It’s a scenario no one wants to imagine: a fire, a burst pipe, or a severe storm leaves your home unlivable. The immediate shock is overwhelming, but a very practical question follows right behind it: "Where are we going to stay?"

This is where loss of use insurance steps in. It's the part of your standard homeowners or renters policy that acts as a financial lifeline, covering the additional living expenses you rack up when you’re forced out of your home. Think of it as a crucial buffer that helps you maintain your family’s standard of living without having to raid your savings during an already stressful time.

Your Financial Safety Net When Disaster Strikes

At its core, loss of use coverage is like a temporary expense account from your insurance company. It’s not designed to pay your mortgage—that’s a regular bill you’d have anyway. Instead, it’s all about covering the extra costs that suddenly appear because you can’t use your own kitchen, do your own laundry, or sleep in your own bed.

This coverage provides a sense of stability when everything else feels chaotic.

The whole point is to bridge the financial gap between your normal life and your temporary, post-disaster life. It’s what keeps a major disruption from spiraling into a full-blown financial catastrophe by helping you handle the new, unexpected costs.

What Does This Coverage Include?

The main feature of loss of use insurance is what's officially known as Additional Living Expenses (ALE). This is a broad term for any reasonable and necessary costs you incur that are above and beyond your normal household budget. You can get a much more detailed breakdown here: https://wexfordis.com/2025/09/26/additional-living-expense-coverage/.

To give you a clearer picture, here’s a quick summary of what you can expect this coverage to handle.

Loss of Use Insurance at a Glance

| Coverage Type | What It Typically Covers |

|---|---|

| Temporary Housing | The cost of a hotel room, a short-term apartment rental, or similar accommodations. |

| Food Costs | Extra money spent on restaurant meals if your temporary place doesn't have a kitchen. |

| Relocation & Storage | The cost of moving personal items and renting a storage unit while your home is repaired. |

| Transportation | Added commuting costs, like extra gas or mileage, if you're living farther from work or school. |

| Laundry Services | The cost of using a laundromat if you no longer have access to a washer and dryer. |

These examples show how ALE is designed to help you replicate your normal lifestyle as closely as possible until you can move back home.

Why This Coverage Matters More Than Ever

Loss of use coverage isn't just a "nice-to-have" anymore; it's becoming absolutely essential. With the frequency of major storms and natural disasters on the rise across the country, more families are finding themselves displaced for weeks or even months.

While it's most often triggered by major events like fires or floods, it's also worth knowing how it might apply in other situations. For example, some policies may provide coverage if a major HVAC system replacement leaves your home dangerously hot or cold and therefore uninhabitable for a short period. It all comes down to the specifics of your policy and what kind of "covered peril" caused the damage.

How Loss of Use Coverage Actually Works

So, how does this coverage actually kick in when you need it? It’s simpler than you might think.

Loss of use insurance comes to life the moment a “covered peril”—think a house fire, a burst pipe causing massive water damage, or a tornado—forces you out of your home because it’s unsafe or unlivable. The key thing to remember is that it’s not designed to pay your normal mortgage or utility bills. Instead, it covers the increase in your living expenses.

Let’s say your family normally spends $800 a month on groceries. But after a kitchen fire, you’re stuck in a hotel with no way to cook. Your food costs jump to $1,500 a month from eating out. Loss of use coverage is there to cover that extra $700, so a disaster doesn’t become a financial catastrophe on top of everything else.

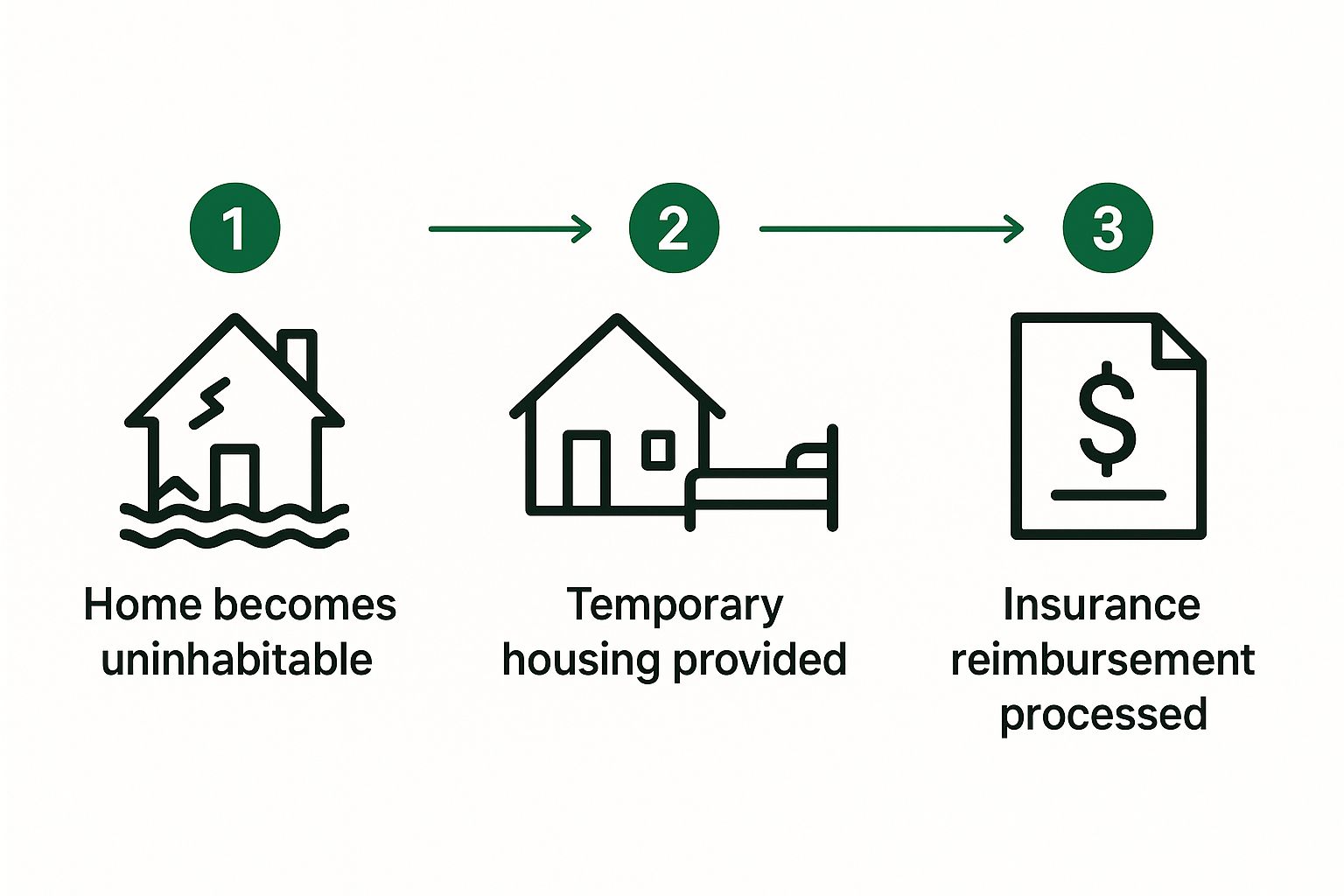

This is the basic flow from the moment you’re displaced to getting that financial support.

Essentially, a covered event triggers the need for help, and your policy steps in to help you maintain your normal standard of living.

The Three Pillars of Coverage

Loss of use coverage is really built on three core components. Each one is designed for a different kind of disruption you might face after a disaster. Getting familiar with them is a smart move, and our guide on how to read an insurance policy can help you spot these details in your own documents.

-

Additional Living Expenses (ALE): This is the part of the coverage most people use. It’s for all the extra day-to-day costs that pop up, like hotel bills, restaurant meals, laundry services, or even the extra gas money you spend if your temporary place is farther from work and school.

-

Fair Rental Value (FRV): This one is for landlords. If a fire or other covered event makes your rental unit uninhabitable, FRV reimburses you for the rent payments you lose out on while repairs are being made. It keeps your income stream flowing.

-

Civil Authority Prohibited Use: This is a unique and often overlooked protection. It applies when a government body, like the police or fire department, orders an evacuation and bars you from accessing your home. This could be due to a nearby wildfire, a chemical spill, or a flood, even if your own property hasn't been directly damaged.

Key Takeaway: Loss of use coverage isn't a blank check. It's a reimbursement system that aims to restore your normal standard of living, not pay for a luxury upgrade. Your insurance company will look at your typical spending to figure out what counts as a legitimate "additional" cost.

A Real-World Example

Let's walk through a quick scenario to see it in action. Imagine a bad storm rips the roof off the Miller family's house, and the water damage makes it impossible to live there for a month.

Here's a breakdown of how their loss of use coverage would help:

- Normal Monthly Mortgage: $2,000 (They still have to pay this)

- Normal Monthly Utilities: $300 (This might be lower if some services are shut off)

- Temporary Apartment Rent: $2,500 (Covered by ALE)

- Extra Commute Costs: $150 (Covered by ALE)

- Laundromat Fees: $80 (Covered by ALE since their washer and dryer are unusable)

In this case, the insurer would reimburse the Millers for the temporary apartment, the extra gas, and the laundromat costs. These are all expenses they only have because they were forced from their home. This kind of practical, real-world support is exactly why loss of use is such a vital piece of a solid homeowners policy.

Understanding Your Coverage Limits

Every insurance policy has its own rulebook, and loss of use coverage is no different. Honestly, getting a handle on your coverage limits before a disaster is one of the smartest things you can do. It's the key to having a solid financial game plan instead of getting hit with nasty surprises when you're already stressed out.

The amount of coverage you have isn't just a number pulled out of thin air. It’s directly linked to how much your home is insured for.

How Limits Are Calculated

Most of the time, your loss of use limit is calculated as a straight percentage of your dwelling coverage—that's the amount it would cost to rebuild your house from the ground up. Typically, you'll see this set at 20% or 30% of that main number.

Let's put that into perspective with some real-world figures.

- Say your home is insured for $400,000. If your policy has a 30% limit for loss of use, you’ve got up to $120,000 to work with for those extra living expenses.

This approach makes a lot of sense because it scales your coverage to your home's value. A more valuable home often comes with a higher cost of living to maintain, so the policy provides a bigger financial cushion. This connection is also fundamental to other insurance concepts, so it's worth taking a moment to understand what coinsurance in property insurance is and how it fits into your overall protection.

Good News About Deductibles: Here's a common question I get: "Do I have to pay my deductible first?" The answer is almost always no. You do not have to pay your standard homeowners deductible to tap into your loss of use funds. This coverage is meant to be there for you right away, so you can get help without having to fork over a big chunk of cash first.

Time-Based Restrictions

Now, besides the dollar amount, there's another limit you absolutely need to know about: the time limit. This is the maximum amount of time your insurer will pay for your extra living costs while your home is under repair.

These time limits usually come in one of two flavors:

- A Fixed Timeframe: Many policies will put a hard stop on coverage at 12 or 24 months after the incident.

- A "Reasonable Time": Other policies promise to pay for the "reasonable time" it takes to fix or rebuild your home. This sounds more flexible, but it can also be a bit more of a gray area.

Knowing which one you have is critical. We've all seen how construction projects and supply chain issues can cause major delays. A major rebuild can easily blow past a 12-month deadline. If your coverage clock runs out before your home is livable again, you're on the hook for those temporary housing costs yourself.

My advice? Pull out your policy's declarations page, find your specific limits, and make sure you have enough of a buffer for a true worst-case scenario.

How to File a Claim Successfully

Having loss of use coverage is one thing; knowing how to actually use it when you're in a crisis is another. When a disaster forces you out of your home, the last thing you want to deal with is a complicated, drawn-out claims process. The key to a smooth experience? It boils down to solid organization and clear communication right from the start.

Think of it this way: you've suddenly become the accountant for your temporary life. Every single dollar you spend because you've been displaced needs to be tracked. This isn't just busywork—it's the single most important thing you can do to get the full reimbursement you're entitled to.

Become a Master of Record-Keeping

The moment you have to leave your home, your number one priority (after your family's safety, of course) is to collect and organize receipts. Get a physical folder, a shoebox, or a dedicated digital folder on your phone or computer. Just pick one system and stick with it. This simple discipline will save you countless headaches when it's time to submit everything.

To make things even easier for you and your insurance adjuster, sort your expenses into categories as you go.

- Temporary Housing: Keep every single invoice and payment confirmation for your hotel, Airbnb, or short-term apartment rental.

- Food and Meals: Save all your restaurant receipts. If you end up in a rental with a kitchen, keep your grocery receipts separate to demonstrate how they differ from your normal food budget.

- Extra Transportation: Did your commute just get longer? Track the extra mileage. You can use a simple notebook or a mileage-tracking app. And don't forget to save those gas receipts!

- Other Essentials: This can include anything from pet boarding fees and laundry services to storage unit rentals. If it's an expense you only have because you're not at home, keep the receipt.

To give you a clearer picture, here's a quick checklist to help you stay organized.

Claim Documentation Checklist

When you're filing a loss of use claim, meticulous documentation is your best friend. This table breaks down what you need to keep for each type of expense.

| Expense Category | Examples of Documentation |

|---|---|

| Temporary Housing | Hotel invoices, short-term lease agreements, security deposit receipts, rental payment confirmations. |

| Meals and Food | Dated receipts from all restaurants, cafes, and take-out orders. Grocery receipts if applicable. |

| Transportation | Gas receipts, mileage logs showing extra travel, public transit passes, ride-share receipts. |

| Utilities | Invoices for any utilities you have to pay at your temporary residence (e.g., internet, electricity). |

| Pet Boarding | Receipts or invoices from the kennel or pet care facility. |

| Laundry Services | Receipts from laundromats or professional cleaning services if your rental lacks facilities. |

| Storage Fees | Invoices and payment confirmations for a temporary storage unit for your belongings. |

Keeping these documents in a dedicated folder will make submitting your claim a much smoother process and help you get reimbursed faster.

Talk to Your Adjuster—The Right Way

Your insurance adjuster is the gatekeeper of your claim, so building a good working relationship is incredibly important. Remember, they are juggling a lot of cases, so anything you can do to make their job easier will ultimately help you. The goal is to be proactive and professional.

I always recommend keeping a log of every conversation. Jot down the date, time, and the main takeaways. After an important phone call, send a quick follow-up email summarizing what you discussed. This creates a paper trail that can prevent misunderstandings down the road. For a deeper dive, our guide on the homeowner insurance claim process walks through every step in more detail.

Pro Tip: Don't be shy about asking for a cash advance. Most loss of use claims work on a reimbursement basis, but insurers know you might need a large sum of money upfront for things like a rental deposit. Many will provide an advance to help you get settled. It never hurts to ask.

Navigating Delays and Disagreements

Even with perfect records, things can get held up. If you feel like your claim is dragging, send a polite but firm email to your adjuster requesting an update and a clear timeline.

What if they deny an expense? Don't panic. Calmly request a written explanation that points to the specific language in your policy they are using to justify the denial. This way, you can review it yourself and decide on your next step. By staying organized and communicating effectively, you can take control of the situation and work toward the best possible outcome.

What Goes Into the Cost of Your Coverage?

Ever wonder how your insurance company lands on that specific number for your premium? It's not just pulled out of a hat. The cost of loss of use coverage is a blend of factors, some about you and your home, and others about the world at large.

The biggest single factor? Your address. It’s all about risk. If you live in a place that sees more than its fair share of hurricanes, wildfires, or other natural disasters, the odds of needing to use this coverage go up. And when risk goes up, so does the price.

Core Factors That Shape Your Premium

Beyond your zip code, insurers zoom in on the specifics of your policy to dial in the final cost. It's a balancing act between how much protection you have and how much you pay for it.

Here are the main things they look at:

- Your Home's Insured Value: This is the big one. Since loss of use is calculated as a percentage of your dwelling coverage, a higher home value means a higher potential payout for the insurer. That, in turn, means a higher premium for you.

- Your Chosen Coverage Limit: Most policies start with a 20% limit, but you can often increase it to 30% or more. A bigger safety net is great, but it comes with a bump in your premium.

- Your Claims History: If you’ve filed claims in the past, insurers might see you as a higher risk, and that can be reflected in what you pay.

Juggling these factors is the key to getting the right coverage at the right price. If you're looking for practical ways to manage these costs, check out our deep dive on how to lower home insurance premiums.

The Bigger Picture: Economic and Environmental Shifts

It's not all about you. Wider trends in the economy and environment are pushing costs up for everyone. The increasing number of severe weather events across the country is a major driver.

After a big storm or wildfire, loss of use claims pour in. We're seeing record insured losses from these catastrophes. In fact, a recent Swiss Re report highlighted that one six-month period saw a 40% jump in insured losses over the previous year. That forces insurers to adjust their pricing across the board.

On top of that, think about the current costs for construction. Everything from lumber to labor is more expensive, and rebuilding takes longer. When repairs drag on, your temporary living expenses add up. Insurers have to price that potential long-term expense into your policy from the start.

Common Questions About Loss of Use Insurance

Once you get the hang of the basics, the "what if" questions start popping up. Loss of use coverage has some tricky nuances, and knowing how it works in real-life scenarios can save you a ton of stress when you need it most.

Let's dive into some of the most common questions homeowners ask. Think of this as your go-to guide for those specific details that might keep you up at night after a disaster.

Does Loss of Use Cover My Mortgage Payments?

This is probably the number one question people ask, and it's a critical one. The answer is a clear no. Loss of use is there to cover your additional living expenses—the costs you only have because you've been forced out of your home.

Your mortgage, on the other hand, is a regular monthly bill you had before the disaster. You're still responsible for paying it, along with other existing expenses like property taxes or HOA fees. The insurance is designed to help you maintain your standard of living, not pay your existing debts.

What if the Temporary Housing My Insurer Offers Is Not Suitable?

You are not obligated to accept an unsuitable offer. Your policy is there to help you maintain your "normal standard of living." This means the temporary spot should be reasonably comparable to your home in size, quality, and location.

If the hotel they offer is an hour-long drive from your kids' school or the apartment is way smaller than your house, you have every right to push back.

Your Action Plan: The best approach is to communicate with your adjuster calmly and professionally. Put it in writing: explain exactly why their offer doesn't work and provide a few reasonable alternatives you've found yourself. Document everything and keep the tone cooperative—it’s the fastest way to a good solution.

Is Loss of Use Coverage Available for a Rental Property?

Yes, but it operates under a different name for landlords. If you own a rental property that becomes uninhabitable from a covered loss, you won't be claiming your own living expenses. Instead, you’ll file a claim under what’s called Fair Rental Value (FRV) coverage.

This is a specific part of your landlord policy that reimburses you for the rent checks you're no longer collecting while the property is being repaired. It’s designed to protect your income stream so that a fire at your rental unit doesn't completely derail your finances.

Does Loss of Use Cover Food Spoilage from a Power Outage?

This is another common mix-up. Spoiled food from a power outage is typically handled by a different part of your homeowner's policy—your personal property or "contents" coverage. This coverage usually has a much smaller, specific limit, often around $500.

So, while a big storm might knock out your power and make your home unlivable (triggering loss of use for a hotel), the spoiled groceries are a separate claim item. It’s always a good idea to check your policy's declaration page to see what your specific limit for food spoilage is.

Keep in mind that every policy has its own fine print. The absolute best way to get answers is to read your documents or, even better, talk to your insurance agent. Knowing what's covered ahead of time is your best defense against surprises.

Navigating the details of loss of use insurance can feel complex, but you don't have to do it alone. The experts at Wexford Insurance Solutions are here to review your current policy, answer your specific questions, and ensure you have the right protection in place for your family. Contact us today for a personalized consultation and gain peace of mind. Visit us at https://www.wexfordis.com to get started.

How to Switch Insurance Companies and Save Money

How to Switch Insurance Companies and Save Money Does Homeowners Insurance Cover Termites? Find Out Now

Does Homeowners Insurance Cover Termites? Find Out Now