just take their word for it over the phone. While you're at it, double-check the details on any pro-rated refund you might be getting.

Once that's handled, it's time to spread the word. Who you need to call next really depends on what kind of insurance you just switched.

Who to Update With Your New Policy Info

If you switched your auto insurance, you have two very important calls to make: one to your state's DMV and the other to your auto loan provider. Your lender is especially critical because they technically own the car until it's paid off. They require constant proof of coverage to protect their investment.

If they don't get your new policy information, they can—and often will—slap their own expensive "force-placed" insurance on your loan. Trust me, you don't want that bill.

When it comes to homeowners insurance, your mortgage company is priority number one. Your lender needs your new policy declaration page right away so they can update your escrow account. A delay here can cause all sorts of problems, from missed payments to them thinking you've let your coverage lapse entirely.

This is more than just busywork. In a market where people are constantly shopping for better rates, clear communication with your lender or lienholder is non-negotiable. It's also a good reminder that many of these updates are triggered by the exact same kind of life changes you should tell your insurance agent about.

Common Questions About Switching Insurance

Thinking about switching insurance companies always brings up a handful of questions. It's totally normal to worry about the timing, potential penalties, and whether you'll get your money back. Let's clear up some of the common concerns so you can feel confident making the change.

A lot of people think they’re stuck with their policy until it’s time for renewal, but that’s not the case. You can switch insurance carriers anytime you want. You're never locked in.

While timing your switch to line up with your renewal date is often the cleanest way to do it, you won't be penalized for leaving mid-term. Most personal car and home insurance policies don't have cancellation fees, giving you the freedom to jump on a better deal whenever you find one.

Will I Get a Refund if I Switch Early?

Yes, you almost always will. If you've paid your premium upfront for a six- or 12-month term, your old insurance company owes you a refund for the time you didn't use. This is known as a pro-rated refund.

For instance, if you paid a $1,200 annual premium and you cancel exactly six months into the policy, you should get back around $600. Once you've officially cancelled, just ask about their refund process. It usually only takes a few weeks to get your money.

A quick pro tip: Always confirm your cancellation in writing. A simple email is perfect because it creates a paper trail and eliminates any confusion about your policy's end date, which can really help speed up your refund.

Does Switching Insurance Hurt My Credit Score?

This is a big one, but the answer is a firm no. Switching your insurance carrier will not damage your credit score.

When you're shopping around and getting quotes, insurers run a "soft inquiry" on your credit history. This isn't the same as the "hard inquiry" you see when you apply for a new credit card or a loan.

Here’s a simple breakdown of the difference:

- Soft Inquiry: Think of this as a background check for things like insurance quotes. It’s only visible to you on your credit report and has zero impact on your score.

- Hard Inquiry: This happens when a lender is actively considering you for new credit. Too many of these in a short time can temporarily ding your score.

So go ahead and shop for as many insurance quotes as you need. The system is built to let you explore your options without penalty, ensuring you can find the absolute best coverage and rate out there.

You don't have to figure all this out on your own. The experts at Wexford Insurance Solutions live and breathe this stuff and can help you compare policies to find the perfect fit. Get your personalized quote today by visiting https://www.wexfordis.com.

Difference Between Broker and Agent Insurance: Key Differences

Difference Between Broker and Agent Insurance: Key Differences What Is Loss of Use Insurance?

What Is Loss of Use Insurance?